I am looking for…

Travel allowance or LAFHA? And how is each taxed?

Thanks to Tax & Super Australia for the article.

Being asked by the boss to travel for work purposes can be demanding on staff — financially, physically and also emotionally. Out of this has developed more than one way to compensate employees; these being a travel allowance and the living away from home allowance (LAFHA).

When both were developed, the difference between the two were often decided by an ATO-initiated rule-of-thumb in that travel of less than 21 days was deemed to be the former, while more than 21 days was considered to have a more LAFHA flavour. The 21-day “threshold” however no longer applies.

For travel allowances, typically employees are:

- paid standard travel allowance for accommodation and food

- working at the one location

- visiting home on weekends

- staying in accommodation provided by the supplier (which may be available for use by other customers when the employee is not there).

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee.

However it has also been found that some employees may be on a travel allowance for six weeks or more.

It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA ) or the income tax rules (for travel allowances ). The tax treatment (and therefore the financial outcomes) of both can be different.

Deciding factors

The FBT framework would generally provide for a more concessional tax outcome where certain prescribed requirements for a LAFHA is met in comparison with the income tax effect of a travel allowance.

The reality is that you could have someone who is away from home but is still considered to be only travelling. Alternatively you could have someone that is away from home for two weeks only, but in those two weeks was actually living away from home.

When an employee is required to travel on business and overnight their food, drink and accommodation expenses become deductible expenses and are FBT free for the employer. The difference between LAFH rules and travelling on business is quite simply the employee on LAFH has to temporarily change their usual place of residence and therefore their food, drink and accommodation expenses become private and non-deductible. And that is why the employer needs the FBT concession for such employees. It is a question of fact as to whether or not the employee has temporarily changed their usual place of residence as opposed to travelling around on business.

So it is a test of substance whether someone is just travelling or is actually living away from home. It would have to be substantiated to be proven in fact as a LAFHA. Similarly, if away from home and treated as a travel allowance, the ATO will generally not challenge such treatment if substantiated as travel. Taxation ruling TR 2017/D6 deals with these factors.

Travel allowance or living away from home?

The following general principles may be of guidance:

- When a person is living away from home, there will be a change in job location and a temporary residence will be taken up near the new work location. Often, but not always, the employee’s spouse and family will accompany the employee to the new location.

- When a person is merely travelling, there will be no change in job location and there will be no establishment of a temporary residence – rather, the person will merely be accommodated while travelling. Usually the employee’s spouse and family will not accompany the employee.

- However the issue of whether the family accompanies the employee is not determinative. The critical factor seems to be where the job is located. If it is temporarily located away from the employee’s usual place of residence, the employee will usually be living away from his or her usual place of residence. Where the job location does not change, but the employee must travel to undertake duties, he or she will be regarded as travelling.

- While the length of period away from home is not determinative, the ATO will generally accept that shorter periods away will generally be deemed to be travelling. In addition, the Tax Commissioner has stated that employees attending short-term staff training courses will generally be treated as travelling in the course of their employment.

- There is no minimum or maximum period of absence to qualify as living away from home, although the application of the FBT rules may be less concessional if someone lives away from their usual place of residence for more than 12 months. The period that a person is living away from home will end when the person returns to his or her usual place of residence, or changes his or her usual place of residence to the new location.

Related resources

analyst report

Get Started

Your privacy is assured.

Allowances are extra payments made to employees for things like travel, meals, tools or particular skills

To add an allowance to an employee's pay, set up the allowance and assign it to the employee

To check which allowances your employees might be entitled to, the Fair Work website is a good place to start.

The specifics of each allowance might vary, but the steps to create them in MYOB are the same. You can create one allowance and assign it to multiple employees, or you can create separate allowances for different employees.

Setting up an allowance

Go to the Payroll menu and choose Pay items .

Click the Wages and salary tab.

Click Create wage pay item .

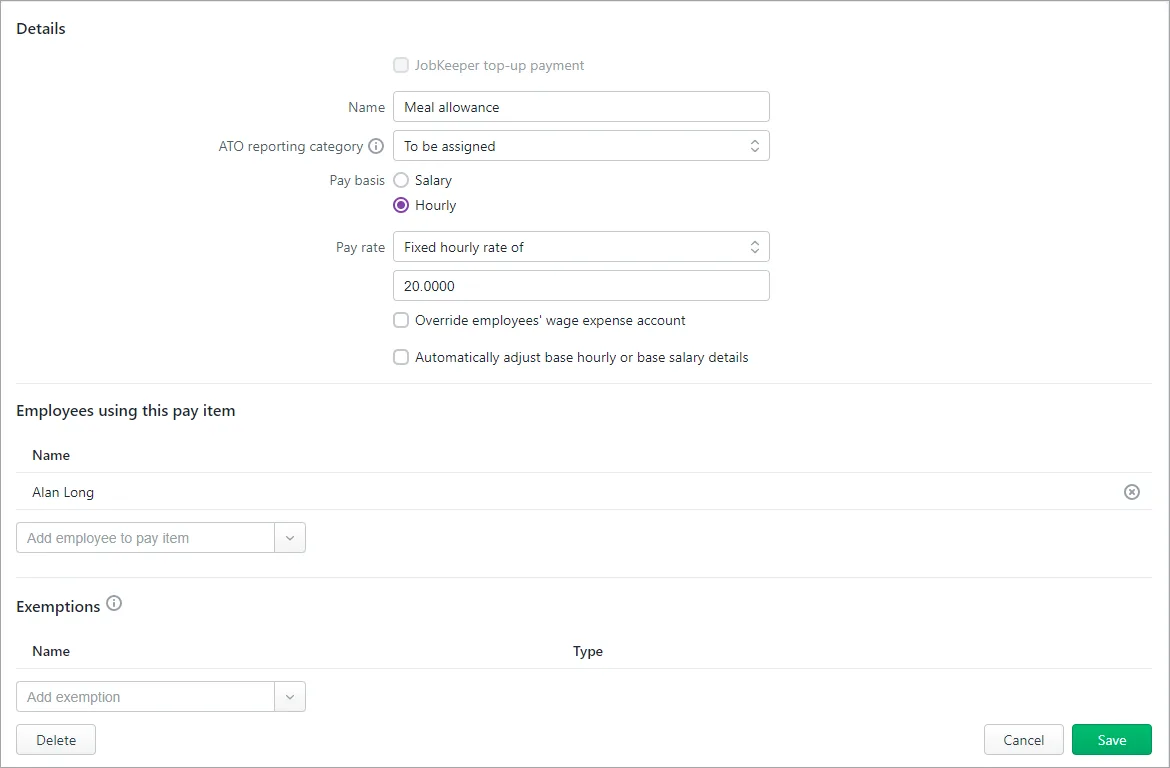

Enter a Name for the allowance.

If you'd like a different, more personalised, name to show on pay slips for this allowance, enter a Name for pay slip , such as "Evening Meal Allowance". If you leave this blank, the pay item Name will display instead.

Choose the ATO reporting category . If you're not sure, check with your accounting advisor or the ATO. Learn about assigning ATO reporting categories for Single Touch Payroll .

If assigning Allowance - other as the ATO reporting category, make sure the name of the allowance adequately describes what the allowance is for, e.g. general, home office, non-deductible, transport/fares, uniform or private vehicle. This will help the ATO assist your employees to complete their tax returns. Learn more...

For the Pay basis , choose Hourly (regardless of whether the employee is paid on an hourly or salaried basis).

Choose the Pay rate :

If the allowance is a fixed amount per unit (per hour, per day, per KM, etc.), choose Fixed hourly rate of and enter the rate. For example, if it's a daily tool allowance, enter the daily rate. If the allowance amount varies each pay, leave the amount as zero and you can enter the amount each time you pay the employee.

if the allowance is based on the employee's regular pay rate, choose Regular rate multiplied by and enter the multiplier. For example, if it's an hourly allowance that's paid at double the employee's regular pay rate, enter 2 as the multiplier.

(Optional) If you want to track these allowance payments through a separate account, select the option Override employees' wage expense account and choose the override account in the field that appears. Need to create a new account?

Under Allocated employees , choose the employees entitled to this allowance.

Under Exemptions , choose any deductions or taxes that shouldn't be calculated on these allowance payments. For example, it's this is a pre-tax allowance, select PAYG Withholding . If you're not sure, check with your accounting advisor or the ATO.

When you're done, click Save .

Here's our example meal allowance pay item:

Assigning an allowance to an employee

As shown above, when you set up an allowance you'll assign it to the relevant employees so it appears on their pays. But you can add or remove the employees assigned to an allowance at any time.

Go to the Payroll menu and choose Pay items .

Click to open the allowance pay item.

Under Allocated employees :

add an employee by choosing them from the list

remove an employee by clicking the delete icon for that employee

When you're done, click Save .

To pay an allowance

OK—you've set up an allowance pay item and assigned it to the relevant employees. Now when you process the employee's next pay, the allowance will be included.

Go to the Create menu and choose Pay run .

Choose the Pay cycle and confirm the pay dates.

Click Next .

Click the down arrow for the employee to open their pay.

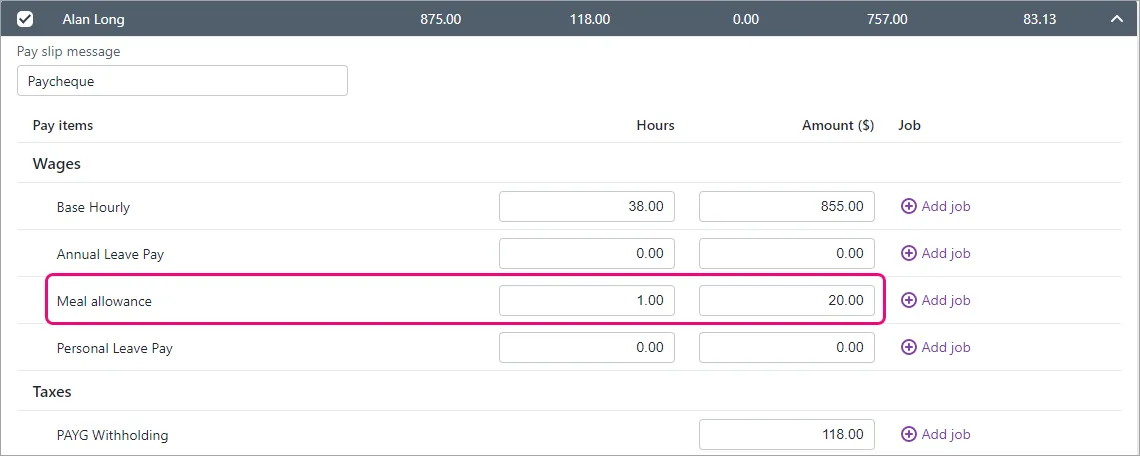

Enter the Hours or Amount of the allowance being paid. If you set up the allowance to be paid on a per-unit basis (per hour, per day, per KM, etc.), enter the number of units being paid in the Hours column. For example, if it's a daily meal or tool allowance, enter 1 in the Hours column and confirm the Amount . Here's our example $20 daily meal allowance:

Continue processing the pay as normal. Need a refresher?

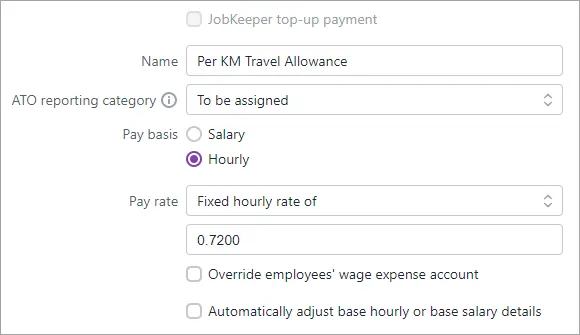

How do I set up a per KM travel allowance?

When setting up an allowance pay item, the Pay rate can also be used for any cumulative unit, such as per KM travelled. You can then enter the value per KM in the next field.

Here's an example pay item where an allowance of 72c is paid for each KM travelled.

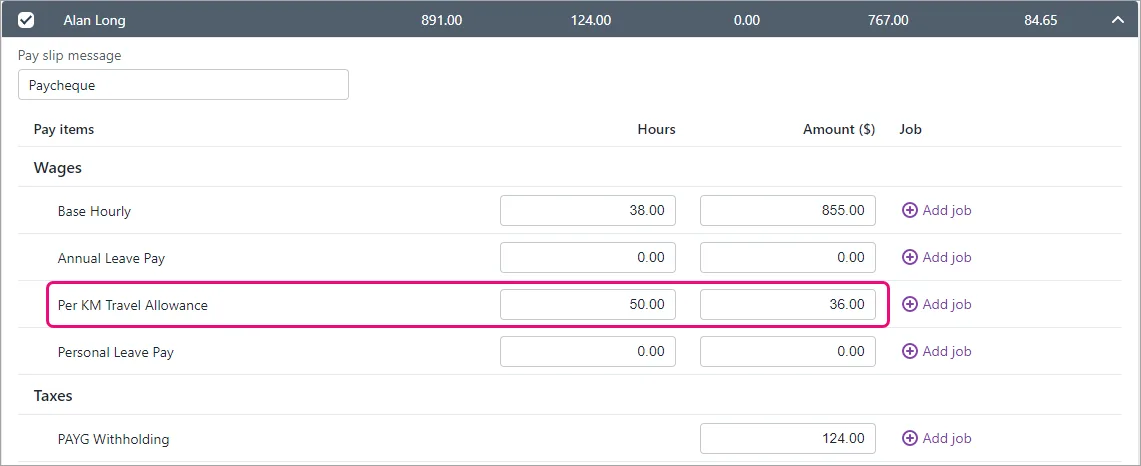

To pay the allowance, simply enter the number of KM travelled in the Hours field on the employee's pay. Here's an example showing an allowance for 50 KM (50 x 0.72 = $36).

Does super or leave accrue on an allowance?

When you create an allowance, by default it'll accrue superannuation and leave entitlements. If you're not sure if an allowance should accrue these entitlements, check with your accounting advisor or Fair Work .

To prevent super or leave accruing on an allowance, open the super or leave pay item and select the allowance pay item under Exemptions . For example, go to Payroll > Pay items > Superannuation tab > click to open the applicable super pay item > select the allowance under Exemptions > Save .

How do I pay different allowance amounts to employees?

To pay different allowance amounts to employees, you can either:

set custom amounts for each employee, or

enter or change the allowance amount when you pay the employee .

Can I set up an “all-purpose allowance"

Historically, an all-purpose allowance may have been added to an employee’s base hourly rate and used for calculating things like allowances, overtime and other types of payments.

But to meet the requirements of the ATO’s STP Phase 2, your employees' base hourly pay must be reported separately from allowances. MYOB does this using the ATO reporting category you assign to your pay items.

Therefore you can’t set up all-purpose allowances in MYOB. Instead, you’ll need to set up pay items for each allowance you need to pay and assign the applicable ATO reporting category to those allowances.

Before STP Phase 2, an employee might have been paid an all purpose allowance which combined the following:

a base hourly rate

an industry allowance (for difficult tasks)

a tool allowance

Now, under STP Phase 2, the industry allowance and tool allowance would need to be set up as separate allowances and the employee's base hourly rate reduced accordingly.

Login Register

Pay calculator tool

Find wages and penalty rates for employees.

Leave calculator tool

Work out annual and personal leave

Shift calculator

Rates for your shifts

Notice and redundancy calculator

- Accessibility

- Subscribe to email updates

- Visit Fair Work on YouTube

- Visit Fair Work on Twitter

- Visit Fair Work on Facebook

- Visit Fair Work on Instagram

- Visit Fair Work on LinkedIn

Automatic translation

Our automatic translation service can be used on most of our pages and is powered by Microsoft Translator.

Language help

For professionally translated information, select your language below.

Popular searches

- minimum wages

- annual leave

- long service leave

Tax and superannuation

Closing Loopholes: Fair Work Act changes

A new criminal offence for intentional underpayments by employers will be added to the Fair Work Act as part of the new ‘Closing Loopholes’ laws from no earlier than 1 January 2025.

We (the Fair Work Ombudsman) will investigate suspected criminal underpayment offences once the changes take effect.

Learn more at Closing Loopholes .

The Australian Taxation Office (ATO) gives advice and information about tax requirements and superannuation (super). The ATO is the primary enforcement agency for the compulsory super guarantee.

On this page:

Superannuation guarantee, superannuation under the national employment standards, extra terms about superannuation.

- When superannuation hasn't been paid

Tools and resources

Related information.

Our role (the Fair Work Ombudsman) is to give employers and employees information and advice on workplace rights and obligations. We can provide information on the entitlement to super in the National Employment Standards (NES) and extra terms about super in awards.

Find out how you can access advice and support on tax and super issues.

The ATO gives information and advice to employers and employees on tax.

If you want to understand your tax obligations as an employer or employee, find information on the ATO website:

- Employers: ATO – Tax and super when engaging an employee

- Employees: ATO – Working as an employee

You can also contact the ATO:

- online at ATO – Contact us , or

- over the phone on 13 28 61 .

If you’re an employer, we have templates to help you record tax or superannuation on employee records or pay slips. Access them at Pay slips and Record-keeping .

For more information on state and territory payroll tax, visit business.gov.au – Payroll tax .

Under the super guarantee, employers have to pay super contributions of 11.5% of an employee's ordinary time earnings when an employee is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

If eligible, the super guarantee applies to all types of employees, including:

- full-time employees

- part-time employees

- casual employees.

Temporary residents are also eligible for super.

Super has to be paid at least every 3 months and into the employee’s nominated account.

The ATO can give advice and assistance on super issues, including the super guarantee. Find out more at:

- ATO – Super for employers

- ATO – Super for employers – How much super to pay

- over the phone on 13 10 20 .

Super is an entitlement under the NES .

This means that most employees covered by the NES can take court action under the Fair Work Act to recover unpaid super, unless the ATO has already commenced proceedings in relation to that super.

The NES entitlement to super aligns with super laws, so if an employer complies with the super guarantee they will also meet their obligations under the NES.

The new NES entitlement doesn’t apply to some employees. Employees who are in the national workplace relations system because their state referred their powers to make workplace laws to the Commonwealth don’t have an entitlement to super under the NES. This broadly includes employees:

- sole traders

- partnerships

- other unincorporated entities

- non-trading corporations

- in Victoria employed in the public sector

- in Tasmania employed in local government.

These employees may still be entitled to super under the super guarantee and under super terms in an award or registered agreement.

Some awards, enterprise agreements and other registered agreements also have extra terms about super.

Find more information about super in your award by selecting from the list below.

Industry Embedded Filter Placeholder

When superannuation hasn’t been paid

Employees who think super hasn't been paid can make a complaint to the ATO.

Before doing this, you should:

- check if an award or registered agreement applies to your employment

- check if your award or agreement has extra terms about super (use the filter above or see our full list of awards )

- follow the steps on the ATO - Unpaid super from your employer page.

If there are extra super terms on top of the super guarantee in your award or agreement, you can contact us for further assistance.

Annual performance test – closed MySuper products

The Australian Prudential Regulation Authority (APRA) conducts an annual performance test for MySuper products. When a MySuper product fails the annual performance test for 2 consecutive years, it cannot accept new members until it passes a future performance test.

To learn more about which MySuper products are currently unable to accept new members go to FWC – Superannuation .

- Record-keeping

- Find my award

- Super – ATO website

- Pay slip template

- Find an enterprise agreement – Fair Work Commission

- National Employment Standards

- ATO website

- Super obligation employer’s checklist

- Super for temporary residents leaving Australia

Help for small business

- Find tools, resources and information you might need in our Small Business Showcase .

The Fair Work Ombudsman acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land, waters, skies and communities. We pay our respects to them, their Cultures, and Elders past, present and future.

Thank you for your feedback. If you would like to tell us more about the information you’ve found today you can complete our feedback form .

Please note that comments aren't monitored for personal information or workplace complaints. If you have a question or concern about your job, entitlements or obligations, please Contact us .

Bookmark to My account

- Get priority support!

- Save results from our Pay, Shift, Leave and Notice and Redundancy Calculators

- Bookmark your favourite pages

- Ask us questions and save our replies

- View tailored information relevant to you.

Log in now to save this page to your account.

- Fair Work Online: www.fairwork.gov.au

- Fair Work Infoline: 13 13 94

Need language help?

Contacting the Translating and Interpreting Service (TIS) on 13 14 50

Hearing & speech assistance

Call through the National Relay Service (NRS):

- For TTY: 13 36 77 . Ask for the Fair Work Infoline 13 13 94

- Speak & Listen: 1300 555 727 . Ask for the Fair Work Infoline 13 13 94

The Fair Work Ombudsman is committed to providing you with advice that you can rely on. The information contained in this fact sheet is general in nature. If you are unsure about how it applies to your situation you can call our Infoline on 13 13 94 or speak with a union, industry association or a workplace relations professional.

Printed from fairwork.gov.au Content last updated: 2024-07-30 © Copyright Fair Work Ombudsman

(02) 4942 0200

- Knowledge Club

- Giving Back

- New Business Setup

- Business Management

- Bookkeeping

- Self-Managed Super Funds

- Financial Planning

- Testimonials

Many business owners regularly pay their employees domestic travel allowances rather than reimbursing them. The ATO has recently released the reasonable travel and overtime meal allowance expense amounts for the 2020-2021 income year Taxation Determination TD 2020/5 .

The determination sets out the amounts that the Commissioner considers are reasonable for the substantiation exception for the 2020-2021 income year in relation to claims made for:

· Overtime meal allowance expenses - food and drink in connection with overtime worked and where a meal allowance has been paid under an industrial instrument;

· Domestic travel allowance expenses – accommodation, food and drink, and incidentals that are covered by the allowance;

· Travel allowance expenses for employee truck drivers – food, drink and incidentals that are covered by the allowance; and

· Overseas travel allowance expenses – food, drink and incidentals that are covered by the allowance.

If you'd like to know more about Allowances such as whether they are; included on payment summaries; subject to PAYG Withholding or subject to superannuation guarantee, you may like to read Allowances and reimbursements .

General Advice Warning: The information provided is of a general nature only and has been prepared without taking into account your financial objectives, situation or needs. These should be considered before you act on any information considered in any article and you may want to seek independent professional advice before making a decision.

Liability limited by a scheme approved under Professional Standards Legislation

Banking Matters Major Banks Analysis FY23 Full-Year

Voice of the Consumer Survey 2024

Entertainment & Media Outlook

PwC’s 27th Annual Global CEO Survey - Australian insights

The winning formula for accelerating performance

Australia’s pathway to energy transition is blowing in the wind

Enhancing governance, culture and accountability

PwC Australia Transparency Report FY23

Our approach to Corporate Sustainability

Create a tech career

Search current jobs

Loading Results

No Match Found

ATO guidance on costs of travelling

19 February 2021

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is “travelling on work” or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses:

Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees: accommodation and food and drinks expenses; travel allowances; and living-away-from-home allowances

Draft Practical Compliance Guideline PCG 2021/D1: Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach, and

Taxation Ruling TR 2021/1 : Income tax: when are deductions allowed for employees’ transport expenses?

TR 2021/D1 overhauls the ATO’s public guidance with respect to deductibility of expenses for accommodation, food and drinks and incidentals. Importantly, the draft Ruling also provides the ATO’s preliminary views on the following concepts which generally underpin the deductibility analysis:

- living expenses which are non-deductible as they are not incurred in performing an employee's income-producing activities, and

- travelling on work costs which are deductible where they have a sufficiently close connection to the performance of employment duties.

The practical compliance approach set out in PCG 2021/D1 allows taxpayers to determine whether an employee is ‘travelling on work’ or ‘living at a location’. Subject to certain conditions, an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

TR 2021/1 continues to reaffirm the general principles around deductibility and associated FBT implications of employee transport expenses, which include that:

- an employee’s costs of travelling between home and a regular place of work are not deductible; and

- travel expenses incurred in the performance of an employee’s employment duties are deductible.

TR 2021/1, which applies before and after its issue date, replaces commensurate transport deductibility guidance in the now withdrawn Draft Taxation Ruling 2017/D6 Income tax and fringe benefits tax: when are deductions allowed for employees’ travel expenses? (TR 2017/D6) and finalises the previously issued Draft Ruling TR 2019/D7. When finalised, TR 2021/D1 and PCG 2021/D1 are also proposed to apply to before and after their date of issue, similarly replacing relevant principles from TR 2017/D6.

Employers should consider how the new guidance may impact any travel benefits provided in the current FBT year and also former FBT years, particularly where application of previous guidance may lead to a different outcome. It is relevant to note that all three documents make reference to the Commissioner of Taxation having regard to earlier ATO guidance, and a taxpayer’s reliance thereon, in deciding whether or not to apply compliance resources with respect to relevant tax matters.

TR 2021/D1 - travelling vs living expenses

Where an employer provides an allowance, or pays or reimburses an employee for travel expenses, including accommodation, food and drink and incidentals, the costs may be deductible (or ‘otherwise deductible’ for FBT purposes) in certain circumstances.

In detailing the ATO’s preliminary view regarding deductibility principles, TR 2021/D1 makes a distinction between the following concepts:

- living expenses which are non-deductible. Although these costs are a prerequisite for gaining or producing an employee’s assessable income, they are not incurred in performing an employee's income-producing activities and are also private or domestic in nature; and

- travelling on work costs which are deductible if they have a sufficiently close connection to the performance of the employment duties and activities through which the employee earns income.

The draft Ruling also sets out that, if any of the following apply, the employee will not be “travelling on work” and therefore, expenses incurred will be non-deductible living expenses:

- Personal circumstances: The employee’s personal circumstances are such that they live far away from where they gain or produce their assessable income and the expenses are incurred as a result;

- Living at a location : The employee has a new regular place of work which is away from their usual residence and therefore the resulting expenses are not an incident of their income-earning activity; and

- Relocation: The employee has relocated from their usual residence, regardless of whether moving to the new location is required by the employer, such that any expenses are living expenses.

The draft Ruling provides guidance in terms of the factors to consider in determining whether an individual is living at a location or relocating.

TR 2021/D1 also distinguishes between certain types of allowances provided by employers to employees:

- travel allowances which can only be paid to cover deductible accommodation, food and drink and incidental expenses incurred by an employee when they are “travelling on work”; and

- living-away-from-home allowances (considered for FBT purposes) which are paid to provide compensation to an employee for the additional living expenses incurred by an employee because their duties of employment require them to live at a location away from their usual residence.

TR 2021/D1 also provides guidance on the deductibility of incidental expenses and additional property expenses, in addition to commentary on apportionment of expenses and substantiation requirements.

PCG 2021/D1 - travelling on work or living at a location - ATO compliance approach

Although TR 2021/D1 provides principles and factors to assess whether an employee is travelling on work or living at a location’, PCG 2021/D1 provides a practical compliance approach in making such a determination.

According to PCG 2021/D1, the Commissioner will accept that an employee is ‘travelling on work”, and will generally not apply compliance resources to determine if benefits alternatively relate to expenses for living at a location, when all of the following circumstances are satisfied:

The 21 day rule of thumb was discarded by the ATO many years ago due to taxpayers increasingly regarding it as a fixed threshold when distinguishing between “travelling on work” and living away from home. This concept is now re-activated in PCG 2021/D1 but together with further criteria that provide sufficient integrity.

TR 2021/1 - Transport expenses

TR 2021/1 finalises TR 2019/D7 and details that transport expenses (for example, in respect to an airline, train, taxi, car, bus, boat or other vehicle) will be deductible where they are incurred in gaining or producing assessable income. This Ruling stipulates that this characterisation will be supported where the travel:

- fits within the duties of employment (i.e. the obligation to incur the transport expenses arises out of the employment itself and not the employee’s personal circumstances); and

- is relevant to the practical demands of carrying out the employee’s work duties or role (i.e. the transport expenses are a necessary consequence of the employee’s income-producing activity).

The Ruling also provides the following additional factors that may be relevant in determining the whether a transport expense is incurred in gaining or producing assessable income:

- the employer asks for the travel to be undertaken

- the travel occurs on work time, and

- the travel occurs when the employee is under the direction and control of the employer.

In conjunction with these factors, the Ruling continues to address what constitutes a regular place of work, along with the deductibility of benefits in specific scenarios, inclusive of employees who are on-call or standby, working from home, or transporting bulky equipment.

The takeaway

The release of the ATO’s new series of travel Rulings and the Practical Compliance Guideline as we head towards the close of the current FBT year are, in one sense, timely with mobility on the rise again, as COVID-19 restrictions continue to ease in Australia. Importantly, it delivers some certainty to taxpayers who have been closely watching and relying on draft Rulings over a number of years.

As the new Rulings and the Guideline apply retrospectively as well as prospectively, taxpayers who have relied on discontinued deductibility concepts in the withdrawn TR 2017/D6, such as “special demands travel” and “co-existing work locations”, should review their current arrangements for travel to validate whether it continues to be regarded as deductible (for example, because they are “travelling on work”).

Additionally, for employers who have new projects or programs requiring benefit and travel policies to be developed, it is paramount that the new guidance is considered in determining the nature of travel and the impact of benefits for each scenario and employee cohort (for example, short-term mobilisation on construction projects versus two-year assignments). Upfront planning, including development of governance and procedures (data capture, travelling versus living determination, etc), is a necessary initiative to manage the ongoing challenges of deductibility assessment for travel arrangements.

Submissions on the draft Ruling and PCG are due by 19 March 2021. PwC will be preparing a submission and would welcome your feedback. If you would like to contribute, please advise your relevant PwC contact.

Related content

PwC's Tax Alerts will ensure you are kept informed of the latest key tax developments as they occur.

Tax Services

Our team provides integrated tax solutions in even the most complex environment.

Partner, PwC Australia

Tel: +61 412 957 101

Anne Bailey

Partner, Workforce, PwC Australia

Tel: +61 407 204 193

Adam Nicholas

Tel: +61 2 8266 8172

Norah Seddon

Partner, Tax, Asia Pacific Workforce Leader, PwC Australia

Tel: +61 2 8266 5864

Paula Shannon

Tel: +61 421 051 476

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. Liability limited by a scheme approved under Professional Standards Legislation.

- Cookies info

- Code of Conduct

- Linking policy

- Site provider

- PAYG Withholding Variation: Tax...

Allowances Exempt From Tax Withholding And Super

Certain allowances are effectively tax-free and are not required to have PAYG instalments deducted from employer payments. They are generally allowances of a kind which are matched by tax-deductible expenditure, or for which any tax is otherwise covered off.

Regulations made under the Taxation Administration Act 1953 provide that there is no requirement to deduct tax from the following allowances (when the allowance amount is up to specified limits):

- Cents per kilometre car expense payments using the approved rates (to a maximum of 5,000 business kilometres)

- Award transport payments for deductible transport expenses. An award transport payment is a transport payment paid under an industrial instrument (i.e. an award, order, determination or industrial agreement) that was in force under Australian law on 29 October 1986.

- Laundry (not dry cleaning) allowance for deductible clothing up to the threshold allowable amount (currently $150).

- Award overtime meal allowances up to the reasonable amounts published in an annual ATO Determination. The allowance must be paid under an industrial instrument in connection with overtime worked.

- Domestic or overseas travel allowance (excluding overseas accommodation allowance) involving an overnight stay away from home, up to the reasonable travel allowances amount published in annual ATO Determinations.

Necessary conditions for the application of the reduced-PAYG tax withholding rules are:

- the payee (i.e. employee) is expected to be eligible for a tax deduction for at least the amount of the allowance

- the amount and nature of the allowance is shown separately in the accounting records of the payer (i.e. employer)

Amounts paid in excess of approved limits (eg cents per km for more than 5,000 kms, or at a rate higher than the approved cents-per-kilometre rate) are generally required to have tax withheld, and certain payments may also be subject to super guarantee obligations.

Checklist of allowances exempt from withholding tax and superannuation

For a schedule of various allowances and how to treat them see here: Withholding for allowances

PAYG ‘nil’ & special rate payments

Certain payments have a withholding tax rate varied to ‘nil’, or a special rate specified by regulation, including (not exhaustive):

- Directors Fees payable to a related entity – PAYG tax is varied to nil – F2016L00222

- Religious Practitioners – when equivalent tax deductible expenditure is incurred and/or payments are under specified low-payment thresholds, the PAYG tax rate is varied to nil – F2016L00107

- Performing Artists – special 20% rate for certain promotional activities – F2018L01119

- Certain insurance and compensation claims payments – the PAYG tax rate is varied to nil – F2016L00433

- Labour Hire reimbursements and allowances of otherwise tax deductible amounts – the PAYG tax rate is varied to nil – F2016L01580

- PAYG Withholding variation for foreign resident capital gains withholding payments – acquisitions from multiple entities – F2017L00390

- PAYG Withholding variation for foreign resident capital gains withholding payments — marriage or relationship breakdowns – F2016L01642

- PAYG Withholding Variation: Donations to deductible gift recipients – F2016L01641 – withholding payment reduced by the amount paid to a deductible gift recipient on a payee’s behalf

- PAYG Withholding Variation: Body Corporates – F2016L01640 – varies the rate to NIL

- payments to foreign resident support staff for entertainment and sports activities who are normally resident in countries with an international tax agreement with Australia – the PAYG rate is varied to nil – F2019L00407

- PAYG Withholding Variation: Certain superannuation beneficiaries who have not quoted a tax file number – The amount to withhold is varied to nil for that portion of the payment which is non-assessable non-exempt income of the payee – F2017L01280

- Taxation Administration: Withholding Variation to Nil for Low Income Minors Legislative Instrument 2022 – varies the rate to NIL for minors on low income (currently $350 per week) who have not submitted a TFN declaration – LI 2022/28

- PAYG Withholding Variation: authorizes the variation of the withholding amount (not less than zero) when the payroll includes occasional deductible gifts (donations) – regulation F2024L00130 specifies a formula

- Taxation Administration: Withholding Variation for Certain Payments to US Resident Entertainers Including Athletes – where a payee is covered by paragraph (1) of Article 17 of the Australia and US international tax agreement the withholding payment is varied to nil – LI 2024/D7

Further Information:

- Reducing PAYG payments

- Withholding from allowances checklist

- PAYG Tax Instalment Tables

This page was last modified 2024-05-16

Contact Info

- Newsletters

Motor vehicle deductions and questions, Superannuation Guarantee deadline and foreign income disclosure rules

Motor vehicles.

You can claim deductions for the use of motor vehicles (including motorcycles) when they’re used for business or work purposes. While your method of deduction will vary depending on your unique circumstances, regardless of how you claim, it’s important to distinguish the applicable work/business-related portion from any personal/private use, and stay on top of your record keeping.

There are three different ways to claim motor vehicle expenses, including:

- Cents per kilometre;

- Actual costs (only available to businesses); and

- Logbook method.

Cents per kilometre This method is commonly used by individuals as it allows you to claim up to 5,000 kilometres per year per car without requiring written evidence of how you calculated your distance travelled. The catch here, however, is that the ATO may well ask you to provide detail on how you’ve arrived at your total and so it’s important to maintain diary or logbook records to help you substantiate your claim, should you need to.

Previously, the rate you could claim under this method was dependent on the type of car you were driving. Now, however, the ATO has a set rate per kilometre, which is $0.72 for the 2020/21 financial year.

Actual costs Actual costs can usually only be claimed by companies and trusts, however, sole traders and partnerships can use this method when calculating deductions related to motorcycles or vehicles designed to carry nine people or more or loads of one tonne or more.

You can then deduct fuel and oil, maintenance and repair costs, tyres, insurance and registration, the interest portion of any loan used to purchase the vehicle, lease payments, signage/branding, add-ons like bull bars and roof racks and depreciation.

Logbook method This method can only be used by sole traders or partnerships and only with reference to cars. If you haven’t kept a logbook before, you’ll need to maintain one for at least 12 straight weeks during the financial year and note not only your opening and closing odometre readings but also the associated expenses incurred in running your car. From there, you’ll be in a position to calculate your business versus private use percentage so that you can identify how much of all of your motor vehicle expenses are deductible.

Once you’ve kept records for 12 weeks, your logbook is then valid for up to five years provided your circumstances don’t change. (You can start a new logbook at any time, if they do.)

Choose the method that best suits you If you are claiming car expenses for more than one car, you can use different methods for different cars. You can also switch between methods for different income years for the same car. It’s important to remember that your choice of method will be limited, however, based on the type of taxpayer you are and the type of motor vehicles you operate.

Record keeping Regardless of how you claim your expenses, you must maintain your records in a legible format for a period of five years from the date of lodgement of your applicable tax return.

More information The ATO has put together an excellent fact sheet on motor vehicles expenses that you can download here (761 KB). You can also contact us at any time with any questions you may have specific to your situation.

Asked & Answered

“I’m considering purchasing a demo model bus with 19,000 km on the clock. Would this be classed as a new asset for the purposes of the accelerated depreciation rules?”

The accelerated depreciation rules can only apply to new assets. The rules basically ensure that the rules cannot apply if another entity held the asset when it was first used, or installed ready for use, other than as trading stock or for the purpose of reasonable testing or trialling. There is a limited exception to this for intangible assets if they have never previously been used for the purpose of producing assessable income.

While dealing with a different set of rules, in ATO ID 2009/101 the ATO concluded that a demonstrator vehicle had not been used for reasonable testing and trialling due to:

- The period it was used for demonstration purposes (almost 12 months);

- The number of kilometres travelled (10,500 kms);

- The decline in market value compared to the new price ($10,000 discount); and

- The balance of the warranty remaining (1 year out of 3 had been used up).

With respect to the “old” investment allowance, IT 2132 indicated that something could continue to be regarded as new where it was used for ordinary demonstration purposes for less than 3 months. If the asset has been used for more than 3 months it is unlikely to qualify unless the distance travelled is less than an ‘ordinary’ amount.

Given the bus has travelled 19,000 kms, it seems like it would be difficult to argue that it has only been used for reasonable testing and trialling based on the ATO guidance referred to above.

“We would like to gift a company car to an employee. Can you please advise whether this is possible and what is the tax implication? Thank you in advance for your help.”

If you decide to gift a company car to your employee as a result of their employment then a property fringe benefit would arise for Fringe Benefits Tax purposes. If the car was acquired by the company at arm’s length, the taxable value of the external property fringe benefit would be the cost to the company reduced by any post-tax employee contribution ( refer to item 17.4 here ). A balancing adjustment event would be triggered when the company car is disposed of to the employee. The company would have an assessable balancing adjustment amount if the termination value is more than the written down value (WDV) on the date of disposal or a deductible balancing adjustment amount if the termination value is less than the WDV. If the car is transferred to the employee for no cost, then the termination value would be the market value just before the employer gifted the car to the employee (refer to item 6 of subsection 40-300(2) ITAA 1997).

“I am getting a $15,000 car allowance a year. My employer has withheld tax on this allowance. Is that correct? I thought allowances should be paid out gross by employers and then included in my assessable income after which I can claim expenses related to the allowance?”

Allowances paid to employees are generally subject to PAYG withholding and your employer would generally need to remit the appropriate amount to the ATO (refer to section 12-35 Schedule 1 TAA 1953). However, there are some exceptions to this general rule. It is possible to apply for a downward variation for PAYG withholding purposes when an employee receives a car or travel allowance but also expects to incur deductible expenses in relation to the use of the car or the travel they undertake. If the variation is accepted the employer only needs to withhold tax based on the difference between the allowance and the anticipated deductible expenses (if any). In order to apply for the variation it is necessary to lodge a “PAYG income tax withholding variation application”. If the employee only wants to reduce the withholding rate applied to allowances, they should complete the short application. The Commissioner has also provided a general approval for employers not to withhold from:

- Car allowances where the payments are calculated using the cents per kilometre rates for up to 5,000 business kilometres; or

- Travel allowances paid in respect of overnight travel if the allowance does not exceed the reasonable rates specified by the Commissioner.

Super Guarantee Payments

A reminder that Superannuation Guarantee payments for the quarter ended 31 December 2020 are due by the 28th of January 2021 . Payments must be received by your employees’ funds by this date to be considered paid on time.

For cashflow purposes, you can make payments more regularly than quarterly (for example, fortnightly or monthly) as long as your total Superannuation Guarantee obligation for the quarter is received into your employees’ super funds by the relevant due date.

If you don’t make your Superannuation Guarantee payments on time and to the correct super funds, you must lodge a Superannuation Guarantee Charge statement and pay the Superannuation Guarantee Charge (SGC) to the ATO.

Unfortunately, the SGC is not tax deductible.

Foreign Income

Are you disclosing your income and assets.

On the 27th of March 2014, the Commissioner of Taxation announced Project DO IT: an initiative within the ATO aimed at encouraging taxpayers to come forward and disclose unreported foreign income and assets. In 2019, the ATO again flagged that it was looking closely at foreign income, however, by then its penalty amnesty had expired.

How you are taxed and what you are taxed on depends on your residency status for tax purposes. As tax residency can be different to your general residency status it’s important to seek clarification. The residency tests don’t necessarily work according to ‘common sense.’ For tax purposes:

- Australian resident s : taxed on worldwide income including money earned overseas (such as employment income, directors fees, consulting fees, income from investments, rental income, and gains from the sale of assets).

- Foreign resident s : taxed on their Australian-sourced income and some capital gains. Unlike Australian resident taxpayers, non-resident taxpayers pay tax on every dollar of taxable income earned in Australia starting at 32.5% although lower rates can apply to some investment income like interest and dividends.

There is no tax-free threshold. Australian-sourced income might include Australian rental income and income for work performed in Australia.

- Temporary residents : generally, those who have come to work in Australia on a temporary visa and whose spouse is not a permanent resident or citizen of Australia. Temporary residents are taxed on Australian-sourced income but not on foreign-sourced income. In addition, gains from non-Australian property are excluded from capital gains tax.

Just because you work outside of Australia for a period of time does not mean you are not a resident for tax purposes during that same period. And, for those with international investments, it’s important to understand the tax status of earnings from those assets. Just because the asset might be located overseas does not mean they are safe from Australian tax law, even if the cash stays outside Australia. Don’t assume that just because your foreign income has already been taxed overseas or qualifies for an exemption overseas that it is not also taxable in Australia. A lot of Australians have international dealings in one form or another and it’s not uncommon for taxpayers to forget to declare income from a foreign investment like a rental property or a business because they have had it for a long time and deal with it in the local jurisdiction with income earned ‘parked’ in that country. However, problems arise when the taxpayer wants to bring that income to Australia, and AUSTRAC or the ATO’s data matching systems pick up on the transaction. Then, the taxpayer will be contacted about the nature of the income and if the income is identifiable as taxable income (for example, from a property sale or income from a business), you can expect the ATO to look very closely at the details, with an assessment and potentially penalties and interest charges following not long after. There is no point telling the ATO the money is a gift if it wasn’t. ATO staff can generally find the source of the transaction and will know it’s not from a very generous grandmother, for instance. Misdirection will only annoy them and ensure that there is no leniency.

What you need to declare in your tax return

If you are an Australian resident, you need to declare all worldwide income in your tax return unless a specific exemption applies (although in some cases even exempt income needs to be reported). Income is anything you earn from:

- employment (including consulting fees);

- pensions, annuities and Government payments;

- business, partnership or trust income;

- crowdfunding;

- the sharing economy (Airbnb, Uber, AirTasker, etc.,);

- foreign income (pensions and annuities, business income, employment income and consulting fees, assets and investment income including offshore bank accounts, and capital gains on overseas assets);

- some prizes and awards (including any gains you made if you won a prize and then sold it for a gain); and

- some insurance or workers compensation payments (generally for loss of income).

You do not need to declare prizes such as Lotto or game show prizes provided that they are not paid to you in an income-stream fashion. “Windfall gains” and ad hoc gifts are tax free.

Do I need to declare money from family overseas?

A gift of money is generally not taxable but there are limits to what is considered a gift and what is income. If the ‘gift’ is from an entity (such as a distribution from a company or trust), if it is regular and supports your lifestyle, or is in exchange for your services, then the ATO may not consider this money to be a genuine gift.

I have overseas assets that I have not declared

Your only two choices are to do nothing (and be prepared to face the full weight of the law) or work with the ATO to make a voluntary disclosure. Disclosing undeclared assets and income will often significantly reduce penalties and interest charges, particularly where the oversight is a genuine mistake.

How to repatriate income or assets

Fares and Travel

Are Fares and Travel classed as OTE

- Report as inappropriate

Most helpful response

Most helpful reply ATO Certified Response

Hi @Yvonne21 ,

Thanks for your post.

Whether fares and travel are considered OTE depends on how these amounts are paid.

If they're paid as a reimbursement, then they're not considered OTE and superannuation guarantee (SG) isn't payable on the amounts.

If, however, these amounts are paid as an allowance, then you need to determine the reason for the allowance being paid.

Where an allowance is paid with the expectation that the allowance will be used in full by the employee in the course of their duties, it doesn't form part of OTE and SG doesn't need to be paid on the amount.

Alternatively, allowances that are an unconditional payment the employee receives do form part of OTE and SG is payable.

SGR 2009/2 paragraphs 120 - 125 provide examples of an expense allowance and an allowance which is an unconditional payment.

It's worth remembering that the information we provide only relates to the federal superannuation law. Sometimes awards, workplace agreements, industrial law and even the governing rules of the super fund may have additional super obligations an employer needs to meet.

Thanks, NicM.

All replies

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

The steps to follow to work out how to report allowances in STP Phase 2.

Last updated 14 November 2023

In Phase 1 reporting, some allowances are reported separately, and some are reported as part of Gross. This has changed for STP Phase 2.

There are 3 steps you should follow to work out how to report allowances in STP Phase 2:

Identify whether the amount is a reportable allowance

Identify whether the allowance needs to be disaggregated.

- Identify the purpose of the allowance.

Generally, allowances are reportable through STP. There are some things which you may know as allowances which don't need to be reported through STP because:

- they are not allowances, or

- there are special rules about reporting them.

To work out whether you need to report allowances you've paid, consider these questions:

- STP is reporting about payments that you make. If you are not paying an amount, there's nothing to report through STP.

- However, if you are providing a fringe benefit , you may need to consider your fringe benefits tax ( FBT ) obligations and you may need to include reportable fringe benefits in your STP reporting.

- There's a difference between allowances and reimbursements. Reimbursements typically compensate an employee exactly for an expense they have incurred on your behalf and the recipient generally needs to verify that they did incur that expense.

- Reimbursements should not be reported through STP.

- Living away from home allowance fringe benefits are not reportable as allowances through STP.

- Some industrial instruments may use the name 'living away from home allowance' to describe a payment that is actually a travel allowance, so it's important to understand which one you're paying.

- There are special rules for reporting overtime meal allowances or travel allowances. You don't need to report overtime meal allowance and travel allowance if it's up to and including the ATO reasonable amount. If the amount you pay exceeds the ATO reasonable amount, you must report the whole amount that you paid.

Example: identify whether the amount is reportable

Harry's business has a large piece of equipment which needs to be moved to a different location. This involves hiring a trailer and one of Harry's employees using their own car to tow that trailer.

The award which covers Harry's employees, provides for an allowance of 88 cents per kilometre to be paid when an employee is required to use their own car for work purposes.

On the day that the equipment is moved, Harry's employee drives their car 8 kilometres from the workplace to the trailer hire lot. They use their own money to pay the trailer hire fee and receive a receipt. They drive 8 kilometres back to the workplace. The equipment is loaded into the trailer and Harry's employee drives 10 kilometres to the equipment’s new location where it is unloaded. They drive 3 kilometres to the trailer hire lot to return the trailer and then drive another 8 kilometres back to the workplace.

Harry's employee provides him with their odometer readings showing that they travelled a total of 37 kilometres and the trailer hire receipt showing the cost of $126.37.

Harry pays his employee a total cents per kilometre allowance of $32.56 and the total trailer hire cost of $126.37.

The $32.56 cents per kilometre allowance is an allowance Harry needs to include in his STP reporting. It's not a reimbursement because it is an estimate of an expense, neither Harry or his employee measured whether or not the decline in value, registration, insurance, maintenance, repairs and fuel costs for each of those 37 kilometres was actually 88 cents and there are no receipts.

The $126.37 trailer hire fee is a reimbursement and Harry doesn't need to include it in his STP reporting. This is because it is precisely compensating a verified business expense.

You must report allowances separately in STP, unless an exception applies. This ensures government agencies that receive your STP reporting can identify amounts which are treated differently for different purposes, such as PAYG withholding, super or income tested payments and benefits.

The 2 exceptions to disaggregating allowances are if:

- As overtime is treated differently for super guarantee purposes, you should include the amount as overtime in your STP report.

- Cashing out of leave entitlements is treated differently in the tax, super and social security systems compared to allowances paid when work is performed or would have been performed.

- Use the applicable leave type to report allowances that form part of cashed out leave entitlements.

All-purpose allowances

Many awards include allowances that are added to an employee's hourly rate and are paid for all purposes, such as when calculating payments for leave or overtime.

In STP Phase 2, you must separately report all-purpose allowances against the relevant allowance type unless one of the exceptions above applies.

Some employers may have historically set up their payroll using a single rate that includes the employees’ hourly rate and all-purpose allowances. However, it is important that those allowances can be identified because they are treated differently in different situations and not being able to identify them may disadvantage your employee. For example, how the ATO treats allowances in a tax return is not the same as how Services Australia treats those allowances when assessing a benefit claim.

You should follow your DSP's instructions about setting up your payroll solution to continue to meet your Fair Work obligations and report all-purpose allowances correctly in STP.

Example: all-purpose allowances

Deanna employs James. James is employed under the Crocodile Award, and is entitled to be paid:

- a base rate of pay of $840.10 per week

- an industry allowance of $33.28 per week

- a tool allowance of $20.02 per week.

The award expresses that both the industry allowance and the tool allowance are to be paid 'for all purposes', including when calculating overtime.

It is an ordinary work week and James has been at work. On top of his ordinary hours, he worked 2 hours of overtime on one weekday, for which he is entitled to be paid at 150% of his all-purpose rate.

When Deanna reports the wages she paid James for his week of work through STP, she includes:

- gross: $840.10 – this is James' base pay for his ordinary work hours

- allowance type KN tasks: $33.28 – she has disaggregated the industry allowance relating to the time James was at work doing ordinary hours to the relevant allowance category

- allowance type TD tools: $20.02 – she has disaggregated the tool allowance relating to the time James was at work doing ordinary hours to the relevant allowance category

- overtime: $70.53 – she doesn't need to separate the components which are part of the calculated overtime payment.

Identify the purpose of the allowance

Understanding the purpose of an allowance is important because it influences how you withhold from it and how you calculate your employee’s super entitlements. It also influences how you report those allowances in STP, because STP allowance categories are based on:

- where there are PAYG withholding considerations (such as an ATO reasonable amount or limit)

- where there are special rules for an employee when completing their tax return (such as substantiation of deductions they claim corresponding to the allowance)

- whether super applies to the allowance (such as allowances relating to working conditions during the employee’s ordinary hours).

Sometimes, awards and industrial instruments may give some allowances names which don't clearly describe the purpose of an allowance. It's important to consider the substance of the allowance and not just what it's called.

When you are identifying how to report allowances in STP, you should consider these questions:

- Is the purpose of the allowance to compensate for an expense? If so, what is the expense and why will the employee incur it?

- Is the purpose of the allowance to compensate for the employee’s work conditions or for doing specific activities? If so, which ones?

Example: identifying the purpose of allowances

The Pond Standing Award provides for the payment of a wet work allowance.

The clause about wet work allowance in the award is surrounded by other clauses dealing with working conditions, such as confined spaces and heights.

Mason begins to think that the purpose of the wet work allowance is also related to working conditions.

Mason reads the clause about wet work allowance more closely. He finds out that 'A wet work allowance of $0.69 per hour must be paid to an employee working in any place where their clothing or boots become saturated by water, oil or another substance. This allowance is paid only for the part of the day or shift that the employee is required to work in wet clothing or boots'.

With all this information, Mason can see that the purpose of this allowance is to compensate employees for the difficult working condition of being in wet clothes.

Thomas operates a business involved in the raising, slaughter and sale of livestock. The Enterprise Bargaining Agreement (EBA) which applies to his employees, provides for the payment of 'cow allowance' and he is trying to identify how to report this allowance in STP.

Thomas cannot only rely on the name of the cow allowance as that could refer to many things. He has employees that are required to:

- provide and maintain equipment to care for cows

- obtain specialised qualifications in the management of cows

- transport cows

- perform duties relating to slaughter of cows

- work in conditions soiled by cows or their slaughter

- wear a cow costume when performing advertising related duties.

Thomas refers to the EBA covering his employees. It tells him that:

- the kind of employees who are entitled to receive cow allowance are those with veterinary qualifications

- the allowance is payable in connection with a requirement to undertake continuing professional development (CPD) in bovine care required as a condition of their professional registration.

With all of this information, Thomas can see that the purpose of this allowance is to compensate his employees for the expense of training required to maintain their professional registration or qualifications.

STP reporting includes allowances paid for:

- transport (in a car, on public transport, or in a different kind of vehicle)

- obtaining or cleaning uniforms and clothing

- employees needing to buy a meal during work time

- employees travelling away from home

- employees needing to supply something to do their work

- getting or keeping a qualification, certificate or licence

- performing extra duties or working in difficult conditions

- employee incurring an expense that was not for business purposes

- other purposes not already covered

Transport (in a car, on public transport, or in a different kind of vehicle)

There are many different types of allowances which are paid for the purpose of compensating an employee for the costs of transport. These can include the cost of:

- driving a car, ute, van or motorcycle

- ride-share and ride-sourcing

- catching a train, plane, taxi, boat, bus or other vehicle.

These kinds of allowances don't relate to travel expenses, such as the costs of accommodation.

When working out how to report in STP about allowances you pay for the purpose of compensating an employee for the costs of transport, consider these questions:

- Yes – continue to the next question.

- No – go to expenses that are not incurred for business purposes .

- Yes – go to question 5.

- No – continue to the next question.

- Yes – report as award transport payments (allowance type AD) .

- Don't know - continue to the next question.

- Yes – report as other allowances (allowance type OD) with the allowance code T1

- No – report as other allowances (allowance type OD) with the allowance code V1

- Yes – report as cents per km (allowance type CD) .

Obtaining or cleaning uniforms and clothing

There are many different types of allowances which are paid in relation to an employee’s clothing. When working out how to report in STP about these allowances, consider these questions:

- Yes – report as other allowances (allowance type OD) with the allowance code U1

- No – go to expenses that are not incurred for business purposes.

- Conventional clothing – report as other allowances (allowance type OD) with the allowance code G1

- Occupation-specific clothing – report as laundry (allowance type LD)

- Protective clothing – report as laundry (allowance type LD)

- A compulsory uniform – report as laundry (allowance type LD)

- A non-compulsory uniform which has been registered on the Register of Approved Occupational Clothing External Link – report as laundry (allowance type LD)

- A non-compulsory uniform which has not been registered on the Register of Approved Occupational Clothing External Link – report as other allowances (allowance type OD) with the allowance code G1.

Employees needing to buy a meal during work time

There are many different types of allowances which are paid for the purpose of compensating an employee for the cost of meals that they consume at work. When working out how to report in STP about these allowances, consider these questions:

- Yes – report as overtime meal allowance (allowance type MD) .

- No – you don't need to report this allowance.

Employees travelling away from home

There are many different types of allowances paid to employees to compensate for the costs of travelling on work. These include allowances for accommodation, meals or incidental expenses. When working out how to report in STP for these allowances, consider these questions:

- Business purposes – continue to the next question.

- Personal circumstances – go to expenses that are not incurred for business purposes.

- Travelling on work – continue to the next question.

- Living at a location – you do not need to report this as an allowance in STP. However you should consider whether you have reportable fringe benefits that you need to report.

- Yes – report as other allowances (allowance type OD) with the allowance code G1

- Yes – report as travel allowance (allowance type RD).

- No – you do not need to report this allowance.

Employees needing to supply something to do their work

There are many different types of allowance which are paid for the purpose of compensating an employee for the costs of supplying and maintaining tools and equipment required for their work. When working out how to report in STP about these allowances, consider these questions:

- Yes – you do not need to report this reimbursement through STP.

- Yes – report as tool allowances (allowance type TD) .

Getting or keeping a qualification, certificate or licence

There are many different types of allowance which are paid for the purpose of compensating an employee for the costs of getting or keeping a qualification or licence.

These kinds of allowances don't relate to situations where the employee is being compensated for performing extra duties , just because those duties might require a certificate for the employee to be eligible to perform them, such as being the first aider on duty.

When working out how to report in STP about allowances you pay for the purpose of compensating an employee for the costs of getting or keeping a qualification or licence, consider these questions:

- Yes – you don't need to report this reimbursement through STP.

- Yes – go to expenses that are not incurred for business purposes .

- Yes – report as qualification and certification allowances (allowance type QN) .

Performing extra duties or working in difficult conditions

Awards and other industrial instruments provide for a wide range of allowances that are paid to compensate the employee for specific tasks or activities performed that involve additional responsibilities, inconvenience, or efforts above the base rate of pay. These allowances are known as services allowances because they are not paid to compensate an employee for expenses they may incur.

When working out how to report in STP about allowances you pay for the purpose of compensating an employee for specific tasks or activities, consider these questions:

- Yes – identify the purpose of the allowance .

- Working conditions – report as task allowances (allowance type KN) .

- Performing additional duties – continue to the next question.

- Allowance – report as task allowances (allowance type KN) .

- Higher base salary or different kind of payment – report as the appropriate payment type (such as Gross ).

Employee incurring an expense that was not for business purposes

Generally, an employee is not entitled to claim a deduction in their tax return for expenses which were not work-related.

A common example is when an award or industrial instrument provides for the employee to be paid an allowance for the costs of transport between their home and their usual workplace. An employee usually won't be entitled to claim a deduction for those costs, as travel between home and work is not considered to be transport for business purposes, except in limited circumstances.

If the allowance you are paying relates to an expense that is not work-related, you should report it as other allowances (allowance type OD) with the allowance code 'ND'.

Other purposes not already covered

While there are 8 specific allowance categories to report in STP, industrial instruments provide such a wide variety of allowances that it is not possible to have categories for all of them.

If you're paying an allowance that isn't covered in the sections above, you should report it as other allowances (allowance type OD) and determine an appropriate description.

Allowance types in STP Phase 2

The allowance types you will separately report in STP Phase 2 are:

- cents per km (allowance type CD)

- award transport payments (allowance type AD)

- laundry (allowance type LD)

- overtime meal allowance (allowance type MD)

- travel allowances (allowance type RD)

- tool allowances (allowance type TD)

- qualification and certification allowances (allowance type QN)

- task allowances (allowance type KN)

- other allowances (allowance type OD)

Cents per km allowance (allowance type CD)

This applies to deductible expense allowances paid to employees using their own car at a set rate for each kilometre travelled for business purposes that represents the vehicle running costs including registration, fuel, servicing, insurance and depreciation.

The amounts you report using this allowance type are the same cents per kilometre allowances which have a varied rate for PAYG withholding based on the ATO rate and business kilometres limit. For reporting through STP, use this allowance type to report both:

- cents per kilometre allowances that exceed the ATO rate or business kilometre limit or both, and

- cents per kilometre allowances that don't exceed the ATO rate or business kilometre limit or both.

You may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or in a different kind of vehicle) , such as flat rate car allowances. Don't report those as cents per kilometre allowances in STP.

The following table outlines some examples of what should and shouldn't be included in Cents per km allowance .

Award transport payments (allowance type AD)

Award transport payments are deductible expense allowances for the total rate specified in an industrial instrument to cover the cost of transport (excluding travel or cents per kilometre reported as other separately itemised allowances) for business purposes, as defined in section 900-220 of the Income Tax Assessment Act 1997 .

The current award transport payment must be traceable to an award in force on 29 October 1986.

The amounts you report using this allowance type are the same award transport payments which have a varied rate for PAYG withholding based on whether the transport expenses are deductible. For reporting through STP, use this allowance type to report only award transport payments that are deductible transport expenses.

You may also pay other kinds of allowances to your employees relating to transport (in a car, on public transport, or in a different kind of vehicle) , such as cents per kilometre allowances or payments for transport that are not traceable to an award in force on 29 October 1986. Do not report those as award transport payments in STP.

The following table outlines some examples of what should and shouldn't be included in Award transport payments .

For more information see Award transport payments .

Laundry allowance (allowance type LD)

This is a deductible expense allowance paid to employees for washing, drying and ironing uniforms required for business purposes.

You should only include laundry allowances for the cleaning of clothing that falls into one or more of the following categories:

- Compulsory uniform – unique and distinctive to identify the employer with a strictly enforced policy that makes it compulsory for the uniform to be worn at work.

- Non-compulsory uniform – only if the design of the uniform has been entered on the Register of approved occupational clothing.

- Occupation-specific clothing – that isn't everyday in nature and allows the public to easily recognise the occupation.

- Protective clothing and footwear – to protect against the risk of illness or injury posed by the activities undertaken to earn the income.

The amounts you report using this allowance type are the same laundry allowances which have a varied rate for PAYG withholding based on the ATO approved threshold.

For reporting through STP, use this allowance type to report both:

- laundry allowances that exceed the ATO approved threshold

- laundry allowances that don't exceed the ATO approved threshold.

You may also pay other kinds of allowances relating to uniforms or clothing , such as allowances which help an employee purchase new uniforms. Don't report those allowances as 'laundry allowances' in STP.

The following table outlines some examples of what should and shouldn't be included in Laundry allowance .

Overtime meal allowance (allowance type MD)

This applies to deductible expense allowances defined in an industrial instrument that are in excess of the ATO reasonable amount, paid to compensate the employee for meals consumed during meal breaks connected with overtime worked.

The amounts you report using this allowance type are the same overtime meal allowances which have a varied rate for PAYG withholding based on the ATO reasonable amount for the financial year. For reporting through STP, use this allowance type to report only overtime meal allowances that exceed the ATO reasonable amount.

You may pay other allowances because the employee needed to buy a meal during work time that are not overtime meals, such as allowances for meals paid to workers doing their ordinary hours on a night shift. Do not report those as overtime meal allowances in STP, report them as other allowances (allowance type OD) with the allowance code ND instead.

The following table outlines some examples of what should and shouldn't be included in Overtime meal allowance .

Travel allowances (allowance type RD)

This applies to deductible expense allowances that are paid for domestic or overseas meals and incidentals and domestic accommodation, undertaken for business purposes, which is intended to compensate employees who are required to sleep away from home.

It is not a reimbursement of actual expenses, but a reasonable estimate to cover costs including meals, accommodation and incidental expenses.

The amounts you report using this allowance type are the same travel allowances which have a varied rate for PAYG withholding based on the ATO reasonable amounts for the financial year. For reporting through STP, use this allowance type to report only travel allowances that exceed the ATO reasonable amount.

As travel allowances for overseas accommodation don't have a varied rate for PAYG withholding, don't report them using this allowance type. Report these as other allowances ( allowance type OD) instead.

Don't use this allowance type to report a living away from home allowance fringe benefit , but be careful as some industrial instruments use the name 'living away from home allowance' to mean a travel allowance that you do need to report here.

The following table outlines some examples of what should and shouldn't be included in 'travel allowances'.

Tool allowance (allowance type TD)

This applies to deductible expense allowances to compensate an employee who is required to provide their own tools or equipment for business purposes. This allowance was formerly required to be reported under other allowances with a description of the allowance type.

The following table outlines some examples of what should and shouldn't be included in Tool allowance .

Qualification and certification allowances (allowance type QN)

This applies to deductible expense allowances that are paid for obtaining or maintaining a qualification, which is evidenced by a certificate, licence or similar, and is required to perform the work or services. For example, this includes allowances to cover registration fees, insurance, licence fees, which are expected to be expended to maintain a requirement of the job.