Would you like to view this website in another language?

Travel allowance: A Comprehensive Guide for Employees

- Written by: Rinaily Bonifacio

- Last updated: 13 September 2024

This article will explain travel allowance, when and how you can use it, and tips for getting the most out of your expenses.

Table of contents

What is travel allowance?

How does business travel allowance usually cover, what is a flat travel allowance, what is the daily allowance, easy ways on how companies manage their procedures for business travel allowances, effective communication, how to manage business travel allowances.

Travel allowance is a type of compensation employers provide to cover employee travel expenses incurred when traveling for business purposes. It helps with employee travel costs, such as transportation, lodging, meals, and other incidentals while on the job. Depending on the company policy, travel allowance may be given in cash or as reimbursed expenses.

For example, some companies provide a fixed daily amount for meals and lodging that employees can use during their travels. Other companies cover expenses incurred by employees when they submit receipts after their trip has ended. This is known as per diem allowance or transport allowance.

Business travel allowance typically covers the cost of airfare, hotel accommodations, and meals. It may also include per diem allowances such as ground transportation, parking, and incidentals. The exact coverage will vary depending on the company's policies and the type of business trip.

A flat travel allowance is a set amount of money an employee provides for travel costs. The employee is responsible for managing the funds and ensuring they are used for the intended purpose. This allowance is typically used for short trips or employees who travel infrequently.

.png?width=323&height=124&name=img-16%20(1).png)

Employee scheduling and Time-tracking software!

- Easy Employee scheduling

- Clear time-tracking

- Simple absence management

A daily allowance, also known as a per diem, is a set amount of money provided to employees for money incurred daily while traveling for business purposes. It typically covers things such as

- Transportation

- And incidentals.

The allowance amount is usually based on the location and duration of the business trip and is intended to cover living costs for that specific location.

Daily allowances are provided in addition to other travel compensation types, such as lodging or airfare reimbursement. The amount and coverage of a daily budget will vary depending on the company's policies and the nature of the business travel.

Companies can manage their procedures for business travel allowances by establishing clear guidelines and policies. This should include information on who is eligible for the assistance, what travel costs are covered, and how to submit expense reports. Additionally, companies can use travel management software to track and approve payments and ensure company policy compliance.

It is also essential for companies to communicate effectively with employees about travel allowance policies so that they are aware of their rights and obligations. This can include providing training and support and regular updates on any policy changes.

By managing their procedures for business travel allowances in a clear and organized manner, companies can ensure that their employees have the resources they need to complete their business trips while also managing the company's expenses.

Another critical aspect of managing business travel allowances is to keep an eye on the per diem rates and lodging expenses. It is essential to ensure that these expenses are within the budget and are in line with the rates established by the General Services Administration (GSA). Companies should also consider implementing a system for meal allowance and car hire reimbursement, as well as for laundry services, parking fees, and other miscellaneous expenses.

To manage business travel allowances effectively, companies should establish clear guidelines for employees traveling within the continental United States and those traveling to foreign countries. This includes setting a budget for each travel and providing employees with the necessary forms for expense reporting and reimbursement.

In addition, companies can use data analysis to identify trends and patterns in travel expenses. This can help them make more informed decisions about travel policies and budgeting and potentially save money on future trips.

It's also important to consider the needs of business travelers and their families and to establish policies that support them. For example, companies may offer additional allowances for family members traveling with a business traveler or for international travel.

Overall, an efficient reimbursement system and clear travel policies can help ensure that employees are promptly reimbursed for their expenses and that the company's expenses are tracked and managed effectively. This can be a great way to manage business travel allowances and keep costs under control.

Written by:

Rinaily Bonifacio

Rinaily is a renowned expert in the field of human resources with years of industry experience. With a passion for writing high-quality HR content, Rinaily brings a unique perspective to the challenges and opportunities of the modern workplace. As an experienced HR professional and content writer, She has contributed to leading publications in the field of HR.

Please note that the information on our website is intended for general informational purposes and not as binding advice. The information on our website cannot be considered a substitute for legal and binding advice for any specific situation. While we strive to provide up-to-date and accurate information, we do not guarantee the accuracy, completeness and timeliness of the information on our website for any purpose. We are not liable for any damage or loss arising from the use of the information on our website.

Ready to try Shiftbase for free?

- Whistleblowing Policy

- First Aid in the Workplace

- Cell Phone Policy at Work

- Inclement Weather Policy

- Employee Non-disclosure Agreement

Are you ready to transfor your HR?

14 days trial, free support

- Simple employee scheduling

- Easy absence management

Travel and Expense

What is a travel allowance definitions and insights.

A travel allowance can be an effective way to manage employee travel expenses and manage costs for the employee.

When employees travel for business, there are myriad expenses, from hotels to taxis or ride-sharing services. Using a travel allowance can help give travelers flexibility and control while increasing compliance with tax regulations.

What Is a Travel Allowance?

A travel allowance is compensation paid by an employer to employees to cover expenses incurred when traveling for business. In addition to lodging and transportation, travel allowances are typically used for airfare, meals, and other expenses related to business travel. It is business travel compensation, provided either before or after travel is completed.

Managing business travel compensation can be complex and hard to manage. The way businesses handle travel compensation is changing, as leaders look to implement tools that aid travelers and companies alike.

Technology is transforming how companies manage all aspects of employee travel , including the creation and coordination of travel allowances.

Types of Travel Allowance

There are many types of travel allowances, which can be given upfront or based on a reimbursement schedule. Here is a look at some of the most common.

Fixed Travel Allowance

A fixed travel allowance is a flat rate that is offered to an employee, irrespective of the level of expenses incurred. Employees are responsible for managing their travel expenses and determining how to use the money best to accommodate their needs. It is commonly used with employees for short trips or who travel infrequently.

Typically, with a fixed allowance, if the employee spends less than the allocated amount, the employee can keep the difference. If the employee spends more, they are responsible for making up the difference. Businesses using fixed travel allowance should work with their tax professional to understand the implications of this practice.

Daily Travel Allowance

Also called a per diem, a daily travel allowance is an amount used for each day of travel and can be used for lodging, transportation, meals, and other travel expenses. Typically, a traveler will reconcile the per diem by submitting an expense report and receipts. The traveler will be reimbursed for any expenses they spent in excess and will return money that was unspent.

Travel Reimbursement

This travel allowance requires the traveler to submit receipts for actual expenses incurred, which are then reimbursed. This process can be cumbersome and time-consuming for the traveler. If reimbursement is not done in a timely manner, it can be burdensome for the employee, who is essentially lending money to the company. Fortunately, there are technologies available today to simplify this work.

Mileage Allowance

This type of allowance pays the employee for miles traveled on business. It is typically used when employees use their own car for business-related travel. Technologies can tracking and reimbursing for mileage simpler and more accurate.

Methods for Calculating Travel Allowances

When using travel allowances as part of a corporate travel program, one key consideration is how the travel allowances are calculated.

The process often has to consider the distance traveled and the time spent traveling. Here is one way to calculate a travel allowance.

Location and Days of Travel

Start by determining the location of the traveler at midnight on each day of travel. A day of travel is defined as a 24-hour period an employee is conducting business while traveling.

The day of travel ends when the next day starts or they return home from a business trip to their home or office. For example, if an employee leaves for a trip at 4 p.m., the first day of travel is from 4 p.m. that day until 4 p.m. the next.

Lodging allowances are provided based on whether an employee spends the night in accommodations other than their own home. Typically, lodging allowances are based on the location and the current price rates for various hotel categories, based on company preferences for the level of hotels allowed.

Unlike with other categories, usually lodging is an either/or determination. Employees are either allowed the lodging allowance or not based on the circumstances of the trip.

Like with lodging, meal allowances are usually based on the prevailing costs of meals in each location. It assumes that a traveler will have three meals a day.

Typically, a meal allowance covers both meals and incidentals, such as snacks. Often it is prorated based on the time in any given day a traveler is on the road.

The meal allowance may also be reduced if there are meals provided as part of the work travel, such as part of a conference registration fee or transportation ticket.

Managing Travel Allowances

Managing travel allowances is a complex task. Here are some tips on how to effectively implement and manage a program:

- Develop a Clear Policy. Travelers need to understand the specifics in your travel program and how allowances are used. The policy needs to spell out, for example, what expenses are allowed and not allowed and the ways in which allowances are calculated. Transparency is essential to ensure all employees understand how travel expenses are covered

- Consider Incidentals. Business travelers face many complexities and challenges. You want a policy that makes it easy for travelers to navigate while on the road. Be sure your policy covers costs that may arise, including parking, fuel, tips, laundry services, printing, internet fees, and luggage check fees

- Analyze Data. You need a system in place that collects and reports on travel data to allow you to better understand trends, shifts and challenges. With visibility into your travel program, you can make timely, well-informed decisions

Developing Travel Allowance Policies and Guidelines

If your company wants to develop a travel allowance policy, where should you begin?

The policy should be rooted in a broader travel policy which should consider the following:

- Scope. What aspects of business travel will your policy cover?

- Coverage. Determine which elements of travel the policy will cover, such as air travel, lodging, meals, incidentals, and ground transportation

- Reimbursement Types. Will your company use travel allowances and, if so, which types?

- Participation. How will policies be determined? Be sure to include staff from human resources, finance, and departments that frequently travel, in determining the policy

- Safety. Be sure your policy provides protection for employees while they are traveling

- Expense Reporting. Develop tools or adopt that will be used for the reporting of travel expenses, with an emphasis on scalability, technology integration, and ease of use

Technological Advancements in Travel Allowance Management

Technology is changing the way companies manage business travel . There are powerful platforms available today that integrate travel policies, allow for the booking of travel and itinerary management and provide robust data collection and travel.

Employees need access to easy-to-use tools that allow for the recording of receipts and other transactions, let them reconcile expenses and generate expense reports, and simplify approvals and routing.

SAP Concur solutions can provide companies with integrated business travel, expense, and invoice solutions. With SAP Concur solutions, companies can book travel, manage expenses, integrate with business systems, manage invoices, and more.

Learn more about how SAP Concur solutions can simplify your travel management .

Travel Allowances, Mileage and Per Diem Rates

Expenses for travel on official business by University employees are reimbursed at the following rates set by State legislation , the Internal Revenue Service (IRS), the US General Services Administration (GSA), US Department of State and the Department of Defense as applicable.

Transportation by Vehicle

University travelers are encouraged to use a state-owned or leased vehicle through Fleet Services . If a state-owned or leased vehicle is not available, travelers should use the least expensive method of ground transportation to meet their business needs.

When a personal vehicle must be used, the allowable IRS mileage rate, effective Jan. 1, 2024 is:

Mileage reimbursements up to 350 miles (round-trip) are reimbursed at the full IRS rate. For trips which exceed 350 miles, mileage above the first 350 miles is reimbursed at fifty percent (50%) of the full rate. Please refer to 1501.4 – Procedure on Ground Transportation Expenses Including Mileage Rates for more information.

Lodging and Meals (Per Diem)

Per diem is the allowable amount for room and meals based on the destination and dates of travel as detailed below. See 1501.5 – Procedure on Per Diem Rates and 1501.6 – Procedure on Lodging Accommodations for more information.

Reimbursement for lodging may be made only in the amount documented by an itemized receipt of actual lodging expenses from a commercial lodging establishment.

Effective for travel beginning March 1, 2023, the University will now utilize the lodging per diem rates set by the US General Services Administration (GSA), US Department of State and Department of Defense as applicable. Travelers should secure lodging no more than 50% higher than the lodging rates set for their destination and dates of travel. Lodging rates only apply to the nightly room rate charged by the establishment and do not include taxes and fees. Lodging obtained in excess of these rates will require additional information.

For more information on lodging rates, excess lodging and third-party lodging information see 1501.6 – Procedure on Lodging Accommodations .

University travelers are only eligible for meal per diem when they make an overnight trip. Partial day per diem is possible when the partial day is the day of departure or return for a trip, but it must be in conjunction with an overnight trip taken. Reimbursement of meals outside of overnight travel is not permitted.

Tax and tips for meals are included in the per diem rate. The cost of meals included in other related activities (registration fees, conference costs, hotel registration, etc.) may not be duplicated in reimbursement requests.

Effective for travel beginning March 1, 2023, the University will now utilize the per rates set by the US General Services Administration (GSA), US Department of State and Department of Defense as applicable.

For employees, all rates are loaded in Concur and will populate based on the dates and location of travel and the meals selected by the traveler for reimbursement.

For all other travelers:

- Look up the rate based on the destination and dates of travel utilizing the links above.

- First and last day of travel are calculated at 75% of the day’s total rate, regardless of the traveler’s time of departure or time of return.

- If a meal was provided to the traveler and not paid for out of pocket, that meal must be deducted from the full day’s per diem rate. A breakdown of meal rates are included in the links above.

- If meals are provided to the traveler on the first or last day of travel, the 75% calculation is taken first and then the full meal rate is deducted. For example, if dinner is provided on the first day of travel for a location with a $65 per diem rate the calculation will be $65 x 75% = $48.75 – $26 Dinner = $22.75.

- Per diem reimbursement for a given day of travel will never be less than the incidental rate for that day, regardless of the calculations above.

For more information on per diem rates, see 1501.5 – Procedure on Per Diem Rates .

- Travel and Payment Card Services

- Accounts Payable Software

- Accounts Receivable Software

- Travel & Expense Management

- Payment Automation

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Finance News

- Press Release

- Get Started

Travel Allowance: A Guide to Enhance Employee Experience

Managing employee travel expenses efficiently is crucial for both employees and employers. From understanding the types of travel allowance to the reimbursement process , we’ll explore key strategies and roadblocks encountered along the way. In the blog, we will discuss best practices for optimizing employee travel allowance to empower your workforce.

What is Travel Allowance?

Travel allowance is a crucial component of employee compensation, particularly for those who frequently embark on business-related journeys. Essentially, it serves as a reimbursement or coverage for expenses incurred during such trips, encompassing various aspects like transportation, accommodation, meals, and incidental costs.

In other words, travel allowance is a financial aid mechanism that ensures employees aren’t burdened financially when carrying out their professional duties away from the office.

Types of Travel Allowance

- Per Diem Allowance: This is a fixed daily allowance provided to cover meals, lodging, transportation, and other miscellaneous expenses. It offers simplicity and flexibility, as employees receive a predetermined amount for each day of travel, regardless of actual expenditure.

- Reimbursed Expenses: Some companies opt for a reimbursement model, wherein employees pay for their travel allowance upfront and then submit expense receipts for reimbursement. This approach requires thorough documentation but ensures that employees are reimbursed for their actual expenses.

- Flat Travel Allowance: In this scenario, employees receive a fixed amount of money upfront to cover their travel costs. They’re then responsible for managing these funds efficiently throughout their trip.

What is Covered as a Business Travel Allowance?

Business travel allowance typically extends to various aspects of travel, including:

- Airfare: Covering the cost of flights or other modes of transportation required for business travel.

- Lodging: Reimbursing expenses related to hotel accommodations or other lodging arrangements necessary during the trip.

- Meals: Providing funds or reimbursement for meals consumed during the business trip.

- Incidentals: This may include expenses like ground transportation, parking fees, Wi-Fi charges, and other miscellaneous costs incurred while traveling for work.

How Does the Travel Allowance Process Work?

Employees can request travel allowance by following a structured process set by their employer. Here’s a typical step-by-step guide for requesting a travel allowance:

1. Review Travel Allowance Policy

Before requesting travel allowance, employees should review their company’s travel allowance policy to understand the eligibility criteria, covered expenses, and the reimbursement process.

2. Submit a Travel Request

If the travel is planned, employees may need to submit a travel request or travel authorization form. This form typically includes details such as the purpose of travel, dates, destination, estimated expenses, and any pre-approved budget or allowance.

3. Expense Estimates

Based on the travel request, employees should estimate their expenses for transportation, accommodation, meals, and other incidentals. This helps in planning and budgeting for the trip.

4. Travel Approval

Once the travel request is submitted, it goes through an approval process . Managers or the finance team may review and approve the request based on the company’s policies and budget constraints.

5. Travel Booking

After approval, employees can proceed with booking their travel arrangements, such as flights, hotels, and rental cars. It’s essential to keep all booking receipts and confirmations for reimbursement.

6. Submit Expense Report

Upon completion of the trip, employees are required to submit an expense report . This report details all expenses incurred during the trip, along with receipts and any other required documentation.

7. Reimbursement Request

Along with the expense report, employees can request reimbursement for the total amount of expenses incurred or up to the approved travel allowance limit. The reimbursement request should be submitted according to the company’s reimbursement process, which may involve submitting the report through an online portal or directly to the finance department.

8. Approval and Payment

The submitted expense report and reimbursement request are reviewed and approved by the appropriate department. Once approved, the employee will receive payment for the approved amount, either through direct deposit or a check.

Roadblocks Encountered During Travel Allowance Process

Processing travel allowances can pose several challenges for employees. One of the main issues is the complexity of the reimbursement process, which often involves submitting detailed expense reports, collecting and organizing receipts, and adhering to strict company policies. This can be time-consuming and cumbersome, especially for employees who are not familiar with the process or have limited administrative support.

Another challenge is the potential for delays in reimbursement. Due to the manual nature of processing travel allowance, there may be delays in reviewing and approving expense reports, which can result in employees having to wait longer to receive their reimbursement. This can be frustrating for employees, especially if they have incurred significant expenses during their trip.

Additionally, there may be discrepancies in how travel allowance is interpreted and reimbursed. Employees may find it challenging to understand what expenses are eligible for reimbursement and what documentation is required, leading to confusion and potential disputes with the finance department.

Travel allowance processing can result in a frustrating and time-consuming experience for employees, highlighting the need for companies to streamline and simplify the reimbursement process to ensure a smoother experience for all parties involved.

How can Companies Improve Travel Allowance Processing for Employees?

To make the travel allowance processing more efficient and employee-friendly, companies can implement several strategies:

1. Clear Policies

Establishing transparent and easily accessible travel allowance policies is crucial. Clearly outline who is eligible for travel allowance, what expenses are covered, and the reimbursement process. Ensure that employees understand the policies and know where to find relevant information.

2. Utilize Technology

Implementing travel management software can streamline the reimbursement process. This software can automate expense tracking, submission, and approval, reducing manual errors and processing time. It can also provide real-time visibility into travel expenses, helping employees and managers make informed decisions.

3. Monitor and Adjust Per Diem Rates

Regularly review and update per diem rates to ensure they are in line with current travel costs. Consider factors such as inflation, seasonal variations, and changes in travel patterns. Providing competitive per diem rates can help attract and retain talent.

4. Data Analysis

Use data analytics to identify trends and patterns in travel expenses . This can help identify areas where costs can be reduced or processes can be improved. For example, analyzing data may reveal that certain travel routes are more cost-effective, allowing companies to optimize travel plans.

5. Consider Employee Needs

Recognize that business travelers have unique needs. Consider offering additional allowances or support for employees traveling with families or for extended periods. Providing flexibility in travel allowances can improve employee satisfaction and productivity.

Closing Thoughts

Travel allowance plays a pivotal role in facilitating business travel and ensuring that employees are adequately compensated for their expenses. By implementing transparent policies, leveraging technology, and monitoring expenses diligently, companies can optimize their travel allowance programs to benefit both employees and the organization as a whole.

Peakflo’s Travel and Expense Management solution plays a crucial role in simplifying and enhancing the employee travel allowance process. By leveraging Peakflo’s advanced features, such as automated expense tracking, real-time visibility into travel expenses, and seamless reimbursement workflows, companies can streamline their travel allowance processing. This not only reduces the administrative burden on employees but also ensures compliance with travel policies and timely reimbursement.

Peakflo empowers companies to provide a more efficient and employee-friendly travel allowance experience, ultimately enhancing employee satisfaction and productivity.

- travel and expense

Why Do You Need Expense Management Automation?

Top benefits of switching to automated expense reporting, how to automate corporate travel management in 2024, latest post, inverting the finance function pyramid: ai-powered cash application, inverting the finance function pyramid: ai-powered 3-way matching, invert finance function pyramid: ai-powered compliance check, peakflo renews soc 2 type 2 certification, ai-powered invoice processing for multi-entity companies.

- Accounts Payable

- Accounts Receivable

- Travel and Expense Management

- B2B Payment Software

- Invoice Management

- Procurement Software

- Product Tour

- Saving Calculator

© 2023 by Peakflo. All rights reserved.

Automated page speed optimizations for fast site performance

U.S. Department of State

Diplomacy in action.

The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated.

The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. Any further clarification of the area covered by a specific listing is contained in associated footnotes which can be viewed by selecting Foreign Per Diems By Location.

If you have questions regarding the per diem rates, please contact the Office of Allowances.

Office of Allowances Bureau of Administration U.S. Department of State Washington, DC 20522-0104 Telephone: (202) 663-1121 E-mail: [email protected]

All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. They should also seek information on the possible avoidance of taxes or their refund upon return to the United States or their post of assignment.

Separate amounts are established for lodging and meals plus incidental travel expenses (M&IE). The maximum lodging amount is intended to substantially cover the cost of lodging at adequate, suitable and moderately-priced facilities. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. The maximum per diem rates for foreign countries are based on costs reported in the Hotel and Restaurant Survey (Form DS-2026) submitted by U.S. government posts in foreign areas. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes. The meal portion is based on the costs of an average breakfast, lunch, and dinner at facilities typically used by employees at that location, including taxes, service charges, and customary tips. The M&IE rate is based on these meal costs plus an additional amount, equal to 10% of the combined lodging and meal costs, to cover incidental travel expenses.

In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. Those agencies that receive complaints about a per diem rate for a locality where there is frequent travel may submit a request to the Department of State for review. This request should include cost data on lodging and meals using Form DS-2026. This information must be submitted in accordance with instructions in section 074 of the Department of State Standardized Regulations (DSSR).

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1455343084-7c3f06178d5b4542877f21112a21d8b2.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

NEW: Run stress-free performance reviews that work your way - find out more

Say Hello To The Future of Filing

Organise your employee data.

Latest blog posts, travel allowance: how it works for employers.

A travel allowance is an optional perk offered by the employer and is discussed on a case-by-case basis between the employer and the employee. The goal of the travel allowance is to help commuters financially. This article will give you all the information you need about the travel allowance, covering the benefits and rules that come with it.

- 1 What is a travel allowance?

- 2 Using travel allowance to retain employees

- 3 Travel allowance: employer's tax responsibility

- 4 How to calculate travel allowance

What is a travel allowance?

In the UK, a travel allowance is a form of financial assistance provided by employers to employees to cover their commuting costs. This allowance helps employees offset the expenses incurred while traveling between their residence and their workplace.

Here's how a travel allowance typically works in the UK:

Employer decision: The provision of a travel allowance is at the discretion of the employer. It's not a mandatory benefit and is usually offered as an incentive to attract and retain employees.

Negotiation and agreement : If an employer offers a travel allowance, the terms are usually negotiated and agreed upon between the employer and the employee. This can include the amount of the allowance, the frequency of payment and any specific conditions.

Commute distance: The travel allowance may be influenced by the distance the employee has to travel to reach their workplace. Longer distances often result in higher allowance amounts.

Taxation : In the UK, travel allowances are subject to taxation. The amount of tax varies depending on various factors, including whether the allowance is considered a taxable benefit or not. Generally, travel allowances are subject to income tax and National Insurance contributions.

Claiming expenses: Alternatively, some employers may provide a travel expense reimbursement system instead of a fixed allowance. In this case, employees can claim expenses for their actual travel costs, such as public transport fares or mileage if they use their own vehicle for commuting.

Reporting and documentation : Employers and employees need to keep accurate records of travel expenses, such as receipts for public transport tickets or mileage logs. These records are important for tax purposes and may be requested by tax authorities.

Tax relief: Some employees may be eligible for tax relief on their travel expenses. This is typically applicable if an employee's travel is necessary for their job and the employer doesn't reimburse the full amount of expenses. The employee can claim tax relief through HM Revenue and Customs (HMRC).

Cycle to work scheme: In the UK, there's a specific scheme called the "Cycle to Work" scheme, which allows employees to obtain bicycles and cycling equipment through salary sacrifice, thereby saving on tax and National Insurance contributions.

Public transport schemes: Some employers may offer discounted or subsidised public transport schemes to their employees as part of their travel allowance benefits.

It's important to note that the specifics of how a travel allowance works can vary from one employer to another. Additionally, tax laws and regulations may change over time, so it's essential to stay informed about the latest guidelines.

Using travel allowance to retain employees

The rising rents in major cities will likely lead more employees to relocate to rural areas in the future. The scarcity of skilled professionals makes finding capable employees even tougher due to sometimes lengthy commutes.

Despite the high number of commuters, many employees prefer workplaces close to home to minimise travel time and expenses. Employers can use travel allowances as an extra tool for retaining employees, alongside other measures.

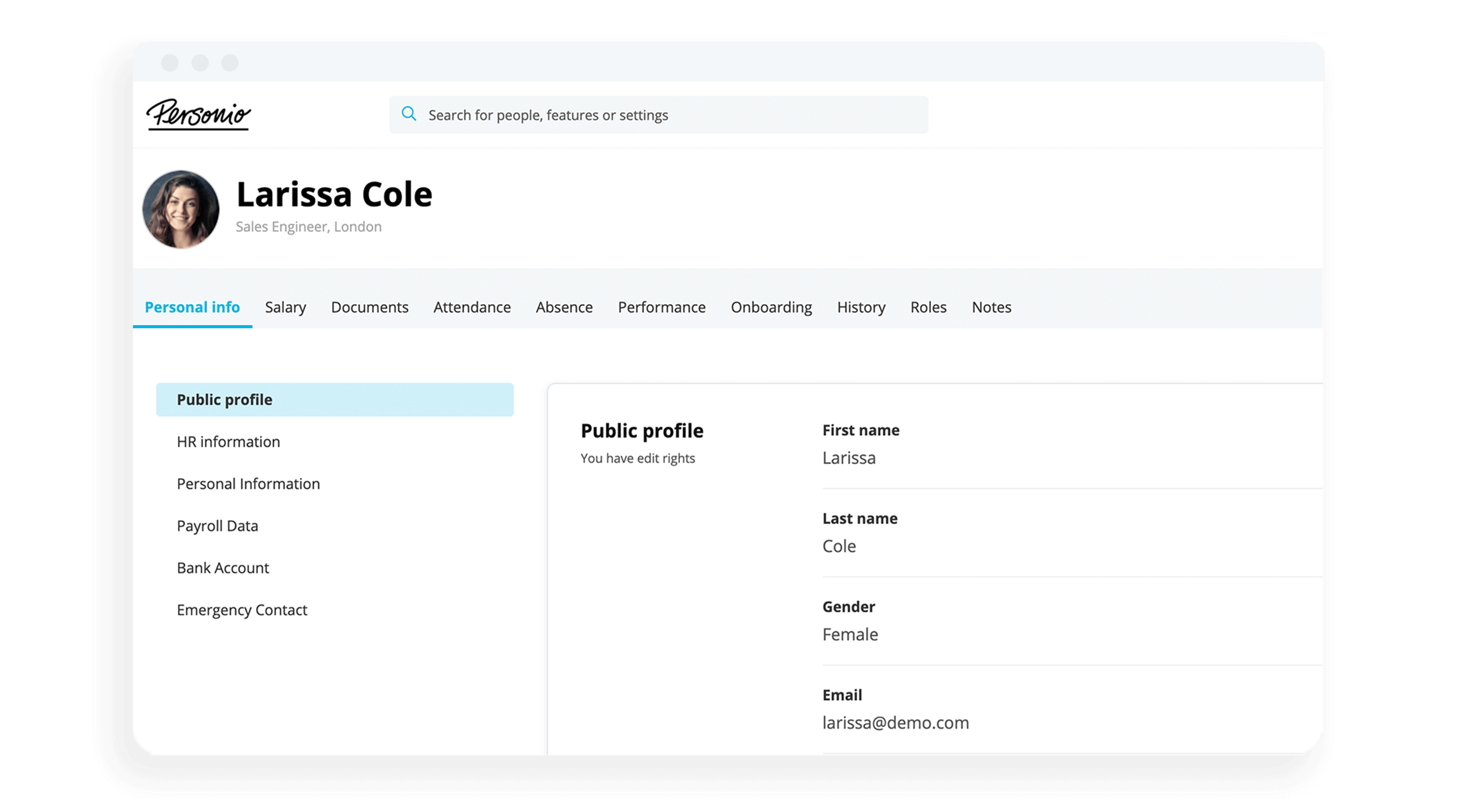

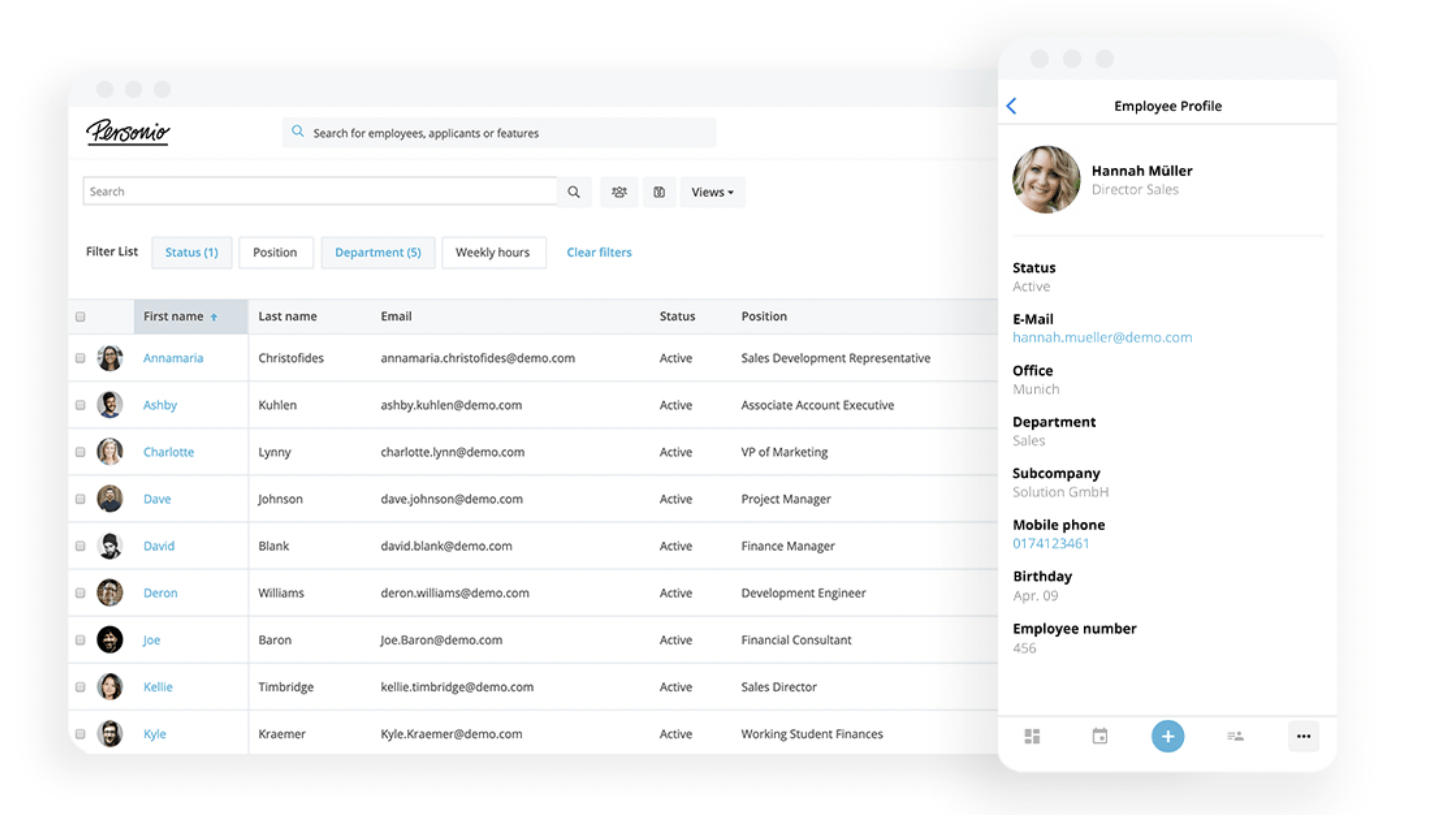

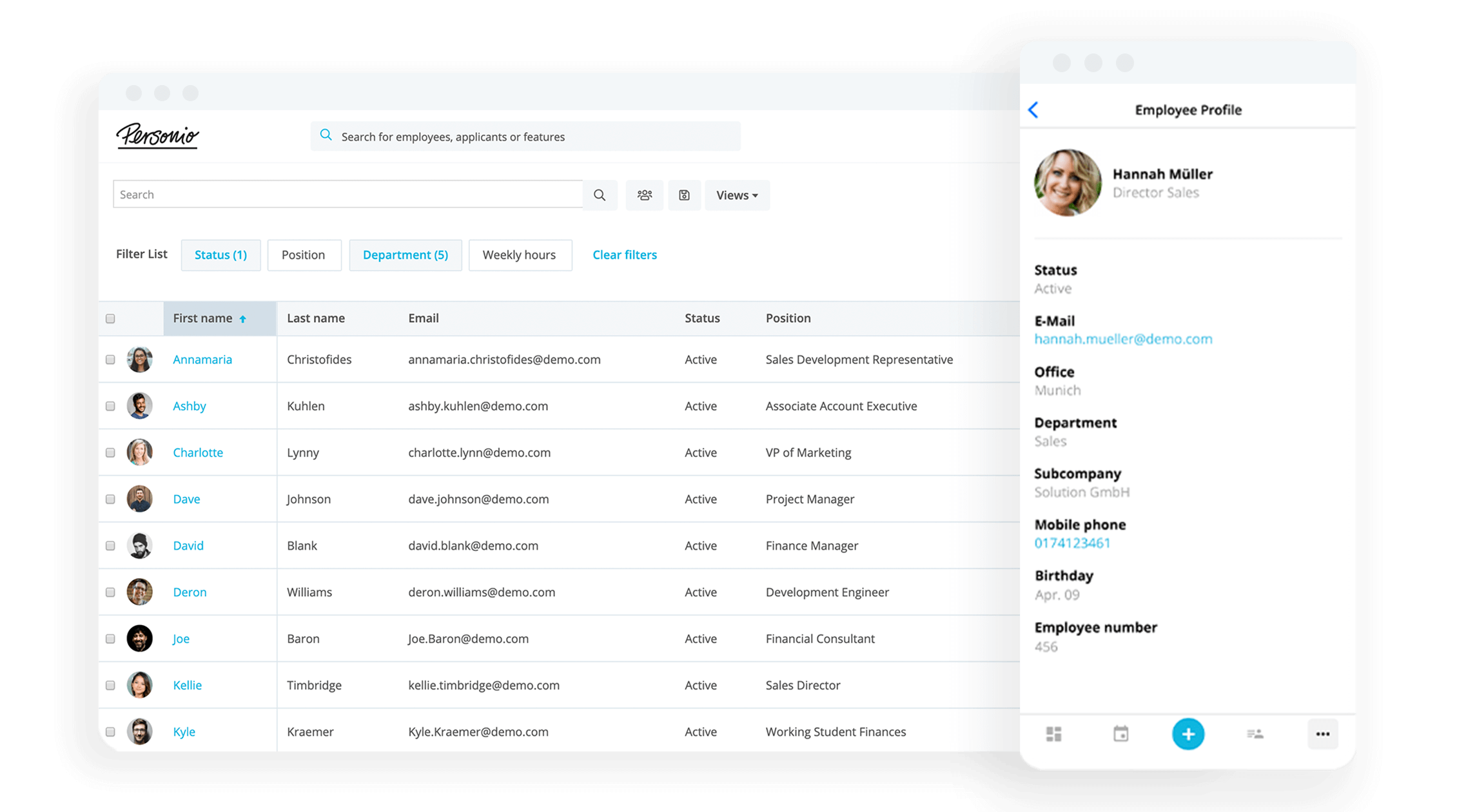

Centralise Your Employee Data

Stop relying on lists and spreadsheets. Organise and edit personnel files and documents with ease, all in one secure, legally compliant place.

Travel allowance: employer's tax responsibility

An employer's tax responsibility for a travel allowance in the UK involves ensuring proper taxation and reporting of the allowance according to the guidelines set by HM Revenue and Customs (HMRC). The tax treatment of a travel allowance depends on various factors, including the nature of the allowance and the method of payment.

Here's an overview of an employer's tax responsibilities for a travel allowance:

Classifying the allowance: Employers need to determine whether the travel allowance is a taxable benefit or an expense reimbursement. This classification affects how the allowance is treated for tax purposes.

Taxable benefit: If the travel allowance is considered a taxable benefit, it will be subject to income tax and National Insurance contributions. Employers are responsible for deducting the appropriate tax and National Insurance from the allowance before paying it to the employee. The value of the taxable benefit is usually calculated based on the amount of the allowance provided.

Expense reimbursement: If the travel allowance is purely a reimbursement of actual expenses incurred by the employee, it may not be subject to income tax and National Insurance. However, the reimbursement must be supported by valid receipts or documentation, and the expenses must be directly related to the employee's business travel.

Flat Rate Scheme: In some cases, employers may choose to use a flat rate scheme for travel allowances. This involves applying a fixed amount for tax purposes, regardless of the actual expenses incurred. The use of a flat rate scheme is subject to HMRC's rules and limitations.

Record keeping: Employers are responsible for maintaining accurate records of the travel allowances provided to each employee. Proper documentation should include details of the allowance, dates, amounts, and the purpose of the travel.

Reporting to HMRC : Employers are required to report taxable benefits and expenses provided to employees on the annual P11D form. This form outlines the value of benefits and expenses provided during the tax year. Employers must submit the P11D form to HMRC and provide a copy to the employee.

PAYE Settlement Agreement (PSA): In certain cases, employers may choose to include travel allowances within a PAYE Settlement Agreement (PSA). A PSA allows employers to settle the tax liability on behalf of the employee, simplifying the reporting process.

Compliance: Employers must ensure compliance with all relevant tax laws, regulations, and guidelines when providing travel allowances to employees. Failure to accurately report and deduct the appropriate taxes can lead to penalties.

It's important for employers to stay informed about any changes in tax laws and regulations related to travel allowances. Consulting with tax professionals or seeking guidance from HMRC can help ensure that an employer's tax responsibilities are met accurately and in line with the current regulations.

How to calculate travel allowance

Calculating a travel allowance in the UK involves considering various factors, including the distance of the commute, the method of transportation and whether the allowance is a flat rate or based on actual expenses.

Here's a general overview of how travel allowances can be calculated:

1. Determine the method of calculation: Some employers use a flat rate for travel allowances. In this case, a fixed amount is provided for each qualifying journey. Alternatively, employers may reimburse employees for the actual expenses incurred during their commute. This requires employees to provide valid receipts or documentation.

2. Calculate the commute distance: For a flat rate allowance, the commute distance may not be a direct factor in the calculation. For reimbursement based on actual expenses, calculate the distance between the employee's home and workplace. This can be done using tools like Google Maps or GPS devices.

3. Calculate the allowance amount: If using a flat rate, the employer decides on a fixed amount to be paid per qualifying journey. This amount could be based on typical travel costs, distance, or other relevant factors.

If reimbursing actual expenses, the allowance amount would be based on the expenses submitted by the employee. These expenses may include public transport fares, mileage for using a personal vehicle, parking fees, and tolls.

4. Take into account tax considerations: Determine whether the travel allowance is taxable or not. Taxable allowances are subject to income tax and National Insurance contributions, while non-taxable reimbursements are not.

5. Report and document everything: Keep accurate records of the allowance calculations, receipts and documentation for each employee. This is important for tax reporting and compliance.

6. Decide on frequency of payment: - Decide how frequently the travel allowance will be paid (e.g. weekly or monthly).

7. Notify employees: Communicate the details of the travel allowance calculation method, amount and payment schedule to employees.

8. Apply tax and national insurance deductions: If the travel allowance is taxable, deduct the appropriate income tax and National Insurance contributions before paying the allowance to the employee. The amount deducted depends on the employee's tax code and earnings.

It's important to note that travel allowance calculations can be complex, and employers should ensure compliance with HMRC guidelines and regulations. Employers may also consider consulting with tax professionals or payroll experts to ensure accurate calculations and reporting. Additionally, employees should be aware of the tax implications and any reporting requirements related to the travel allowance they receive.

We would like to inform you that the contents of our website (including any legal contributions) are for non-binding informational purposes only and does not in any way constitute legal advice. The content of this information cannot and is not intended to replace individual and binding legal advice from e.g. a lawyer that addresses your specific situation. In this respect, all information provided is without guarantee of correctness, completeness and up-to-dateness.

Keep Vital Data At Your Fingertips

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the Administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

M&IE breakdowns

Fy 2025 m&ie breakdown now available.

Please note! The FY 2025 rates are NOT the default rates until October 1, 2024.

You must follow these instructions to view the FY 2025 M&IE Breakdown. Navigate to the “Per diem files” page from the left navigation panel. Under the “Meals & incidental expenses breakdown” heading, click on the “FY25 M&IE Breakdown” file.

The meals and incidental expense (M&IE) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished by the government or included in a registration fee from their M&IE allowance consistent with Federal Travel Regulation 301-11.18 . Meals provided by a common carrier or a complimentary meal provided by a hotel/motel do not affect per diem ( 301-11.17 ).

M&IE breakdown for foreign and non-foreign areas outside the continental U.S. (OCONUS)

For M&IE rates greater than $265, allocate 15%, 25%, and 40% of the total to breakfast, lunch, and dinner, respectively. The remainder is the incidental expense allowance.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2022 and 09/30/2025.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Here’s what taxpayers need to know about business related travel deductions

More in news.

- Topics in the news

- News releases

- Multimedia center

- Tax relief in disaster situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax scams and consumer alerts

- The tax gap

- Fact sheets

- IRS Tax Tips

- e-News subscriptions

- IRS guidance

- Media contacts

- IRS statements and announcements

IRS Tax Tip 2022-104, July 11, 2022

Business travel can be costly. Hotel bills, airfare or train tickets, cab fare, public transportation – it can all add up fast. The good news is business travelers may be able to off-set some of those costs by claiming business travel deductions when they file their taxes.

Here are some details about these valuable deductions that all business travelers should know.

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. The travel period must be substantially longer than an ordinary day's work and a need for sleep or rest to meet the demands the work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business and there are special rules for conventions held outside North America .

Deductible travel expenses while away from home include the costs of:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station to a hotel, from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business which can include an increase in mileage rates .

- Lodging and non-entertainment-related meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records, such as receipts, canceled checks, and other documents that support a deduction.

More information:

- Publication 463, Travel, Gift, and Car Expenses

- IRS updates per diem guidance for business travelers and their employers

Subscribe to IRS Tax Tips

Your browser doesn't support javascript. This means that the content or functionality of our website will be limited or unavailable. If you need more information about Vinnova, please contact us .

Our e-services for applications, projects and assessments close on Thursday 19 September at 4:30pm because of system upgrades. We expect to open them again on Friday 20 September at 8am the latest.

You're using version {0} of the web browser {1}. This means that the content or functionality of our website may be limited or unavailable. We recommend that you upgrade your browser to optimise your experience of our website.

- We open the way for innovation that makes a difference

- Big Science Sweden - Sveriges Industrial Liaison Office (ILO)

- Industrial production and manufacturing

- Bio-based materials and polymers

- Biomedical engineering

- Medicines and biotechnology

- Construction materials

- Food and agriculture - granted project

- Metallic materials and mining

- Environmental technology and recycling

- Aircraft and vehicles

- Energy applications

- Magnetic materials

- Nanotechnology and nanomaterials

- Chemistry and catalysis

- Electronics

- A new office will help the market benefit from research facilities in Lund

- Climate neutral and circular production

- Resource efficient and resilient value chains

- Global competitiveness

- A socially sustainable industry

- Sustainable food systems of the future – innovation for health, environment and competitiveness

- Framtida EU-program för hållbara livsmedelssystem

- Follow and contribute to the programA new recipe for the food system

- A new recipe for the food system

- School meals should speed up the transition to a sustainable food system

- The food of the future

- Agriculture of the future

- The trade of the future

- Sustainable mobility

- Government assignment to follow the Swedish life science sector

- International cooperation in health

- Power gathering for sustainable precision health

- Government assignment on support to public actors to strengthen the work with policy development

- Major Swedish involvement in European call for proposals on urban transformation

- EU:s Cities Mission kan snabba på utvecklingen av klimatneutrala städer i Sverige

- Do you want to develop work with innovation in the public sector?

- Basic capacity and innovative capacity

- Next generation digital systems and solutions

- Transformative technology areas - cutting edge technology

- Mobilization for societal transformation

- Extended reality (XR) - en lovande framtidsteknik

- How deeptech can create a safer and more sustainable Sweden

- Deeptech companies important for Swedish competitiveness

- What is Vinnväxt?

- iHubs Sweden

- Emerging innovations

- Learn more about innovation

- Our international work

- Find the right funding

- Things to think about before budgeting and accounting

- State aid for economic activities (companies)

- How to apply for funding

- Follow up on results

- Words and roles that are good to know

- This is how it works

- Meetings and collaboration arenas

- Press photos

- Subscribe to our newsletter

- Current affairs within Horisont Europa

- Funding from Horizon Europe

- The basics of the regulations for Horizon Europe

- Support for small and medium-sized enterprises

- National contact persons for Horisont Europa

- Official documents and confidentiality

- Personal data

- Your rights to get information and guidance

- Aktuella regeringsuppdrag

- Regeringsuppdrag slutrapporterade 2024

- Government assignment final reporting in 2023

- Regeringsuppdrag slutrapporterade 2022

- Regeringsuppdrag slutrapporterade 2021

- Regeringsuppdrag slutrapporterade 2020

- Regeringsuppdrag slutrapporterade 2019

- Regeringsuppdrag som slutrapporterades 2018

- Regeringsuppdrag som slutrapporterades 2017

- Our organization

- Postdoctoral fellowships standard programme - JSPS

- Vinnovas värdegrund

- Our terms of employment

- Invoicing Vinnova

- Submitting a tender

- Internal whistleblower channel

- Funded projects

- Our reports

- Project database

Travel allowance 2024, Canada, Sweden Canada Innovation Days, 1st-3rd October

Last updated 19 September 2024

Reference number 2024-03083

IMAGES

VIDEO

COMMENTS

Per diem is a daily allowance for travel expenses, such as lodging and meals. GSA provides the standard and individual rates for CONUS and OCONUS areas, which can be searched by city, state, or ZIP code.

Find competitive and negotiated rates for airfares, hotels, per diem, and other travel services for federal employees on official business. Search by city, date, or location for domestic and international destinations.

Learn what travel allowance is, how it covers business travel expenses, and how to manage it effectively. Find out the difference between flat and daily allowance, and how to use travel management software and policies to optimize your budget.

Learn how to deduct car expenses for business or personal use, including standard mileage rate, actual expenses, depreciation, and section 179 deduction. Find out the rules and limits for employer-provided vehicles, leased cars, and casualty losses.

Per diem is a set allowance for lodging, meal and incidental costs incurred while on official government travel. DTMO publishes revised per diem rates in the Federal Register via a Civilian Personnel Per Diem Bulletin.

Per diem is an allowance paid to employees for travel expenses. Learn how to calculate, report, and pay per diem, and when it is taxable or not.

The JTR establishes travel and transportation allowances for Uniformed Service members, DoD civilian employees, and others traveling at the DoD's expense. It covers topics such as per diem rates, authority, governance, policy change process, and policy questions and clarifications.

Learn what a travel allowance is, how it is used to cover business travel expenses, and how to manage it effectively. Find out the different types of travel allowances, how to calculate them, and how to develop a clear policy and use technology to simplify the process.

Learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. Find out the rules for tax home, temporary or indefinite work assignment, conventions, and standard meal allowance.

When a personal vehicle must be used, the allowable IRS mileage rate, effective Jan. 1, 2024 is: 67 cents per mile. Mileage reimbursements up to 350 miles (round-trip) are reimbursed at the full IRS rate. For trips which exceed 350 miles, mileage above the first 350 miles is reimbursed at fifty percent (50%) of the full rate.

Learn the IRS rules and options for reimbursing employee travel expenses, such as deductible expenses, tax home, assignment duration, and travel policy. This paper by AGC of America provides practical advice and examples for construction employers and employees.

Find answers to common questions related to DoD travel policies and programs, such as per diem allowances, travel documents, and reimbursement. Access more than 800 additional FAQs in the TraX Knowledge Center.

Learn about the Federal Travel Regulation (FTR) set by GSA for most Executive branch agencies, including per diem and mileage rates, and how to contact your internal agency travel policy office. Find answers to common travel questions and access the latest FTR amendments and bulletins.

Learn what travel allowance is, how it works, and how to optimize it for employees. Find out the types, covered expenses, and roadblocks of travel allowance, and how to use technology and data to improve it.

Per diem is an allowance for lodging, meals, and incidental expenses for official travel. Learn how to find the per diem rate for your destination, what is considered an incidental expense, and how to request a special review of a non-standard area.

Learn how to claim travel expenses for work-related trips, such as fares, lodging, meals, and tips. Find out the rules for employees, self-employed, farmers, and military reservists.

Find the current and prior monthly rates for lodging and meals plus incidental expenses (M&IE) for U.S. Government civilians traveling in foreign areas. See the breakdown of rates by meals and incidentals, the list of foreign areas, and the regulations and contact information for per diem inquiries.

Learn what travel expenses are, which ones are tax-deductible, and how to record them. Find out the types of expenses, such as airfare, lodging, meals, and personal vehicle costs, that can be ...

A travel allowance is an optional perk offered by the employer and is discussed on a case-by-case basis between the employer and the employee. The goal of the travel allowance is to help commuters financially. This article will give you all the information you need about the travel allowance, covering the benefits and rules that come with it.

The meals and incidental expense (M&IE) breakdowns in the tables below are provided should federal travelers need to deduct meals furnished by the government or included in a registration fee from their M&IE allowance consistent with Federal Travel Regulation 301-11.18. Meals provided by a common carrier or a complimentary meal provided by a ...

Find out the per diem allowance for lodging, meal and incidental costs incurred while on official government travel. Learn about the breakdown of Government and Proportional meal rates and information on meal tickets.

Learn how to get reimbursed for mileage and other travel expenses to and from VA health care or approved non-VA care. Find out if you're eligible, what expenses are covered, and how to file a claim online or by mail.

Learn how to claim deductions for business travel expenses paid or incurred in 2022. Find out the rules, requirements and examples for different types of travel, such as conventions, self-employment and military service.

Travel allowance 2024, Canada, Sweden Canada Innovation Days, 1st-3rd October. Travel allowance 2024, Canada, Sweden Canada Innovation Days, 1st-3rd October. Reference number: 2024-03083: Coordinator: Katam Technologies AB : Funding from Vinnova: SEK 25 000: Project duration: September 2024 - ...