An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

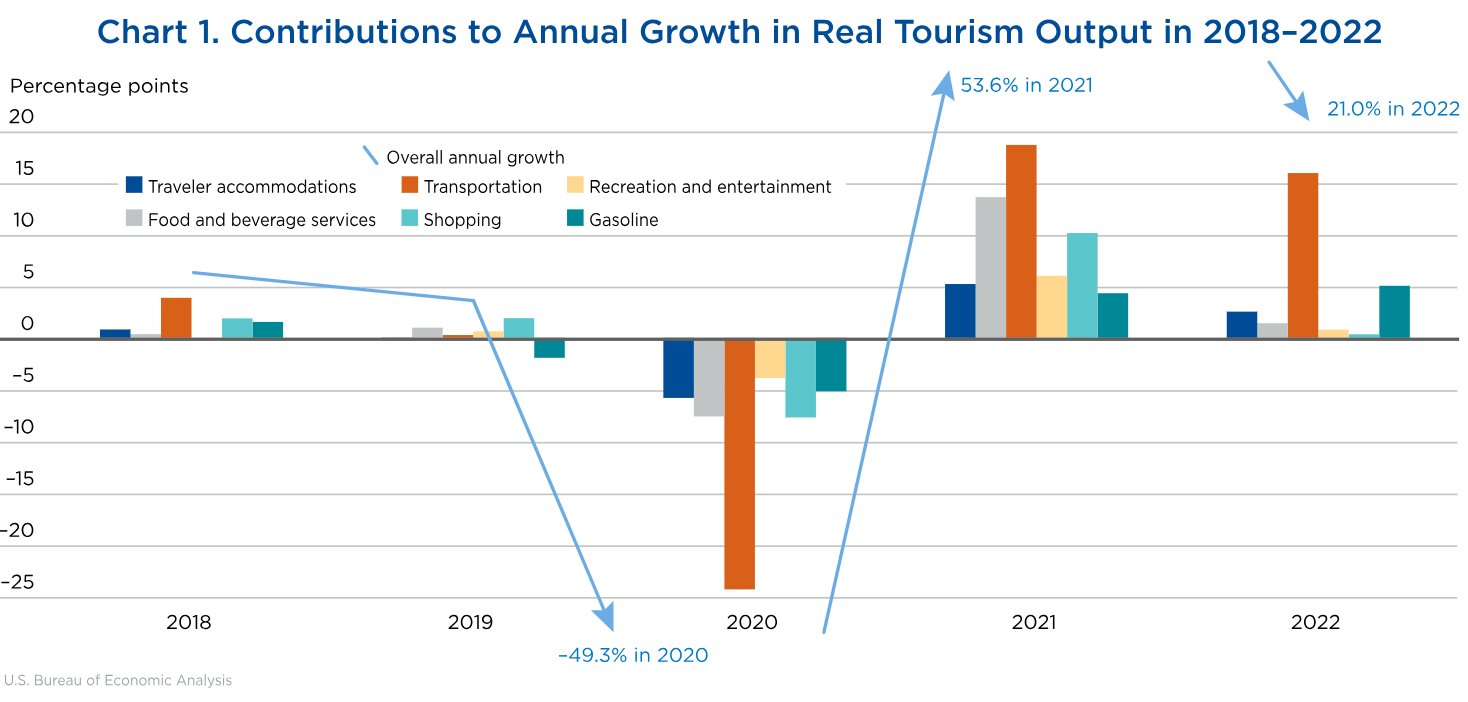

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

U.S. Traveler Profile and Key Statistics

Related reports.

- State of Travel 2024: Travel in 350 Charts August 2024

- Carbon Offsets: Fact from Fiction June 2024

- Debunking the Myth of Vacation Rental Consumer Fatigue May 2024

- U.S. Travel Trends Q1 2024: Exploring Day Tours and Experiences May 2024

Report Overview

Skift Research has conducted an analysis of travel data provided by multiple government agencies and our own proprietary estimates to create a profile of the American leisure travel consumer that includes spending estimates and key stats that businesses need to understand.

We are able to answer questions like how many Americans travel and what does a typical American spend on travel in a given year? Further, we break the answer to these questions down by a number of important demographic factors such as income, education, family type, age, residential area, and race.

In this report, travel spending is grouped into four top-level categories (transportation, lodging, food and drink, and entertainment) as well as several subcategories which are contextualized relative to each other, relative to general year-round consumer spending, and as average household spends. Travel spending is also presented in a historical context with data spanning the time frame from 1997–2017.

This report closes with profiles of international trips taken by Americans. This includes frequency of international travel, trip planning tools used and timing, top overseas destinations and how they have changed over time, and preferred activities while in-destination.

Taken together, Skift Research aims to provide travel executives with the key statistics they can use to better understand, and ultimately to drive more business with, American consumers.

What You'll Learn From This Report

- The number of Americans who travel each year and how participation rates vary by demographics

- Detailed American consumer spending on travel in aggregate and per household, cross-tabbed by income, education, family type, age, residential area, and race

- Travel spending broken down by categories. Top-level groupings are transportation, lodging, food and drink, and entertainment

- Historical time series data on travel spending from 1996–2017

- Profiles of overseas trips taken by Americans including frequency of travel, trip planning process and timing, overseas destinations, and in-destination activities

Key Takeaways on American Travelers

- Travel participation skews towards wealthy, educated: We estimate that 56% of American households traveled in 2017, slightly below estimates from other sources. We believe that this reflects the broader scope and the larger sample size of the survey that our analysis is primarily based on. Travel is, at the end of the day, still a privilege afforded to many of us by our incomes, education, and other factors. We should appreciate that and enjoy it as such.

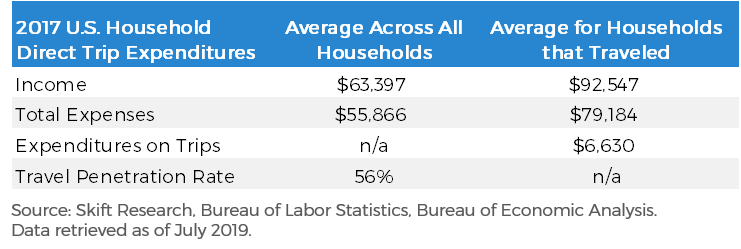

- American consumers spend an average of $6,630 per household on travel in 2017: Overall the mean American household income is $63k a year, but those that traveled at least once in 2017 made, on average, $93k a year. Those that traveled spent about 8% of their overall annual expenses toward trips. On an individual basis, the average American traveler spend in 2017 was $2,618.

- Demographics matter for travel spend: Of households that make over $120,000, 91% travel and those that do spend an average of $9,060 on travel annually. Married couples with no children travel at a rate of 71% and spend an average of $8,144 per household. Single people are more hit or miss, only 44% travel, but those that do spend $4,346 per person; the highest per person spending rate of any other demographic studied.

- In aggregate, American consumers spent $480bn on travel in 2017: Transportation and Lodging account for 2/3 of those travel expenses. After getting these core logistics out of the way, American consumers would go on to spend $95bn on restaurants, cafes, and bars. In fact, 12% of all American consumer spending on restaurants and bars by Americans (including spend by those that do not travel) happens while traveling.

- 20+ years of American travel spending reveals shift to experiences over things: The Great Recession seems to have triggered a reprioritization of travel in the mind of the U.S. consumer. From 1997–2007, travel expenses were shrinking as a share of overall American budgets. It’s only in this most recent decade that we have seen travel grow as a share of wallet for the overall U.S. consumer. Effectively all of the real growth in travel spending above pre-recession levels has come since 2014.

- American international travel rapidly growing: Americans took 93 million international trips in 2018, part of a steadily growing preference for exploring abroad — international trips have grown from 60.7 million trips in 2012, a 7.4% compound annual growth.

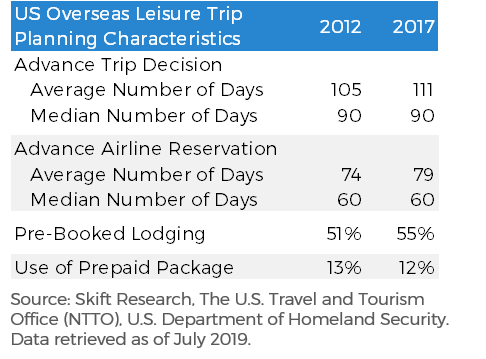

- A lot of thought goes into planning long-haul vacations: Americans reported deciding to take their vacations 111 days in advance, on average, in 2017, up from 105 days in 2012. After deciding on which trip to take, most Americans then spend the next month planning and comparison shopping and book airline reservations 79 days in advance of departure.

- Americans getting outdoors more: A growing share of Americans abroad take guided tours and/or visit national parks. In exchange, we are seeing declines in those going nightclubbing and gambling. Taken together, these seem to suggest a shift in preference towards going outdoors more and away from “hedonistic” activities.

Profiles of American Travelers

How many Americans travel and what does a typical American traveler spend on travel in a given year?

To answer these questions, Skift Research has conducted a proprietary analysis of the Bureau of Labor Statistics’ Consumer Expenditure Survey (CEX), combined with other data sources, to generate estimates of travel expenditures and the rate of travel by U.S. households. The data is for 2017, the latest available year; however, we believe that many of the ratios and averages derived from this data can be applied in 2019.

We believe that incorporating CEX data paints a more accurate portrait of the U.S. traveler, given its scope and sample size — approximately 7,000 individuals each quarter (28,000+ unique individuals a year). That means we are working from a sample size an order of magnitude larger than most commercial surveys which typically encompass one to three thousand individuals. This helps insulate the CEX survey from the fallacy of the “ law of small numbers ” whereby laypeople and researchers alike draw overly confident conclusions from insufficiently large populations.

Another strength of incorporating CEX survey results is that interview responses are collected primarily by Census Bureau workers during personal home visits, supplemented by some telephone interviewing. In contrast, most commercial surveys are conducted by internet or phone polls (with internet polls growing significantly in popularity over recent years). While useful, these methods of polling may introduce unintentional biases, such as excluding those with lower income or education levels, the elderly, and rural populations, all of which are less likely to respond to internet polling.

We believe the utilization of CEX data gives us a more inclusive view into these easily overlooked corners of America and helps us to more accurately fit those Americans that travel and their trip expenditures in the broader context the country.

Importantly, the survey asks consumers to report only their direct expenses, so our analysis excludes trips directly paid for by a business or government, received as a gift, or funded by some other means. That makes our data a good proxy for American consumer spending on leisure travel but not business travel.

How Many Americans Travel Every Year?

So how Americans traveled in 2017? You may find that this is a surprisingly difficult question to answer.

Many data providers, including both private and governmental sources, only report the number of trips taken, not a count of how many unique Americans travel in a given year. We do not deny that trip volume is an important metric for travel businesses and we include information about it later on in this report. But it is skewed by a small pool of high-frequency travelers and hides a stark difference in travel participation rates (i.e. the percent of those in a certain demographic that traveled in a given year).

Our analysis indicates that 72 million households, containing 181 million Americans, spent money on travel in 2017, a participation rate of 56% of the total U.S. population.

This was a bit surprising to us at first, as it falls outside the conventional wisdom that pegs American travel participation rates at 60–80%. To wit, a 2017 Gallup poll of 1,000 persons which reported that 62% of adults took a vacation away from home in the past year, as well as the results of previous Skift Research travel consumer polls which show 70–80%+ participation.

It should also be considered that the CEX survey excludes indirect expenses, so the overall American travel participation rate, inclusive of business and government trips is likely higher. Also not counted in this figure are trips where no expenses are incurred. It is also possible that survey respondents are under-reporting their true incidence of travel and related travel expenses.

Nonetheless, we should seriously consider the possibility that the conventional wisdom, being based primarily on internet, and to a lesser extent phone, polling is systematically overcounting travelers.

For instance, the Census Bureau estimates that just over 80% of households have at least a broadband internet subscription. And while that is a clear majority, the few Americans that do not have internet access skew predominantly lower income, lower education levels, rural, and older. As our analysis below shows, those are all prime indicators of a below national average travel participation rate.

Exhibit 1: Participation in travel varies greatly within the U.S., 2017

If you are playing along at home and trying to picture how many Americans travel, it is likely that you are basing your estimate, subconsciously or not, off your family, friends, and colleagues. But how typical are they of the overall country, really? Just 1/3 of Americans have completed a bachelor’s degree or higher and half of households make under $60,000 a year. We suspect that the profile many of our readers hold in their heads skews closer to the upper-echelon of American households than they realize.

Travel is, at the end of the day, still a privilege afforded to many of us by our incomes, education, and other factors. We should appreciate that and enjoy it as such.

Aggregate U.S. Consumer Spending on Travel

Skift Research estimates that American consumers spent an aggregate of $480 billion on travel in 2017.

Our estimates represent direct spending by U.S. consumers on travel goods and services on both domestic and international trips. Importantly these figures exclude spending by business, governments, and non-residents. Direct U.S. consumer spending on travel is an important metric, but readers should be aware of these limitations. Further, our figures do not represent industry estimates as the U.S. travel industry also generates revenues from businesses, non-residents, and governments.

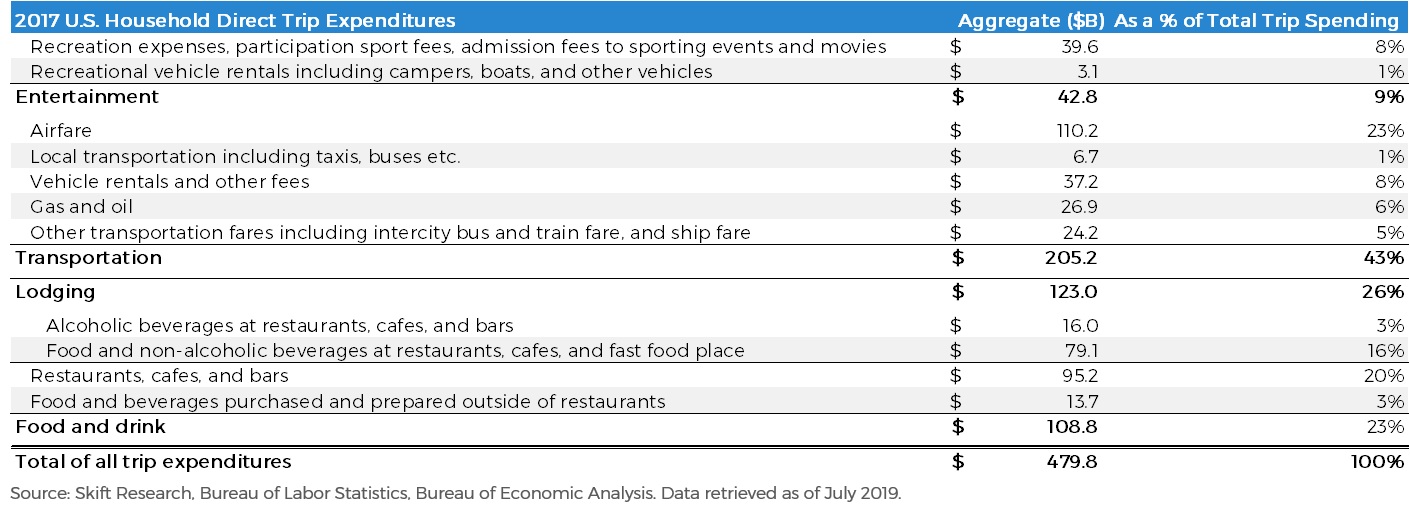

$480 billion is a top-level figure, but how exactly do those dollars get divided up? The figure below provides a detailed allocation of trip costs by category.

The single largest type of travel expense in the U.S. is transportation. Americans spent nearly $205bn on transportation for out-of-town trips in 2017, representing 43% of total travel expenditures. A majority of that is the cost of airfare, on which American consumers spend an estimated $110bn, a quarter of total trip costs (again, this excludes businesses and non-residents). Vehicle rentals are the next largest transportation-related expense for for consumers at approximately $37bn. Also, the American road trip appears to be alive as well, with gas and oil expenses from self-driven travel the third-most prominent transportation expense, at $27bn in total.

Exhibit 2: Allocation of Trip Costs by Expense Category, 2017

Naturally, lodging is also a major travel expense, coming in at an aggregate of $123bn spent by U.S. consumers in 2017. Along with transportation, the core logistics of how to get where you are going and where to stay once you get there account for 2/3 of all travel expenses. That means, most Americans devote the remaining 1/3 of their travel budgets to leisure.

The largest of these expenses is dining out, and American consumers spent $95bn in 2017 on restaurants, cafes, and bars while traveling, 20% of total trip expenses. The other leisure category is entertainment, which represented $43 billion of spend that year. This includes spending on tickets to shows, sporting events, and other recreational expenses.

Travel as a Share of American Household Spending

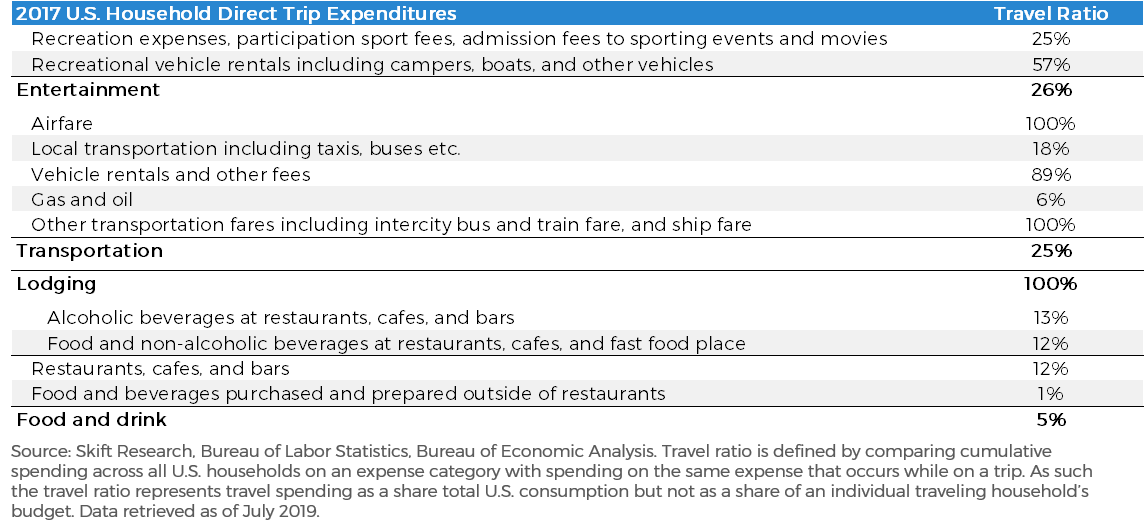

Certain expenses, like airfare and lodging, are by definition only incurred while traveling. But other expenses can pop up both while on a trip and in day-to-day life.

To understand how U.S. consumer spending on these items is budgeted towards travel in aggregate, we calculated the year-round amount that all Americans spend on certain categories and compared that figure to the amount spent on that same category while traveling for 2017. This gives us a travel ratio for each spending category, i.e., How much of any given expense’s annual budget is spent on travel. It should be noted that these travel ratios compare travel spending to spending within that category from all Americans in the U.S. economy, including those that do not travel.

For instance, 12% of cumulative Americans’ annual restaurant budget is spent while on a trip — even after including restaurant spending by consumers that did not travel. In sharp contrast to just 1% of their annual grocery budgets. Local transportation can be a major pain point with nearly a fifth of total U.S. household spending on taxis, buses, and subways being incurred while on a trip. This likely reflects the fact that most Americans have a car or regular commuter plan for daily travel, but need to splurge on taxis while on vacation.

Also notable is that a quarter of all U.S. consumption on tickets and other fee admissions to events happen while traveling. This is despite it having one of the smallest shares of total travel costs, just 8% of total trip expenses. This is partially because necessities like food, rent, and healthcare dominate American budgets. It likely also reflects an increased willingness to travel to ‘destination’ events for concerts, festivals, or sporting playoffs.

Exhibit 3: The Travel Ratio for Expenses Incurred on a Trip, 2017

Travel Spending per Household

U.S. households that traveled spent $6,630 on trips in 2017, budgeting about 7% of their income and 8% of their overall annual expenses toward trips.

U.S. households that traveled are wealthier on average than their non-traveling peers. Overall the mean American household income is $63k a year, but those that traveled at least once made, on average, $93k a year, 45% more.

The base unit for the analysis is the household, but it should be noted that both the broad U.S. household and the traveling household has an average of 2.5 members. This means that on an individual basis, the average travel spend in 2017 was $2,618.

Exhibit 4: Profile of the Average American Traveling Household, 2017

Travel Breakdown by Category

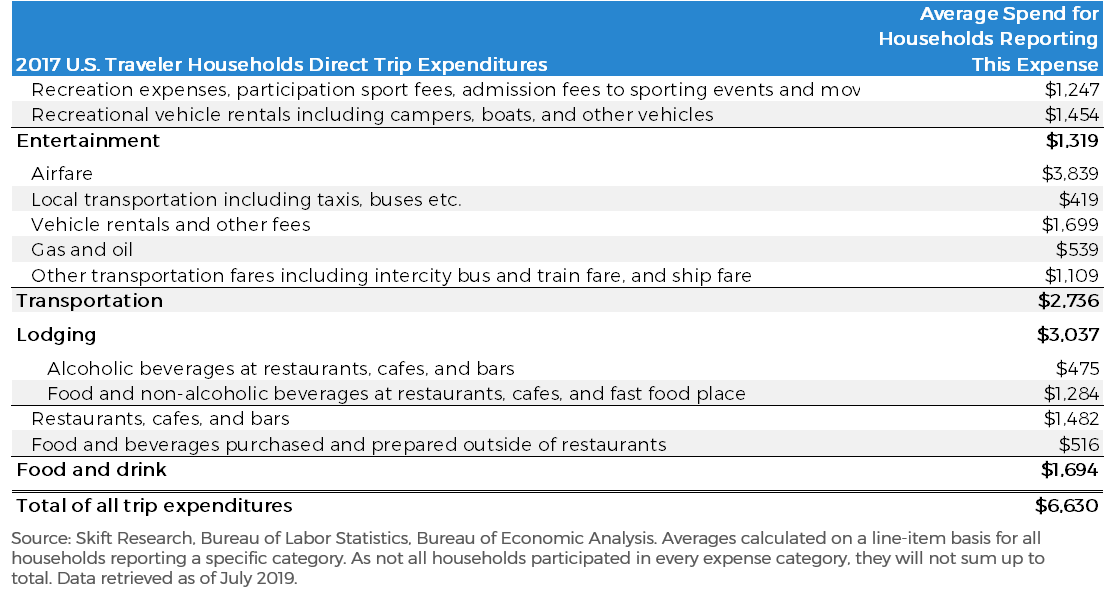

We further break this high-level average down into specific travel spending categories. Note that the figures below reflect averages only for households that reported a given expense. As not all households participated in every expense category, they will not sum up to total average.

The most expensive travel category for most is airfares. Households that flew spent an average of $3,839 on air tickets in 2017. That is followed by lodging, with American households spending an average of $3,037 on hotels, motels, and other places to stay in 2017.

Once in-destination Americans like to eat out, on average spending $1,482 per household at restaurants while traveling. Entertainment is the smallest category, but still notable at $1,319 per household.

Exhibit 5: Average Spending on Specific Travel Related Categories for U.S. Traveling Households, 2017

Travel Breakdown by Demographics

These nation-wide averages hide significant differences between consumers. To explore underlying trends, Skift Research broke down U.S. traveler spending by household demographics. We report out mean trip expenditures per household as well as per person to account for differences in household size. We also give a distribution of aggregate households and travel spending for each crosstab so as to better understand which types of individuals under- or over-index on travel spending.

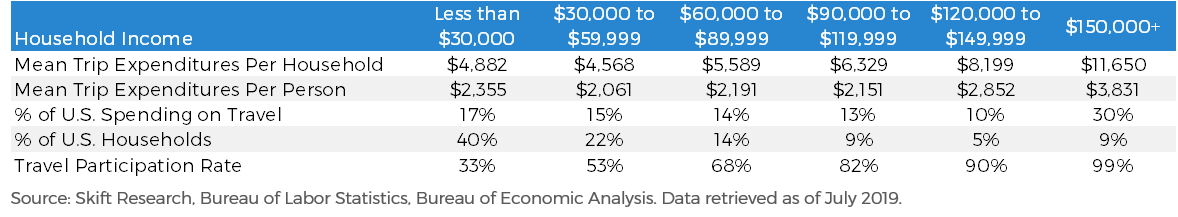

Household income is probably the single most important predictor of travel spending and the cross-tab where we see the greatest range of possible household travel spending. Households making less than $30,000 a year dramatically under-index on travel spending. These households spent on average $4,882 on travel in 2017, 26% below the nation-wide average. Those making under $60,000 a year also under-indexed on travel spend, though to a lesser extent.

On the other hand, wealthier households, especially those making more than $120,000 a year significantly over-index on travel spending. They account for 40% of all U.S. consumer spending on travel while making up just 14% of households. At the upper end of this spectrum, households making $150,000+ have an average travel spend of $11,650, 76% above the national average.

Given the out-sized impact of affluent travelers, Skift Research conducts an annual survey digging into the details of this demographic’s travel habits. Please see our third annual, Affluent Traveler Trends , for more details.

Exhibit 6: Average Travel Spending for U.S. Traveling Households and Individuals by Income, 2017

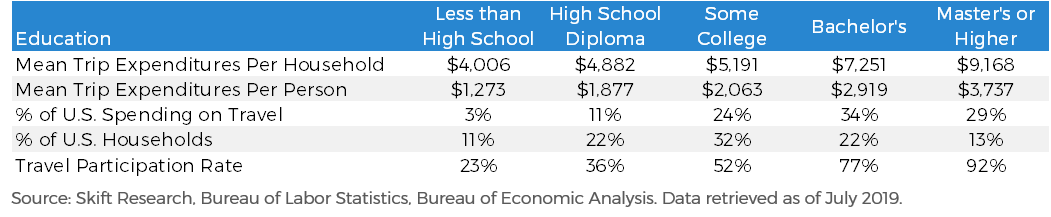

Education is another important determinant of travel spending. This is unsurprising as an individual’s highest level of educational attainment is often linked to their incomes. Americans with a bachelor’s degree or higher accounting for the majority of consumer travel spending (63%) while making up 35% of the population.

Exhibit 7: Average Travel Spending for U.S. Traveling Households and Individuals by Education, 2017

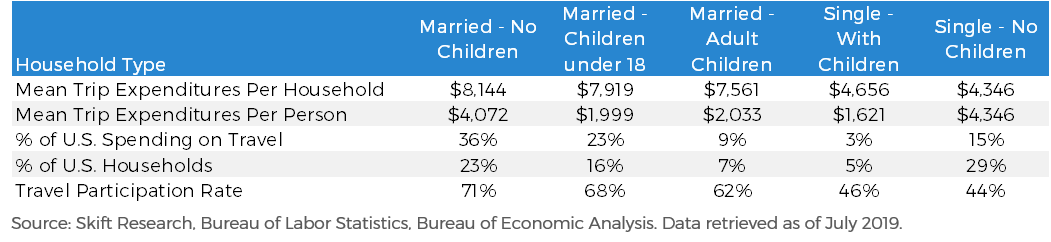

Household Type

Family type matters a great deal in household spending on travel. It comes as no surprise to any parent that traveling with kids is expensive, and married couples with children spent $7,919 on average on travel. Despite making up 16% of households, these families control 23% of total travel spending.

Given the different household structures and family sizes at play here, it makes sense to adjust for household size when analyzing average spend. With that adjustment, single households (individuals who are unmarried and have no children) stand out: while they control a smaller absolute share of overall travel expenditures, they spend more on themselves on a per capita basis than any other household type.

Married couples without children split the difference here and appear to be a sweet spot for travel. Some of these families fall into the “DINKs” category — double income, no kids. They account for the greatest share of direct consumer travel spending out of any form of household in the U.S., controlling 36% of spend while making up 23% of the population landscape. Married families with no children spend slightly less per person than single folks do, but this seems mainly due to economies of scale — e.g., the ability to split a hotel room — than out of any impulse to scrimp.

Exhibit 8: Average Travel Spending for U.S. Traveling Households and Individuals by Family Type, 2017

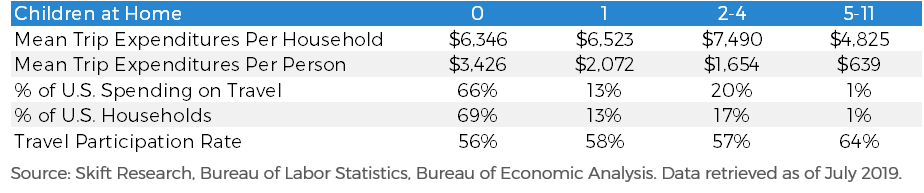

Diving deeper into family travel, we look at how many children live at home and the impact they have on travel. As mentioned above, traveling with kids costs money, and household expenditure on travel per household grows alongside the number of children at home.

There is, however, a point of diminishing returns. And once a family grows to over five children, travel spending drops precipitously. At a certain point, it’s just too much work and too cost prohibitive for most of those families to travel extensively.

Adjusting for household size shows that households with no children to look after still spend the most per person. We believe that this is due to packaged deals and other scale savings that larger families can take advantage of, as well as to the additional disposable income that many of these no-kid families have to spend on travel.

Exhibit 9: Average Travel Spending for U.S. Traveling Households and Individuals by Number of Children, 2017

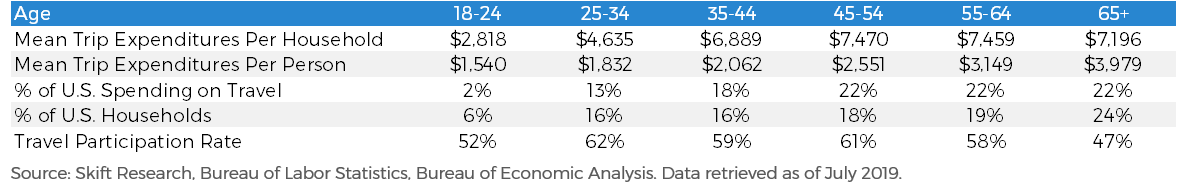

Americans aged 35–64 are, on average, the biggest travelers. These households spend the most on travel and over-index relative to their representation within the U.S. population. This makes sense as individuals within this age range are more likely to be at or near their peak earnings potential as well as more likely to be married and have a family — all of which are strong indicators of high travel spend as described above.

Younger Americans under the age of 34 spend below average amounts on travel as they are likely to be earlier in their careers and to make less money.

On the other end of the spectrum, older American’s 65+ spend near the top in terms of travel per household and the absolute highest for travel per person. But this group of Americans actually under-indexes in terms of aggregate travel expenses relative to their share of the population. In our view, this likely reflects the fact that while they may have the most money to spend per person, there are also many elderly households that face physical/medical or financial barriers to travel.

Exhibit 10: Average Travel Spending for U.S. Traveling Households and Individuals by Age, 2017

Residential Area

Cities are home to the biggest spenders on travel. American households located in counties with populations of 1.2mn or more account for nearly 2/3 of overall travel spending. Those from smaller statistical areas with 330k people or less, spend even less on travel than you would predict based on their share of U.S. households.

Exhibit 11: Average Travel Spending for U.S. Traveling Households and Individuals by Residential Area, 2017

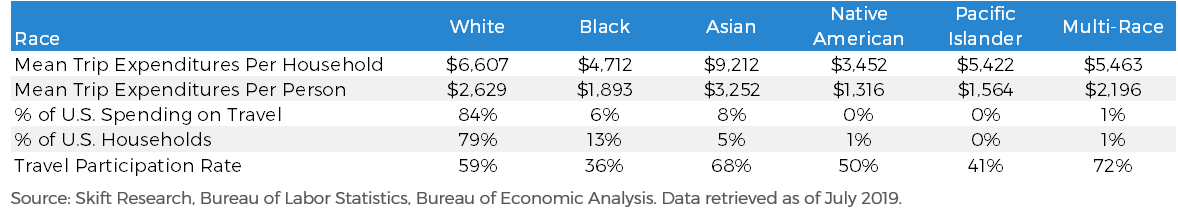

The economic divide along racial lines is reflected in travel spending among U.S households. White Americans account for a majority of travel spending in the U.S. and over-index relative to their share of households. Asian Americans spend the most on both a per-household and per-person basis. Spending on travel by Black Americans is below the national average and under-indexes relative to their share of households.

Exhibit 12: Average Travel Spending for U.S. Traveling Households and Individuals by Race, 2017

Changes in U.S. Consumer Travel Spending Over Time

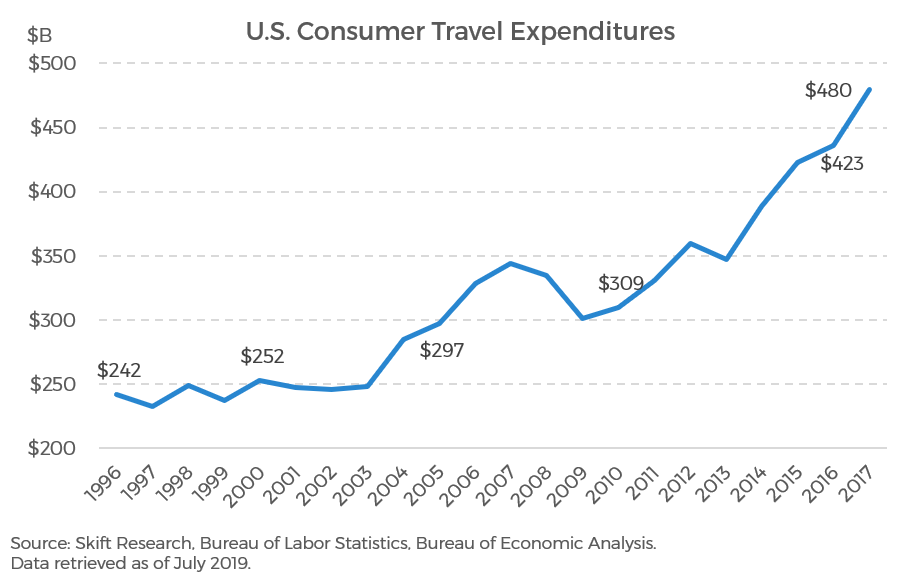

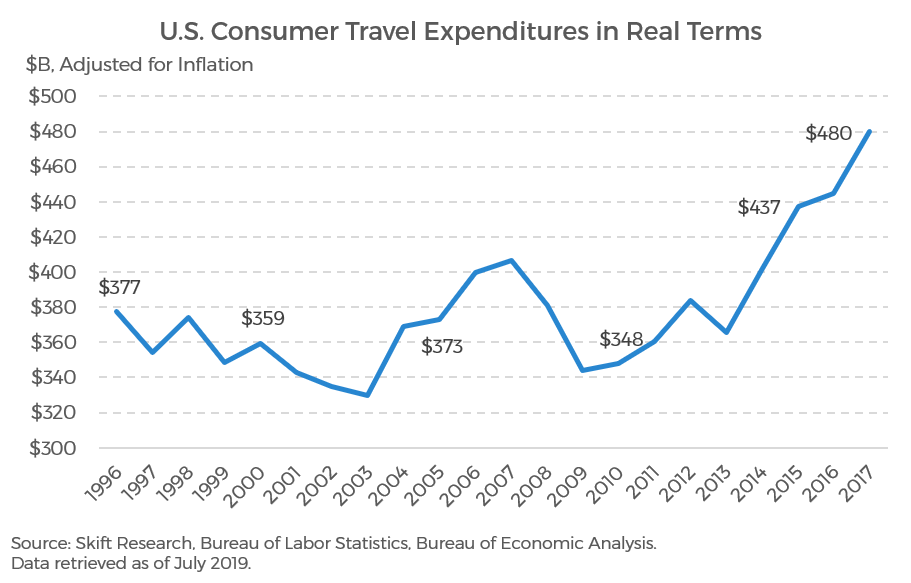

Skift Research was able to reconstruct American household spending on travel over time for the last 21 years. This long-dated time series is able to reveal a number of unique trends. American household spending on travel has grown from $242bn in 1996 to $480bn today, a 3.3% compound annual growth rate over the last 21 years.

Exhibit 13: Twenty-One Years of U.S. Consumer Spending on Travel

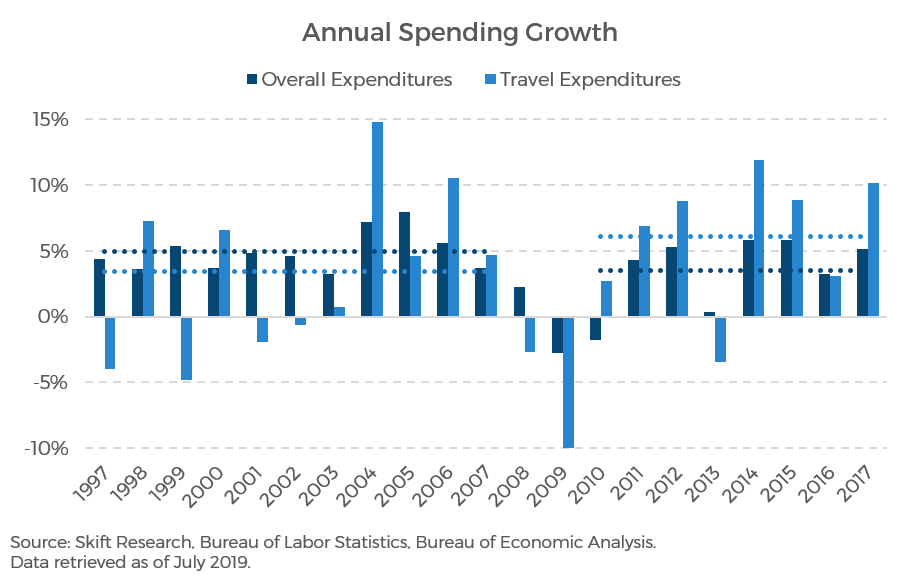

Perhaps most interesting is how travel spending has accelerated after the ‘08/’09 financial crisis. This becomes even more clear when we examine annual growth rates of travel expenses compared to total expenses.

For the 10-year time frame spanning from 1997–2007, travel expenses grew 3.4% a year on average, while overall U.S. spending grew 4.9% a year. This means that travel was shrinking as a share of overall American budgets during this period.

Then the Great Recession hit and, as expected, travel spending plummeted far faster than overall expenses. Travel is a discretionary item after all, that can be cut much sooner and easier than, say, rent. Travel spending fell -10% in 2009 while overall budgets were reduced by -2.7%.

But coming out of the Great Recession there seems to have been a reprioritization of travel in the mind of the U.S. consumer, in line with a broader shift towards favoring experiences over things. And from 2010–2017 American households have increased spending by 6.1% a year on average versus just 3.5% for total expenditures. It’s only in this most recent decade that we have seen travel grow as a share of wallet for the overall U.S. consumer.

Exhibit 14: Spending on Travel Growing Faster Than Overall American Expenditures Since the Financial Crisis, a Reversal of Prior Trend

This shift in consumer behavior can also be seen if we adjust for inflation, which has run around 2% a year for the last 20 years. After adjusting for this, U.S. consumer spending on travel was $377bn in 1996.

The most striking thing about this chart is that, after adjusting for purchasing power, real spending on travel decreased from 1996–2003.

Exhibit 15: Twenty-One Years of U.S. Consumer Spending on Travel in Real Terms

Trip spending grew in the 2004–2007 boom years, but was quickly undone by the financial crisis. Here, the post-recession travel bump becomes even more clear. Effectively all of the real growth in travel spending above pre-recession levels has come since 2014.

The recent past looms large in our minds. It’s a cognitive bias that many of us hold that gives greater priority to the present, but we should not be fooled into believing that the past has always been this good for the travel industry. It also means that we should not take our current good fortune for granted, and that the industry must work hard to maintain its performance.

American International Trip Profiles

The next sections turn to profiles of international trips (not unique travelers) taken by Americans, primarily leisure trips. The data is collected by the U.S. Travel and Tourism Office (NTTO) based on the U.S. Department of Homeland Security Advanced Passenger Information System (APIS — formerly DHS I-92) and the Survey of International Air Travelers (SIAT). The data covers the time period from 2012–2018.

Frequency of International Travel

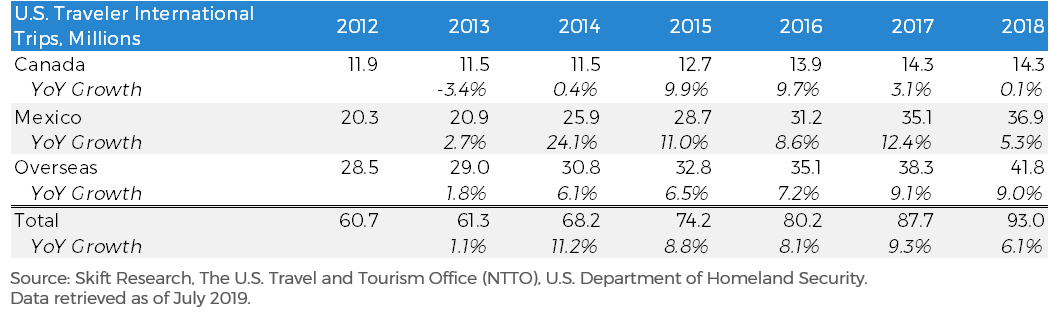

Americans took 93 million international trips in 2018, part of a steadily growing preference for exploring abroad — international trips have grown from 60.7 million trips in 2012, a 7.4% compound annual growth.

Canada and Mexico are still the most popular destinations, accounting for 55% of international trips in 2018, and of these three groupings (travel overseas, to Canada, and to Mexico) Mexico is the fastest growing destination.

Exhibit 16: U.S. Resident International Trips, Millions, 2012–2018

Mexico and Canada are worth splitting off from all other overseas destinations for two reasons. Firstly, these are the only two countries that the U.S. shares a land border with and the relatively short distance makes traveling to these two countries resemble domestic travel in some key areas. Secondly, they are two of the U.S.’s largest trading partners (in fact its top two largest export markets) and many U.S. businesses have complex supply chains that run through these nations.

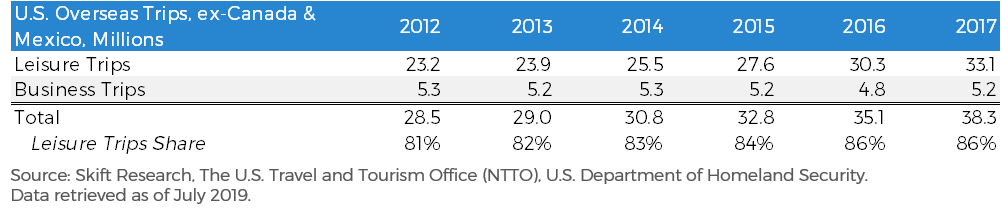

Focusing on just non-Canada and non-Mexico international trips, what the NTTO refers to as overseas travel, lets us reduce some of this noise and better isolate leisure trips. 86% of overseas trips (which going forward will exclude Canada and Mexico) were for leisure purposes in 2017, the last year for which data is available, up from 81% in 2012.

Exhibit 17: U.S. Resident Overseas (ex-Canada & Mexico) Trips by Purpose, Millions, 2012–2017

U.S. Overseas Leisure Trip Planning

A lot of thought goes into planning long-haul vacations. Americans reported deciding to take their vacations 111 days in advance, on average, in 2017, up from 105 days in 2012. After deciding on which trip to take, most Americans then spend the next month planning and comparison shopping. On average, they finally pull the trigger on booking an airline reservation for their trips 79 days in advance of departure. More than half (55%) will have booked some form of lodging in advance as well. A small, but notable, share of trips, 12% in 2017, were booked as prepaid packages.

Exhibit 18: U.S. Resident Overseas (ex-Canada & Mexico) Leisure Trip Planning Characteristics, 2012 versus 2017

Part of the reason for such lengthy deliberation is that these are generally long trips. The average length of time spent outside of the U.S. on a leisure trip in 2017 was 15.6 days. More than half of international leisure trips were longer than 10 days.

While this is still quite lengthy, it is worth noting that the average trip length is declining, down from 16.9 days in 2012.

Exhibit 19: U.S. Resident Overseas (ex-Canada & Mexico) Leisure Trip Length of Trip, 2012 versus 2017

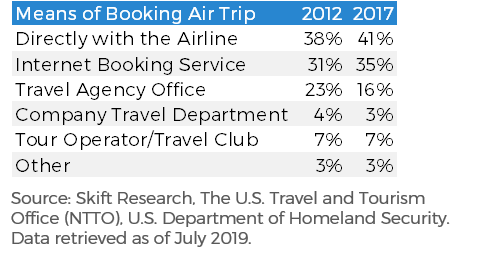

The most common channel for booking air tickets when planning overseas leisure travel is direct with the airline. 41% of trips were booked this way in 2017, up from 38% in 2012. The next most popular channel is through internet booking services, also growing share to 35% of trips in 2017 from 31% in 2012.

The gain in the booking share of these two channels has come at the expense of traditional, offline travel agencies. Though still a popular method for booking air tickets, travel agencies saw their share of trips decline to 16% in 2017 from 23% in 2012.

Exhibit 20: U.S. Resident Overseas (ex-Canada & Mexico) Means of Booking Leisure Airfare, 2012 versus 2017

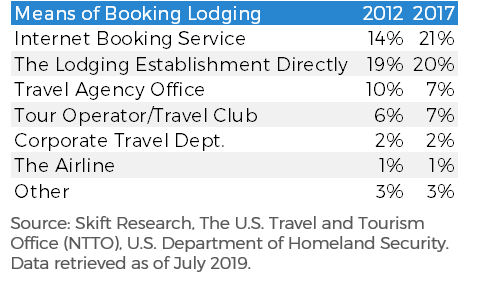

Americans use a greater diversity of channels when booking lodging compared to airfare. Interestingly, the most popular channel in 2017 for lodging reservations was internet booking services, used in 21% of trips versus 20% booked direct.

Said another way, hotels have a 15 percentage point lower share of customers booking directly compared to airlines. This might help explain why online travel agencies are able to charge higher commissions on hotels versus airlines ; hotels find it harder to drive direct bookings and have a greater reliance on third parties.

Exhibit 21: U.S. Resident Overseas (ex-Canada & Mexico) Means of Booking Leisure Lodging, 2012 versus 2017

Another noteworthy difference between leisure booking patterns for airlines versus lodging is regarding traditional travel agents. Offline travel agents are more than twice as prominent a channel for airfare as they are for lodging (16% vs. 7%). This speaks to the complicated, love-hate relationship that airlines have with the global distribution systems that connect them to a wide network of travel agents.

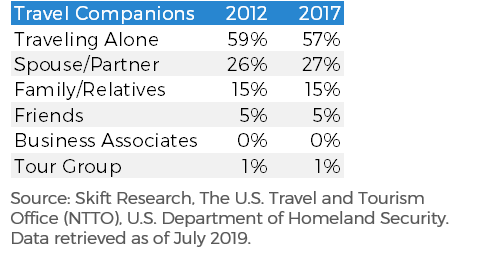

Most American travelers are planning these vacations for themselves; solo travel is the most popular type of overseas leisure trip. But its popularity is decreasing somewhat. The share of those traveling alone fell to 57% of trips in 2017 from 59% in 2012.

Exhibit 22: U.S. Resident Overseas (ex-Canada & Mexico) Leisure Traveling Companions, 2012 versus 2017

Further, most have some previous experience planning international vacations. Just 7% of overseas trips in 2017 were taken by first time international travelers, up from 6.6% in 2012. In actuality, when it comes to overseas trips taken, the traveler had been on an average of 2.3 international trips within the past year.

Exhibit 23: U.S. Resident Overseas (ex-Canada & Mexico) Repeat Leisure Travel, 2012 versus 2017

U.S. Overseas Leisure Destinations

Where do Americans travel on these overseas leisure trips?

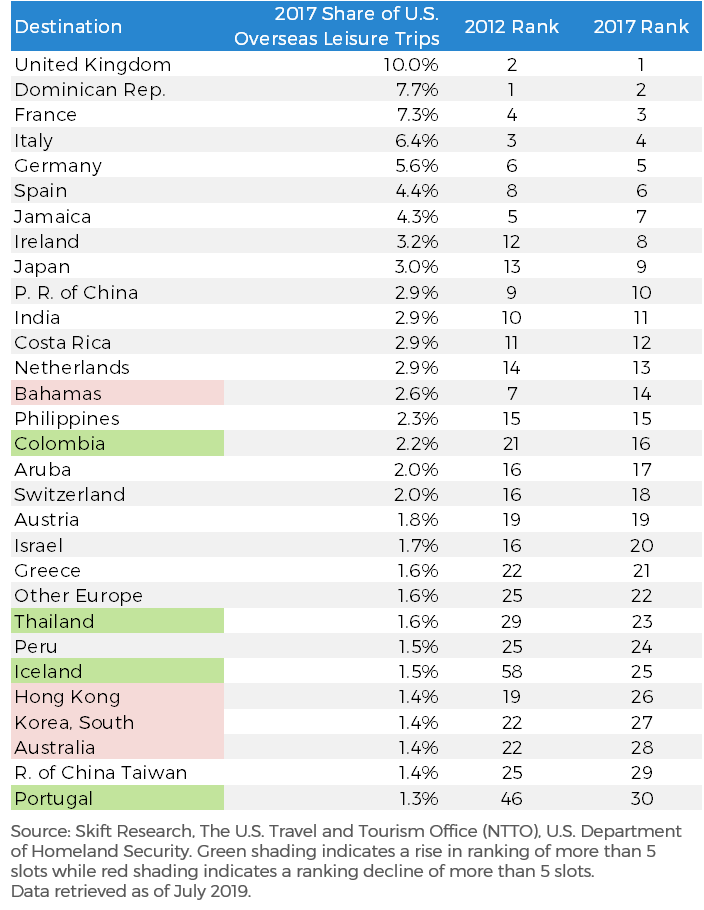

The U.S.’s “special relationship” with the United Kingdom appears to be alive and well. It is the most popular overseas leisure destination for Americans, according to the NTTO, accounting for nearly 10% of all overseas (excluding Mexico and Canada) trips, representing 3.3 million visits. This is followed by a Caribbean stalwart, the Dominican Republic, the destination for 7.7% of U.S. leisure trips representing 2.5 million visits.

The full list of top 30 U.S. leisure destinations for 2017 is below, along with their market share and 2012 rank. Countries shaded in green saw a rank increase of five or more from 2012 through 2017. Conversely, countries shaded red saw a decline of five or more ranking positions.

Exhibit 24: U.S. Resident Overseas (ex-Canada & Mexico) Leisure Travel Top Destinations, 2012 versus 2017

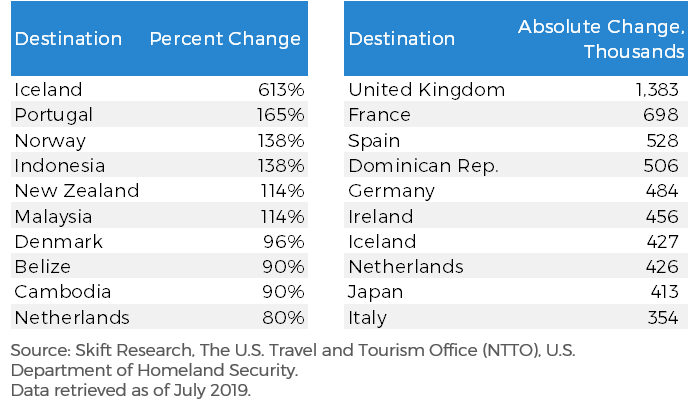

The fastest growing destinations for American overseas leisure travelers on a percent basis was Iceland, by a long shot. Trips to Iceland grew 613% between 2012 and 2017, a growth of 427 million new visits. It rose from being ranked at number 58 in overseas travel popularity in 2012 to 25 in 2017, the highest position increase of any country.

The next fastest growing was Portugal, up 165%. Other notable high-growth destinations were Nordic states Norway and Denmark, and Southeast Asian countries including Indonesia, Malaysia, and Cambodia.

Exhibit 25: Top 10 Growing Destinations for U.S. Overseas (ex-Canada & Mexico) Leisure Travel, 2012–2017

On the other hand, some Middle Eastern nations have seen a decline and/or slow down in U.S. leisure visits. Turkey saw the largest percentage decline in visits with Saudi Arabia next, and Egypt elsewhere in the list.

Some Caribbean destinations have also taken a hit with the Bahamas showing the largest absolute decline in U.S. visitors, with a 184,000 fewer trips. Jamaica and Trinidad & Tobago also saw some of the largest absolute declines in U.S. leisure visitation.

Exhibit 26: Top 10 Declining (or Slowest Growing) Destinations for U.S. Overseas (ex-Canada & Mexico) Leisure Travel, 2012–2017

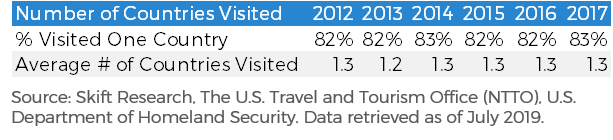

The average number of countries visited per trip was 1.3 in 2017. But this hides a divide. In fact, most trips, 83% of them, will only visit one country. But if a trip crosses borders, the itinerary tends to include more than two countries. These multi-country trips will visit, on average 2.8 nations.

Exhibit 27: U.S. Overseas (ex-Canada & Mexico) Leisure Trip Countries Visited, 2012–2017

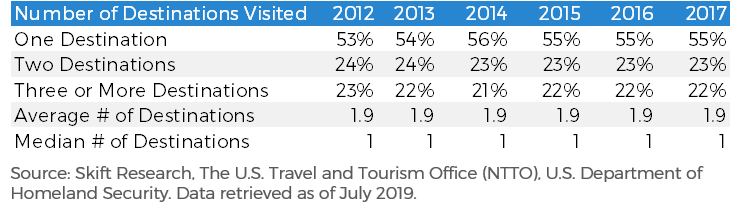

But that doesn’t mean Americans who stay in just one country are stationary during their vacations. Accounting for multiple stops within the same country, the average American visits 1.9 destinations on an overseas trip. 23% of American travelers visited at least two destinations, while a further 22% visited three or more.

Exhibit 28: U.S. Overseas (ex-Canada & Mexico) Leisure Trip Destinations Visited, 2012–2017

American In-Destination Activities While Overseas

What do Americans do while on vacation?

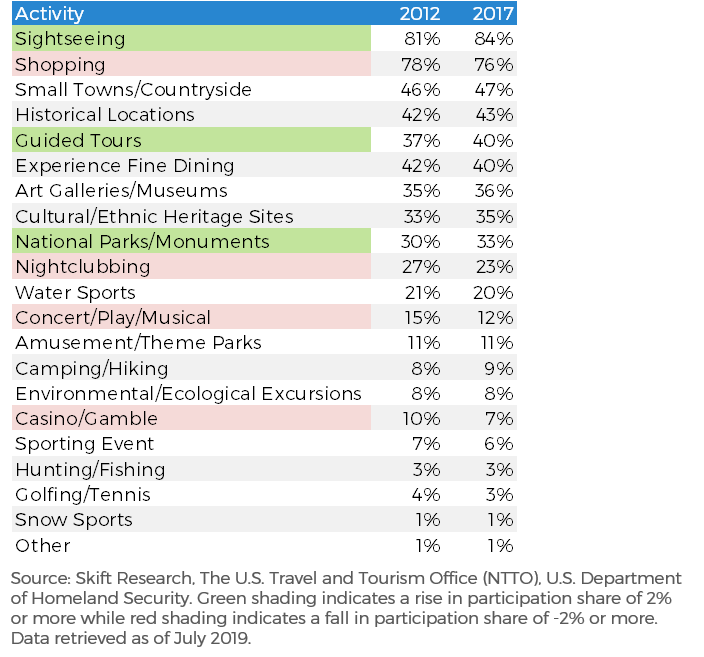

The table below details the participation rate of 20 activities that Americans took part in while traveling overseas on leisure. The green shading indicates share gains of 2% or more from 2012 through 2017, while the red shading indicates a similar decrease.

Almost all of these trips — 84% of them in 2017 up from 81% in 2012 — involved sightseeing, the most popular activity for overseas tourists. Rapidly growing too are guided tours (40% of trips in 2017, up from 37% in 2012) and visits to national parks (33% from 30%).

Shopping remains the second most popular leisure activity for Americans by a long shot, but the trend is declining somewhat, falling to a 76% participation rate from 78%. Other notable declines include nightclubbing (23% from 27%), attending concerts/plays/musicals (to 12% from 15%), and gambling (to 7% from 10%).

Taken together, these trends seem to indicate a shift in preference away from indoor activities and towards outdoor activities, and away from “things” and towards experiences, ; it also suggests a decline in “hedonistic” activities such as drinking and betting.

Exhibit 29: Activities that U.S. Overseas (ex-Canada & Mexico) Leisure Travelers Participated, % of Trips, 2012 versus 2017

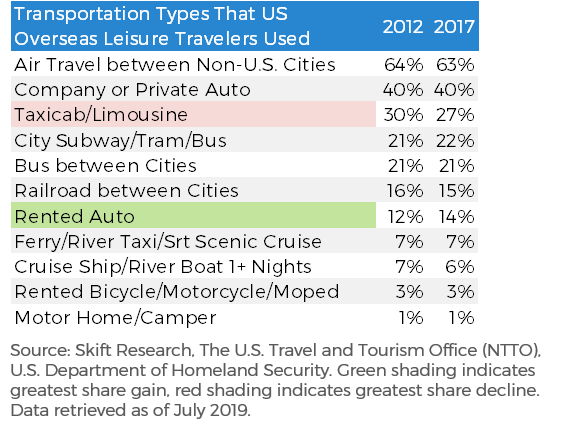

In terms of getting around, the most common type of transportation used on overseas leisure trips was air travel (63% of trips) and private automobiles (40%). The table below has detailed results for share of trips using a given transportation type in both 2017 and 2012. Green shading indicates greatest share gain while red shading indicates greatest share decline.

Taxicabs remain popular, used on 27% of trips in 2017, though this transport method saw the largest share decline, down from 30% in 2012. Offsetting this was a gain in trips using rented automobiles, which rose to 14% in 2017 from 12% in 2012.

Light rail remains popular with American overseas travelers, used in just over a fifth of all trips. And 6% of American overseas leisure trips were cruises.

Exhibit 30: Transportation used by U.S. Overseas (ex-Canada & Mexico) Leisure Travelers, % of Trips, 2012 versus 2017

Travel companies rein in their forecasts as US consumers cut spending

- Medium Text

- Lower-income earners delay vacations as savings dwindle, economic outlook uncertain

- Hilton, Marriott see minimal leisure travel growth; international revenue offsets U.S. demand

- Airbnb and Booking Holdings report slowing U.S. growth, last-minute bookings increase

Sign up here.

Reporting by Doyinsola Oladipo in New York; Additional reporting by Aiswarya Jain in Bengaluru; Editing by Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Asian stocks poised for weekly gain as recession fears dwindle

Asian shares were headed for a weekly gain on Friday and Japan's benchmark Nikkei was poised for its best week in more than four years as upbeat risk sentiment spilled over from Wall Street, while the dollar and U.S. Treasury yields held broadly steady.

Travel Cost Calculator

Quick links, trip pricing calculator.

Travelmath provides an online cost calculator to help you determine the cost of driving between cities. You can use this data to figure out a budget for a road trip. The driving calculation is based on the average fuel efficiency of your vehicle, and you can change the gas mileage in mpg or L/100 km to match your exact make and model. Gas prices are automatically estimated based on current fluctuations, and again you can adjust these to fit your local gas station prices. Both U.S. and international units are available to make the calculations easier to use, and the output is given for both one-way and round trip travel routes.

Check the driving distance for your planned route, and see if the total driving time requires an overnight stay. If it's a long trip, you may want to research some hotels along the way . Or compare whether it's better to fly or drive to your destination.

Home · About · Terms · Privacy

Watch CBS News

Americans continue to rack up credit card debt, hitting a record $1.14 trillion

By Khristopher J. Brooks

Edited By Anne Marie Lee

Updated on: August 6, 2024 / 4:52 PM EDT / CBS News

U.S. consumers collectively owe a record $1.14 trillion in credit card debt, figures released Tuesday by the Federal Reserve Bank of New York show . That's $27 billion more than the $1.13 trillion in credit card debt they carried during the second quarter of 2024.

The high tally comes amid concerns of an economic downturn triggered by modestly rising unemployment, and as soaring costs in food , housing and auto rates continue to drain household budgets. Americans have increasingly been relying on credit cards to make ends meet, with 6 in 10 adults, or 60%, using credit cards to buy groceries in 2023, according to a May report by the Urban Institute.

Prolonged debt also plays a factor in the historic amount as more Americans fall behind on their credit card bills. About 7.18% of cardholders fell into delinquency in the second quarter, up from 5% in the previous quarter, Fed statistics show.

"More people are carrying more debt for longer periods of time," Ted Rossman, senior industry analyst at Bankrate, said in a statement.

Americans paid down some of their credit card debt in 2020, using pandemic-related federal stimulus funds, Rossman noted. But beginning in 2021, credit card balances "rocketed upward by 48%, fueled by a post-pandemic boom in services spending as well as high inflation and high interest rates," he added.

Debt owed on mortgages and auto loans also climbed by $77 billion and $10 billion, respectively, according to the Fed's data. Total consumer debt grew to $17.8 trillion.

Rising interest rates

Compounding the problem is the soaring price of plastic, as interest rates on credit cards also continue to reach record highs. The average interest rate on a new credit card is now at 24.84%, the highest since LendingTree started tracking rates in 2019.

To be sure, both credit card debt and credit card interest rates could decline if the Federal Reserve decides to cut its benchmark rate in September — or perhaps even sooner .

The time for a rate cut "is approaching, and if we do get the data we hope we get, then reduction of our policy rate could be on the table at our September meeting," Fed Chairman Jerome Powell said last week.

- Could the Fed enact an emergency rate cut before its next meeting? Here are the odds.

The Federal Reserve's benchmark rate doesn't translate directly into movements in credit card annual percentage rates, or APRs, but because card rates are tied to the prime rate used by banks, which closely follows the Fed's federal funds rate, there is an indirect correlation.

In other words, credit card companies could lower their APRs in response to a rate cut by the Fed, LendingTree credit analyst Matt Schulz told CBS News , providing some relief for borrowers in the months ahead.

- Credit Card Debt

Khristopher J. Brooks is a reporter for CBS MoneyWatch. He previously worked as a reporter for the Omaha World-Herald, Newsday and the Florida Times-Union. His reporting primarily focuses on the U.S. housing market, the business of sports and bankruptcy.

More from CBS News

How credit utilization affects your credit score (and what to do about it)

How much will credit card debt forgiveness cost you? Here's what to know

What's the home equity loan interest rate forecast for fall 2024?

Home Depot warns consumers are cutting back amid economic uncertainty

Travel, Tourism & Hospitality

Global travel and tourism expenditure 2019-2022, by tourist type

Travel and tourism spending worldwide grew by approximately 30 percent in 2022 compared to the previous year, following a sharp drop with the onset of the coronavirus (COVID-19) pandemic. Despite the significant increase, both domestic and international travel spending remained below pre-pandemic levels, totaling roughly 3.9 trillion and 1.1 trillion U.S. dollars, respectively.

Total travel and tourism spending worldwide from 2019 to 2022, by type of tourist (in trillion U.S. dollars)

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

November 2023

2019 to 2022

figures are in constant 2022 prices and exchange rates as of March 2023

Figures for 2019 and 2022 were calculated by Statista by combining data on spending provided by the source for the following regions: North America, Europe, Caribbean, Latin America, Africa, Middle East, North East Asia, South Asia, South East Asia, and Oceania. All regional figures can be found here . Data for 2020 and 2021 were calculated by Statista based on the percentage changes in global international and domestic travel spending as indicated by the source.

Other statistics on the topic

- Number of outbound tourists from Australia FY 2023, by destination

- Number of international visitors to Australia FY 2023, by country of residence

- Number of international visitors to Australia FY 2010-2023

- Number of domestic overnight visitors Australia 2023, by state visited

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in Australia "

- Share of the GDP of the tourism sector in Australia 2013-2028

- Direct tourism GDP Australia FY 2006-2023

- Direct tourism GDP growth rate Australia FY 2006-2023

- Tourism contribution Australia FY 2023, by industry

- Tourism contribution Australia FY 2023, by state

- Number of tourism businesses Australia 2023, by type

- Tourism sector employment Australia FY 2023, by state and type

- Number of international visitors to Australia FY 2023, by age group

- Number of international visitors to Australia FY 2023, by state visited

- Number of international visitors to Australia FY 2023, by purpose of visit

- International visitor trip expenditure Australia FY 2010-2023

- International visitor trip expenditure Australia FY 2023, by country of residence

- Number of outbound tourists from Australia FY 2006-2023

- Number of outbound tourists from Australia 2017-2024, by state of residence

- Outbound tourist trip expenditure FY 2019-2023

- Outbound tourist trip expenditure Australia FY 2023, by destination

- Leading tourism experience interests among outbound travelers Australia 2022

- Leading sport tourism experience interests of outbound travelers Australia 2022

- Number of domestic overnight visitors Australia 2014-2023

- Number of domestic overnight visitors Australia 2023, by purpose of visit

- Domestic overnight tourist trip expenditure Australia FY 2014-2023

- Domestic overnight tourist trip expenditure Australia 2023, by state or territory

- Number of domestic day visitors Australia 2023, by state visited

- Number of domestic day visitors Australia 2023, by purpose of visit

Other statistics that may interest you Travel and tourism in Australia

- Premium Statistic Share of the GDP of the tourism sector in Australia 2013-2028

- Basic Statistic Direct tourism GDP Australia FY 2006-2023

- Basic Statistic Direct tourism GDP growth rate Australia FY 2006-2023

- Basic Statistic Tourism contribution Australia FY 2023, by industry

- Premium Statistic Tourism contribution Australia FY 2023, by state

- Premium Statistic Number of tourism businesses Australia 2023, by type

- Premium Statistic Tourism sector employment Australia FY 2023, by state and type

Inbound tourism

- Premium Statistic Number of international visitors to Australia FY 2010-2023

- Premium Statistic Number of international visitors to Australia FY 2023, by country of residence

- Premium Statistic Number of international visitors to Australia FY 2023, by age group

- Premium Statistic Number of international visitors to Australia FY 2023, by state visited

- Premium Statistic Number of international visitors to Australia FY 2023, by purpose of visit

- Premium Statistic International visitor trip expenditure Australia FY 2010-2023

- Premium Statistic International visitor trip expenditure Australia FY 2023, by country of residence

Outbound tourism

- Premium Statistic Number of outbound tourists from Australia FY 2006-2023

- Basic Statistic Number of outbound tourists from Australia 2017-2024, by state of residence

- Premium Statistic Number of outbound tourists from Australia FY 2023, by destination

- Premium Statistic Outbound tourist trip expenditure FY 2019-2023

- Premium Statistic Outbound tourist trip expenditure Australia FY 2023, by destination

- Premium Statistic Leading tourism experience interests among outbound travelers Australia 2022

- Premium Statistic Leading sport tourism experience interests of outbound travelers Australia 2022

Domestic tourism

- Premium Statistic Number of domestic overnight visitors Australia 2014-2023

- Premium Statistic Number of domestic overnight visitors Australia 2023, by state visited

- Premium Statistic Number of domestic overnight visitors Australia 2023, by purpose of visit

- Premium Statistic Domestic overnight tourist trip expenditure Australia FY 2014-2023

- Premium Statistic Domestic overnight tourist trip expenditure Australia 2023, by state or territory

- Premium Statistic Number of domestic day visitors Australia 2023, by state visited

- Premium Statistic Number of domestic day visitors Australia 2023, by purpose of visit

Further related statistics

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic Camping expenditures for food, beverages and entertainment in North America 2014

- Basic Statistic Importance of BRICS countries to UK tourism businesses 2011

- Premium Statistic Number of Royal Caribbean Cruises passenger cruise days worldwide 2007-2023

- Premium Statistic Number of Royal Caribbean Cruises available passenger cruise days worldwide 2007-2023

- Premium Statistic National park visitor spending in the U.S. 2012-2022, by trip type

- Premium Statistic Economic contribution of national park visitor spending in the U.S. 2012-2022

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

Further Content: You might find this interesting as well

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Camping expenditures for food, beverages and entertainment in North America 2014

- Importance of BRICS countries to UK tourism businesses 2011

- Number of Royal Caribbean Cruises passenger cruise days worldwide 2007-2023

- Number of Royal Caribbean Cruises available passenger cruise days worldwide 2007-2023

- National park visitor spending in the U.S. 2012-2022, by trip type

- Economic contribution of national park visitor spending in the U.S. 2012-2022

- Middle Eastern countries with the largest international tourism receipts 2018

- Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Growth of inbound spending in the U.S. using foreign visa credit cards

COMMENTS

The dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry, tracking industry performance, travel volumes and predictive indicators of recovery including air and lodging forecasts, DMO website traffic, convention and group trends, travel spending and losses, traveler sentiment ...

Total travel spending in the United States from 2019 to 2022, with a forecast until 2026 (in trillion U.S. dollars) Premium Statistic Direct travel spending in the U.S. 2019-2022, by traveler type

Due to travel restrictions relating to the coronavirus (COVID-19) pandemic, both 2020 and 2021 saw a significant drop in travel spending in the United States over 2019, dropping to 0.72 trillion U.S.

Travel and Tourism Satellite Account for 2018-2022. The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Satellite Account. Read the Article.

Total Travel Spending $1.17 T $680 B $877 B $1.06 T $1.16 T $1.23 T $1.26 T Domestic $992 B $642 B $838 B $932 B $997 B $1.04 T $1.06 T Leisure $722 B $555 B $702 B $726 B $745 B $766 B $776 B Business $270 B $88 B $136 B $206 B $252 B $277 B $284 B Transient $157 B $59 B $93 B $127 B $152 B $164 B $169 B ...

International tourism, expenditures (% of total imports) International tourism, expenditures for passenger transport items (current US$) International tourism, receipts (current US$) ... receipts for travel items (current US$) Download. CSV XML EXCEL. DataBank. Explore Our DataBank. WDI Tables. Thematic data tables from WDI. All Countries and ...

Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019's total. More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national ...

total travel spending $1.17 t $722 b $886 b $1.05 t $1.15 t $1.21 t $1.24 t $1.26 t business $306 b $101 b $122 b $222 b $270 b $287 b $287 b $286 b leisure $867 b $622 b $764 b $827 b $880 b $920 b $952 b $970 b ... u.s. travel forecast - spending, % of 2019 levels (adjusted for inflation) u.s. travel forecast - where we should be ...

This becomes even more clear when we examine annual growth rates of travel expenses compared to total expenses. For the 10-year time frame spanning from 1997-2007, travel expenses grew 3.4% a year on average, while overall U.S. spending grew 4.9% a year. This means that travel was shrinking as a share of overall American budgets during this ...

Signs of a slowdown are surfacing across the travel economy. On recent earnings calls, hotel and travel company executives have pointed to lethargic domestic leisure demand from U.S. consumers ...

Furthermore, as a result of spending in local areas by the employees of travel businesses and their suppliers, additional sales are generated: induced output. Total travel related output was $2.6 trillion in 2019. The total number of American jobs supported by travel was 15.8 million in 2019. This indicates

Add in the cost of airport transfers to the hotel or the cost of rental car for the trip. Once you estimate each of these four costs, total them up for a good estimate of travel flight costs. You would use the same process for train tickets and public transportation instead of flights and car rental/airport transfers.

International tourism, expenditures for travel items (current US$) World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0

NEW YORK, Aug 8 (Reuters) - Travel companies including Airbnb (ABNB.O), opens new tab and Marriott International (MAR.O), opens new tab are forecasting a slowdown in leisure travel as U.S ...

Published by Statista Research Department , Nov 15, 2023. The domestic and international travel expenditure in the United States was projected to amount to 1.09 trillion U.S. dollars in 2023. As ...

Travelmath provides an online cost calculator to help you determine the cost of driving between cities. You can use this data to figure out a budget for a road trip. The driving calculation is based on the average fuel efficiency of your vehicle, and you can change the gas mileage in mpg or L/100 km to match your exact make and model.

Total direct travel spending in the United States from 2019 to 2022, by type of traveler (in billion U.S. dollars) [Graph], US Travel Association, June 14, 2023. [Online].

Debt owed on mortgages and auto loans also climbed by $77 billion and $10 billion, respectively, according to the Fed's data. Total consumer debt grew to $17.8 trillion.

This chapter presents history, economic statistics, and federal government directories of Kemerovo Oblast. Kemerovo Oblast, known as the Kuzbass, is situated in southern central Russia.

The $500 billion loss in travel spending has cost the U.S. $1.1 trillion in economic output. Prior to the pandemic, direct travel jobs accounted for 6% of the workforce and total travel-supported jobs accounted for 11%. But in 2020, direct travel jobs accounted for a disproportionate 35% of jobs lost and total travel supported jobs accounted ...

Average domestic travel spending intentions during Golden Week in Japan 2009-2019; Forecast travel expenditures in the U.S. 2023-2026; Annual growth of travel expenditure in the U.S. 2019-2026

See our radar map for Novokuznetsk, Kemerovo-Oblast-Kuzbass weather updates. Check for severe weather including wildfires and hurricanes, or just check to see when rain is due.

Kemerovo Oblast—Kuzbass is situated in southern central Russia. Krasnoyarsk Krai and Khakasiya lie to the east, Tomsk Oblast to the north, Novosibirsk Oblast to the west, and Altai Krai and the Republic of Altai to the south-west.

Published by Statista Research Department , Nov 7, 2023. Travel and tourism spending worldwide grew by approximately 30 percent in 2022 compared to the previous year, following a sharp drop with ...

Kemerovo Oblast — Kuzbass, also known simply as Kemerovo Oblast (Russian: Ке́меровская о́бласть) or Kuzbass (Кузба́сс), after the Kuznetsk Basin, is a federal subject of Russia (an oblast). Kemerovo is the administrative center and largest city of the oblast. Kemerovo Oblast is one of Russia's most urbanized regions, with over 70% of the population living in its ...