- Press Releases

- About Who We Are Why Select Us Careers

- Services Consulting Other Services Research

Search Result

Space tourism market size, growth, opportunity, report, 2024-2032.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Non vel laborum, eveniet eos mollitia error in sequi quasi repudiandae libero iure, nemo deleniti, tempore deserunt voluptas eaque debitis quaerat recusandae?

What's Included in Full Report?

- PDF Format Report

- Industry Dynamics

- Market Size and Share Analysis

- Industry Trends and Growth Outlook

- Major Market Players Detailed Analysis

- Key Driving Factors and Analysis by Segments

- Regional Analysis (Can be Customized based on Region and Country)

- Future Commercial Growth Analysis

Request Sample Report

Request a Sample report to know overview of the report's scope and coverage.

Know more about key segmentations and regional analysis during the current and forecast periods. Discover market top players share, their industry performance, and strategies.

Your data is secure and will never be shared with third parties.

Space Tourism Market Share, Size, Trends, Industry Analysis Report, By Type(Sub-Orbital, Orbital, Others); By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Format: PDF

- Report ID: PM4521

- Base Year: 2023

- Historical Data: 2019 – 2022

- Description

Table of Contents

- Analysis Type

- Research Methodology

Request Free Sample

Report outlook.

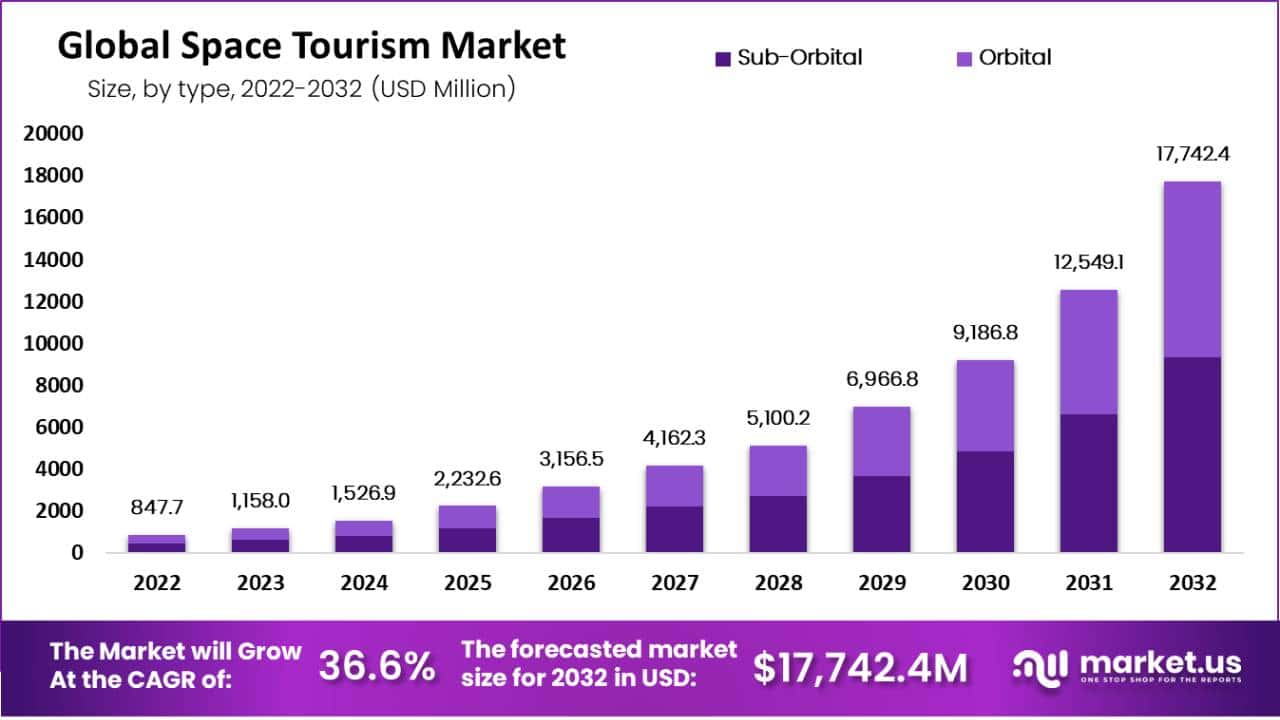

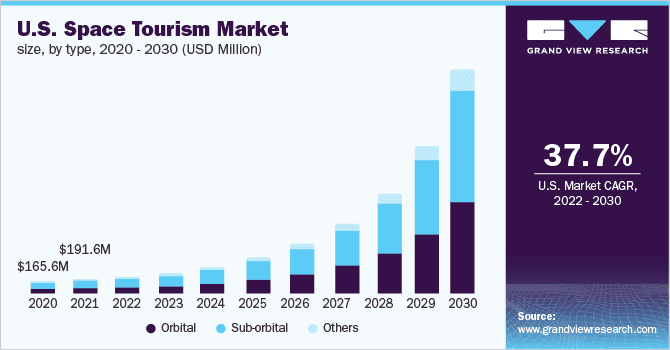

Space tourism market size was valued at USD 848.28 million in 2023. The market is anticipated to grow from USD 1,248.32 million in 2024 to USD 27,861.99 million by 2032, exhibiting the CAGR of 47.4% during the forecast period.

Space Tourism Market Overview

Rising technological advancements, a growing interest among adventure travelers, elevated attention on research and development efforts, and a high net worth of the individuals in spaceflight are driving the space tourism market growth. Space tourism allows people to journey beyond Earth's orbit for leisure or business purposes. In the future, space tourism will become more accessible to the general public, even to those who are not trained astronauts. This will allow more people to explore space and experience its wonders.

- For instance, in April 2022, Axiom, SpaceX, and NASA cooperated to send a SpaceX Dragon spacecraft to the International Space Station (ISS) with four people on board - three civilians and a former NASA astronaut. The journey, which lasted for a week, cost USD 55 million per participant and involved scientific research, outreach efforts, and various commercial activities .

Space tourism is offering space travel experiences to tourists or private individuals, primarily for leisure, recreational, and adventure processes. It consists of a range of activities, including orbital and suborbital spaceflights, deep space or lunar missions, and other space-based related adventures that allow customers to travel near the Earth's atmosphere and get firsthand experience. Space tourism is an emerging industry that has been gaining popularity in recent years. Key players in this industry include those that offer space exploration experiences, spacecraft manufacturers, spaceports, and related service providers. These companies work to provide high-end encounters to a growing number of customers who are willing to pay for such experiences.

To Understand More About this Research: Request a Free Sample Report

The space tourism market is expected to experience growth due to the rising number of suborbital space offerings from key market players. This increase in demand for space tourism is also expected to create ample opportunities in the future. Additionally, the growing awareness of moon tourism and the increased efforts by key players to send people to the moon are expected to offer further possibilities for growth in the space tourism market.

As the market continues to evolve, companies are seeking strategic partnerships, acquisitions, and collaborative ventures to combine resources, share expertise, and overcome financial and technological challenges. Mergers and acquisitions present businesses with opportunities to leverage synergies, enhance operational efficiency, and facilitate the exchange of knowledge and technologies. This dynamic corporate transaction landscape highlights the industry's dedication to achieving economies of scale and creating a collaborative environment that fosters innovation.

The COVID-19 pandemic has had a significant negative impact on the space tourism market. As the governments implemented the lockdown across all the nations around the globe, the key market players suspended their operations, and the manufacturing plants were forced to shut down owing to the shortages of labor. COVID-19 has also affected supply chain management as there are border restrictions imposed by the government, which results in the decline of the space tourism market growth rate.

Space Tourism Market Dynamics

Market Drivers

Technological advancements in space tourism drive the growth of the market

The technological advancements in space tourism drive the space tourism market growth. Advancements in spacecraft design and engineering have significantly enhanced efficiency, safety, and overall experience for passengers. The introduction of reusable rockets and spacecraft has significantly reduced launch and transportation costs, making space travel more economically attractive and viable to a broader audience. Improved life support systems, upgraded habitats, and advanced onboard medical facilities have instilled greater confidence in prospective space tourists regarding the safety and comfort of their space expedition.

Advancements in immersive technologies like virtual reality allow for pre-flight training to prepare passengers for their space trip. Also, internet and communication capabilities on spacecraft enable visitors to instantly share their experiences, creating a sense of community and sparking interest among potential space explorers worldwide.

The development of private space enterprises and partnerships with government space agencies have given rise to innovative business models in recent years. These models offer a range of space tourism experiences, from short suborbital joyrides to longer stays on space stations. This variety of options appeals to a wide audience, attracting adventurers, scientists, researchers, and enthusiasts alike. With advancements in technology, space tourism is becoming more accessible, providing humanity with unprecedented opportunities to explore the cosmos.

Rising interest beyond the different types of space tourism is facilitating the growth of the market

Rising interest among the millionaires and billionaires in various types of space tourism is driving the space tourism market growth. Suborbital space tourism offers short but exciting trips to the outer reaches of Earth's atmosphere. It is particularly attractive to people who want an experience of space exploration without committing to prolonged journeys. The fascination with experiencing weightlessness and marveling at Earth from an exclusive perspective fuel both interest and financial backing for suborbital initiatives.

Orbital space tourism involves longer stays on space stations such as the International Space Station (ISS), providing people with a more immersive space experience. This opportunity appeals to wealthy individuals who are attracted by the prospect of conducting research, advancing science, and enhancing their space travel experiences.

Lunar tourism is an ambitious and forward-thinking concept that involves missions to the Moon and potential excursions on its surface. Venturing beyond Earth's orbit is a daring endeavor that captures the fascination and curiosity of high-net-worth individuals, contributing to the expansion of lunar tourism initiatives. The prospect of setting foot on the Moon, along with the prestige of participating in lunar exploration history, serves as a persuasive reason for wealthy individuals to support these pioneering ventures financially.

Market Restraints

Environmental concerns associated with the rocket launching and space shuttle hampering on the growth of the market

Environmental concerns associated with the rocket launching and space shuttle hampering the growth of the market

The space tourism industry is facing a challenge as environmentally conscious consumers are becoming increasingly concerned about the environmental impact of space launches. Issues like greenhouse gas emissions and pollution of air and water are forcing the industry to prioritize environmentally friendly practices. As regulations on environmental sustainability become more stringent, companies in the space tourism sector must allocate resources to research and development to minimize the ecological impact of their launches. This is necessary to ensure long-term sustainability and growth prospects of the space tourism market, as sustainability becomes a crucial factor in consumer decision-making and industry advancement.

The growing concern over the environmental damage caused by space shuttle and rocket launches is hindering the space tourism market growth. The chemical pollutants, carbon emissions, and other environmental effects associated with these launches are viewed as harmful to the planet. This increased awareness is causing potential space tourists to opt for more environmentally friendly options, dampening their enthusiasm for space travel experiences. This will ensure a more eco-conscious approach that aligns with the changing expectations of environmentally conscious consumers today, ultimately reducing the factors that are anticipated to hinder space tourism market growth.

Report Segmentation

The market is primarily segmented based on type, end-user, and region.

To Understand the Scope of this Report: Speak to Analyst

Space Tourism Market Segmental Analysis

By Type Analysis

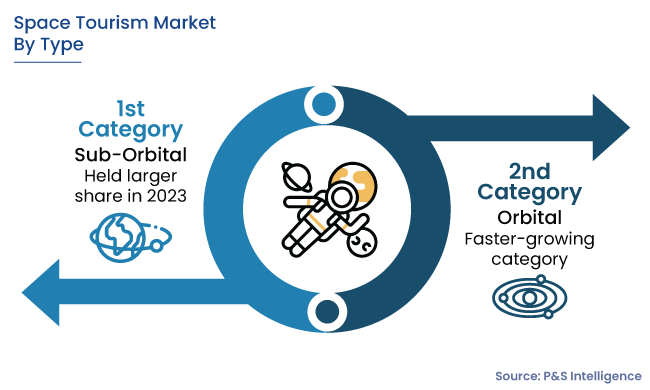

- The sub-orbital segment held the largest market share in 2023. Suborbital tourism allows individuals to experience weightlessness and see space without leaving Earth's orbit. This advancement in human spaceflight expands the possibility of space travel without requiring spaceships to enter orbit. Suborbital flights are slower and need more acceleration to enter orbit. Instead, they go up to a predetermined altitude and then come back down when the engines shut off. Many companies are focusing on suborbital flights because they can reuse rockets, which reduces the cost of manufacturing.

- The orbital segment has witnessed the fastest growth in the market. Orbital missions can last from a few days to several weeks, depending on the destination, such as Mars, the Moon, or the International Space Station (ISS). Companies like Orion Span and SpaceX are primarily focused on achieving orbital flights, while Virgin Galactic and Blue Origin mostly concentrate on suborbital missions.

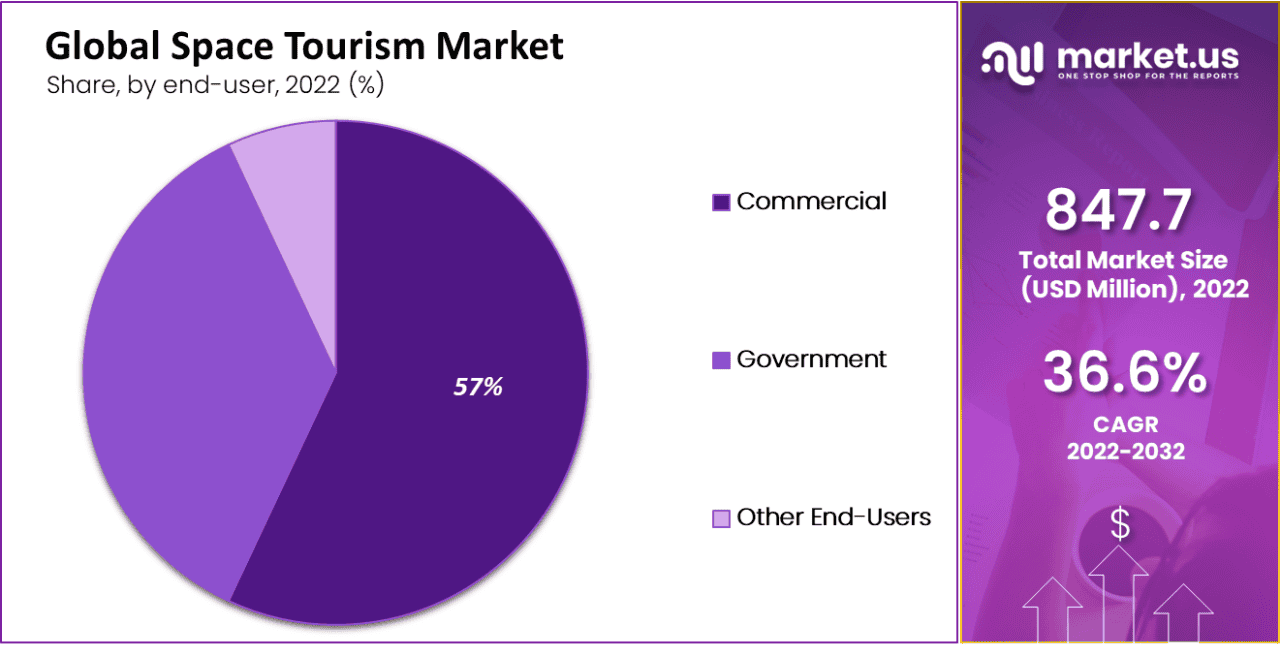

By End-User Analysis

- Based on end-user analysis, the market has been segmented on the basis of commercial, government, and others. The commercial segment dominated the space tourism market in 2023. In 2021, thirteen commercial spaceflight missions were undertaken by numerous government and private organizations; out of them, seven missions were executed successfully. The space tourism industry is on the rise, and technological innovations are making it easier to expand commercial space tourism. Industry stakeholders are putting in their best efforts to make space experiences more accessible by reducing the barriers associated with space tourism.

- The government segment has witnessed the fastest growth in the space tourism market. Governments and space agencies around the world have sent astronauts beyond Earth's atmosphere. For example, NASA currently permits amateur astronauts to visit the International Space Station (ISS). To promote commercial space tourism in Low Earth Orbit, NASA has formed a partnership with SpaceX and Axiom.

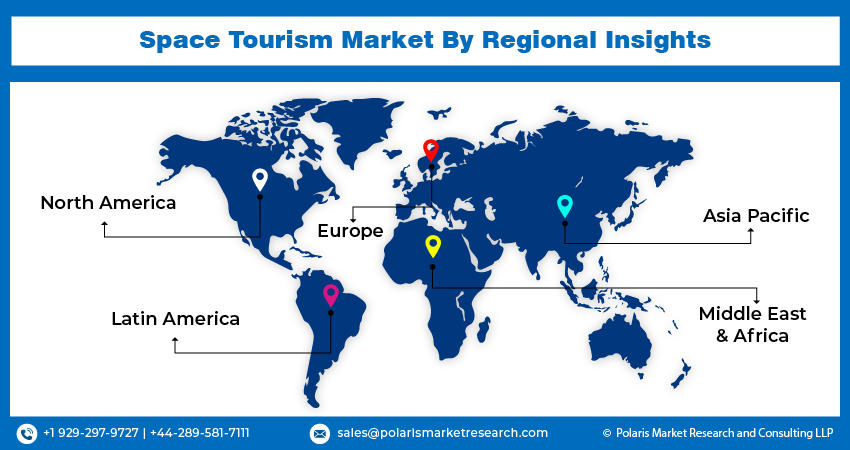

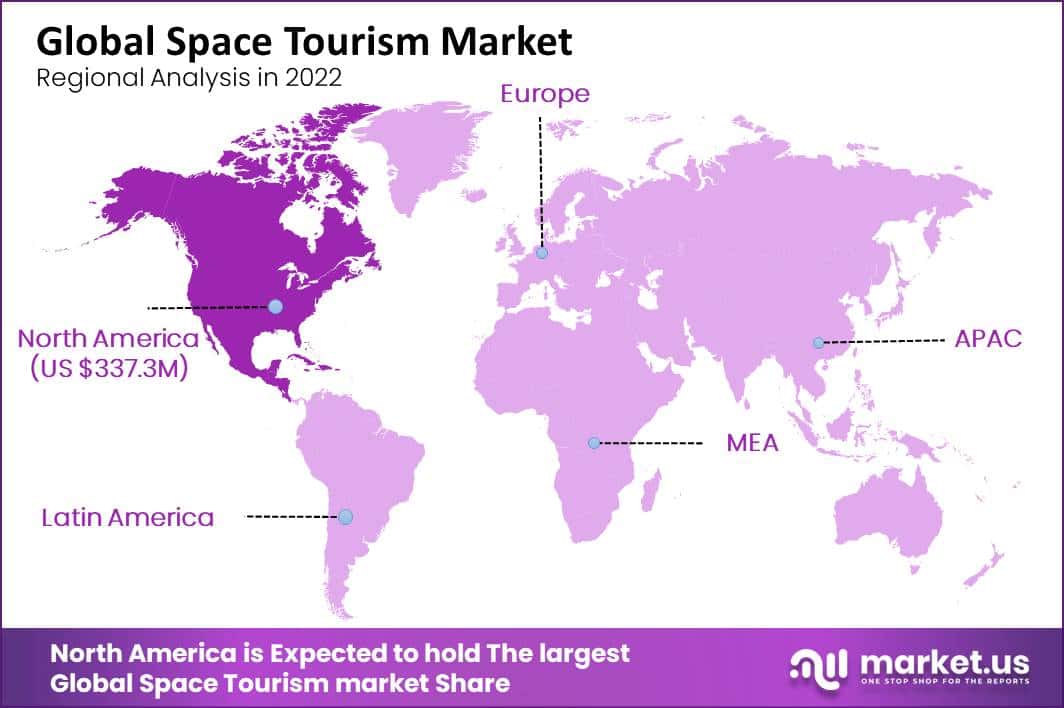

Space Tourism Market Regional Insights

North America dominated the largest market in 2023

North America dominates the space tourism market; the region has a wide research and development base and is equipped with a hugely developed infrastructure that makes the region a top revenue contributor in the space tourism market over the forecast period. North America is anticipated to maintain its dominance over the forecast period due to the leaning of rich individuals towards space tourism and increasing technological investment in the region.

Asia-Pacific has witnessed for the fastest growth in the space tourism market. China has been manufacturing rockets in more numbers for commercial satellite launches. Also, the Indian Space Research Organizations (ISRO), Japan Aerospace Exploration Agency (JAXA), and China National Space Administration (CNSA), are the substantial contributors for the space tourism market growth in the region.

Competitive Landscape

The space tourism market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Axiom Space

- Blue Origin

- Rocket Lab USA

- Space Adventures

- Space Perspective

- Virgin Galactic

- World View Enterprises, Inc.

- Zero 2 Infinity

- Zero Gravity Corporation

Recent Developments

- In June 2023, Virgin Galactic launched its commercial spaceflight service, with the first-ever commercial space voyage scheduled to begin on June 27 and run through June 30 during the first "Galactic-01" flight window.

- In May 2023, Vast plans to launch Vast Haven-1, the first commercial space station, on a Falcon 9 rocket with two crewed spaceflights in August 2025. They are also developing a larger space station to be integrated into Haven-1. The partnership with SpaceX aims to expand space exploration and make space more accessible.

- In November 2022, Axiom Space and Virgin Galactic partnered up to perform a mission that centers around microgravity research and training. The two companies will combine their expertise and resources to conduct the mission, promote scientific advancement, and offer valuable training opportunities in the field of microgravity.

Report Coverage

The space tourism market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-user, and their futuristic growth opportunities.

Space Tourism Market Report Scope

Gain profound insights into the 2024 Space Tourism Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report .

Browse Our Top Selling Reports

Peptide and Oligonucleotide CDMO Market Size, Share 2024 Research Report

Energy Engineering Service Outsourcing (ESO) Market Size, Share 2024 Research Report

Scooters Market Size, Share 2024 Research Report

Trim Tabs Market Size, Share 2024 Research Report

Universal Remote Controls Market Size, Share 2024 Research Report

Lipsum generator: Lorem Ipsum - All the facts www.lipsum.com Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

The space tourism market size is expected to reach USD 27,861.99 million by 2032, according to a new study by Polaris Market Research.

Key players in the market are Airbus, Axiom Space, Blue Origin, Boeing, Rocket Lab USA, Space Adventures, SpaceX, Space Perspective, Virgin Galactic

North America contribute notably towards the global Space Tourism Market

Space tourism market exhibiting the CAGR of 47.4% during the forecast period.

The Space Tourism Market report covering key segments are type, end-user, and region.

1. Introduction 1.1. Report Description 1.1.1. Objectives of the Study 1.1.2. Market Scope 1.1.3. Assumptions 1.2. Stakeholders 2. Executive Summary 2.1. Market Highlights 3. Research Methodology 3.1. Overview 3.1.1. Data Mining 3.2. Data Sources 3.2.1. Primary Sources 3.2.2. Secondary Sources 4. Global Space Tourism Market Insights 4.1. Space Tourism Market – Industry Snapshot 4.2. Space Tourism Market Dynamics 4.2.1. Drivers and Opportunities 4.2.1.1. Technological advancements in space tourism drive the growth of the market 4.2.1.2. Rising interest beyond the different types of space tourism is facilitating the growth of the market 4.2.2. Restraints and Challenges 4.2.2.1. Environmental concerns associated 4.3. Porter’s Five Forces Analysis 4.3.1. Bargaining Power of Suppliers (Moderate) 4.3.2. Threats of New Entrants: (Low) 4.3.3. Bargaining Power of Buyers (Moderate) 4.3.4. Threat of Substitute (Moderate) 4.3.5. Rivalry among existing firms (High) 4.4. PESTLE Analysis 4.5. Space Tourism Industry trends 4.6. Value Chain Analysis 4.7. COVID-19 Impact Analysis 5. Global Space Tourism Market, by Type 5.1. Key Findings 5.2. Introduction 5.2.1. Global Space Tourism, by Type, 2019-2032 (USD Million) 5.3. Sub-Orbital 5.3.1. Global Space Tourism Market, by Sub-Orbital , by Region, 2019-2032 (USD Million) 5.4. Orbital 5.4.1. Global Space Tourism Market, by Orbital , by Region, 2019-2032 (USD Million) 5.5. Others 5.5.1. Global Space Tourism Market, by Others , by Region, 2019-2032 (USD Million) 6. Global Space Tourism Market, by End-User 6.1. Key Findings 6.2. Introduction 6.2.1. Global Space Tourism Market, by End-User, 2019-2032 (USD Million) 6.3. Commercial 6.3.1. Global Space Tourism Market, by Commercial , by Region, 2019-2032 (USD Million) 6.4. Government 6.4.1. Global Space Tourism Market, by Government , by Region, 2019-2032 (USD Million) 6.5. Others 6.5.1. Global Space Tourism Market, by Others , by Region, 2019-2032 (USD Million) 7. Global Space Tourism Market, by Geography 7.1. Key findings 7.2. Introduction 7.2.1. Space Tourism Market Assessment, By Geography, 2019-2032 (USD Million) 7.3. Space Tourism Market – North America 7.3.1. North America: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.3.2. North America: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.3.3. Space Tourism Market – U.S. 7.3.3.1. U.S.: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.3.3.2. U.S.: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.3.4. Space Tourism Market – Canada 7.3.4.1. Canada: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.3.4.2. Canada: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4. Space Tourism Market – Europe 7.4.1. Europe: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.2. Europe: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.3. Space Tourism Market – UK 7.4.3.1. UK: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.3.2. UK: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.4. Space Tourism Market – France 7.4.4.1. France: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.4.2. France: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.5. Space Tourism Market – Germany 7.4.5.1. Germany: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.5.2. Germany: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.6. Space Tourism Market – Italy 7.4.6.1. Italy: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.6.2. Italy: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.7. Space Tourism Market – Spain 7.4.7.1. Spain: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.7.2. Spain: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.8. Space Tourism Market – Netherlands 7.4.8.1. Netherlands: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.8.2. Netherlands: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.4.9. Space Tourism Market – Russia 7.4.9.1. Russia: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.4.9.2. Russia: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5. Space Tourism Market – Asia Pacific 7.5.1. Asia Pacific: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.2. Asia Pacific: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.3. Space Tourism Market – China 7.5.3.1. China: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.3.2. China: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.4. Space Tourism Market – India 7.5.4.1. India: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.4.2. India: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.5. Space Tourism Market – Malaysia 7.5.5.1. Malaysia: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.5.2. Malaysia: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.6. Space Tourism Market – Japan 7.5.6.1. Japan: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.6.2. Japan: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.7. Space Tourism Market – Indonesia 7.5.7.1. Indonesia: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.7.2. Indonesia: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.5.8. Space Tourism Market – South Korea 7.5.8.1. South Korea: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.5.8.2. South Korea: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.6. Space Tourism Market – Middle East & Africa 7.6.1. Middle East & Africa: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.6.2. Middle East & Africa: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.6.3. Space Tourism Market – Saudi Arabia 7.6.3.1. Saudi Arabia: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.6.3.2. Saudi Arabia: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.6.4. Space Tourism Market – UAE 7.6.4.1. UAE: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.6.4.2. UAE: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.6.5. Space Tourism Market – Israel 7.6.5.1. Israel: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.6.5.2. Israel: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.6.6. Space Tourism Market – South Africa 7.6.6.1. South Africa: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.6.6.2. South Africa: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.7. Space Tourism Market – Latin America 7.7.1. Latin America: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.7.2. Latin America: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.7.3. Space Tourism Market – Mexico 7.7.3.1. Mexico: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.7.3.2. Mexico: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.7.4. Space Tourism Market – Brazil 7.7.4.1. Brazil: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.7.4.2. Brazil: Space Tourism Market, by Type, 2019-2032 (USD Million) 7.7.5. Space Tourism Market – Argentina 7.7.5.1. Argentina: Space Tourism Market, by End-User, 2019-2032 (USD Million) 7.7.5.2. Argentina: Space Tourism Market, by Type, 2019-2032 (USD Million) 8. Competitive Landscape 8.1. Expansion and Acquisition Analysis 8.1.1. Expansion 8.1.2. Acquisitions 8.2. Partnerships/Collaborations/Agreements/Exhibitions 9. Company Profiles 9.1. Airbus 9.1.1. Company Overview 9.1.2. Financial Performance 9.1.3. Product Benchmarking 9.1.4. Recent Development 9.2. Axiom Space 9.2.1. Company Overview 9.2.2. Financial Performance 9.2.3. Product Benchmarking 9.2.4. Recent Development 9.3. Blue Origin 9.3.1. Company Overview 9.3.2. Financial Performance 9.3.3. Product Benchmarking 9.3.4. Recent Development 9.4. Boeing 9.4.1. Company Overview 9.4.2. Financial Performance 9.4.3. Product Benchmarking 9.4.4. Recent Development 9.5. Rocket Lab USA 9.5.1. Company Overview 9.5.2. Financial Performance 9.5.3. Product Benchmarking 9.5.4. Recent Development 9.6. Space Adventures 9.6.1. Company Overview 9.6.2. Financial Performance 9.6.3. Product Benchmarking 9.6.4. Recent Development 9.7. SpaceX 9.7.1. Company Overview 9.7.2. Financial Performance 9.7.3. Product Benchmarking 9.7.4. Recent Development 9.8. Space Perspective 9.8.1. Company Overview 9.8.2. Financial Performance 9.8.3. Product Benchmarking 9.8.4. Recent Development 9.9. Virgin Galactic 9.9.1. Company Overview 9.9.2. Financial Performance 9.9.3. Product Benchmarking 9.9.4. Recent Development 9.10. World View Enterprises, Inc. 9.10.1. Company Overview 9.10.2. Financial Performance 9.10.3. Product Benchmarking 9.10.4. Recent Development 9.11. Zero 2 Infinity 9.11.1. Company Overview 9.11.2. Financial Performance 9.11.3. Product Benchmarking 9.11.4. Recent Development 9.12. Zero Gravity Corporation 9.12.1. Company Overview 9.12.2. Financial Performance 9.12.3. Product Benchmarking 9.12.4. Recent Development

List of Tables

Table 1 Global Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 2 Global Space Tourism Market, by Type, 2019-2032 (USD Million) Table 3 Space Tourism Market Assessment, By Geography, 2019-2032 (USD Million) Table 4 North America: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 5 North America: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 6 U.S.: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 7 U.S.: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 8 Canada: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 9 Canada: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 10 Europe: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 11 Europe: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 12 UK: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 13 UK: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 14 France: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 15 France: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 16 Germany: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 17 Germany: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 18 Italy: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 19 Italy: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 20 Spain: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 21 Spain: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 22 Netherlands: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 23 Netherlands: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 24 Russia: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 25 Russia: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 26 Asia Pacific: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 27 Asia Pacific: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 28 China: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 29 China: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 30 India: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 31 India: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 32 Malaysia: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 33 Malaysia: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 34 Japan: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 35 Japan: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 36 Indonesia: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 37 Indonesia: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 38 South Korea: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 39 South Korea: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 40 Middle East & Africa: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 41 Middle East & Africa: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 42 Saudi Arabia: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 43 Saudi Arabia: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 44 UAE: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 45 UAE: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 46 Israel: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 47 Israel: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 48 South Africa: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 49 South Africa: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 50 Latin America: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 51 Latin America: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 52 Mexico: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 53 Mexico: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 54 Brazil: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 55 Brazil: Space Tourism Market, by Type, 2019-2032 (USD Million) Table 56 Argentina: Space Tourism Market, by End-User, 2019-2032 (USD Million) Table 57 Argentina: Space Tourism Market, by Type, 2019-2032 (USD Million)

List of Figures

Figure 1 Global Space Tourism Market, 2019-2032 (USD Million) Figure 2 Integrated Ecosystem Figure 3 Research Methodology: Top-Down & Bottom-Up Approach Figure 4 Market by Geography Figure 5 Porter’s Five Forces Figure 6 Market by End-User Figure 7 Global Space Tourism Market, by End-User, 2022 & 2032 (USD Million) Figure 8 Market by Type Figure 9 Global Space Tourism Market, by Type, 2022 & 2032 (USD Million) Figure 10 Space Tourism Market Assessment, By Geography, 2019-2032 (USD Million) Figure 11 Strategic Analysis – Space Tourism Market

Report Scope

Space Tourism Market, Type Outlook (Revenue - USD Million, 2019-2032)

- Sub-Orbital

Space Tourism Market, End-User Outlook (Revenue - USD Million, 2019-2032)

Space Tourism Market, Regional Outlook (Revenue - USD Million, 2019-2032)

Qualitative Analysis

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL Analysis

- Value Chain Analysis

- Key market opportunities prioritized

- Type benchmarking

- Latest strategic developments

- Price Trend Analysis

Quantitative Analysis

- Market size, estimates, and forecasts from 2019-2032

- Market revenue estimates for Type up to 2032

- Market revenue estimates for End-User up to 2032

- Regional market size and forecast up to 2032

- Company financials

We take great pride in "Delivering game-changing business opportunities reports with report customizations", so please don't hesitate to share with us your unique interests and business difficulties in much more detail.

This website is secure and your personal details are safe. Privacy Policy

© 2024 Polaris Market Research and Consulting. All rights reserved

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Space Tourism Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, End Use : Global Opportunity Analysis and Industry Forecast, 2022-2031

Report Code: A10674

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

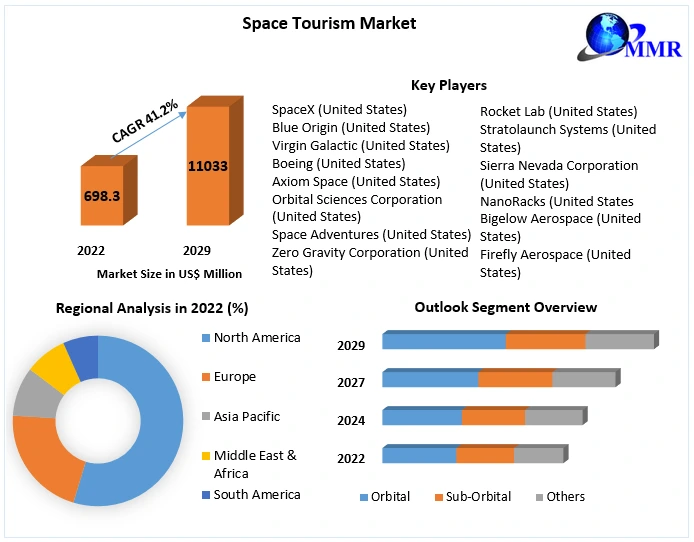

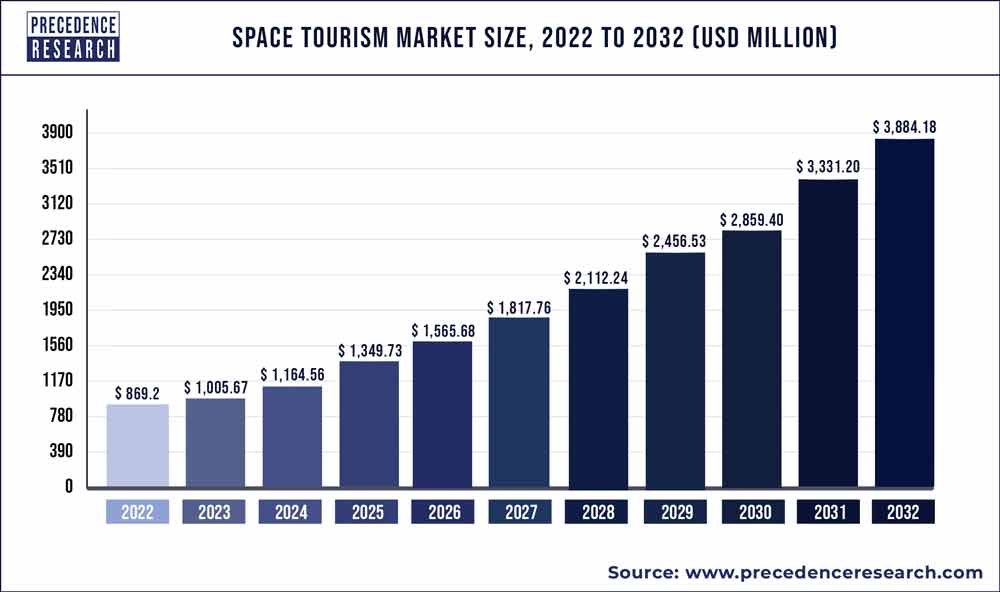

The space tourism market size was $598.4 million in 2021 and is expected to reach $12,690.6 million by 2031, registering a CAGR of 36.4% from 2022 to 2031.

Space tourism is human space travel for recreational purposes. There are several different types of space tourism, including orbital and suborbital. Space tourism is a type of vacation where travelers pay to fly into space. The phrase "space tourism" has evolved to refer to the practice of regular people purchasing tickets for trips to and from space. This concept is considered futuristic by many. But since more and more expert work has been done on the topic in recent years, it is now evident that establishing commercial space tourism services is a viable business goal in the present day.

The space tourism industry is projected to be fueled by the rise in technological advancements, consistent transformations in technology are proliferating the demand for the space tourism market globally. Moreover, technological advancements in the field of space travel are fueling the development of spacecraft and superior rockets at a robust pace. This way, space tourists are allowed to travel into space and gain the expected experience. Moreover, major emerging economies across the globe are exploring space programs, which, in turn, is anticipated to fuel the space tourism market growth.

Moreover, the rising trend of space tourism is the major driver which propels the Space tourism market demand. The market for space tourism is expected to grow faster than expected throughout the projected period as the practice becomes more widely accepted in international markets. In addition, it is anticipated that increasing competition in the space tourism sector will drive down prices. Furthermore, as the orbit is reached by the next-generation space planes, the cost of entering space is anticipated to fall sharply. As a result, the price of launching satellites is probably going to drop significantly, which would lower the overall cost of space exploration operations. Such factors are propelling the space tourism market growth.

Additionally, a decline in the costs of space tourism flights is also a key factor boosting market growth. The downfall in the ticket prices of space tourism is attracting a large number of consumers. A journey into space now costs only $250,000 overall, down from its initial price of roughly $600,000. Customers that typically fall among the top 1% of income earners make up the entire client base for this market.

Moreover, the focus on Research and Development (R&D) initiatives by market players is creating many opportunities in the space tourism market. There are numerous commercial suborbital spacecraft being developed right now, each with a different set of characteristics. The Suborbital Applications Research Group (SARG), founded by the Commercial Spaceflight Federation, aims to increase public awareness of the research and educational possibilities of the suborbital reusable launch vehicles now under development.

However, technical risks with these types of activities are a factor hampering the growth of the market. Despite the fact that space missions have been successfully conducted for more than 50 years, there are many technical dangers associated with commercial, high-volume space flights employed for space tourism.

Additionally, Strict Government rules related to spaceships are restraining the market growth.

The Space tourism market forecast is segmented on the basis of type, end use, and region. On the basis of type, the market is classified into orbital and sub orbital. By end use, the market is bifurcated into Government, and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Orbital segment would witness the fastest growth, registering a CAGR of 37.2% during the forecast period.

By Type, the Space tourism market is segmented into orbital, and sub orbital. The sub orbital segment accounted for a major space tourism market share in 2021, and is expected to grow at a significant CAGR during the forecast period. Sub orbital tourism packages that can provide the longest duration of zero-gravity and the most thrilling Earth view from space to its consumer can be considered superior than the others. Suborbital tourism is on the rise as it allows individuals to experience weightlessness and observe space without actually exiting the Earth's orbit. As a result, human spaceflight can reach the edge of the universe without entering orbit.

The government segment would witness the fastest growth, registering a CAGR of 37.2% during the forecast period.

By end use, the Space tourism market is segmented into Government, and commercial. The commercial segment accounted for a major share in the Space tourism market in 2021, and is expected to grow at a significant CAGR during the forecast period. Commercial space tourism means the private companies in the space industry such as space x, blue origin, and others. The commercial space tourism market is rising and expected to dominate the market. There were thirteen commercial spaceflight missions undertaken by several private and government organizations, of which seven missions were executed successfully. Billionaires have invested considerable sums in traveling to space and witnessing the Earth from above. Such factors are surging the demand for this segment in the near future.

The LAMEA region would witness the fastest growth, registering a CAGR of 68.1% during the forecast period.

By region, the space tourism market is segmented into North America, Europe, Asia-Pacific, and LAMEA. The North America Space tourism market is accounted for a major share in the Space tourism market in 2021 and is expected to grow at a significant CAGR during the forecast period. The area has a highly developed infrastructure and a sizable research and development base, which will enable it to dominate the global market in terms of revenue throughout the anticipated time. Modern technology has been implemented more quickly thanks to an established infrastructure.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the Space tourism market include Blue Origin, Virgin Galactic, SpaceX, Airbus Group SE, Boeing, ZERO-G, Axiom Space, Bigelow Aerospace, Orion Span, Space Adventures, Space Perspective, World View Enterprises, Zero2Infinity.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Space tourism market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and Space tourism market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Space tourism market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Space tourism industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Space tourism market trends, key players, market segments, distribution channel areas, and Space tourism market growth strategies.

Space Tourism Market Report Highlights

Analyst Review

According to the insights of the CXOs, the global space tourism market is expected to witness robust growth during the forecast period. This is attributed to the rising trend of space tourism across the globe. The trend of space tourism is gradually gaining recognition in the global markets and is anticipated to accelerate the growth of the global space tourism market during the forecast timeframe. In addition, the growing completion in the space tourism industry is expected to decrease the cost of space tourism. Furthermore, to attract consumers around the globe, key players in the market are focused on Research and Development (R&D) initiatives.

CXOs further added about the increase in technological advancements. Global demand for space tourism is growing as a result of ongoing technological advancements. Moreover, the construction of spacecraft and better rockets is advancing at a rapid rate thanks to technological developments in the field of space travel. Space tourists are able to go into space in this fashion and have the experience they desire. Major growing economies all around the world are also investigating space projects, which is expected to promote the expansion of the space tourism industry globally. However, despite the fact that space missions have been successfully conducted for more than 50 years, there are many technical dangers associated with commercial, high-volume space flights employed for space tourism. Thus, such factors are hampering the market growth.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Adventure Travel

- Travel Experiences

- Adventure Destinations

- Sustainable Travel

- Outdoor Activities

The CAGR of Space Tourism Market is 36.4%.

Kindly get in touch with the sales person for better options.

2021 is the base year calculated in the Space Tourism Market report.

The key players profiled in the report include Blue Origin, Virgin Galactic, SpaceX, Airbus Group SE, Boeing, ZERO-G, Axiom Space, Bigelow Aerospace, Orion Span, Space Adventures, Space Perspective, World View Enterprises, Zero2Infinity.

Type and end use are the segments of Space Tourism Market.

Increasing competition in the space tourism sector and rise in technological advancements, consistent transformations in technology are the key trends in the Space Tourism Market report.

North America has the highest Space Tourism market share in 2021.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Space Tourism Market

Global Opportunity Analysis and Industry Forecast, 2022-2031

- Travel, Tourism & Hospitality ›

Leisure Travel

Space tourism - statistics & facts

What is the public’s opinion on space tourism, do the public want to travel to space, key insights.

Detailed statistics

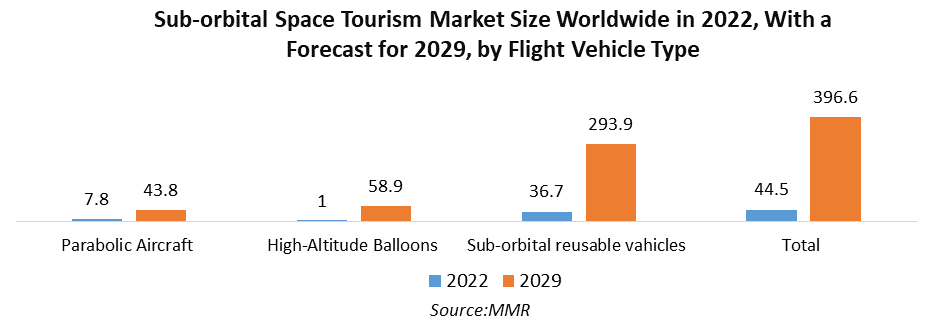

Global sub-orbital space tourism market size 2021-2031, by flight vehicle type

Amount invested globally into space companies by venture capitalists 2013-2022

Equity investments in space companies worldwide 2013-2022, by type

Editor’s Picks Current statistics on this topic

Travel, Tourism & Hospitality

Forecast revenue of orbital space travel and tourism worldwide 2021-2030

Share of U.S. adults who want to travel to space 2021

Further recommended statistics

Market overview.

- Premium Statistic Global sub-orbital space tourism market size 2021-2031, by flight vehicle type

- Premium Statistic Forecast revenue of orbital space travel and tourism worldwide 2021-2030

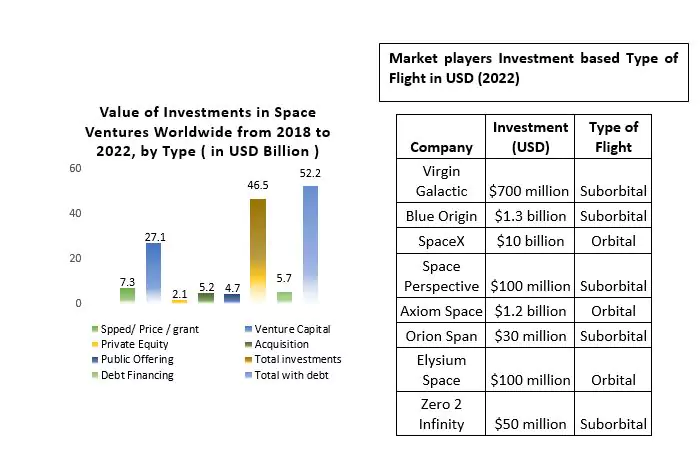

- Premium Statistic Amount invested globally into space companies by venture capitalists 2013-2022

- Premium Statistic Equity investments in space companies worldwide 2013-2022, by type

- Premium Statistic Share of investment deals in space start-ups worldwide by company in 2020

- Premium Statistic Distribution of space start-up investors by type 2000-2020

Sub-orbital space tourism market size worldwide in 2021, with a forecast for 2031, by flight vehicle type (in million U.S. dollars)

Forecast revenue of the orbital space travel and tourism market worldwide from 2021 to 2030 (in million U.S. dollars)

Amount venture capitalists invested into space companies worldwide from 2013 to 2022 (in billion U.S. dollars)

Cumulative equity investment in space companies worldwide from 2013 to 2022, by type (in billion U.S. dollars)

Share of investment deals in space start-ups worldwide by company in 2020

Distribution of investment deals on space start-ups worldwide in 2020, by company

Distribution of space start-up investors by type 2000-2020

Distribution of investor groups in space start-ups from 2000 to 2020, by investor type

Public opinion

- Premium Statistic U.S. public opinion on which private space companies are leading the space race 2021

- Premium Statistic U.S. opinion on which private space companies are leading the space race 2021, by age

- Premium Statistic Share of U.S. adults that believe space travel should be accessible to everyone 2021

- Premium Statistic U.S. public opinion on profitability of space exploration companies in future 2021

- Premium Statistic U.S. adults that believe billionaires should spend money on space travel 2021

U.S. public opinion on which private space companies are leading the space race 2021

Public opinion on which space companies are leading the private sector's push into space in the United States as of December 2021

U.S. opinion on which private space companies are leading the space race 2021, by age

Public opinion on which space companies are leading the private sector's push into space in the United States as of December 2021, by generation

Share of U.S. adults that believe space travel should be accessible to everyone 2021

Share of adults that believe space travel should be accessible to everyone and not just those that can afford the costs in the United States as of September 2021

U.S. public opinion on profitability of space exploration companies in future 2021

Share of the public that believe private companies focused on space exploration will make a profit in the next 10 years in the United States as of December 2021

U.S. adults that believe billionaires should spend money on space travel 2021

Share of adults that believe billionaires should be spending money traveling to space in the United States as of September 2021

Traveler interest

- Premium Statistic Share of U.S. adults who want to travel to space 2021

- Premium Statistic Share of U.S. adults who want to travel to space 2021, by gender

- Premium Statistic Share of the U.S. public who would go to the moon if money was not a factor 2021

- Premium Statistic Share of the U.S. public who would go to the moon in 2021, by generation

- Premium Statistic Share of the U.S. public who would go to the moon in 2021, by gender

- Premium Statistic Share of U.S. adults who would travel to the moon 2021, by age

- Premium Statistic Share of U.S. adults who would spend over 100 thousand USD to travel to space 2021

Share of adults that would want to travel to space if money was not an issue in the United States as of September 2021

Share of U.S. adults who want to travel to space 2021, by gender

Share of adults that want to travel to space if money was not an issue in the United States as of September 2021, by gender

Share of the U.S. public who would go to the moon if money was not a factor 2021

Share of the public that would go to the moon as a tourist if money was not a factor in the United States as of December 2021

Share of the U.S. public who would go to the moon in 2021, by generation

Share of the public that would go to the moon as a tourist if money was not a factor in the United States as of December 2021, by generation

Share of the U.S. public who would go to the moon in 2021, by gender

Share of the public that would go to the moon as a tourist if money was not a factor in the United States as of December 2021, by gender

Share of U.S. adults who would travel to the moon 2021, by age

Share of adults that would travel to the moon in the United States as of May 2021, by age

Share of U.S. adults who would spend over 100 thousand USD to travel to space 2021

Share of adults that would spend more than 100 thousand U.S. dollars to travel to space in the United States as of September 2021

Further reports

Get the best reports to understand your industry.

- European aerospace industry

- Space industry worldwide

- Space tourism

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Report Code: 12971

- Get Free Sample

- Customize Report

Space Tourism Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Space Tourism Market Report Prepared by P&S Intelligence, Segmented by Type (Orbital, Sub-Orbital), End User (Commercial, Government), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

- Report Code: 12971

- Order this report

- Inquire Before Ordering

- Report Summary

- Table of Contents

- Sample Pages

Space Tourism Market Size

Market statistics, market size comparison.

Key Players

Key Report Highlights

Explore the market potential with our data-driven report Get Sample Pages

Space Tourism Market Analysis

The space tourism market generated revenue of USD 921.4 million in 2023, it is predicted to witness a CAGR of 45.0% during 2024–2030, to reach USD 12,355.7 million by 2030. The key drivers for the market are the evolution of the technologies being used for space exploration and the increasing curiosity of people about the cosmos.

This subindustry of the aerospace sector aims to provide amusement, leisure, and adventure to individuals by sending them into space. However, the market is in its initial stage, but shows the potential of becoming a multi-billion-dollar market. The growth of the market solely depends on technological advancements and price reduction, which will lead space tourism to become accessible and affordable for consumers.

The market space for space tourism has a relatively small customer base, which includes both affluent people looking for unique experiences and organizations funding scientific research and promotional activities. The market is heavily dependent on one group of consumers, but businesses nevertheless need to periodically assess and adjust their products according to the shifting demands and preferences of a wide range of clients.

Space Tourism Market Trends & Drivers

Technological advancements are trending in market.

The continuous technological advancements are the key trend in the space tourism market. The significant advancements in space technology over time have increased the viability, safety, and accessibility of space travel.

- The creation of reusable rockets and spacecraft, pioneered by companies such as SpaceX is one of the major breakthroughs. Reusing launch vehicles results in a major reduction in space travel costs, making commercial space tourism ventures more financially feasible.

- Furthermore, the improvements in materials science, propulsion technology, and spaceship design have raised the overall efficiency and safety of space travel. Moreover, while developments in navigation and communication technologies improve the entire experience and safety of space travelers, innovations in life support systems guarantee the wellbeing of passengers during their journey. These advancements have greatly impacted the market by increasing the interest in space tourism.

- Momentus, a U.S.-based firm, uses reusable rockets to lower the cost of travel. The reusable vehicles de-orbit to another orbit, following the last drop-off. Robust robotic arms enable the ship to execute docking, refueling, and proximity maneuvers.

Growing Interest in Experimental Tourism Is Major Market Driver

Experimental tourism is becoming increasingly popular, which is driving the growth of the market.

- Space tourism offers a once-in-a-lifetime chance to explore the cosmos and offer the experience of being an astronaut, which is something modern-day travelers are increasingly looking for, without undergoing the physically and psychologically demanding training of most national space agencies.

- One of the biggest factors that drive The market is the desire to see earth from space and become a part of a select group of individuals who have traveled beyond earth, which was not possible in the past even for the uber rich.

- The popularity of space travel has also been aided by the growth of social media and experience sharing. People have the chance to capture breathtaking photos and videos, sharing them on social networks, and making enduring memories. This market has a great chance to extend its clientele and draw in a wider spectrum of tourists due to rising demand for immersive travel.

Space Tourism Industry Outlook

Safety and regulatory hurdles restraint market growth.

After more than 50 years’ experience of space exploration, meeting regulatory obstacles and guaranteeing passenger safety are still major challenges for the industry.

- These challenges are because of the inherent hazards in a space flight, wherein it is critical to ensure space tourists’ safety. Strict safety guidelines and procedures must be followed by businesses in the space tourism sector in order to reduce risks and guarantee the successful completion of every mission.

- Governments and international agencies set such policies and require valid licenses, which are granted only to companies once they demonstrate adherence to the safety mandates.

- Finding the ideal balance between promoting industry growth and safety is the problem. Governments, regulatory agencies, and industry stakeholders must work together to create strong, transparent frameworks that address safety issues and support innovation and expansion in the space tourism sector.

Type Insights

- The orbital category is predicted to experience the faster growth, with a CAGR of 45.3%, during the forecast period. This is because orbital tourism would provide a better experience of space, by taking individuals to earth’s orbit by achieving the ideal escape velocity.

- The sub-orbital category will hold the dominant market position, with a share of around 70%, in 2030.

- As these spacecrafts will travel with a velocity lower than that of an orbital variant, it will be feasible, less complex, and, most of all, safer. The affordability of sub-orbital flights makes them more appealing for consumers with a lower safety risk.

During the study, we have analyzed two types in the report:

- Orbital (Faster-Growing Category)

- Sub-Orbital (Larger Category)

End User Insights

- The commercial category holds the dominant position in the market, with a more than 65% share in 2023. This is because of the stiff competition between private space exploration companies resulting in technological advancement, cost reduction, and increased accessibility.

- Additionally, the economic potential of space tourism has benefitted the business sector. Private companies operating in this domain have made large expenditures in spacecraft and testing & launch infrastructure development.

- The government bifurcation will witness the higher CAGR, of 45.4%, over the forecast period. This will be because governments have recognized the potential economic benefits of the market.

- Governments will invest heavily in this market as it is a profitable business and can also help countries growth.

During the study, we have analyzed two end users in the report:

- Commercial (Larger category)

- Government (Faster-Growing Category)

Drive strategic growth with comprehensive market analysis Preview With a Free Sample

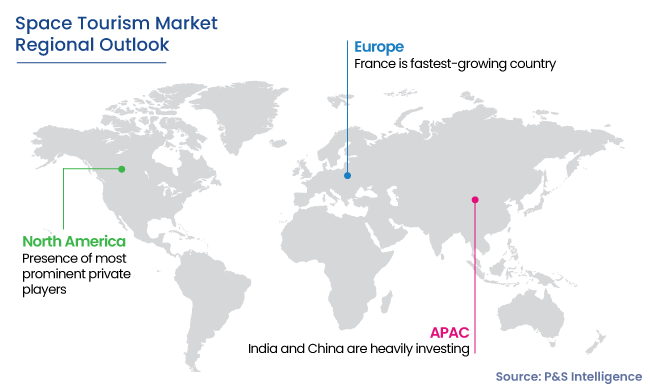

Regional Insights

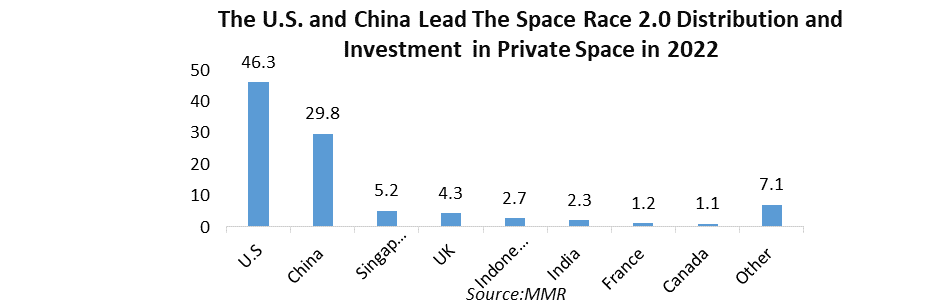

- Geographically, North America dominated the space tourism market, with a revenue share of around 55%, in 2023. The fact that U.S. is the home of the foremost space exploration agency and numerous established aerospace firms makes it largest market worldwide.

- Most prominent private players in the market, including SpaceX, Blue Origin, and Virgin Galactic, are headquartered the region, and they have been at the forefront of technological development.

- The region’s dominance on the sector is also due to the strong financial support of the U.S. government for space-related projects. Space technology and tourism ventures witness an intense desire among investors to provide vital funding for research and development as well as operational scaling.

- In addition, the region has a long tradition of space exploration and a well-established aerospace infrastructure. This is because NASA has already acquired advanced technology and created a culture that is strongly in favor of space exploration activities.

- APAC is predicted to become the fastest-growing region in the forecast period, with a CAGR of 45.7%. India and China are heavily investing in this sector for tourism purposes and to advance national interests.

- China has invested heavily in space infrastructure, including the development of its own space station and lunar exploration missions. Companies such as Galactic Energy and iSpace are investing in its space sector.

The regions and countries analyzed in this report include:

- U.S. (Larger Country Market)

- U.K. (Largest Country Market)

- France (Fastest-Growing Country Market)

- Rest of Europe

- China (Largest Country Market)

- Japan (Fastest-Growing Country Market)

- South Korea

- Rest of APAC

- Brazil (Largest Country Market)

- Rest of LATAM

- Saudi Arabia (Fastest-Growing Country Market)

- South Africa (Largest Country Market)

- U.A.E.

- Rest of MEA

Space Tourism Market Share

The main companies operating in the industry are concentrating on new product launches, mergers, collaboration, partnerships, and acquisitions. They are also focusing on expanding their market reach to keep their reputation in the business.

Moreover, the key players are investing significantly in R&D in order to integrate advanced technologies in spacecraft to give consumers the best experience at reasonable prices and with increased safety.

Major Space Tourism Offering Companies:

- Space Exploration Technology Corp.

- Blue Origin Enterprises L.P.

- Virgin Galactic

- Airbus Group SE

- The Boeing Company

- Zero Gravity Corporation

- Axiom Space Inc.

- Zero 2 Infinity S.L.

- World View Enterprises Inc.

- Space Adventures Inc.

Space Tourism Industry News

- Virgin Galactic operated its first commercial spaceflight, Galactic 01, on June 29, 2023. Moreover, the second ever commercial spaceflight, Galactic 02, operated on August 10, 2023.

- NASA awarded Blue Origin a sustaining lunar development contract in May 2023, under NextSTEP-2 Appendix P. Under the terms of the deal, Blue Origin is in charge of creating and operating a lunar lander that can land anywhere on the moon, as well as creating a cislunar transporter.

- The Axiom Space Access Program, which enables nations to recognize the potential of permanent economic and scientific benefits of microgravity, was unveiled by Axiom Space in April 2023.

Frequently Asked Questions About This Report

During the forecast period (2024-2030), the market for space tourism will propel at a CAGR of 45.0%.

The major players in the market for space tourism are focused on mergers, new product launches, partnerships, acquisitions, and collaboration. They are also concentrating on increasing their market reach to enhance their presence.

The space tourism industry will reach a value of USD 12,355.7 million in 2030.

Commercial is the leading end-user in the space tourism industry, with a share of 65% in 2023.

APAC is the fastest-growing regional industry for space tourism.

The major drivers in the space tourism market are the development of the technologies being employed for space exploration and the increasing interest in experimental tourism.

Want a report tailored exactly to your business need?

We are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

- Request Customization

- Request Free Sample

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages

Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount

Space Tourism Market: Global Industry Analysis and Forecast (2023-2029)

“ Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount ”

- Request Sample

- Customization

Space Tourism Market Dynamics:

Space Tourism Market Segment Analysis

Space Tourism Market Regional Insights:

Space Tourism Market Scope: Inquire before buying

Space tourism market by region:, space tourism companies analysis, about this report.

- INQUIRE BEFORE BUYING

Related Reports

Runtime application self-protection market: global industry analysis and forecast (2022-2029).

- Price for Single User : 4600 USD

- Report ID : 882

- July 13, 2019

Runtime Application Self-Protection Market size was valued at US$ 666.65 Mn. in 2021 and the total revenue is expected to grow at 31.98 % through 2021 to 2029, Runtime Application Self-Protection Market is reaching nearly US$ 6137.16 Mn. by 2029. Runtime Application Self-Protection Market Overview and Dynamics: Runtime application self-protection […]

Europe Virtual Data Room Market: Industry Analysis and Forecast (2024-2030)

- Price for Single User : 2600 USD

- Report ID : 2435

- August 07, 2019

The Europe Virtual Data Room Market size was valued at USD 5152.80 Million in 2023 and the total Europe Virtual Data Room revenue is expected to grow at a CAGR of 9.8% from 2024 to 2030, reaching nearly USD 9914.25 Million by 2030. The Europe Virtual Data Room market is experiencing robust growth driven by increasing demand for secure and […]

South America Smart Fleet Management Market: Outlook 2027 & Key Trends

- Price for Single User : 3900 USD

- Report ID : 3176

- August 04, 2019

- Pages : Feb 2022

South America Smart Fleet Management Market was at 3.47 Billion in 2020. Automotive is one of the segments reviewed in the MMR report dominating the Smart Fleet Management market. South America Smart Fleet Management Market Overview: A smart fleet solution is a fully integrated system for creating effective maintenance plans in the automotive […]

Data Governance Market: Data Quality and Accuracy to boost the Market growth

- Report ID : 5668

- October 07, 2019

Global Data Governance Market size was valued at USD 3.84 Bn in 2023 and is expected to reach USD 15.73 Bn by 2030, at a CAGR of 22.32 % over the forecast period. Data Governance Market Overview Data Governance is a principled approach to manage data during its life cycle, from acquisition to use to disposal. Ensure that data is accurate, […]

Global User Provisioning Market Key Trends – Market size

- Report ID : 6559

- May 06, 2018

- Pages : 225

Global User Provisioning Market Key Trends (2017-2018) _ by Component, Deployment Mode, Organization Size, Services, Business Application, Business Function, Application, Vertical and Geography Global User Provisioning Market include the growing awareness and the seriousness of user compliance management and governance and rapid growth in the […]

Global Space Tourism Market – Industry Trends and Forecast to 2031

- Upcoming Report

- No of Tables: 220

- No of Figures: 60

Global Space Tourism Market, By Type (Sub-Orbital Space Tourism, Orbital Space Tourism, Lunar Tourism, Inter-Planetary Tourism, Space Hotel Tourism), End User (Government, Commercial, Others), HNW Communities (20M to 40M, 40M to 60M, More than Above Ranges), and Sales Channel (Launch Provider, Third Party Partnership, OTAs) - Industry Trends and Forecast to 2031.

Space Tourism Market Analysis and Size

The essential factors contributing to the growth of the space tourism market in the forecast period of 2024 to 2031 include allure of experiencing weightlessness and witnessing Earth. Also, the advancements in virtual reality and immersive technologies allow for realistic pre-flight training are significantly contributing to the market’s growth. Growing government support in the realm of space tourism has emerged as a crucial catalyst, unlocking immense potential within the market.

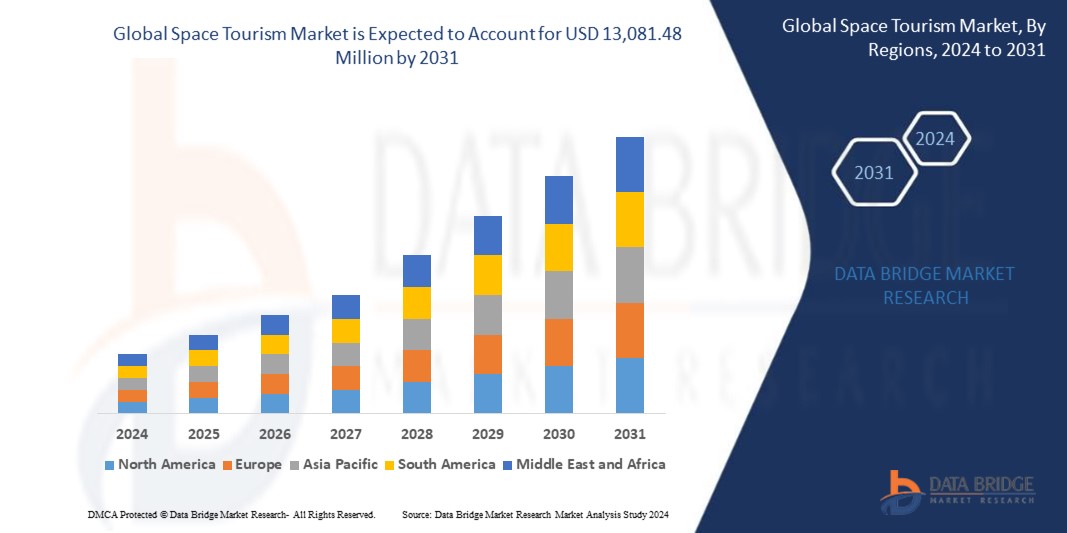

Data Bridge Market Research analyzes that the global space tourism market which was USD 876.34 million in 2023, is expected to reach USD 13,081.48 million by 2031, growing at a CAGR of 40.2% during the forecast period of 2024 to 2031. In 2024, the sub-orbital space tourism segment will dominate the market due to the growing interests and motivations among billionaires and billionaires in diverse types of space tourism. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Space Tourism Market Scope and Segmentation

Market Definition

Space tourism refers to the space travel experiences for individuals or tourists, typically for recreational, leisure, or adventure purposes. It encompasses a range of activities, including suborbital and orbital spaceflights, lunar or deep space missions, and other related space-based adventures that allow paying people to travel beyond Earth's atmosphere and experience space first-hand.

Global Space Tourism Market Dynamics

- Technological Advancement in Space Tourism

Technological advancements in space tourism are revolutionizing the market, propelling it into a new era of accessibility and potential growth. Innovations in spacecraft design and engineering have significantly enhanced safety, efficiency, and overall passenger experience. Reusable rockets and spacecraft have lowered the cost of launching and transportation, making space travel more economical and appealing to a broader demographic. Advanced life support systems, improved habitats, and sophisticated onboard medical facilities have bolstered the confidence of potential space tourists in the safety and comfort of their space journey.

- Growing Interests and Motivations

Growing interests and motivations among billionaires and billionaires in diverse types of space tourism are propelling the space tourism market into a new era of growth and investment. Suborbital space tourism, offering brief yet exhilarating journeys to the edge of space, appeals to individuals seeking a taste of space travel without the extended time commitment. The allure of experiencing weightlessness and witnessing Earth from a unique vantage point drives interest and investment in suborbital ventures. In addition, orbital space tourism, involving longer stays aboard space stations, such as the International Space Station (ISS), attracts those aspiring for a more immersive space adventure.

Opportunity

- Government Support in Space Tourism

Government support in the realm of space tourism has emerged as a crucial catalyst, unlocking immense potential within the market. Investment initiatives and regulatory frameworks backed by governments are fostering a favorable environment for private enterprises to flourish and innovate. Financial incentives, research grants, and collaborative partnerships with governmental space agencies provide essential resources and credibility to budding and established space tourism ventures. These strategic alliances not only bolster the industry credibility but also encourage the development of cutting-edge technologies and infrastructure, essential for the growth and sustainability of space tourism.

Restraint/Challenge

- Environmental Damage Through Space Shuttle or Rocket Launching

The adverse environmental impact stemming from space shuttle and rocket launches presents a significant restraint to the market growth. The environmental concerns associated with these launches, such as greenhouse gas emissions and air and water pollution, have prompted a growing segment of environmentally conscious consumers to reconsider their support for space tourism. This shift in consumer behavior poses a notable challenge for companies within the space tourism sector.

This space tourism market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the space tourism market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In September 2023, according to Firefly Aerospace, Inc., L3Harris Technologies and Firefly Aerospace, Inc. have inked a multi-launch agreement for three dedicated launches on Firefly's Alpha vehicle in 2026. The arrangement strengthens Firefly's position as the industry's top provider of small-lift launch services as it increases Alpha vehicle manufacturing to meet the expanding demands of both government and commercial clients

- In June 2023, Virgin Galactic commercial spaceflight service launch was announced. The "Galactic -01" flight window, the first commercial space mission, was scheduled for June 27 to June 30. The second mission was then scheduled for early August

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Space Tourism Market Scope

The space tourism market is segmented on the basis of type, end user, HNW communities, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

- Sub-Orbital Space Tourism

- Orbital Space Tourism

- Lunar Tourism

- Interplanetary Tourism

- Space Hotel Tourism

HNW Communities

- More than Above Ranges

Sales Channel

- Launch Provider

- Third Party Partnership

Global Space Tourism Market Regional Analysis/Insights

The space tourism market is analyzed and market size insights and trends are provided by country, type, end user, HNW communities, and sales channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, Israel, South Africa, and rest of Middle East and Africa.

North America is expected to dominate the market due to the active participation from the private sectors.

Asia-Pacific is expected to grow with the highest growth rate in the forecast period of 2024 to 2031 due to its rising research and development and planning in space tourism manufacturing.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Space Tourism Market Share Analysis

The space tourism market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to space tourism market.

Some of the major players operating in the space tourism market are:

- Virgin Galactic (U.S.)

- Boeing (U.S.)

- SPACEX (U.S.)

- BLUE ORIGIN (U.S.)

- SPACE ADVENTURES (U.S.)

- Bigelow Aerospace (U.S.)

- Lockheed Martin Corporation (U.S.)

- ROCKET LAB USA (U.S.)

- MITSUBISHI HEAVY INDUSTRIES LTD. (Japan)

- Elysium Space, Inc. (U.S.)

- fireflyspace (U.S.)

- China Aerospace Science and Technology Corporation (China)

- World View Enterprises, Inc. (U.S.)

- Space Perspective (U.S.)

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available