- Tour Operators

- Destinations

- Hotels & Resorts

- Agent Feedback

- Deals & Incentives

- On Location

- Industry Experts

- Sphere – HomeBased

- Digital Editions

- Subscribe today!

- Hotels and Resorts

- Types of Travel

- Subscribe Now

Air Transat enhances flexibility to change and cancel bookings

Post date: Apr 22 2022

Date: Apr 22 2022

By: Travelweek Group

TORONTO — Air Transat is making it easier for passengers to change and cancel their bookings in both Economy and Club Class.

According to the airline, it is now possible to cancel a trip, regardless of the chosen fare. For Eco Budget, Eco Standard and Club Standard fares, a cancellation fee of $200 applies. The refund will be done according to the payment method on file.

For Eco Flex and Club Flex fares, cancellation is possible at no additional cost.

In addition, Air Transat continues to allow flexibility to change flight itineraries, which has been in effect since Dec. 1, 2021. Passengers can now change their date and/or destination free of charge up to 24 hours before departure. Only the fare difference applies.

For more details go to www.airtransat.com .

Tags: Air Transat, Lead Story

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Protect Your Travel Plans: Trip Cancellation Insurance Explained and the 5 Best Policies

Jessica Merritt

Editor & Content Contributor

103 Published Articles 541 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

170 Published Articles 807 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3357 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

The 5 best trip cancellation insurance policies, what is trip cancellation insurance, how trip cancellation insurance works, is trip cancellation insurance worth it, what trip cancellation insurance costs, choosing trip cancellation insurance , final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

You’ve booked your flight, hotel, and tours and are ready to go on your trip — but what happens if you can’t make it? Unexpected circumstances can pop up that force you to cancel your trip, such as illness or natural disasters. If you can’t get refunds from travel suppliers, trip cancellation insurance can help.

Let’s look at what trip cancellation covers, whether you need a trip cancellation policy, and what you should know before shopping for a plan.

You’ll have plenty of options if you want a cheap, standalone trip cancellation policy, comprehensive travel coverage, or Cancel for Any Reason (CFAR) coverage.

Consider these trip cancellation insurance policies that offer good value and coverage, quoted for a 35-year-old visiting Mexico on a $1,500 trip in September 2023:

Best Cheap Trip Cancellation Insurance: battleface

We were quoted just $20 for a battleface Discovery Plan with trip cancellation benefits up to $1,500. But that’s all it offers — you won’t get trip interruption coverage, medical coverage, evacuation, loss or delay, or other benefits offered by comprehensive travel insurance plans.

Best Extensive Trip Cancellation Reasons: IMG

IMG’s iTravelnsured Travel Essential plan isn’t CFAR coverage, but it has multiple covered reasons for cancellation. You’re covered for foreign and domestic terrorism, financial default, medical reasons, and accommodations made uninhabitable. Our $35.92 quote offered up to 100% of the total trip cost for trip cancellation and 125% for trip interruption.

Best Comprehensive Trip Cancellation Coverage: TinLeg

TinLeg’s Basic travel insurance plan covers up to 100% of your total trip cost for trip cancellation , but you’ll also get other major travel insurance coverages. This plan we were quoted $41 for offers trip interruption, travel delay, baggage delay, emergency medical, evacuation and repatriation, and more.

Best Layoff Protection: Aegis

Like the battleface plan, Aegis Go Ready Trip Cancellation insurance covers up to 100% of your trip cost if you need to cancel — but not much else. But a big value-add is employment layoff coverage , which allows you to get reimbursed if you need to cancel your trip due to involuntary layoff or termination of employment. We were quoted $45 for this plan.

Best Cancel for Any Reason: Seven Corners

The Seven Corners Trip Protection Basic plan offers optional CFAR coverage, which reimburses up to 75% of your trip cost for reasons not otherwise covered by your policy. Regular trip cancellation and interruption coverage offer reimbursement of up to 100% of your trip cost. Our quoted cost for this plan came to $58.

Trip cancellation insurance is a type of travel insurance. With trip cancellation coverage, you can get reimbursement for nonrefundable prepaid travel expenses if you need to cancel your trip before departure. Trip cancellation is one of the main coverage areas for travel insurance, the other being medical emergency coverage.

Many comprehensive travel insurance policies offer trip cancellation coverage; standalone trip cancellation insurance is less common than comprehensive travel policies. Travel credit cards may offer trip cancellation coverage as a cardholder benefit, as well.

Trip cancellation insurance kicks in if you must cancel your trip due to unforeseen circumstances such as an illness, injury, or other covered reasons. You can get reimbursed for nonrefundable expenses if you have travel cancellation insurance and need to cancel your trip.

Covered nonrefundable expenses typically include:

- Hotels and vacation rentals

- Rental cars

Travel insurance policies with trip cancellation coverage often include trip interruption benefits. Similar to trip cancellation coverage, trip interruption benefits can help you recoup your costs if you need to delay or cut your trip short due to covered reasons.

When To Buy Trip Cancellation Insurance

You can usually purchase trip cancellation insurance up to the day before your scheduled departure. Still, you’ll get more value if you purchase insurance as soon as you make your first trip deposit . That way, your travel plans are covered from the start.

Trip Cancellation Insurance Covered Reasons

Unless you opt for Cancel for Any Reason travel insurance, trip cancellation insurance only applies to covered cancellation reasons. For example, you can’t use trip cancellation insurance to cancel your trip for a refund because there’s rain forecasted for your beach vacation. But, you could get reimbursement if a named hurricane forms after you purchased your policy.

Common reasons covered by trip cancellation insurance include:

- Death, including the death of a family member or traveling companion

- Government travel warnings or evacuation orders for your destination

- Home damage or burglary

- Illness, injury, or quarantine that makes you or a covered travel companion unfit to travel

- Legal obligations such as jury duty or subpoena

- Natural disasters such as hurricanes, earthquakes, or floods affect travel operations at your destination

- Terrorist incidents at home or your destination

- Travel supplier cancellation

- Unexpected military duty

- Unexpected pregnancy complications

- Unexpected work obligations

These are common covered reasons for trip cancellation insurance, but policies vary in coverage . Reviewing the terms and conditions of your trip cancellation insurance is a good idea so you understand what’s covered.

You should also understand what’s explicitly not covered. For example, changing your mind is not a covered reason on a standard trip cancellation insurance policy. And trip cancellation insurance typically doesn’t cover foreseeable events, routine health treatments, substance abuse, sporting events, mental health, acts of war, self-harm, or dangerous activities such as skydiving.

Cancel for Any Reason Trip Cancellation Coverage

Need to expand your list of covered cancellation reasons? Cancel for Any Reason trip cancellation insurance is an option.

You can use CFAR to cancel your trip for reasons not covered by trip cancellation insurance, such as changing your mind, fear of travel, unexpected obligations, weather, or budget concerns.

The catch? You’ll pay more for CFAR coverage , and it only reimburses up to 50% to 75% of your nonrefundable travel expenses. Generally, trip cancellation insurance offers 100% reimbursement for covered expenses.

The other main stipulation is that you’ll need to purchase your coverage within a specified period , usually within 10 to 21 days of your first trip deposit. And to get reimbursement under CFAR, you must cancel your travel within the cancellation timeframe, usually at least 48 hours from your scheduled departure.

Annual Travel Insurance

Most annual travel insurance policies, also known as multi-trip policies, cover trip cancellation for multiple trips taken within the policy period, usually 12 months. You’ll also typically get coverage for medical expenses.

Trip Cancellation vs. Trip Interruption

Trip cancellation insurance covers your nonrefundable travel expenses if you have to cancel before departure, while trip interruption covers your trip costs after departure . For example, trip interruption coverage kicks in if you get injured while traveling and have to go home early.

Trip cancellation insurance can be worth it if you have nonrefundable travel expenses and there’s a risk you’ll have to cancel your travel due to unforeseen events. It offers financial protection if you’re traveling to a destination with potential risks such as natural disasters or political instability — or if you have risk factors at home, such as unpredictable work commitments or family members with health conditions that could interfere with travel.

If you plan an expensive trip with nonrefundable bookings or deposits, trip cancellation is probably worth it. But if your travel is inexpensive, or most of your travel expenses are refundable, you might not need trip cancellation insurance.

Consider the cost of insurance, the likelihood you’ll need to cancel, and the cost of nonrefundable travel at stake when you decide if trip cancellation is worth it.

A basic travel insurance policy with trip cancellation coverage generally costs between 5% to 10% of your trip costs . So a travel insurance policy for a $5,000 trip would cost $250 to $500. Your costs will be higher if you opt for CFAR coverage.

Factors that influence how much your trip cancellation insurance costs include traveler age, trip expenses, trip length, coverage options, and how many people you need to cover.

A comprehensive travel insurance policy with emergency medical or lost baggage coverage and trip cancellation coverage can offer additional value.

If you’re mainly concerned with trip cancellation coverage, look for cheap travel insurance policies that still offer this coverage, but have either nonexistent or low coverage limits for other coverage areas, such as lost baggage or medical evacuation .

Credit Cards With Trip Cancellation Insurance

You might not have to pay for trip cancellation insurance if you have the right credit card. Some credit cards offer trip cancellation and interruption coverage as a cardholder benefit.

Credit cards with trip cancellation coverage generally provide between $2,000 to $10,000 per person in trip cancellation benefits, often covering trip interruption.

For example, the Capital One Venture X Rewards Credit Card offers cardholders $2,000 in trip cancellation or interruption benefits per person. With the Chase Sapphire Reserve ® , cardholders get up to $10,000 per person in trip cancellation coverage with a maximum of $20,000 per trip and a $40,000 limit per 12-month period.

If your nonrefundable travel costs exceed the covered benefit offered by your credit card, you may prefer to purchase separate trip cancellation insurance.

If you only need trip cancellation and interruption coverage, your credit card may have adequate protection benefits.

Consider these factors as you shop for a trip cancellation insurance policy:

- Cost: Compare policy premiums and consider how the cost fits into your overall travel budget.

- Coverage Amount: Your trip cancellation coverage should cover all of your nonrefundable prepaid trip expenses. But a policy with too much coverage could be more costly than necessary.

- Policy Limits: Know the policy’s limits, including deductibles, exclusions, and limitations.

- Covered Reasons: A policy that offers a variety of covered cancellation reasons offers the most protection.

- CFAR Coverage: Understand whether CFAR coverage is included in the policy and its additional cost.

- Reputation and Customer Service: Read travel insurance reviews to learn about the experiences policyholders have had, whether they’re good or bad.

- Refund Policies: Understand what happens if you cancel your policy before the trip.

Travel insurance comparison sites such as Squaremouth make it easy to enter your trip details and get quotes from multiple insurance providers.

Trip cancellation coverage can provide valuable peace of mind if you’re concerned about losing nonrefundable prepaid travel expenses. It can be worth it if there’s a chance you’ll have to cancel your travel plans, and you’ll lose money on nonrefundable costs. Before you choose a trip cancellation policy, consider factors including cost, coverage, and cancellation reasons, and look at what’s covered with any credit cards you hold.

For Capital One products listed on this page, some of the benefits may be provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Air transat travel insurance.

Are you planning a trip with Air Transat? If so, you may want to consider purchasing travel insurance to protect yourself and your belongings while abroad. In this article, we’ll discuss everything you need to know about Air Transat travel insurance, including what it covers, how to purchase it, and frequently asked questions.

What is Air Transat Travel Insurance?

Air Transat offers travel insurance to its passengers, which provides coverage for unexpected events that may occur during their trip. This insurance can be purchased at the time of booking or added to an existing reservation.

What Does Air Transat Travel Insurance Cover?

There are several different types of coverage available through Air Transat travel insurance, including:

- Emergency medical expenses

- Trip cancellation and interruption

- Baggage loss or delay

- Flight and travel accidents

Each of these types of coverage has specific limits and conditions, which are outlined in the policy documentation.

How Much Does Air Transat Travel Insurance Cost?

The cost of Air Transat travel insurance varies depending on a number of factors, including the type of coverage selected, the length of the trip, and the age of the traveler. As a general rule, travel insurance typically costs between 4% and 10% of the total trip cost.

How Do I Purchase Air Transat Travel Insurance?

Air Transat travel insurance can be purchased at the time of booking or added to an existing reservation. To purchase travel insurance, simply select the desired coverage options when booking your flight or contact Air Transat customer service to add coverage to an existing reservation.

Frequently Asked Questions

Overall, Air Transat travel insurance can provide valuable peace of mind for travelers. Whether you’re concerned about medical emergencies, lost luggage, or flight cancellations, travel insurance can help protect you from unexpected expenses and provide assistance when you need it most. If you’re planning a trip with Air Transat, consider purchasing travel insurance to ensure a worry-free travel experience.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How Does Flight Insurance Work, and Is It Worth It?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is flight insurance?

What does flight insurance cover, what does flight insurance not cover, how do i get flight insurance, should i get flight insurance, flight insurance on award tickets, is flight insurance worth it.

Flight insurance covers flight expenses only — lodging, rental cars, etc. are not covered.

You can purchase standalone flight insurance from a third party or from the airline itself.

Your qualifying expenses are only reimbursed if a covered reason affects your flight.

You might already have sufficient flight insurance through your credit card.

Whether you’re booking a flight with cash or miles, flight insurance can help you get your money or miles back if your trip is unexpectedly canceled or delayed. Here’s what you need to know to decide if flight insurance is worth it for your trip.

Travel insurance terminology can get confusing. To keep things simple, when we refer to flight insurance, we mean insurance that will protect your nonrefundable flight that was paid for in cash or with miles.

Generally, flight insurance is offered when you:

Purchase a comprehensive travel insurance policy through a travel insurance provider (i.e. TravelSafe , Berkshire Hathaway , etc.)

When you use a premium travel card (that offers complimentary travel insurance) to book your flight.

Are buying a flight and get an option to purchase the airline’s trip insurance during the checkout process.

Since flight insurance specifically covers your flight, it can be a good option if you need to insure only a flight but no other aspects of your trip. For example, you buy a nonrefundable flight to visit family — you'll be staying with them, and you don’t need to book a hotel, car rental or excursions. Flight insurance might be sufficient for this type of trip, and buying a comprehensive travel insurance plan might be overkill.

» Learn more: Is travel insurance worth it in 2024?

Whether you’re getting flight insurance through a comprehensive travel insurance plan, your premium credit card or as an add-on from the airline, there are a few common types of coverage that may be included. Naturally, coverage amounts and limits will vary by policy and/or credit card.

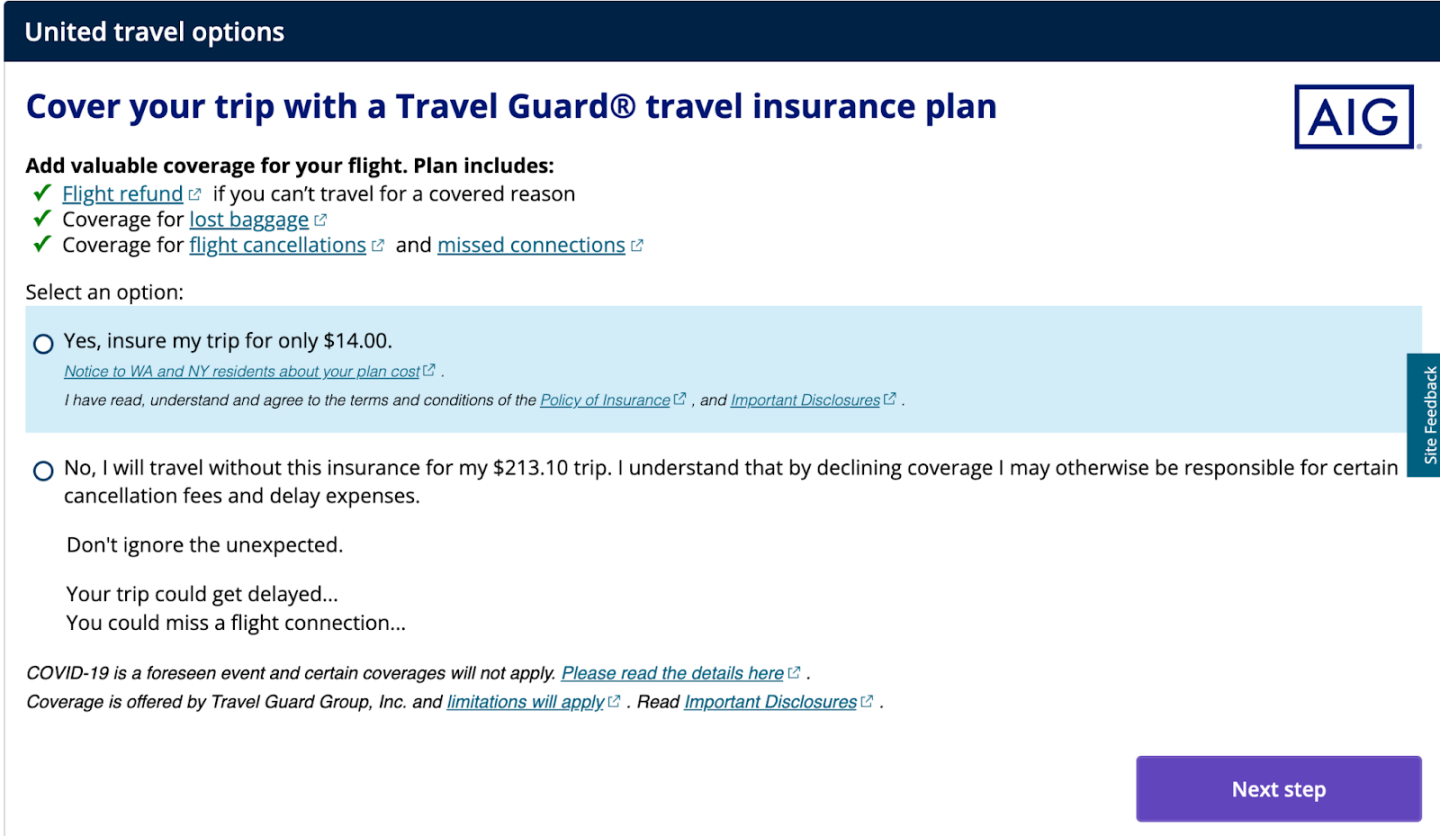

Here’s an example of what coverage is included on a flight insurance plan offered by United Airlines when purchasing a flight.

The flight insurance add-on is provided by Travel Guard and costs $14 to insure a $213 flight. The plan includes: a flight refund (i.e., trip cancellation insurance) if you cannot travel for a covered reason, lost baggage coverage, as well as coverage for flight cancellations and missed connections.

There's a notice posted for residents of Washington and New York, so if you live in one of those states, the coverage may differ.

» Learn more: What to know before buying travel insurance

Trip cancellation insurance

Trip cancellation insurance will reimburse you for prepaid, nonrefundable expenses if your flight is canceled for a covered reason. In the event you use your premium travel card from American Express or Chase to book your trip with points or miles, the trip cancellation insurance that comes with these cards will reimburse you in cash for the value of the points you used.

Notably, trips booked with an American Express card are only covered when booked as roundtrips. If you have a travel card with American Express, you’ll want to check the benefits guide for your card because that's where this caveat is located, and it's easy to overlook.

If you purchase a comprehensive travel insurance policy or an airline add-on policy, you typically will be reimbursed for the full cost of your flight, up to the policy maximums.

» Learn more: The best travel insurance companies

Trip delay insurance

This coverage kicks in if you’re delayed during a trip and you incur expenses as a result. Each policy details the reimbursement amount that is allowed, along with how long the delay must be in order for the trip to qualify.

For example, say you’re going on vacation and you have a connecting flight with a layover. An approaching snowstorm in the connecting city delays your flight, and after hours of waiting in the airport, you find out your upcoming flight is delayed until the next morning . Now you need a hotel room, toiletries, dinner and breakfast the next morning.

If you have trip delay coverage, you will be reimbursed for all of these expenses, as long as the delay exceeds a certain number of hours and you remain within the allowed daily monetary limit. For the United policy shown above, you will be covered up to $500 if you miss your connecting flight due to inclement weather or a delay of your original flight.

According to Squaremouth, a travel insurance comparison site, not all travel insurance policies offer coverage for missed connections, so if you’re booking a flight that has connections, you’ll want to pay attention to this benefit.

» Learn more: Chase trip delay insurance: What to know

Lost-luggage insurance

If you have lost-luggage insurance, you'll be eligible for reimbursement for your luggage contents if your luggage is lost, damaged or stolen during a trip. In the event of damage, the reimbursement would be for the cost to repair or replace, whichever is lower.

Lost-luggage coverage will likely include an overall limit as well as a per-item limit, and a separate limit for expensive items. We examined a flight insurance add-on offered by American Airlines and found that the baggage loss coverage had a limit of $300. If your luggage or its contents cost more than $300, that limit may not be sufficient for you.

» Learn more: Baggage insurance: How it works, what to know

Although flight insurance offers many protections, it's important to be aware of what may not be covered. Some examples of things that aren’t covered include:

Change of mind: If you cancel a flight because you change your mind about going, that won't be covered. The cancellation must be for a covered reason (i.e., too sick to travel and you have a doctor's note, job loss, inclement weather, etc.).

Expensive luggage: As detailed above with the American Airlines policy, the lost-luggage coverage is capped at $300. If you’re traveling with high-end luggage or your the contents of your luggage exceed that amount, anything above $300 won't be insured if the luggage is lost or damaged.

Medical evacuation: This type of coverage generally kicks in when you have a medical emergency during your trip and you need to be transported to the nearest medical facility. This type of coverage goes beyond a flight and is a benefit more likely to be included in a comprehensive insurance policy.

A comprehensive travel insurance policy will typically include medical evacuation and higher limits for luggage coverage.

If you’re looking for coverage that goes beyond your flight, you’ll want to look into a standalone travel insurance policy, a credit card that offers travel insurance or the Cancel For Any Reason (CFAR) travel insurance add-on to a comprehensive policy. This optional additional coverage will allow you to cancel your trip for any reason and get the majority (up to 75%) of your nonrefundable trip costs reimbursed.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

If you’re planning a trip and decide to insure your flight, you’ll first need to determine what type of policy will provide the coverage you need. There are a few ways to protect your flight:

Purchase a standalone travel insurance policy

A comprehensive travel insurance policy will include the most benefits, including trip cancellation, trip delay, baggage loss , emergency medical , repatriation and more. Providers that offer comprehensive travel insurance plans include Seven Corners , World Nomads and Allianz .

Use the complimentary travel insurance provided by your credit card

Many travel cards offer complimentary travel insurance protections that are similar to those offered on standalone travel insurance policies.

However, the limits are usually lower, medical costs may not be included, and the entire trip must be charged on the same card to receive coverage.

Here are a few examples of cards with travel insurance benefits:

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

Purchase the airline’s travel insurance add-on when buying a flight

When you buy your flight from an airline (in cash or miles), you may see an option to purchase trip insurance during the checkout process. As examples, United offers a flight insurance option provided by Travel Guard, while American Airlines’ flight insurance provider is Allianz. Trip protections may include trip cancellation, trip interruption and trip delay, as well as coverage for lost bags.

Since coverage will differ between airlines, you’ll want to be aware of any restrictions. One common theme among the policies is that the protections are only valid if your trip is canceled or delayed for a covered reason, such as a natural disaster, illness, death or other extraordinary event.

NerdWallet recently reviewed travel insurance policies to help you choose the plan that provides the best travel insurance for your trip .

» Learn more: Comparing travel insurance options: airline or credit card?

If you have a credit card that provides some form of travel insurance, the coverage limits may be enough to protect your flight. If you don’t have one of these cards and your trip only includes a nonrefundable flight, purchasing the travel insurance add-on from the airline when booking your flight may provide sufficient coverage.

However, if your trip also includes a hotel and other nonrefundable bookings, you’d be better off with a standalone travel insurance policy or relying on your credit card coverage (if the limits are sufficient and your entire trip was booked with the card).

» Learn more: Airline travel insurance vs. independent travel insurance: Which is right for you?

If you use airline miles to book an award ticket, the flight insurance offered during the checkout process typically covers a redeposit of your miles back to your frequent flyer account if the trip is canceled.

Comprehensive trip insurance policies and credit card travel insurance will reimburse you for the taxes and fees paid on award tickets but may not cover the miles.

Make sure to check your policy if booking with points; some comprehensive and credit card plans will reimburse you for "redeposit fees" that the airline will charge you to get your miles back (if you didn’t purchase their add-on protection). That redeposit fee reimbursement allows you to get your miles back.

» Learn more: Does travel insurance cover award flights?

If you’re interested in insuring only your flight, you have many options to choose from.

For tickets purchased with cash, comprehensive insurance plans, premium travel credit cards and airline trip insurance will cover your nonrefundable flight costs. Award flights that are booked with miles could benefit from any of the three options if redeposit fees are part of the coverage.

If you want to be able to cancel your flight for any reason whatsoever, CFAR will protect most of your nonrefundable trip deposit, but it is also more expensive and only available as an add-on to a comprehensive travel insurance plan.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Trip Cancellation Insurance: Covered Reasons Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

IMAGES

COMMENTS

Top reasons to purchase insurance with Transat. Applies to Canada only. 1. You have to cancel your trip because of illness or accident. No need to worry, you are covered by our cancellation insurance. 2. While travelling, you have become sick or have been involved in an accident. We are there to help you get the assistance you need and to cover ...

Top reasons to buy an insurance from Allianz Global Assistance via Air Transat* You have to cancel your trip because of illness or accident. No need to worry, you are covered by our cancellation insurance. While travelling, you have become sick or have been involved in an accident. If you purchased a travel insurance, you will receive the assistance you need and covert the costs. If your ...

Cancel 7 days or more prior to departure and receive up to 80%. Cancel 6 days to 24 hours prior to departure and receive up to 80% (up to $2,500) Discover our new Interruption for Any Reason (IFAR) benefit which allows you to claim up to 80% of the unused non-refundable pre-paid portion of your trip, maximum $2,500 (except the cost of prepaid ...

Download the flight delay certificate to submit to your insurance company, up to 180 days after your initial departure date. Your claim must be received by Air Transat within one year of the date of the flight disruption. Air Transat will respond to your claim within a maximum of 30 days of the date of receipt of the submitted claim for flight ...

TORONTO — Air Transat is making it easier for passengers to change and cancel their bookings in both Economy and Club Class.

Trip cancellation insurance can reimburse nonrefundable travel expenses if you need to cancel travel. Learn about coverage, costs, and more.

There are several different types of coverage available through Air Transat travel insurance, including: Emergency medical expenses. Trip cancellation and interruption. Baggage loss or delay. Flight and travel accidents. Each of these types of coverage has specific limits and conditions, which are outlined in the policy documentation.

What to know about trip cancellation insurance before deciding if you should buy it before your next holiday, according to experts.

Our Travel Professionals can provide you with further information regarding Transat Travel Insurance benefits and coverage when a Canadian Travel Advisory is occurring.

Airtransat basically told me to contact manulife and get their insurance coverage so they can cover the cancellation or whatever; although frankly that doesn't feel like the best move. Otherwise, there's simply no refund options. I don't know what to do. If anyone has any advice at all on getting even a partial refund or just some guidance on ...

Not every reason for canceling a trip will qualify for coverage under travel insurance policies. Here's what to know about trip cancellation insurance.

Product: Air Transat Cancellation Insurance Policy This document only provides a basic summary of policy cover. The full terms and conditions of the contract are shown on the policy document, which you should read carefully to ensure you have the cover you need.

The flight insurance add-on is provided by Travel Guard and costs $14 to insure a $213 flight. The plan includes: a flight refund (i.e., trip cancellation insurance) if you cannot travel for a ...

Thank you for your interest in Air Transat Cancellation Only Travel Insurance This document provides you with the links to access the full terms and conditions of the insurance in the policy document and the brief summary of the policy cover in the Insurance Product Information Document (IPID).

If you purchase a basic travel insurance policy that includes trip cancellation coverage, you can expect to pay between 5% and 10% of your trip costs. For instance, if you buy a $10,000, nine-day ...

In what it calls "an effort to offer more flexibility to its clients," Air Transat has eased its conditions for changing and cancelling bookings in both Economy and Club Class fares. It is now possible to cancel a trip, regardless of the chosen fare. For Eco Budget, Eco Standard and Club Standard fares, a cancellation fee of $200 will apply.

Why can't travel insurance cover every possible scenario? Allianz Global Assistance explains what covered reasons are and what to look for when you're buying trip cancellation insurance.

Download the flight delay certificate to submit to your insurance company, up to 180 days after your initial departure date. Your claim must be received by Air Transat within one year of the date of the flight disruption. Air Transat will respond to your claim within a maximum of 30 days of the date of receipt of the submitted claim for flight ...

Non-medical protection ideal for travel outside your province or territory of residence, with enhanced coverage and benefits, including: •. Cancel for covered reason (sickness, accident etc) and receive 100% of the trip cost that is insured. Cancel for any reason 24 hours or more prior to departure & receive up to 75% of the trip cost that is ...

Booking cancellation request within 24 hours of purchase This form is for the use of our customers for individual flight bookings made on airtransat.com only. This form must be used to cancel a reservation within 24 hours of purchase with a departure date of more than 7 days. It does not apply to group or package bookings.