How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

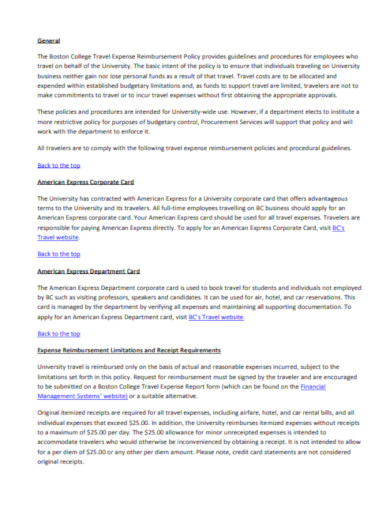

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Business Travel Expenses: A Guide to Management, Calculation, Tax Deductions & More

In this Article

Business trips are vital to the modern professional landscape, but managing travel expenses can feel like a constant battle.

Did you know that the average U.S. business trip in 2023 cost a staggering $1,293, with daily expenses reaching $325? Unsurprisingly, business travel is also the second-largest cost factor for most businesses.

For both employees and employers, streamlining business travel expense management and reimbursements becomes a top priority. This guide will equip you with all the necessary information: what qualifies as a travel expense, what you can claim as tax deductions, and, most importantly, how to manage it efficiently.

Let’s take the stress out of travel expenses and get you back to focusing on what matters most–a successful business trip.

What Is A Travel Expense?

For tax purposes, a travel expense is any cost you incur while traveling for work. This can include transportation, lodging, meals, and incidental costs directly related to your business trip.

When does travel qualify as a business trip?

The IRS considers a trip a business trip if it takes you away from your tax home or main place of work for business reasons and requires you to sleep over for work purposes.

Quick definitions

Tax home: Your tax home isn't where you live with your family but rather the general area where you report to work every day. This applies to your whole city or the surrounding region where your job is located.

Main place of work:

To identify your main work location if you have multiple workplaces, consider these factors:

- The amount of time you typically spend at each location. The place where you log the most hours might be the frontrunner.

- The intensity of your work activities at each location. Where do you take on the most crucial tasks and responsibilities?

- The relative importance of your income from each location. Does one location bring in significantly more income than the others?

For more information, refer to IRS Publication 463 (2023), Travel, Gift, and Car Expenses .

A List Of Deductible Travel Expenses

Businesses can claim tax deductions when employees travel outside their main place of work. These expenses must be ordinary and necessary to travel away from home for business purposes. You cannot deduct expenses that are lavish, personal, or unrelated to work. Employers can also deduct costs associated with temporary work assignments lasting less than a year.

Here’s a list of deductible business travel expenses while you’re away from home:

- Transportation ✈️: Flights, trains, buses, or your own car to get to your business destination (including free frequent flyer tickets at face value).

- Local travel 🚕: Taxis, shuttles, or rideshares between airports/stations, hotels, and work locations (clients, meetings, temporary assignments).

- Shipping 🛄: Baggage, samples, and display materials between your regular and temporary workplaces.

- Car expenses 🚗: Using your car (actual expenses or mileage rate), tolls, parking (business use only for rentals).

- Accommodation 🏨: Lodging for your business stay.

- Instead of tracking every meal expense, you can use a standard meal allowance that changes based on your travel destination. However, remember that only 50% of the cost (even using the standard allowance) is typically deductible for business meals.

- Laundry and dry cleaning 🧺: Keeping your clothes presentable during the trip.

- Business communication📱: Calls, faxes, or other work-related messages.

- Tips💰: Associated with any of the deductible expenses.

- Other miscellaneous costs 💸: As long as they're reasonable and necessary for your business trip, like travel to/from business meals, stenographer fees, computer rentals, or maintaining a work trailer.

And What You Can't Deduct As Travel Expenses

You can only claim expenses that are ordinary and necessary for your business trip. This means no personal expenses like buying gifts, extravagant meals, fines incurred, or even expenses made for companions like a friend or family member who might have accompanied you on the trip.

Can You Bring Friends And Family On A Business Trip?

Do you feel like taking your friends or your spouse on a business trip? While you can’t deduct the expenses of bringing your family on the trip, some costs can be offset indirectly.

Carpooling on a business trip

- Need a ride? No problem! If you're traveling for business and renting a car is a legitimate expense, you can still deduct your mileage or car rental costs even if you offer rides to others.

- But be careful! You can't deduct extra expenses caused by carpooling, like the need for a bigger car to fit your family. The key is that the expense must be "ordinary and necessary" for your business trip.

Sharing a hotel room

- Similar to carpooling, you can only deduct the cost of lodging you would typically use for a solo business trip.

- However, there's some wiggle room! If you pay for a bigger room to accommodate your family, you can still deduct the portion a single room would cost.

So, What If I Extend My Trip For a Vacation?

Great idea! But remember, you can only deduct business travel expenses. This covers getting you to and from your work location, plus any work-related costs while you're there. Personal detours or leisure activities won't count.

Example: Imagine you take a business trip to Seattle from your usual grounds in Chicago. The round-trip mileage for that work travel clocks in at 2,200. But on the way back, you take a quick detour to catch up with your family in Portland. Over your 10-day trip (including the detour), your travel, meals (excluding entertainment), lodging, and other expenses add up to $3,400.

Now, if you'd skipped Portland and flown straight back, the trip would've been 8 days and cost $2,800. The good news? You can still deduct the full $2,800 for your business trip, including the round-trip flights to and from Seattle.

Some Methods of Reimbursing Travel Expenses

Per-diems simplify expense reimbursements by providing a fixed daily rate for meals and incidental expenses during travel. The rate varies depending on location and reflects typical costs.

Employees don’t need to submit receipts for these covered expenses; they just need to document their travel dates and locations. This saves time but requires setting appropriate per diem rates and ensuring employees understand what’s included.

- What is Per Diem? What are Per Diem Rates?

Corporate Credit Card

Companies issue corporate credit cards specifically for business travel. Employees use these cards for approved expenses, eliminating the need for upfront personal costs. The company handles the bill directly, and employees submit expense reports for record-keeping. This offers convenience but requires clear spending policies and monitoring.

Post-trip Expense Reimbursements

Sometimes, accurately predicting all business travel expenses upfront can be tricky. Unexpected expenses like laundry, repairs, or tolls can throw off the estimate.

To address this, you can reimburse employees for documented expenses after their trip. Traditionally, this involves manually entering expenses on a spreadsheet and submitting receipts for verification.

But did you know there’s a faster and much easier way to do this?

Travel expense management software like Fyle use Conversational AI , which enables employees to submit receipts via text messages for out-of-pocket and credit card expenses. Expense reports are automatically created by extracting all relevant information from receipts, and card expenses are automatically reconciled with the correct card transaction when the data flows in.

This makes the reimbursement process faster, more efficient, and ultimately more convenient for employees.

How To Manage Travel Expenses?

Automate with a travel expense management software.

This is one of the easiest ways to manage business travel expenses. Invest in a travel expense management software that automates receipt collection, approval workflows, and your expense reimbursement process.

It enables employees to submit receipts on the go and leaves little room for manual errors. Additionally, with real-time compliance, your approvers will know if expenses do not align with company policies and can take necessary action. This saves time and reduces errors for both employees and approvers alike.

Establish Clear Travel Policies

Having clear and well-communicated travel policies helps employees understand what expenses are reimbursable and set spending limits. This can include guidelines for meals, accommodation, and incidentals. Specifying preferred vendors or booking platforms can also help control costs.

Issue Virtual Cards to Your Employees

Do you use an Amex Business Credit Card? With travel expense management software like Fyle, you can create American Express virtual cards on the spot, perfect for one-time or regular costs like meals, travel, or office supplies.

This eliminates the need for physical cards and simplifies expense tracking for traveling employees. Plus, you can monitor spending in real time, giving you greater control over your budget.

How To Calculate Travel Expenses?

Calculating business travel expenses involves two main steps: estimating the costs before the trip and then reconciling the actual expenses after the trip. Here’s a breakdown:

Before the trip

1. research average costs.

- Use online travel booking tools and resources to understand your destination's average flight fares, hotel rates, and meal prices.

- Consider factors like travel seasonality and location when researching.

2. Consider additional expenses

- Factor in potential costs like local transportation (taxis, buses), laundry, internet access, and business calls made during the trip.

3. Utilize corporate travel tools

- Companies often have negotiated discounted rates with hotels, airlines, and car rentals. You could leverage folks in your network for the best deals.

4. Set realistic budgets

- Based on your research and additional expenses, set a realistic budget for each category (transportation, accommodation, meals).

- This will ensure you stay on track during the trip.

After the trip

1. collect and categorize receipts.

- Keep all receipts for flights, hotels, meals, and other business-related expenses incurred during the trip.

- Categorize expenses as per your expense policy (e.g., transportation, accommodation, meals)

2. Reconcile expenses with estimates

- Compare your actual spending against the pre-trip estimates you made.

- Identify areas where you might have overspent or underspent.

3. Use a travel expense management software

- Consider using a travel expense management system to automate receipt management , expense categorization, expense reporting, and reimbursements.

- This can save you a significant amount of time and effort in the reconciliation process.

Additional tips

- Get pre-approval for high-cost items : If you anticipate any large expenses (e.g., expensive client dinners), seek pre-approval from your manager to avoid any issues with reimbursements.

- Use travel rewards programs : Take advantage of travel rewards programs offered by airlines, hotels, and credit card companies to earn points or miles that can be redeemed for future travel.

How Can Businesses Reduce Travel Expenses?

Leverage technology.

- Video conferencing: Whenever possible, use video conferencing platforms like Zoom or Google Meet for meetings. This eliminates travel costs and saves employees time.

- Travel booking tools: Implement online booking tools that offer negotiated corporate rates for flights, hotels, and car rentals.

Implement a Clear Travel Policy

- Define trip approval criteria: Establish clear guidelines for what qualifies as a business trip and who can approve travel requests.

- Set expense limits: Based on the destination and travel duration, set reasonable spending limits for different expense categories (e.g., meals and accommodation).

- Promote alternative travel options: Encourage employees to consider cost-effective travel options like economy-class flights or budget-friendly hotels when appropriate.

Negotiation and Cost Optimization

- Negotiate bulk rates: For frequent business travelers, negotiate discounted rates with airlines, hotels, and car rental companies.

- Utilize travel management companies (TMCs): Partner with a TMC specializing in sourcing cost-effective business travel solutions.

- Encourage early booking: Promote early booking of flights and hotels to take advantage of lower fares and rates.

Analyze and Optimize Travel Data

- Track travel spending: Track and analyze business travel expenses to identify areas for cost reduction. Look at trends and identify destinations with higher-than-average costs.

- Review travel policies regularly: Review your travel policies regularly and adjust them based on updated data and changing business needs.

- Benchmark against industry standards: Compare your business travel spending with industry benchmarks to identify areas for improvement.

What Penalties Will I Face For Breaking IRS Rules?

The IRS takes tax compliance seriously, and there can be penalties for claiming non-deductible expenses on your business travel report. Here’s a breakdown of what you might face:

Owed-back taxes

If the IRS discovers you claimed non-deductible expenses, you’ll be responsible for paying back the taxes you avoided plus interest. This interest accrues from the date the tax was originally due.

Tax-penalities

The penalties you face will depend on whether the mistake was intentional or unintentional.

- Negligence: If the mistake was unintentional due to negligence (not properly understanding the rules), you may face a penalty of 20% of the additional tax owed.

- Fraud: If the IRS determines the mistake was intentional fraud, you could face a steeper penalty of 75% of the additional tax owed, plus potential criminal charges.

For more information, please refer to the IRS documentation on penalties .

Additional filing requirements

In some cases, the IRS may require you to file additional forms, such as Form 8275, to disclose the error and potentially avoid penalties.

How Form 8275 Can Help You Avoid Tax Penalties

The Form 8275 lets you explain any deductions you claimed that might not be perfectly clear on your tax return. As long as you had a good reason for claiming the deduction (which wasn't something the IRS specifically disallows), filing Form 8275 can help you avoid owing extra taxes or facing penalties. However, it's important to note that this form won't work if you intentionally tried to mislead the IRS.

For more information, please refer to Instructions for Form 8275 (01/2021)

How Fyle Can Help Manage Business Travel Expenses

Fyle streamlines expense reporting from start to finish. Thanks to Conversational AI, you can submit receipts with a simple text message , and Fyle's integrations with Visa , Mastercard , and American Express give you real-time notifications on all card spending while also automatically reconciling credit card transactions.

Fyle goes beyond automation, offering features like business mileage tracking and the ability to issue Amex virtual cards specifically for travel expenses. Plus, real-time compliance checks keep your spending on track. This comprehensive approach helps you identify cost-saving opportunities and ensures your business stays within budget.

See how Fyle transforms your travel expense management. Sign up for a demo today!

Rahul Radhakrishnan

Rahul believes everyone has a story to tell. If he isn't writing one, he's hearing one from someone.

Stay updated with Fyle by signing up for our newsletter

What Are Real-Time Feeds, and Why Do They Matter

How to record credit card charges in quickbooks online.

Visa Purchase Alerts: A Complete Guide

Quickbooks Payments: Overview, Credit Card Processing Fees and Rates

Close books faster with Fyle. Schedule a demo now.

- Search Search Please fill out this field.

What Are Transportation Expenses?

- How They Work

Special Considerations

- Supply Chain

Transportation Expenses: Definition, How They Work, and Taxation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

June Wachira / Getty Images

The term transportation expense refers to specific costs incurred by an employee or self-employed taxpayer who travels for business purposes. Transportation expenses are a subset of travel expenses, which include all of the costs associated with business travel such as taxi fare, fuel, parking fees, lodging, meals, tips, cleaning, shipping, and telephone charges that employees may incur and claim for reimbursement from their employers. Some transportation expenses may be eligible for a tax deduction on an employee's tax return .

Key Takeaways

- Transportation expenses are a subset of travel expenses that refer specifically to the cost of business transportation by car, plane, train, etc.

- Expenses such as fuel, parking fees, lodging, meals, and telephone charges incurred by employees can be claimed as transportation expenses.

- These expenses may be deducted for tax purposes subject to the appropriate restrictions and guidelines.

How Transportation Expenses Work

Transportation expenses are any costs related to business travel by company employees. An employee who travels for a business trip is generally able to claim the cost of travel, hotel, food, and any other related expense as a transportation expense. These costs may also include those associated with traveling to a temporary workplace from home under some circumstances. For instance, an employee whose travel area is not limited to their tax home can generally claim that travel as a transportation expense.

These expenses, though, are narrower in scope. They only refer to the use of or cost of maintaining a car used for business or transport by rail, air, bus, taxi, or any other means of conveyance for business purposes. These expenses may also refer to deductions for businesses and self-employed individuals when filing tax returns . Commuting to and from the office, however, does not count as a transportation expense.

The cost of commuting is not considered a deductible transportation expense.

Transportation expenses may only qualify for tax deductions if they are directly related to the primary business for which an individual works. For example, if a traveler works in the same business or trade at one or more regular work locations that are away from home such as a construction worker, it is considered a transportation expense.

Similarly, if a traveler has no set workplace but mostly works in the same metropolitan area they live in, they may claim a travel expense if they travel to a worksite outside of their metro area. On the other hand, claiming transportation costs when you have not actually done any traveling for the business is not allowed and can be viewed as a form of tax fraud .

Taxpayers must keep good records in order to claim travel expenses. Receipts and other evidence must be submitted when claiming travel-related reimbursable or tax-deductible expenses.

According to the Internal Revenue Service (IRS) travel or transportation expenses are defined as being: "...the ordinary and necessary expenses of traveling away from home for your business, profession, or job." And it further defines "traveling away from home" as duties that "...require you to be away from the general area of your tax home substantially longer than an ordinary day's work, and you need to sleep or rest to meet the demands of your work while away from home."

The IRS provides guidelines for transportation expenses, deductibility, depreciation, conditions, exceptions , reimbursement rates, and more in Publication 463 . The publication sets the per-mile reimbursement rate for operating your personal car for business. Travelers who use their vehicles for work can claim 58.5 cents per mile for the 2022 tax year , increasing to 62.5 cents for the remaining six months. That's up from 56 cents eligible for 2021. The IRS' determined rate treated as depreciation for the business standard mileage is 26 cents as of Jan. 1, 2021.

Internal Revenue Service. " Topic No. 511 Business Travel Expenses ."

Internal Revenue Service. " 2022 Standard Mileage Rates ," Pages 3-4.

:max_bytes(150000):strip_icc():format(webp)/bottleneck.aspfinal-410b48262f8244a88f74662647287858.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Travel expenses list: A guide to managing your travel budget

Explore our travel expenses list and learn how to optimize your travel budget. Stay organized, track your spending, and make informed decisions with Accrue.

A travel expenses list is essential for mapping and managing your travel budget. It helps ensure you don’t overspend or underestimate the cost of your trip. You can keep track of planned and unplanned expenses, ensuring they fit within your overall budget.

Unfortunately, for most travelers, budgeting isn’t easy. The cost of airfare, accommodation, and meals vary greatly and can quickly add up. Without an organized strategy in place, it’s all too easy to blow your budget and end up with a mountain of debt.

Learn in this comprehensive guide the basics of creating a travel expenses list, including transportation, accommodations, food & beverage, and activities, and offer advice on saving money while traveling.

1. Transportation

Transportation costs refer to all your costs of moving from point A to point B. They account for the biggest chunk of most travel budgets and include:

Many travelers, especially those traveling for business purposes, prefer booking flights due to convenience, speed, and cost-effectiveness. Airfare is the amount you pay for the plane ticket and can vary greatly depending on the airline, route, and time of year. However, there are other additional airport expenses, such as luggage, taxes, and transfers you must factor into your budget.

Car rental and gas

You may need a rental car at the destination to help you get around, especially if you plan to explore the area and take side trips. Depending on where you’re going and for how long, renting a car might be more cost-effective than using public transportation, taxis, or rideshares — factor in the rental cost, insurance, and gas.

Other additional fees include parking fees, tolls, and pit stops on the road. If you’ll be driving a lot, look into getting a fuel-efficient car and research the average cost of gas in the area.

Public transit

Public transportation is typically the cheapest way to get around a city, especially if you plan on taking multiple trips. It includes subways, buses, ferries, and trains, each with its own rate. Buses, metro, and train tickets vary in price depending on the region.

Consider buying a day pass or multipass to save transport money if you plan on taking multiple trips. Most cities also offer rideshare services like Uber and Lyft, which can be more cost-effective than driving a personal vehicle. Research the public transit options available at your destination to see which fits your budget.

Parking fees and tolls

If you plan to drive a lot during your trip, you might have to pay parking fees and tolls. Parking fees vary depending on the city and are usually hourly or daily. Some cities have free street parking but most paid lots and garages charge a fee.

Tolls are charges for using certain roads and bridges. You can pay the tolls in advance or use a toll pass for the duration of your trip. Other expenses associated with car rentals include insurance, gas, and repairs.

2. Accommodations

Accommodation expenses are the costs of staying at a place during your trip. They include hotel stays, Airbnb rentals, hostels, and campsites. The prices vary depending on the accommodation type, amenities, and location — research various options to determine what works best for your budget.

Hotels and resorts

Hotels and resorts are the most common option for short-term stays. They can range from budget-friendly motels to luxurious five-star hotels and offer a range of amenities like swimming pools, spas, saunas, and fitness centers.

Their prices depend on the location, star rating, and amenities. You will incur additional fees for hotel room service, extra beds, laundry, and other services. Book in advance or use hotel rewards and loyalty programs to save money .

Bed and breakfast (B&B) expenses

Bed and breakfast establishments offer a more affordable and intimate experience than hotels. They can range from private rooms in someone’s home to luxurious properties with multiple bedrooms.

Prices usually include bed and breakfast, but you may be charged for extra amenities like housekeeping, dry cleaning, and Wi-Fi. Unlike hotels, you’ll be dealing directly with the owner, so it’s essential to read reviews and ask questions before booking.

Meal expenses also account for a considerable chunk of your travel budget, so it’s important to plan ahead and budget accordingly. How much money you spend on food depends on where you’re going, the type of food you like, and how often you plan to eat out.

Local cuisine is usually the cheapest option, so find places that offer authentic dishes. Bringing snacks such as nuts, energy bars, and trail mix is always a good idea. You can save money by snacking instead of buying expensive meals. Ordinary meal expenses include:

Restaurants and dining out

Restaurant dining is the most common way to eat while on vacation or a business trip, but it can be costly. Prices vary depending on the type of restaurant, cuisine, and location. Fine dining establishments charge premium prices for their food and drinks, while casual eateries and fast food joints are more affordable. Check out local restaurants and read reviews before going out. Deals such as discounts for early birds or happy hours are creative ways to help you save on these expenses.

Street food and vendors

Street food is a popular option for travelers who want to indulge in the local culture and cuisine. Street vendors often serve traditional dishes at low prices. You can find food carts or stalls selling sandwiches, kebabs, tacos, and other dishes. However, be mindful of food safety and hygiene protocols to avoid getting sick. Research average prices for the area to make sure you’re not being overcharged.

Coffee and beverages

Coffee and beverages are usually the least expensive items on the menu. You can find coffee shops and cafes selling specialty drinks, like lattes, cappuccinos, and frappuccinos, at a fraction of the price of restaurants.

Most places also offer tea, smoothies, juices, and other non-alcoholic drinks. Local markets will usually have cheaper options for bottled water and other beverages. For alcoholic drinks, look for local breweries, pubs, and bars and take advantage of happy hours and specials to save money.

Tipping and service charges

Tipping is common in many countries and is expected for certain services, such as restaurant meals and hotel stays. The tip amount varies depending on the quality of service and local customs. It’s usually 15-20% for a meal, but you can check with the restaurant or your server if in doubt.

Service charges come with the bill and should be indicated on the menu. Allocate a portion of your travel budget to cover tips and service charges. Staff at hotels, restaurants, and other establishments rely on tips for their income, so be generous when you can.

4. Activities and entertainment

A vacation wouldn’t be complete without some fun and entertainment. You can find inexpensive or free activities to do depending on where you’re traveling. Museums, galleries, and other cultural attractions are usually free or have discounted admission for students and seniors. Typical expenses for activities and entertainment:

Sightseeing and attractions

Sightseeing is a big part of many people’s travel plans. Historical and cultural attractions, like monuments, churches, and museums, are usually the most popular sightseeing destinations. You can also visit theme parks, zoos, aquariums, and art galleries.

Prices vary depending on the type of attraction, and access passes are usually cheaper than buying tickets for individual attractions. You can pay a small fee to take historical tours from locals, while in certain cities, free walking tours are also available.

Organized tours and excursions

The best and most fun-filled way to see a new place is to join an organized tour or excursion. Most cities have tours that take you to the must-see sights and attractions but you can also book day trips to castles, vineyards, or nature reserves.

An organized tour covers entrance fees, transport, and sometimes meals. Compare rates and read customer reviews to find the best value for your money.

Outdoor activities

Outdoor activities like hiking, biking, and water sports are great ways to explore the local landscape. Many national parks and forests have trails for biking, horseback riding, and climbing.

Some parks offer guided tours with experienced instructors. The guided tours usually include equipment rentals and safety gear, but you may incur park entrance or permit fees for certain activities.

Shows and performances

If you’re looking for a bit of culture, shows, and performances are a great way to spend an evening. Theaters and opera houses often have discounted prices for matinee shows or special performances.

If you’re staying in a city, look out for street performers and enjoy free outdoor concerts. Cinemas are usually cheaper than live performances, so you can taste the local culture without breaking your budget.

Spa and wellness

Spa treatments are a great way to re-energize after a long flight or an intense sightseeing session. Some hotels offer complimentary spa treatments, while others have special deals for guests.

Try a local massage parlor or a yoga studio if you want something more affordable. You will pay from a few dollars to hundreds, depending on your chosen services. Spa services usually include massages, facials, saunas, and steam rooms.

5. Shopping and souvenirs

Bringing back souvenirs is a fun part of any trip, but it can be easy to overspend on gifts for yourself and your loved ones. The cost of souvenirs depends on where you’re traveling and the type of item you want to buy. It’s common to bargain or haggle for lower prices in some places. Research the local currency and market prices to avoid getting ripped off.

Travelers should also be aware of import laws and customs regulations. There may be restrictions on certain items such as food, alcohol, and tobacco.

6. Emergency and unprecedented expenses

Despite how well you plan your trip, there may be unexpected costs. Unforeseen events, such as a life-threatening medical emergency or natural disaster, can result in high expenses. Budget for emergency funds and purchase travel insurance to cover any medical costs or unexpected losses.

Carry enough cash for emergencies, and use a debit or credit card for international purchases. Also, double-check your documents to ensure you have all the necessary visas and permits before your trip.

7. Currency exchange rates

Exchange rates make a huge difference when transferring money or paying in foreign currency. Compare current rates with those from the booking time to ensure you get the best deal. Check with your local bank or credit card provider for their rates and fees.

You can also look up online currency converter tools to see how much you spend in your home currency. Be aware of hidden charges when exchanging money. Such hidden charges include ATM fees, commissions, and other administrative costs that can quickly add up.

Tips for managing travel expenses

Proper travel expense management is critical to a successful and enjoyable trip. Planning ahead and budgeting for each expense will help you manage your travel expenses.

Set daily spending limits and monitor your expenses

Estimate your total budget for the trip and then divide it into daily spending limits. This will help you stay on budget while still allowing you to enjoy the activities and attractions. Monitor your personal expenses throughout the trip to ensure you don’t exceed the budget.

Save money on product purchases with Accrue Savings

Saving money for travel expenses is a challenging feat. Juggling everyday expenses while saving for a trip can be overwhelming. Accrue Savings is a great way to save money for travel without having to scrimp and sacrifice everyday items.

This easy-to-use service allows you to save money for travel expenses by automatically putting aside a portion of your everyday purchases. You only need to create a free Accrue account, fund your wallet, and track your progress. And there is no set amount you must contribute — save as little as $1 weekly or $50 monthly, depending on your flexibility.

Book everything in advance

Book flights, accommodations, and activities in advance to get the best deals and save on travel costs. Check for airline discounts or hotel loyalty programs, and watch for last-minute discounts and deals on attractions and activities.

Traveling during the off-peak season

Flights and accommodation prices tend to be higher during the peak season. Consider traveling during the off-peak season when prices are lower. Hotels usually offer discounts or special packages during this time, saving you money on accommodations. You may have to sacrifice some activities due to fewer available options, but you’ll get more bang for your buck.

Keep an eye out for discounts

Take advantage of discounts and special deals to save on out-of-pocket expenses. Look for coupons, student or senior discounts, and loyalty club memberships that offer discounts on activities and attractions. You can also find discount codes for car rentals, restaurants, and other services online. Business travel expenses, for instance, may be tax-deductible depending on your situation.

Save intelligently on your purchases Accrue Savings

Poor budgeting decisions can quickly put a damper on your trip. Accrue Savings provides a smart and easy way to save money for travel expenses while avoiding the risk of overspending.

It’s a great way to keep your travel expenses in check without missing out on the fun. Once you sign up and fund your wallet, you can track your progress and watch your savings grow. You will also earn rewards along the way to help you realize your travel dreams quickly.

Register today and check out our partners to earn money toward your future travel expenses and purchases.

Latest articles

What is opt-in email marketing, and how does it work?

12 unique wedding ideas to try on a budget

July 22, 2024.

Trending Courses

Course Categories

Certification Programs

- Free Courses

Accounting Resources

- Free Practice Tests

- On Demand Webinars

Travel Expenses

Published on :

21 Aug, 2024

Blog Author :

Edited by :

Reviewed by :

Dheeraj Vaidya

Travel Expenses Definition

Travel expenses refer to the total amount spent by an employee or a group of employees while traveling to another city, state, or country for a professional purpose. According to the IRS, the expenses are tax deductible only if the assignment lasts for less than a year.

Travel expenses include food, transport, accommodation, commute, and expenses for other services. The employee is responsible for maintaining receipts and other documents that reveal a particular expense they claim. After examination, the employer will reimburse the employee. Hence, they should be vigilant while requesting reimbursement for travel expenses.

Table of contents

- Travel Expenses Explained

Travel Expenses And IRS

List of travel expenses, frequently asked questions (faqs), recommended articles.

- Business travel expenses denote an employee's spending on transportation, food, lodging, and other services like laundry, business calls, etc.

- The internal revenue service (IRS) clearly outlines which expenses, under what circumstances, will be eligible for a tax deduction.

- It is important that the employee can only ask for the reimbursement of their business-related expenses. Therefore, the company will not bear any amount spent on luxuries, extravaganza, personal use, or unnecessarily spent.

- The employees should have proper evidence to back their claims in case of a legal necessity.

Travel Expenses Explained

Travel expense reimbursement might seem less significant, but it has serious legal implications and should be well understood. In a professional context, there might be situations where employees will have to travel as part of a deal, or signing a contract, or attend a conference. Here, the employees represent the company and travel as part of their profession.

When employees incur work-related travel expenses, it is the responsibility of the employer to reimburse them. For this, the employee should maintain all receipts that correspond to any business-related expense . So this implies that the employee should exercise due care while spending. In some cases, employees will spend unnecessarily or purchase luxury items , hoping the company will pay them back. But the companies are legally obliged to pay only for professional travel expenses.

Let's understand how the internal revenue service (IRS) looks at business travel expenses. According to the IRS, these expenses occur when an employee works away from his tax home and for a work day longer than a normal work day (at tax home). Here, tax home refers to the region where a person works. Consider a simple example.

Smith works at his office in New York for 8 hours a day. New York is his tax home. He has to travel to Chicago as part of a business trip and stays there for a week. Smith incurs a total work-related expense of $1500. This amount can be reimbursed.

However, if he visited his friend while on the trip, any amount incurred to travel and reach his friend's destination and back to the hotel (or his place of stay) would have to be borne by him.

Now, consider another scenario. Suppose Smith's family stayed in Kentucky, and he visited them every month. The expenses that occur in doing so are not related to business. Hence, he will not receive reimbursement.

Also, IRS mandates that the period of the business trip or assignment should be less than a year if the company wants to claim a tax deduction on the expenses.

The IRS lays down a list of tax-deductible travel expenses for any company:

- Transportation fare (by airplane, car, train, etc.) between the employee's tax home and the destination, including return.

- Commute expenses from or to the airport, hotel, or work location. The fuel cost, parking, and toll fee reimbursement can be claimed if the employee uses their personal vehicle.

- Shipping charges (baggage, etc.)

- Lodging/accommodation and food expenses .

- Dry cleaning and laundry services

- Internet or cellular data charges

- Tips paid for services.

- Any other expenses related to the work.

Let's discuss some examples to understand travel expense reimbursement.

Haley works for company X, based in California. She has to attend a 2-day conference in Denver as part of her work. Following is the list of her expenses:

Flight fare = $300

Hotel expenses = $500

Commute (Hotel to work to the hotel) = $200

A visit to Rocky Mountain National Park with friends = $150

Total travel expenses = Flight fare + hotel expense + food + commute

Haley's visit to the national park is her personal expense and will not be considered here.

Following the abortion ban in the United States, many multinational companies in the U.S. have decided to undertake their employees' travel expenses when they travel out of the state or country to obtain a safe and legal abortion. The last week of June 2022 saw many companies coming forward and supporting their employees in this regard. Goldman Sachs, Meta, JPMorgan, Walt Disney Co., Microsoft, Amazon, Apple, Tesla, and Bank of America are some big players who have implemented the addition to employees' healthcare policies.

Yes. However, the tax-deductible travel expenses should be strictly related to one's profession, provided that the work assignment or the business trip lasts for less than a year. Also, the employee should be able to support their claims with proper evidence.

Any employee traveling on behalf of their company can ask for reimbursement of their expenses, and the firm is legally mandated to compensate them. However, the employees should maintain all the receipts which back a particular claim. Only if the employer is convinced that the employee has sincerely presented the information will they reimburse the employee.

Travel expenses include the total amount an employee spends for trips or visits undertaken in the company's name. It includes transportation, lodging, food, commute, and other services like laundry, data, etc. Any other expense incurred for personal use will not be considered work-related and should not be accounted for.

This article has been a guide to Travel Expenses and its definition. Here, we explain it with a list of tax-deductible & business expenses, reimbursement, & examples. You can learn more about it from the following articles –

- Traveler’s Check

- Incidental Expenses

- Expense Report

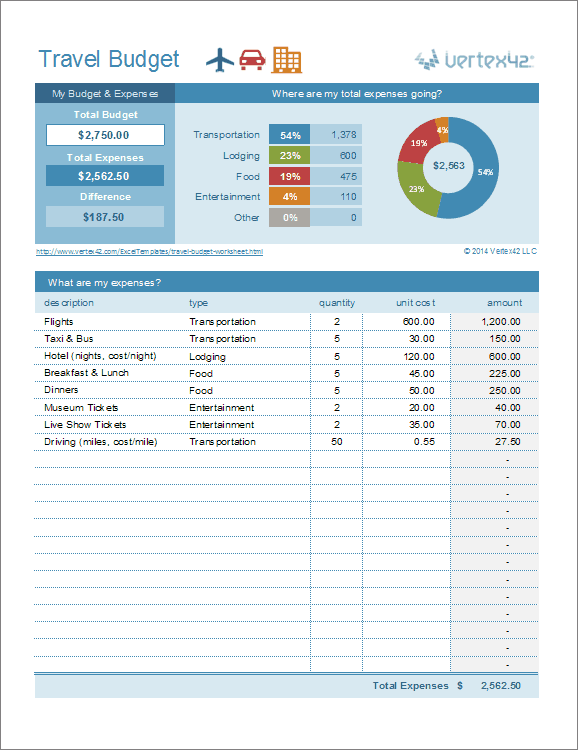

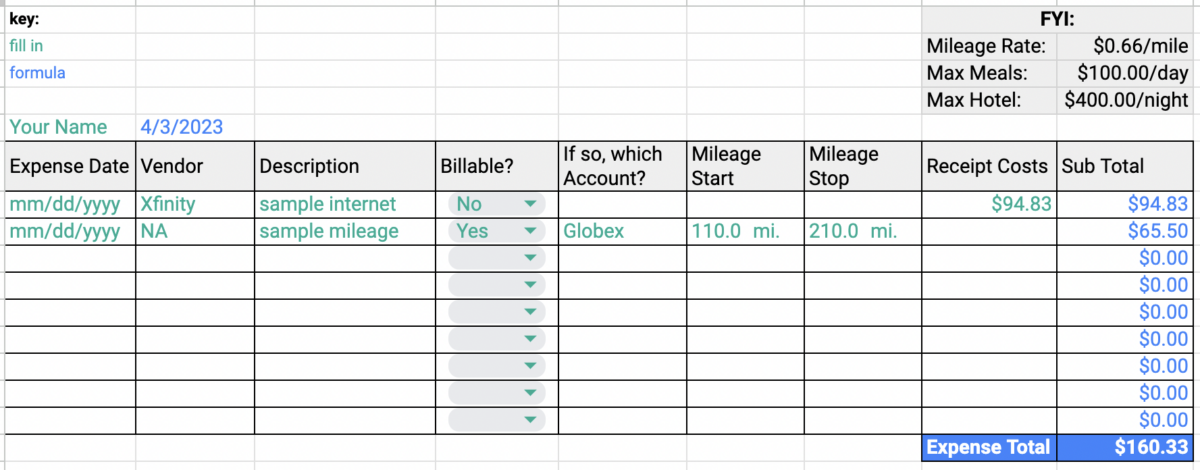

Travel Budget Worksheet

Are you planning a major trip? Will you be able to stay within your budget? Rather than just spending without a plan and then dealing with the debt for the next few years, use our travel budget template to list your travel expenses. It will help you estimate your total travel costs and see if you will be able to take your trip without going over budget.

License : Private Use (not for distribution or resale)

Authors: Jon Wittwer and Jim Wittwer

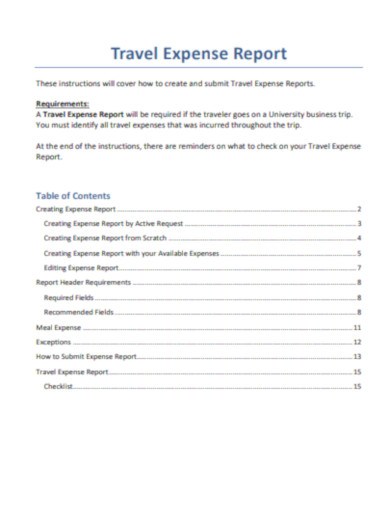

Description

This travel budget template makes it easy to enter your travel expenses for your next trip. The top section allows you to set a total budget, and as you enter your travel costs you can quickly see where the money is going, how much extra you'll have, or how much you'll need to add to your budget.

The worksheet is set up to let you enter a quantity and unit cost for each item. For example, for lodging you can enter the number of nights you will be staying and the cost per night. If you will be driving rather than flying, you can enter the total miles and the cost per mile. Remember to include both fuel and wear as part of the cost (see the link below for what the IRS uses as the standard mileage rate - $0.56/mile in 2014).

Additional Resources

- Be sure to check out our Travel Itinerary and Packing List templates.

- IRS Publication showing Standard Mileage Rates at irs.gov - You might consider using the standard mileage rate if you are estimating the cost of driving.

- Tips for Creating a Budget for Travel at wikihow.com - This article is actually a really good resource to help you remember what to consider when budgeting for a trip.

Follow Us On ...

Related templates.

For Home and Family

Accounting | How To

Determining Tax Deductions for Travel Expenses + List of Deductions

Published August 15, 2023

Published Aug 15, 2023

WRITTEN BY: Tim Yoder, Ph.D., CPA

This article is part of a larger series on Accounting Software .

- 1. Determine Your Trip Meets the Requirements of a Business Trip

- 2. Check the List of Business Expenses That Qualify for Deductions

- 3. (For Those Mixing Business & Personal Travel): Allocate Expenses

Bottom Line

The IRS considers deductible travel expenses to be any ordinary and necessary expenses you incur while traveling away from home on business. To get tax deductions for travel expenses, the trip must have a business purpose and be temporary (less than one year) and you must be away from your tax home for a length of time that exceeds your usual work day or be away overnight to get sleep to fulfill the demands of your job while away.

Key Takeaways

- A qualifying business trip must take you away from home overnight long enough to require rest.

- Most expenses incurred during a qualifying business trip are deductible, including meals on days off.

- Partnerships, limited liability companies (LLCs), and corporations can directly pay or reimburse employees for business travel expenses and deduct them from their business returns.

- Self-employed business owners will deduct their travel expenses on Schedule C, while farmers will use Schedule F.

- Purely personal expenses on business trips, such as sightseeing, are nondeductible.

Step 1: Determine Your Trip Meets the Requirements of a Business Trip

A business trip for tax purposes is one that meets the following criteria:

- There must be a business purposes for the travel

- You are required to be away from your tax home

- The trip lasts overnight or a period long enough to require rest

- The trip is temporary

Business Purpose

Your trip must be an ordinary and necessary part of conducting your business for your expenses to be deductible. Below are some reasons you may decide to travel for business:

- Meeting with clients or customers: If you travel overnight to meet with clients or customers for business purposes, such as negotiating contracts, discussing projects, or providing consultations.

- Attending business conferences or seminars: If you travel to attend conferences, seminars, or trade shows that are relevant to your business activities, including acquiring new industry knowledge or networking with other professionals.

- Training or professional developmen t : If you travel to attend training programs, workshops, or courses directly related to your business or profession.

- Conducting in-person meetings or negotiations: If you need to travel to have face-to-face meetings or negotiations with business partners, suppliers, or other stakeholders.

Your tax home is not your residence but rather your principal place of business activity including the entire city or general location of your business. So, your business trip cannot be in the general vicinity of your principal place of business for you to be away from home.

- Amount of time you spend at each location

- Degree of business activity in each area

- Relative significance of the financial return from each area

- No regular place of business: If, by the nature of the work, there is no regular or principal place of business, then your tax home will be the place where you regularly live and where you travel to different job sites to perform your service.

For example, a self-employed repair person may not have a regular place of business because they spend each workday at a different customer’s location.

Overnight Stay

Overnight stays for travel purposes do not specifically mean staying from evening to the next morning. Instead, overnight means that the trip is longer than a typical day’s work and long enough for you to require rest. Resting in your car is generally not enough, but if you have to get a hotel room, then the trip will qualify as overnight regardless of when you sleep.

Transportation vs travel expenses: Local transportation at your tax home can be deductible without an overnight stay—if there is a business reason for the transportation, such as driving from your office to visit a client. On a tangent, when you travel overnight, your transportation is deductible, and so are things like lodging, meals, and incidental expenses.

Temporary Travel

For purposes of business travel, a temporary stay is one that is expected to last for less than one year. Open-ended trips are not temporary.

However, say you initially anticipate that your trip will last less than one year, but it later becomes apparent that it will last more than one year. The trip is a deductible business trip up until the point in time it becomes apparent it will last more than one year.

The IRS will also consider a series of assignments to the same location, all for short periods, that together cover a long period to be an indefinite assignment. Any expenses you incur from this type of trip will not be deductible.

Step 2: Check the List of Business Expenses That Qualify for Deductions

Your travel expenses must be business-related—unless an exception applies—to qualify for a deduction. However, if you incur expenses that are purely for personal pleasure, they are nondeductible.

Here is a list of business travel expenses that can be deducted.

Round-trip Transportation To-and-From the Destination

Transportation for a round trip to and from your temporary work location is deductible—and it could be anything that gets you to the location, including via your personal car. If you use your personal car, your costs are calculated using either the actual expenses or the standard mileage rate .

In addition, you can deduct additional round trips to return to home when you are not working.

However, the deduction for the additional round trips is limited to the cost you would have incurred if you stayed at the temporary location. Those costs could include meals and lodging.

- The business purpose of the meals is your business trip and are thus deductible—even if you eat alone.

- Meals on days off qualify.

- Travel to and from meals is deductible—even on your days off.

- The meals do not have to have a specific business purpose, such as meeting with a client.

- For longer trips, lodging can include monthly rentals.

- If you return home on your days off but keep the lodging at your travel location, then the lodging is still deductible if it is ordinary and necessary. For instance, the monthly rent of an apartment at your travel location would be deductible even if you return home on the weekends.

Transportation at the Destination

Once you arrive at your destination, you may need additional transportation to get around town—and these costs are deductible. The only exception would be if you travel to the destination for a purely personal reason like sightseeing on your day off.

Incidentals

Incidental expenses are minor expenditures associated with business travel. You can deduct the actual cost of any one of the following expenses:

- Shipping of baggage and sample or display material between your regular and temporary work locations

- Business seminar and registration fees

- Dry cleaning and laundry

- Business calls include business communications by fax machine and other communication devices

- Tips you pay for services related to any of these expenses

- Parking, tolls, and fees

- Any other similar ordinary and necessary expenses related to your business travel

Step 3 (For Those Mixing Business & Personal Travel): Allocate Expenses

When trips are both business and personal, the allocation of expenses varies based on the primary purpose of the trip. Determining the primary purpose of your journey requires you to evaluate the time spent on business vs personal activities.

Primarily Business Domestic Trips

If your trip is primarily for business purposes, then the round-trip transportation is 100% deductible and does not need to be allocated to the personal portion of your trip. However, all other expenses, like lodging and meals, must be allocated to personal expenses for days where there was no business reason for staying.

For example, if your seminar ends on Friday and you stay until Sunday, then the lodging and meals for Saturday and Sunday are nondeductible.

Primarily Personal Domestic Trips

If the primary purpose of your trip is personal, then none of the round-trip expenses are deductible. However, you can deduct the business portion of meals, lodging, and local transportation that was incurred for a business purpose.

Let’s say you stay a couple of days after your family vacation to meet with a client. The lodging and meals for those extra days are deductible.

Business Foreign Trips

The allocation of travel expenses on foreign trips is slightly different from the rules above. Round-trip transportation for foreign trips must be allocated to business and personal based on the number of business vs personal days on the trip. This is different from the “all or nothing” rule for the cost of domestic round-trip travel.

If your spouse joins you on a business trip, you usually cannot deduct any of their expenses. However, if your spouse’s trip satisfies a business purpose, then expenses must be otherwise deductible by the spouse.

Generally, for the travel costs of a spouse, dependent, or any other person to be tax-deductible, they must work for the business or be a co-owner.

Frequently Asked Questions (FAQs)

Are travel expenses tax deductible for business.

Yes, roundtrip travel is 100% tax deductible as long as the primary purpose of the trip is business. Once at your destination, expenses must be allocated between business and personal. However, all meals are deductible as long as the reason for your continued stay is business.

Can I deduct travel expenses for my employees?

Yes, you can generally deduct travel expenses for your employees as long as the expenses are ordinary and necessary, directly related to your business, and properly substantiated.

Is there a limit to the amount of travel expenses I can deduct?

Yes, there are some such as business travel on a cruise ship, where the expense is limited to $2,000 per year. Also, your expenses are limited to the non-lavish or extravagant cost of the trip, so you may want to be careful before booking a 5-star hotel.

Travel expenses are ordinary and necessary expenses you incur while you are temporarily away from home, so these expenses cannot be lavish in nature. To determine if a travel expense is deductible, it must be directly related to your trade or business.

When it comes to travel expenses, having well-organized records makes it much simpler to complete your tax return. Keep track of any records that may be used to substantiate a deduction, such as receipts, canceled checks, and other documentation.

About the Author

Find Timothy On LinkedIn

Tim Yoder, Ph.D., CPA

Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Request Demo

Sarah Chetrit

Apr 11, 2022

When Can You Expense Travel? 5 Travel Expense Examples

Did you know that you can expense travel if you’re a freelancer, creator or any type of sole proprietor? There are certain rules and restrictions to expensing travel so we’ll list out five specific travel expense examples to help you out.

Whether you’re traveling abroad on a content trip or simply driving across town to pick up supplies for a client project, these types of business-related excursions can be considered expenses.

It gets a little tricky when personal time gets involved but it’s not as bad as it sounds. In this post, you’ll also learn how to split the difference between a business and personal trip when both are involved.

Disclaimer: This post does not contain financial advice and is purely for entertainment purposes. Reach out to your local CPA for specific tax information for your business.

What are travel expenses?

Travel expenses are costs incurred by a freelancer or creator through traveling on work-related activities.

These work related activities must take place away from their usual place of work and must be associated with a specific business, non-personal reason.

Basically, whatever the travel expense is, it needs to be able to support your daily business operations.

List of Travel Expenses to Take

The most common travel expenses are generally:

Train rides

Ubers / taxis

Hotels / accommodation

Mileage for your car

Additionally, travel expenses also include other types of expenses, which are incurred because you are away from home. These include but are not limited to:

Auto rentals

Bike rentals

*For the purposes of this blog post, we will be talking about meals when traveling; not meals at your usual place of business.

5 Travel Expense Examples for Creators and Freelancers

It might be easier to conceptualize when travel expenses can be taken so let’s take a look at these 5 specific travel expense examples.

Traveling to Another City to Visit a Client

If you’re traveling to another city to visit a client, there are all types of travel expenses you can take.

Since the purpose of this trip is to visit a client who is essential to your business operations, this can be considered a business trip.

With a trip like this, you can expense:

Your method of travel (i.e. plane, bus, train etc.)

Method of transportation while in the city (i.e. car rental, toll costs, Ubers, etc.)

Business meals* if “ordinary and necessary” on days of travel

Business meals* with a business contact such as if you take your client out to a meal and isn’t “lavish or extravagant”

*Meals are not always deducted at a full 100% like other expenses are. See the Food & Drink Expense section under 5 Surprising Tax Write Offs for Freelancers.

Flying Abroad as a Travel Blogger

If you’re flying abroad as a travel blogger , since traveling and creating content out of those experiences are the main way of making money, costs related to these can be expensed as travel.

This with include but not be limited to:

Method of travel

Accommodation

Business meals

Activities for product purposes

Flying Abroad as a Travel Blogger and Spending Time With Family

If you’re flying abroad as a travel content creator but happen to fly to an area where you have close family and friends and spend time with them, then your trip is no longer 100% for business purposes.

As a result, the travel expense examples mentioned above can only be expensed for the business portion.

For example, if you fly to New York City for 10 days but are planning to spend 7 days creating content and 3 days visiting with family, then you can only expense 70% of business-related expenses.

In detail, if your flight is $1000, then you would expense $700 for business and assume $300 as a personal cost.

Driving Across Town to Pick Up Production Supplies

If you’re driving across town to pick up production supplies or dropping goods off at a client’s place of business, then you can expense the mileage driven for business purposes.

As of December 2021, the IRS allows you to expense 58.5 cents per mile driven for business use.

For example, if you drove 10 miles to pick up production supplies and another 10 back home, that’s 20 miles total.

20 miles X the allowable expense of 58.5 cents per mile equals out to $11.70 expense for miles driven.

Driving Across Town to Pick Up Production Supplies and Doing Personal Errands

If you drive across town to pick up production supplies and also add on extra driving to do some personal errands such as go grocery shopping, you can only expense mileage for miles driven for business purposes.

For example, if you drove 20 miles to/from a client but then going to the grocery store added on an extra two miles to your trip, then you can only calculate the mileage expense on the 20 miles, not the 22 miles.

How can I keep track of travel expenses?