- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- The Morning Brief

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Editor's Picks

- Investing Insights

- Trending Stocks

- Morning Brief

- Opening Bid

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Unwto and fdi intelligence report highlights global tourism investment surge with united tourism llc’s strategic expansion.

Global tourism investment surges in 2023, with United Tourism LLC playing a significant role in acquiring cultural assets and expanding its presence in Asia-Pacific.

LONDON; UK, Feb. 26, 2024 (GLOBE NEWSWIRE) -- Previously, the World Tourism Organization (UNWTO) partnered with the fDi Intelligence from the Financial Times jointly released the 2023 Global Tourism Investment Report. The report shows that from 2022, as the global tourism industry recovers, both the global tourism reception and investment in the tourism industry have been improving.

Data shows that in 2022, the total number of FDI (Foreign Direct Investment) projects in the global tourism industry increased from 286 in 2021 to 352, a year-over-year increase of 23%. The number of new jobs created by investment in the tourism sector is also growing. In 2022, the global tourism industry is expected to add about 36,400 new jobs from FDI, also a 23% increase compared to the previous year.

In the five years from 2018 to 2022, among the top ten investment enterprises in the global tourism industry, four are from Europe, three from North America, and three from the Asia-Pacific region. The leading global tourism investor is the UK’s Selina, which invested in a total of 90 FDI projects from 2018 to 2022. The second-ranked French Accor Group invested in 79 projects. Besides these top ten investment enterprises, the recovery of the global tourism market has also allowed more investment companies to see opportunities, starting the globalization layout of tourism assets.

Take United Tourism LLC, established in 2021, as an example. As a group enterprise spanning Asia, Europe, and America, it has established more than 50 offices worldwide, with over 500 partners covering aviation, hotels, asset management, the internet, and other fields, including more than 20 Fortune 500 companies, maintaining long-term cooperation with tourism bureaus of more than 30 countries. Recognizing the development potential of the global cultural tourism industry and the value of quality cultural tourism assets, in recent years, United Tourism LLC has continued to acquire or invest in high-quality assets through its wholly-owned subsidiary — Mass United Invest Ltd, improving its industrial chain layout. Up to now, it has accumulated cooperation with 180 cultural tourism IPs, participated in 30 asset restructurings, successfully returned 28 groups of assets to profitability, completed the construction of data for 200 cultural tourism RWA, and the assets on the blockchain have reached 500 million US dollars.

The report also shows that between 2018 and 2022, the Asia-Pacific region absorbed a total of 517 new FDI projects in tourism. The Asia-Pacific is also a key area where United Tourism LLC focuses its efforts. In 2023 alone, the group reached asset cooperation with the ancient city of Galle in Sri Lanka and arranged industries such as hotels and seaplanes on three islands including Cocoa Island and Digurah Island in the Maldives. In the future, it will continue to explore valuable cultural and tourism assets worldwide and create unique experiences and values for global travelers through international and diversified services.

During the period from 2018 to 2022, the new FDI projects in the hotel accommodation and tourism sector accounted for two-thirds of the entire tourism industry cluster. In 2022, the total number of FDI projects in the hotel and tourism sector increased by 25% year-over-year. As an important part of the tourism industry, hotels are directly related to the travel experience of tourists; hence, the hotel sector is also a key focus of United Tourism LLC’s layout. Apart from the acquisition of the Residensea Hotel on Digurah Island in the Maldives mentioned above, United Tourism LLC also successfully invested 8.55 million US dollars to become the second-largest shareholder of Sri Lanka’s leading hotel brand — Royal Mosvold Villa hotel.

Benefiting from policy-driven and the release of travel demand, the global tourism industry has experienced an explosive recovery, and more and more practitioners who left the industry have returned, showing the industry’s strong resilience. At the same time, technological innovation and the development of new technologies have made the innovation of the tourism industry more visible to people, and the value of tourism assets has become increasingly prominent, which has also attracted more capital and practitioners. Professional tourism companies like United Tourism LLC provide new momentum for the high-quality development of the tourism industry and also explore new development paths for the industry.

Company:UNITED TOURISM LTD Contact Person:Albert Bernard Email:[email protected] Website:https://www.unitedtourism.xyz

City:LONDON Disclaimer: Please note that any views or opinions presented in this press release are solely those of the source and do not necessarily represent those of KISS PR and its partners. Neither KISS PR or its partners are responsible for the accuracy or completeness of the information provided in this press release. People making any decision based on this press release's content are doing so at their own risk and are advised to contact the source company issuing the content, LinkTo Technology Ltd, for more information.

Should we be promoting tourism sector investment?

Kusi hornberger, hermione nevill.

When most people think of tourism, they think about a vacation to a new destination, an island retreat, a beautiful vineyard, or a hike in the mountains. They rarely think of tourism as a source of inclusive poverty reduction in the developing world.

Nkwichi Lodge in Mozambique is a good example. Investments to the projects created 75 jobs for locals supporting over 1,000 community members. It also established a community trust that built five local schools, a maternity clinic and a maize mill that provided nutrition and education to more than 350 farmers and their families. This is having a transformative impact on poverty reduction and improvements in the quality of life of some of the worlds poorest.

The potential of the tourism sector

The tourism sector is one of the priority sectors of the Investment Climate Advisory Services for investment generation and regulatory simplification. We and institutions like UNCTAD , as well as the World Economic Forum strongly believe this sector can boost competitiveness , expand economic opportunity and provide a pathway to prosperity in client countries. Unsurprisingly, developing economies like Haiti, Mozambique , the Solomon Islands, Yemen and Zambia recently prioritized tourism as a key target to produce economic growth.

But what makes the tourism sector so attractive?

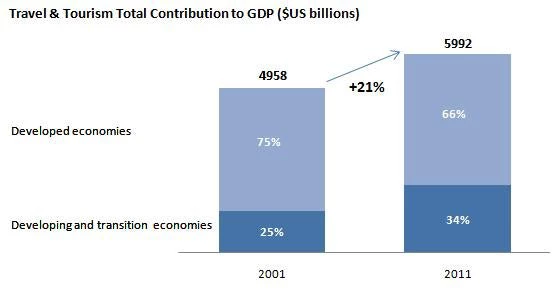

While the answer is not 100 percent clear, it is clear that the tourism sector is growing and in particular in developing in transition countries. Its total contribution to global GDP has grown by 21 percent in the last decade to$5,992 billion in 2011 (Figure 1).

Source: World Travel and Tourism Council (WTTC) 2011

The tourism sector has strong links to economic growth.

Economic (GDP) growth is of principal concern for all countries, particularly those engaged in poverty reduction as a means to spread wealth across the population. Empirical studies in countries as diverse as Barbados, Croatia, India, Taiwan and Turkey have shown a causal relationship between tourism development and economic growth. A cross country study by the IMF showed that an increase of one standard deviation in the share of tourism in exports leads to about 0.5 percentage point in additional annual growth, everything else being constant. Thus many governments (particularly low income economies) should view investing in its tourism industry as a means to stimulate growth over the long term and enabling the poor to share in economic gains.

Tourism investments can benefit local people

Tourism is one of the only industries in the world where the ‘good’ or ‘service’ is consumed at the site of production. For this reason, local people are both at an advantage to reap the benefits associated with the sector, but also at risk from exclusion or even the negative impacts it can bring. A well planned, regulated and responsible tourism can be an excellent mechanism of channeling resources from rich to poor - even at the large scale. Commercial tourism activities provide an opportunity for local people to participate in direct employment, in providing goods and services to tourism businesses through the supply chain, but also in direct interaction with the tourist (for example: crafts, excursions, food and beverage). The generation of earnings amongst those local people directly involved with the industry in turn stimulates indirect spend (of wages) in the local economy.

Tourism provides opportunities for economic diversification and skills upgrading

Developing countries can leverage tourism to support local companies and entrepreneurs in developing new products and exports. The tourism sector provides a means by which local entrepreneurs can experiment with new products and test them on international markets in their home country before exporting. International tourists typically create demand for products and services which may not have already existed in the local market and also demand certain quality standards. Whilst these can be a challenge to meet in the short-term, tourism creates the market and the incentive to drive the process – leading to growth and improvement over time.

Sustainably protecting environmental and cultural assets

Many developing countries have rich natural or cultural heritage assets such as national parks, coral reefs, rare species, ancient cities or monuments that are under threat. Often, states do not have the financial resources to allocate to the preservation of these areas and more creative ways of funding their protection must be sought. The revenue generated from tourism is one such solution – provided it is regulated and managed in a responsible manner.

- Competitiveness

Get updates from Private Sector Development Blog

Thank you for choosing to be part of the Private Sector Development Blog community!

Your subscription is now active. The latest blog posts and blog-related announcements will be delivered directly to your email inbox. You may unsubscribe at any time.

Investment Policy Officer

Join the Conversation

- Share on mail

- comments added

Towards resilience and sustainability: Travel and tourism development recovery

The travel and tourism sector is slowly beginning to recover. Image: Unsplash/Eva Darron

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Kate Whiting

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, davos agenda.

Listen to the article

- The World Economic Forum has published its inaugural Travel and Tourism Development Index .

- It focuses on the growing role of sustainability and resilience in travel and tourism growth.

- Recovery for the sector is uneven and tourist arrivals in January 2022 were still 67% below 2019 levels, according to the World Tourism Organization.

- Here are some key findings from the index on how the sector can build back better.

In 2018, international tourism grew for the ninth consecutive year. Tourist arrivals reached 1.4 billion and generated $1.7 trillion in export earnings, according to the World Tourism Organization (UNWTO).

Travel and tourism: post-pandemic

The picture looked very different two years later, as COVID-19 lockdowns hit the travel and tourism (T&T) sector hard. In 2020 alone, it faced losses of $4.5 trillion and 62 million jobs , impacting the living standards and well-being of communities across the globe.

While the roll-out of COVID-19 vaccines and easing of restrictions means a recovery has now started, it’s proving gradual and uneven largely due to variations in vaccine distribution, and because of Omicron and its BA.2 subvariant. And customers are not only being more cautious when it comes to health, but also around the impact of travel on the environment and local communities.

International tourist arrivals rose by 18 million in January 2022 compared with a year earlier. This equals the increase for the whole of 2021 from 2020, but January’s numbers were still 67% below the same month in 2019, according to the UNWTO.

The war in Ukraine has added to instability and economic disruption for the sector. Against this backdrop, the World Economic Forum’s inaugural Travel and Tourism Development Index reflects the growing role of sustainability and resilience in T&T growth, as well as the sector’s role in economic and social development more broadly.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The Travel and Tourism Development Index 2021

The index covers 117 economies, which accounted for around 96% of the world’s direct T&T GDP in 2020. It measures the factors and policies that will enable sustainable and resilient development of the sector.

These include everything from business, safety and health conditions, to infrastructure and natural resources, environmental, socioeconomic and demand pressures.

“As the sector slowly recovers, it will be crucial that lessons are learned from recent and current crises and that steps are taken to embed long-term inclusivity, sustainability and resilience into the travel and tourism sector as it faces evolving challenges and risks,” says the publication, a collaboration between many of the sector’s stakeholders.

The index consists of five subindexes, 17 pillars and 112 individual indicators, distributed among the different pillars, as shown below.

On average, scores increased by just 0.1% between 2019 and 2021, reflecting the difficult situation facing the sector. Only 39 out of 117 economies covered by the index improved by more than 1.0%, while 27 declined by over 1.0%.

Nine of the top 10 scoring countries are high-income economies in Europe or Asia-Pacific. Japan tops the ranking, with the United States in second, followed by Spain, France, Germany, Switzerland, Australia, the United Kingdom and Singapore. Italy completes the top 10, moving up from 12th in 2019.

Viet Nam experienced the greatest improvement in score, with a rise of 4.7% lifting it from 60th to 52nd on the overall index. Indonesia achieved the greatest improvement in rank, increasing its score by 3.4% to climb from 44th to 32nd, while Saudi Arabia achieved the second greatest improvement in rank, moving up to 33rd from 43rd as its score rose by 2.3%.

Rebuilding travel and tourism for a sustainable and resilient future

Here are some of the key findings from the publication:

1. The need for travel and tourism development has never been greater

The sector is a major driver of economic development, global connectivity and the livelihood of some of the populations and businesses most vulnerable to, and hard hit by, the pandemic. In 2019, T&T’s direct, indirect and induced GDP accounted for about 10% of global GDP . For many emerging economies, T&T is a major source of export revenue, foreign exchange earnings and investment. Research has shown that T&T growth can support social progress and create opportunities and well-being for communities, so supporting travel and tourism development and recovery will be critical.

2. Shifting demand dynamics have created opportunities and a need for adaptation

In the shorter term, challenges such as reduced capacity, geopolitical tensions and labour shortages are slowing recovery. However, opportunities have been created in markets such as domestic and nature-based tourism, the rise of digital nomads and “bleisure” travel – the addition of leisure activities to business travel. Many countries have provided incentives to boost domestic tourism. For example, Singapore, South Korea, Japan and Hong Kong SAR, China, have rolled out programmes that provide discounts, coupons and subsidies for domestic travel. The trends towards more rural and nature-based tourism offer an opportunity for less-developed economies to harness the benefits of travel and tourism given that the distribution and quality of natural assets are less tied to performance in economic development, with natural resources being one of the few pillars where non-high income economies typically outperform high-income countries. The travel and tourism sector stakeholders’ ability to adapt under these conditions highlights its capacity for adaptation and flexibility.

3. Development strategies can be employed to help the sector build back better

Amid the current challenges, shifting demand dynamics and future opportunities and risks, a more inclusive, sustainable and resilient travel and tourism sector can be – and needs to be – built, says the publication. But this calls for thoughtful and effective consideration. It also requires leveraging development drivers and strategies. This can be done by: restoring and accelerating international openness and consumer confidence through, for example, improved health and security; building favourable and inclusive labour, business and socioeconomic conditions; focusing more on environmental sustainability; strengthening the management of tourism demand and impact; and investing in digital technology.

A note on the methodology

Most of the dataset for the Travel & Tourism Development Index (TTDI) is statistical data from international organizations, with the remainder based on survey data from the World Economic Forum’s annual Executive Opinion Survey, which is used to measure concepts that are qualitative in nature or for which internationally comparable statistics are not available for enough countries. The index is an update of the Travel & Tourism Competitiveness Index (TTCI), but due to the altered methodology, framework and other differences, the 2021 TTDI should not be compared to the 2019 TTCI. To help address this, the 2019 results were recalculated using the new framework, methodology and indicators of the TTDI. Therefore, all comparisons in score and rank throughout this report are between the 2019 results and the 2021 results of the TTDI. Data for the TTDI 2021 was collected before the war in Ukraine.

Have you read?

How quickly is tourism recovering from covid-19, this is how the covid-19 crisis has affected international tourism, what covid-19 taught us about collaboration – 7 lessons from the frontline, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Forum Institutional .chakra .wef-zh0r2a{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;padding-left:0px;padding-right:0px;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-zh0r2a{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-zh0r2a{font-size:1rem;}} See all

Balancing growth and biodiversity: Why we need policy coherance on nature-based solutions

Andreas Obrecht and Akanksha Khatri

September 25, 2024

About 2.5 billion people lack internet access: How connectivity can unlock their potential

Heather Johnson

Mainstreaming food innovation – what will it take?

Tania Strauss and Shalini Unnikrishnan

The Intelligent Age: A time for cooperation

Klaus Schwab

September 24, 2024

Global Treaty to Protect Ocean Biodiversity: Why cross-sector collaboration is key

Katherine M. Crosman

5 mindset shifts for employers to tackle obesity and improve workplace well-being

Shyam Bishen and Dominik Hotz

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

A service from the Financial Times

- Search reports

- Sign in or Register

Select location(s)

Refine your criteria by source market . By default, all source markets are included.

Refine your criteria by destination market . By default, all destination markets are included.

Select industry(s)

Search and select an industry to refine your report criteria. Otherwise, all industries are included by default .

Select date

Select date range. Otherwise, the widest date range is included by default .

Select Company

Search and select a company. Please note, only one company can be selected at a time and only companies with more than 20 FDI projects will be displayed. Please contact us to discuss companies that fall outside this criteria.

See details

Select Tags

Search and select a tag/s. Please note, tags are only available on FDI projects from 2016 onwards .

Select Project type

Please select the project types

- Project Type

The fDi Tourism Investment Report 2023 PDF

September 14, 2023 fDi Intelligence

Investment in the global tourism cluster has started to bounce back from the lows it touched during the pandemic off the back of the steady recovery of international tourist arrivals, according to a newly released report jointly produced by fDi Intelligence and the World Tourism Organization (UNWTO).

Sign in Register

Sign up for our free newsletter

Sign up to receive our free fDi Intelligence newsletter so that you stay current with the latest trends driving crossborder investment and get access to our free whitepapers including The fDi Report.

- We will never sell your data

- Unsubscribe at anytime

- No spam, ever.

- IPAs & EDOs

- Corporates & Multinationals

- Consultants & Intermediaries

- Academics & Multilateral organisations

- How fDi Insights works

- Special Reports

- White Papers

The most comprehensive greenfield FDI tracking database on the market. Powering the most influential global FDI analytics, decision making and identify future opportunities and trends.

Assess the relative competitiveness of more than 900 locations across over 65 sectors to assess global footprint strategies.

Full range of investment promotion and research solutions. In-depth commentary and comprehensive data and intelligence since 2001.

Make better decisions and gain insights utilising our extensive database of FDI data and trends presented in easy to digest reports.

, ZoomProspector

Comprehensive information to help new, expanding, and relocating businesses find their best locations for success in your region.

Offer web visitors virtual tours of your location's most important features with our powerful, new cloud-based ZoomTour software.

Unlike traditional CRM systems, Amplify enables EDOs and IPAs to manage their entire investor life-cycle.

An FDI and economic development e-learning platform which provides practical tools you need to enhance your skills and knowledge as an economic developer.

Unique online contacts platform providing a complete solution for EDOs and IPAs to develop and implement an intermediaries strategy.

Global deal database tracking real-time financial incentives awarded to companies for foreign and domestic investment projects.

A suite of database platforms which track domestic investments and investor signals in Canada, and the UK.

Highly innovative solution to track all investment in your location, measure organisational performance and the quality and economic impact of investment, and to market your location to the world.

Shopping cart

Your shopping cart is empty.

0 items in the cart

Search for reports

Total £ ...

Payment failed.

Unfortunately your payment has not gone through. Please double check your payment information.

Delete publication

Are you sure you want to delete this publication?

Publications that are deleted will not be retrievable. Please make sure you want to delete before confirming.

Leave without saving?

You are about to leave a page you have entered information on. If you leave now, it will not be saved. Save as a draft instead to complete later.

Description

- Search Search Please fill out this field.

- Portfolio Management

5 Ways To Invest In Travel And Tourism

:max_bytes(150000):strip_icc():format(webp)/MHP-ChipHeadshot-2-d1d3928ade0f496abeb7411d3b2e1d4f.jpg)

Most consumers are familiar with the travel and tourism industry from using its services for some needed rest and relaxation during family and related vacations . However, these same activities can be invested in, with many publicly-traded firms offering travel activities for the end benefit of growing the capital of their underlying shareholders . Listed below are five areas of the travel and tourism market that could prove lucrative from an investing standpoint. It could also help committed travelers better understand the landscape and hunt down some travel deals.

Online Travel Providers

As with many industries, revenue continues to shift to the internet when it comes to providing travel and tourism services. Stock brokers have been replaced in large part with online trading platforms, while traditional travel agents have had to compete with online websites that allow consumers to shop for low prices and convenient schedules.

Leading online travel providers include publicly-traded players such as Orbitz, Priceline and Expedia. In particular, Booking Holding's Priceline has been highly successful in driving traffic to its website to book flights and bid for cheap, last minute travel deals.

The cruise line industry has been in existence for more than a century, but still is not that widespread as a travel choice for many consumers. Carnival, the largest cruise line operator in the world, has estimated that only 3.9% of the population in North America has ever been on a cruise. The percentages are even lower in many other areas of the world.

Capacity is also growing nicely; Carnival estimates the entire industry will see average annual capacity growth of roughly 6.8% through 2023.

The hotel industry is dominated by a couple of leading international players. This includes publicly-traded firms Marriott and Starwood Hotels, as well as privately owned Hilton. These companies announced their merger in 2015. They have largely blanketed their home United States market and are growing internationally. The chains have also pursued the managing of properties for hotel owners, as well as timeshares where they sell the rights for consumers to use their properties for a week, or more, during each calendar year.

Mega Resorts

Large resort operators combine the development of hotels with other entertainment and related amenities. Publicly-traded operators in this space include Ryman Hospitality Group, which owns the Opryland resort in Nashville and other properties in Texas, Florida and Maryland. It specializes in massive resorts that allow big travel groups to host conventions and other giant gatherings.

Vail Resorts owns some of the best-known ski resorts in Colorado and surrounding areas. This includes Vail Mountain, Breckenridge and Beaver Creek Resort. Of course, Walt Disney specializes in kid-friendly theme parks, hotels and entertainment complexes, such as Disney World in Florida and Disneyland in California.

Las Vegas-style gambling is growing rapidly across Asia. Macao has grown into the largest gambling market in the world and has seen the building of massive casino resorts from Las Vegas-based firms such as Wynn Resorts and Las Vegas Sands. Both are publicly traded companies. This growth is expanding to other parts of Asia, including Singapore, and potentially Vietnam and Japan.

The Bottom Line

These are just some of the many opportunities to invest in the travel and tourism industries across the world. Overseas growth, especially in emerging market economies , should continue to outpace that in more developed markets in North America and Europe. However, as with the online travel space, there will always be pockets that are picking up market share in every part of the world.

Booking Holdings. " Schedule 10-K 2019 ," Page 44.

Carnival Corporation. " Schedule 10-K 2019 ," Page 7.

Carnival Corporation. " Schedule 10-K 2019 ," Page 8.

Marriott. " Starwood Acquisition & Historical Information ."

Ryman Hospitality Group. " About Us ."

Vail Resorts. " Vail Resorts Reports Fiscal 2020 Third Quarter Results ."

Vail Resorts. " Who We Are ."

University of Nevada Las Vegas Gaming Research & Review Journal Volume 16 Issue 1. " The Boomerang Effect ," Pages 88-89.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1353798240-61bbcf6f183b4c42b709624686f44046.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

17 Travel & Tourism VC Investors Who Can Fund Your Startup in 2024

Evolving Travel Trends and Market Analysis

The pandemic not only gave rise to a new way of traveling but also changed how people want to travel, providing them with new opportunities. Investments in alternative accommodation startups and other businesses in this area have been on the rise, and this trend will continue.

With remote work now an option for most people, new growth opportunities for coworking, coliving, and traveling have emerged. There are also new alternatives to Airbnb , such as Kindred , which offers travelers a members-only home exchange network where the community can swap or share their homes to travel for a fraction of the cost.

Market Size and Growth

The global travel and tourism market is showing robust growth post-pandemic. According to the World Travel & Tourism Council (WTTC), the sector is projected to grow by 5.8% annually over the next decade, reaching $8.6 trillion in 2024. This recovery is driven by pent-up demand, easing travel restrictions, and a growing middle class in emerging markets.

Current Trends and Consumer Behavior

The pandemic has significantly reshaped how people approach travel, leading to new preferences and expectations. As travel begins to rebound, businesses must adapt to these changes to effectively meet consumer demands and capitalize on emerging opportunities. Here’s a look at the key trends that are currently influencing consumer behavior in the travel and tourism industry.

- Flexible Booking Policies: The uncertainty caused by the pandemic has led to a high demand for flexible booking options. Travelers prefer refundable bookings and the ability to change travel plans without penalties. According to Expedia’s Travel Trends Report , flexible booking options are a top priority for 78% of travelers.

- Remote Work and Digital Nomadism : The shift to remote work has led to a surge in digital nomadism, with more people combining work and travel giving rise to “ flexcations ”. Combining work and leisure, travelers are choosing destinations where they can work remotely while enjoying a vacation. This trend has led to an increase in demand for long-term rentals and accommodations with work-friendly amenities.

- Experiential Travel: There’s a growing preference for experiential travel, where travelers seek unique, immersive experiences rather than traditional sightseeing. This includes activities like culinary tours, cultural workshops, and adventure travel. Skift’s Megatrends 2023 report highlights that travelers increasingly seek personalized and authentic experiences that allow them to connect with local cultures and communities.

- Personalized Travel: Travelers are also looking for personalized travel experiences that cater to their individual preferences and interests. This includes tailored itineraries, unique accommodations, and bespoke tours.

- Technology-Driven Travel: The use of technology to enhance the travel experience is on the rise. This includes mobile check-ins, digital payment options, and virtual tours. Travelers rely heavily on apps and online platforms for booking, navigating destinations, and accessing travel information. The integration of AI and machine learning in these platforms helps in providing personalized recommendations and seamless travel planning.

- Sustainable Tourism: Sustainable tourism has gained significant traction as travelers become more environmentally conscious. Eco-friendly accommodations, carbon offset programs, and sustainable travel practices are in high demand. According to a report by Booking.com , 83% of global travelers think sustainable travel is vital, and 61% say the pandemic has made them want to travel more sustainably in the future.

Future Outlook: Technological Advancements Shaping the Travel and Tourism Industry

Rapid technological advancements and evolving consumer preferences will shape the future of the travel and tourism industry. For startups in this space, staying ahead of these changes is key to maintaining a competitive edge and meeting the needs of modern travelers. Here’s a look at what’s on the horizon.

Blockchain Technology

- Blockchain can revolutionize travel by providing secure and transparent transactions. It can improve the accuracy of booking systems, reduce fraud, and enhance data security. For example, blockchain can be used for secure identity verification and streamlining payments and loyalty programs.

- Startups can leverage blockchain to create decentralized travel platforms, reducing reliance on intermediaries and lowering costs for travelers. Companies like Winding Tree are already pioneering decentralized travel marketplaces, allowing direct transactions between suppliers and consumers .

Artificial Intelligence (AI)

- AI can analyze vast amounts of data to provide personalized travel recommendations and experiences. Chatbots and virtual assistants powered by AI can offer 24/7 customer service, helping travelers with bookings, itinerary changes, and travel advice.

- AI can optimize operations for travel businesses by predicting demand, managing inventory, and automating repetitive tasks. For instance, AI-driven analytics can help airlines and hotels forecast occupancy rates and adjust pricing strategies in real-time.

Virtual Reality (VR) and Augmented Reality (AR)

- VR and AR technologies can offer immersive previews of travel destinations, helping travelers make informed decisions. VR tours of hotels, attractions, and destinations can enhance the booking process.

- AR can enhance travelers’ experiences at destinations by providing interactive guides, real-time language translation, and augmented reality tours. For example, AR apps can overlay historical information and directions onto real-world environments, enriching the travel experience.

Internet of Things (IoT)

- IoT can create a seamless travel experience by connecting various devices and services. Smart luggage that tracks its location, hotel rooms that adjust settings based on guest preferences, and connected transportation systems are some examples.

- IoT can help travel businesses monitor equipment performance, manage energy usage, and enhance guest safety and convenience. For instance, airports can use IoT to track baggage and improve security systems.

Journey Ventures

- Location : Israel

- About : Journey Ventures is a multi-stage VC dedicated to the booming Travel Tech industry. Travel is one of the world’s fastest-growing sectors. Travel startups of the last few years have already disrupted some of the largest sectors in our industry, a momentum we expect to continue. This large market of ever-increasing Travel Tech offerings is ready for smart investments, and Journey Ventures is an expert in the field.

- Thesis: Our goal is to develop a portfolio of Israeli and international companies specializing in the fields of tourism, travel Tech and the hotel industry that have reached an advanced stage of technological development.

- Investment Stages : Pre-seed, Seed, Series A, Series B, Series C

- Roomerang LTD

Related Resource: 9 Active Venture Capital Firms in Israel

MairDuMont Ventures

- Location : Stuttgart, Germany

- About : MAIRDUMONT VENTURES is the venture capital arm of the MAIRDUMONT Group and has been supporting digital travel companies in their future growth since 2015. MAIRDUMONT VENTURES uses its unique sector focus “Travel” to dive deeply into different business models and to evaluate potentials together with our portfolio companies. We have extensive know-how and can leverage the huge network of the MAIRDUMONT Group – with well-known brands such as Marco Polo, DuMont, Baedeker, Kompass or Falk – to offer our portfolio companies not only financial resources, but also strategic and operational support. We invest in fast-growing, early-stage and innovative companies that revolutionize travel. These can be solutions for end customers (B2C) as well as business customers (B2B).

- Paul Camper

Related Resource: 8 Active Venture Capital Firms in Germany

JetBlue Technology Ventures

- Location : San Carlos, California, United States

- About : JetBlue Technology Ventures invests in and partners with early stage technology startups improving the future of travel and hospitality.

- Thesis : We invest in and partner with early stage startups improving travel and hospitality.

- Investment Stages : Seed, Series A, Series B, Growth

500 Startups

- Location : Mountain View, California, United States

- About : 500 Startups is a global venture capital firm with a network of startup programs headquartered in Silicon Valley.

- Thesis : Uplifting people and economies through entrepreneurship

- Investment Stages : Seed, Series A

- Location : Venice, California, United States

- About : At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

- Investment Stages : Seed, Series A, Series B

Thayer Ventures

- Location : Valencia, California, United States

- About : Thayer Ventures invests in Travel Technology.

- Thesis : We invest in early-stage travel and transportation technology.

- Snapcommerce

Structure Capital

- Location : San Francisco, California, United States

- About : Structure Capital help passionate teams build great companies by investing seed-stage capital, time, experience and relationships.

Portugal Ventures

- Location : Porto, Lisboa, Portugal

- About : Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

- Thesis : We invest in companies in the seed and early stages operating in the digital, engineering & manufacturing, life sciences and tourism sectors.

- Investment Stages : Pre-Seed, Seed, Series A

- DefinedCrowd

- Sleep & Nature

aws Gründerfonds

- Location : Vienna, Wien, Austria

- About : Venture Capital for Ideas and Innovations aws Founders Fund invests venture capital during the start-up and early growth phase of Austrian start-ups. We offer support for your future (financial) plans as a long-term investor and partner and believe in the additional value of co-investments.

- CheckYeti.com

VentureFriends

- Location : Athens, Attiki, Greece

- About : VC fund based in Athens but investing across Europe, we focus on FinTech, Travel, PropTech, B2C & Marketplaces. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach

- Thesis : We are entrepreneurial investors who love to support startups and help them become impactful companies with a worldwide presence.

- Investment Stages : Seed, Series A, Series B, Series C, Growth

- Welcome Pickups

Travel Impact Lab

- Location : Utrecht, Netherlands

- About : Travel Impact Lab helps start-ups to get started and sets existing travel organizations in motion.

- Investment Stages : Accelerator

Travel Capitalist Ventures

- Location : Irvine, California, United States

- About : Travel focused Venture Capital and Private Equity Investor.

- Thesis : We identify, invest and help travel companies rapidly and sustainably expand.

- Investment Stages : Seed, Series A, Growth

Alstin Capital

- Location : Munich, Bayern, Germany

- About : Alstin Capital is an independent venture capital fund based in Munich. We invest in rapidly growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. We not only invest in convincing technology, but above all in the entrepreneurs behind the technology. We support our entrepreneurs with capital and know-how so that they can grow faster and more successfully. Our investment is based on the conviction that entrepreneurial know-how, many years of transaction experience, international networks and sales excellence are the success factors for sustainable growth. Our team brings a variety of complementary strengths to help make any investment a success.

- Location : Hamburg, Germany

- About : We believe venture capital will make the best returns if you invest in the big future markets. Therefore we are strong believers in Tech (managed by Norbert Beck), Brain Computer Interface (managed by Florian Haupt) and pharma to prevent age related disease and prolong healthy human lifespan managed by Nils Regge with the investment vehicle Apollo.vc.

- DreamCheaper

Howzat Partners

- Location : London, England, United Kingdom

- About : We are looking to invest in and build internet businesses that have a “HOWZAT” factor. This may sound a little trite; but we see major changes caused by the internet and the opportunities are genuinely exciting. The right idea; the right business; the right time; should generate the “HOWZAT” feeling. David felt it when he came across Cheapflights and was involved in acquiring the Company in 2000. We are seeking the same feeling again in the investments we make.

Slow Ventures

- About :Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Thesis : Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Location: London, England, United Kingdom

- About: We are the innovation team at International Airlines Group, one of the world’s largest airline groups and home to iconic brands in the UK, Spain and Ireland. We are on a mission to transform aviation, helping test and scale high impact emerging technologies across our group. We scout for and partner with leading entrepreneurs to fund, support and scale solutions with the potential to transform the way we do things.

- Investment Stages : Pre-Seed, Seed, Series A, Series B

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors .

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here .

- Event Calendar

- Art Museums & Galleries

- Theaters & Performances

- Cultural Centers/Organizations

- Pick-Your-Own-Harvest Chart

- Farm Fresh Specialty Shops

- Farm Fresh Recipes

- Farmers Markets

- Dutchess County Passport

- Historic Sites & Museums

- Haunted History Trail

- Distilleries

- Restaurants

- Wineries, Cideries & a Meadery

- Specialty Food Shops

- Drive-In Movie Theaters

- Fun For All

- Parks & Gardens

- On the river

- Hunting, Fishing and Shooting Sports

- Motorcycling

- Scenic Tours

- Racquet Sports

- Antiques & Auction Centers

- Boutiques & Gift Shops

- Bookstores & Specialty Shops

- Shopping Malls & Flea Markets

- Experience Passes

- B&Bs & Inns

- Campgrounds

- Hotels & Motels

- Overnight Packages

- Brochures & Guides

- Cities, Towns and Communities

- Emergency Services

- Request info

- Getting Here

- Itineraries & Tours

- Tourist Information Centers

- Accessible Travel

- Commander in Cheers

- College Visit

- Family Friendly

- LGBTQ+ Friendly

- Dutchess in All Seasons

- About Dutchess County

- About Dutchess Tourism

- Local Resources & Permits

- Qualified Production Facilities

- SmugMug Location Gallery

- Productions Filmed in Dutchess

- Testimonials

- Press Releases

- Dutchess in the News

- Information & Resources

- Partner with us

- Workshops & Events

- Economic Impact of Tourism

- Hospitality Heroes

- Simpleview Extranet Access

- Featured Videos

- Air Dutchess

- Video Archive

Dutchess County’s Tourism Industry Shows Strong Growth | More than $2 Million a Day Spent by Visitors in 2023

Dutchess County’s tourism industry continues to thrive with significant growth in visitor spending, job creation, and investment in attractions and amenities which increase residents’ quality of life. Data from the recently released 2023 Hudson Valley Tourism Economic Impact Report from Tourism Economics, an Oxford Economics company, highlights Dutchess County’s steady climb as a premier destination in New York State, underscoring the importance of tourism as a driving force in the local economy. Last year, the revenue generated from visitors to the county grew to more than three quarters of a billion dollars, reflecting a 7.1% increase year over year, with an average of more than $2 million spent daily. The record $756 million spent in 2023 was $50 million higher than the previous record set in 2022.

Melaine Rottkamp, president and CEO of Dutchess Tourism, Inc. (DTI), emphasized the importance of tourism to the county’s economic well-being and the collaborative efforts behind the organization’s success driving visitors to the region. “Tourism plays an indispensable role in the strength and vitality of our community. The hard work and dedication of our staff, board of directors, marketing partners, hospitality businesses, funders and ambassadors ensures that Dutchess County remains a top-tier destination for visitors from all over the world.”

She noted that DTI continues to leverage its proximity to key drivable markets while also targeting new opportunities through outreach to underrepresented groups. Additionally, international sales missions and partnerships with I Love NY and Brand USA increased interest from global markets such as Australia, New Zealand, Germany and the United Kingdom.

Visitors to the county also contributed $93 million in local and state taxes, which were then reinvested into government programs such as those supporting parks and trails, roads and bridges, essential services, workforce development, youth programing and mental health. Without this net new money generated by visitors, each household in Dutchess County would need to pay an additional $817 in taxes to make up for the loss.

Sarah Lee, CEO of Think Dutchess Alliance for Business, said, “Dutchess County has evolved into a major hospitality hub, attracting investment from a number of businesses looking to serve visitors and especially to meet the growing demand for lodging, meeting and event space.” These include the Dassai Blue Sake Brewery and The Inn at Bellefield, a 137-suite hotel across from The Culinary Institute of America in Hyde Park, as well as The Heartwood at the Vassar Institute for the Liberal Arts, and Home2 Suites in Poughkeepsie. In 2023, Dutchess County collected a record-breaking $4.5 million in occupancy taxes.

With that comes 9,854 tourism-related jobs, accounting for 9% of the county’s workforce. These come from a wide variety of sectors including hotels, restaurants, museums and historic sites, theaters and galleries, farms and craft beverage producers, as well as sports, festivals, parks, gardens and trails. Additionally, these jobs generated $389 million in wages, more than $10 million over 2022 earnings. Those wages are then spent back in the local economy on essentials like groceries, housing, transportation, clothing and other everyday expenses, further increasing the ripple effect of tourism.

Dutchess County Executive Sue Serino noted, “Tourism is a key component of Dutchess County’s economy and supporting our hospitality industry — comprised of so many small businesses — is essential for our stability and growth.” She added, “Dutchess Tourism’s award-winning efforts have helped elevate the county’s tourism offerings, resulting in an improved quality of life for residents in addition to attracting new visitors and those who return time and time again to our beautiful corner of the Hudson Valley.”

About Dutchess Tourism Dutchess Tourism, Inc., the officially designated destination marketing organization for Dutchess County, is accredited by the Destination Marketing Accreditation Program (DMAP) of Destinations International. As a 501(c)(6) non-profit organization, it works to bring tourism dollars to area businesses and the community by marketing and promoting the assets of Dutchess County to the nation and the world. DTI has 20 Tourism Information Points located around Dutchess County to assist visitors with resources and information. Dutchess Tourism, Inc. is partially funded by monies received from the County of Dutchess. DutchessTourism.com

Thank you for your interest in Dutchess County! How can we help you?

* Required By opting in, you are consenting to receive marketing emails from Dutchess Tourism, Inc. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact.

Thank you for reaching out to Dutchess Tourism, Inc. Due to the volume of inquiries, please allow 48 hours for a response. For immediate assistance, please call our main line at (845) 463-4000.

Don't forget to sign up for our monthly newsletter to receive the latest news, top attractions and upcoming events in Dutchess County. For more travel inspiration, view our digital Destination Guide .

Our top priority is the safety, health, and wellbeing of our community, its residents and visitors.

Travel, Tourism & Hospitality

Travel and tourism: capital investment worldwide 2019, by country

Capital investment in the travel and tourism industry in leading countries worldwide in 2019 (in billion u.s. dollars).

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

February 2020

Includes capital investment spending by all industries directly involved in travel and tourism. This also constitutes investment spending by other industries on specific tourism assets such as new visitor accommodation and passenger transport equipment, as well as restaurants and leisure facilities for specific tourism use. Figures show nominal prices. Release date is date accessed.

Other statistics on the topic

- International tourist arrivals in Hungary 2009-2023

Accommodation

- Tourist arrivals in accommodation in Budapest 2000-2023

Leisure Travel

- Leading international tourist markets arriving in Hungary 2023

- Number of outbound trips from Hungary 2008-2023

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in Hungary "

- Number of foreign arrivals in tourist accommodation in CEE 2013-2022, by country

- Inbound visitor growth in CEE 2020-2024

- Inbound tourist arrivals growth in CEE 2021-2026, by country

- Travel & Tourism market revenue in Hungary 2017-2028, by segment

- Share of the GDP of the tourism sector in Hungary 2013-2028

- Gross value added (GVA) of tourism industries in Hungary 2010-2022

- Accommodation services and hospitality's share in GVA in Hungary 2015-2022

- International tourist expenditure in Hungary 2009-2023

- International overnight tourist arrivals in Hungary 2009-2023

- International same-day tourist arrivals in Hungary 2009-2023

- Share of inbound overnight tourist trips to Hungary 2023, by region visited

- Share of inbound tourist spending in Hungary 2023, by type of expense

- Total number of days spent by foreigners in Hungary 2018-2023

- Domestic tourist spending on overnight trips in Hungary 2008-2023

- Number of overnight domestic tourism trips in Hungary 2008-2023

- Number of domestic overnight tourism trips in Hungary 2023 by motivation

- Nights spent on domestic trips in Hungary 2014-2023