- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Business Travel Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is business travel insurance?

Why should business travelers get a business travel insurance policy, does travel insurance cover business trips, what is business travel accident insurance, do credit cards offer business travel insurance, business travel insurance, recapped.

Imagine the following scenarios. You’re meeting potential clients in their city in the morning, but your checked back, including your suit, didn’t make it. You’re giving a presentation, but some equipment has been stolen out of the hotel conference room. You got food poisoning from a restaurant where you had a business lunch and now require medical attention.

When going on the road for business, the last thing you want is to worry about these types of situations.

Business travel insurance provides coverage for the trips you take as part of your business or for a company that employs you. Knowing that some things don’t always go as planned during travel, you might find yourself benefitting from a business travel insurance policy.

Just like personal trip insurance , business travel insurance covers the unexpected during a business trip. A business travel insurance policy can help get reimbursements for travel expenses caused by trip delay and interruption , baggage delay, business equipment theft, emergency medical care, emergency medical evacuation and collision damage insurance for a rental car.

Depending on how often you travel, it's possible to get an annual insurance plan that will cover multiple trips or insure select travel on a trip-by-trip basis. An annual travel insurance plan is more cost-effective, but it might have lower limits than a single-trip policy.

The short answer is because you can never predict anything. The long answer is that it’s good for the following:

Reducing out-of-pocket expenses: One thing gone wrong, and you’re on the hook for unforeseen travel expenses. For example, medical evacuation can cost tens of thousands of dollars, so it’s important to keep those potential financial losses at bay when possible.

Increasing existing coverage: If you have a personal medical insurance plan, it’s important to note that most private insurance providers don’t provide medical coverage abroad. A credit card with travel protections can be a good start, but these benefits typically offer lower coverage limits.

Providing peace of mind: Having insurance can take some of the anxiety out of traveling. Even if the business trip is going according to plan, you'll know that you have safety nets in place should anything go awry.

» Learn more: How to find the best travel insurance

It depends. Some corporations offer travel insurance plans for their employees on the road. You should double-check with the human resources manager of your company as to whether business trips are covered.

It gets tricky if you’re an independent contractor or a freelancer since you don’t have a corporation behind you. As a sole proprietor, make sure to consult with your insurance provider, but be aware that a personal travel insurance policy might not cover business travel.

Instead, we recommend looking into business travel insurance that will cover your personal trips as well.

For example, the annual AllTrips Executive insurance plan from Allianz covers all trips for the year — personal and business — for a one-time fee. This becomes especially handy when you decide to mix business with pleasure and extend a work trip by adding on a few vacation days.

This policy covers trip emergency medical coverage for up to $50,000 and emergency medical transportation for up to $250,000. Travel delay is covered up to $1,600 and baggage loss or delay is covered up to $1,000 each.

An important feature offered by the AllTrips Executive plan is business equipment coverage. If it’s lost, stolen or delayed by the airline, equipment rental or replacement will be covered up to $1,000 each.

AIG Travel Guard , IMG Global and Zurich all offer business travel insurance, too.

Business travel accident insurance covers you in the event of the unthinkable — death or dismemberment. If it sounds like life insurance, it’s because it provides similar coverage but for when you’re traveling on a common carrier, such as an aircraft, a train, a bus or a cruise ship.

If you or someone in your family holds a life insurance policy for you, business travel accident insurance is going to pay out on top of it.

Some travel rewards credit cards offer travel coverage , but it isn’t always on par with a dedicated business travel insurance plan.

For example, the Ink Business Preferred® Credit Card and the United℠ Business Card offer primary auto rental collision damage waiver on cars rented for business purposes. To receive coverage up to the cash value of the car, you must decline the rental company’s own collision damage insurance and pay for the rental with one of these credit cards.

Note that trip cancellation and trip interruption are covered up to $5,000 with the Ink Business Preferred® Credit Card , but trip delay maxes out at $500. Although the United℠ Business Card comes with the same trip delay coverage limit, trip cancellation and trip interruption top out at up to $1,500 per ticket. Baggage delay is limited to $100 per day under both cards’ coverage.

The Business Platinum Card® from American Express offers the same secondary coverage for trip interruptions and trip cancellations: up to $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. For trip delay, the card covers up to $500 per covered trip up to two times per 12 consecutive month period. Terms apply.

Although some insurance coverage offered by your travel rewards credit card is good to have, as you can see above, the coverage limits are typically lower than if you were to buy an annual policy or a single-trip business travel insurance policy.

Credit cards also offer common carrier travel accident insurance and cover costs in case of accidental death and dismemberment. In this case, the first two of the aforementioned cards include coverage for up to $500,000, which is higher than what some annual or single-trip business travel insurance policies usually cover.

» Learn more: The best travel credit cards right now

Business travel accident insurance covers costs accrued in the course of business travel related to medical emergencies, accidental death and dismemberment and emergency evacuations. Specific coverage will vary by insurer.

Given that business travel is typically undertaken with specific business goals in mind and requires companies to take on overhead, travel insurance is likely worth the fraction of trip expenses that it costs to ensure that a company doesn't lose both cash and opportunity at the same time should things not go as planned.

Business travel insurance costs will vary based on the destination, duration of the trip, age of the traveler and the amount of money spent on the trip, among other factors. Some insurers offer annual plans, while others provide coverage on a trip-by-trip basis.

While specific coverage will vary from insurer to insurer, a business travel accident policy typically covers expenses related to medical incidents that occur in the course of the covered business travel.

If you have a personal travel insurance policy, check the terms to see how much applies to business travel. If none, consider purchasing an annual insurance plan for frequent business trips or a single-trip policy for occasional business travel and check with your company to see if the cost of the travel insurance is something you can expense.

Remember that some credit cards offer travel insurance for your business, but note the low payout limits if you choose not to purchase additional coverage.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The complete guide to corporate travel policies

The business travel policy guide you’ve been waiting for .

Creating a business travel policy for employees can feel really daunting. You don’t want to just throw something together and hope for the best, but it feels impossible to anticipate every possible scenario. The truth is your policy serves as more than a rule book; it's a guide to better decision-making about your corporate travel program and can save you a world of headaches down the road.

Introduction

What is a travel policy .

- Why do you need a travel policy?

- How to create a travel policy

What to include in a travel policy

- Travel policy best practices

- How to promote travel policy compliance

- How to market your travel policy

When to review and update your travel policy

- Final thoughts

When it comes to company travel, a travel policy brings it all to one place. It acts as an influencer for travelers to make the most cost-effective choices, an important visibility tool for your managers and HR department, and it protects your people if it’s done right.

If you’re new to business travel or haven’t looked at your travel policy in a while, we’ll start with the basics and then move into the nitty gritty of corporate travel policies. We’ll touch on a few best practices for writing a travel policy, what to include, and offer plenty of resources along the way.

Ready to get cracking? Let’s go!

A travel policy is a guide for business travelers to follow that outlines:

- How, where, and when to book

- Approved technology for travel management

- Preferred suppliers for air travel, land travel, and accommodations

- Approvals process for out-of-policy bookings

- Trip extensions and personal travel

- Expenses and what is covered or not covered

- Reimbursement processes

- Business travel insurance information

- Emergency procedures and contacts

Your company’s travel policy should reflect your company culture and values, be supportive of your travelers and their needs, and protect your company from unforeseen circumstances. It acts as a central document that guides your team to the processes of embarking on company business travel, from start to finish!

While you might hear a few grumbles and groans around the words “policy” or “process,” don’t worry! A travel policy does not need to be rigid and inflexible.

Do your travelers prefer to book on their own? Don’t take away their autonomy. They can still self-book, you’ll just provide them with a better tool and way to do it more efficiently.

Do your people feel prepared for any event that can cause a travel hiccup? With a travel policy, you can give them clarity and help them feel more prepared when traveling for business purposes.

Why do you need a travel policy?

Your travel policy is an extension of your travel program and company culture. It’s the glue that holds your travel program together – from approvals, expenses, booking processes, and emergency contacts.

Having a travel policy helps you:

- Control travel costs

- Determine how reimbursement works

- Compile a list of trusted and approved travel vendors

- Manage an employee’s travel experience and safety

- Cut rogue bookings – and simplify approvals

- Budget, report on travel expenses and activity and reconcile bookings

It’s a roadmap or guidebook that your travelers can reference when they’re booking their own travel if they run into a tricky situation abroad, and it helps provide clarity around processes.

As a company though, your travel policy helps centralize your travel program, makes data and tracking more accurate and easier to navigate, and it saves time and money (including on expense management). Plus, if you take the time to craft your policy in an intentional and inclusive way, you’ll have a policy your travelers are happier to follow.

How to create a travel policy for employees

- Determine business travel guidelines

- Create a travel policy that puts your people first

- Set reasonable budget limits

- Simplify the process of expense claims

- Adopt a user-friendly all-in-one travel platform

Once you’ve read through our tips, be sure to download our free travel policy template so you can get started on creating a travel policy of your own!

1) Determine corporate travel guidelines

When you take the time to create a policy that meets the needs of your business, you are making sure that your travelers are safe, costs are controlled, and you’ve made every business trip count.

Start by looking at what types of travel are allowed and the reason for each trip.

If you have team members traveling all over the globe, you might want to set some extra safety measures. You should also decide if there will be restrictions on the type of ground transportation used or where employees can stay.

Create a process for booking flights, hotels, and other ground transportation needs. How far in advance should they be booking? Do different rules apply based on the traveler’s position? Who is the point of contact for bookings and other travel questions?

Making sure to include your company’s travel insurance info is also important. Make sure to note if your policy covers medical expenses and/or any losses due to cancellations or delays in transportation services due to factors outside an employee’s control.

Do you have a policy for reporting and documenting expenses? This includes having a system in place for claims (like meal expenses) and a reimbursement process, so your team can easily get their money!

2) Create a travel policy that puts your people first

You’ve heard the term “duty of care” before, so it’s important to create a corporate travel policy that puts traveler safety and accessibility needs first. You’ll need to define and assign the roles and responsibilities of everyone involved, including a travel manager, if you have one.

Set up an emergency plan and provide access to traveler safety information. Determine who is the emergency contact (your TMC?) and how to get in touch. Do they have 24/7 emergency support available by phone or chat? What about email support?

Invite your HR department, the travelers themselves, and your DE&I manager into a discussion to find out what needs your team has as individuals, what hiccups they face when traveling, and what holes exist in your travel program that make it difficult to navigate.

Working with a TMC is a great way to ensure travelers are kept safe before and during their trip.

3) Set reasonable budget limits for business travel

You have a budget you need to adhere to, but is it realistic? Setting reasonable budget limits is key to an effective policy.

Your budget should account for all travel-related expenses, including airfare, accommodation, meals, and ground transportation. And once you’ve set your budget, you can determine reasonable costs for hotels and accommodation, ground transport, flights, and more. Build these caps into your travel booking software to help travelers stay within the set parameters, which will later help with accountability.

It's important to set clear rules on what the company can pay back and what types of expenses are out-of-pocket.

If you’ve set a maximum daily rate for meals on work trips, it's crucial that travelers understand the limit before racking up additional charges. Requiring receipts can also help keep track of employee spending and make sure they're not going over budget.

By working with a travel management company like Corporate Traveler, you can review your previous year’s expenses and find where you can optimize or make changes based on market changes.

4) Simplify the process of expense claims

If you're unfamiliar with how to write a travel expense policy, creating a simple process for claiming expenses is key to getting your team on the same page. Do you have access to a payment system that pays for the majority of expenses at the time of booking? This could be a good way to save time and stress down the road.

The more you can pay for before your travelers get to their destination, the easier everything is to reconcile after they get home.

If you have a person in charge of reviewing expense reports and watching pre-trip approvals, make sure to set criteria for claim approvals and look at automating processes to make approvals simple!

5) Adopt a user-friendly all-in-one travel platform

Finding the right corporate travel platform is essential. The right booking platform can provide travelers with an easy-to-use experience, giving them access to the best fares and availability.

For example, at Corporate Traveler, we use Melon . It’s a booking tool, reporting suite, travel policy pusher, traveler profile manager, and so much more. Melon features a “recommended spend” function, which helps keep travelers booking in policy. Hello, visual guilt!

Melon’s simple user interface, combined with dedicated travel consultants and expert 24/7 support, makes it simple to book, manage, and keep track of your business travel. You’ll be able to access Melon-exclusive deals and perks (alongside many negotiated contracts and online deals) and take care of all your travel needs from one place.

From the get-go, you’ll be able to work closely with our team to ensure that all of your needs are met. We'll help you customize your travel program to meet specific business needs, build your travel policy into the platform, and offer training to staff to help them along the way.

Putting it all together

Wow! You’ve reached the end and should have a better idea of how to write a corporate travel policy. High five! Now it’s time to put it all together and get it on paper.

Maybe you already have something in place that needs some work or an entire overhaul. Check out our easy-to-use template and start checking those boxes!

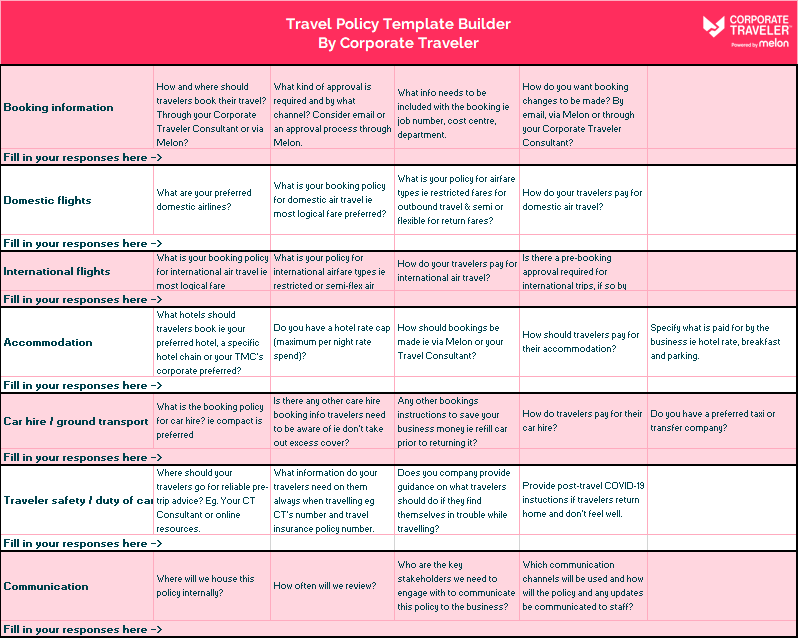

Grab our corporate travel policy template builder

Not sure where to start? No worries! We’ve got you. Here’s how to streamline your process with a travel policy template!

While there’s no one-size-fits-all travel policy for every company, following the set guidelines helps you nail a perfect-for-you policy that can see you through an ever-changing travel climate.

Travel policy template

When you’re crafting your business travel policy, there are so many considerations to be made. Things might come up that you never even thought of, but not to worry. We have loads of resources to help you see this through.

Starting out, it might be looking a little drab and wordy, but depending on your travel program size, a visual travel policy might be just what you need. You can search for examples online or take a look at an example of a visual travel policy we’ve created.

When building your policy, it’s important to include:

1. International or foreign travel policies

When you’ve got travelers all over the globe, you need to build out a policy for international or foreign travel. This is a protects them (and you) on anything from travel safety, to expenses, and everywhere in between.

Whether your travelers are individuals or entire teams, your international travel policy needs to cover:

- How and where to book – is that with a travel manager, online booking tool, a travel management company (TMC) ?

- Travel insurance coverages and contact info – international numbers and policy information

- Emergency contacts – how to reach them and the process of in-destination emergencies

- Travel expenses – limits and how to file for reimbursement

- Travel documentation – who to contact with questions

- Advance booking timelines – when should they be booking for international travel?

- Travel extensions – are these allowed and what are travelers expected to cover if they choose to extend their trip for leisure?

By outlining all of this information in your policy, you’ll streamline the process for your finance teams, travel managers, and your travelers. And really, who doesn’t want to make travel a smoother experience?

2. Corporate travel policy for business class travel

Does your corporate travel program have different rules, limits, or allowances for different levels of seniority? Are some junior members expected to travel in economy class, while some executives are allowed to book in business class?

If some certain exceptions and situations might allow for an employee to book business class, regardless of their position, you should include that in your policy as well.

Making this as clear as possible will avoid an approvals nightmare down the road.

3. Corporate meal allowance policy

It’s great if you’ve already centralized most of your business travel expenses like flights, accommodation, transportation, and car rentals, but your people gotta eat! It’s super important to include a meal allowance policy that clearly outlines which meals (and how much) you’ll cover.

Some of your team might be traveling with corporate credit cards, while others might need to be reimbursed. The guidelines and procedures for submitting expenses or asking for reimbursement need to be crystal clear!

Make sure to outline if you have a corporate travel policy for alcohol, too! You don’t want murky policies when it comes to footing the bill for drinks.

Some things to consider for your meal allowance and alcohol travel policy:

- Which meals are covered and for how much?

- Who is footing the bill for an alcoholic beverage with dinner?

- If entertaining clients, what is the budget, and how flexible is it?

- What is the process of submitting company card expenses?

- What is the process for requesting reimbursement?

Your team will always have questions about the policy on food and drinks, so make sure they can find the info easily and have a point of contact for whoever can offer more clarity.

4. Executive travel policy

We briefly touched on executive travel when we talked about traveling in business class, but there is certainly more to the top dogs traveling.

Executive travel can be a touchy subject if there are more lenient policies in place than there is for less senior team members. Your executives also may need to know the guidelines in place for their own travel, so they don’t accidently go overboard, which could be an accounting nightmare!

You’ll need to make sure you deliver a guide for approvals, procedures, booking deadlines, meals, accommodation, basically everything.

Lay it all out. Make your policy as digestible as possible, and for a busy exec, consider bullet points and titles in bold so they can easily skim to the areas they need to know.

5. Natural disaster or COVID-19 business travel policy

We can all agree that COVID-19 caused business travel to come to a screeching halt. Across most industries, the pandemic impacted client relationships, the ability to gain new clients and caused budgets to get slashed pretty dramatically.

While this was only one event, many businesses have begun to consider the “what-ifs” of their travel programs should another outbreak of COVID or something else happen. Crossing our fingers and toes doesn’t cut it, unfortunately.

There is also the chance of their travel being impacted by a natural disaster. We’ve seen it before – earthquakes, tsunamis, volcano eruptions, hurricanes. Do you have a plan or policy to aid your team and guide them through the unthinkable?

In 2022, we surveyed 120 employees across various industries and businesses. More than half, 51% of respondents said their companies didn’t provide resources or tips for safety on their trips. Duty of care isn’t something to put on the back burner, it’s your legal obligation to make sure your team is informed.

So, what’s the solution, you ask?

Working with a TMC gives you the backup you need if anything ever happens and you have people traveling abroad. At Corporate Traveler, our travel management software, Melon, is a central place to house your policy for quick and easy access. Plus, our travel experts can help you paint the big picture of what to do, who to call, and how to get your team home safely as quickly as possible.

Is there anything missing from your travel policy?

Let’s break it down. If you think of your policy like a sandwich, it should include:

The bread and butter

- Where and why: Are there any restrictions on who travels domestically or internationally? Or guidelines around reasons for travel?

- When: Are there any restrictions on when business travel is a no-no, like during an auditing period or financial downturn?

- How? How should travel arrangements be booked? Through your corporate travel booking software or with a preferred Travel Management Company (TMC)? How far in advance should domestic and international trips be booked?

- Preferred suppliers: Do you have preferred partners for air travel, accommodation, ground transport or travel insurance?

- Approvals: Who’s responsible for giving the green light on trips?

- Show me the money: What’s the process for managing/submitting expenses, paying for travel and reimbursements?

- Uh-oh: How will you prevent or deal with non-compliance to the travel policy?

- Noise level: Getting loads of ‘noise’ and questions about things in your policy? This means it’s not clear and it’s time to review why and where the stumbling block is for travelers (or your finance team!)

The filling

- Classy, baby: Who gets to fly business class, book 5-star properties or order UberLUX? And how does your business handle upgrades or airport lounge access for long-haul flights?

- All work, some play: What are the conditions if someone wants to extend their business trip to take personal leave? Are you happy for them to enjoy a bleisure trip, and if so, who foots the bill and for what?

- Loyalty: Are there any travel rewards or business loyalty programs that can be used during booking?

- Spending money: Do your business travelers have a daily allowance for meals, snacks, and drinks? How much is it, what does it include – and what’s not covered? Can they order room service, drink from the mini-bar, or use the in-house laundry service?

The not-so-secret sauce

- Safety first: your policy should support air, accommodation and ground transport suppliers that have been safety and security vetted. Guidelines or information on travel insurance for work trips is also helpful.

- Now what: What’s the plan of action in the case of Acts of God or Force Majeure events? Does your team know who to call for help?

- What’s next: Who is responsible for updating and reviewing your travel policy, and how often?

Corporate travel policy best practices

- Write for skim readers

- Guide travelers to the right resources

- Automate your policies

- Stipulate a timeframe for expense claims

- Be prepared for the unexpected

1. Write for skim readers

One of the first steps towards writing a people-first travel policy is understanding how your travelers will read it. And the truth is…

They probably won’t.

Research has shown that adults get distracted every 47 seconds . So if a business traveler is looking at your policy, they’re most likely just searching for a specific answer – and they want it fast. So what can you do?

First, make sure the document is easy to navigate. That means including things like:

- A table of contents

- Visual elements to help guide the eye toward crucial information, like flow charts and tables

- Clear headings and important details in bold

- Bulleted lists (see what we did here?)

And even though it’s a technical document, don’t make it sound like one. An effective travel policy should be clear, concise, and easily comprehended. So skip the long, complex sentence structures and technical jargon, and write in plain, simple English. It helps to pretend like you’re writing it so an eighth-grader can understand it.

2. Guide travelers to the right resources

Remember when we said travelers will only read your policy to find a solution for a specific need? Whether it’s a link, a phone number, or a step-by-step tutorial – a well-managed travel policy should provide them with the right resources.

Instead of treating a travel policy as a list of rules, treat it like a resource sheet. Here are some key pieces of information travelers might need to pull up easily:

Your approved online booking tool (and steps on how to use it)

- QR codes to download your mobile travel app

- Preferred airlines, including class, budgets, and other limits

- Permissible hotels, including guidelines on star-class and incidental expenses

- Guidelines on ground transportation (trains, ride-sharing services, rental cars, and personal car usage)

- How to get travel support

- Travel insurance carrier

- Clarification on the reimbursement process (more on this later)

You can also include other factors specific to your company, but this should at least be the necessary groundwork to help employees make the right choices on their own.

3. Automate your policies

Let’s face it: even with the best communication efforts, there’s always a chance that an employee may violate policy, even unintentionally. So, what can you do?

Build policy into booking.

By building your travel policy into your travel management software, it becomes unavoidably embedded in the booking process, so even the most easily confused employees end up following by default.

Automation tools can sound the alarm on out-of-policy bookings and even provide an audit trail. This can be especially helpful for employees who may struggle to remember procedures and policies, especially after big changes to your travel program.

4. Stipulate a timeframe for expense claims

No one wants to get stuck waiting on the money they’re owed – or worse – find out they’re not getting reimbursed for an expenditure they thought would be covered.

Having a clear and well-defined expense claim process is critical in any travel policy. Employees need to know how to claim their travel expenses, how soon they need to submit an expense report, and when to expect reimbursement.

The policy should also be clear about what expenses are and are not reimbursable, including any limits or exceptions. For example, if an employee needs to book a different seat class to accommodate a disability , the policy should include the process for requesting and approving this expense.

Plus, a submission deadline reduces cash flow issues and provides more accurate and complete expense data for that period (your finance team will thank you later).

5. Be prepared for the unexpected

As a company, you have a duty-of-care responsibility. When it comes to business trips, you need to be prepared for the unexpected. No matter how much effort you put into planning, there will always be a few hiccups along the way.

For instance, lost luggage, canceled or delayed flights, and sudden weather or political emergencies in unfamiliar destinations could all leave your employee stranded.

“Companies need to be prepared to plan for the particular, not just the universal. Every aspect of the travel program needs to be able to fit each of your travelers like a glove, from adaptable plans and experts on call, to technology that makes the journey seamless.” - Emese Graham, DE&I Manager @ FCTG

Don’t let unexpected situations blindside you. Have processes in place to ensure travel safety and security. Make sure they know what to do, where to go, and who to get a hold of if something goes wrong. Taking a proactive and prepared approach to your policy can minimize the impact of emergencies and take care of your team’s well-being while they’re on the road.

BONUS TIP: Update your policy regularly

Here’s a free business travel policy best practice just for you! It isn’t just a “one and done” deal – it’s a living document.

What’s that mean? As your company grows and travel conditions change, so should your travel policy. Revisit your expense policy at least once a year to keep it relevant and effective – and lead you towards new cost-saving solutions.

Data is going to be your best friend here. Here are a few key factors you should look into when updating your travel policy:

- Analyze travel spend patterns – are you throwing a lot of company money at certain suppliers? You might want to see if you can negotiate a new deal or find better rates elsewhere.

- Identify areas of overspending or inefficiency – are employees accruing high parking or travel costs? See if you can get season tickets or other accommodations.

- Evaluate the overall performance of your policy – are you still compliant with any new regulations that have come into play since the policy was established? How can traveler experience be improved?

You may even want to consider enlisting the help of professionals, such as a travel management company with experience in expense management, to give advice on how to optimize your travel policy to better meet the needs of your employees and your business as a whole.

Building a travel policy that's good for business and travelers and meets their needs is no small feat. But whether you're looking to retain your team, attract new talent, or make life a little easier for your travelers, investing in a well-designed travel policy is definitely worth the effort and great for company culture.

By following these travel policy best practices and ensuring your policy meets all travelers' needs, you’ll be on your way to smoother, safer, and more enjoyable travel experiences for all.

How to promote travel policy compliance

Whether compliance is a big or small issue in your company, it takes a little bit of investigating to figure out why it’s an issue at all.

Maybe your policy meets the needs of only a few of your team members. Maybe it’s too difficult to navigate your policy. Or maybe, your policy is written in legalese and makes your travelers vision blur before they go rogue and book how they want.

It could be that your travelers prefer a bit of freedom in booking and would rather do it on their own. Or, maybe they have specific needs that aren’t being met by the options provided.

Whatever their reasons, it’s your job to figure out why they aren’t following and what you can do to build better compliance.

Here are a few tips to improve travel policy compliance:

- Make your policy easy to navigate, understand, and find

- Use an online booking tool (OBT) for travelers who prefer to self-book

- Allow a bit of flexibility so travelers feel they have some autonomy

- Include a category for last-minute bookings so it doesn’t mess up your data

- Understand your traveler needs and build an inclusive policy

Read the full guide:

You've researched, gathered the necessary resources, and communicated your travel and expense (T&E) policy to your employees. But now, you're not so sure they're actually following it.

Read the full guide: How to Improve Corporate Travel Policy Compliance

How to market your corporate travel policy internally?

Corporate travel might be off the radar for most employees, especially those outside of customer-facing positions. The first step in promoting successful corporate travel policies is awareness.

Do employees know about the policy? Where can they find information and updates on business travel? Clear communication at pivotal points and frequent intervals can help keep everyone aware.

Review common and expected challenges

Business trip policies might be ineffective if they don't meet the needs of some business travellers. You can get ahead of challenges by understanding that last-minute travel can be necessary or that different travellers have unique needs.

Inclusive policies plan for employee safety and comfort on a range of business trips, paying attention to details such as arrival and departure times, car rentals, ground transportation, and noise levels.

Communicate business travel policies effectively

Travel managers can use best practices to ensure all employees are aware of and understand travel programs. Visual policies, internal documents, and guides all work well. People learn differently, so it’s a good idea to have key information in both visual and text formats.

A yearly update is also beneficial, as well as communication on any major changes, like new technology or changes in the approval process or submitting expenses. An internal FAQ page can increase understanding of corporate travel guidelines, as well as prompt new questions.

Book a demo of Melon , the all-in-one travel platform.

Increase employee engagement

Highlight areas of company travel that offer flexibility, to show what’s possible for different preferences. Talk about benefits like an online booking tool vs. working directly with a TCM.

Developing interactive content, like employee surveys, can show if traveller satisfaction is achieved. It also helps identify travel arrangements that are unnecessary for cost savings.

Find internal champions for the business travel program

Travel policies cross paths with a lot of different departments, from sales to the finance team. Identifying key people and keeping them involved in developing the travel program means getting buy-in and internal support.

Corporate Traveler has a long history of travel management and is ready to join forces as an external member of your travel planning team. Let’s make booking a breeze , together.

Case studies: effectively marketing your corporate travel program

A travel manager should match your company culture for the best fit. Find out how these companies successfully targeted the right mix of technology and service to meet employee expectations and business goals.

Flipp Travel Case Study

Streamlining global travel for Eliquent Life Sciences

Beyond Energy Case Study

If the last time you reviewed or upgraded your travel policy was more than a year ago, it’s outdated and needs a refresher. If your company is small and has low turnover, you could probably get away with making small tweaks and optimizations.

But if you have a larger company with multiple departments and higher turnover, you probably need to do an overhaul and review it more regularly. We’re not saying you have to change it every time someone is hired or leaves the company, but making sure it’s relevant to the people who are there and are traveling matters!

Corporate Traveler conducted a survey in 2022, which showed that 48% of respondents didn’t know if their company had resources for specific traveler profiles, while 41% said their company didn’t provide resources for specific traveler profiles. This really goes to show that there’s room for improvement in how policies are built to support their people and their businesses.

A people-first travel program and policy have become necessary as the world grows and begins to understand neurodiversity, disabilities, and cultural differences. When we learn about our team members’ diverse needs, we can better understand how to support them when they venture abroad for our businesses.

GUIDE: Download the How to design a people-first travel program guide

We recommend policy reviews every 3-6 months, but at the minimum, once per year.

Final thoughts

Business travel is so unpredictable, as we’ve seen in recent years. There will always be circumstances you can’t avoid as a company, but making sure that you have the necessary checks and balances in place can help to make things just a little easier. If you have groups traveling, VIPS, or people heading to high-risk destinations, it’s important that your policy is relevant.

Don’t forget that travel policies shouldn’t be written and forgotten about – these are living documents that must be regularly updated to make sure they best protect your people.

Remember these best practices when writing your travel policy:

- Keep it simple and make it pop with visuals, bullet points, and bold headings.

- Answer any and every question possible – think of all the eventualities

- Always put your people first

- Implement a quick and simple approval process

- Automate as much as you can

- Use technology that’s supports your policy

- Be flexible with due reason

- Be clear about what’s not allowed

- Update your travel policy at least once a year

- Keep it somewhere easy to find

And finally, it doesn’t hurt to have a couple of different formats. Consider a visual version and an extended version so the message is delivered best depending on the person reading. For some, it might be easier to digest one over the other.

Looking for a policy review? We’d be happy to work with you.

Let’s chat .

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

What's the Best Business Travel Insurance?

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

COVERAGE ALERT: Travel insurance must have been purchased prior to the date when an event became foreseeable to be eligible for coverage. The following event is considered known and foreseeable as of the date listed. Tropical Storm Ernesto: August 12, 2024.

Get a Free Insurance Quote

Help protect yourself and your family while on vacation.

Get A Free Travel Insurance Quote

Travel smarter with travel insurance from RoamRight. Get your free, no-obligation quote online today.

Corporate Travel Insurance

Travel insurance for corporate travelers

For businesses, there are two main advantages to purchasing a corporate travel insurance plan when an employee takes a trip: to protect the company’s investment in the trip, and to protect the safety of the employee.

First and foremost, protecting your employees through corporate travel insurance is paramount. The laws of most countries place a “Duty of Care” on your company if your staff is traveling for business. Employers are legally responsible through what is known as Duty of Care to protect the health, safety and security of their employees when they travel. Whether your staff is traveling across the state or across continents, the least your corporation can do is provide adequate insurance. With a corporate travel insurance plan, your business fulfills its Duty of Care by protecting your traveling employees.

Secondarily, corporate travel insurance can protect the financial investment in the trip. For example, the included baggage coverage can be tailored to cover company equipment or sales samples. Likewise, trip cancellation and trip interruption can reimburse you for certain costs resulting from missed flights – such as non-refundable deposits or extended hotel stays.

Corporate travel insurance also comes with valuable assistance services that your employees can use, such as foreign language assistance or emergency medical assistance – all available 24 hours per day.

RoamRight offers competitive pricing for our corporate travel insurance plans. Get an instant quote to start comparing today. For more information on coverages and pricing, please contact one of our representatives today.

- Our Products

- Company Info

- Travel Destinations

- Travel Blog

- Video Testimonials

- Arch RoamRight Partners

- Partner Portal

- Brochures & Forms

- BBB A+ Accredited Business

Copyright© 2024 Arch Insurance Company. All rights reserved.

Site Map | Privacy and Data Protection Policy | Consumer Disclosures | Terms of Use | Accessibility Statement | Fraud Notices | Money-Back Guarantee

What is business travel insurance?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- • Personal finance

- • Mortgages

- • Building credit

- • Credit card debt

- Get in contact with Liza Carrasquillo via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Business travel insurance reimburses particular unexpected expenses or financial losses you suffer before or during a trip for work.

- A travel insurance policy usually covers things like trip cancellation/interruption, medical costs, lost baggage, travel delays, lodging expenses and more.

- Costs for business travel insurance often run between 5 and 7 percent of the trip's total expense.

- If you have a business travel credit card, however, you likely already have at least basic travel insurance under its policy, so you might not need to purchase any additional coverage.

A lot can go wrong before or during a faraway meeting, out-of-state conference, remote office visit or other planned business trip. The airport can lose or damage your luggage, your travel plans may need to be canceled suddenly due to a personal emergency, or you could simply get sick while away from home.

For these and other reasons and more, it’s smart to consider getting business travel insurance . This coverage should safeguard you financially if you incur a covered setback prior to or while you’re traveling for work .

This guide will help you find out more about business travel insurance, how it works and what’s covered, as well as who should get business travel insurance and whether this level of coverage is worth it.

How does business travel insurance work?

You have insurance for your home, car and health care. You might even have life insurance coverage. But where do you turn if you want to protect yourself financially from a business trip setback? Fortunately, you can purchase business travel insurance, also called corporate travel insurance or business trip insurance.

“Business travel insurance is insurance coverage specifically designed to protect individuals traveling for a business-specific reason. It offers comprehensive protection against unexpected incidents and expenses that can occur during a business trip,” explains Mark Friedlander, director of Corporate Communications for the Insurance Information Institute in St. Johns, Florida.

Consider that many expenses related to an upcoming business trek have to be paid well in advance and are not refundable. That means if something happens that prevents you from traveling, you could be on the hook for hundreds if not thousands of dollars. That’s where having business travel insurance comes in handy.

“You can purchase a single-trip policy, which covers expenses that arise on a single trip — usually between travel dates specified in advance,” Andrew Schrage, CEO of Money Crashers in Boston, notes. “Or, you can choose an annual or multi-trip policy that covers any eligible expenses that arise during the policy’s effective period — usually one year — regardless of how many trips you take during that time.”

What does business travel insurance cover?

Here’s what a standard business travel insurance policy typically covers, per Friedlander:

- Trip cancellation/interruption costs

- Expenses related to travel delays

- Medical bills incurred while traveling, including those related to COVID-19

- Missed connection assistance expenditures

- Costs and hassles related to lost baggage

- Car rental and lodging expenses

Stan Sandberg, co-founder of TravelInsurance.com, says many consumers opt for business trip insurance for the trip cancellation/interruption protections offered.

“Standard trip cancellation coverage will reimburse non-refundable, prepaid costs if an insured traveler has to cancel for a wide range of reasons, including getting sick unexpectedly,” he says.

Coverage for medical emergencies and health care away from home are other popular standard features in most plans.

“This is especially valuable for employees traveling abroad, where regular medical insurance might not apply. And individuals with chronic conditions can find coverage for flare ups during travel by declaring them before the business trip,” says Justin Albertynas, a travel industry expert and CEO of RatePunk.

A business travel insurance policy doesn’t cover every possible expense, however. Among the typical exclusions are:

- Reasonably foreseen events

- Acts of war

- Declared epidemics and pandemics (by the World Health Organization and/or U.S. Centers for Disease Control and Prevention)

- Travel restrictions imposed by a government entity.

Who should get business travel insurance?

Good candidates for purchasing business travel insurance include those who frequently travel for work but are not already covered by their employer.

“As most large employers most likely have travel insurance plans in place to cover their employees’ work-related travel, individual business travel insurance plans are typically targeted to independent contractors and small business owners,” adds Friedlander.

Examples of business travel insurance in action

Here are three hypothetical scenarios that underscore the value of having business trip insurance:

1. You need to cancel your trip last minute

“Let’s say you have a single-trip business travel policy with trip cancellation/interruption coverage that reimburses up to $5,000 in prepaid non-refundable expenses,” Schrage explains. “The day before your flight, an immediate family member has a medical emergency and you need to cancel your trip to care for them. If you paid $500 for round-trip airfare, $1,000 for a five-day hotel stay, and $300 for a five-day car rental, your insurer should honor a claim for $1,800 total, as long as the expenses are fully paid and not refundable by the vendor under any circumstances.”

2. You get into a medical emergency

“Imagine an employee traveling for business in Germany who unexpectedly falls ill and requires medical attention,” Albertynas says. “The incurred expenses may include a doctor’s consultation, prescription medications, hospital stay and necessary medical tests. In this scenario, the employee’s total medical expenses could add up to €1,950 or more. Business travel insurance could cover these costs, ensuring that the employee is not burdened by unexpected medical bills during their trip.”

3. Your baggage is delayed

Assume your suitcase gets lost or delayed by the airline and you need to pay extra money out of pocket for clothing, medicine and toiletries. Your policy should cover your expenses up to a predetermined amount. “Just keep in mind that business travel insurance policies often have a waiting period before coverage begins for baggage delays — typically around 12 hours,” Albertynas continues.

The average cost of business travel insurance

Business trip insurance policies commonly run approximately 5 percent to 7 percent of the total cost of your trip. “For example, travel insurance for a $3,000 business trip would cost between $150 and $180 in premium for the policy,” Friedlander says.

What you will pay will depend on the type of policy, your destination, coverage inclusions, your age and other factors. Schrage adds, “Basic trip interruption/cancellation coverage can cost as little as $10 to $20 per day, while more comprehensive policies can cost $50 or more per day. Policies that cover voluntary cancellations, known as CFAR policies, cost 50 percent to 100 percent more than policies that cover involuntary cancellations only.”

Choosing a higher deductible can lower your premium, but you’ll pay more upfront if you have to make a claim.

“Opting for a $200 deductible, for example, means you will pay that amount before coverage starts. Co-pays, co-insurance and out-of-pocket expenses refer to costs beyond the coverage limits,” Albertynas says. “It’s important to carefully review all policy details and premium quotes and understand the trade-offs involved so you can select the right plan while balancing your premium, deductible and additional expenses.”

Do credit cards offer business travel insurance?

Getting trip insurance is almost always a smart idea. But the truth is, it might be an unnecessary expense if you already have free coverage included with your credit card , which some cards provide.

“Many business credit cards provide generous business travel coverage at no out-of-pocket cost. As long as you use your credit card to pay for eligible travel expenses, this is a better deal than buying a policy separately,” advises Schrage.

The most common types of coverage included in business travel insurance provided by a credit card are trip interruption/cancellation, accidental death and dismemberment, and rental car loss/damage.

“Before assuming your trip is covered in full, look at the limits for each coverage type and do the math. For example, if the non-refundable portion of the trip costs $10,000 and your policy only provides $5,000 in interruption/cancellation coverage, you’ll pay at least $5,000 out-of-pocket,” Schrage cautions.

The bottom line

Acquiring business travel insurance is worth it if you frequently travel for work — especially if you spend a lot on business trips, travel abroad or to riskier countries and don’t already have coverage provided by your employer or a travel credit card .

“But all business travel policies are not the same,” adds Friedlander. “It’s wise to read the fine print of your policy so you have a clear understanding of what’s covered and what’s excluded.”

Related Articles

What is trip cancellation and interruption insurance?

Multi-car insurance policies: What are they and how do they work?

SIPC insurance: What it covers and how it protects investors

Do I need credit card travel insurance?

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

How to find the best business travel insurance

Jennifer Simonson

Kara McGinley

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 7:22 a.m. UTC Jan. 18, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- Business travel insurance can cover trip cancellation, interruption and delay, medical and emergency evacuation, lost baggage and stolen personal belongings.

- Not all travel insurance plans cover work equipment.

- Consider buying business travel insurance if you are self-employed, traveling overseas for business or planning to add leisure time to your business trip.

While business travel insurance might not be the first thing you think of when preparing for a business trip, a comprehensive travel insurance policy can help protect you from financial loss.

Business travel insurance may make sense for you if you are self-employed and footing the bill for your business trip, or if you are traveling internationally and are worried about the cost of medical care abroad. It may also be a smart purchase if your company won’t reimburse you for extra expenses if you experience flight delays or need to cut your trip short because of an emergency back home.

Compare the best travel insurance offers

Travel insured.

Via TravelInsurance.com’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

RoundTrip Basic

$500,000/$1 million

What does business travel insurance cover?

Business travel insurance bundles together several types of coverage, which typically include:

- Trip cancellation insurance.

- Trip interruption insurance.

- Trip delay insurance.

- Travel medical insurance.

- Emergency evacuation insurance.

- Baggage insurance.

- Death and dismemberment insurance.

Coverage types and amounts vary depending on the travel insurance plan you buy.

“Travel insurance may cover trip cancellation, trip interruption, trip delay, medical expense and baggage for both leisure and business,” says Christina Tunnah, spokesperson for World Nomads.

“The specific outcome of a claim, however, depends on the nature of the loss,” she says. “No matter what type of policy you choose, be sure to read the policy in its entirety so you understand any limitations or exclusions.”

Trip cancellation insurance for business trips

Trip cancellation insurance can reimburse you for 100% of the insured cost of your prepaid, nonrefundable travel expenses, such as airline tickets and hotel reservations, should you need to cancel your trip because of a reason listed in your policy.

Reasons that are acceptable for trip cancellation benefits typically include severe weather and injury, serious illness or death of you, your traveling companion or a family member.

Some travel insurance plans, such as AIG Travel’s Travel Guard Deluxe, will allow you to cancel if your business partner is injured, becomes seriously ill or dies. The Deluxe plan also provides trip cancellation benefits for select work reasons, such as unexpected job loss, employer-initiated transfer more than 100 miles from home and being required to stay and work during the scheduled trip.

Trip interruption insurance for business trips

Trip interruption insurance can reimburse up to 150% of your insured trip expenses when you need to end your business trip early for a reason in your policy.

If you have a death in your immediate family and need to return home early, trip interruption benefits could cover the cost of transportation to the airport and a last-minute flight home. It can also reimburse you for nonrefundable expenses like a hotel room that you will no longer need if you cut your trip short.

Trip delay insurance for business trips

If your connecting flight is delayed or canceled, travel delay insurance can cover the cost of unexpected expenses you incur, like a meal at the airport or a night at a hotel.

Trip delay insurance typically has a waiting period before benefits begin, so check your policy to see how many hours the delay must be before you can file a claim. Also, look for the daily and overall maximum benefits per person. If your trip delay insurance only provides $250 in coverage per day, that might not be enough for a taxi and hotel room.

Know more about flight cancellations: Flight cancellations

Travel medical insurance for business trips

When on your business trip, if you get hurt or sick, travel medical insurance can help pay for medical care, imaging tests, lab work, medicine and a hospital stay. This can be particularly valuable if you travel to a country where your U.S. health care plan does not provide coverage.

Emergency evacuation insurance

If you are badly injured or become severely ill in a remote location or underdeveloped country, emergency evacuation travel insurance covers the cost of transporting you to the nearest adequate medical facility for treatment. On some occasions, this coverage pays to fly you home for treatment. It may also include coverage for repatriation of remains if you die on the trip.

Baggage insurance

If your luggage or personal items are lost, damaged or stolen, baggage insurance can cover the depreciated value of your belongings. This is typically secondary insurance, which means you’d have to file a claim with your airline or homeowners insurance first.

Baggage delay coverage can reimburse you for extra expenditures if you are without your bags for a period of time. There is usually a waiting period, such as six or 12 hours before benefits begin. If your bags still haven’t arrived after the waiting period, you can buy replacement items and file a claim for reimbursement. Be sure to note the maximum coverage limit per person as baggage delay coverage might only be a few hundred dollars.

Many travel insurance plans do not include coverage for lost business equipment, so be sure to read your policy for exclusions.

Death and dismemberment insurance

Business travel insurance often includes accidental death and dismemberment insurance. This might cover death or dismemberment that happens while traveling on public transportation, that results from a common carrier accident, that happens in any way except on a common carrier or that occurs at any point during your trip. Read your plan for details.

What to look for in a business travel insurance plan