JavaScript is required to use this site.

- Cruise/Travel Insurance

Nationwide FlexPlus Travel Insurance Changes

By daveoc , February 20 in Cruise/Travel Insurance

Recommended Posts

Nationwide are making some major changes to their travel insurance from May 1st. The insurer is changing to Aviva and amongst the changes are:

1) At present you can buy an extension to increase your cancellation cover to £20000 but from May 1st the maximum you can increase it to will be reduced to £10000, so possibly this will have an impact on longer cruises.

2) At present you can buy a cruise cover extension for the year that covers things like missed port cover. From May 1st you must buy the extension for each cruise that you do.

There are several other changes and people are reporting that they are starting to receive emails from Nationwide. I cannot post a direct link but if you do a search for 'Nationwide FlexPlus Travel Provider Change ' it should bring up the relative links.

Link to comment

Share on other sites.

Yes, I am deliberately renewing mine on March 25th, so I stay with UK Insurance for one more year. Already spoken to them.

16 minutes ago, jeanlyon said: Yes, I am deliberately renewing mine on March 25th, so I stay with UK Insurance for one more year. Already spoken to them.

Excellent idea.

Presumably this will only take effect from the members next annual renewal, as we have recently paid the supplements for 12 months cover?

I’m not surprised that the cruise add on is changing. We paid a ridiculously small supplement for cruise cover (no more than £30 from memory) and already have £600 in missed port claims.

Old_tilly_billy

Need to look at renewing before these changes take affect

Winifred 22

3 hours ago, Selbourne said: Presumably this will only take effect from the members next annual renewal, as we have recently paid the supplements for 12 months cover? I’m not surprised that the cruise add on is changing. We paid a ridiculously small supplement for cruise cover (no more than £30 from memory) and already have £600 in missed port claims.

It’s £40 for cruise cover.

Just now, Winifred 22 said: It’s £40 for cruise cover.

Thanks. I knew it wasn’t much, especially when just one missed port nets a couple £300. I can’t see how they can do it for that price in all honesty. Seems like they couldn’t!

13 minutes ago, Selbourne said: Thanks. I knew it wasn’t much, especially when just one missed port nets a couple £300. I can’t see how they can do it for that price in all honesty. Seems like they couldn’t!

No I can’t either I only have claimed one r for missed port . Apparently you stay on the old scheme until you renew. I don’t renew until October but half wondering to renew end of April. I cruise several times a year sometimes at short notice so annual cover is a better option for me.

12 hours ago, Winifred 22 said: No I can’t either I only have claimed one r for missed port . Apparently you stay on the old scheme until you renew. I don’t renew until October but half wondering to renew end of April. I cruise several times a year sometimes at short notice so annual cover is a better option for me.

You can't renew if your policy or upgrades are not due for renewal. Mine are due on April 17th and you can do it one month in advance, so they told me to ring around March 25th. Although there is no longer an age extension with Aviva, I know they don't cover over 85s, but whether they will with Nationwide I have yet to find out.

Is an option if allowed. We are due for renewal 21st May so will be with Arvia.and don't know if they will allow me to renew before 1st May and stay with UK Travel for another 12 months. If they won't allow will wait to see what Arvia charge for pre existing medical conditions and individual charge for every extra c ruise cover and conditions because don't seem to have revealed that yet.

6 minutes ago, majortom10 said: Is an option if allowed. We are due for renewal 21st May so will be with Arvia.and don't know if they will allow me to renew before 1st May and stay with UK Travel for another 12 months. If they won't allow will wait to see what Arvia charge for pre existing medical conditions and individual charge for every extra c ruise cover and conditions because don't seem to have revealed that yet.

I think you mean Aviva? 😊

49 minutes ago, jeanlyon said: You can't renew if your policy or upgrades are not due for renewal. Mine are due on April 17th and you can do it one month in advance, so they told me to ring around March 25th. Although there is no longer an age extension with Aviva, I know they don't cover over 85s, but whether they will with Nationwide I have yet to find out.

Oh let me know about the over 85s if you do find out. My mother is 85 but luckily our renewal is now so she is OK for this year.

I wonder how much cruise cover per cruise will be. I tried a dummy booking on their normal travel insurance site but it didn’t give cruise cover as an optional extra.

1 hour ago, jeanlyon said: You can't renew if your policy or upgrades are not due for renewal. Mine are due on April 17th and you can do it one month in advance, so they told me to ring around March 25th. Although there is no longer an age extension with Aviva, I know they don't cover over 85s, but whether they will with Nationwide I have yet to find out.

Thanks I had a feeling I was being a bit optimistic.

2 hours ago, jeanlyon said: I think you mean Aviva? 😊

Yes sorry my mistake got Arvia on my brain thinking of our cruise in April.

Please remember it is not Aviva you are insuring with, it is Nationwide and they will be "buying in" underwriting from Aviva not selling their policies. This means Nationwide will have effectively "shopped" the underwriting market to find a provider matching as near as possible their current offering or what they wish to offer under a new contract. This will then have been adjusted and negotiated between the parties before Nationwide "bought" their package to offer to their customers. The Nationwide offering has for very many years been a big selling point to their customers so they won't want to cause too much discontent amongst them however the underwriting market has changed massively since the pandemic with many leaving it (as UK Insurance have chosen to do). A large number of these packaged bank accounts in particular have had to look elsewhere - Halifax/Lloyds losing AXA in November 2021 and moving to Allianz for example. Although your policy is underwritten by Aviva it will still be Nationwide setting the terms. Aviva will, however, be responsible for setting the underwriting for things like medical issues with Nationwide having little say in the policy costs. It is almost inevitable there will be some increase in the cost of these but it is not just an Aviva/Nstionwide but across the whole insurance market in some cases as much as 40% but averaging 20%.

Things like the 85 year cut off with Aviva may not apply to the Nationwide one - presumably the age add on people used to buy covered people beyond that age (I have no personal experience of this so assume it to be the case). As Nationwide state you no longer need an age addition it may be that they have negotiated this with Aviva - Nationwide should be able to explain this even before the Aviva policies go live as someone in their organisation will have negotiated the policy and terms.

Again with the cruise add on being cruise by cruise instead of one add on, it will have been a policy decision by Nationwide not Aviva. At a guess I would say that over the past few years payouts on this section will have greatly increased and it will have been a commercial decision based on this.

I've looked at the new policy as I'm approaching my 70th and my current insurer won't insure me from September and I intend to swap as the benefits look very good even under Aviva.

Hope that helps.

4 hours ago, Megabear2 said: Please remember it is not Aviva you are insuring with, it is Nationwide and they will be "buying in" underwriting from Aviva not selling their policies. This means Nationwide will have effectively "shopped" the underwriting market to find a provider matching as near as possible their current offering or what they wish to offer under a new contract. This will then have been adjusted and negotiated between the parties before Nationwide "bought" their package to offer to their customers. The Nationwide offering has for very many years been a big selling point to their customers so they won't want to cause too much discontent amongst them however the underwriting market has changed massively since the pandemic with many leaving it (as UK Insurance have chosen to do). A large number of these packaged bank accounts in particular have had to look elsewhere - Halifax/Lloyds losing AXA in November 2021 and moving to Allianz for example. Although your policy is underwritten by Aviva it will still be Nationwide setting the terms. Aviva will, however, be responsible for setting the underwriting for things like medical issues with Nationwide having little say in the policy costs. It is almost inevitable there will be some increase in the cost of these but it is not just an Aviva/Nstionwide but across the whole insurance market in some cases as much as 40% but averaging 20%. Things like the 85 year cut off with Aviva may not apply to the Nationwide one - presumably the age add on people used to buy covered people beyond that age (I have no personal experience of this so assume it to be the case). As Nationwide state you no longer need an age addition it may be that they have negotiated this with Aviva - Nationwide should be able to explain this even before the Aviva policies go live as someone in their organisation will have negotiated the policy and terms. Again with the cruise add on being cruise by cruise instead of one add on, it will have been a policy decision by Nationwide not Aviva. At a guess I would say that over the past few years payouts on this section will have greatly increased and it will have been a commercial decision based on this. I've looked at the new policy as I'm approaching my 70th and my current insurer won't insure me from September and I intend to swap as the benefits look very good even under Aviva. Hope that helps.

Don't think that is correct when we have taken out pre- medical quote and paid for it and also the extra cruise cover supplement we paid UK Travel direct and when we claimed for missed ports we had to ring UK Travel direct to make the claim and they paid the money direct into my account. The only dealing we have with Nationwide is the £13 monthly cost which they take automatically from your Flexplus account.

5 minutes ago, majortom10 said: Don't think that is correct when we have taken out pre- medical quote and paid for it and also the extra cruise cover supplement we paid UK Travel direct and when we claimed for missed ports we had to ring UK Travel direct to make the claim and they paid the money direct into my account. The only dealing we have with Nationwide is the £13 monthly cost which they take automatically from your Flexplus account.

There are many companies putting their names to travel insurance and designing their own products, however there are actually very few travel insurance underwriters. Aviva is one of these as is UK Travel and they underwrite for a large number of third parties including leading banks, big corporate companies such as M&S, John Lewis etc. The design and terms of the product belong to the headline name, in the case under discussion this is Nationwide but it could just as easily be M&S or another company. It is confusing but none of these products are actually the underwriters policies. Even more confusing the Aviva insurance arm and the Aviva underwriting arm are actually two different entities. However your contract of insurance is issued and owned by Nationwide, hence your monthly fee, but managed on their behalf by UK Travel/Aviva on their behalf.

These are the details for the presently in place Nationwide insurance as provided by them on their website. It clearly shows UK Insurance Limited is the Underwriter not the Provider.

"U K Insurance Limited

Just for info, this is from trade magazine last year explaining Aviva's acquisition along with "buying" Barclays Home Insurance Book. Towards the end it mentions that Aviva did this deal with Nationwide in May 2023 for the travel insurance. It would appear they are in quite an acquisitive phase in their business.

https://www.insurancebusinessmag.com/uk/news/property-insurance/aviva-announces-major-home-insurance-swoop-453638.aspx

I see they will not be charging a supplement for the over 70s, as Uk nsurance did, but does anyone know if the new Aviva/Nationwide policy has an upper age limit?

- 3 weeks later...

An ordinary Aviva Travel insurance policy has an upper age limit of 74, that's why I was concerned, but as someone said, it would upset a lot of people who must be over that age, so we will see.

- 4 weeks later...

TravellerSRC

Has anyone found out if new nationwide flex plus travel insurance will have an upper age limit? I’ve contacted Nationwide bank but told to ring back in May.

3 hours ago, TravellerSRC said: Has anyone found out if new nationwide flex plus travel insurance will have an upper age limit? I’ve contacted Nationwide bank but told to ring back in May.

Nationwide have sent me couple of booklets regarding the switch to Aviva. One, entitled FlexPlus Travel Insurance Provider Change , gives details of the changes in cover from the original UK Insurance policy to the new Aviva policy. In this booklet on page2 under the heading Upgrades it states: " Age : You will no longer need to buy a separate upgrade to be covered beyond your 70th birthday. You will be covered automatically. "

There is no mention of an age limit under this Age heading!

57 minutes ago, Astrajet said: Nationwide have sent me couple of booklets regarding the switch to Aviva. One, entitled FlexPlus Travel Insurance Provider Change , gives details of the changes in cover from the original UK Insurance policy to the new Aviva policy. In this booklet on page2 under the heading Upgrades it states: " Age : You will no longer need to buy a separate upgrade to be covered beyond your 70th birthday. You will be covered automatically. " There is no mention of an age limit under this Age heading!

Any idea of cruise upgrade prices ?

3 hours ago, Winifred 22 said: Any idea of cruise upgrade prices ?

Unfortunately not. There is no mention of any costs in the literature I have been sent other than the monthly fee for the FlexPlus account will remain at £13.

You may find this useful

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- Hurricane Zone 2024

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

- How To: Follow Topics & Forums (Get Notifications)

1018 What Kind of Cruise Ship Decor Do You Like Best?

1. what kind of cruise ship decor do you like best.

- Colorful and wacky! It sets the vibe for fun.

- Serene and soothing! Greige helps me relax.

- Arty and sophisticated! Whimsical pieces make me smile.

- Nautical and classic! I want to feel like I'm on a ship.

- Mod and shiny! Give me all the glass and chrome.

- Please sign in or register to vote in this poll.

Write An Amazing Review !

Click this photo by member XFrancophileX to share your review w/ photos too!

Parliament, Budapest

Features & News

LauraS · Started 32 minutes ago

LauraS · Started Friday at 02:45 PM

LauraS · Started Friday at 03:54 AM

LauraS · Started Wednesday at 02:01 PM

Cruise Planning

Find a cruise, popular ports, member reviews.

© 1995— 2024 , The Independent Traveler, Inc.

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

If you are already a Cruise Critic member, please log in with your existing account information or your email address and password.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Nationwide Travel Insurance Review: Is it Worth The Cost?

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

What does Nationwide travel insurance cover?

What does nationwide travel insurance cost, what isn’t covered by nationwide travel insurance, can you buy a nationwide plan online, is nationwide travel insurance worth it.

Are you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

» Learn more: Common myths about travel insurance and what it covers

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

» Learn more: How to find the best travel insurance

Additional options and add-ons

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

» Learn more: The best travel credit cards right now

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician.

Participation in canyoning or canyoneering, extreme sports or bodily contact sports.

War or any act of war whether declared or not.

Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

» Learn more: Is there travel insurance that covers COVID quarantine?

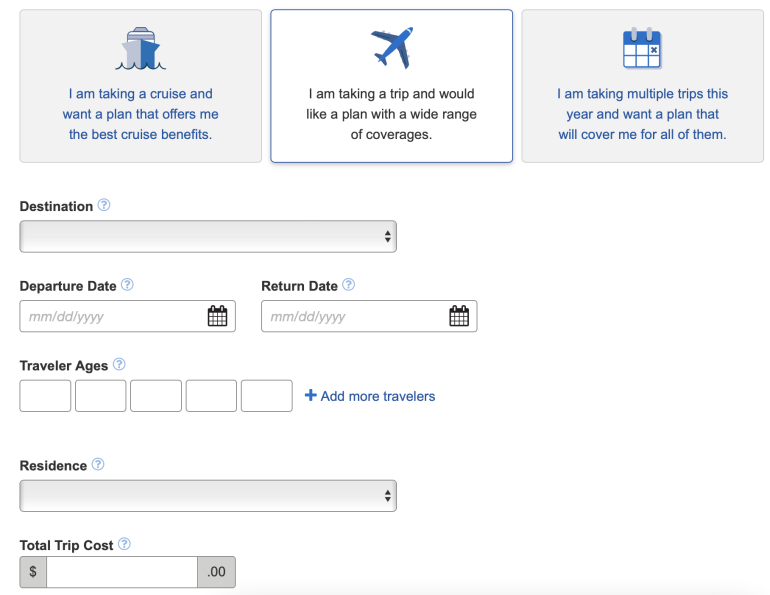

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

» Learn more: How much is travel insurance?

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

COMMENTS

Worldwide family cover. Worldwide travel for you, your partner and dependent children. Whether you're travelling alone or together. Includes the USA, Canada, Mexico and the Caribbean. Cover for trips up to 31 days. If you're going away for longer than 31 days, you can buy a longer trip upgrade. Winter sports.

Travel insurance. We'll match you with the right plan at a price you can afford. Nationwide continues to monitor COVID-19 and its impact on your travel. Despite your best efforts to avoid them, unexpected incidents can turn your vacation adventures upside down. Accidents, illnesses, injuries, cancelled flights, lost luggage and bad weather can ...

We'll provide the insured persons with the cover set out in their terms and conditions for trips up to a maximum of £5,000 per person. If you or anyone covered by this policy are planning a trip and want to increase this limit you can upgrade to a maximum of either £7,500 or £10,000 per person. This upgrade covers one single trip, you will ...

For those who only bank online or over the phone. Get access to in-credit interest on your money and, for the first 12 months, you can get an interest-free arranged overdraft. Conditions apply. Our everyday bank account. Bank your way. Fees. £13 a month (increasing to £18 a month from 1 December 2024) Free. Free.

Lines closed: Christmas Day, Boxing Day and New Year's Day. 8am - 8pm Monday to Friday 8am - 6pm Saturday 10am - 4pm Sunday and Bank holidays. Lines closed: Christmas Day, Boxing Day and New Year's Day. General travel insurance queries. 0800 0512 532. Large print, audio or Braille policy documents. 03457 30 20 11.

This Travel Insurance is underwritten by U K Insurance Limited. Registered office: The Wharf, Neville Street, Leeds LS1 4AZ Registered in England and Wales No. 1179980. U K Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Annual travel insurance plans: Protect all your trips with one policy. Start your quote. Or call 1-877-970-9059. If you're a frequent traveler for work or fun, there's no reason to purchase travel insurance each time you take a trip. Instead, an annual travel insurance plan covers an entire year of trips. These plans can save you money even ...

How to buy travel insurance. Start your quote. Or call 1-877-970-9059. Comparing and choosing travel insurance coverage can be confusing. There are conditions, restrictions and exclusions, as well as various benefits with limits that may or may not apply to your situation. The following tips about the travel insurance buying process can help ...

Posted February 20. Nationwide are making some major changes to their travel insurance from May 1st. The insurer is changing to Aviva and amongst the changes are: 1) At present you can buy an extension to increase your cancellation cover to £20000 but from May 1st the maximum you can increase it to will be reduced to £10000, so possibly this ...

We analyse and rate 66 key elements of travel insurance policies to come up with the overall policy score. We assess how important each individual element is to travellers when choosing and using a travel insurance policy, and factor this in when calculating our total policy score. Initially, we score all of the product elements out of five ...

Nationwide will raise the fee on its popular FlexPlus packaged bank account from £13 a month to £18 a month in December, the building society has announced. If you've got the account, it's likely worth sticking with for now - though you should diarise to look at alternatives when the new fee kicks in.

How to start your FlexPlus travel insurance, breakdown cover or mobile phone insurance claim, either online or over the phone. ... Nationwide Building Society is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 106078.

News Reporter. 3 September 2021. Nationwide has decided to axe its free European travel insurance offer for all existing FlexAccount customers who still have it from 31 December. This follows its earlier decision to stop offering the perk to new FlexAccount customers back in December 2016. FlexAccount holders who've held an account since before ...

The Nationwide packaged account includes added insurance for a monthly fee. Nationwide FlexPlus is a packaged bank account, so it's a paid alternative to the Nationwide Flex Account, costing £13 a month (although this is rising to £18 per month on 1 December 2024).I won't go into any detail on the nitty gritty of the bank account.

Nationwide's Prime Plan earned 3.7 stars in our scoring of the best travel insurance companies. The Prime plan has superior medical evacuation coverage limits of $1 million, and $150,000 in ...

60 day look back, 21 day waiver (certain conditions apply). test. Policy cost. $260.48. $418.22. % of trip cost. 3.72%. 5.97%. A quick Nationwide travel insurance review shows that you'll see ...

In order to maintain your travel insurance cover you will need to maintain the account eligability criteria as specified in the Flex Account terms and conditions. To keep your cover you ll need to: Pay in at least £750 into your account per month (excluding transfers from any Nationwide account held by you or anyone else), and

I will have a dilemma next April 2025 when I come to renew my travel insurance bought as an account holder with Nationwide Flex Plus. Nationwide are no longer using UK Insurance as from the end of April this year. Fortunately I was able to renew my insurance for a further year on the existing terms because my insurance renewal date was before the end of April. My concern is regarding the ...

Nationwide are making some major changes to their travel insurance from May 1st. The insurer is changing to Aviva and amongst the changes are: 1) At present you can buy an extension to increase your cancellation cover to £20000 but from May 1st the maximum you can increase it to will be reduced to £10000, so possibly this will have an impact ...

Our FlexPlus Travel Insurance provider is changing to Aviva Insurance Limited (Aviva). For lots of our FlexPlus members, this will happen automatically on 1 May 2024. If you have an upgrade in place, U K Insurance Limited will continue to be your provider until your upgrade expires. When this happens, your cover will switch to Aviva who will ...

15 May 2020 at 3:26PM. If it's any reassurance, I had to claim on my FlexPlus insurance when my flights were cancelled due to the Gatwick drone fiasco and they were great, very quick and straightforward. £40k-in-'23#18 £78,628.29/40,000 (196.57%) Posts: 69 Forumite. 15 May 2020 at 4:30PM edited 15 May 2020 at 4:32PM.

Hi does anyone know what the excess is on the nationwide flex travel insurance _____ 2022 OKW in May 2018 Art of Animation 2017 All Stars Movies 2016 Boardwalk Villas 2015 Pop Century 2014 Old Key West Shanghai and Tokyo 25 May 24, 06:47 PM #2 : Bal. Imagineer ...

0800 051 0154 We are open 8am to 8pm Monday to Friday, 9am to 5pm Saturday and 9am to 4pm Sunday. insurance works. If you are injured or ill while on your trip or you need to cut short. your trip call our emergency assistance service.