Unraveling the Comprehensive Travel Insurance Coverage by Emirates Airlines

When it comes to air travel, securing a reliable travel insurance plan is paramount for a worry-free journey. Emirates Airlines, recognized for its exceptional service and commitment to passenger comfort, has taken a pioneering step by offering an extensive multi-risk travel insurance coverage. This comprehensive plan aims to provide travelers with peace of mind and a hassle-free experience, no matter where their adventure takes them.

A Game-Changer in the Travel Insurance Industry

Emirates Airlines has set a new industry standard by introducing an innovative multi-risk travel insurance coverage that extends beyond the traditional COVID-19 cover. Effective December 1, 2020, this groundbreaking initiative automatically applies to all Emirates tickets purchased, including codeshare flights operated by partner airlines, as long as the ticket number starts with 176.

Highlights of the Multi-Risk Travel Insurance Coverage

Emirates’ multi-risk travel insurance coverage offers a range of benefits, designed to cater to various contingencies that may arise during your journey. Here are some of the key highlights:

1. Out-of-Country Emergency Medical Expenses and Emergency Medical Evacuation

This coverage provides up to $500,000 for out-of-country emergency medical expenses and emergency medical evacuation, valid for COVID-19 (contracted during the trip) and other medical emergencies while traveling abroad.

2. Trip Cancellation

If you or a relative (as defined in the policy) is unable to travel due to being diagnosed with COVID-19 before the scheduled trip departure date or for other named reasons, you can claim up to $7,500 for non-refundable costs.

3. Trip Cancellation or Curtailment Due to School Year Extension

If the school year is extended due to COVID-19 beyond the departure date, and you or a relative (as defined in the policy) is a full-time teacher, employee, or student at a primary or secondary school, you can claim up to $7,500 for non-refundable trip costs and additional costs to return to your country of residence.

4. Trip Curtailment

If you or a relative (as defined in the policy) falls critically ill, such as contracting COVID-19 while traveling abroad, you can claim up to $7,500 for non-refundable trip costs and additional costs to return to your country of residence.

5. Travel Abandonment

If you fail a COVID-19-related test or medical screening at the airport and are required to abandon the trip, you can claim up to $7,500.

6. Mandatory Quarantine Allowance

If you test positive for COVID-19 while outside your country of residence and are unexpectedly placed into mandatory quarantine by a governmental body, you can receive $150 per day for up to 14 consecutive days.

Additional Benefits and Provisions

In addition to the above-mentioned coverage, Emirates’ multi-risk travel insurance also includes provisions for personal accidents during travel, winter sports cover, loss of personal belongings, and trip disruptions due to unexpected air space closures, travel recommendations, or advisories.

Customers do not need to register or fill out any forms before they travel, and they are not obligated to utilize this cover provided by Emirates Airlines.

Flexibility and Assurance: Emirates’ Booking Policies

To further enhance the travel experience, Emirates Airlines offers flexible booking policies that provide customers with confidence and peace of mind when planning their trips. Customers who purchase an Emirates ticket for travel on or before March 31, 2021, can enjoy generous rebooking terms and options, including the ability to change their travel dates or extend their ticket validity for two years.

Health and Safety: Emirates’ Commitment

Emirates Airlines has implemented a comprehensive set of measures at every step of the customer journey to ensure the safety of its passengers and employees on the ground and in the air. This includes the distribution of complimentary hygiene kits containing masks, gloves, hand sanitizer, and antibacterial wipes to all customers.

Dubai: A Destination Ready to Welcome Travelers

Dubai, the hub of Emirates Airlines, is open for international business and leisure visitors. From sun-soaked beaches and heritage activities to world-class hospitality and leisure facilities, Dubai offers a variety of experiences for visitors. The city has obtained the Safe Travels stamp from the World Travel and Tourism Council (WTTC), endorsing its comprehensive and effective measures to ensure guest health and safety.

Emirates Airlines’ multi-risk travel insurance coverage is a game-changer in the travel industry, providing travelers with unparalleled peace of mind and a hassle-free journey. With its comprehensive coverage and flexible booking policies, Emirates continues to set new standards in passenger care and comfort. Whether you’re planning a business trip or a long-awaited vacation, Emirates Airlines has your back, ensuring that your travel experience is truly extraordinary.

Emirates Travel Insurance – AARDY

Is travel insurance included on Emirates flights?

Does Emirates have a cover?

Do I need travel insurance to travel to Dubai?

Related posts:

- Does Homeowners Insurance Cover Powder Post Beetle Damage?

- Florida Car Rental Insurance Requirements: Everything You Need to Know

- The Top Life Insurance Companies in Ohio for 2023

- Farmers Insurance vs Liberty Mutual: Which is Better in 2023?

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Beach Getaways

- City Breaks

- Short Breaks

- Family Holidays

- Romantic Escapes

- Active Holidays

- Island Escapes

- Summer Escapes

- Bucket List

- Surfing Breaks

- Ski Holidays

- Winter Breaks

- Middle east

- Australasia

- North America

- South America

- Hotels & Resorts

- Eco Friendly

- Food & Drink

- In The News

Select Page

Emirates Leads The Airlines With Complementary Multi-Risk Travel Insurance & COVID-19 Cover

by Staff Writer | Jan 4, 2021

Whether essential, business or leisure travel, Emirates' latest complimentary insurance covers most unforeseen eventualities that may pop up during this pre-vaccine era, including contracting Covid, trip postponements, cancellations or quarantine.

Travelling from any of the major destinations to or via Dubai while on Emirates is now a less stressful affair. Thanks to Emirates’ latest complementary expanded, multi-risk travel insurance cover on top of its current COVID-19 cover, the insecurity and unsurety of travelling in the pre-vaccine era now eases.

One of the perks now of being an Emirates customer is that there is peace of mind when planning for travel – knowing that borders may close abruptly, an outbreak or a large cluster could be detected leading to regional closures for a short period of time, or mandatory quarantines may be announced out of the blue – you are covered financially for medical or cancellation costs.

Emirates latest industry-first initiative to provide expanded, multi-risk travel cover on top of its current COVID-19 cover reassures its customers, existing and new that air travel continues to be one of the safest ways of getting around, despite most insurance companies going extra slow on Covid cover for new insurance plans.

HH Sheikh Ahmed bin Saeed Al Maktoum, Emirates Chairman and Chief Executive said: “Emirates was the first airline to offer complimentary global COVID-19 cover for travelers back in July, and the response from our customers has been tremendously encouraging. We’ve not rested on our laurels and instead continued to look at how we can offer our customers an even better proposition. We’re very pleased to be able to now provide this new multi-risk travel insurance and COVID-19 cover, which is another industry first, to all our customers.

“We see a strong appetite for travel around the world, especially heading into the winter holidays as people seek warmer climates and family destinations like Dubai. By launching this new multi-risk travel insurance and COVID-19 cover, we aim to give our customers even more confidence in making their travel plans this winter and moving into 2021.”

Emirates multi-risk travel cover for all

This new multi-risk travel insurance and COVID-19 cover will automatically apply to all Emirates tickets purchased in any class, from 1 December at no additional cost, and extends to Emirates codeshare flights operated by partner airlines, as long as the ticket number starts with 176.

Highlights of the insurance coverage include:

- Out-of-Country Emergency Medical Expenses & Emergency Medical Evacuation up to US$500,000, valid for COVID-19 (contracted during the trip) and other medical emergencies while travelling abroad.

- Trip Cancellation up to US$7,500 for non-refundable costs if the traveller is unable to travel because they are diagnosed with COVID-19 before the scheduled trip departure date, or for other named reasons – similar to other comprehensive travel cover products.

- Trip Cancellation or Curtailment up to US$7,500 if the school year is extended due to COVID-19 beyond the departure date, and the traveller is a full-time teacher, full-time employee, or a student at a primary or secondary school.

- Trip Curtailment up to US$7,500 for non-refundable trip costs and additional costs to return to their country of residence if the traveller falls critically ill, for instance, contracts COVID-19 while travelling abroad.

- Travel Abandonment up to US$7,500 if the traveller fails a COVID-19-related test or medical screening at the airport and is required to abandon the trip.

- US$150 per day per person, for up to 14 consecutive days if, while outside of their country of residence, the traveller tests positive for COVID-19, and if they are unexpectedly placed into a mandatory quarantine outside their country of residence by a governmental body.

In addition to Covid, Emirates’ cover also has provisions for personal accidents during travel, winter sports cover, loss of personal belongings, and trip disruptions due to unexpected air space closure, travel recommendations or advisories.

Other airlines such as Cathay Pacific, FlyDubai, Japan Airlines, Virgin Atlantic, WestJet and Etihad have also started offering complementary COVID-19 insurance cover that generally covers medical expenses related to COVID-19 diagnosis whilst overseas, hospitalisation, testing, mandatory quarantine and repatriation costs.

To pre-empt any developing situation that may arise, all tickets for travel on or before 31 March 2021 on Emirates have an easy rebooking option of extending the ticket validity for two years or change the travel dates.

When onboard the flight, in addition to the superb safety measures in place, the airlines provides a complimentary hygiene kit containing masks, gloves, hand sanitiser and antibacterial wipes to all customers. ◼

Subscribe to the latest edition now by clicking here.

© This article was first published online in Jan 2021 – World Travel Magazine.

Social Media

World travel experience app.

Related Articles

- https://www.facebook.com/WTravelMagazine

- https://twitter.com/WTravelMagazine

- https://www.linkedin.com/company/worldtravelmagazine/

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Emirates Travel Insurance - 2024 Review

Emirates travel insurance.

- Available at Check-Out

- Very Expensive

- Weak Benefits

- Insufficient Travel Insurance Cover

Sharing is caring!

Emirates is one of two flagship carries of the United Arab Emirates and is based in Dubai. It is a subsidiary of the Emirates Group, which is owned by the government of Dubai’s Investment Corporation of Dubai.

When booking a flight on Emirates from the US, travel insurance is offered at checkout. We’ll take a look at the insurance offered and then compare it to what is available on the open market. But first let’s book a trip on Emirates.

Our Sample Flight – San Francisco to Dubai

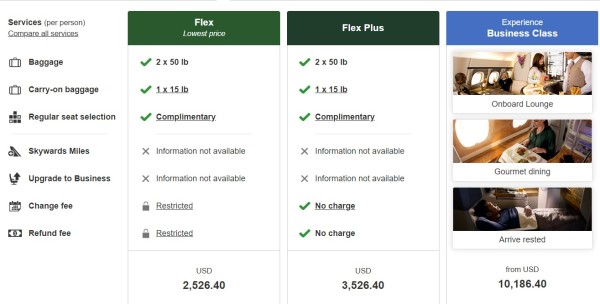

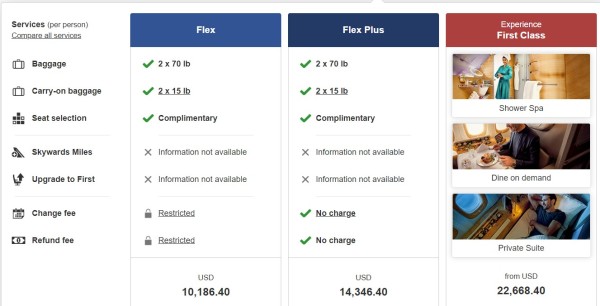

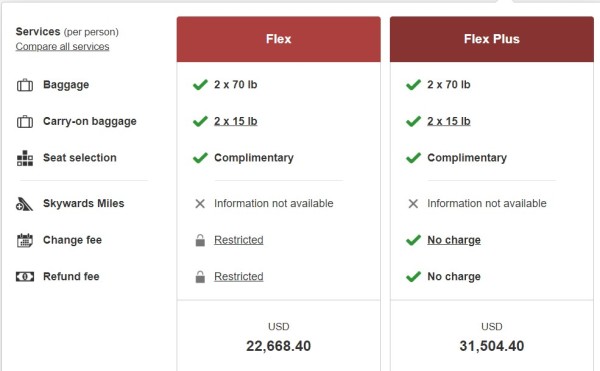

For our review, we booked a trip for two travelers from San Francisco to Dubai from December 12 – January 2.

To their credit, Emirates makes it very simple for a traveler to compare the benefits of different fare seats.

For each fare type, you have two choices: Flex or Flex Plus. The main differences (besides the price) are the fees charged for changing the ticket or for refunds.

Flex Plus does not charge penalty fees for changes or refunds for any fare class. However, with Flex fares there are various fees depending on the type of cancellation and fare class.

Economy Flex charges change fees of $400 if the traveler no shows before departure and $600 for no-shows after departure. They charge different fees if requesting a refund prior to departure or after departure. Prior to departure the fee is $400 but after departure is $800.

Business Flex charges a flat fee of $800 if the traveler no shows either before or after departure. They charge different fees if requesting a refund prior to departure or after departure. Prior to departure the fee is $800 but after departure it is $1,400.

Finally, First-Class Flex charges change fees of $400 if the traveler no shows before departure and $800 for no-shows after departure. They charge the same fees if requesting a refund prior to departure or after departure.

The least expensive fare was the Economy Flex at $2,526.40. The least expensive Business seat came in at $10,186.40, while the least expensive First-Class seat was $22,688.40. That’s a huge price difference!

After reviewing the various fares, we opted for the Economy Flex for our departure but had to upgrade to Economy Flex Plus for the return leg as Economy Flex was sold out.

Total cost before seat selections and any other options is $7,853.

When you choose trip details, Emirates shows you the total cost based on the fare type chosen but also allows you to upgrade if desired.

Later, we’ll show you how to turn the Non-Refundable ticket into a Refundable one and have maximum cancellation flexibility. If possible do NOT buy a Refundable ticket!

After choosing our seats at an additional $120 cost, our trip cost increased to $7973. But before we check out, we’re offered one final option – travel insurance.

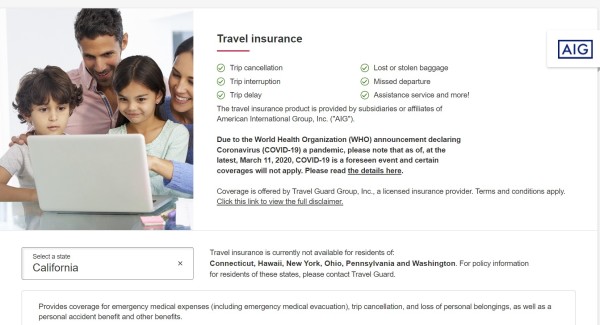

Emirates Travel Insurance – AIG Air Ticket Plan

We are used to being offered travel insurance upon check-out whenever we buy a flight. Emirates is no different and offers the AIG Deluxe Airline Ticket Protection Plan for its US customers. Note that this is NOT travel insurance – it is air ticket protection. Travelers would be well advised to seek actual travel insurance in the open marketplace to fully protect their trip.

The policy is not available in Connecticut, Hawaii, New York, Ohio, Pennsylvania and Washington. This is worrying. Almost every trip insurance policy that we see is available in all 50 states and DC.

Let’s look at the benefits.

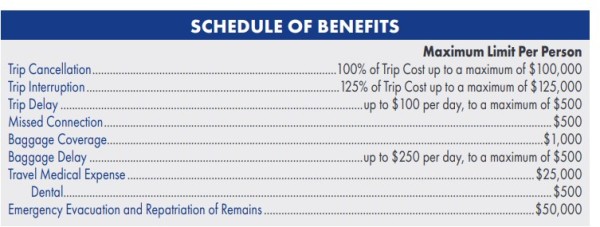

The policy provides only $25k for Medical Expenses and only $50k for Emergency Medical Evacuation. These amounts are quite low and certainly would not be sufficient for most international travelers, in our opinion.

The cost of the insurance is $480.60, which is expensive considering the limited coverage provided.

Let’s see what we can find on the open marketplace.

TravelDefenders – Compare and Save

At TravelDefenders we are a travel insurance marketplace and get binding insurance quotes, anonymously, from all our major travel insurance carriers and present them in an easy-to-read format.

Inputting our trip details for a quote, we were presented with 27 options for travel insurance. How do we determine which one to choose?

For travel to Asia, Africa, and destinations far from US shores, TravelDefenders recommends having a minimum of $100,000 of medical coverage and a minimum of $500,000 for medical evacuation coverage.

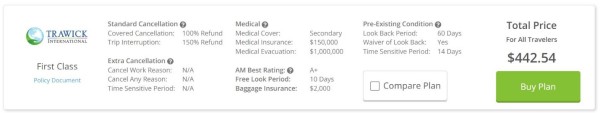

The least expensive option that provides adequate coverage is the Trawick First Class . This policy provides $150k of medical coverage and $1 million of medical evacuation coverage as well as a waiver to cover pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date.

Total cost for the Trawick policy is $442.54, about $40 less than the AIG policy and has significantly better coverage! The policy will also allow us to cancel for standard reasons such as illness or injury prior to departure and receive a 100% of our non-refundable trip costs. Unlike Emirates, Trawick doesn’t charge a penalty if we need to cancel the trip or change trip details.

Cancel for Any Reason (CFAR) Policies

You may recall earlier we talked about not purchasing a refundable ticket. We can use travel insurance to buy a non-flexible ticket but enjoy flexible benefits. Cancel for Any Reason policies will give us this flexibility.

This is a super-powerful benefit that does exactly what it says. A traveler needs to have no reason at all to cancel and still receive a significant refund. The policies that we have can provide either a 50% or a 75% refund depending on the policy chosen.

Looking at our quote from TravelDefenders, the least expensive CFAR policy with adequate coverage is the John Hancock Silver (CFAR 75%). This policy provides $100k of medical benefits and $500k of medical evacuation benefits as well as a waiver to cover pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date. Total cost for both travelers combined is $732.

If we cancel prior to departure for a reason listed in the policy, such as illness or injury, we will receive a 100% refund of our trip costs. However, if we decide to cancel for any reason NOT listed in the policy, such as simply deciding not to travel, we’ll receive a 75% refund of our trip costs.

The use of Cancel for Any Reason insurance to lower ticket prices has been described as the Airline Ticket Hack . Refundable benefits, yet with Non-Refundable Ticket costs.

In this way, we can purchase a lower-priced ticket yet have maximum flexibility for cancellation without the penalty fees Emirates charges.

TravelDefenders – One Site – Many Carriers

We love Amazon and are fans of Expedia. Comparison-shopping is simple. Sites like TravelDefenders do the same for travel insurance. Would you like to visit each travel insurance carrier directly? Of course not. Take the Amazon-like travel insurance experience at TravelDefenders.

The beauty of insurance comparison through a marketplace like TravelDefenders is that you get to see all the best prices in the market and make an informed decision.

Does TravelDefenders Charge More?

You won’t find the same trip insurance plans available at a better price – price certainty is guaranteed because of anti-discriminatory insurance law in the US. Take a look at the article Travel Insurance Comparison – Will I Pay More Buying Travel Insurance from a Comparison Website? This is powerful consumer protection.

A travel insurance marketplace like TravelDefenders will offer a multitude of different plans from some of the most respected travel insurance carriers in the country. You will only need a few minutes to check value for money, coverage, and insurance carrier ratings.

Enjoy your next trip Emirates and don’t forget your travel insurance.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Helpful and courteous representative

Friendly and Efficient

Kendall was excellent. Direct, informative,friendly and efficient. He offered and delivered just what I needed.

Judy Bauercustomer

Amanda was efficient an knowledgeable.

Amanda was efficient an knowledgeable. Made the process easy and affordable

- Destinations

- United Arab Emirates

United Arab Emirates Travel Insurance Requirements

Last updated: 03/07/2024

As of November 7, 2022, the United Arab Emirates lifted all Covid-19 related entry requirements, including the longstanding travel insurance requirement.

Squaremouth’s UAE Travel Insurance Recommendations

Squaremouth recommends travelers visiting UAE buy a travel insurance policy with at least $100,000 in Emergency Medical coverage and at least $100,000 in Medical Evacuation coverage. This coverage is reimbursement-based, meaning the traveler is typically required to pay their medical expenses upfront and then file a claim for reimbursement when they return home.

In addition to these medical benefits, most travel insurance policies are comprehensive and include a variety of other benefits, without increasing the cost of a policy. This includes coverage for travel delays and lost or delayed luggage.

Travelers visiting the UAE also have the option to insure their trip costs under the Trip Cancellation benefit. This benefit can reimburse all of their prepaid and non-refundable trip payments if they need to cancel due to an illness or injury, inclement weather, or terrorist incident, among other events.

Click here to begin your search for UAE Travel Insurance.

UAE Travel Insurance Trends and Data

Travel to the United Arab Emirates ( UAE ) has skyrocketed over the past few years. Technologically advanced cities, namely Dubai and Abu Dhabi, have made the UAE one of the most attractive and breathtaking countries to visit in the world.

Destination Rank: 61

Percentage of Squaremouth Sales: 0.33%

Average Premium: $276.93

Average Trip Cost: $3,938.33

Helpful Resources

- U.S. Department of State – UAE

Available Topic Experts for Media:

Squaremouth's destination information is free and available for use within your reporting. Please credit Squaremouth.com for any information used.

Squaremouth's topic experts are on hand to answer your questions. Contact a member of our team for media inquiries about Squaremouth Analytics or to schedule an interview.

Steven Benna, Lead Data Analyst: [email protected]

We're here to help!

Have questions about travel insurance coverage? Call us! 1-800-240-0369 Our Customer Service Team is available everyday from 8AM to 10PM ET.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Complaints & Feedback

Travel insurance that meets your needs

Millions of travelers rely on Travel Guard® travel insurance from AIG UAE, to help them recover from unexpected circumstances that can interrupt their travel plans. Travel Guard® is a comprehensive insurance plan that caters to travelers worldwide.

Platinum Plan

Silver plan.

Our most comprehensive travel insurance plan going above and beyond Schengen visa requirements.

- Up to $500,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $250,000

- Baggage Loss or Damage up to $2,500

- Trip Cancellation up to $5,000

- Up to $1,000 in Travel Delay Cover

- Emergency Family Travel up to $2,500

- Secure Wallet up to $1,000 in Credit Card Fraud

- 24h Worldwide Assistance Services

Our most popular travel insurance plan covering Schengen visa requirements.

- Up to $100,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $100,000

- Baggage Loss or Damage up to $1,000

- Trip Cancellation up to $2,500

- Up to $500 in Travel Delay Cover

- Secure Wallet up to $500 in Credit Card Fraud

Our basic travel insurance plan covering Schengen Visa requirements.

- Up to $50,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $50,000

Why AIG Travel Guard ® ?

Schengen Visa Compliant

All our three travel Insurance plans (Silver, Gold & Platinum) are Schengen Visa Compliant.

Exceptional Price Tag

Whether you are heading near or far, our annual & single trip covers comes at an affordable price letting you get on with your holiday.

Cover Plans To Suit You

AIG offer 3 types of Travel insurance cover plans with optional additions to ensure that we have a policy to match your needs.

Covid-19 Covered

- COVID-19 Medical Expenses up to $250,000 under Platinum plan

- COVID-19 Medical Expenses up to$100,000 under Gold plan

- COVID-19 Medical Expenses up to$50,000 under Silver plan.

- USD 150 per day, per person for up to 14 consecutive days if you test positive for COVID-19 and are unexpectedly placed into mandatory quarantine while overseas.

Enjoy a worry-free holiday with a comprehensive travel insurance from AIG UAE

Pick up a travel policy and explore more with our fantastic cover that provides a range of benefits.

Get Your Travel Insurance in Dubai, Abu Dhabi & The Rest of Emirates Online From AIG UAE

24/7 worldwide support.

Whenever you need us, our 24/7 emergency assistance helpline are here to help as standard.

Get your Travel Insurance online in 4 easy steps

Provide trip information

Enter details about the trip.

Select the preferred plan

Choose the Silver, Gold or Platinum plan.

Fill out personal details

Provide personal information about the traveller.

Review & Pay

Pay online, and the system will successfully issue the policy.

What is AIG Travel Insurance?

AIG Travel Insurance is insurance that is designed to protect your health, belongings and the cost of your trip should anything go wrong while you are abroad or in some cases before you leave.

Travel Guard FAQs

What is travel guard.

Travel Guard is a travel insurance product, underwritten by American Home Assurance Co (Dubai Branch) a subsidiary of American International Group, Inc (AIG). Travel Guard provides coverage in case of unforeseen circumstances that may force you to cancel or shorten your trip or seek emergency medical treatment while traveling. Your travel insurance also offers coverage for the loss or delay of your baggage, in addition to many other benefits described in the policy, which you can review before making your purchase. All coverage is subject to the policy terms and conditions.

How do I buy a Travel Guard policy?

You can buy a Travel Guard policy via www.aig.ae .

Who is eligible to be covered under a Travel Guard policy?

Individuals in the age bracket from 3 months to 74 years and 364 days who are residents or citizens the United Arab Emirates.

Is there a special rate for children?

Yes. There is a 50% reduction on standard rates for a person aged between 3 months and 17 years and 364 days.

Does the Travel Guard policy cover a family traveling together? How is family defined?

Yes. There is a family rate under the Travel Guard policy. Family is defined as insured person, his/her spouse, and unlimited number of their children.

What is the Annual Multi Trip option?

The Annual Multi Trip option covers you for one-year period for unlimited number of trips, but each trip should not exceed 90 days.

Who do I contact for an emergency assistance or if I need to be admitted to a hospital while overseas?

For 24-hour emergency assistance or if you need to be admitted to a hospital, please contact +1 (817) 826 7276 and quote your policy number.

Can I amend my policy?

Yes, the Travel Guard policy can be amended in special cases, but amendment can only be made prior to the departure of the first part of the journey.

Do I have to carry a copy of my certificate of insurance with me while traveling?

No, you don't need to carry a copy of your certificate of insurance with you. All you need is your policy number which can be found on your certificate of insurance.

What do I do if I lose my certificate of insurance?

Please Click here to download your certificate of insurance.

When does my coverage begin?

For Trip Cancellation:

- For a single trip policy, cover starts at the time that you book the trip or pay the premium, whichever is later;

- For an annual multi trip policy cover starts at the time you book a trip, or the effective date shown on the certificate of insurance, whichever is later.

For other benefits, coverage begins when you leave your country of residence. The initial departure point has to be from the United Arab Emirates.

How will my out-patient medical expenses be paid ?

The medical expenses incurred will be reimbursed to you subject to policy T&Cs. Please retain all original medical bills/invoices, medical reports, and laboratory tests (if applicable) and submit them as part of your claim.

Does the Travel Guard policy cover sports and other similar activities?

Travel Guard policy offers an optional coverage for hazardous & winter sports with 100% loading on standard rates.

Can I cancel my trip for any reason and get all my money back under the “Trip Cancellation” Benefit?

The Trip Cancellation Benefit provides coverage for specific reasons as described in your policy terms and conditions and reason for cancellation should be amongst those reasons for the claim to be covered.

Can I buy a Travel Guard policy, if I have a pre-existing medical condition?

Yes. However, Travel Guard policy has an exclusion for pre-existing medical conditions as detailed in the policy wording.

Does “Baggage & Personal Effects” benefit cover theft?

Yes, Travel Guard policy covers theft (and damage due to an attempted theft) as long as incidence occurs while travelling outside of your country of residence and within the period of insurance as stated in your certificate of insurance. Please refer to the Terms & Conditions of the Travel Guard policy to know more on this benefit.

How do I report a claim?

You can submit your claim online by clicking here

Alternatively, you can contact our local office with the below contact details:

How long is the claim processing time?

Claims will be processed within 7 working days after you have submitted all the required documentation.

Can I cancel my Travel Guard policy?

Yes, provided it is before the policy effective date as stated in your certificate of insurance and there is no claim registered under your policy.

Quick & Easy Online Quote

Get your great value Travel Insurance today

Travel Insurance Documents

Table of benefits, policy wordings, verify insurance policy & check coverage, travel insurance claim.

Submit online your claim in few easy steps

Looking for Accident & Health Insurance?

Personal Accident Insurance

Cover for when the unexpected happens

Hospital Cash Insurance

Financial care for every day of hospitalization

Critical Illness Insurance

A helping hand for you and your loved ones

- Travel Insurance

- Best Travel Insurance Companies

12 Best Travel Insurance Companies: Forbes-Rated 2024

Expert Reviewed

Updated: Sep 18, 2024, 11:21am

Prime Cover, Travel Insured International and WorldTrips are among the best travel insurance companies, based on our analysis of 42 policies. We evaluated costs and a variety of coverage features to find the best policies. See all our top picks.

Considering Travel Insurance?

Via Forbes Advisor's Website

Compare Travel Insurance Quotes

Best travel insurance companies: summary, best travel insurance companies ranked by experts, how much does travel insurance cost, best cancel for any reason travel insurance, best cruise insurance.

- Best Senior Travel Insurance

- Best Annual Travel Insurance

Cheapest Travel Insurance Companies

Methodology, more travel insurance ratings, best travel insurance companies frequently asked questions (faqs), learn more about travel insurance, compare & buy travel insurance.

Via Forbes Advisor’s Website

$371 (Explore) $400 (Elevate)

$250,000/$1 million (Elevate) $150,000/$750,000 (Explore)

$539 (Deluxe) $413 (Preferred)

How We Chose the Best Travel Insurance

We assessed cost, travel medical and evacuation limits, baggage and trip delay benefits, the availability of cancellation and interruption upgrades, and more. Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. You can read more about our editorial guidelines and the methodology for the ratings below.

- 42 travel insurance policies evaluated

- 1,596 coverage details analyzed

- 102 years of insurance experience on the editorial team

BEST FOR EVACUATION

Top-scoring plan

Average cost

Medical & evacuation limits per person

$250,000/$1 million

We recommend the Luxe policy because it has superior benefit limits for nearly all core coverage types. We were especially impressed with its generous evacuation coverage, short waiting periods for delays and wide range of optional benefits.

More: PrimeCover Travel Insurance Review

- Provides “hospital of choice” in its medical evacuation coverage, meaning you choose the medical facility rather than being transported to the nearest adequate treatment center.

- Non-medical evacuation benefits of $100,000.

- Superior trip interruption reimbursement of 200%, which is twice as much as many competitors.

- You can buy a “cancel for any reason” upgrade within 21 days of your initial trip deposit, compared to 15 days for many other top-rated companies.

- Medical expense coverage of $250,000 per person is great, but some competitors provide $500,000.

Here’s a look at whether top coverage types are included in the Luxe policy.

Also included:

- Change benefits of $300 for changing original travel arrangements, such as transferring airlines.

- Itinerary change benefits of $500.

- Lost golf fee benefits of $500 and lost ski/snowboard fee benefits of $150.

- Rental property damage liability benefits of $1,500.

- Search and rescue benefits of $5,000.

- Sports equipment rental coverage of $1,000.

- Travel inconvenience coverage of $100 each for closed attractions and flight diversions.

Optional add-on coverage includes:

- AD&D flight-only choices of $100,000, $250,000 and $500,000.

- “Cancel for any reason” upgrade.

- Increased trip delay coverage choices of $4,000 or $7,000.

- “Interruption for any reason” upgrade.

- Rental car damage coverage of $50,000.

BEST FOR NON-MEDICAL EVACUATION

Travel insured international.

Worldwide Trip Protector

Average price

$100,000/$1 million

We recommend Travel Insured’s Worldwide Trip Protector policy because it offers robust benefits at the lowest average price among top-rated plans we analyzed. We also like its superior non-medical evacuation coverage.

More: Travel Insured International Travel Insurance Review

- “Cancel for any reason” and “interruption for any reason” upgrades available.

- Top-notch non-medical evacuation benefits of $150,000 per person.

- Good travel delay and baggage delay benefits kick in after just a three-hour delay.

- Medical coverage of $100,000 per person is on the low side compared to top competitors but might be enough for your needs.

- Missed connection benefits of $500 are low compared to top-rated competitors and for cruise and tours only.

Here’s a look at whether top coverage types are included in the Worldwide Trip Protector policy.

- Pet kennel benefits of up to $500 are included if you return home three hours or more later than your planned return date.

Optional add-ons offered:

- Rental car damage and theft coverage of up to $50,000.

- Event ticket protection pays up to $1,000 if you can’t attend for a reason covered by the policy.

- Travel inconvenience coverage allows you to recoup money for unforeseen circumstances, such as closed beaches and attractions, rainy weather, tarmac delays and more.

- Bed rest benefits pay up to $4,000 if a doctor requires you to stay on bed rest for at least 48 hours during your trip.

I have been working with Travel Insured for over 15 years, and have been using them almost exclusively. Typically, they have been quite responsive and pay their claims in a timely fashion.

– Stephanie Goldberg-Glazer, chief experience officer of Live Well, Travel Often

GREAT FOR ADD-ON COVERAGE

Atlas Journey Premier

We like the Atlas Journey Elevate plan for its wide choice of add-ons. These add-ons provide extra coverage for pets traveling with you, adventure sports, medical expenses, and more. We also like that this plan has a low average cost compared to competitors.

Another option is the Atlas Journey Escape plan, but this policy doesn’t offer the “interruption for any reason” upgrade and has lower travel medical benefits of $150,00 per person. Still, it hits all the marks for great benefits at a low price. It also offers lots of choices for add-on coverage.

More: WorldTrips Travel Insurance Review

- Very good travel delay benefits of $2,000 per person after only five hours.

- Good baggage insurance coverage of $2,500.

- Medical coverage limits of $150,000 aren’t as high compared to some top-rated competitors but you might find it’s sufficient.

- Baggage delay benefits have a 12-hour waiting period.

Here’s a look at whether top coverage types are included in the Atlas Journey Premier policy.

- Travel inconvenience benefits of $750 if your arrival home is delayed due to a transportation delay and you can’t work for at least two days, your flight lands at a different airport than scheduled, your passport is stolen and can’t be reissued, and more.

- “Cancel for any reason” and “interruption for any reason” coverage.

- Destination wedding coverage in case the wedding is canceled.

- Baggage insurance upgrade to $4,000 per person.

- Rental car theft and damage coverage of $50,000.

- Political or security evacuation benefits of $150,000 per person.

- Vacation rental accommodations coverage of $500 if unclean or overbooked.

- Adventure sports add-on to extend coverage to safaris, bungee jumping and more.

- Hunting and fishing coverage for equipment and cancellation due to government restrictions.

- School activities coverage if trip has to be canceled due a test, sporting event, etc.

WorldTrips offers a streamlined process for purchasing insurance online and filing claims. A user-friendly interface and efficient claims handling contribute to a positive customer experience and increased satisfaction.

– Joe Cronin , advisory board member

BEST FOR MISSED CONNECTIONS

Classic Plus Plan

TravelSafe’s Classic Plus plan stood out in our analysis for its superior missed connection benefits of $2,500. We also like the Classic Plus plan’s top-notch medical evacuation coverage of $1 million.

More: TravelSafe Travel Insurance Review

- “Cancel for any reason” upgrade available.

- Superior baggage loss coverage limits of $2,500.

- Great travel delay limits of $2,000 per person after a six-hour delay.

- $100,000 in medical benefits is on the low side compared to top competitors but might be sufficient for your needs.

- Baggage delay coverage is a little skimpy at $250 per person after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Classic Plus policy.

- Itinerary change coverage of $250 per person if your travel supplier makes a change that forces you to lose non-refundable costs for missed activities.

- Reimburses $300 for fees if you have to redeposit frequent traveler awards for reasons covered by your trip cancellation insurance.

- Pet kennel coverage of $100 a day if your return home is delayed by 24 hours or more due to a reason covered in your policy.

- “Cancel for any reason” coverage of 75% of lost trip costs.

- Accidental death and dismemberment for flights, up to $500,000 per person.

- Rental car damage and theft up to $35,000.

- Business equipment and sports equipment coverage of $1,000 if lost, stolen or damaged.

TravelSafe packs essential coverage into budget-friendly rates without skimping on key benefits, and its responsive claims handling preserves peace of mind.

– Timon van Basten, tour guide and founder of Travel Spain 24

BEST FOR POLICY PERKS

Cruise Luxury

$150,000/$1 million

Nationwide’s Cruise Luxury plan is one of our favorites because it has a treasure trove of benefits such as “interruption for any reason” and “cancel for work reasons” coverage. You can upgrade to “cancel for any reason” coverage. Some competitors offer none or one of those options. We also like its excellent missed connection benefit of $2,500 per person.

Note that you do not have to be going on a cruise to take advantage of this policy’s coverage.

More: Nationwide Travel Insurance Review

- “Interruption for any reason” benefit of $1,000 per person is included.

- Includes $25,000 per person in non-medical evacuation benefits for problems such as a natural disaster or security or political problem.

- Good travel delay benefits of $1,000 per person.

- Medical coverage of $150,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to some competitor policies with only a 12-hour delay requirement.

Here’s a look at whether top coverage types are included in the Cruise Luxury policy.

- Inconvenience benefit of $250 per person if your cruise ship’s arrival at the next port of call is delayed for two or more hours due to mechanical breakdown or fire.

- “Interruption for any reason” up to $1,000.

- Coverage for extension of the school year, terrorism in an itinerary city, work-related emergency issues.

- Coverage if the CDC issues a health warning at your destination.

Optional add-on offered:

- “Cancel for any reason” upgrade that provides 75% reimbursement of insured trip cost if you cancel two or more days prior to your departure for a reason not listed in the base policy.

Count me in as a believer in Nationwide’s trusted track record in insurance. Their travel policies check all the boxes, especially for cruises. My only gripe is that some of their medical limits seem lower than other guys. But the rates are easy on the wallet.

– Tim Schmidt, travel expert, entrepreneur, published travel author and founder of All World

BEST FOR CUSTOMIZATION

Travel Guard Deluxe

The Travel Guard Deluxe plan impressed us with its optional pet, wedding, security, baggage, medical, adventures sports and travel inconvenience upgrades. These add-ons allow you to customize the policy to your needs. We also like that the policy includes benefits if, under certain conditions, you must start your trip earlier than planned—a feature not found in all policies.

More: AIG Travel Insurance Review

- Offers upgrades to meet the needs and budgets of many kinds of travelers.

- Includes $100,000 per person for security evacuation and superior medical evacuation coverage of $1 million per person.

- Provides up to $750 per person for “travel inconveniences” such as a flight delay to your return destination, runway delays and cruise diversions.

- Has good travel delay coverage of $1,000 per person, with a short waiting period of five hours.

- The Travel Guard Deluxe policy has robust coverage across the board but also a high average cost ($539) compared to other top-rated policies.

- Medical expense coverage of $100,000 per person is on the low side but might be adequate for your needs.

Here’s a look at whether top coverage types are included in the Travel Guard Deluxe policy.

- Travel inconvenience benefits of $750 total ($250 per problem) if you encounter issues such as closed attractions, cruise diversion, hotel infestation, hotel construction and more.

- Trip exchange benefits of 50% of your trip cost that pay the difference in price between your original reservation and the new one.

- Ancillary evacuation benefits up to $5,000 for expenses related to return of children, bedside visits, baggage return and more.

- Flight accidental death and dismemberment coverage of $100,000 per person.

- Rental vehicle damage coverage.

- “Name Your Family” upgrade allows you to add a person to your policy who will qualify for family member-related unforeseen events that can apply to claims for trip cancellation and interruption.

- Adventure Sports Bundle for adventure and extreme activities.

- Pet Bundle for boarding and medical expenses for illness or injury of dog or cat while traveling. Includes trip cancellation or trip interruption if your pet is in critical condition or dies within seven days before your departure.

- Wedding Bundle to cover trip cancellation due to wedding cancellation. Sorry cold-feeters: Coverage does not apply if you are the bride or groom.

The Travel Guard Preferred plan also earned 4.3 stars in our analysis. We recommend this policy if you’re looking for a lower price and don’t need the higher coverage amounts provided by the Deluxe plan. The Preferred plan provides $50,000 for medical expenses and $500,000 for medical evacuation benefits per person.

AIG’s TravelGuard offers an easy-to-use online platform for purchasing insurance and filing claims. A streamlined process minimizes hassle for customers, making it convenient to obtain coverage and receive reimbursement for eligible expenses.

GREAT FOR MEDICAL & EVACUATION COVERAGE

Seven corners.

Trip Protection Choice

$500,000/$1 million

We like Seven Corners’ Trip Protection Choice plan because it has superior travel medical expenses and evacuation benefits. It also provides great upgrade options and benefits across the board.

More: Seven Corners Travel Insurance Review

- “Cancel for any reason” and “interruption for any reason” upgrade available.

- Very good travel delay coverage of $2,000 per person.

- Includes $20,000 for non-medical evacuation.

- Hurricane and weather coverage has a 48-hour delay, compared to some competitors that require only 12-hour delays.

- Average cost ($527) is only so-so compared to other top-rated policies we evaluated.

Here’s a look at whether top coverage types are included in the Trip Protection Choice policy.

- Accidental death and dismemberment coverage of $40,000 per person for qualifying common carrier events

- Change fee compensation of $300 per person if you have to change your flight or original travel arrangements due to qualifying events.

- Pet kennel benefits of $500 if your return home is delayed by six hours or more due to qualifying missed connection, interruption or delay problems.

- Frequent traveler coverage of $500 to pay for the cost to redeposit awards due to a trip cancellation caused by a reason listed in your policy.

- “Cancel for any reason” coverage.

- “Interruption for any reason” coverage.

- Rental car damage coverage of $35,000.

- Sports & golf equipment rental coverage up to $5,000.

- Event ticket fee registration coverage of $15,000 if you can’t attend an event due to unforeseen reasons listed in trip cancellation and interruption coverage.

With over two decades of experience in the insurance industry, Seven Corners has built a reputation for reliability and customer service. Their track record of handling claims efficiently and providing support to customers in need adds to their credibility. Their Choice plan offers primary coverage, meaning they will pay all claims as if they are the primary insurer, so your claims will be processed faster.

BEST FOR BAGGAGE

Axa assistance usa.

Platinum Plan

AXA’s Platinum plan is among our favorites because it hits all the high points for coverage that you’ll want if you’re looking for top-notch protection, including excellent baggage benefits of $3,000 per person. Excellent medical and non-medical evacuation benefits are another reason we like the Platinum plan.

More: AXA Assistance USA Travel Insurance Review

- Generous medical and evacuation limits, plus $100,000 per person in non-medical evacuation—among the highest for plans we analyzed.

- Coverage for lost ski days, lost golf rounds and sports equipment rental.

- Travel delay and baggage coverage kicks in only after a 12-hour delay.

- The average cost for the Platinum plan is only so-so compared to other top-rated plans, although you do get robust coverage for the money.

Here’s a look at whether top coverage types are included in the Platinum policy.

- “Cancel for any reason” coverage

- Lost ski days

- Lost golf rounds

AXA Assistance USA impresses with its strong global reach and access to an extensive network of medical providers. This is particularly valuable in travel insurance, where emergencies can occur in any part of the world. Their attention to detail in crafting policies that include benefits for trip cancellations and interruptions adds a layer of security that reaffirms their strengths in protecting travelers against a wide array of potential issues.

– John Crist, founder of Prestizia Insurance

GREAT FOR PRE-EXISTING MEDICAL CONDITION COVERAGE

Generali global assistance.

Generali’s Premium policy stood out in our analysis for its generous window for pre-existing condition coverage. Travelers with pre-existing conditions can get coverage as long as you buy a Premium policy up to or within 24 hours of your final trip deposit. Competitors often have a deadline of 10 to 20 days after making your first trip deposit .

We also like the policy’s excellent trip interruption insurance and superior medical evacuation benefits of $1 million per person.

More: Generali Global Assistance Travel Insurance Review

- Excellent trip interruption coverage of up to 175% of your trip costs.

- Very good baggage loss coverage at $2,000 per person.

- If you want “cancel for any reason” coverage you must buy it within 24 hours of making your initial trip deposit, compared to 10 to 20 days from top competitors.

- This plan’s “cancel for any reason” coverage will reimburse you for only 60% of lost trip costs; most competitors provide 75%.

- Baggage delay benefits kick in only after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Premium policy.

- Rental car coverage for theft and damage of $25,000.

- Sporting equipment coverage of $2,000.

- Sporting equipment delay coverage of $500.

- “Cancel for any reason” upgrade that reimburses you 60% of your insured trip cost if you cancel at least 48 hours prior to your scheduled departure.

Generali Global Assistance excels in providing user-friendly services and efficient claims processing, which enhances customer experience significantly. Their policies are particularly valuable due to the inclusion of concierge services, which can be a lifesaver during unforeseen travel disruptions.

– Pradeep Guragain, co-founder of Magical Nepal

BEST FOR FAMILIES

Travelex insurance services.

Travel Select

$50,000/$500,000

We recommend Travelex’s Travel Select plan for families because it provides coverage for children at no extra cost (when accompanied by an adult covered by the policy). Its average price is also among the lowest among the companies we evaluated, making it an option to take a look at

More: Travelex Travel Insurance Review

- Very good travel delay coverage of $2,000 per person after a 5-hour delay.

- Medical coverage of $50,000 per person is on the low side, but you can buy an upgrade to double it.

- Baggage delay coverage requires a 12-hour delay and has a low $200 per person limit.

- Missed connection benefits of $750 per person are lower than many other competitors.

Here’s a look at whether top coverage types are included in the Travel Select policy.

- Sporting and golf equipment delay benefits of $200 after 24 hours or more.

Optional add-ons & upgrades offered:

- Medical coverage upgrade to $100,000 per person.

- Medical evacuation upgrade to $1 million per person.

- “Cancel for any reason” coverage of 75% (up to max of $7,500).

- Accidental death and dismemberment coverage of $200,000 per person for flights.

- Financial default coverage if your travel supplier goes out of business that provides 100% reimbursement of your insured trip cost.

- Car rental collision coverage of $35,000.

- Adventure sports upgrade to cover activities that would otherwise be excluded.

Travelex is a go-to for many of our clients due to its straightforward coverage options and ease of use. The company excels in offering plans that are simple to understand, which is great for first-time buyers of travel insurance. However, their basic plans might lack the depth of coverage seen with more premium offerings.

– Jim Campbell, independent travel agent and founder of Honeymoons.com

BEST FOR TRIP INTERRUPTION

Hth worldwide.

TripProtector Preferred Plan

We were impressed by TripProtector Preferred’s superior trip interruption benefits—200% of the trip cost. Most competitors provide 150%. Luxury-level benefits are another reason we recommend the TripProtector Preferred plan.

More: HTH Worldwide Travel Insurance Review

- Top-notch coverage limits for medical expenses and evacuation.

- Coverage for adventure sports—such as zip-lining, snowmobiling, whitewater rafting, and more—are included.

- Very good travel delay coverage of $2,000 per person after a 6-hour delay.

- Higher average price ($602) compared to most companies we evaluated, but you’re buying robust benefits.

- Baggage delay coverage requires a 12-hour delay.

Here’s a look at whether top coverage types are included in the TripProtector Preferred policy.

- Pet medical expense coverage of $250 if your dog or cat traveling with you gets injured or sick during your trip.

- Rental car coverage of $35,000 for damage and theft.

- “Cancel for any reason” upgrade available that provides 75% reimbursement of trip costs if you cancel at least two days prior to your scheduled departure.

My experience with HTH Worldwide Travel Insurance has been positive. While their policies may come at a slightly higher cost, the peace of mind and level of coverage they offer make it worth considering for travelers seeking comprehensive protection. HTH Worldwide stands out for its extensive coverage of medical emergencies, which is essential for international travel. Their policies are flexible, allowing travelers to customize coverage based on their specific requirements, and their worldwide assistance services ensure travelers have access to support wherever they are in the world.

– Kevin Mercier, travel expert and founder of Kevmrc.com

GREAT FOR CRUISE ITINERARY CHANGE/INCONVENIENCE

Cruise Choice

$100,000/$500,000

The Cruise Choice plan gets our attention for its compensation if you miss activities because your cruise ship changes its itinerary and for the inconvenience of delays to the next port of call. The Cruise Choice plan’s competitive price is another reason we recommend taking a look.

- Includes ”interruption for any reason” coverage of $500 if you buy policy within 14 days of trip deposit.

- Includes $25,000 per person in non-medical evacuation benefits.

- Provides benefits if your cruise ship has a fire or mechanical breakdown that delays arrival at the next port of call for two or more hours.

- Medical coverage of $100,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to many competitors with shorter required times.

- “Cancel for any reason” coverage not available.

Here’s a look at whether top coverage types are included in the Cruise Choice policy.

- Shipboard service disruption of $200 per person if your cruise ship has a fire or mechanical breakdown that delays the next port of call for 2 or more hours or changes the scheduled itinerary.

- Coverage for an extended school year, terrorism in an itinerary city and work-related emergency issues.

Nationwide stands out primarily for its versatility in coverage options catering to diverse travel needs—a vital advantage often overlooked by travelers until they face a mishap. They have built a robust system for handling claims efficiently, which I find crucial for travel insurance, where timely support can dramatically impact the customer experience.

The average cost of travel insurance is 6% of your trip cost , based on our analysis. The cost of travel insurance is usually mainly based on the age of travelers and the trip cost being insured.

Here’s a look at the average travel insurance cost for a 30-year-old woman traveling from California to Mexico for a 14-day trip.

What Affects Travel Insurance Costs?

Unlike many other types of insurance, there are usually only a few factors that go into travel insurance pricing.

Trip Cost Being Insured

The more trip costs you insure, the higher your travel insurance cost. Your trip cost includes any prepaid, non-refundable expenses, such as airfare, hotel accommodations, tours, event tickets, excursions and theme park passes.

The traveler’s age is also taken into account in travel insurance pricing. That’s because older travelers tend to have a higher likelihood of filing medical claims.

The more protection you buy, the more you’ll pay. For instance, if you opt for a “cancel for any reason” upgrade and generous travel medical expense coverage, you’ll pay more.

EXPERT TIPS

How to Buy Travel Insurance

Michelle Megna

Insurance Lead Editor

Insurance Managing Editor

Ashlee Valentine

Insurance Editor

Les Masterson

Begin Shopping Right After Your First Trip Deposit

It’s wise to buy travel insurance immediately after you make your first trip deposit. That way, you get the maximum length of time for cancellation coverage. Plus, you’ll qualify for time-sensitive benefits, such as CFAR and pre-existing medical condition exclusion waivers

Start by Estimating the Non-Refundable Trip Cost

The non-refundable trip cost is the amount you want to insure for trip cancellation. If you’re unsure of what the total cost will be, estimate the amount and then update it later with the travel insurance company, as long as you do so before your departure date.

Buy Travel Medical Insurance for International Trips

If you’re traveling outside the U.S., make sure you buy a policy with ample travel medical and emergency medical evacuation insurance. It’s important because you may have little to no coverage under your U.S. health plan. Look for a policy where the medical insurance is primary, meaning the policy will pay out first, before any other health insurance you have.

Check for Delay and Missed Connection Coverage

If you’re flying to your destination, your itinerary could be derailed by weather, airplane mechanical issues or missed connections. If you’re worried about paying extra money due to a delay or missed connections, look for a policy that has a generous amount of travel and baggage delay coverage and missed connection insurance. You’ll also want to find a policy with a short waiting period for delay coverage, such as six hours.

Decide How Much Cancellation Flexibility You Want

If you have a lot of non-refundable expenses and can’t afford to lose your trip investment, consider buying a “cancel for any reason” upgrade. You never know what life will bring, and unfortunately it might bring a reason to cancel a trip that’s not covered by the base policy. Having CFAR coverage ensures you can get partial reimbursement for any oddball problems that crop up.

We found that AIG, Seven Corners and World Trips offer the best “cancel for any reason” travel insurance , based on our analysis of 24 policies. A “cancel for any reason” (CFAR) upgrade is a great choice if you want the most flexibility to cancel your trip and still receive partial insurance reimbursement for your insured trip cost.

WorldTrips, Nationwide, PrimeCover and Travel Safe earned the top scores in our ranking of the best cruise travel insurance companies . If you want top-notch cruise insurance, look for policies that provide robust coverage for medical expenses, trip interruption and cancellation, and missed connections.

PrimeCover and Seven Corners offer the best travel insurance for seniors , based on our evaluation of 26 policies. Travel insurance for seniors should include high medical evacuation benefits (at least $500,000 per person in coverage) and have at least $250,000 per person in coverage for medical expenses.

In our analysis, GeoBlue and Trawick International have the best annual travel insurance policies. Annual travel insurance, also known as multi-trip travel insurance, is ideal if you take several trips a year because it simplifies logistics and minimizes your travel insurance costs.

Travel Insured International and WorldTrips are the cheapest travel insurance companies , based on our research. Our top picks include policies that provide generous coverage at the lowest cost.

Ask The Expert

We Answer Your Questions

What’s the best travel insurance option for 19 family members planning a multi-generational trip abroad.

– D. Frankfurt, Crested Butte, CO

Consider buying a group travel insurance plan. These policies usually allow parties of 10 or more to purchase one travel insurance policy to cover the entire group on a trip. However, individual policies typically offer higher benefit limits and upgrades. So if some family members have specific coverage needs—for example, they want high limits for medical expenses—an individual travel insurance policy might be a better fit for them.

Do I still need travel insurance if my airline is required to refund canceled flights?

– Anna P., Austin, Texas

Travel insurance still makes sense if you have a lot of non-refundable trip costs, such as excursions, accommodations and tours. It’s especially beneficial if you’re traveling internationally. It can help pay for medical expenses and evacuation if you get sick or injured during your trip.

Why do travel insurance companies need my state of residence when I get a quote?

– John T., Lewiston, Maine

Travel insurance regulations and laws vary by state, so insurers use that information to ensure the policy you buy is the one that’s approved in your state.

We researched and analyzed 42 policies to find the best travel insurance. When companies had more than one highly rated travel insurance policy we used the highest-scoring plan. Ratings are based on the following metrics.

Cost (25% of score): We analyzed the average cost for each travel insurance policy for trips to popular destinations:

- Couple, age 30 for a Mexico trip costing $3,000.

- Couple, age 40, for an Italy trip costing $6,000.

- Family of four for an Italy trip costing $15,000.

- Family of four for a France trip costing $15,000.

- Family of four for a U.K. trip costing $15,000.

- Couple, age 65, for an Italy trip costing $6,000.

- Couple, age 70, for a Mexico trip costing $3,000.

Missed connection coverage (10% of score): Travel insurance policies were awarded more points if they include missed connection benefits of $1,000 per person or more.

Medical expenses (10% of score): Travel insurance policies with travel medical expense benefits of $250,000 and up per person were given the highest points.

Medical evacuation (10% of score): Travel insurance policies with medical evacuation expense benefits of $500,000 and up per person were given the highest points.

“Cancel for any reason” upgrade (10%): Travel insurance policies received points if “cancel for any reason” upgrades are offered. More points were awarded for “cancel for any reason” upgrades with reimbursement levels of 75%.

Baggage delay required waiting time (5%): Policies with baggage delay benefits kicking in at 12 hours or less were given points.

Cancel for work reasons (5%): Travel insurance plans that allow cancellations for work reasons were awarded points.

Hurricane and weather (5%): Policies received points if the required waiting period for hurricane and weather coverage was 12 hours or less.

“Interruption for any reason” upgrade (5%): Policies were awarded points if they offered an “interruption for any reason” upgrade.

Pre-existing medical condition exclusion waiver (5%): Points were given to policies that cover pre-existing medical conditions (if purchased within a required timeframe after the first trip deposit).

Travel delay required waiting time (5%): Policies with travel delay benefits kicking in after six hours or less were given points.

Trip interruption travel insurance (5%): Points were given if trip interruption reimbursement is 150% or higher.

Read more: How Forbes Advisor Rates Travel Insurance Companies

Editor’s note: While our parent company has an interest in PrimeCover, this review was subjected to our team’s standard rigorous editorial process, which remains independent of any influence from insurance companies, business relationships, affiliates or any other external parties.

While these policies were not among our winners, they may still be good options based on your travel needs. Many of these plans have lower coverage limits, which may be suitable depending on your trip.

What is travel insurance?

Travel insurance is a type of policy that reimburses you for money you lose from non-refundable deposits and payments when something goes wrong on your trip. These problems can range from lost baggage to flight delays to medical problems.

The more you’re spending on your trip, the more you likely need travel insurance. This is especially true for international trips and cruises, where travel problems become more expensive to solve.

What do I need for travel insurance?

The information you need to buy travel insurance includes the trip cost being insured, your age, your destination, length of trip and age. Buying travel insurance online is relatively easy. You don’t have to answer a lot of questions, and you can update your trip cost and itinerary later if plans change, as long as you do so before your departure.

What’s not covered by travel insurance?

Problems not covered by travel insurance tend to be similar among policies. We recommend that you read a policy’s exclusions so you’re not caught by surprise later if you try to make a claim. Typical exclusions include:

- Injuries from high-risk activities such as scuba diving.

- Problems that happen because you were drunk or using drugs.

- Medical tourism, such as going abroad for a face lift or other elective procedure.

- Lost or stolen cash.

- Best “Cancel For Any Reason” Travel Insurance

- Best Cruise Insurance Plans

- Best Covid-19 Travel Insurance Plans

- 5 Cheapest Travel Insurance Companies

- Best Travel Medical Insurance

- Best Travel Medical Insurance For Visitors To The USA

- Trip Cancellation Insurance

- Travel Medical Insurance

- Emergency Medical Evacuation Insurance

- Travel Delay Insurance

- Trip Interruption Insurance

- Baggage Insurance

- “Cancel For Any Reason” Travel Insurance

- “Interruption For Any Reason” Travel Insurance

- Accidental Death and Dismemberment Insurance

- Parents Visiting The U.S.

- The Worst Cities For Summer Travel, Ranked

Get Forbes Advisor’s ratings of the best insurance companies and helpful information on how to find the best travel, auto, home, health, life, pet, and small business coverage for your needs.

Michelle is a lead editor at Forbes Advisor. She has been a journalist for over 35 years, writing about insurance for consumers for the last decade. Prior to covering insurance, Michelle was a lifestyle reporter at the New York Daily News, a magazine editor covering consumer technology, a foreign correspondent for Time and various newswires and local newspaper reporter.

Amy Danise is the managing editor for the insurance section at Forbes Advisor, which encompasses auto, home, renters, life, pet, travel, health and small business insurance. She is a highly experienced editor, writer and team leader with an extensive background in the insurance sector. With a career spanning more than three decades, she has focused her work on consumer-oriented publications.

Shayla Northcutt is the CEO and founder of Northcutt Travel Agency and a leading world travel expert. Her main expertise includes destination weddings, honeymoons, large group travel, family travel, world travel and travel insurance. Northcutt appears regularly on KHOU 11 and ABC 13 Eyewitness News, among other media outlets, providing guidance on travel insurance for consumers. Her first-hand knowledge of destinations and resorts makes her a leading travel professional. Northcutt is married to an amazing husband and is a mom to two boys, Cayman and Crockett. She found a passion in travel and exploration of all the things the world had to offer. Feeling such a strong connection to the travel industry, she decided to open Northcutt Travel Agency in 2017. Northcutt has visited different parts of Europe numerous times, and has visited over 350 resorts in Mexico and the Caribbean leading to detailed first-hand knowledge of the resorts. She has also sailed on multiple cruise lines, giving her experience with the cruise world as well. The other places Northcutt has visited, and now helps people plan, include Disney, Hawaii, Fiji, Australia, Thailand and all major cruise lines.

What is Travel Insurance?

Travel insurance is your last line of defense if something goes wrong on a trip—it pays for unexpected expenses like lost bags, cancelled flights, and medical emergencies. But not all policies are created equal.

So you’re planning a trip and someone asked you if you have travel insurance. Wait, what? Yes, at this point, it’s perfectly reasonable to ask yourself (and the internet): what is travel insurance?

For years, I didn’t know anything about travel insurance, and I went without it. Knowing what I do now, I’ve come to believe that if you can’t afford a travel insurance policy, you can’t afford to travel.

Essentially, travel insurance covers expenses from unforeseen events like a canceled trip, lost bag, or medical treatment.

It’s important to understand how it works so you can pick the right plan. Ready? Let’s dive right into the details of travel insurance.

How Does Travel Insurance Work?

If you’re just here for a quick and dirty answer, let’s get right down to it.

When you travel, you take on risk, whether you know it or not. You put down a lot of money on flights, hotels, rental cars, and more. But what if your trip gets canceled? Oops, looks like you’re out a lot of cash.

Plus, did you know that regular health insurance plans usually don’t provide any coverage outside your home country?

Travel insurance protects you from unexpected events like these. You pay a relatively small up-front fee to a company in exchange for a guarantee that they will pay for expenses that are covered by a specific policy.

Travel insurance policies typically include two different categories of protection: trip coverage and emergency medical coverage.

- Trip insurance includes protection for the expenses of your trip. If your trip is canceled or interrupted (for a covered reason), the company will reimburse you for the cost. Trip coverage can also include reimbursements for lost baggage, delayed flights, rental car damage, and more.

- Emergency medical insurance is exactly what it sounds like. If you are injured or become ill overseas, your regular health insurance may not pay for your care. Travel medical coverage includes overseas care or emergency medical evacuation if needed.

There you have it. That’s the basics of how travel insurance works, and no, it isn’t that complicated. If you want to get into more details, let’s keep going.

Different Types of Travel Insurance

Did you know that there’s more than one type of travel insurance?

Yep, it can be broken up into several categories, from single trip insurance to long-term healthcare designed for digital nomads. The type of insurance you need will depend entirely on your trip, your destination, how often you travel, and your personal preferences.

Single-trip comprehensive coverage is most often the best choice, but not always. Here are the most important types of travel insurance so you can pick the right coverage type for you.

- Comprehensive Travel Insurance covers every aspect of your travel, from luggage to trip cancellations to emergency medical bills. For most people most of the time, this is what I recommend. I’ll dive deeper into every aspect of comprehensive travel insurance soon.

- Travel Medical Insurance only covers medical expenses, so you don’t get any of the trip expense coverage. Travel medical plans range from emergency coverage to full-fledged health care for living abroad.

- Single Trip Travel Insurance Insurance is exactly what it sounds like: insurance for a single trip. You enter your destination and travel dates to get covered during your trip.

- Annual Travel Insurance is, again, pretty straightforward. Rather than covering a single trip, annual plans include all your travels for an entire year. Note that there are often limits on how many days abroad in the year are covered.

- Nomad Travel Insurance (like the Nomad Insurance Plan from SafetyWing) is designed for people living long-term outside their home country. It typically renews monthly.

What Does Travel Insurance Cover?

Any travel insurance policy has a lot of pieces to it, and sometimes the legalese terminology can be difficult to understand. The most important thing to understand is what is covered, and what isn’t. After all, you want to know what you’re paying for, right?

There are many varieties of travel insurance; essentially, they all just mix and match different coverages. Here are the most common things that a plan covers, and how that coverage works.

Trip Cancellation Coverage

If you have a lot of prepaid nonrefundable trip costs, the idea of having to cancel your trip can be scary. You’ve put hundreds or thousands of dollars into your upcoming trip, and you would lose all that money if your travel plans change.

Life happens though, and there’s always a chance that you get sick, a natural disaster happens, your house floods, you get called in for jury duty, or something else bad happens that causes you to cancel your trip.

That’s where trip cancellation coverage comes in. If you have a travel insurance plan, you can file a claim, and the company will refund the total trip cost.

Yep, that’s pretty cool.

It’s important to know that you can’t just cancel for any reason you want and expect to have your trip’s price refunded. Most insurance policies only pay out reimbursements for a “covered reason.” Covered reasons include things like serious illness to yourself or a family member, losing your job, a natural disaster or terrorist attack in your destination, or other unpredictable events.

Reasons that aren’t covered typically include things that could be predicted ahead of time, like ongoing civil and political unrest, severe weather due to a predicted tropical storm, or “because I want to.”

Also, cruises are not always covered under typical trip cancellation insurance, so make sure your plan covers cruise lines if that’s what you need.

Cancel For Any Reason

If you want the greatest peace of mind, you’ll want to look for Cancel For Any Reason (CFAR) coverage. CFAR is exactly what it sounds like, you can cancel your trip for any reason, and the insurance company will pay you for any non-refundable expenses from hotel stays, flights, and more.

Just know that CFAR insurance costs more.

Trip Interruption Coverage

Trip interruption is similar to trip cancellation insurance, but it covers travel expenses in case you have to cut your trip short after you’ve already departed (while trip cancelation is for before you leave).

Trip interruption coverage typically has similar rules and limits, so you can just think of it as an extension of trip cancellation.

Good trip interruption coverage also includes coverage for travel costs to return home. That’s a great benefit so you don’t have to pay your own way home if anything goes wrong.

Trip Delay Coverage

Beyond trip cancellation and interruption, comprehensive travel insurance policies also typically have coverage for trip delays. That means they’ll help pay for inconveniences and extra expenses caused by flight delays, cancellations, missed connections, and other delays.

Usually, this is a per-day amount while your trip is delayed to pay for unexpected hotel stays or transport costs to rejoin your trip itinerary.

Medical Emergency Coverage

No one wants to think about having a medical emergency overseas, but it’s always a good idea to be prepared.