Can You Cash American Express Travelers Checks

Sharing is caring!

As a frequent traveler, I always make sure to have enough cash and cards for my trips. However, there are times when these options may not be available or convenient. That’s where travelers checks come in handy.

In this article, we’ll discuss American Express travelers checks and answer the question: can you cash them?

First and foremost, it’s important to understand what travelers checks are. They’re essentially prepaid checks that you can use as a form of payment while traveling. Unlike cash or credit cards, they offer added security as they can be replaced if lost or stolen.

American Express is one of the most popular issuers of travelers checks, but not all places accept them for payment. So let’s dive into the details of how to cash American Express travelers checks and what fees and exchange rates to consider before doing so.

Table of Contents

Understand the Basics of Travelers Checks

Learning the fundamentals of using travelers checks involves grasping their basic concepts and functions. Travelers checks are pre-printed, fixed-amount checks that can be used to make purchases or get cash while traveling abroad. They were designed to provide a safe and convenient alternative to carrying large amounts of cash.

Travelers checks are available in various denominations and currencies, making them an ideal option for people who need to travel internationally. To use travelers checks, you simply sign each check in front of the person accepting it as payment or when cashing it at a bank or currency exchange office. Once signed, the check becomes valid and can be redeemed for its face value.

Travelers checks provide peace of mind because they can be replaced if lost or stolen. American Express is one company that offers travelers checks which can be exchanged for local currency at banks, hotels and other locations around the world. Knowing where to cash American Express travelers checks is essential when planning your trip abroad.

There are many places where you can cash these checks such as banks, currency exchange offices, hotels and airports. However, some locations may charge fees or have restrictions on how many travelers checks they will accept per transaction. It’s important to research ahead of time so you know where to go without any problems during your travels.

Know Where to Cash American Express Travelers Checks

This section’s all about where to convert those little slips of paper into cold, hard cash and boy oh boy, you’re in for a treat! American Express Travelers Checks can be cashed at many locations around the world.

The first place to check is with your hotel or resort. Most hotels will allow their guests to exchange travelers checks for cash, but be sure to ask if they charge any fees.

Additionally, banks are also a great option for exchanging travelers checks. Many banks won’t charge fees if you have an account with them.

If you’re traveling internationally, it’s important to note that some countries may not accept American Express Travelers Checks as readily as others. In this case, it might be a good idea to research ahead of time which places will accept them.

Another thing to consider is the exchange rate and any associated fees when converting your travelers checks into local currency. We’ll dive deeper into these considerations in the next section about ‘consider the fees and exchange rates’.

Consider the Fees and Exchange Rates

When it comes to cashing American Express travelers checks, it’s important to consider the fees and exchange rates involved. Service fees and commissions can vary depending on where you go, as can conversion fees for exchanging the checks into local currency.

It’s also worth comparing these costs with other payment methods to ensure you’re getting the best deal possible.

Service Fees and Commissions

Don’t miss out on important information about service fees and commissions when using Amex traveler’s checks. While American Express travelers checks are widely accepted around the world, it’s important to note that there may be service fees and commissions associated with cashing them. These fees can vary depending on where you are traveling and which bank or exchange office you use.

It’s always a good idea to research the fees and commissions beforehand so that you know what to expect. Some banks or exchange offices may charge a flat fee, while others may charge a percentage of the total amount being exchanged. By knowing these details in advance, you can better plan your budget for your travels.

Keep in mind that some places may also have minimum or maximum cashing limits, so it’s best to check with the specific institution before attempting to cash your travelers checks. With this knowledge in hand, you’ll be able to make informed decisions about how and where to cash your Amex travelers checks without any surprises along the way.

As we move into discussing exchange rates and conversion fees, it’s important to keep in mind how service fees and commissions may impact those costs as well.

Exchange Rates and Conversion Fees

As we delve into the topic of exchange rates and conversion fees, it’s worth considering how these factors can affect your overall expenses while using Amex’s popular alternative to cash. When you cash an American Express traveler’s check, you’ll receive the local currency at a rate that may differ from the current exchange rate. This difference is known as the exchange rate margin, which is essentially a fee charged by Amex for converting your funds.

In addition to the exchange rate margin, there may also be other conversion fees associated with cashing your traveler’s checks. For example, some banks or money changers may charge an additional commission fee for processing the transaction. It’s important to research and compare these fees before deciding where to cash your traveler’s checks in order to minimize any unnecessary expenses.

With this in mind, let’s take a closer look at how Amex traveler’s checks stack up against other payment methods.

Comparison with Other Payment Methods

If you’re looking for a payment method that won’t break the bank, it’s worth comparing Amex traveler’s checks to other options available.

While traveler’s checks are still accepted in many places around the world, they may not be as convenient or cost-effective as other payment methods.

For example, using a credit card with no foreign transaction fees can often be a better option for making purchases abroad, especially if you plan on traveling frequently or for an extended period of time.

Another alternative to traveler’s checks is using cash withdrawal from ATMs. While there may be fees associated with ATM withdrawals, they are often lower than the conversion and transaction fees charged by banks for traveler’s check transactions.

Plus, withdrawing cash at an ATM allows you to get local currency at a competitive exchange rate without having to worry about carrying large amounts of cash around with you.

Ultimately, your choice of payment method will depend on your individual needs and preferences when traveling abroad. However, it’s important to follow the proper procedure when using any form of payment overseas to ensure security and avoid unnecessary expenses.

Follow the Proper Procedure

So, now that I’ve considered the fees and exchange rates, it’s time to talk about following the proper procedure for cashing my American Express Travelers Checks.

The first step is to sign each check as soon as they’re received and keep them in a safe place until ready to use.

Then, when presenting the checks to a cashier or teller, be sure to bring identification and any additional information requested by the establishment.

It’s important to follow these procedures carefully in order to ensure a smooth and secure transaction.

Sign the Checks and Keep Them Safe

Don’t forget to sign and secure your precious travel funds. When you receive your American Express traveler’s checks, it is vital that you immediately sign them on the designated line. Your signature acts as a verification of ownership and authorizes you to use them.

Remember that these checks are like cash, so if they fall into the wrong hands unsigned, anyone can use them without any authorization. Therefore, always keep them in a secure location such as a hotel safe or a locked luggage compartment.

In addition to signing and securing your traveler’s checks, it’s essential to keep track of each check’s serial number. This information may help you in case of loss or theft since it identifies every single check uniquely.

Also, when presenting them for payment at an exchange office or bank, make sure not to detach any part of the check until after the transaction is complete. Doing so invalidates it and makes it unusable for future transactions.

Now that your traveler’s checks are signed and secured, let’s move on to how you can present them to the cashier or teller at the foreign exchange office or bank.

Present Them to the Cashier or Teller

Now that you’ve signed your American Express travelers checks and stored them safely, it’s time to present them for cashing. It’s important to note that not all merchants or financial institutions accept traveler’s checks anymore, so it’s best to check beforehand if they are accepted.

When you’re ready to cash the traveler’s checks, head over to a bank or other financial institution that accepts them. Present the signed checks to the cashier or teller and provide any additional information they require such as your ID and where you obtained the checks from. Once everything is verified, the teller will give you cash for the amount of the traveler’s check.

It is crucial to remember that presenting proper identification is necessary when cashing in traveler’s checks. In addition, some places may require additional information such as proof of purchase or an explanation for why you are cashing a large number of checks at once. By providing this information upfront, you can save yourself time and potential headaches during the cashing process.

Show Your ID and Provide Additional Information

When presenting your identification and providing additional information at the bank or financial institution, it’s important to have all necessary documents ready to avoid any delays or frustrations.

The teller will typically ask for a government-issued ID, such as a driver’s license or passport, to verify your identity. In addition, they may ask for additional information such as your home address and phone number.

It’s also important to note that the process of cashing travelers checks may take longer than a typical transaction due to the added security measures in place. Therefore, it’s best to plan ahead and be prepared with all necessary documents and information beforehand.

This can help expedite the process and prevent any unnecessary delays or frustrations.

Plan Ahead and Be Prepared

When preparing for a trip, it’s important to plan ahead and be prepared when it comes to using travelers checks.

First, I order my travelers checks in advance to ensure I have them before leaving.

Next, I check the acceptance and availability of the checks at my destination to avoid any issues with using them.

Finally, I always carry some cash and other payment methods just in case the travelers checks are not accepted or if there are any unexpected situations that arise during my travels.

Order Travelers Checks in Advance

Plan ahead and order your currency in the form of travelers checks before your trip. This ensures that you have enough time to receive them and check them for accuracy.

You also have the option to choose the denominations that fit your needs, making it easier to stay within your budget while traveling. Ordering travelers checks in advance also gives you peace of mind knowing that you have a safe and secure way to carry money during your travels.

Instead of worrying about losing cash or having your credit card information stolen, travelers checks provide a more reliable alternative. However, it’s important to check the acceptance and availability of travelers checks at your destination before relying solely on them as a source of payment.

Check the Acceptance and Availability

Make sure to check if the places you plan to visit accept and have availability for using travelers checks as payment, giving you peace of mind during your travels.

Not all businesses or establishments accept American Express travelers checks, so it’s crucial to do some research beforehand. You can contact your hotel or travel agency for information on where these checks are accepted, or you can browse through the American Express website for a list of participating merchants.

In addition to checking acceptance and availability, it’s also wise to carry some cash and other payment methods. While travelers checks are convenient and safer than cash, they may not be accepted everywhere or may take longer to process.

Carrying some local currency in small denominations is useful for buying small items like snacks or souvenirs. It’s also helpful to have a credit card readily available in case of emergencies or unexpected expenses that may arise during your trip.

Carry Some Cash and Other Payment Methods

It’s wise to also have alternative payment methods, such as local currency and credit cards, as not all establishments accept travelers checks. While American Express Travelers Checks are widely accepted around the world, some merchants may not be familiar with them or may simply prefer other forms of payment. In addition, there is always a risk of losing or misplacing your travelers checks while on the go.

Carrying some cash in the local currency is always a good idea, especially for small transactions or in areas where credit card usage is limited. It’s important to check exchange rates before you travel and to withdraw cash from ATMs at reputable locations to avoid any potential scams.

Credit cards are also convenient and widely accepted but make sure to notify your bank of your travel plans beforehand to avoid any issues with fraud alerts or blocked transactions.

By having multiple payment options available, you can enjoy your travels without worrying about how to pay for your expenses.

In conclusion, cashing American Express travelers checks can be a bit of a hassle but it’s definitely doable. Understanding the basics of travelers checks and knowing where to go to cash them are key factors in making the process smoother. However, one must also consider the fees and exchange rates that come with cashing these checks.

Following the proper procedure is also crucial in ensuring a successful transaction. It’s important to plan ahead and bring all necessary identification and paperwork. While it may seem like a lot of effort, it’s always better to be prepared than stranded without any means of payment while traveling.

So if you’re planning on using American Express travelers checks for your next trip, make sure to do your research and follow these tips for a seamless experience. Don’t let unexpected fees or lack of preparation ruin your vacation – take charge and enjoy yourself worry-free!

Meet Audrey and Carl Thompson. This dynamic married couple not only shares a passion for each other but also a deep love for exploring the world. Through their captivating writing, Audrey and Carl offer a unique perspective on traveling as a couple. They delve into their personal experiences, shedding light on the challenges and joys of navigating the globe hand in hand. Their insightful articles address the questions and concerns many travelers face, helping you forge a stronger bond with your partner on your own incredible adventures.

Related Posts

What Kind Of Travelers Checks Don’t Work In France

Can You Cash Travelers Checks At A Bank

UniBul's Money Blog

American express travelers cheques: what you need to know.

American Express Travelers Cheques are just like cash, with the added benefit of offering more convenience and security. Travelers Cheques are safer than cash because if they are ever lost or stolen, they may be refunded.

There are thousands of banks and foreign exchange partners in countries around the world where you can exchange your American Express Travelers Cheques for local currency. You may also use your Travelers Cheques like cash to pay for products and services at accepting retail locations, restaurants and hotels.

What Is American Express Travelers Cheque?

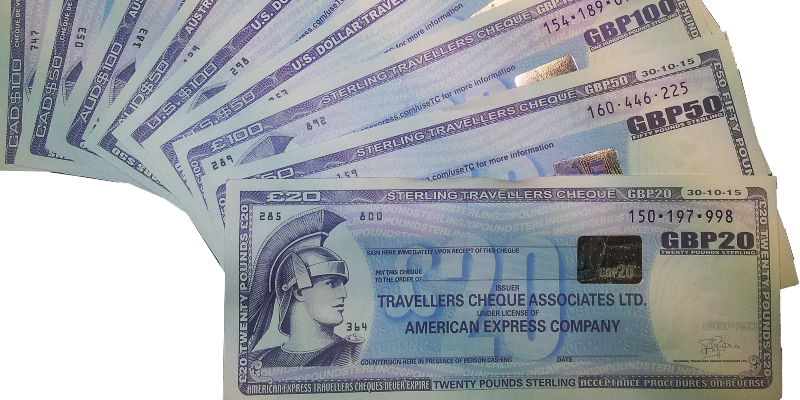

The Travelers Cheque is a financial instrument originated by American Express Company in 1891. It provides users with a convenient and safe alternative to carrying cash. The traditional cheque was designed for one purchaser and one user. Unlike cash, however, lost, stolen or destroyed Travelers Cheques may be refunded.

Technically, an American Express Travelers Cheque is an order drawn on the issuer to pay the named payee or holder, on presentation, the indicated amount of the Cheque. It is negotiable only when countersigned by the original purchaser and may be made payable to the order of anyone designated by the purchaser at the time of use.

Cheques are offered in various denominations. For example, U.S. currency Travelers Cheques are issued in the denominations of $20, $50, $100, $500, and $1,000. The issuance of $10 Cheques has been discontinued.

You can purchase Travelers Cheques at thousands of banks and credit unions. It is highly recommended that you call the location prior to your visit and verify fees, limits, payment methods, restrictions, exchange rates and availability. Commission fees may apply and can vary by country and / or exchange partner.

Gift Cheques – The Gift Cheque was first introduced in 1987 as a convenient, safe and elegant way to give money and to compete in the gift certificate market.The purchaser is not required to sign the signature line at the time of purchase, because the Cheque is intended for someone else.

Gift Cheques are refundable to either the purchaser or the recipient, depending on who was last in possession of the cheque when it was lost or stolen.They are sold individually with their own purchase record and refund information. Encashment procedures are identical to that of the Travelers Cheque ($10, $25, $50 and $100 only).

Cheques for Two – These cheques were launched in 1992 and are almost identical to the standard American Express Travelers Cheques. The only exception is that two signature lines appear in the upper left-hand corner The words “Signature I” and “Signature 2” appear over the signature lines.

Cheques for Two are available only in U.S. currency. As indicated by its name, Cheques for Two authorize two people to use the cheques. The purchaser and his/her companion must sign the cheques as soon as possible. Either matching signature can be used for the countersignature.

How to Use American Express Travelers Cheques

Using Travelers Cheques is simple:

- Sign – As soon as possible, sign your name in the upper left corner to help protect yourself in case of loss or theft.

- Record and keep separate – Write down your serial numbers and keep them with you when you travel, separate from your Travelers Cheques.

- Protect – Safeguard your Travelers Cheques as you would cash.

- Use – To pay, sign your Travelers Cheque in the lower left-hand corner in front of the person accepting your cheques.

Where to Use Travelers Cheques

You can either:

- Exchange your Travelers Cheques for local currency in your destination (see point 3 in the next chapter), or

- Use your Travelers Cheques to pay directly for goods and services at accepting retailers, restaurants and hotels (see below).

Exchanging Travelers Cheques for Local Currency

There are thousands of locations in countries around the world where you can exchange your Travelers Cheques for local currency. Please note:

- Photo identification may be required.

- It is strongly recommended that you retain and carry your original purchase receipt with you when you travel.

- Commission charges may apply and can vary by country or exchange partner.

- Exchange limits may apply due to local regulations and exchange policies.

Using Travelers Cheques to Pay for Goods and Services

Often in the USA and sometimes elsewhere, you can use Travelers Cheques like cash to pay directly for products and services at accepting retailers, restaurants and hotels. Please note:

- American Express does not guarantee that places will accept Travelers Cheques as a form of payment.

- Outside the USA, such usage is less common. Always check with the merchant first.

Refunds and Customer Service

Call American Express immediately for assistance with any of the following:

- You encounter an issue while trying to use your cheques.

- A service provider is unfamiliar with how to accept your cheques.

- To obtain a refund for lost or stolen cheques.

Remember to have the serial numbers of your cheques with you when you call.

For other locations not listed in the table above, please call collect to the USA +1 801 964 6665 or visit americanexpress.com/useTC.

EUROZONE COUNTRIES : Travelers Cheques acceptance in the Eurozone is very limited away from airport locations. This document indicates partners who, at the time of publishing, were known to be encashing Travelers Cheques for non-account holders. You are strongly advised to use the TC Locator americanexpress.com/useTC to confirm the latest position.

Acceptance of American Express Travelers Cheques

The acceptance of American Express Travelers Cheques is based on two principles: authentication and authorization.

These principles give a cheque acceptor the best possible protection against accepting a fraudulent item that might not be honored by American Express.

Authentication is the process whereby the acceptor validates both the presenter and the cheques.

- The Presenter – Through the standard Watch and Compare procedure.

- The Cheque – By identifying the security features and ensuring that there are no visible signs of alteration to the cheque or the original signature.

Authorization is the selection of one of the cheques from those presented and submitting the serial number for verification by AmEx’s Positive Authorization system.

- The system performs a series of checks against the serial number to ensure that it is eligible for encashment.

- If the cheque passes, the system gives the acceptor an approval code which must be written on all cheques presented. If authorization is declined, the acceptor is given a telephone number (usually toll-free) to call for clarification – this could still lead to the cheque being approved.

The authentication process must be performed first before seeking authorization. An approval code has no meaning if you establish that the presenter and / or the cheque are not genuine.

Standard Features of American Express Travelers Cheques

American Express Travelers Cheques are just like cash and few products offer more convenience or security. But because there are counterfeits being circulated worldwide, you must ensure that the American Express Cheque products presented at your location are valid before accepting them.

All American Express Travelers Cheques are printed on special watermarked paper. The text, border and picture on the face of the cheque are printed from steel engravings that give a relief effect and emphasize sharpness and clarity of details.

Magnetic ink characters or other machine-readable characters are printed in the lower left corner to permit automatic cheque handling. American Express Travelers Cheques are valid without time limit. Therefore, cheques of earlier issue may continue to be presented for payment indefinitely.

There are a number of safeguards built into the design of all American Express Travelers Cheques:

Watermark – Watermark of the Centurion is visible when held to the light.

Holographic Foil – The holographic foil shows shifting images of the currency and denomination, Centurion and American Express logo when tilted.

Security Thread – A metallic Security thread reading “AMEX” is embedded in the cheque and can be clearly seen from both sides when held up to the light.

Smudge Test – Both left denomination panels on the back of the cheque smear when wet and the right panels do not. It is one of the easiest and most effective tests for cheque authenticity.

Serial Number – Each cheque has a unique serial number.

Fraudulent Use of American Express Travelers Cheques

Lost and Stolen Cheques – These generally are associated with losses of other property from customers. When stolen, they are usually connected to another crime.

Blank Losses – Losses of blank cheques originate with robberies and burglaries of selling outlets and larcenies of shipments missing in transit. Another area of loss involves what is most often termed “SneakThefts” larceny committed in a bank or financial institution and achieved by distraction.

The key to criminal success in sneak thefts as well as in large burglary rings lies in the criminal’s willingness to travel.Victim locations are selected in smaller urban areas where such activity was previously rare or unknown. The American Express Security Department can play a vital role for law enforcement in these situations, acting as a clearing house for investigative information.

Fraudulent Refund Schemes – Such schemes attempt larceny by deception. A Travelers Cheque purchaser reports cheques lost or stolen and applies for a refund, having already cashed the cheques (or having had them cashed by a confederate).

Counterfeit – Because of the liquidity of the cheque, American Express is often the victim of counterfeiting much like that with U. S. Currency. Quite often, the same criminal groups are involved. In those cases where a counterfeit cheque is suspected, the field tests previously delineated (smear test, etc.) should be applied. A call to the 24-hour 800 number should resolve any further questions.

Counterfeiting by Color Copier / Color Digital Computer Scanner – The ever-increasing refinements in the field of document reproduction now present a significant threat to any issuer of security documents. Images are digitized, capable of being manipulated and altered. Storable, they can then be reproduced on a color copier or other color printer. Such counterfeiting operations can be conducted by one individual.

Fraud Encashment Characteristics:

- Erasure or chemical eradication of the signature (upper) line.

- Use of a felt-tip pen to disguise alterations or trace type forgeries.

- “Dry pen” technique issued by experienced passers at the point of encashment. The countersignature has already been traced or simulated as the passer with a dry pen pretends to sign the cheque.

- Alterations of serial number and magnetic microline are used to neutralize authorization calls.

- Alterations / raising of denomination buttons to increase profitability of lower denomination, e.g., $20.00 to $500.00.

Accepting American Express Travelers Cheques

There are three simple steps to accepting an American Express Travelers Cheque:

- Holographic foil

- Security thread

- Conduct smudge test

- Internet – Online Travelers Cheque Authorization (web-based browser) at americanexpress.com/verifyamextc.

- IVR (Interactive Voice Response): USA 1-800-525-7641.

Frequently Asked Questions

- What if I did not see the cheques being signed? It is essential that you see every cheque being countersigned by the customer. If necessary ask the customer to sign again on the back of the cheque(s) while you WATCH and COMPARE.

- What if I suspect a forged signature? Ask the customer to sign the reverse of the cheque and compare the signature to the original signature on the front of the cheque. Still suspicious? Call American Express at the number shown in Step 3, option B. Press “0” at the end of the transaction to be transferred to a representative.

- What if the customer said he / she received the cheque(s) as payment for services rendered or goods he / she sold? Authenticate and authorize them to ensure their validity. Please refer to Step 3. As this is regarded as a third party transaction (cheques are not being presented by the original purchaser and you cannot WATCH and COMPARE), you should accept these cheques on a collection basis and wait for them to clear before releasing funds to the customer. However, do authenticate and authorize them to ensure their validity.

- What do I do if I suspect a counterfeit or altered cheque(s)? Call American Express at the number shown in Step 3, option B. Press “0” at the end of the transaction to be transferred to a representative. Explain to the representative why you suspect the cheque to be counterfeit or altered. The call center will then connect you to the Security Department of American Express who will give you further advice. Please remember not to place yourself or your colleagues in danger.

Related Posts

American Express Merchant Card Acceptance Guide

10 Steps to Using Express Checkout at Your Hotel

American Express Platinum Card Review

Dear American Express After my Mom has passed away, she left me some traveler checks on her name. I live in Israel and would like to know, how to cash them? where can I find out about it? I can write their no. according to your advise.! Sincerely yours Anat Chen

I have several thousands in traveler’s cheques, and it is already third months since i filed my first refund claim. All the cheques are in my name, and i am the original purchaser of them. During several years already i could not find a single place where this crap can be accepted. So i tried to file an online claim, had to provide multiple documents, and still it is the third month i can not get my money back. I am sure i will not touch with a long stich any other products from Amex, and i am quite confident in saying they are just a bunch of liars. They failed to provide any infrastructure of accepting their colored papers, and even themselves are failing to return the money i gave them in the exchange of their fake promises.

Your email address will not be published. Required fields are marked *

Email Address: *

Save my name, email, and website in this browser for the next time I comment.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3360 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

What are traveler’s checks, how to buy and use traveler’s checks, what to do if traveler’s checks are stolen, best ways to use traveler’s checks, cons of using traveler’s checks, other alternatives, money tips for traveling abroad, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

You can still buy and use traveler’s checks in the U.S. and other countries.

Where To Buy Traveler’s Checks

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

How To Use Traveler’s Checks

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

The following are situations when you might consider using traveler’s checks:

1. No Access to Credit or Debit Card

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

2. Limited Access to ATMs

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

3. Access Good Exchange Rates

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

4. Avoid Common Credit or Debit Fees

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

5. As an Added Safety Measure

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Here are some reasons that might discourage you from using traveler’s checks:

1. Limited Availability for Use

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

2. Not All Banks Offer Them

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

3. Potential for Additional Fees

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

4. Bulky Paperwork

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Credit Card

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

Prepaid Card

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Do Your Research

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Tell Your Bank You Are Traveling

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Don’t Keep All of Your Money in 1 Place

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Related Posts

![travel cheques american express where to exchange IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Quick Facts

- Sights & Attractions

- Tsarskoe Selo

- Oranienbaum

- Foreign St. Petersburg

- Restaurants & Bars

- Accommodation Guide

- St. Petersburg Hotels

- Serviced Apartments

- Bed and Breakfasts

- Private & Group Transfers

- Airport Transfers

- Concierge Service

- Russian Visa Guide

- Request Visa Support

- Walking Tours

- River Entertainment

- Public Transportation

- Travel Cards

- Essential Shopping Selection

- Business Directory

- Photo Gallery

- Video Gallery

- 360° Panoramas

- Moscow Hotels

- Moscow.Info

- Essential Guide

- Money Matters

Money matters

Prices have risen rapidly in the past few years, and St. Petersburg is now on a par with (or even slightly more expensive than) most major European cities for groceries, dining out, nightlife, entertainments, and sightseeing. While the cost of museums and cultural events is generally lower than elsewhere in Europe, almost nothing is free, and several cultural institutions (including the Mariinsky Theatre and the Hermitage) continue to operate a dual price system whereby foreigners pay considerably more than Russian citizens.

That said, there are still some pleasant surprises for visitors to the city. Public transport is on the whole very cheap, and that includes taxis (provided you use reputable taxi firms and indulging your bad habits will also cost very little, provided you stick to vodka and cigarettes. The average tourist should probably budget to spend around $100 per day excluding accommodation, while budget travelers will probably be able to get by on around $30 per day with a little effort.

Currency Questions

Since the crash of 1998, the Russian ruble has remained fairly stable, except for a few wobbles during the 2008 financial crisis, standing at around 30 rubles to the US dollar and around 40 rubles to the euro. You can see today's exchange rates here . One ruble is 100 kopeks, and denominations are as follows: Notes - 50, 100, 500, 1000 and 5000 rubles; Coins - 1, 5, 10 and 50 kopeks, 1, 2, 5 and 10 rubles. Some 10-ruble notes are still in circulation, but rarely seen in Moscow or St. Petersburg. Why one kopek coins exist is something of a mystery, but they're quite fun to keep.

It is illegal to charge for goods or services in any currency other than rubles, and no longer will taxi drivers or bartenders happily take your dollars. Nonetheless, salaries and rents are still sometimes quoted 'unofficially' in dollars. There may also still be some bars and restaurants quoting prices in 'y.e.', which means 'standard units'. Popular in the late 1990s and early 2000s, this system allowed establishments to set their own conversion rate, normally somewhere between, and thus not have to alter their menus every time the ruble jumped. With the currency's increased stability, this practice has thankfully almost completely disappeared.

Recent legislation has dramatically cut the number of places you can exchange money in St. Petersburg, although there are still many more bureaux de change than in most European cities, some open 24-hour. The market is very competitive, and it's worth shopping around to find the best rates, particularly if you plan to change large sums. This only applies to dollars and euro, though, and other currencies are normally only changeable at larger banks or central exchange offices. Commission is normally negligible.

How To Bring Money To Russia

Buying rubles abroad is usually extremely difficult, and exchange rates, at least for dollars and euro, are much more competitive in St. Petersburg. If you want to carry cash, then bring it in one of those currencies.

Otherwise, the easiest way to access funds is through ATM machines once you get to St. Petersburg. Machines have sprung up all over the city in the last few years, and can be found in the lobbies of most hotels, in metro stations and, of course, next to banks. The flat-rate charges are small, and exchange rates are normally reasonable (although there's little way of checking beforehand).

Traveller's cheques are, of course, a safe option, and can now be exchanged in any branch of Sberbank, Russia's national savings bank, and several other large banks.

Credit and bank cards are now widely accepted in large shops, most restaurants (including fast-food outlets), and larger bars and nightclubs. It is always worth checking before you order, however, as some businesses don't consider it a major problem if their card terminals are out-of-order for a few days. Visa and Mastercard are accepted almost everywhere, while American Express and Diner's Club can rarely be used.

It is also worth noting that, due to high instances of card fraud emanating from Russia, some Western banks need to be notified of your travel plans, otherwise they may block your card automatically after the first time you use it in Russia, whether to make a payment or withdraw cash.

We can help you make the right choice from hundreds of St. Petersburg hotels and hostels.

Live like a local in self-catering apartments at convenient locations in St. Petersburg.

Comprehensive solutions for those who relocate to St. Petersburg to live, work or study.

Maximize your time in St. Petersburg with tours expertly tailored to your interests.

Get around in comfort with a chauffeured car or van to suit your budget and requirements.

Book a comfortable, well-maintained bus or a van with professional driver for your group.

Navigate St. Petersburg’s dining scene and find restaurants to remember.

Need tickets for the Mariinsky, the Hermitage, a football game or any event? We can help.

Get our help and advice choosing services and options to plan a prefect train journey.

Let our meeting and events experts help you organize a superb event in St. Petersburg.

We can find you a suitable interpreter for your negotiations, research or other needs.

Get translations for all purposes from recommended professional translators.

Wise-Answer

Find answers to all questions with us

How do I redeem a travelers check for a deceased person?

Table of Contents

- 1 How do I redeem a travelers check for a deceased person?

- 2 How do I cash Old Travellers Cheques?

- 3 Where can you redeem travelers checks?

- 4 What happens to travelers checks when someone dies?

- 5 What can I do with old Travellers Cheques?

- 6 What can you do with unused travelers checks?

- 7 What do you do with old travelers checks?

- 8 How long are travelers checks good for?

- 9 How can I redeem a traveler’s check from a deceased person?

- 10 Can a deceased executor cash a travelers check?

- 11 Where can I redeem my American Express travelers cheques?

Call your financial institution if you have questions. Redeem a deceased person’s unused traveler’s checks if you’re the executor of the estate, or if you’re named as the beneficiary. To do so, take the traveler’s checks, death certificate and papers declaring the executor or beneficiary to the estate’s bank.

How do I cash Old Travellers Cheques?

Simply present the Cheque to the acceptor or bank where you wish to cash it. Make sure the acceptor watches while you countersign the Cheque in the lower left-hand corner. You can also exchange your Travellers Cheques for local currency free of charge at thousands of locations around the world.

Can you still cash Old Travellers Cheques?

Nevertheless, you can still buy and redeem American Express travellers cheques at the Post Office. And they never expire. An American Express spokesman has apologised for the inconvenience you faced. Anyone else who wishes to redeem old AE travellers cheques can find the most convenient place at aetc locator.com.

Where can you redeem travelers checks?

You can usually cash travelers cheques at banks, currency exchange bureaus (bureaux de change in some countries) and at American Express travel service locations. Some larger hotels and other businesses still accept them, too.

What happens to travelers checks when someone dies?

In the event you possess travelers checks that belonged to a person now deceased, store the serial numbers in a safe place and give them to the estate executor for deposit. A surviving spouse may take the travelers checks and death certificate to her bank and instruct the bank to call the issuer of the checks.

Can you deposit travelers checks in your bank account?

We have learned all major banks including BofA will let you deposit uncashed traveler’s checks that are in your name into your account. Most banks like Bank of America, JPMorgan Chase and Wells Fargo, no longer issue traveler’s checks, and many merchants will not honor them.

What can I do with old Travellers Cheques?

If you’ve returned from your holiday with unused travellers’ cheques, you can save them for your next trip as they don’t have an expiry date. Alternatively, you can request a refund at the Post Office or currency exchange office.

What can you do with unused travelers checks?

To redeem your travelers checks, date them in the upper right-hand corner, fill out the “Pay To” field and countersign in the presence of the cashier or merchant. Any unused value should be returned to you in cash.

Can I deposit travelers checks into my bank account?

What do you do with old travelers checks?

How long are travelers checks good for.

Traveler’s checks don’t expire: You can either keep them for future use or deposit them into your bank account once you’re home. If checks get lost or stolen, contact the issuer immediately: You may be able to get replacement checks locally, and the issuer needs to know which checks are potential fraud risks.

How much money can you put on a travelers check?

If you bring more than $10,000 USD you have to notify customs and fill out a Report of International Transportation of Currency and Monetary Instruments (FinCEN 105). It’s very important to know that this means any form of cash that equals $10,000 USD.

How can I redeem a traveler’s check from a deceased person?

Can a deceased executor cash a travelers check.

Where can I deposit a travelers cheque in my account?

Where can I redeem my American Express travelers cheques?

Share this post

Privacy overview.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

The Vinoy Resort and Golf Club, Autograph Collection

The History Gallery off the main lobby showcases original items such as hotel keys, lobby tiles, photos, and vintage china. Guided walking tours with high tea are available.

The historic resort’s design blends Golden Age elegance with modern, contemporary style. Rooms are luxurious and timelessly decorated in an ocean-inspired blue and white color palette. Bathrooms are clad in marble.

Start your day with coffee and a homemade pastry at the French-inspired Lottie. Take in views of the marina from Paul’s Landing, which specializes in local seafood and international dishes. The indoor/outdoor Veranda highlights creative cocktails and shareable plates with Mediterranean flavors, while Parasol offers poolside seating and creative Latin cuisine.

Kickstart your day with a workout in the 24-hour fitness center, equipped with cardio equipment, Peloton bikes, and weights. Group classes include water aerobics, Pilates, and yoga. Soak up the Florida sunshine at the outdoor swimming pool, where private cabanas are available. Unwind with a massage, facial, or body treatment at the Vinoy Spa.

Tee off at the Ron Garl-designed Vinoy Golf Club, or enjoy a game of tennis. Explore the St. Petersburg Museum of History or the Salvador Dalí Museum, both nearby. Spend an afternoon at one of the nearby beaches or bike around the area on one of the hotel's electric bikes.

Location of The Vinoy Resort and Golf Club, Autograph Collection

501 5th Avenue NE. St. Petersburg, Florida 33701 United States

Tampa International Airport.

- Room upgrade upon arrival, when available †

- $100 property credit to spend on qualifying dining, spa, and resort activities. ‡

- 12pm check-in, when available

- Late check-out, when available

- Complimentary breakfast for two people each day of stay

† Certain room categories are not eligible for upgrade. ‡ Eligible charges vary by property.

You May Also Be Interested In

Looking for more? See all our luxury hotels in St. Petersburg, Florida US

*Terms and Conditions

Fine Hotels + Resorts Program: Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® Members, and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the credit will be applied to eligible charges up to the amount of the credit. To receive the credit, the eligible spend must be charged to your hotel room. The credit will be applied at check-out. Advance reservations are recommended for certain credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at check-out. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

The Hotel Collection Program: The Hotel Collection (THC) benefits are available for new bookings of two consecutive nights or more made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer and Business Gold Card, Platinum Card® Members, and Centurion® Members. Additional Card Members on Consumer and Business Platinum Card Accounts, and Additional Card Members on Consumer and Business Centurion Accounts are also eligible for THC program benefits. Delta SkyMiles® Gold and Platinum Card Members are not eligible. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. Noon check-in, late check-out and the room upgrade are subject to availability; certain room categories are not eligible for upgrade. The type of $100 credit and additional amenity (if applicable) varies by property; the $100 credit will be applied to eligible charges up to $100. To receive the $100 credit, the eligible spend must be charged to your hotel room. The $100 credit will be applied at check-out. Advance reservations are recommended for certain credits. Benefit restrictions vary by property. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional THC benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke the THC benefits at any time without notice if we or they determine, in our or their sole discretion, that you have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your THC benefits. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for THC program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

$200 Hotel Credit: Basic Card Members on U.S. Consumer Platinum Card Account are eligible to receive up to $200 in statement credits per calendar year when they or Additional Platinum Card Members use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card) or when Companion Platinum Card Members on such Platinum Card Accounts pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card). Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $200 per calendar year, per Card Account. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Companion Platinum Card Members on the Platinum Card Account. Delta SkyMiles® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after July 1st, 2021, that is prepaid (referred to as "Pay Now" on amextravel.com and the Amex App), for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings must be processed before December 31st, 11:59PM Central Time, each calendar year to be eligible for statement credits within that year. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise).

Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, then the statement credit available in the next calendar year will be applied. Statement credits may not be received or may be reversed if the booking is cancelled or modified. If the Card Account is canceled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and AmericanExpress.com/HC for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

5X Membership Rewards® Points Platinum Card: Basic Card Members will get 1 Membership Rewards® point for each dollar charged for eligible purchases on their Platinum Card® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com. Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info for more information about rewards.

5X Membership Rewards Points on Flights and Prepaid Hotels Booked at AmexTravel.com: You will get one point for each dollar charged for an eligible purchase on your Business Platinum Card® from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible travel purchases. Eligible travel purchases include scheduled flights and prepaid flight and hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel, over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight and hotel packages over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 5x Membership Rewards® points, you must both reserve and charge the travel purchase with the same eligible Business Platinum Card®. To modify a reservation you must cancel and rebook your reservation. You can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 5X Membership Rewards® point benefit. To be eligible to receive extra points, Card account(s) must not be cancelled or past due at the time of extra points fulfillment. If booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this benefit (e.g., 1.5X and 2X bonuses for Business Platinum Card Members, etc.). Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. The benefits associated with the Additional Card(s) you choose may be different than the benefits associated with your basic Card. To learn about the benefits associated with Additional Card(s) you choose, please call the number on the back of your Card.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. You may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, you may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

Pay with Points: To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude non-prepaid car rentals and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If a charge for a purchase is included in a Pay Over Time balance on your Linked Account the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card. Corporate Card Members are not eligible for Pay Over Time.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit americanexpress.com/travelterms

California CST#1022318; Washington UBI#600-469-694

IMAGES

COMMENTS

Travelers Cheques Exchange Locator Redeem your Travelers Cheques directly with American Express Travel Related Services Company, Inc. To redeem online, you can register a redemption claim . Please refer to the locations listed on the left side of the screen in the Search Results for physical locations to redeem Travelers Cheques.

CALL US. Call American Express Customer Service at 1-800-221-7282 or find additional contact numbers based on your location to redeem over the phone. DEPOSIT WITH YOUR BANK. Travelers Cheques. Fees may apply. EXCHANGE FOR LOCAL CURRENCY. Travelers Cheques can be exchanged worldwide.

Find answers to our most Frequently Asked Questions about Online Travelers Cheques. Get Information on redeemable currencies, exchange rates, and more.