- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Nationwide Travel Insurance Review: Is it Worth The Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Nationwide travel insurance cover?

What does nationwide travel insurance cost, what isn’t covered by nationwide travel insurance, can you buy a nationwide plan online, is nationwide travel insurance worth it.

Are you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

» Learn more: Common myths about travel insurance and what it covers

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

» Learn more: How to find the best travel insurance

Additional options and add-ons

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

» Learn more: The best travel credit cards right now

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician.

Participation in canyoning or canyoneering, extreme sports or bodily contact sports.

War or any act of war whether declared or not.

Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

» Learn more: Is there travel insurance that covers COVID quarantine?

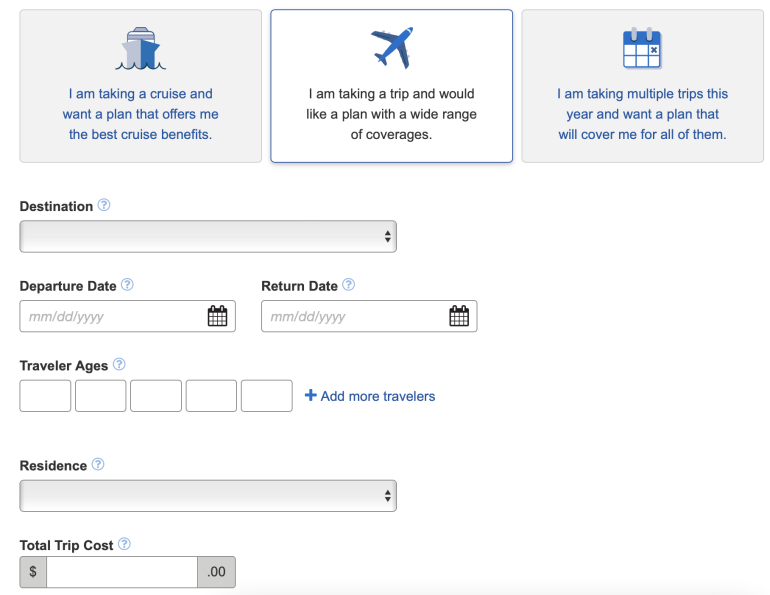

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

» Learn more: How much is travel insurance?

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

What does chase freedom® travel insurance cover.

The Chase Freedom ® family of cards come with several attractive features, such as 1.5% cash back on purchases. But did you know that Freedom cards also come with travel insurance benefits that can help you book a vacation with greater peace of mind?

It's true, common carrier expenses such as a plane ticket or cruise line booking can be reimbursed — if certain covered situations arise that interrupt your vacation or force the cancellation of your reservation. Read on to learn more about these benefits, as well as some important facts to know before you purchase your next vacation using your Freedom card.

Do Chase Freedom credit cards come with travel insurance?

All three currently issued Freedom cards: Chase Freedom Unlimited ® , Chase Freedom Flex ® and Chase Freedom Rise ® offer their cardmembers basic travel insurance covering trip interruption or cancellation. This covers certain ‘‘what if’’ situations that may impact your travel plans, providing reimbursement after a claim is filed and processed.

For the Freedom family of cardmembers, the maximum amount of this reimbursement benefit is up to $1,500 per cardmember, their immediate relative or domestic partner. The maximum reimbursement benefit per trip is $6,000.

In order to be covered, the flight or cruise trip must be paid in full or partially using your Chase Freedom card or accumulated Ultimate Rewards ® . Immediate family members do not necessarily need to be traveling with the Freedom cardmember who booked the trip for the trip interruption or cancellation benefit to apply.

What’s the difference between trip interruption and trip cancellation?

Trip interruption insurance is a form of reimbursement for unused, prepaid and non-refundable travel expenses if a trip needs to be cut short by covered situations that come up during or after departure.

Trip cancellation insurance is a pre-departure benefit that can reimburse trip costs if a traveler needs to cancel their trip altogether due to unforeseeable and non-refundable circumstances.

There can be some subtle differences between the coverage provided in trip interruption versus cancellation insurance-covered situations. For more information, consult your Chase Freedom Guide to Benefits. The following is a summary of some applicable trip interruption or cancellation situations:

What is covered by Chase Freedom’s travel insurance?

The Chase Freedom card may cover trip interruption or cancellation from:

- Hurricanes, tornadoes, or other severe weather either impacting the point of origin or destination of your trip, as well as the airspace or route between the two points, that causes the cessation or cancellation of service by the airline or another type of common carrier, such as a cruise line. This also applies to hotels and resort destinations you may have booked when they are impacted by severe storms.

- Accidental bodily injury , or a severe illness prior to or during a trip that impacts the cardmember traveler, their traveling spouse or domestic partner, or their immediate relative—see cardmember Benefits Guide for details

- An organized strike impacting the common carrier (airline) or public transportation that causes you or your spouse or domestic partner to miss at least 20% of your booked itinerary

- A change in military orders for you, your spouse or domestic partner that requires you to cut short or cancel your trip

What’s not covered by Chase Freedom travel insurance

The following is a short list of common exclusions from Chase Freedom travel insurance:

- Trip interruption and cancellation insurance does not apply to trips lasting more than 60 days

- Trip interruptions or cancellations caused by the financial insolvency of a booked airline, tour operator or travel agency

- Any pre-existing medical conditions are not covered

Please note that these benefits are payable over and above any amount due from valid or collectible insurance, such as a travel insurance policy you may have taken out from an insurance company to insure you trip. Please also be aware that these benefits will not apply if you fail to contact the common carrier such as an airline and address any compensation you may be owed from the airline. Nor do these benefits apply to a voluntary situation when a cardmember accepts compensation in miles from an overbooking airline to take a later flight.

What Travel and Emergency Assistance Services are available to Chase Freedom cardmembers?

Chase through its Benefits Administrator offers a Travel and Emergency Assistance line that can be reached 24 hours a day, 365 days a year. This helpline can assist you with pre-trip information about your destination, such as currency exchange rates and the required visas and immunizations to visit a country. The Travel and Emergency Assistance help line can also assist with certain stressful situations that can arise while traveling in a foreign country, such as:

- Medical referral assistance to hospitals, doctors and dentists

- Legal referral assistance

- Arranging for emergency ground transportation to leave the country

Although the Travel and Emergency Assistance helpline can direct you to legal, medical, dental and transportation providers in the foreign country you are visiting, all costs associated with these services will be your responsibility.

Chase Freedom card coverage benefits for rental cars

The Chase Freedom Auto Rental Collision Damage Waiver (ARCDW) that comes with your Chase Freedom card can reduce some of the stress involved in renting a car, by offering some protection against damage or theft to domestic rental cars. Your cardmember benefit also can provide primary coverage for damage or theft to international car rentals. Note that in order for this coverage to apply, you must waive the rental car company’s own collision damage waiver coverage when reserving your vehicle and picking it up at the rental car counter.

Car rentals that last more than 31 days, as well as high-performance or luxury cars and boat rentals are not covered. Rental car provider, country and vehicle type restrictions apply—see your Guide to Benefits terms and conditions for details.

If there’s been a collision damaging your rental car, please report the damage to the rental car company before contacting the Benefits Administrator.

How to file a Chase Freedom travel insurance claim

If your flight or cruise line trip is interrupted or cancelled, contact the common carrier first to see if they can address the situation first, before contacting the Benefits Administrator.

In order to qualify for these benefits and file a claim for an interrupted or cancelled trip with the Benefits Administrator, you must:

- Take action within 20 days of your trip being cancelled or interrupted, by calling the Benefit Administrator using the number on the back of your card, or logging on to eclaimsline.com

- Provide the Freedom card statement for the travel expenses charged and any necessary documentation from your trip, such as your travel itinerary, unused or cancelled flight plane tickets or medical treatment records

- Submit all documentation requested by the Benefits Administrator within 90 days of your interrupted or cancelled trip

Final thoughts: What to know before you go

The trip interruption and cancellation insurance coverage that comes with booking holiday travel or vacations using your Chase Freedom card shouldn’t be viewed as a replacement, but as a supplement to any travel insurance policies you may purchase through an insurance company. Researching and purchasing a travel insurance policy is highly recommended if you plan to travel internationally for more than several weeks. Exclusions apply for trips that exceed 60 days duration — see your cardmember Benefits Guide for details.

Knowing that help is just a phone call away can be a relief when you are traveling to an unfamiliar destination or a foreign country. So too can be knowing you have collision damage coverage when renting a car in the U.S. or abroad using your Chase Freedom credit card.

- card travel tips

- credit card benefits

What to read next

Credit card basics how to find your frequent flyer number.

How do you find your frequent flyer number? Learn several ways you may be able to track down your number so you can use it when booking that flight.

credit card basics Guide to Chase Sapphire® travel insurance

Learn all about the travel insurance benefit that comes with Chase Sapphire Preferred and Reserve cards.

credit card basics How to use the Priority Pass app

The Priority Pass app allows users to more seamlessly discover digital features of Priority Pass to enhance their travel experience. Learn some ways to best use the app with an informative guide.

credit card basics Can I bring guests to a Priority Pass lounge?

One of the perks of Priority Pass is the opportunity to bring guests with you to a lounge. Most memberships allow lounge access for up to two guests.

- Saving & banking

- Cost of living & bills

- Cards & loans

The three best bank accounts with travel insurance bolted on: We pick our favourites and whether they're worth paying for

- Some bank accounts include annual worldwide travel insurance

- They often also include car breakdown cover and mobile phone insurance

- Although there is a monthly cost, having such an account may make sense

By Ed Magnus For Thisismoney.co.uk

Updated: 03:28 EDT, 9 August 2022

View comments

Many Britons will feel a bank account isn't something they're prepared to pay for - after all, most current accounts are 'free'.

However, some packaged bank accounts offer a host of benefits that added together could justify their monthly cost.

The typical perks include free annual worldwide travel insurance, car breakdown cover and mobile phone insurance, often with family members included.

There is also the convenience factor of having three insurance policies taken care of saving both time and effort in having to organise it separately.

Some bank accounts charge a monthly fee, but throw in perks such as annual worldwide travel insurance.

Michelle Stevens, banking expert at comparison site Finder, says: 'If you and your family are frequent travellers, then a current account with packaged travel insurance could be well worth the monthly fee, especially given the rising cost of travel insurance premiums in the last two years.

'But before signing up to any premium current account, it’s important you check that the terms of the travel insurance policy - as well as the other account features and perks - suit your needs.'

RELATED ARTICLES

Share this article

How this is money can help.

- Best savings rates: Compare branch and online savings accounts

She adds: 'Another benefit of getting free travel insurance with a current account is that a lot of people usually forgo it - up to 8.6million in 2019 - which is not an advisable move.

'If you get seriously injured abroad then the bill can reach hundreds of thousands of pounds, so having travel insurance included with a current account may result in a lot of people getting covered who may not have done so otherwise.'

We pick our three favourite current account deals for travel insurance, taking into account the monthly cost and the additional perks on offer.

1. Nationwide Flex Plus

This account offers worldwide travel insurance as well as mobile phone and European breakdown cover.

It does come with a £13 monthly charge, which, compared to other packaged bank accounts looks relatively cheap.

Its worldwide family travel insurance, includes winter sports, golf, weddings and business cover.

Nationwide offers worldwide travel, mobile phone and European breakdown cover and charges £13 a month for maintaining the account.

Cover for travel essentials includes luggage, documents and cash as well as protecting against travel-specific problems like delays, cancellations and medical expenses.

Then cancellation cover is up to £5,000, the medical expenses cover up to £10 million, whilst cover for travel disruption will be eligible when caused by natural disasters, or airline or travel end supplier failure.

The policy doesn't cover medical conditions unless they have been declared to Nationwide and accepted. In some instances, you can pay for a medical upgrade to your insurance policy.

Two other clauses to be aware of is that the longest trip length allowed is 31 consecutive days.

For any person to be insured who is aged 70 or over, they must buy an age upgrade to cover them.

Although the monthly cost will add up to £156 a year, it's possible to offset much of this during the the first year, thanks to Nationwide's current account switching incentive.

Non-Nationwide members can currently get £100 for switching, whilst members who switch to the Flex Plus account could get £125.

Saves the extra admin: Nationwide's annual travel insurance policy is worldwide, and covers a whole family for multiple trips, not just the individual account holder.

On top of travel insurance, account holders get vehicle breakdown cover both in the UK and the rest of Europe and mobile phone insurance for the whole family.

The car insurance is valid whether someone is a driver or a passenger in a vehicle, and comes with no excess to pay and unlimited callouts.

The mobile insurance covers mobiles belonging to the account holder and those belonging to their partner and dependent children. It covers for loss, theft, damage and faults.

2. Virgin Money's Club M Account

Virgin's Club M Account comes with a £14.50 monthly charge.

Similar to Nationwide, it offers 31 days' worldwide cover per trip. It will cover the account holder and a partner living with them if there're both under 75, so it's a little more generous on that front.

Virgin's worldwide family multi-trip travel insurance - includes winter sports, golf and weddings. Plus, 24 hour access to a doctor at home or abroad.

There's also cover for up to four dependents under 18 - either in full time education or living with the account holder.

Emergency medical treatment, includes falling ill with coronavirus while away, and cover for the journey home, if it's medically necessary.

It also covers lost, damaged or stolen items, and if the baggage is delayed, any essentials will be paid for in the interim period. It also includes cover for delays or missed departures and winter sports as standard.

Account holders are also covered when cancelling or cutting short a trip if they fall ill with coronavirus as long as they didn't know they had it and weren't being tested for it when they booked their trip.

The cover includes emergency medical, surgical, hospital, treatment and ambulance costs, as well as any additional accommodation and travel expenses if someone cannot return to the United Kingdom.

There is a maximum allowance of 31 days of worldwide cover per trip.

It covers the account holder and their partner living with them if they're both under 75. There's also cover for up to four dependents under 18.

A claim will be void if it relates to any medical treatment received because of a medical condition or an illness related to a medical condition which a person knew about at the time of opening the account.

What else?

On top of the travel insurance it also offers UK breakdown cover with no call out charges, whether as the driver or the passenger and offers help at the roadside and at home.

It also offers worldwide mobile phone and gadget insurance covering against loss theft, damage, and breakdown

Just make sure you've declared any pre-existing medical conditions and don't leave your valuables unattended to be fully covered.

Its Worldwide family multi-trip travel insurance - including winter sports, golf and weddings. Plus, 24 hour access to a doctor at home or abroad.

Virgin current account holders also benefit from various other perks.

It offers access to an easy-access linked savings account paying 1.71 per cent on balances up to £25,000. C ustomers can also benefit from 2.02 per cent on balances up to £1,000 in their bank account.

New customers switching to the Virgin Money Club M Account can also receive a bonus of 20,000 Virgin Points to spend with Virgin Red, thanks to Virgin Money's latest current account switching offer.

Virgin Red is a rewards club that turns everyday spending into points. Once you are a member, you can earn and spend Virgin Points across almost 200 different rewards.

The 20,000 Virgin Points boost means travellers could get a return flight to Barbados, the Bahamas or St Lucia, while bakery enthusiasts could turn their points into 100 sausage or vegan sausage rolls, 61 coffees or teas or 100 doughnuts or muffins.

3. Halifax Ultimate Reward Current Account

Halifax Ultimate Reward current account costs £17 per month, the equivalent of £204 per year. However, there are ways to dramatically reduce this via its cashback and switching offers.

The account includes a family travel insurance policy for the account holder, their spouse or partner and children aged 18 or under, or up to 24 if they're in full time education.

It includes cover for personal belongings, certain sports and activities such as winter sports golf trips.

At £17 a month Halifax is the most expensive of our three top picks. However, its £150 cash incentive and £5 monthly cashback could help account holders to significantly reduce the cost.

Its cover includes, up to £10million for hospital fees, repatriation, medical confinement, funeral and dental costs incurred if taken ill or injured on your trip.

Up to £5,000 in total for loss of pre-paid travel and accommodation expenses in the case of cancellation or curtailment.

It covers personal baggage up to £2,500 if it is lost, damaged or stolen. This includes up to £500 for valuables, and up to £500 for a single item or pair or set of items.

It also covers personal money up to £750 for loss, or theft. This includes up to £300 cover for cash. This is limited to £50 for under 16s.

Watch out:

Existing medical conditions are not covered, unless these are agreed with the insurer first, and an additional premium may be payable.

The longest trip length is 31 consecutive days. For winter sports, a maximum of 31 days cover in a calendar year.

Halifax's travel insurance covers personal Baggage up to £2,500 if it is lost, damaged or stolen.

It's also worth noting that a £75 excess per adult per incident may apply and to be covered trips must start and end in the UK.

All cover ends when the account holder turns 71. As long as the account holder is less than 71, their spouse or partner will also be covered until they reach 71.

Eligible children can also be covered so long as they are travelling with the spouse, partner or civil partner of the policyholder.

What else:

It also offers car breakdown cover with the AA. This covers any vehicle the account holder is travelling in, at the roadside or at home. But only in the UK.

For mobile insurance, it covers breakdown, accidental damage, loss and theft up to £2,000.

However, it only Covers one phone per account holder or two in the case of a joint account. An excess of £100 is payable on all successful claims.

The £17 fee makes it a little more expensive than a few others but there are ways to reduce the cost.

Halifax is currently offering a £150 switching incentive for those who switch from another current account.

On top of the £150 bribe there are other perks to take advantage of. There is a choice of £5 a month paid into the account, two film rentals or three magazine rentals, or a free cinema ticket each month.

In order to benefit from this account holders must choose to either Spend £500 on their debit card each month or Keep at least £5,000 in the account at all times.

They must also pay in £1,500 or more into your account each month and stay in credit - keeping your balance at £0 or above.

THIS IS MONEY'S FIVE OF THE BEST CURRENT ACCOUNTS

Chase Bank will pay £1% cashback on spending for the first 12 months . Customers also get access to an easy-access linked savings account paying 3.8% on balances up to £250,000. The account is completely free to set up and is entirely app based. Also no charges when using the card abroad.

Nationwide's FlexDirect Account offers 5% in-credit interest to new joiners when they switch on balances up to £1,500. This rate only lasts for one year. The account is fee free.

Halifax Reward Account pays £150 when you switch. Also earn up to an extra £75 cashback when you spend £750 each month for 3 months. There is a £3 monthly account fee, but that’s stopped by paying in at least £1,500 each month.

First Direct will give newcomers £175 when they switch their account . It also offers a £250 interest-free overdraft. Customers must pay in at least £1,000 within three months of opening the account.

NatWest's Select Account account pays £200 when you switch. The account has no monthly charges, but to be elligible for the £200, you'll need to deposit £1,250 into the account and log into mobile banking app within 60 days.

Share or comment on this article: Best bank accounts with travel insurance included

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Most watched Money videos

- Ford revives Capri with new electric SUV priced from £42,075

- Trump brands revised jobs data a 'massive scandal'

- Rolls-Royce's £2m Phantom Scintilla is inspired by Greek marble

- Ford Capri name returns but as a sporty electric SUV

- Lamborghini's new Temerario hybrid supercar can exceed 210mph

- We review the UK's cheapest EV - the £14,995 Dacia Spring

- Britain's favourite affordable SUV: We take a spin in the new MG HS

- Step inside new high-security vehicle storage facility near Gatwick

- Auctioneer sends iconic gold 2001 Lamborghini Diablo under the hammer

- Nineties Ford Escort RS Cosworth could sell for new auction record

- What to do if you're charged with energy bill due to expired meter

- 1992 Ford Escort RS Cosworth used by Jeremy Clarkson to be auctioned

MOST READ MONEY

Comments 31

Share what you think

- Worst rated

The comments below have not been moderated.

The views expressed in the contents above are those of our users and do not necessarily reflect the views of MailOnline.

We are no longer accepting comments on this article.

More top stories

- Best savings rates tables

- Find the best mortgage calculator

- Power Portfolio investment tracker

- Stock market data and share prices

- This is Money's podcast

- This is Money's newsletter

- The best DIY investing platforms

- The best bank accounts

- The best cash Isas

- The best credit cards

- Save on energy bills

- Compare broadband and TV deals

- How to find cheaper car insurance

- Investing Show videos

- Financial calculators

Best buy savings tables

- Cash Isa rates

- Instant access rates

- Fixed-rate bonds

- Bonus boosters

- Monthly income rates

- Phone/postal accounts

- Junior Isas and children's accounts

- National Savings & Investments

- MORE...

THIS IS MONEY PODCAST

- Gold price hits record high - should you invest in the precious metal?

- Why now might NOT be the time to fix your savings at 5%

- Five best cash Isas 2024: Top fixed-rate and easy-access deals

- Where to find the best savings rates as deals are pulled at lightning speed

- First new £1 coin design since 2017 enters circulation and features bees - are they a future collectible?

- I gave a friend £3,000 when I was drunk - can I legally get it back?

- Should you ditch your savings account now if it tracks the Bank of England base rate?

- Britain's favourite banks revealed with Monzo, Starling and Chase leading the pack

- How to get a top 6.1% one-year savings fix with Raisin and BEAT the best buys

- Should I pick local currency or pounds when paying by card abroad?

- Best inflation-beating savings rates: Here's where to find the best deals

MORE HEADLINES

DON'T MISS...

Inside saving & banking.

Premium Bonds Winners

More must reads....

Head Start to Home Cooked

This is Money is part of the Daily Mail , Mail on Sunday & Metro media group

- What is travel insurance?

- Average cost

- When to buy travel insurance

- Average cost by age

- What does travel insurance cover?

Travel Insurance Cost: Average Travel Insurance Prices in 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

- The average travel insurance premium this week is $297.42, down about 0.38% compared to last week.

- For travel in the United States, the average premium is $175 to $350.

- Travel insurance protects against delayed baggage, trip cancellation, and more.

The average cost of travel insurance fluctuates throughout the year, based on demand and whether or not school's in session. Also keep in mind that where you're traveling and how many people are taking the trip will affect your exact premium.

Understanding Travel Insurance

Travel insurance plans can cover both domestic and international travel. It could protect against something as familiar as delayed baggage (experts estimate 85% of lost luggage is returned to its owner within 48 hours) or as complicated as trip cancellation.

The benefits and limitations of travel insurance vary based on the company and plan. Above all else, this insurance coverage offers peace of mind.

Some credit cards offer a limited amount of travel insurance annually. If you need clarification on what your credit card offers, contact your provider to verify. These plans are great for cancellations and interruptions but may not cover more costly losses associated with unexpected medical expenses or emergency evacuations.

Individual travel insurance plans include this and much more. Travel insurance protects travelers from the unexpected when away from home.

Average Cost of Travel Insurance by Destination

Some countries are naturally more expensive travel destinations due to higher flight and lodging costs, which could increase travel insurance costs. Travel insurance will generally cost 5% to 10% of your total trip price, according to SquareMouth travel insurance .

Here's how the prices stack up:

Source: SquareMouth

How Far in Advance to Purchase Travel Insurance

According to an AAA travel survey , 88% of travelers say that reimbursement after a trip cancellation is the most valuable benefit of trip insurance.

According to data gathered by SquareMouth in the last six months, travelers tend to purchase trip cancellation travel insurance 53 days before their trip. Meanwhile, travelers without trip cancellation insurance will buy a policy approximately 16 days before their trip. Regardless of when you buy, cancellation protection can kick in to protect you against the unexpected.

Average Cost of Travel Insurance by Age

A traveler's age is a significant factor in determining the cost of travel insurance. The older a traveler is, the higher travel insurance premiums are. For instance, a senior traveler may need more insurance for health-related emergencies than a millennial.

When calculating your travel insurance premium, travel insurance providers consider the likelihood of a medical emergency.

Get your free travel insurance quote with SquareMouth »

Travel Insurance Rate Tips

Travel insurance rates through most providers fall between 4% and 8% of the total trip cost. Like the cost of flights, cruises, etc., rates may vary substantially based on the season, your original location, your destination, and other factors. This week, the average cost of a policy was close to $300.

To save money on travel insurance, tailor your policy to your specific needs and avoid unnecessary extras. You should also shop around to compare quotes from multiple insurers. Opting for an annual plan if you're a frequent traveler, checking existing coverages from other insurance policies or credit card benefits, and choosing a policy with a higher deductible can significantly lower your premiums. Always read the fine print to understand your coverage fully, ensuring you don't pay for redundant or irrelevant features.

To find affordable travel insurance, consider using online comparison websites like SquareMouth or InsureMyTrip to see rates from various providers. Other ways to save include purchasing directly from insurance companies, exploring package deals from travel agencies or airlines, utilizing included coverage from credit card benefits, and checking for discounts through membership organizations such as AAA or AARP.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best Global Payroll Services 2024

- Best Payroll Software for Accountants in 2024

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

Travel Insurance for Flight Cancellations: 2024 Guide

with our partner, Faye

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Taking off on a flight to your vacation destination is an exciting moment. But unforeseen circumstances can cause long delays and flight cancellations — and adventures cut short. That’s where travel insurance comes in. Travel insurance offers the assurance that you’ll get reimbursed for non-refundable travel costs from a travel insurance provider. Frequent or business travelers also benefit from this safety net for flight cancellations.

Flight insurance is usually sold as part of a comprehensive travel plan that includes trip interruption and trip cancellation coverage along with emergency medical insurance. Because most airlines aren’t required to compensate you for flight delays, trip delay travel protection helps you recoup losses for tours and accommodation.

Understanding Travel Insurance Coverage for Real Scenarios

When you buy travel insurance, comprehensive plans typically reimburse you the costs of canceled and delayed flights through travel delay coverage and trip cancellation insurance. Depending on the plan you choose, you can get reimbursed full refunds or prepaid costs once you qualify during the claims process. Reimbursements may include the money you paid for extra accommodations and food.

Whether you buy flight insurance with your airfare from major airlines or through another travel supplier, flight cancellation protection is subject to limited circumstances. These may include:

- Bad weather or natural disasters that cause the airline to cancel flights

- Medical emergencies causing you to cancel flights

- The unexpected death or illness of a family member or travel companion

- Delays caused by missed flight connections

For more flexibility, consider CFAR — cancel for any reason coverage. It’s still subject to exclusions and conditions, such as the requirement to cancel within 48 hours of the departure date. But the reasons for canceling are at your discretion. About 75% of prepaid non-refundable trip expenses get reimbursed.

Will Travel Insurance Cover Airline Cancellation?

According to the U.S. Department of Transportation , if an airline cancels your flight or makes changes that cause significant delays, you’re entitled to a refund if you choose not to reschedule. But the definition of a “significant delay” gets decided on a case-by-case basis, and refunds aren’t guaranteed.

Travel insurance covers the specific emergency reasons outlined in your policy. Under trip delay, interruption or cancellation policies, other expenses are covered. For example, if inclement weather results in a canceled flight with a delay to reschedule, you may need to cancel a non-refundable excursion through a tour operator. Insurance benefits help recoup these financial losses.

Does Travel Insurance Cover Delayed Flights?

If your flight is delayed significantly, an airline may offer to refund your money under certain conditions. Travel insurance features trip cancellation and trip delay benefits to reimburse you for applicable expenses incurred. Costs might include transportation, food and accommodations while you wait for a rescheduled flight if the airline doesn’t come through with hotel and food vouchers.

As a general rule, trip delay benefits apply after a specifically defined length of time. For example, you might need to be delayed for at least five hours to qualify for reimbursement or extra transportation. Daily spending limits typically apply for additional expenses incurred.

Will Travel Insurance Cover Costs if I Need to Switch Flights?

Travel insurance for flight changes is also available. But most policies don’t cover you if you simply change your mind about a flight. Trip interruption and cancellation policies cover a range of unforeseen circumstances. For example, a trip cancellation claim may reimburse the difference in cost between a canceled flight and a more expensive alternative to get you to a destination on time.

Does Travel Insurance Cover If Connecting Flights Get Canceled?

If your connecting flights get canceled, the airline may offer you a refund or put you on another flight (likely the latter). Travel insurance reimburses you for non-refundable trip costs relating to trip interruptions or cancellations. If you miss a connecting flight for reasons listed in your policy, part of your prepaid trip expenses get reimbursed along with any extra expenses you incurred to get pushed forward on your trip or to get home.

Choosing the Right Travel Insurance Plan

The quality of travel insurance plans varies. That makes it important to compare as you shop. When selecting a plan for flight cancellations, choose one with competitive coverage for the following:

- Trip cancellation coverage : This policy can reimburse you for non-refundable, prepaid trip costs for trips canceled for reasons that are covered by your policy, such as the death of a family member or a medical emergency. Reimbursements include airline tickets, hotel rooms and tours. Coverage limits can range from $10,000 for basic plans up to $300,000 for premium plans.

- Trip delay coverage : If your flight gets delayed for reasons that are covered in your policy, such as severe weather or airline maintenance, your plan provides financial relief for expenses, such as alternative transportation, food and accommodations. Basic plans may have a $300 coverage limit and a daily spending limit of $150.

- Trip interruption coverage : You may need to cut your trip short because of an injury or an unexpected event. Trip interruption coverage may reimburse you for non-refundable expenses including prepaid airline tickets and accommodation. Coverage limits can range from $5,000 for basic plans to $300,000 for premium plans.

While it’s possible to buy basic travel insurance with trip cancellation policies only, most are comprehensive. They include emergency medical and baggage loss coverage. Upgrades for CFAR, pre-existing medical conditions and rental car coverage provide further protection.

Use the tool below to find and compare rates for plans with flight insurance to suit your travel requirements.

Making a Claim for Flight Cancellations

To file a claim, most travel insurance companies offer systems via websites, apps and customer support teams available by phone and email. For flight cancellations , claims are usually filed under trip cancellation, interruption or delay coverage. With each claim, you’re required to present supporting documentation highlighting reasons for cancellation. This may include:

- Proof of an emergency or incident, such as a doctor’s certificate or a police report

- Copies of itineraries for all trip components claimed, including flight bookings

- Receipts for expenses incurred because of flight delays, such as meals and accommodations

Insurance companies process claims to approve them for reimbursement. Once complete, most companies send a payment to your selected account ( credit card , bank, etc.).

Common Challenges Travelers Face

You can get confused reading travel insurance policies as you figure out what’s covered and what’s not. A common challenge travelers encounter is misunderstanding a policy’s terms and conditions. As a general rule, travel insurance covers losses from unforeseen circumstances.

With flights and trip cancellations, covered reasons include emergencies, such as unexpected natural disasters, the death of a family member or a serious illness or injury. Otherwise, any flight cancellation refunds fall to the discretion of the airline.

Tips To Minimize Flight Cancellation Risks

Unless you experience an unexpected emergency, it’s possible to minimize the risks of flight cancellations and enjoy smooth journeys. Reduce the likelihood of it happening to you with the tips below.

- Book flights that depart early in the morning. Statistically, they’re the least delayed and least canceled.

- Choose nonstop flights to eliminate the risk of missed or delayed connections.

- Pick airlines with multiple flights to your destination per day for easy rescheduling if necessary.

- Ensure your airline offers a suitable cancellation policy.

- Travel a day or two in advance of events or celebrations that you don’t want to miss

- Monitor the weather at home and at your intended destination to be forewarned of potential cancellations.

- Implement backup transport plans if possible, including driving routes, ferry and train timetables.

Should You Get Travel Insurance For Flight Cancellations?

Travel is much more than a trip; it’s an investment. With so many things that can go wrong, it’s important to protect travel investments with comprehensive insurance for flight cancellations. Along with reimbursement for flights in emergencies, you’ll enjoy peace of mind knowing additional costs, such as hotel rooms and meals, are covered if your trip is delayed.

Frequently Asked Questions (FAQ)

What happens if my flight is canceled.

Your airline will put you on another flight or, in some cases, offer you a refund. Travel insurance protects with reimbursement for flights canceled via predetermined reasons covered by policies, along with additional expenses.

Do I need flight insurance?

We recommend flight insurance as a safety net for unexpected circumstances. These may include the death of a family member or a serious injury that results in canceling flights.

What does flight insurance normally cover?

As part of comprehensive travel insurance plans, flight insurance covers the cost of non-refundable, canceled flights subject to limited reasons. Most providers also offer coverage for flight delays and tours missed due to cancellations.

Does travel insurance cover hotel expenses if my flight is canceled?

Yes. Trip interruption and cancellation coverage provide reimbursement for hotel expenses, meals and alternative transport required due to canceled flights.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed.

IMAGES

COMMENTS

FlexPlus current account travel insurance provides cover for you and your family including business, wedding, golf and winter sports.

Nationwide provides travel insurance coverage. Do not let weather, cancelled flights, lost luggage, or certain medical emergencies ruin your trip.

This travel insurance includes cover for emergency medical and travel expenses, cancellation or cutting short your trip, missed, delayed or abandoned departures, lost, stolen or damaged belongings and personal liability cover.

This policy wording confirms who is eligible for Nationwide FlexAccount Travel Cover: 1) Eligible Nationwide FlexAccount holders. If you have taken the family upgrade option, cover applies to you and. 2) The Nationwide FlexAccount holder's partner. 3) The Nationwide FlexAccount holder's dependant children.

Explore the product features of Nationwide FlexPlus Travel Insurance for a comprehensive understanding of the coverage offered.

Nationwide has decided to axe its free European travel insurance offer for all existing FlexAccount customers who still have it from 31 December. This follows its earlier decision to stop offering the perk to new FlexAccount customers back in December 2016.

Nationwide offers many travel insurance tips, including when to buy travel insurance and whether your coverage is too little, too much or just right for you.

What does Nationwide travel insurance offer? Nationwide's travel insurance comes with its FlexPlus packaged current account, along with UK and European breakdown assistance and worldwide family mobile phone insurance. You will need to pay a £13 monthly fee for maintaining the account.

Annual travel insurance plans: Protect all your trips with one policy. Start your quote. Or call 1-877-970-9059. If you're a frequent traveler for work or fun, there's no reason to purchase travel insurance each time you take a trip. Instead, an annual travel insurance plan covers an entire year of trips. These plans can save you money even ...

Open a FlexPlus current account, a packaged bank account with travel insurance, breakdown recovery and mobile phone cover.

Nationwide travel insurance policies offer all the travel coverage you'd expect, with the option to purchase add-ons like cancel for any reason coverage.

Nationwide FlexPlus is a packaged bank account that gets you travel insurance, mobile phone cover and breakdown cover.

The frequently asked questions do not replace the terms and conditions of the policy. If you're still unsure, can't find what you're looking for or looking for answers relating to your NBS Flex account, please contact us . Covid-19 and your Travel Insurance Cover for pre-existing medical conditions

Do Chase Freedom credit cards come with travel insurance? All three currently issued Freedom cards: Chase Freedom Unlimited ®, Chase Freedom Flex ® and Chase Freedom Rise ® offer their cardmembers basic travel insurance covering trip interruption or cancellation. This covers certain ''what if'' situations that may impact your travel plans, providing reimbursement after a claim is ...

1. Nationwide Flex Plus. This account offers worldwide travel insurance as well as mobile phone and European breakdown cover. It does come with a £13 monthly charge, which, compared to other ...

Important information about your UK and European FlexAccount Travel Cover (underwritten by U K Insurance Limited) This policy information is correct as of 1 November 2019

Unlike individual travel insurance, group travel insurance does not factor the individuals' age into account. What it does factor in is the number of travelers and the total cost of the trip.

FlexAccount Travel Insurance summary of changes. Below you'll find an outline of certain changes that are being made to the FlexAccount Travel Insurance as a result of the coronavirus (Covid-19) pandemic. These will apply to any trips booked on or after 1 January 2021 and will form part of the travel insurance policy.

See Forbes Advisor's Nationwide travel insurance review for details about top-rated Nationwide travel insurance plans, benefits and average costs.

This travel insurance is a benefit of your Nationwide FlexPlus current account. If you close your account your travel insurance will be cancelled from the same date including any upgrades that you have.

The average travel insurance premium this week is about the same compared to last week. Travel insurance rates this week: Average premium: $297.42; Average trip cost: $6,576.04; Average trip ...

Discover how travel insurance can safeguard your travel investment when facing flight cancellations. Learn about coverage options, policy considerations, and essential tips for choosing the right ...

How to start your FlexPlus travel insurance, breakdown cover or mobile phone insurance claim, either online or over the phone.

C) What to do if you are booking or taking a trip. A) Some general questions you may have 1. Why is my FlexPlus Travel Insurance provider changing? U K Insurance Limited, who currently provide your FlexPlus Worldwide Family Travel Insurance, have decided to withdraw from some of the travel insurance market.

FCO travel advice 'All travel': Foreign & Commonwealth Offce advise against 'All travel' to your destination.The advice must have come into force after you opened your Nationwide FlexAccount, or booked your trip whichever is later.

FlexAccount Travel Insurance summary of changes. Below you'll fnd an outline of certain changes that are being made to the FlexAccount Travel Insurance as a result of the coronavirus (Covid-19) pandemic. These will apply to any trips booked on or after 1 January 2021 and will form part of the travel insurance policy.