20% Off Allianz Travel Insurance Promo Code (1 Active) 2024

AllianzTravelInsurance.com Coupon: Get an Exclusive Benefits When You Create an Account at Allianz Travel Insurance

See Today's Travel Insurance Deals at Amazon + Free Shipping w/Prime

Get a $100k Funded Trading Account at TopStep Trader!

Get 30% Off Travel Insurance Using These Allianz Travel Insurance Competitor Coupons (Active Today)

Try these unverified codes for allianz travel insurance and get up to 30% off if they apply to your purchase, why search for allianz travel insurance coupons.

eBay Savings: Save Up to 30% on Travel Insurance at eBay

Allianz Travel Insurance Deal: Get Up to 20% Off Travel Insurance at Walmart (Free Next-Day Shipping on Eligible Orders $35+)

Unverified promo codes for allianz travel insurance, allianz travel insurance promo code: extra 5% off sitewide, allianztravelinsurance.com coupon code: 20% off eligible items, try this seasonal discount code at allianztravelinsurance.com, allianz travel insurance promo codes: complete timetable.

Knoji is the largest database of AllianzTravelInsurance.com coupons and Allianz Travel Insurance discount codes online. Our massive community of shoppers adds over 10,000 coupons per day and makes thousands of coupon edits, ensuring we have every working Allianz Travel Insurance code available while minimizing the likelihood that you'll run into an expired code.

Every promotional code displayed on this table has been hand-verified by multiple members of our community. We show you this table so you have a complete record of Allianz Travel Insurance promo codes , including older promotions that you can test yourself on Allianz Travel Insurance's website. (In some cases, Allianz Travel Insurance may have reactivated older codes, which may still work for discounts at allianztravelinsurance.com).

Why Trust Knoji for Allianz Travel Insurance Coupon Codes

Verified allianz travel insurance promo codes, site-wide discount codes, email discount codes, allianz travel insurance free shipping coupons, community-powered savings, earning rewards.

- Active Contributors (Last 30 days): 3,204 Our vibrant community of savings enthusiasts actively shares and verifies promo codes, helping everyone save more.

- Codes Added (Last 30 days): 125,371 We constantly update our database with the latest promo codes, ensuring you never miss a chance to save.

- Codes Tested (Last 30 days): 590,818 Our advanced AI algorithms and community members rigorously test codes to guarantee their validity.

- Number of Working Codes: 973,878 We maintain an extensive collection of real-time, working promo codes for your favorite brands.

- Number of Merchants With Working Codes: 96,117 From major retailers to niche brands, we have working promo codes for a wide range of merchants.

Allianz Travel Insurance: How to Save Money and Find Coupon Codes

Allianz travel insurance coupon stats, allianz travel insurance coupon faq, is allianz travel insurance offering any coupons today, how often does allianz travel insurance release new coupons, how do i find allianz travel insurance coupons, what's allianz travel insurance's best coupon discount right now, how do i use my promo code for allianz travel insurance, does allianz travel insurance offer loyalty programs, how to apply your allianz travel insurance discount code, holiday insurance products promo codes and deals - active today, why knoji is the best source for allianz travel insurance promo codes, coupons & deals.

Looking for a travel insurance discount in August 2024?

Enjoy a travel insurance promo code or coupon on us..

In this guide

Save now with these travel insurance coupon codes

Compare your travel insurance quotes.

- Travel insurance - when to buy & how to save

How will a coupon code help me?

What are the pros and cons of using an online promo code, how do i use my coupon code, travel insurance providers offering coupon codes on finder.com.au, why use travel insurance coupon codes, how to save on travel insurance, traps to watch out for when looking for a deal on travel insurance.

Destinations

- These travel insurance promo codes offer discounts on your travel insurance policy so you can spend less on insurance and more on your trip.

Save 10% on InsureandGo policies with Finder

Get 10% off Freely travel insurance policies

Qantas Travel Insurance’s BIGGEST offer ever is on now

Get 12% off Kogan travel insurance policies

Get 10% off on Tick travel insurance policies

ahm and Medibank members get 10% off travel insurance

Earn Velocity Points with Cover-More

Get 8% off your Wise and Silent policy

15% off travel insurance for Medibank Private members

Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Travel insurance - when to buy & how to save

Travel insurance coupon codes are online promo codes that allow you to save money when you buy travel insurance. Simply by entering one of the codes above when you buy a policy online from one of our travel insurance partners, you can access a discounted premium. This means you can enjoy all the benefits you would usually expect when you purchase travel insurance, but with the added bonus of substantial savings off the normal price of cover.

Thinking of using a coupon code to help save money on the cost of travel insurance for your next trip? Make sure you consider the pros and cons first.

- Save money. Yeah, obviously! With these coupon codes at your disposal, you can pay less for travel insurance – it’s as simple as that.

- Quick and easy. You don’t need to fill out any complicated forms or sign up to any spam email marketing service; all you need to do is enter the relevant code when you buy a policy.

- Variety. Finder.com.au offers coupon codes from a number of travel insurance providers, which means there are several options to choose from when searching for cover.

- Wide range of policies. Travel insurance coupon codes can also be used across a range of policies, allowing you to choose cover that suits your needs.

- You may need to look past the cost. The premium is far from the only factor that determines whether a travel insurance policy is right for you. You should also look at policy features, limits and exclusions when choosing an insurer.

- Terms and conditions can apply. Make sure you’re aware of any terms and conditions that apply to travel insurance discounts.

- Not all policies may be discounted. Some insurers only offer discounts on particular policies, so make sure that you're getting the policy you want.

- The discount may only be available for a limited time. Some discounts are offered for a short period, so don't miss out.

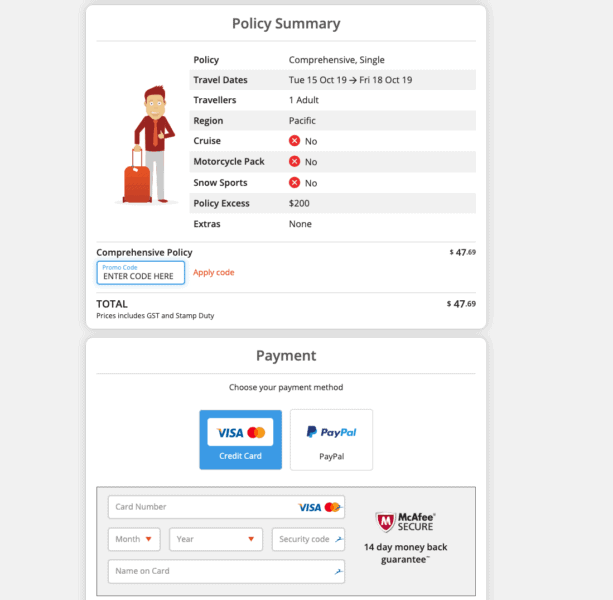

Using a finder.com.au coupon code is quick and easy. All you have to do is follow a few simple steps:

- Review the current coupon codes listed above and choose the one you want

- Click on the relevant link to view the code for your chosen travel insurer

- By clicking on the link, you will also be taken to the insurer’s website so you can obtain a detailed quote

- Review your travel insurance quote. If you’re happy with the cost of cover and the features the policy offers, proceed to checkout

- Enter your coupon code in the field provided during the checkout process. Click “Apply” if necessary

- The coupon code discount will be automatically deducted from the cost of your policy

- Pay for the policy and hit the road with peace of mind!

Tick Travel Insurance offers simple and straightforward travel insurance policies to suit the needs of a wide range of travellers. For discount travel insurance tailored to your requirements, check out our Tick coupon codes.

youGo offers discount travel insurance to offer financial protection against a broad range of travel risks. Browse our youGo travel insurance coupon codes to save money when purchasing cover for your next trip.

Why should you use a travel insurance coupon code? Because you could save money, that’s why. We could all do with a little extra spending money on our next holiday, and using coupon codes is a simple way to save when buying travel insurance and keep more money in your own pocket.

Just by copying and pasting one of the codes above, you could enjoy substantial savings on the cost of travel insurance. Our range of travel insurance coupon codes is also constantly updated, so make sure to check back with us whenever you’re planning your next holiday for the latest deals and discounts.

Coupon codes aren’t the only way you can save money on travel insurance. Keep the following tips in mind to help cut the cost of your premium:

- Buy online. Travel insurance from travel agents and airlines tends to be far more expensive than insurance purchased online, simply because many travel agents and airlines charge a commission on top of the price of cover. When you use finder.com.au, you'll pay the same as going direct.

- Choose a lower level of cover. It shouldn’t come as a surprise to find that the lower the level of travel insurance cover you choose, the cheaper your premium will be. So if the cost of cover is important to you, consider choosing a basic policy rather than comprehensive cover, and remember to remove any optional extras you don’t need.

- Consider multi-trip cover. Are you a frequent traveller? If so, buying a separate travel insurance policy for every trip you take can add up to be quite expensive. That’s why it could be worth your while considering annual multi-trip insurance , which covers all your holidays across a 12-month period and works out to be much cheaper for regular travellers.

- Purchase a joint policy. If you’re travelling with a friend or relative, it can be quite expensive if each of you purchase separate travel insurance policies. But if you pool your resources and buy a joint policy, you can enjoy significant savings.

- Adjust your excess. Many insurers allow you to choose the excess amount payable when you make a claim. By shifting to a higher excess, you can enjoy lower premiums.

- Student discounts. Students tend to travel on a tight budget, so saving a little extra money on your travel insurance cover is always welcome. With this in mind, you may want to hunt around for an insurer that offers discounted cover for student travellers.

- Senior discounts. If you’re over 55 years of age and no longer working full time, some insurers will offer discounted travel insurance for seniors . Check the fine print or contact the insurer directly to find out whether they offer any seniors discounts.

- Group discounts. Travelling as part of a group? Use your strength in numbers to negotiate a better deal on your travel insurance policy.

- Find cover for the whole family. If you’re planning a family holiday, did you know that many insurers will cover your children and other dependents travelling with you free of charge? This can help reduce the cost of cover, so check the fine print to find out whether your insurer offers cover for the whole family.

- Shop around. Last but definitely not least, make sure to shop around for the best policy. This will not only help you find the most affordable cover, but more importantly, it will allow you to choose the policy that provides the best value.

For more tips on travel insurance discounts and savings, check out our guide to reducing your travel insurance premium . Otherwise, choose the discount you want from those listed above and enjoy the savings on offer.

It can be easy to snatch up the policy offering the lowest premium when comparing policies but doing this could leave you drastically underinsured. Here are some key points you may want to consider when looking for value for money travel insurance:

- Benefit excess: Low cost policies may have higher excesses applied for the payment of benefits. It is important to work out what you stand to pay in excess charges prior to application.

- Deterioration: Many policies will take into consideration the “wear and tear” of items when determining the benefit that will be paid. It can be worth assessing how this will be applied on your policy.

- Exclusions on the policy: Many low cost policies have many exclusions for claim payment in place. As stated previously, it can be worth comparing the exclusions of policies prior to application.

- Documentation required: It can be helpful to get an understanding what documentation your insurer will require in order for a claim to be paid. Many insurers will require either a receipt or valuation document for some types of claims, for example.

- Limits on valuable items: Basic policies will generally only provide cover for items up to a certain value. You may want to consider registering any high-value items prior to departure to ensure adequate cover is in place.

- Activities covered: Insurer will often have a complete list of the sports and activities that they are willing to cover under the policy. Many basic policies do not provide cover for potentially risky activities. If you are going to be participating in any high-risk activities on your trip, it might be worth considering a specialist policy.

- Don’t ignore warnings in the media or from the government: Many insurers will not honour claims for events that have taken place in countries that have been recommended as no-travel areas by the government or mass media, or for claims resulting from the events warned about in travel advisories. It can be worth checking travel advisories before heading overseas, and checking whether your policy covers you there.

Zahra Campbell-Avenell

As former Head of Publishing and Editorial for Finder in Australia, Zahra Campbell-Avenell led a team of experts to deliver on Finder's mission to help people make better decisions with their money. Zahra has over 12 years of experience in editorial content, and a Bachelor of Arts in Anthropology and English from Georgetown University in Washington DC. See full bio

More guides on Finder

Hitting the slopes? Avoid huge bills by getting ski travel insurance for your trip.

Find out how domestic car rental excess insurance could save you thousands.

Find travel insurance to enjoy Sri Lanka, and learn more about how you're protected overseas.

Ready to get moving? See quotes and compare travel insurance policies for Indonesia from 16 brands

Why do volunteers need travel insurance? Who should provide it? What should it cover? This guide looks at volunteering in general and doing overseas volunteer work.

Finder examines an average travel insurance policy with useful tips on how to get value out of your policy.

Everything you need to know about travel insurance for your gadgets and electronics.

Keep yourself and your belongings safe on your European escape by comparing insurance polices today.

Whether your are travelling regularly for business or a senior travelling one time, compare policies from AIG Travel Insurance. Review AIG policy features and take out cover online.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

8 Responses

Age 83. Had heart stent 8 years ago. Want travel insurance for all but heart problems. (Have traveled frequently in last 8 years- no problems). Where to find?

Thank you for your question.

If you had a heart stent before, this is generally considered a pre-existing heart condition. If you would like to get a travel insurance, you may compare your options from our list of travel insurance for pre-existing heart conditions .

The insurers will typically assess your condition by phone or online questionnaire before they could provide a quote. Please feel free to click the name of the insurer and press the “Get quote” button if available request a quote.

Please make sure that you’ve read the relevant T&Cs or PDS of the product/ policy before making a decision and consider whether it is right for you.

I hope this helps.

Cheers, Anndy

I am 84 years of age and am quite fit and have no ongoing health problems however when I ask for a travel insurance quote and state my age I am told that they don’t cover older people. Where can I get an insurance company that will insure me on my next trip and not having to pay huge markups because of my age?

Thanks for reaching out.

You can refer to our page that lists insurers who offer insurance for people of your age . Simply fill out your travel details on the comparison form and click “Get a quote now” to receive and compare quotes from various travel insurance brands. There’s also a comparison table on the same page for you to quickly get an overview of what each insurance brand offers.

Please make sure to disclose all relevant information about your medical history to your insurer when you apply for cover. Failing to do so could result in your cover being void when it comes time to make a claim.

Cheers, Liezl

I am looking for codes for travel insurance companies

Actually, you are currently present on the correct page in regards to travel insurance promo codes. In the top of the page, you can see listed promo codes from some of the travel insurance brands in our panel.

Cheers, Zubair

I have heard of people being sick on cruise ships and having to be airlifted back to australia. Which insurance companies provide cover for this?

Thanks for getting in touch. Whether or not you’ll have cover for medical evacuation and repatriation will depend on the policy you choose. You can find out more about this topic by reading our article on travel insurance for medical evacuation .

Cheers, Richard

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in August 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

IHG One Rewards Premier Credit Card

Earn 5 free nights at an IHG property after $4k in spend (each night valued at up to 60k points).

5 Best Cheap Travel Insurance in 2024 (plus DISCOUNTS)

Home | Travel | 5 Best Cheap Travel Insurance in 2024 (plus DISCOUNTS)

When traveling abroad, get a policy from one of the best travel insurance companies . You can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

If you’re taking a trip and looking for the best cheap travel insurance , you’ve come to the right place. Travel insurance may not be the most exciting topic, but it’s an essential part of planning a trip , so make sure you don’t leave home without it!

Besides, you can find affordable travel insurance for all types of budgets, so rest assured that you can get great coverage without spending a lot of money. In this guide, I’ll share the 5 cheapest international travel insurance companies to help you find the perfect fit for your trip needs.

5 Best cheap travel insurance in 2024

I will say upfront that we use Heymondo for all our trips. It’s one of the best travel insurance companies out there, offering tons of coverage and competitive prices. Plus, Heymondo is the only provider that pays your medical expenses upfront , so you don’t have to pay out of pocket and file a claim for reimbursement. Plus, you can get a 5% Heymondo discount just for being a Capture the Atlas reader.

5% OFF your travel insurance

Of course, there are other great options, such as SafetyWing , a cheap travel medical insurance that’s perfect for those on a tight budget who don’t mind having a deductible. Keep reading to see all the best options, compare prices, and see what inexpensive travel insurance should include.

Top 5 cheap travel insurance companies in 2024

In this guide, you’ll find the 5 best cheap travel insurance companies of 2024, so I’m sure you’ll find an option that’s perfect for you. To sum up, these are my top 5 recommendations:

- Heymondo , the best cheap travel insurance company

- SafetyWing , the best medical-only cheap travel insurance

- IMG , the best budget travel insurance for seniors

- Trawick International , a cheap travel insurance for pre-existing conditions

- Travelex , a cheap travel insurance for families

Keep reading to learn more about each company, including its prices, coverage limits, and other benefits, as well as a chart comparing the cheapest travel insurance policies.

Best cheap travel insurance price comparison

Before I get into details about each of these cheap travel insurance companies , I want to give you an overview of their prices and benefits. This chart will let you see each provider’s price per person, deductible, and coverage limits at a glance.

For this cheap travel insurance comparison , I used the example of a 30-year-old traveler from Canada who was going to Costa Rica for one week with a trip cost of $2,500. I also chose the most affordable plan for each company:

As you can see, Heymondo and SafetyWing are the two cheapest international travel insurance options. While Heymondo costs more, it also offers much higher coverage limits than SafetyWing, which is why it’s our favorite. It’s also the only provider that pays your medical expenses upfront , so you don’t have to pay out of pocket.

IMG Global, Trawick International, and Travelex offer similar coverage in some categories, but they also cost more. I recommend reading about each company below so you can determine which one best suits your needs .

1. Heymondo , the best cheap travel insurance company

Heymondo is one of the best cheap travel insurance companies overall, offering a high amount of coverage at a great price. With Heymondo, you’ll have comprehensive travel and medical-related benefits, including emergency medical expenses, trip cancellation insurance , and baggage loss.

There is also a $0 deductible for single-trip and annual multi-trip insurance, and the deductible for long-stay travel insurance is just $250 per claim. Best of all, they’re the only company that pays your medical bills upfront , so you don’t have to pay any medical bills and file a claim later to get a reimbursement.

Heymondo was also one of the first providers to include COVID coverage in its policies, which set the bar for other insurers. Moreover, the 24/7 traveler assistance app is another testament to Heymondo’s dedication and customer service. You can use it to get in touch with a team of doctors for advice and recommendations for the nearest clinic or hospital.

For all these reasons, we’ve been traveling with this insurer for 5 years, and we have a detailed Heymondo insurance review that you can read for more information. Overall, it’s the best value for money, and for just a bit more, you can upgrade your coverage to include adventure sports, cruises, and electronics.

Right now, we have the annual multi-trip policy from Heymondo, which is the cheapest international travel insurance for frequent travelers. If you decide to purchase from Heymondo, don’t forget to take advantage of our 5% Heymondo discount code by using our link .

2. SafetyWing , the best medical-only cheap travel insurance

Another affordable travel insurance to look into is SafetyWing . Their Nomad Insurance plan offers excellent, budget-friendly medical coverage with some travel-related benefits like baggage loss.

One of the most unique things about SafetyWing is that you can get coverage in your home country for 30 days after you’ve been abroad for 90 days, so it’s a good deal if you want supplementary protection for any medical issues. Moreover, this is a good, cheap travel insurance for families since it offers free coverage for up to two kids under the age of 10.

Keep in mind that while SafetyWing has cheap travel medical insurance , it focuses mostly on health-related benefits like emergency medical expenses and COVID coverage. That said, if you’re fine with having medical-only insurance for travel , it’s one of the best deals.

Another drawback of SafetyWing is that it has a $250 deductible per claim, so you’ll have to pay $250 toward your medical bills before the company will cover the rest. If you don’t want a deductible, Heymondo is a good alternative.

3. IMG Global , the best budget travel insurance for seniors

If you’re looking for travel insurance for seniors , then IMG Global is one of the best options. Finding budget-friendly travel insurance for seniors can be super tricky, but IMG Global has a plan specifically designed for travelers 65 and older.

The GlobeHopper Senior Single Trip plan offers travel and medical-related benefits and the option to choose a maximum coverage limit of $50,000, $100,000, $500,000, or $1,000,000. It’s also one of the few cheap travel insurances for pre-existing medical conditions , so it’s ideal for older travelers. While there aren’t as many travel-related benefits with this plan, it does offer lots of flexibility, as customers can choose a deductible of $0, $100, $250, $500, $1,000, or $2,500.

And for other travelers, IMG Global’s iTravelInsured Travel Lite plan is a good deal, with a $0 deductible and a good amount of coverage in all travel and medical-related categories. This includes emergency medical, evacuation, and trip cancellation/interruption benefits. In fact, its trip cancellation covers a wide range of reasons, including work transfers, job loss, passport/visa theft, natural disasters, and injury/illness.

However, this plan is among the most expensive options we found, so if you’re looking for cheaper single-trip travel insurance , I recommend Heymondo .

4. Trawick International , an affordable travel insurance for pre-existing conditions

Trawick International is another cheap travel insurance for pre-existing medical conditions , so if that’s something you’re looking for, I suggest getting a quote.

The company’s Safe Travels Explorer Plus plan is just a few dollars more than the Safe Travels Explorer plan, so it’s worth shelling out a bit more for its comprehensive coverage. This includes emergency medical expenses, repatriation, trip cancellation, baggage loss, and more, plus a $0 deductible. You can even add cancel for any reason travel insurance to your policy.

While Trawick International offers travel insurance for pre-existing conditions , you must purchase your plan within 7 days of the initial trip deposit date to enjoy this benefit. Also, it’s worth noting that the medical expenses coverage is on the lower end, at $250,000. If you don’t have a pre-existing medical condition and want higher medical coverage, you can get about five times more protection by going with Heymondo .

5. Travelex , a cheap travel insurance for families

Finally, Travelex is another cheap travel insurance company and a great option if you’re looking for domestic travel insurance for the USA . Travelex’s plans are affordably priced and offer comprehensive protection, including coverage for pre-existing medical conditions.

You can choose from the Travel Basic or Travel Select plan, although we recommend the latter, especially if you have a pre-existing condition or want a higher amount of coverage. That said, make sure to purchase your policy within 15 days of your initial trip payment so you receive a Pre-existing Medical Condition Exclusive Waiver.

Additionally, Travelex is a good option to consider if you want cheap family travel insurance since kids under 17 are included for free. Plus, you can upgrade your coverage to include things like rental cars, Cancel for Any Reason, and extra medical coverage.

Travelex’s benefits include coverage for baggage loss, trip cancellation, trip interruption, and evacuation and repatriation. While it also offers emergency medical expenses coverage, the limits are quite low, especially considering the price.

Also, for Canadian residents, there is a medical-only plan, which could be a good option if you’re looking for cheap medical-only travel insurance .

What does cheap international travel insurance cover?

When looking for the best deals on travel insurance , remember to check the policies carefully so you understand what’s included. Some cheap travel medical insurance plans include higher amounts of coverage compared to others with similar prices, so it gets a bit tricky.

Below, you’ll find the most important things to consider when browsing affordable travel insurance .

Emergency medical coverage

First, emergency medical expense coverage is one of the most crucial aspects of any cheap travel health insurance . You want to be covered for any unexpected costs that arise from an injury or illness while abroad. Emergency medical coverage includes things like hospitalizations, doctor-prescribed tests, treatments, and even dental procedures.

Emergency medical coverage with cheap travel insurance

Again, this is one of the most important benefits to look for, even if you want inexpensive travel insurance . It’s worth paying a bit more for a high amount of coverage, especially if you’re shopping around for travel insurance for the USA , where healthcare costs are through the roof.

Medical evacuation & repatriation

Another thing to look for when browsing the cheapest holiday insurance is medical evacuation and repatriation. The costs for these services are super expensive, so having this type of coverage is essential.

With medical evacuation and repatriation protection, you’ll be covered if you need to be transported from a remote area to a hospital or from your travel destination to your home country due to a serious injury or illness. It’s easy to overlook this benefit but should something happen and you don’t have this coverage, it could result in a huge financial loss.

Medical evacuation & repatriation coverage

Should an emergency arise, you don’t want to delay getting proper medical care, so having this type of coverage is very important!

Covid-related coverage

As I mentioned, Heymondo was one of the first providers to cover COVID-19 the same as any other illness, and many other insurance companies soon followed suit. While the height of the pandemic is over, it’s still worth having COVID coverage.

Besides, most cheap international travel insurance includes this type of coverage, so it won’t increase the price of your policy. If you do happen to contract COVID during your trip, you’ll be covered for the medical and travel-related expenses.

The exact terms and conditions depend on the company, but most insurers cover travelers for COVID testing, treatment, and quarantine.

Trip cancellation (and trip interruption)

Another thing you’ll want your plan to include is some type of trip cancellation coverage. This usually covers reasons like illness, inclement weather, strikes, and jury duty. However, you should always double-check your policy since providers vary on what they will and won’t cover.

Trip cancellation and trip interruption benefits

Also, be aware that cheap travel insurance typically doesn’t include Cancel For Any Reason (CFAR) but may offer it as an add-on. You can check our guide on the best cancel for any reason travel insurance for more information.

Along the same lines, trip interruption coverage will reimburse you if you need to cut your trip short due to a serious illness, injury, or the death of a family member. When buying cheap travel insurance , check to see if this benefit is included and what exactly falls under this category.

Lost or stolen baggage & delays

Lastly, baggage loss is something that even the most affordable travel insurance plans should cover. Anyone who has traveled knows that there is always the risk of your luggage getting lost, damaged, or delayed, so having this type of coverage is a good idea.

Under this benefit, you’ll receive a reimbursement so you can buy new toiletries, clothes, and other essentials if something happens to your luggage. The amount depends on the particular plan you choose.

What’s not covered by cheap travel insurance?

Now that you know the most important things to look for when shopping for travel insurance on a budget , let’s talk about what’s not covered. While cheap travel insurance can definitely offer comprehensive coverage, some policies only cover medical-related expenses, so you won’t be covered for travel-related issues.

Others exclude certain things like coverage for pre-existing medical conditions, natural disasters, and fear of travel. Again, it’s crucial that you look over your policy carefully so you know exactly what you’re getting.

Tips for buying travel insurance on a budget

Getting cheap international travel insurance isn’t just a matter of purchasing the least expensive policy you see. To get the best bang for your buck, keep these tips in mind:

- Pay attention to the policy limits to make sure you’re getting the best deal on travel insurance . While you might find lots of plans with low prices, that doesn’t mean they all offer the same amount of coverage.

- Buy at the right time . It’s better to purchase a policy as soon as you book your vacation so you know the exact price of your trip (this makes the claims process easier). Also, if you buy your policy just after booking your trip, you will have more benefits regarding the cancellation coverage.

- Shop around and compare cheap travel insurance policies from different providers.

- Only buy what you need and decline any unnecessary extras. For example, if you just need medical coverage, you don’t need to bother with things like trip cancellation and baggage loss coverage.

- If you travel more than three times a year, consider getting annual multi-trip insurance , which will save you money in the long run.

- Check to see if your credit card has travel insurance benefits . Some cards offer protection for trip cancellation or delayed/lost baggage (I’ll touch on this later).

By keeping these tips in mind, you can find cheap travel insurance for any type of trip.

Medical-only vs. cheap travel insurance

As you’re shopping for low-cost travel insurance , you’ll probably come across medical-only travel insurance . While they’re both affordable options, they aren’t the same, so it’s important to know the difference.

Cheap international travel insurance includes both medical and travel-related coverage. This means that you’ll be covered for health emergencies like sicknesses and injuries, as well as trip cancellation and baggage loss.

On the other hand, medical-only travel insurance will only apply to medical-related scenarios, and the coverage limits tend to be a lot higher. Of course, this really comes in handy when you’re traveling to countries where healthcare is exceedingly high, like the United States or Japan.

For our trips, we like to have insurance that covers medical and travel-related situations, which is why we always go with Heymondo travel insurance plans. This way, we’re covered for medical emergencies, trip delays, lost baggage, evacuation, repatriation, and more.

Is getting affordable travel insurance worth it?

Without a doubt, travel insurance is worth it , always! When you travel as much as us, you realize that anything can happen while you’re abroad, so it’s always a good idea to be prepared. We’ve had several scary experiences and mishaps, and if it weren’t for our annual travel insurance from Heymondo , we would’ve been stuck with huge headaches and financial losses.

Here are just a few examples of times when we’ve had to rely on our insurance:

- We had our most traumatic experience in the Peruvian Amazon when our boat capsized and tossed all of the passengers and their bags into the river . We were carried away by the water for about 15 minutes before we were able to get rescued and climb back on land. While Dan and I didn’t need medical attention, we lost a lot of equipment, including a couple of laptops and cameras, several lenses, two hard drives, and our passports. Fortunately, we were able to contact Heymondo via their 24/7 app, and they helped us connect with the Spanish embassy to return to Spain for new passports. Plus, our policy included $750 dollars each for Dan and me to cover our lost equipment.

- A less dramatic but still terrifying incident occurred in Alaska when Dan’s drone hit a tree and fell on me, cutting up my hand . I got freaked out by all the blood, and, in a rush, we drove to the nearest hospital for medical care. If we had contacted Heymondo first, they would’ve arranged the medical payments in advance, but since we forgot to, we had to pay the $3,000 bill upfront. Heymondo quickly reimbursed us, of course, but imagine if we hadn’t had trip insurance!

- In Ecuador, Dan got a stomach sickness that led to a hospital visit. Luckily, with our cheap holiday insurance , we were covered for this emergency medical expense.

So yes, getting insurance is totally worth it! Best of all, there are affordable travel insurance plans out there, as you’ve seen in this guide, so there’s no reason not to get it.

Credit cards with cheap travel insurance benefits

The last thing I want to touch on involves getting cheap travel insurance with one of the best credit cards for travel . While not all cards have this benefit, some offer trip cancellation protection or reimbursement for lost or delayed baggage.

For example, the Chase Sapphire Preferred credit card is one option that offers cardholders coverage for trip cancellation and interruption, as well as baggage loss/delay coverage. So, if you’re thinking about buying cheap travel insurance that mostly covers medical-related expenses, you might want to look into a credit card with travel-related benefits.

That said, I still recommend investing in a good travel insurance policy, especially if you’re a frequent traveler. You can find the best deals on travel insurance by looking into any of the providers I mentioned in this guide.

FAQs – Cheap travel insurance

To end this guide, I’m sharing the answers to the most common questions about affordable travel insurance :

What is the best affordable travel insurance?

In my opinion, Heymondo has the best cheap travel insurance on the market, although it’s also worth looking at SafetyWing , IMG Global , Trawick International , and Travelex .

How much does travel insurance cost?

You can buy cheap travel insurance for under $10 per week, although the amount of coverage varies.

What are the different types of budget travel insurance?

You can find cheap medical-only travel insurance or affordable insurance with travel and medical-related coverage.

The best cheap travel insurance covers emergency medical expenses, repatriation, baggage loss/delay, and trip cancellation.

What’s not covered by cheap travel medical insurance?

Some budget travel insurance policies won’t cover pre-existing conditions or travelers over a certain age.

When should I get travel insurance if I’m on a budget?

You should purchase your travel insurance as soon as you book your holiday.

Is buying cheap travel insurance worth it?

Yes, even if it’s a cheaper travel medical insurance , it’s still worth getting. This way, you’re covered in case anything goes wrong during your trip, so you can focus on enjoying yourself.

I hope this guide helps you find the best affordable trip insurance for your needs. Don’t forget that you can save money on a Heymondo policy by using our link .

If you have any other questions about budget travel insurance , feel free to leave me a comment below. I’d be happy to help you out.

Until then, have a great trip, and don’t leave home without travel insurance!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Click here for our travel alert about the Israel – Gaza conflict. Due to the current conflict in Ukraine, our policies exclude coverage for any trips to Russia, Ukraine or Belarus. Check out latest travel alerts here before buying a policy.

InsureandGo Promotional Codes

Are you keen to save on travel insurance ?

We understand the true value of our customers and their passion for all things travel, and that’s why we offer regular discounts and promotional codes to help you save on your travel insurance purchases .

To redeem any active discount simply enter the code into the promo code box when buying online, or mention the code over the phone when booking with our customer service team.

If you don’t have a code, follow us on Facebook, we often have discounts on insurance, and you’ll stay updated with travel tips and trends .

We are offering you 10% off your travel insurance. Enter the code “Offer10” and save on your next policy.

Why Travel With Us?

Most Common Questions

Excess is the amount you pay us in the event of a claim being approved. Our excess applies per person, per event, per claim.

You can choose the excess you want ($100, $200, $0), but be aware this will change the price of your initial premium.

Under the InsureandGo Silver and Gold levels of cover, we will reimburse the cost of your necessary additional meals and accommodation expenses, if during a trip, any individual leg of your trip, is delayed for more than 12 hours, as long as you eventually go on the holiday.

The amount you can claim varies depending on the level of cover that you have purchased with us. Please refer to the policy wording documents for more information.

Our Gold policies cover your rental car excess up to $8,000 for International policies and up to $7,500 on Domestic policies. However, you need to make sure that the rental car is insured (confirmed by the rental company), as we do not pay for full damages to a rental car, only your excess. Please note, motorbikes are excluded.

You need to be in Australia at the time of purchasing your insurance. If you are overseas, we are unable to offer you new or different insurance. You may be eligible to extend the dates of your existing cover, so shoot us an email and find out.

A pre-existing medical condition is any condition for which you have received medical advice, treatment or medication in the last five years. Our policies cover many pre-existing conditions; to see if we cover yours, please complete our medical assessment online or over the phone. Please note, failing to declare a pre-existing condition can void your policy.

Our premiums would be astronomical if we could do that! There are limits and exclusions to all travel insurance policies, so we strongly advise you to read our product disclosure statement.

Follow us to keep up to date with competitions, giveaways and all things travel

**Children (including fostered, or adopted children) travelling with either their parents or grandparents will be provided with travel insurance cover for no additional cost (any pre-existing medical conditions may incur an additional charge). This is provided they are under 18 years of age, named on the Policy Schedule and are financially dependent on either their parents or grandparents.

Good To Go Insurance Discount Codes August 2024

Find working voucher codes, sales & offers.

Find the latest Good To Go Insurance discount code, sales and savings for August below - powered by our community of over 3 million bargain hunters. Promo not working? We're really sorry but let us know and you can earn free gift cards!

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Goodtogo Insurance 10% Discount Code at Good To Go Insurance

Good to go travel insurance 20% discount code at good to go insurance, 10% off travel insurance at good to go insurance.

Active Good To Go Insurance Offers

Hints & tips.

- What our expert thinks about Good To Go Insurance

How to use Good To Go Insurance discount codes

Good to go insurance sales, buyer's guide, good to go insurance overview, what does good to go insurance sell, frequently asked questions, delivery & returns.

- Good To Go Insurance Reviews

Alternatives to Good To Go Insurance

Looking to protect your holiday without breaking the bank? Why settle for overpriced cover when Good To Go Insurance offers travel policies tailored to all? From single trips to annual coverage, isn't it time you explored smarter savings? Dive into their deals, armed with discount codes, and isn't peace of mind on your travels worth shopping for discounts at Good To Go Insurance?

- All retailers

- Good To Go Insurance Voucher Code

Yes, Good To Go Insurance sometimes offers special discounts for first-time customers. It's wise to check their website or sign up for their newsletter to catch these deals.

Seasonal discounts are not consistently available at Good To Go Insurance. However, they may offer savings opportunities during certain times of the year, such as January or summer sales. Keep an eye on their website for any temporary seasonal discounts.

Good To Go Insurance values loyalty and occasionally rewards customers who renew their policies. While it's not a guaranteed discount, it's best to contact their customer service closer to your renewal date to enquire about any available loyalty discounts.

Saving money at Good To Go Insurance can be achieved through various means, including looking out for promotional codes, special offers through their newsletter, and bundling insurance policies. Comparing policies and choosing only necessary coverage can further help in saving costs.

Good To Go Insurance occasionally shares promotions and discounts through their social media platforms. Following their pages on platforms like Facebook or Twitter is a good strategy for catching any exclusive social media promotions.

- Make sure your destination is actually covered before fantasizing about sipping margaritas by the sea. Good To Go Insurance does wonders but doesn't cover Mars yet.

- Don't just wing it on travel insurance. Use Good To Go's straightforward quote system. It’s simpler than trying to understand British politics or why tea is superior to coffee.