U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

International travel medical insurance and travel protection

Travel with less worry with safetrip from unitedhealthcare global.

With SafeTrip travel protection plans from UnitedHealthcare Global, you can set off on your next adventure prepared and ready for what comes your way — whether that’s medical, emergency or trip cancellation surprises. Choose the right SafeTrip travel medical insurance or travel protection plan for you, with plans that include medical coverage, trip cancellation, evacuation and other coverage options.

Find SafeTrip travel medical insurance and travel protection options for you

Get coverage to protect yourself and your trip expenses on all of life’s travels.

What is international travel medical insurance?

International travel medical insurance is secondary emergency coverage for people who are leaving their home country and provides coverage while they are outside of their country, whether that’s for a trip, work outside the country, a volunteer trip or any other travel circumstance.

What does international travel medical insurance cover?

International travel medical insurance typically offers benefits that cover emergency medical, dental and evacuation services. Some plans, like those with added travel protection benefits, cover specific travel-related circumstances, like trip cancellation, trip interruptions or lost baggage.

Why buy international travel medical insurance and travel protection?

With travel medical insurance and travel protection, you’ll have coverage to help protect your financial investment — and your health and safety. It’s your ticket to help you travel with less stress. Some advantages of choosing travel medical and trip protection include:

Financial protection

Get reimbursement for missed connections, trip delays, cancellations, baggage loss and eligible covered non-refundable expenses

Health coverage

Ensure you’re covered for medical emergencies and evacuation coupled with assistance coordinating arrangements and more

Safety and security

Be sure you’re protected — many domestic health insurance plans may not cover medical emergencies while traveling abroad

Explore our top SafeTrip plans for travelers

Our travel protection plans offer flexible benefits for any voyage — from bucket-list trips to out-of-country work and more. These 3 plan choices include coverage for everything from trip delays and cancellations to unexpected health care needs and helpful details like destination profiles and evacuation coverage.

International Travel Medical Plus

Protect yourself with a combination plan that covers unexpected medical needs and unanticipated trip cancellations.

- No deductibles

- Trip cancellation, interruption, delay and baggage coverage

- Medical and security assistance

- Option to add Extreme Sports and Rental car coverage

International Travel Medical

Choose plan options with emergency medical insurance for travel off the beaten path — and anywhere else your trip may take you.

- Up to $1 million for medical expense limit

- Medical evacuation and medical assistance

- Option to add Extreme Sports coverage

Travel Protection

Be prepared by choosing a plan with backup for domestic U.S. trip cancellations, interruptions and delays.

- Full AD&D coverage

- Option to add Rental car coverage

Why choose SafeTrip Travel Medical Insurance from UnitedHealthcare Global?

24/7 support.

Get support from instant customer service, available in more than 100 languages

Global providers

Get connected to quality physicians, clinics and hospitals worldwide

Around-the-world coverage

Explore coverage options available in more than 150 countries

All-in-one service

Count on service all within our one company that brings you 45 years of experience

Frequently asked questions about international travel medical plans

Read on to learn more about why international travel medical plans may be right for you.

Who should buy travel medical insurance?

If you’re traveling abroad, going on a business trip overseas or planning an expensive trip, travel insurance or travel protection may be a good choice for you. It’s a way to be better prepared for the possibility that your trip may be interrupted or canceled or if you experience a medical emergency while away. It’s coverage that connects you with medical care, travel protection and more.

Nearly every traveler can benefit from the extra protection of travel medical insurance. Some in particular who may want to consider it include:

- Families with children

- Anyone visiting a country that speaks a different language

- Solo travelers

- Travelers to a remote location

What kind of travel insurance is right for me?

SafeTrip travel protection includes 3 plan options for you to choose from. The right plan for you will depend on your situation and the level of coverage that’s important to you.

International Travel Medical Plus is a combination protection plan including travel medical insurance and travel protection (including trip cancellation).

International Travel Medical Plus plans focus on coverage in the event your trip is cancelled or interrupted, but still includes eligible medical expense limits ranging from $50,000 to $150,000.

International Travel Medical provides emergency travel medical coverage including evacuation.

International Travel Medical plans are geared towards travelers who may want more robust medical coverage for unexpected accidents or sickness. These plans start at a minimum medical expense limit of $100,000 and allow for a maximum of $1,000,000.

- Travel Protection plans give you coverage if your trip is interrupted, delayed or cancelled in the U.S. — domestic travel only.

Does my health insurance work internationally?

Many health insurance plans do not cover you when you are out of the country. For those that do, the coverage is often limited and requires you to pay at the time of service, save receipts and file for reimbursement once you get home.

In case of a medical or dental emergency while in another country, this could require you to spend a large amount of your own personal funds or charge significant amounts on credit cards while you are still traveling.

Travel medical insurance plans typically cover emergency medical and dental costs. Emergency transportation costs, such as ambulance or air lift, also are often covered, as are emergency evacuations that would get you from a remote location to appropriate medical care.

How much is travel insurance?

While travel insurance, or travel protection, is often more expensive than travel medical insurance, these plans give you the additional assurance that you are covered against the financial loss due to covered reasons under the policy. Travel protection costs are based on the total trip cost and can therefore vary by trip.

Travel medical insurance, on the other hand, only covers you for any medical emergencies or medical evacuations and is often cheaper than the combined plans offering travel medical insurance and trip protection in one.

How long before traveling should you get travel insurance?

It is generally recommended to purchase travel insurance as soon as you have made any non-refundable payments towards your trip. This helps to ensure that you are covered for any unforeseen circumstances that may arise before your departure. A SafeTrip policy can be purchased as little as 24-hours or one full day prior to travel departure.

Are non-medical benefits available with travel medical insurance?

Even if you’re facing a non-medical challenge, UnitedHealthcare Global SafeTrip plans are here for you with support and assistance. You can call our 24/7 Emergency Response Center to assist with lost or stolen passports, legal referrals, translation services, emergency transfer of funds and a host of other non-medical problems. Please refer to your policy for details.

How do I make a claim if I have a travel medical plan?

If you currently have a SafeTrip plan and you need to make a claim, follow these simple steps:

- Visit CBP Connect

- Follow the instructions on screen

For additional questions:

Call: 1-877-693-8530

Email: [email protected]

Ready for your next travel adventure?

Get travel tips and information to help you on your way.

Explore more supplemental plans

View more plans, like dental, vision and other cash-benefit plans, that offer coverage for expenses not covered by a medical plan.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Buying the Best Travel Medical Insurance for You [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

47 Published Articles 3397 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![health insurance travel abroad Buying the Best Travel Medical Insurance for You [2024]](https://upgradedpoints.com/wp-content/uploads/2020/12/Travel-Medical-Insurance.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

What is travel medical insurance, what does travel medical insurance cover, what doesn’t travel medical insurance cover, what travel medical insurance isn’t, how does travel medical insurance work, how much does travel medical insurance cost, which company has the best travel medical insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The thought of getting sick or injured while traveling can be one of the most stressful aspects of planning a trip. Often, travelers assume that their primary health insurance will cover all costs of medical expenses on their trip, but not every health insurance plan covers every country and situation.

To ensure you have coverage if you need it, you may need to consider purchasing travel medical insurance. This can fill the gap between your regular insurance and any coverage you may have with your credit cards . We’ll break down all of the important details and tell you everything you should know about travel medical insurance.

If you are traveling domestically within your own country, you will likely be covered by your primary health insurance. If you are traveling abroad, your coverage may not extend to those other countries. This is primarily where travel medical insurance comes into play.

Travel medical insurance is a type of international insurance designed to cover emergency health care costs you might face when you are traveling or vacationing abroad.

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.

Bottom Line: Travel medical insurance is recommended by the U.S. Department of State, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO).

According to Allianz Travel, the most common overseas medical emergencies that are claimed include:

- Fractures from falls

- Cardiovascular problems such as a heart attack or stroke

- Trauma involving motor vehicles

- Respiratory problems such as a collapsed lung

So going with that first item, let’s say you’re exploring Europe and end up twisting your ankle on the beautiful, but uneven cobblestone streets in Rome. Depending on the plan you choose, you may be covered for:

- The cost of a local ambulance to transport you to the hospital

- Your emergency room co-payment

- The bill for your hospital room and board

- Any other eligible medical expenses, up to your plan limits

But there are limitations to travel medical insurance. Before you purchase a plan, it’s important to know exactly what you are buying — including which things are and aren’t included in your coverage.

Travel medical plans are designed to help in the event of an unforeseen illness or injury while traveling abroad. Travel medical insurance offers emergency medical expense coverage as well as emergency evacuation coverage. This means that the plan will reimburse you for reasonable and customary costs of emergency medical and dental care (up to the plan limits — discussed below).

It is important to look closely at all plans you are interested in since many important things are hidden in the details. You might also find it helpful to brush up on your insurance lingo before doing this.

Plan Limits

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000. This is obviously a HUGE range, so you will have to determine the correct amount of coverage based on a few key items:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country? As we discussed above, Medicare doesn’t cover you at all outside of the U.S., so this would be an instance where you might want your plan’s coverage limit to be higher.

- How long is your trip? If you’re going to be away for more than 1 to 2 months, you might want a higher plan limit to account for the greater exposure to risk.

- Do you need extra coverage due to risky activities? For example, if you expect to ski, mountain climb, or do any other risky activities where you might get injured, you might want a higher plan limit.

- What do you feel comfortable with? If you feel safer having $100,000 as opposed to $50,000, then that may be the right decision for you. This insurance plan should provide you a sense of security so you can enjoy your trip.

- Deductibles

Most medical single trip plans have some sort of deductible that you must pay before any benefits will be paid. After this, your travel medical insurance will cover any remaining costs, up to the plan’s limit.

However, you will be offered the option to increase, decrease, or remove the deductible altogether. Based on this choice, the price you pay (aka the premium) will be affected accordingly. For example, if you choose a higher deductible, your premium will decrease. If you choose a lower (or no) deductible, your premium will increase.

Length of Trip

You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types:

Single-Trip Coverage

This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip. While on your trip, you can still visit multiple countries and destinations all under the umbrella of this single trip. You will be covered for the duration of this trip under a single trip travel medical insurance plan.

Multi-Trip Coverage

Multi-trip coverage is for multiple trips and often purchased in 3-, 6-, and 12-month segments.

Long-Term Coverage

This is continuous medical coverage for the long-term traveler (think expats or people working abroad) and is typically paid on a monthly basis.

Does Travel Medical Insurance Cover COVID-19?

Many travel insurance policies offer good medical coverage, but not all plans cover expenses related to COVID-19 . If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract COVID-19.

In general, cancellations due to fear of travel are not covered. However, some plans cover you if you or your covered traveling companion were to become sick as a result of COVID-19. This means that you could still receive benefits for the losses that are covered by the plan.

Many countries around the world , such as Costa Rica and the United Arab Emirates, are even requiring travelers to hold a specific level of medical coverage to account for COVID-19-related medical care and evacuation.

In addition, “ Cancel for Any Reason ” has become a hot topic. This optional coverage is not available with all plans but lets you cancel a trip for a partial refund no matter what your reason — including unexpected travel bans, lengthy quarantine periods, or cancellations due to concerns over COVID-19.

Since travel medical insurance is meant to cover emergencies, certain types of expenses are excluded from most travel medical policies. In addition, for insurance purposes, a pre-existing condition is general defined as any condition:

- For which medical advice, diagnosis, care, or treatment was recommended or received within a defined period of time prior to your coverage date (varies from plan to plan, but is typically within 60 days to 2 years)

- That would cause a “reasonably prudent person” to seek medical advice, diagnosis, care, or treatment prior to your coverage date

- That existed prior to your effective date of coverage, whether or not it was known to you (commonly includes pregnancy)

Hot Tip: You do not need a medical examination in order to purchase travel insurance. If you have a claim, the insurance company will investigate to ensure that your claim occurred during the coverage period of your policy and wasn’t a result of any pre-existing conditions.

Here are some of the most frequent exclusions:

- Pre-existing conditions as defined above

- Routine medical examinations and care (i.e. wellness exams, ongoing prescriptions, etc.)

- Routine prenatal, pregnancy, childbirth, and post-natal care

- Medical expenses for injury or illness caused by extreme sports

- Mental health disorders

- Injury caused by the effects of intoxication or illegal drugs

- Payments exceeding the plan limit

Unless you’ve purchased a comprehensive travel insurance plan, other exclusions include claims related to:

- Trip cancellation

- Lost luggage

- Rental car damage

Be sure to read the description of coverage for any plan you’re considering before you make the purchase. While reading the entire document front to back can be tedious, it’s better to know what’s excluded before you attempt to make a claim.

Now that we’ve let you know what is and isn’t covered by travel medical insurance, we’ll also breakdown the difference between travel medical insurance and other similar options.

Comprehensive Travel Insurance

Comprehensive travel insurance plans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Some comprehensive plans also offer additional coverage for things like rental car damage, Cancel for Any Reason, or a pre-existing condition waiver.

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip.

Health Insurance

You might be thinking that already have medical insurance provided by your employer or through Medicare. However, when you travel to other countries, your primary health insurance might not go with you. Before your trip, check to see whether your domestic plan provides any coverage once you’ve left your home country since many offer limited or no coverage.

In case of a medical emergency, you will want to be able to lay your hands quickly on your travel insurance plan’s contact information for the 24-hour Emergency Assistance program as well as your policy number, so make sure to keep this information somewhere that is easily accessible. Also, be sure you know how to place a call to that number from outside the country.

This is important because you’ll be required to call your travel insurance provider and notify them that you need to be seen by a medical professional as soon as possible. Obviously, you may not be medically able to call before you seek emergency medical treatment, but you should do so as soon as you are able to.

The earlier you can call, the more likely it is that you can avoid any issues for payment of claims and you can also get help and advice from the company’s emergency assistance program.

Bottom Line: Specific details on when and how to contact your insurance provider in case of a medical emergency vary by plan and provider, so thoroughly review these details in your plan information.

For example, in the event of an emergency that requires emergency medical evacuation, your insurance provider will have to approve the evacuation and even make those arrangements for you. If you don’t call ahead to have them do this, the company may not approve the expense and you may be stuck paying for the evacuation in full.

Once you are actually at a medical facility to receive care, make sure to document the experience as thoroughly as possible. This means asking for copies of all of your records before you check out. You’ll need to provide these records to the insurance company when you eventually file your claim and having proof of treatment and costs will assist you in filing a successful claim and getting your money back as soon as possible.

Travel medical insurance plans can vary widely in price, but in general, plans cost anywhere between 4-10% of your total non-refundable trip cost. The pricing of any plan takes into consideration many things, including a few that we discussed above, to determine the cost. These include:

- Age of travelers

- Plan limits

- Supplemental plans such as “Cancel For Any Reason” coverage or coverage for pre-existing conditions

- Length of trip

In addition, if you decide that a comprehensive plan is a better choice for you, this will also increase the price.

The best travel medical insurance company for you may be determined by what type and how much coverage you’d like to have. Let’s review a few options and companies to consider.

Credit Card Coverage

Many premium cards have some medical coverage, so be sure to look over all of the best credit cards for travel insurance coverage and protection.

For example, cardholders of The Platinum Card ® from American Express may already have $15,000 of secondary medical coverage . For many, this may be enough, but for others, you may not feel comfortable at this level of coverage and want to purchase a travel medical insurance policy.

Travel Medical Insurance Policies

If you are looking to purchase a plan from a reputable company, a few options include:

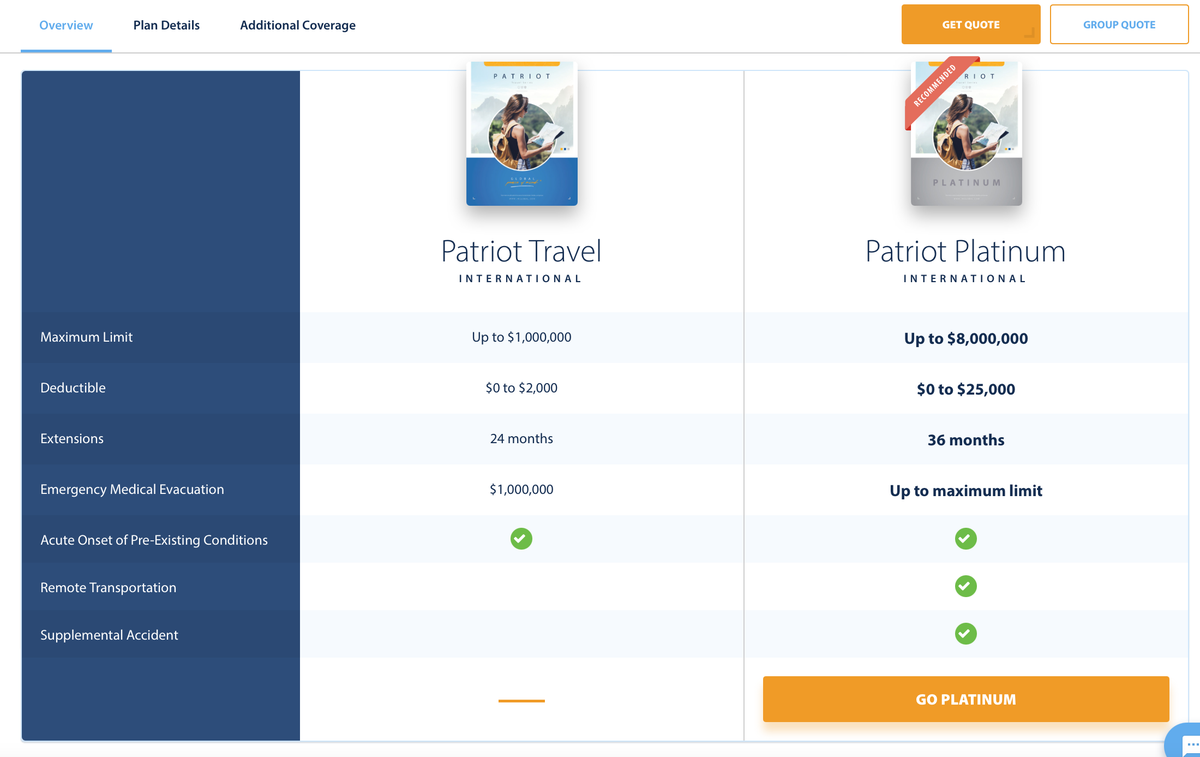

1. Patriot Travel Medical Insurance from IMG Global

For the out-of-country plans, Patriot offers:

- Short-term travel medical coverage

- Coverage for individuals, groups, and their dependents

- Daily or monthly rates

- Freedom to seek treatment with the hospital or doctor of your choice

The following plans are available based on the level of coverage that you desire and you can request a quote through their website linked above.

2. GeoBlue Single Trip Traveler Medical Insurance

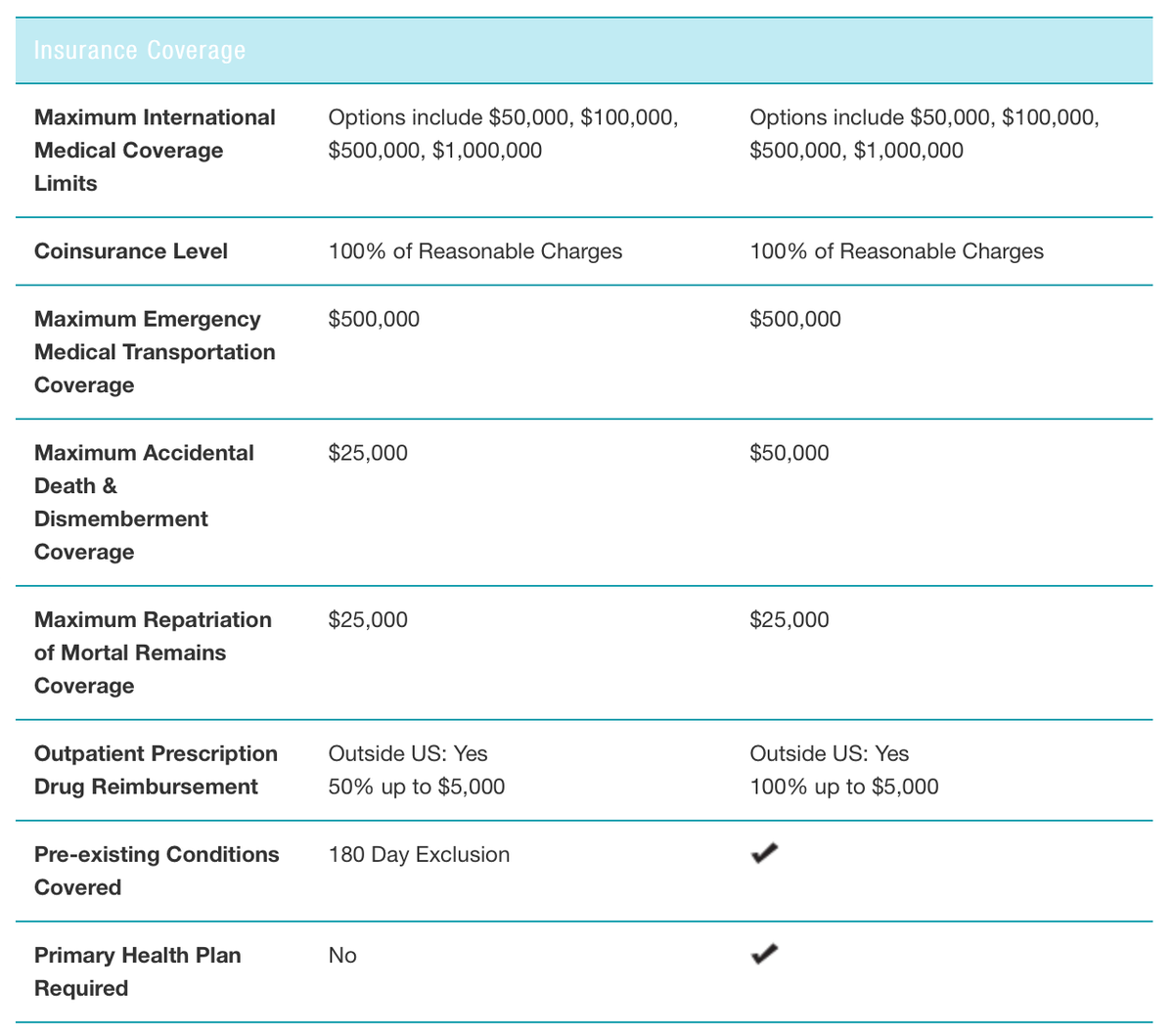

GeoBlue offers both the “Voyager Choice” and “Voyager Essential” single trip plans. Both plans allow you to choose your level of medical coverage (from $50,000 up to $1 million) and offer $500,000 in emergency medical transportation and repatriation coverage.

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

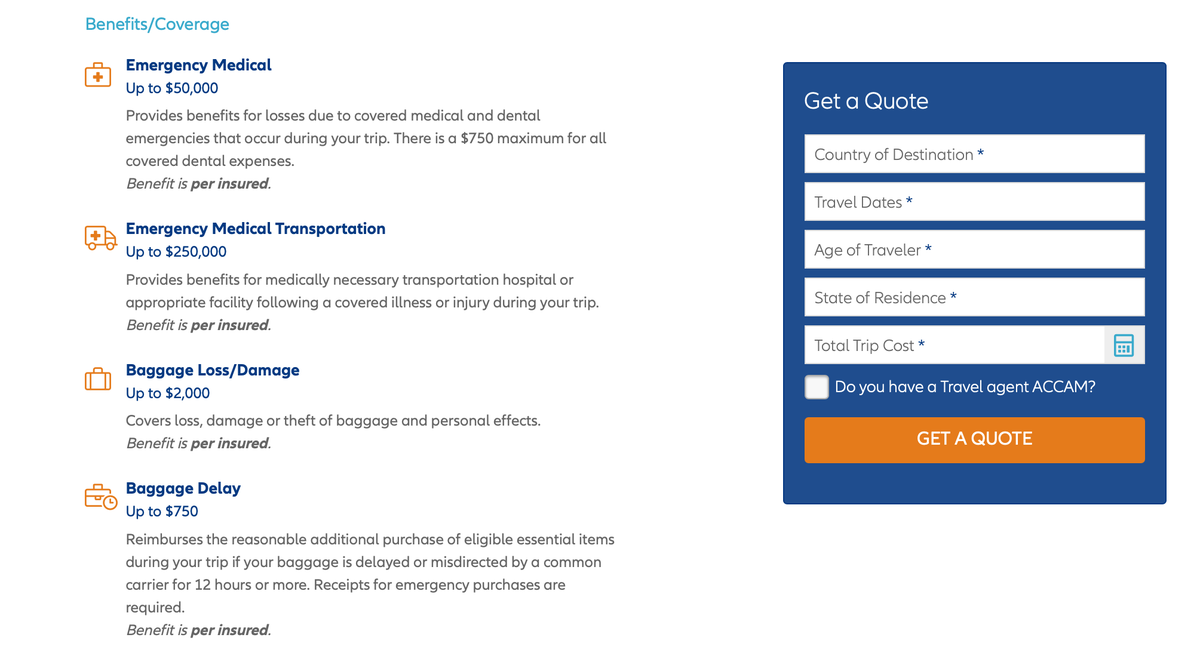

3. Allianz Travel Medical Insurance

Allianz offers an Emergency Medical plan that offers additional benefits that extend beyond simply medical coverage. This plan is a comprehensive plan that covers lost baggage and trip cancellation and delay, in addition to emergency medical coverage. See just a few of these benefits below:

In addition, many companies, such as AAA, offer travel insurance through Allianz, so you may receive a further discount if you reference your AAA policy.

Travel medical insurance can be beneficial for most travelers when traveling internationally as most primary health insurance plans won’t cover you abroad. We hope we’ve given you the tools you need to select a plan that works best for you and your travel needs.

At the end of the day, a travel medical plan is a great option if you’re traveling abroad and are not worried about covering trip costs due to a cancellation or added expenses due to a travel delay. Anyone looking for robust coverage for baggage or interruption should consider an upgrade to a more comprehensive plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for medical-only coverage

- Best for family coverage

- Best for long trips

- Why You Should Trust Us

Best International Travel Insurance 2024: Your Ultimate Guide to Safe and Secure Adventures Abroad

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best International Travel Insurance of 2024 Summary

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

- Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

Top International Travel Insurance Companies Comparison

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most U.S. health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best International Travel Insurance Overall

Allianz travel insurance.

Allianz offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allianz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz travel insurance review .

Best International Travel Insurance for Exotic Trips

World nomads travel insurance.

World Nomads offers coverage for over 300 adventure activities and sports, so you can focus on the adventure without worrying about gaps in your coverage. Both its Standard and Explorer plans cover a wide array of sports. Most activities will be covered under the Standard plan, but extreme sports like skydiving and scuba diving below 165 feet are only covered in the Explorer plan.

Another added benefit of the World Nomads plan is that plans are available after departure. Though if you purchase a plan after you leave for your trip, you'll have to wait 72 days before your coverage kicks in.

World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads travel insurance review .

Best International Travel Insurance for Trip Interruption

C&f travel insured.

C&F offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review .

Best International Travel Insurance for Medical Coverage

Geoblue travel insurance.

GeoBlue offers policies that covers emergency medical treatments when you're abroad. While GeoBlue lacks trip cancellation coverage, that allows it to charge lower premiums than the other companies on this list.

GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs.

Read our GeoBlue travel insurance review .

Best International Travel Insurance for Family Coverage

Travelex travel insurance.

Travelex offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance.

Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex travel insurance review .

Best International Travel Insurance for Long Trips

Seven corners travel insurance.

Seven Corners offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners travel insurance review .

How to Find the Right International Travel Insurance Company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

Your needs for travel insurance will depend on the type of trip you're taking. You'll need to consider your destination and what you'll be doing there, either business, leisure, or adventure traveling. Policies covering adventure sports and activities will cost more. Longer, more expensive trips will also cost more.

Research the reputation of the company

When researching a company, you'll want to closely review the description of services. You'll want to see how claims are handled, any exceptions, and limitations.

You'll also want to look at the company's customer reviews on sites like Trustpilot, BBB, and Squaremouth, as this will provide insight on the quality of customer service and the claims process. You should also take note of whether companies respond to customer reviews.

Compare prices

You can get quotes through a company's website or travel insurance aggregators like InsureMyTrip and VisitorsCoverage. You'll need to be prepared to provide the following information about your trip:

- Trip destination(s)

- Travel dates

- Number of travelers

- Traveler(s) age/birthday

- State of residence

- Total trip cost

For companies that offer travel medical insurance, you'll also want to play around with the deductible options, as they can affect your policy premium.

Understanding International Travel Insurance Coverage Options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the Best Price for International Travel Insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find the cheapest travel insurance that still meets your needs.

You can use insurance aggregators like Squaremouth , InsureMyTrip , or VisitorsCoverage to directly compare rates.

Why You Should Trust Us: How We Reviewed International Travel Insurance Companies

We ranked and assigned superlatives to the best travel insurance companies based on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

Read more about how Business Insider rates travel insurance .

International Travel Insurance FAQ

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

International health insurance and travel insurance serve different purposes. While both may cover medical expenses, international health insurance provides long-term health insurance for working abroad. Meanwhile, travel insurance offers short-term coverage for the duration of your trip.

Yes, you can travel to multiple countries under one travel insurance policy, but you should tell your insurance provider about your travel plans as it may change your premiums.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

You should purchase travel insurance as soon as possible after making payment on your trip. This makes you eligible for add-ons like coverage for pre-existing conditions and CFAR. It also mitigates the chance of any losses in the days leading up to your trip.

- Retail investing

- The stock market

- Debt management

- Credit scores

- Credit bureaus

- Identity theft and protection

- Main content

- GENERAL TRAVEL

Health Insurance Abroad: The Complete Guide

The GoAbroad Writing Team is a collection of international travel writers with decades of experie...

- Health & Safety Tips

- button]:border-none [&>button]:bg-white [&>button]:hover:cursor-pointer [&>button]:hover:text-cyan-400"> button]:hover:text-cyan-400 [&>button]:bg-white hover:cursor-pointer" height="1em" width="1em" xmlns="http://www.w3.org/2000/svg">

Going abroad for the first time without your family can be thrilling, yet simultaneously terrifying. The same can be said for the second, third, and tenth time. Are you 30 and planning for a volunteer trip overseas? It’s still scary, and that’s okay!

On the cusp of any international travel—short- or long-term—it’s normal to have an imminent feeling of the unknown and unexpected weighing down on your mind. As much as I’d love to tell any future adventurer to look to toward the horizon, ignore the risks and gallop off into the Icelandic sunset on a miniature fluffy horse, the fact is that that’s just awful advice to give. The better piece of advice is plain and simple: Cover your hiney with health insurance abroad.

Traveling to Asia? Get Covered with the Luma ASEAN Pass

No matter the adventure, don’t leave without securing medical insurance abroad!

No matter your age, international travel experience, destination, or purpose for venturing abroad—be it studying, volunteering, teaching, interning, or otherwise—there are very real risks that need to be acknowledged and properly prepared for before you head overseas. While packing your life away for a study abroad trip and raising funds for a volunteer stint abroad are pretty important, your medical insurance abroad carries the most significant weight. Forgetting a hairbrush or not having enough money for a daily gelato is a bummer, but not having health insurance coverage abroad when tragedy strikes can have lifelong consequences.

Travelers, parents, and other family members alike can be comforted by the knowledge that there are comprehensive coverage packages out there customizable for any type of travel abroad—from teaching in China to snorkeling at the Great Barrier Reef. And just like that, taking the first step out into the Barcelona cobblestoned street doesn’t seem so intimidating! You’re covered.

In this comprehensive guide to health insurance while abroad, you’ll learn the ins and outs of…

- An overview of medical insurance abroad

- How your destination influences your coverage

- Using an existing domestic plan overseas

- What’s covered in international health insurance

- Difference between travel insurance and international medical insurance

- What to do if an emergency happens abroad

- Insurance abroad considerations for types of travel

- Suggested insurance providers

If you’ve been ignoring the nitty-gritty logistics of traveling abroad, then this guide to health insurance abroad will cover everything you need to know. Let’s get started!

The rundown of medical insurance abroad

Even if you don’t plan on skiing in Austria—or anywhere—during your travels, stay safe by having health insurance coverage abroad.

In the unusual case that you’ve already mastered how your domestic insurance and healthcare system works at home, that’s great! It won’t be of much help here, however. With a spectrum of healthcare systems around the world and third-party insurance providers working as middlemen to make it all easier to understand, that Thai snack of grasshoppers isn’t the only foreign concept on the table.

Generally, medical insurance abroad covers whichever dates you want, ranging from a day to a year and more. As health and finances are inarguably some of the most important assets we have, finding the correct health insurance while abroad should be a priority. Because it’s a preventative service, it’s easy to consider it an afterthought and not budget sufficiently for an adequate policy. Just remember, insurance abroad should be one of the top items on your travel list!

All your insurance abroad travel questions answered

The world of insurance is complicated enough, and throwing “international” into the mix makes it all the more confusing. How’s one to know about insurance abroad without having spending hours making phone calls to countless companies and embassies? We got the answers to your questions.

1. Do I need health insurance while traveling internationally?

Just like at home, health insurance helps pays for medical attention ranging from emergency room visits to prescription drugs. Internationally, you may face additional challenges as a foreign national that health insurance coverage abroad will help face, such as emergency evacuation or exorbitant healthcare costs if not covered. Apart from the fact that many travel programs or visas require some degree of coverage, having a safety net while traveling is always a good idea .

Our recommendation is Lewerglobal . Whether traveling for business, pleasure, or education, Lewerglobal provides the protection and support you need to travel with confidence. Find peace of mind for your short-term holiday, year-long internship, or four-year degree program. Lewerglobal members can choose a variety of health, travel, and trip protection plans to meet any budget and itinerary!

[ Browse All Providers of Medical Coverage Abroad ]

2. does my travel destination make a difference.

Yes! Your destination country or countries can impact what kind of health insurance coverage abroad you need and if you need it at all. For example, U.S. citizens whose long-term travels take them to countries in the Schengen area will need a certain amount of insurance coverage to qualify for a visa after the 90-day tourist visa period is up. Most countries in Western Europe are in the Schengen area , including Spain, France, Germany, and Italy.

Those who aren’t U.S. citizens may need insurance coverage to apply for a visa just to enter the area to begin with. For either case, there are specific stipulations for the holiday health insurance abroad to qualify for a Schengen area visa. Amongst other requirements, the insurance must cover a certain amount of Euros and should be valid for the applicant’s length of stay.

Other countries requiring proof of health insurance before entry are Cuba, Antarctica, and the United Arab Emirates. Before securing a generic health insurance abroad, be absolutely sure that your destination countries’ insurance requirements are met. Otherwise, your coverage may be all for nothing!

[ Get 6 FREE Travel Program Recommendations ]

3. does my health insurance cover international travel.

Depending on your domestic insurance, you may have some coverage abroad for basic short-term trips in some countries. However, more often than not, you’re looking at limited coverage, higher deductibles, and higher minimums to pay if an emergency does arise. For Medicare recipients, there is generally no coverage outside of the U.S. and its territories.

Before purchasing insurance abroad, check in with your current health insurance provider to be sure you’re not getting double coverage!

Health insurance comes in handy if you need to visit a doctor or clinic on your travels.

4. What does insurance abroad cover?

Medical insurance abroad alone typically covers anything from emergency doctor visits to lab orders to emergency surgeries to dental care for pain relief. Although often included, emergency evacuation and repatriation of remains (return of a body if passed away) are considered separate line items. When reading through policy coverage, be sure these basic services are included, as well as others like emergency family travel arrangements in case a family member needs to fly out to the bedside.

For travelers with a chronic illness or preexisting conditions, its essential that a health insurance abroad covers all medical needs and provides for prescription drugs for longer trips. Otherwise, you may be looking at out-of-pocket expenses and that’s the last way anyone wants to remember their travels!

5. How much does insurance abroad cost?

Rule of thumb when when choosing an insurance abroad: Don’t shop for the cheapest. A low price isn’t reflective of a good deal, rather it may just hint at a bare boned policy with high deductibles and minimums. Policies can start at a little more than a dollar a day for shorter trips , but ultimately, travel health insurance cost is determined by these factors:

- Limit of coverage, amount of deductible, and add-ons (i.e. ski insurance)

- Traveler’s age

- Duration of travel

After you have an idea of the coverage your travels and your health condition requires, the fun part begins. Shopping! Medical insurance websites include an option for a free quote, so you can get a fairly good idea of cost and the policy breakdown before you commit.

[ Get Even More Travel Medical Insurance Advice ]

6. what’s the difference between travel insurance and medical insurance abroad.

After doing a bit of research you may have come across insurance abroad, travel insurance, and international medical coverage. What’s the difference? Sometimes these variations are combined into comprehensive packages. Let’s break down common types of coverages:

- Trip insurance or travel cancellation insurance: This type compensates for lost, stolen, or damaged luggage while in transit and for unplanned trip cancellations in stated circumstances, such as a relative passing away.

- Medical evacuation and repatriation: If you need to get transported to a hospital or even airlifted to seek special emergency care, then evacuation coverage has got your back. Repatriation also makes sure you can get paid to back home for special care in unforeseen circumstances.

- Emergency medical expenses: When generally thinking of medical insurance abroad, this kind of coverage is most commonly referenced. Avoid paying medical bills by making sure you have an adequate coverage for medical expenses.

Travel worry-free for flight delays, lost luggage, and other inconveniences—your insurance will have your back!

7. Who do you contact if you need medical attention?

First and foremost, after purchasing a suitable medical insurance abroad you need to print out your policy (if you don’t receive a physical card) and carry it on your person at all times. Having a claim form or two printed, saved and ready in a secure place will also save buckets of travel down the road if you’re unable to later. Participants of an organized travel program can also get assistance from program organizers, who may also have a good idea of how to approach medical emergencies in the country.

Every international insurance provider will have a hotline available to contact with country-specific protocol and instructions if you need to seek medical attention. Additionally, the country’s U.S. Embassy provides information on local doctors and hospitals available. Just look for the “American Citizens Services” tab on your country’s U.S. Embassy website .

8. What’s the right type of insurance for my travels (study/intern/work/etc)?

Not all health insurance coverage abroad is made equal. Meaningful travel comes in all lengths and varying degrees of adventure. While some adventure travel may involve extreme sports like scuba diving, a two week volunteer project in a large city is relatively low-key. Be aware of what risks and characteristics your travels entail and make sure you pick up the right plan to cover them.

- Study abroad . With durations ranging from a few weeks to a whole year, study abroad can be confusing when it comes to insurance. Luckily, most study abroad program providers offer comprehensive information on how to get covered, if they don’t already include a plan in the program. ( P.S. Studying abroad with a chronic illness? Read about what you need to know ! )

- Volunteer abroad . The unique characteristic of volunteering abroad is that your horizons are a lot wider, including stays in off-the-beaten path areas and more community integration. As such, infrastructure and access to comprehensive healthcare can be scarce. For volunteers with medical conditions relying on special treatment, look into plans that cover pre-existing conditions and prescription drugs abroad.

- Intern abroad . Organized internship abroad opportunities through third-party programs or universities will often offer insurance abroad for the duration of stay. These plans are already suggested with the internship and destination country in mind, so you don’t have to navigate the confusing world of coverage yourself.

- Teach abroad . One of the perks of teaching English abroad is the medical insurance abroad included in work compensation packages (or at least a partnership with a company to direct you too)! Included insurance policies are a sign of a well-rounded employer and saves a ton of leg-work in the relocation process. Whether the coverage is offered through a third-party recruiting organization or directly by the employing institution abroad, there’s bound to be a preplanned insurance policy available.

- TEFL courses abroad . TEFL courses abroad never last for more than a few months at a time, and as such are easily coverable by normal health insurance abroad. For the time spent abroad learning about grammar games and classroom management, a general international medical insurance should do!

- Gap year . Going abroad through an organization? Then you may already have international insurance coverage included! Students traveling independent can look into youth plans or student-targeted packages.

- Completing a degree abroad . Being a full-time student for multiple years as you complete a degree abroad looks similar to expat insurance. However, students may be able to qualify for a domestic insurance depending on your citizenship and the destination country. The best place to get information is the university’s international office or a health department that’s familiar with insurance for international students.

- High school abroad . Typically, high school students won’t be traveling internationally solo. Teen travel programs should offer insurance as a part of the deal, so check in with an advisor to be sure what the benefits are.

- Language school . Because many language school courses are short enough to fit into a tourist visa stay and students won’t theoretically be cliff diving, basic international insurance packages are a good fit. Depending on the program, you may be fit for a student insurance type of coverage, specially tailored to your needs.

- Adventure travel . Thinking of bungee jumping in Costa Rica or horseback riding in Mongolia? Because of the “living on the edge”, extreme sports aspect of adventure travel, you’ll need insurance that includes those kinds of riskier activities. Read into the find print and be certain that the kinds of activities you’re interested in are covered.

- Work abroad . Working abroad long-term means needing health insurance coverage abroad will almost certainly be a given. If your employer doesn’t provide it, then look into plans geared toward expats and working professionals.

9. How do I find international travel-specific insurance?

A quick search for “international medical insurance” can yield a good number of reliable sources. Ultimately, quality health insurance abroad comes down to reading the fine print and knowing exactly what you’re getting. The U.S. Department of State provides a list of recommended insurance providers for international travel that’s definitely worth checking out.

Take the scary out of travel abroad with the right international health insurance coverage!

Friends don’t let friends travel without having health insurance while abroad!

Securing a well-rounded health insurance coverage abroad should be one of the first items on that travel checklist ! Even if you don’t have a preexisting condition or need for medical attention while overseas, you can never anticipate emergencies and accidents. Because insurance is often a requirement for travel programs, international visas, and some types of employment abroad, it’s best to start researching ASAP to have a thorough understanding of it works and which plan fits best.

Remember: Even if a medical risk is 0.01%, it’s a real risk that can put you financially in a pickle for your entire life. Get all your ducks in a row, secure an insurance plan, and then go forth to have the time of your life abroad worry-free!

Sign up for GoAbroad’s newsletter for even MORE helpful travel advice

DISCLAIMER: While our site doesn’t feature every company or product available in the market, we aim to be the most comprehensive resource for meaningful travel and provide thoughtful, valuable resources—whether that's written content, programs and travel experiences, or products and services for purchase. Our partners compensate us to promote their products and services. This may influence where those products appear on our site, but the decision to purchase is up to you. We do not represent any of our partners directly, including insurance providers, program providers, and other service providers. For more information, please click here .

Look for the Perfect Program Abroad Now

Related Articles

By Aaron Horwath | 3 days ago

By Elizabeth Gorga | September 13, 2024

By Jhasmine Wade | August 30, 2024

By Gabrielle Sales | August 27, 2024

Popular Searches

Study abroad programs in italy, study abroad programs in spain, marine biology study abroad programs, study psychology abroad, fall study abroad 2024, spring study abroad programs, recommended programs.

2584 reviews

International TEFL Academy

1707 reviews

International Volunteer HQ [IVHQ]

2126 reviews

MAXIMO NIVEL

713 reviews

Intern Abroad HQ

Subscribe to our newsletter

Travel resources, for partners, connect with us.

© Copyright 1998 - 2024 GoAbroad.com ®

- Study Abroad

- Volunteer Abroad

- Intern Abroad

- Teach Abroad

- TEFL Courses

- Degrees Abroad

- High School Abroad

- Language Schools

- Adventure Travel

- Jobs Abroad

- Online Study Abroad

- Online Volunteer Programs

- Online Internships

- Online Language Courses

- Online Teaching Jobs

- Online Jobs

- Online TEFL Courses

- Online Degree Programs

Protect Your Trip »

Does your health insurance plan cover you while abroad.

A primer on figuring out if you're covered and advice on investing in supplemental insurance.

Does Health Insurance Cover You Abroad?

Getty Images

First, determine if your plan covers emergency care abroad. Then decide if buying supplemental coverage is a smart decision based on factors like your itinerary and any pre-existing health conditions.

Picture this: You're traveling overseas and you come down with a fever. You don't speak the native language and you're uncertain if your health plan covers medical care, like a visit to a doctor or hospital, abroad.

While this is probably the last scenario you want to consider while planning your trip, medical emergencies happen. But here's the silver lining: You can easily find out what your insurance will cover while traveling abroad by asking your provider a few key questions. To determine what coverage you have, and what you'll need when traveling overseas, begin by asking these five questions.

1. What does my health plan cover overseas?

The level of medical coverage available for international travel can vary widely, depending on your domestic health care provider and plan. The State Department advises contacting your insurance company prior to your trip and inquiring about the specific medical services overseas that are included in your coverage.

The Centers for Disease Control and Prevention also encourages travelers to ask what's excluded from their policy, such as risky activities. And depending on what is available to you, the CDC advises considering a supplemental policy. The State Department also recommends inquiring about specifics such as whether the plan includes coverage for emergency evacuations to the U.S. and pre-existing medical conditions. You should also familiarize yourself with any out-of-pocket costs that you may encounter for medical procedures or services overseas.

[ Compare travel insurance plans and get a quote .]

2. What if I have Medicare?

Keep in mind that Medicare does not cover emergency medical service for travelers out of the country. There are some Medigap plans that can offer supplemental coverage but remember that there is a lifetime cap of $50,000 for foreign travel emergency coverage.

3. What about emergency medical evacuations?

Few domestic health insurance providers will pay to transport ill patients back to the United States. And emergency evacuations can be expensive, costing more than $100,000, depending on your health condition and where you're located at the time the emergency takes place. If you're visiting a place that's isolated or where the quality of health care is subpar, do a cost-benefit analysis of investing in a supplemental evacuation insurance plan.

4. Should I buy travel medical insurance for my next vacation?

It's a smart idea to consider investing in travel insurance . But before you make a final decision, you'll want to evaluate a variety of factors, including the type of trip you're planning and if you'll be taking part in risky activities, such as scuba diving or mountain climbing during your trip. According to the CDC, there are three types of insurance travelers should consider while traveling: trip cancellation insurance, travel health insurance and medical evacuation insurance.

And according to a report released by InsureMyTrip, a travel insurance comparison and booking site, 75 percent of the site's consumers pick comprehensive travel insurance plans, which typically include emergency medical coverage, emergency medical evacuation coverage, trip cancellation coverage, trip interruption coverage and baggage coverage.

Another important reason to consider purchasing travel health insurance is that travel health insurance can help fill any gaps in domestic health insurance coverage. Plus, travel health insurance can provide 24/7 emergency assistance to help aid you in the event of a medical emergency. A licensed travel insurance agent can provide advice on appropriate coverage limits and how to qualify for coverage for pre-existing medical conditions.

5. What if I have to file a claim?

A claim is typically required in order to request reimbursement for medical bills. Most providers will require all hospital records (usually translated if in a non-English language) and receipts in order to evaluate the validity of the claim.

Sign Up for STEP

Travelers are encouraged to enroll in the Smart Traveler Enrollment Program (STEP) prior to international travel. Doing so will notify the nearest U.S. Embassy or Consulate of your travel plans. The local embassy can also help connect American travelers with a local medical facility.

Tags: Travel , health insurance , Travel Tips

About En Route

Practical advice on the art of traveling smarter with tips, tricks and intel from En Route's panel of experts.

Contributors have experience in areas ranging from family travel, adventure travel, experiential travel and budget travel to hotels, cruises and travel rewards and include Amy Whitley , Claire Volkman , Holly Johnson , Marsha Dubrow , Lyn Mettler , Sery Kim , Kyle McCarthy , Erica Lamberg , Jess Moss , Sheryl Nance-Nash , Sherry Laskin , Katie Jackson , Erin Gifford , Roger Sands , Steve Larese , Gwen Pratesi , Erin Block , Dave Parfitt , Kacey Mya , Kimberly Wilson , Susan Portnoy , Donna Tabbert Long and Kitty Bean Yancey .

Edited by Liz Weiss .

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

Fun things to do in minnesota.

Rachael Hood Sept. 24, 2024

The Best All-Inclusive Resorts for Teens

Holly Johnson Sept. 23, 2024

All-Inclusive Family Resorts in Mexico

Sharael Kolberg Sept. 20, 2024

The Best Pearl Harbor Tours

Amanda Norcross Sept. 19, 2024

Top All-Inclusive Cancun Family Resorts

Amanda Norcross Sept. 18, 2024

The Best Stonehenge Tours

Kim Foley MacKinnon and Ann Henson Sept. 18, 2024

Best Grand Canyon Helicopter Tours

Holly Johnson and Ann Henson Sept. 17, 2024

The Best Eiffel Tower Tours

Kristy Alpert Sept. 17, 2024

Fun Things to Do in Ohio

Gwen Pratesi and Heather Rader Sept. 17, 2024

The Top River Cruise Lines

Nicola Wood and Brittany Chrusciel Sept. 17, 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in August 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.