- GLOBAL - EN

Select your location

No results found

Travel in a world of geopolitical, climate, and digital disruptions

Travel weekly insight annual report 2023-24.

Consumers’ appetite for travel in 2023 showed no signs of abating as post-pandemic pent-up demand continued to fuel spending in the sector despite surging inflation and geopolitical instability. As ‘revenge travel’ gradually subsides, the travel industry is expected to return to pre-pandemic performance patterns in 2024, barring any major unforeseen events. The growth rate of recent years is not sustainable and there are indications of softening demand, particularly in the US market.

Following the disruptions to the sector over the last three years, consumers have found a renewed interest in travel giving the industry the opportunity to redefine itself. The future of travel lies in recognising it can play a fundamental part in the human experience. Beyond being a ‘commodity’, travel is increasingly becoming a means of self-discovery and personal enrichment. To redefine its role and its offering, the travel industry needs to embrace innovation, better understand the diversity of its customers and prioritise the delivery of personalised experiences.

Changing consumer priorities

Despite initial forecasts of a decline in living standards, outbound travel demand in 2023 exceeded expectations. However, the lag effect of high inflation and interest rate hikes may lead consumers to be more cautious with their holiday spending. There is likely to be a continued focus on securing value for money including booking more all-inclusive trips, holidaying closer to home, reducing the length of trips, seeking cheaper flights or planning holidays outside of the peak season. Additionally, the growing concern regarding climate change and sustainability is influencing consumer behaviour, with a significant percentage of UK adults willing to pay more to travel with companies that prioritise carbon emission reduction. Overall, the industry remains optimistic. However, operators are prepared to adapt and offer more flexible capacity based on evolving consumer demands.

Explore the potential implications for your business in 2024.

Find out more

Transforming for tomorrow

Generative AI has the potential to disrupt the travel and hospitality industry, particularly in areas such as itinerary generation and hyper-personalisation. AI has the potential to redefine loyalty by focusing on personalised experiences rather than point-based programmes. AI based models are accelerating the speed at which businesses can make decisions and drive better outcomes. However, the need for quality data to feed into these models will be critical to the success of AI.

Explore how technology is helping business growth and efficiency.

Building resilience

The world officially experienced its hottest year on record in 2023. Between January and November 2023, the global average temperature reached 15.1°C, marking a record-breaking increase of 1.46°C from preindustrial levels.1 The progress on sustainability in the travel industry has been modest, with incremental improvements rather than a step change. A recent Environmental Impact Research report on the global impact of travel concluded that given the current climate and biodiversity crises, continuing business as usual risks breaching environmental tipping points at a time when the sector is more dependent than most on the natural world.2 While corporate responsibility and marketing play a role, customers do not consistently reward sustainable practices when making travel decisions. Institutional investors and government regulations are the key drivers for change, but the pace of change is often slow. Sustainability and ESG considerations are increasingly important to investors as businesses that demonstrate sustainability and have clear ESG plans are likely to command higher valuations and be more attractive. However, there are costs incurred in becoming more sustainable, whether it is investment in technology or processes. The cost pressures businesses are currently under impact how much investment they can make in sustainability, but equally the cost and the impact of not transitioning is also becoming increasingly clearer.

Explore what your business can do to build a sustainable future.

Visit the Travel Weekly website to explore the findings and view images of the launch event.

Previous editions

Travel Weekly Insight Annual Report 2022-23

Travel Weekly Insight Annual Report 2021-22

Travel Weekly Insight Annual Report 2020-21

Travel Weekly Insight Annual Report 2019-20

Travel Weekly Insight Annual Report 2018

__________________________________________________________________________________________________________________

1 Climate records tumbled ‘like dominoes’ during world’s hottest year (ft.com) 2 TheEnvironmentalImpactofGlobalTourismOct2023.pdf (wttc.org)

Our thinking

Attitudes to trade survey 2023 | deloitte uk.

Flexibility is the key to future success | Deloitte UK

Capturing pent-up demand with revenue technology | Deloitte UK

Get in touch, alistair pritchard.

Perspectives on travel recovery: UK

As one of the sectors acutely impacted by the COVID-19 pandemic, UK tourism dropped by 52% between 2019 and 2020 (or by a value of 66.5 GBP bn) and it is not expected to return to its pre-crisis level until 2024 (for domestic tourism) and 2025 (inbound).

At a general level, UK has been less affected than countries like France (drop of 60%) or Italy (55%) but more than others like Germany (38%).

Outbound expenditures dropped by approximately 75% between 2019 and 2020 (the business segment suffered more than the leisure segment with a drop in expenditures of about 78% and a 73% respectively). However, UK occupies the second position regarding total outbound spend only behind Germany. In terms of average trip expenditure for international trips, UK is not among the ‘big spenders’ and countries such as Finland, Germany and Switzerland are above UK.

Inbound market trends are quite similar and don’t differ significantly from outbound market ones, with a 73% of drop in expenditures in total (combining business and leisure) and a recovery horizon of 2027 for business segment and 2024 for leisure.

Related Articles

Perspective on travel recovery

- Travel, Tourism & Hospitality ›

Leisure Travel

Travel & Tourism market revenue in the United Kingdom 2019-2029, by segment

Revenue of the travel & tourism market in the united kingdom from 2019 to 2029, by segment (in billion u.s. dollars).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

Other statistics on the topic Travel and tourism in the United Kingdom (UK)

- Leading outbound travel destinations from the UK 2019-2023

Travel, Tourism & Hospitality

- Inbound tourist visits to the UK 2002-2023

- Leading UK cities for international tourism 2019-2023, by visits

Accommodation

- Most popular hotel brands in the UK Q2 2024

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Travel and tourism in the United Kingdom (UK) "

- Travel and tourism's total contribution to GDP in the UK 2019-2022

- Distribution of travel and tourism expenditure in the UK 2019-2022, by type

- Distribution of travel and tourism expenditure in the UK 2019-2022, by tourist type

- Travel and tourism's total contribution to employment in the UK 2019-2022

- Median full-time salary in tourism and hospitality industries in the UK 2023

- CPI inflation rate of travel and tourism services in the UK 2023

- Inbound tourist visits to the UK 2019-2022, by purpose of trip

- Leading inbound travel markets in the UK 2019-2022, by number of visits

- Leading inbound travel markets in the UK 2023, by growth in travel demand on Google

- Number of overnight stays by inbound tourists in the UK 2004-2022

- International tourist spending in the UK 2004-2024

- Leading inbound travel markets for the UK 2019-2023, by spending

- Number of outbound tourist visits from the UK 2007-2023

- Outbound tourism visits from the UK 2019-2022, by purpose

- Leading outbound travel markets in the UK 2023, by growth in travel demand on Google

- Number of outbound overnight stays by UK residents 2011-2023

- Outbound tourism expenditure in the UK 2007-2023

- Domestic overnight trips in Great Britain 2010-2022

- Domestic tourism trips in Great Britain 2018-2022, by purpose

- Number of domestic overnight trips in Great Britain 2023, by destination type

- Number of tourism day visits in Great Britain 2011-2022

- Total domestic travel expenditure in Great Britain 2019-2022

- Domestic overnight tourism spending in Great Britain 2010-2022

- Expenditure on domestic day trips in Great Britain 2011-2022

- Average spend on domestic summer holidays in the United Kingdom (UK) 2011-2023

- Number of accommodation businesses in the UK 2008-2022

- Number of accommodation enterprises in the UK 2018-2021, by type

- Turnover of accommodation businesses in the UK 2008-2022

- Turnover of accommodation services in the UK 2015-2022, by sector

- Number of hotel businesses in the UK 2008-2022

- Consumer expenditure on accommodation in the UK 2005-2022

- Attitudes towards traveling in the UK 2024

- Travel frequency for private purposes in the UK 2024

- Travel frequency for business purposes in the UK 2024

- Share of Britons taking days of holiday 2019-2023, by number of days

- Share of Britons who did not take any holiday days 2019-2023, by gender

- Share of Britons who did not take any holiday days 2019-2023, by age

- Leading regions for summer staycations in the UK 2024

- Preferred methods to book the next overseas holiday in the UK October 2022, by age

- Travel & Tourism market revenue in the United Kingdom 2019-2029, by segment

- Travel & Tourism market revenue growth in the UK 2020-2029, by segment

- Revenue forecast in selected countries in the Travel & Tourism market in 2024

- Number of users of package holidays in the UK 2019-2029

- Number of users of hotels in the UK 2019-2029

- Number of users of vacation rentals in the UK 2019-2029

Other statistics that may interest you Travel and tourism in the United Kingdom (UK)

- Basic Statistic Travel and tourism's total contribution to GDP in the UK 2019-2022

- Basic Statistic Distribution of travel and tourism expenditure in the UK 2019-2022, by type

- Basic Statistic Distribution of travel and tourism expenditure in the UK 2019-2022, by tourist type

- Basic Statistic Travel and tourism's total contribution to employment in the UK 2019-2022

- Premium Statistic Median full-time salary in tourism and hospitality industries in the UK 2023

- Premium Statistic CPI inflation rate of travel and tourism services in the UK 2023

Inbound tourism

- Basic Statistic Inbound tourist visits to the UK 2002-2023

- Premium Statistic Inbound tourist visits to the UK 2019-2022, by purpose of trip

- Basic Statistic Leading inbound travel markets in the UK 2019-2022, by number of visits

- Premium Statistic Leading inbound travel markets in the UK 2023, by growth in travel demand on Google

- Premium Statistic Number of overnight stays by inbound tourists in the UK 2004-2022

- Premium Statistic International tourist spending in the UK 2004-2024

- Premium Statistic Leading inbound travel markets for the UK 2019-2023, by spending

- Premium Statistic Leading UK cities for international tourism 2019-2023, by visits

Outbound tourism

- Premium Statistic Number of outbound tourist visits from the UK 2007-2023

- Premium Statistic Outbound tourism visits from the UK 2019-2022, by purpose

- Premium Statistic Leading outbound travel destinations from the UK 2019-2023

- Premium Statistic Leading outbound travel markets in the UK 2023, by growth in travel demand on Google

- Premium Statistic Number of outbound overnight stays by UK residents 2011-2023

- Premium Statistic Outbound tourism expenditure in the UK 2007-2023

Domestic tourism

- Premium Statistic Domestic overnight trips in Great Britain 2010-2022

- Premium Statistic Domestic tourism trips in Great Britain 2018-2022, by purpose

- Premium Statistic Number of domestic overnight trips in Great Britain 2023, by destination type

- Premium Statistic Number of tourism day visits in Great Britain 2011-2022

- Premium Statistic Total domestic travel expenditure in Great Britain 2019-2022

- Premium Statistic Domestic overnight tourism spending in Great Britain 2010-2022

- Premium Statistic Expenditure on domestic day trips in Great Britain 2011-2022

- Premium Statistic Average spend on domestic summer holidays in the United Kingdom (UK) 2011-2023

- Premium Statistic Number of accommodation businesses in the UK 2008-2022

- Premium Statistic Number of accommodation enterprises in the UK 2018-2021, by type

- Premium Statistic Turnover of accommodation businesses in the UK 2008-2022

- Premium Statistic Turnover of accommodation services in the UK 2015-2022, by sector

- Premium Statistic Number of hotel businesses in the UK 2008-2022

- Basic Statistic Most popular hotel brands in the UK Q2 2024

- Premium Statistic Consumer expenditure on accommodation in the UK 2005-2022

Travel behavior

- Premium Statistic Attitudes towards traveling in the UK 2024

- Premium Statistic Travel frequency for private purposes in the UK 2024

- Premium Statistic Travel frequency for business purposes in the UK 2024

- Premium Statistic Share of Britons taking days of holiday 2019-2023, by number of days

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by gender

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by age

- Premium Statistic Leading regions for summer staycations in the UK 2024

- Premium Statistic Preferred methods to book the next overseas holiday in the UK October 2022, by age

- Premium Statistic Travel & Tourism market revenue in the United Kingdom 2019-2029, by segment

- Premium Statistic Travel & Tourism market revenue growth in the UK 2020-2029, by segment

- Premium Statistic Revenue forecast in selected countries in the Travel & Tourism market in 2024

- Premium Statistic Number of users of package holidays in the UK 2019-2029

- Premium Statistic Number of users of hotels in the UK 2019-2029

- Premium Statistic Number of users of vacation rentals in the UK 2019-2029

Further related statistics

- Premium Statistic Revenue forecast for the Hotels market by category in the United States in 2029

- Premium Statistic Revenue of the package holidays industry in Switzerland 2020-2029

- Premium Statistic Revenue of the hotels industry in Asia 2020-2029

- Premium Statistic Travel & Tourism market - Revenue forecast in Switzerland 2021 - 2029

- Premium Statistic Revenue per user of hotels in the U.S. 2020-2029

- Premium Statistic Penetration rate of vacation rentals in Italy 2020-2029

- Premium Statistic User forecast in selected countries in the Hotels market in 2023

- Premium Statistic Revenue forecast for the Hotels market by category in France in 2029

- Premium Statistic Revenue of the package holidays industry in Europe 2020-2029

- Premium Statistic Revenue of the hotels industry in the U.S. 2020-2029

- Premium Statistic Revenue of the package holidays industry in Germany 2020-2029

- Premium Statistic Revenue of the vacation rentals industry in Spain 2020-2029

- Premium Statistic Travel & Tourism market - Revenue forecast in China 2021 - 2029

- Premium Statistic Revenue per user of vacation rentals worldwide 2020-2029

- Premium Statistic Penetration rate of vacation rentals in the U.S. 2020-2029

- Premium Statistic Revenue per user of trains in the U.S. 2020-2029

- Premium Statistic Number of users of buses in Germany 2020-2029

- Premium Statistic Revenue per user of buses in Asia 2020-2029

- Premium Statistic Number of users of car rentals in Italy 2020-2029

Further Content: You might find this interesting as well

- Revenue forecast for the Hotels market by category in the United States in 2029

- Revenue of the package holidays industry in Switzerland 2020-2029

- Revenue of the hotels industry in Asia 2020-2029

- Travel & Tourism market - Revenue forecast in Switzerland 2021 - 2029

- Revenue per user of hotels in the U.S. 2020-2029

- Penetration rate of vacation rentals in Italy 2020-2029

- User forecast in selected countries in the Hotels market in 2023

- Revenue forecast for the Hotels market by category in France in 2029

- Revenue of the package holidays industry in Europe 2020-2029

- Revenue of the hotels industry in the U.S. 2020-2029

- Revenue of the package holidays industry in Germany 2020-2029

- Revenue of the vacation rentals industry in Spain 2020-2029

- Travel & Tourism market - Revenue forecast in China 2021 - 2029

- Revenue per user of vacation rentals worldwide 2020-2029

- Penetration rate of vacation rentals in the U.S. 2020-2029

- Revenue per user of trains in the U.S. 2020-2029

- Number of users of buses in Germany 2020-2029

- Revenue per user of buses in Asia 2020-2029

- Number of users of car rentals in Italy 2020-2029

Viewing offline content

Limited functionality available

- US-EN Location: United States-English

- Saved items

- Content feed

- Subscriptions

- Profile/Interests

- Account settings

2024 travel industry outlook has been saved

2024 travel industry outlook has been removed

An Article Titled 2024 travel industry outlook already exists in Saved items

2024 travel industry outlook

Unpack the biggest travel trends for the year ahead.

- Save for later

After more than two years of consistent year-over-year gains, leisure travel may have tapped all its pent-up demand from the peak pandemic years. Is US travel demand due for a correction? Our 2024 travel industry outlook explores signals of the strength of travel demand.

Balancing budgets with the benefits of travel

Even during times of financial anxiety, travel has held a consistent share of Americans’ wallets. Enthusiasm for in-destination activities, growing interest in more diverse destinations, and the return of baby boomers in greater numbers add to the positive indicators for travel. And workplace flexibility appears poised to further buoy demand.

Despite this optimistic outlook, could an economic downturn shift travel behaviors? Travel frequency and certain indulgences may see a decline, but if higher-income groups are relatively insulated from economic headwinds, higher-end travel products could have a better year than budget ones. On the corporate side, many decision-makers in the coming year will seek a delicate balance between conservative budgeting and pursuing the strategic benefits that travel can support.

Our 2024 travel outlook takes a closer look at five trends expected to shape the industry this year:

- Suppliers find ways to touch up the travel experience. High interest rates and elevated costs of some goods can make it difficult to update, let alone upgrade, hotels. And some of airlines’ biggest challenges have stemmed from weather events and staffing matters not entirely in their control. Still, airlines and hospitality providers know they need to improve the experiences they offer or risk losing travelers’ attention.

- The corporate comeback continues, but gains decelerate. While trips to build client relationships and support team collaboration remain key to business success, costs are a significant concern. Amid these efforts at prudent budgeting, US corporate travel spend is still likely to finally pass the pre-pandemic line within the next year.

- More trips or longer trips? Travelers choose their own adventure. One of the most lasting effects of the pandemic has been a shift in how white-collar work gets done. Remote and hybrid arrangements appear to be here to stay, and the share of travelers who plan to work on their longest leisure trips has surged. In addition to adding and extending trips, this laptop lugger behavior also has an impact on travelers’ in-destination needs and preferences.

- Marketing spend shifts to account for changes in platforms and demographics. As travel demand has returned and shown continued resilience to economic anxiety, the industry’s marketing spend has trended up, and travel providers have ridden a wave of pent-up demand. But as travel growth slows, there will be a greater need for more targeted marketing and for travel providers to build new strategies for a changing landscape.

- Gen AI: Behind the scenes and front and center. Gen AI is already influencing travel, with call center efficiencies the most widely reported benefit. In the coming year, expect it to influence the industry in major ways. More visible applications (new options for discovery, shopping, booking) will garner much of the attention, but less visible applications might actually be more influential. Promising use cases for travel providers include advertising strategy, marketing content, and personalization.

Download our full report to learn more about the opportunities and challenges ahead.

ConsumerSignals™ for the travel industry

Where are travelers willing to splurge? And where are they looking to cut back during their trips? Keep up with consumer spending trends in our ConsumerSignals dashboard—refreshed with new data each month.

${second-image-title-copy}

Subscribe to learn more

Want to chat more about the trends covered in our 2024 travel industry outlook—and what they mean for your organization? Fill out the form below to get in touch with our team.

Get in touch

Eileen Crowley

Vice Chair US Transportation, Hospitality and Services attest leader Deloitte & Touche LLP

Michael Daher

Vice Chair US Transportation, Hospitality and Services non-attest leader Deloitte Consulting LLP

Matt Soderberg

Principal US Airlines leader Deloitte Consulting LLP

Matthew Usdin

Principal US Hospitality leader Deloitte Consulting LLP

${fifth-leader-name}

${fifth-leader-title}

${fifth-leader-email}

${fifth-leader-additional-info}

Recommendations

Technology trends in the airline industry

Retooling to take flight

The future of restaurants

Creating dynamic value in the new normal

Welcome back

To join via sso please click on the key button below.

To stay logged in, change your functional cookie settings.

Social login not available on Microsoft Edge browser at this time.

Link your accounts

You previously joined my deloitte using the same email. log in here with your my deloitte password to link accounts. | | deloitte users: log in here one time only with the password you have been using for dbriefs/my deloitte., you've previously logged into my deloitte with a different account. link your accounts by re-verifying below, or by logging in with a social media account., looks like you've logged in with your email address, and with your social media. link your accounts by signing in with your email or social account..

- Brazil | PT

- Chinese | (中文)

- German | DE

- Japanese | JA

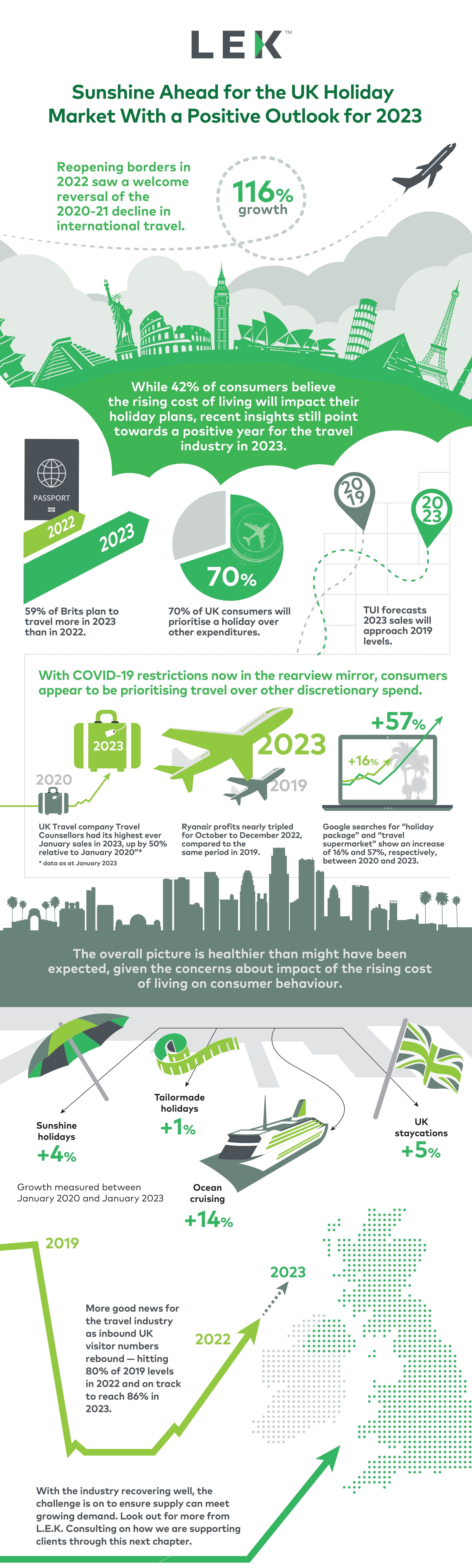

Sunshine Ahead for the UK Holiday Market With a Positive Outlook for 2023

- April 19, 2023

During the pandemic, the holiday sector suffered from closed borders and lockdowns, curtailing travel plans for all. After 2022 saw a strong rebound in the travel industry, the forecasts are increasingly positive for 2023. The ongoing cost-of-living crisis in the UK is putting pressure on consumer discretionary spend, which in principle leaves holiday companies vulnerable; however, in reality the picture is better than expected. Despite high inflation and prices, research points to a majority of UK consumers planning to increase travel in 2023. Data signals more good news for UK tourism, with inbound travel levels recovering well. Keeping on top of technology disruption, staffing levels and strategies to meet increasing demand are all key in 2023.

Related Practice

Related insights, travel, transport & logistics, seizing the moment: evolving opportunities for infrastructure investors, sustainability, to meet decarbonization targets, master the circular economy, enterprise digital impact study, 2023 enterprise digital impact study, new mobility, aaus podcast series: natasha santha - partner, l.e.k consulting (aam special episode), ai has moved beyond hype — it is driving performance and deployment is widespread.

Outbound Travel Industry Analysis in the United Kingdom

Demand Outlook of Outbound Travel in the United Kingdom by Day Trips and Local Gateways through 2034

Leading Companies Facilitate Solo Travelers with Tailored Packages, Safety Measures, and Community-based Activities to Encourage Independent Exploration and Social Interaction

- Report Preview

- Request Methodology

Analytical Study of Outbound Travel in the United Kingdom from 2024 to 2034

The United Kingdom's outbound travel industry is projected to hit a value of US$ 90.46 billion by 2024. This momentum is expected to be sustained as it is rising at a CAGR of 8.60%, leading to an estimated valuation of US$ 206.43 billion by 2034.

A number of factors contribute to this positive outlook. The elevation in household incomes has resulted in increased disposable income. This allows individuals to allocate more funds towards leisure trips such as overseas holidays. In addition, the strong British pound sterling has further boosted the affordability of international traveling for United Kingdom residents through favorable exchange rates with weaker currency countries.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Key Highlights in the United Kingdom Outbound Travel Industry

- Adventure travel experiences are increasingly becoming popular among individuals in this country. Hence a significant increase in demand from their adventurous population. This, therefore, creates an opportunity for hiking companies, cycling agencies, and other outdoor activity firms to target this expanding section of tourists.

- Increasing focus on well-being has led to a demand for wellness travel experiences across various locations within the country, including spa retreats, yoga getaways, and highly reputed places.

- Despite outbound travel remaining buoyant, there has also been a rise in the “staycations” trend that promotes domestic tourism in the country.

Key Trends Influencing Demand for Outbound Travel in the United Kingdom

- Work vacations for the Nomadic Workforce

The increase in remote work culture in the United Kingdom has boosted the workcation trend, where professionals mix both working and traveling. Travel companies can target this section by providing co-working spaces, reliable Wi-Fi connectivity, and extended stay packages in attractive destinations. Therefore, these professionals can combine work and tourism.

- Luxury Travel Evolution

Luxury travel is moving on from traditional luxury to more authentic experiences throughout the United Kingdom. These include private tours with local guides, access to exclusive cultural events, or bespoke itineraries that uncover hidden gems. To meet this demand, travel companies can provide personalized itineraries that mirror the unique interests and tastes of luxury tourists.

- Festival Tourism Takes Flight

Music festivals, food fairs, and cultural fetes have become popular tourist highlights. Hence, British travelers are incorporating these events into their sojourns, thus fueling travel needs for festival-oriented packages and logistics around main occasions. They may also collaborate with festival organizers to offer all-inclusive deals, including ticketing, transport, or lodging services.

- Wellness and Spa Retreats

Individuals in the United Kingdom are looking after their health, visiting places with famous Spas, wellness resorts, and natural healing therapies. Yoga, meditation, spa treatments, and healthy food are included in a travel package. The traveler can unwind and rejuvenate while trying to focus on his or her physical as well as mental well-being.

- Culinary Experiences

Food tours, cooking classes, and local market visits have gained immense popularity among travelers over the past few years. These include dining experiences like eating at local establishments, learning how to cook from top chefs, and tasting traditional meals and ingredients.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Category wise insights

The section offers an analysis of the dominant segments influencing the demand outlook for outbound travel in the United Kingdom. Notably, the day trips and local gateways segment takes the lead with a 44.70% share in 2024. Following this, the online booking channel is estimated to secure a share of 29.60% in 2024.

Day Trips & Local Getaways Predicted to Dominate the Industry

Day trips and local getaways are likely to take 44.70% of the industry in 2024.

- Short getaways cater to busy lives so that there is no need to give up precious time for traveling purposes.

- Day trips and local adventures present a low-cost alternative compared with extended vacations.

- Travelers are moving away from seeing typical tourist attractions towards feeling part of them, which is often obtained on neighboring routes.

- The remote work trend allows professionals to explore nearby destinations while maintaining work commitments.

Online Booking Platforms to Secure a Share of 29.60% in 2024

Online booking platforms are likely to have 29.60% of the industry in 2024.

- The online booking channel enables travelers to study, make comparisons, and place orders for travel arrangements through one single platform, hence reducing time wastage.

- These online platforms give travelers access to a wide pool of options from different travel providers, thereby encouraging competition and, perhaps, lower prices.

- This gives people the ability to know about available review ratings, as well as real-time information that would assist them while making choices on holiday destinations or when deciding where to stay during their trips.

- Many such platforms offer perks like discounts and exclusive offers along with mobile app-based facilities that customers can use when they are on the move.

Competitive Analysis of Outbound Travel in the United Kingdom

The outbound travel industry in the United Kingdom is a vibrant one, with many established players and new entrants competing against each other. Traditional travel agencies still have a strong presence, especially when it comes to complex itineraries or luxurious holidays.

They use their knowledge and relationships with customers to offer bespoke services and expert advice. Nevertheless, they are expected to embrace the online world and provide competitive rates as well.

Online travel agents (OTAs), such as Expedia and Booking.com, have emerged as key forces grabbing an increasing percentage of the industry. Their user-friendly portals, combined with a wide range of choices, including flights, hotels, and attractions, make them appealing to budget-conscious travelers who prefer convenience.

Specialized travel companies catering to specific interests like adventure travel, eco-tourism, or cultural immersion trips are gaining traction. These companies cater to a growing segment of travelers seeking unique and authentic experiences. Additionally, travel bloggers and social media influencers are emerging as powerful voices, influencing travel trends and potentially disrupting traditional marketing strategies.

Recent Developments Observed in the United Kingdom Outbound Travel Business

- In 2020, Trailfinders won several awards for its customer service, quality, and value, such as the Which? Travel Brand of the Year, the British Travel Awards, and the Travel Weekly Globe Awards. It also launched a new loyalty scheme, Trailfinders Rewards, to offer benefits and discounts to its customers.

- Saga Plc introduced new health and safety measures, such as mandatory vaccinations, testing, and insurance, for its travel customers. It had also launched a new river cruise ship, Spirit of the Rhine, in March 2021.

- Lotus Group expanded its business by acquiring the online travel agency Travelbag from dnata, a subsidiary of Emirates Group. It also launched a new brand, Lotus Journeys, to offer luxury and experiential holidays to destinations such as Japan, India, and Vietnam.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Key Players Offering Outbound Travel Services in United Kingdom include

- Booking.com

- Thomas Cook Group Plc

- Trailfinders Group Limited

- Hogg Robinson Group Plc

- Hays Travel Limited

- The Globespan Group Plc

- Lotus Group Ltd.

5 Strategies for United Kingdom’s Outbound Travel Companies to Thrive

- Embrace Digital Shift

Online portals are becoming increasingly popular among customers making travel bookings. Businesses need websites that are easy to navigate and mobile apps that offer seamless booking experiences at competitive rates. Moreover, AI-powered chatbots for customer support and personalized recommendations can improve the digital experience even more.

- Tailor Experiences, Cater to Niches

The introduction of new niche travel segments creates opportunities for companies. Firms can specialize in adventure tours, eco-tourism outings, and cultural immersion trips or target certain demographics, such as families, singles, or digital nomads. Creating unique local experiences with curated itineraries and partnerships with niche providers is likely to cultivate customer loyalty.

- Become a Content Hub, Build Trust

Before booking, travelers often look for inspiration and information. This can be achieved by producing engaging online content - blogs, social media posts, travel guides - about destinations, local attractions, and cultural differences. Moreover, making practices involved in sustainable tourism more visible may draw more conscious tourists into the fold.

- Offer Flexibility and Value

Flexible travel options reign dominance. Offering customizable itineraries, last-minute deals, and cancellation policies that cater to changing plans can attract a wider audience. Consider incorporating travel insurance and activity bookings within your packages for additional value and convenience.

- Prioritize Customer Experience

Building strong customer relationships is key to success. Personalized service goes beyond just booking. Offer pre-departure support, in-destination assistance, and post-trip follow-ups to ensure a seamless travel experience. Leveraging technology like chatbots and live chat support can enhance responsiveness and address customer concerns efficiently. By focusing on building trust and exceeding expectations, companies can cultivate loyal customers who will return for future trips.

Key Coverage in the United Kingdom Outbound Travel Industry Report

- United Kingdom Tourism Source Industry Key Destinations

- Outbound Tourism by United Kingdom Residents

- Outbound Travel Sector in the United Kingdom

- Overseas Tourism Market in the United Kingdom

- Travel & Tourism Sector in the United Kingdom

Key Segments

- Day Trips & Local Gateways

- Pilgrimages

- Religious and Heritage Tours

By Traveler Type:

- Independent Traveller

- Package Traveller

By Booking Channel:

- Online Booking

- Offline Booking

By Age Group:

- 0 to 20 Years

- 21 to 40 Years

- 41 to 60 Years

Frequently Asked Questions

What is the industry size for outbound travel in the united kingdom.

The outbound travel industry in the United Kingdom is poised to reach US$ 90.46 billion in 2024.

What is the Future Outlook of Outbound Travel Adoption in the United Kingdom?

The industry is anticipated to surpass a valuation of US$ 206.43 billion by 2034.

What is the Anticipated Growth Rate of Outbound Travel in the United Kingdom?

The demand for outbound travel in the United Kingdom is likely to rise at a CAGR of 8.60% from 2024 to 2034.

Which Outbound Travel Type is Most Popular in the United Kingdom?

Day trips & local gateways are the leading outbound travel type in the industry.

Which Booking Channel Secures the Prime Share of the Industry in 2024?

The online booking channel is anticipated to lead the industry in 2024.

Table of Content

Recommendations.

Travel and Tourism

Industry Analysis of Outbound Tourism in Germany

REP-GB-15691

Outbound Medical Tourism Market

REP-GB-3051

Russia Outbound Tourism Market

November 2022

REP-GB-15791

India Outbound Meetings, Incentives to Europe Market

REP-IN-3008

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Get a Free Sample -

- Request Methodology -

- Customize Now -

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Global travel ‘to grow faster than worldwide economy’ over next four years

- Share on WhatsApp

- Share by email

The global travel market will grow faster than the worldwide economy over the next four years, new research suggests.

The market set to expand at a 6% compound annual growth rate (CAGR) between 2024 and 2028.

Furthermore, global travel spend is expected to surpass 2019 levels for the first time since the pandemic to reach over $2 trillion this year.

This will be driven by strong travel demand in the US and Europe, as well as the growth of the middle classes particularly in India, Indonesia, the Philippines and Vietnam; globalisation and freedom of movement, and workplace flexibility.

The global travel market forecast report by London-based Forrester Research expects international travel to recover to pre-pandemic levels by 2025.

The report says: “Domestic tourism has taken off in the past four years, however the recovery of outbound travel has been impacted by political instability from the war in Ukraine and the Israel-Palestine conflict.

“International travel will exceed pre-pandemic levels two full years behind the recovery in domestic tourism.”

But Forrester notes: “Consumers are making more mindful decisions when it comes to their environmental footprint, and travel brands need to take note.

“This trend toward sustainability has far-reaching implications for the travel industry.

“Travel brands can work to encourage sustainable travel options such as promoting ‘under-touristed’ destinations, encouraging the use of public transport, and promoting eco-accredited hotels and resorts.”

The study highlights online travel agents (OTAs) as gaining market share.

It cites the leading seven OTAs as accounted for nearly 46% of global online travel spending last year, up from 40% in 2022.

OTAs have an ability to leverage their highly variable cost structures to respond to and rebound quickly from market fluctuations, according to the report.

“With 71% of its travel spending happening online, the UK leads in online travel channel share, followed by China and Australia,” it adds.

Meanwhile, consumers are exhibiting a sustained interest in travel by reprioritising travel budgets.

“We see that the share of household spending on leisure travel is trending upward,” the Forrester study adds.

“Across key markets, spending on travel accounts for up to 6.5% of total household consumption in the UK and 6.2% in the US and Germany.

“Furthermore, in Forrester’s financial services benchmark recontact survey, 2023 on finances, when asked what online purchase adults are saving for, roughly one-third of respondents in each market said that they were saving up for vacations and travel (except for metro India at 28%).

“What’s more, respondents in the UK, EU, and Australia placed travel above all other savings categories.”

However, travel recovery has been uneven across regions . The US continues to be the largest travel market, with $566 billion in total travel spending and the market forecast to grow at a CAGR of 3.8% to reach $650 billion in 2028.

The UK, China, and South Korea are among the markets with high online travel market and online retail penetration thanks to their supportive e-commerce and digital payment infrastructures.

China is seen as playing a “pivotal role” in global travel recovery.

“Strong double-digit growth in 2024 and 2025 will propel China’s outbound travel market to 99% of its pre-pandemic levels before making a full recovery by 2026,” according to the report.

Forrester forecast analyst Cindy Liu said: “UK is Europe’s second largest travel market at $77 billion in 2024.

“Though spending fell over 39% in 2020 when the pandemic hit, recovery has been swift underscoring the importance of travel in the daily lives of UK residents.

“Travel spending growth appears to be levelling out, providing some much welcome stability to the tourism industry.

“We see strong enthusiasm for international travel and in 2024 we will see a full recovery in outbound travel spending by UK residents.”

Share article

View comments, british airways to set new record for north america flights, united to offer free in-flight starlink wi-fi to passengers, improved etihad carryings reflect increased fleet and network, etihad doubles manchester-abu dhabi frequency, jacobs media is honoured to be the recipient of the 2020 queen's award for enterprise..

The highest official awards for UK businesses since being established by royal warrant in 1965. Read more .

Travel Agencies in the UK - Market Research Report (2014-2029)

£29.4bn

Past 5-Year Growth

£X.Xbn

Travel Agencies in the UK industry analysis

Industry revenue is anticipated to dip at a compound annual rate of 2% over the five years through 2024-25 to £29.4 billion. The fall is largely due to COVID-19 wreaking travel havoc, the pound weakening against foreign currencies and mounting online competition. More and more bookings are being made online, cutting out high-street agencies and putting pressure on their finances. Rising external competition did lead to the exit of more bricks-and-mortar travel agencies, including the collapse of the industry's second-largest player, Thomas Cook, in September 2019.

Trends and Insights

- The Russia-Ukraine war kickstarted a few problems for travel agencies. Energy and oil prices shot up in 2021, raising airline costs – this was passed onto travel agencies through higher ticket prices. It’s also rerouted some flights and cruises.

- Online booking now dominates the market. As traditional bricks-and-mortar agencies falter, more travel agencies are moving online, or at least part online. Market niches also propel the online segment of the industry.

- High populations give more sales to agencies. This is why the spread of agencies across the UK isn’t that dissimilar to the spread of the population; the top three regions for travel agencies are also the three most populated.

- Travel websites draw sales away from agencies. They enable people to seek out and book their own travel, accommodation and activities without any of the added markup travel agencies cause.

Everything you need in one report

- Reliable market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Powerful SWOT, Porter’s Five Forces and risk management frameworks

- Online membership platform with PDF, Word, Excel and PPT exports

Industry Overview

Table of contents, methodology, market size and recent performance (2014-2029).

Industry revenue has declined at a CAGR of 2.0 % over the past five years, to reach an estimated £29.4bn in 2024.

Knocked travel confidence and post-pandemic travel chaos have people turning to travel agencies for comfort

- Appetite for travel has grown after years of COVID-19 lockdowns, but restrictions, extreme weather conditions, airport strikes, staff shortage chaos and overall uncertainty have dented customers’ confidence.

- Additional trends and insights available with purchase

Industry outlook (2024-2029)

Market size is projected to grow over the next five years.

Booking earlier and opting for all-inclusive holidays will keep holiday plans on track

- Travellers are set to keep prioritising holidays despite the cost-of-living crisis but search for more affordable deals.

Biggest companies in the Travel Agencies in the UK

To view the market share and analysis for all 5 top companies in this industry, view purchase options.

Products & Services Segmentation

Industry revenue is measured across several distinct product and services lines, including Travel agency services and Online booking services. Travel agency services is the largest segment of the Travel Agencies in the UK.

Online booking services mean holidays are only a click away

- Travel websites offer flights, accommodation and transport. It doesn't include major airline websites and accommodation chains.

- More insights available in the full report

Unbiased research for even more industries at your fingertips

- 5000+ Industries covered

- 100+ Local analysts

- 250k+ Hours of detailed analysis

- 100k+ Subscriber community

Purchase a membership to access this industry and so much more.

Widen you competitive advantage with related industries

Competitors.

- There are no industries to display.

Complementors

- Sea & Coastal Passenger Water Transport in the UK

- Scheduled Passenger Air Transport in the UK

- Non-Scheduled Passenger Air Transport in the UK

- Tour Operators in the UK

International industries

- Global Travel Agency Services

- Travel Agencies in the US

- Travel Agencies in Canada

- Travel Agency and Tour Arrangement Services in Australia

- Travel Agency and Tour Arrangement Services in New Zealand

View all industries in United Kingdom

About this industry

Industry definition.

This industry is composed of agencies that provide booking, reservation and information services to UK residents travelling domestically and internationally. This includes agencies that are solely or partially online or shop-front operators. Travel agencies generate their income from commissions.

What's included in this industry?

Purchase this report to view all 5 major companies in this industry.

Related Terms

Industry code.

SIC 79.11 - Travel Agencies in the UK

Performance

Get an indication of the industry's health through historical, current and forward-looking trends in the performance indicators that make or break businesses.

Analyst insights

The Russia-Ukraine war kickstarted a few problems for travel agencies. Energy and oil prices shot up in 2021, raising airline costs – this was passed onto travel agencies thr...

In this chapter (4)

- Current Performance

Key metrics

- Annual Revenue, Recent Growth, Forecast, Revenue Volatility

- Number of Employees, Recent Growth, Forecast, Employees per Business, Revenue per Employee

- Number of Businesses, Recent Growth, Forecast, Employees per Business, Revenue per Business

- Total Profit, Profit Margin, Profit per Business

- Revenue, including historical (2014-2023) and forecast (2024-2029)

- Employees, including historical (2014-2023) and forecast (2024-2029)

- Businesses, including historical (2014-2023) and forecast (2024-2029)

- Profit, including historical (2014-2024)

- Industry Volatility vs. Revenue Growth

- Industry Life Cycle

Detailed analysis

- Trends in supply, demand and current events that are driving current industry performance

- Expected trends, economic factors and ongoing events that drive the industry's outlook

- Key success factors for businesses to overcome volatility

- How contribution to GDP, industry saturation, innovation, consolidation, and technology and systems influence the industry's life cycle phase.

Products and Markets

Learn about an industry's products and services, markets and trends in international trade.

Analyst insight

Online booking now dominates the market. As traditional bricks-and-mortar agencies falter, more travel agencies are moving online, or at least part online. Market niches also...

In this chapter

- Products & Services

- Major Markets

- Largest market segment and value in 2024

- Product innovation level

- Products & services segmentation in 2024

- Major market segmentation in 2024

- Trends impacting the recent performance of the industry's various segments

- Innovations in the industry's product or service offering, specialization or delivery method

- Key factors that successful businesses consider in their offerings

- Buying segments and key trends influencing demand for industry products and services

Geographic Breakdown

Discover where business activity is most concentrated in an industry and the factors driving these trends to find opportunities and conduct regional benchmarking.

High populations give more sales to agencies. This is why the spread of agencies across the UK isn’t that dissimilar to the spread of the population; the top three regions fo...

In this chapter (1)

- Business Locations

- Share of revenue, establishment, wages and employment in each region

- Share of population compared to establishments in each region in 2024

- Number and share of establishments in each region in 2024

- Number and share of revenue each region accounts for in 2024

- Number and share of wages each region accounts for in 2024

- Number and share of employees in each region in 2024

- Geographic spread of the industry across Europe, and trends associated with changes in the business landscape

- Key success factors for businesses to use location to their advantage

Competitive Forces

Get data and insights on what's driving competition in an industry and the challenges industry operators and new entrants may face, with analysis built around Porter's Five Forces framework.

Travel websites draw sales away from agencies. They enable people to seek out and book their own travel, accommodation and activities without any of the added markup travel a...

- Concentration

- Barriers to Entry

- Substitutes

- Buyer & Supplier Analysis

- Industry concentration level

- Industry competition level and trend

- Barriers to entry level and trend

- Substitutes level and trend

- Buyer power level and trend

- Supplier power level and trend

- Market share concentration among the top 4 suppliers from 2019-2024

- Supply chain including upstream supplying industries and downstream buying industries, flow chart

- Factors impacting the industry’s level of concentration, such as business distribution, new entrants, or merger and acquisition activity.

- Key success factors for businesses to manage the competitive environment of the industry.

- Challenges that potential industry entrants face such as legal, start-up costs, differentiation, labor/capital intensity and capital expenses.

- Key success factors for potential entrants to overcome barriers to entry.

- Competitive threats from potential substitutes for the industry’s own products and services.

- Key success factors for how successful businesses can compete with substitutes.

- Advantages that buyers have to keep favorable purchasing conditions.

- Advantages that suppliers have to maintain favorable selling conditions.

- Key success factors for how businesses can navigate buyer and supplier power.

Learn about the performance of the top companies in the industry.

Thomas Cook’s collapse both helped and hindered TUI. On the one hand, TUI had to act fast to help customers left stranded because it used Thomas Cook flights. On the other, i...

- Market Share Concentration

- Company Spotlights

- Industry market share by company in 2020 through 2024

- Major companies in the industry, including market share, revenue, profit and profit margin in 2024

- Overview of TUI Travel Ltd's performance by revenue, market share and profit margin from 2018 through 2024

- Overview of Trailfinders Ltd's performance by revenue, market share and profit margin from 2018 through 2024

- Overview of Expedia Group Inc's performance by revenue, market share and profit margin from 2018 through 2024

- Overview of revenue, market share and profit margin trend for 2 additional companies

- Description and key data for TUI Travel Ltd, and factors influencing its performance in the industry

- Description and key data for Trailfinders Ltd, and factors influencing its performance in the industry

- Description and key data for Expedia Group Inc, and factors influencing its performance in the industry

- Description, key data and performance trends for 2 additional companies

External Environment

Understand the demographic, economic and regulatory factors that shape how businesses in an industry perform.

Regulations ensure travellers are protected. The Package Travel Regulations are the most important – agencies have to follow them to make sure they provide customers with fin...

- External Drivers

- Regulation & Policy

- Regulation & policy level and trend

- Assistance level and trend

- Regulation & Policy historical data and forecast (2014-2029)

- Assistance historical data and forecast (2014-2029)

- Demographic and macroeconomic factors influencing the industry, including Regulation & Policy and Assistance

- Major types of regulations, regulatory bodies, industry standards or specific regulations impacting requirements for industry operators

- Key governmental and non-governmental groups or policies that may provide some relief for industry operators.

Financial Benchmarks

View average costs for industry operators and compare financial data against an industry's financial benchmarks over time.

Wage costs have slipped but staff are still essential. Physical travel agents are dependent on customer service and expert knowledge means agencies can give better recommenda...

- Cost Structure

- Financial Ratios

- Profit margin, and how it compares to the sector-wide margin

- Average wages, and how it compares to the sector-wide average wage

- Largest cost component as a percentage of revenue

- Industry average ratios for days' receivables, industry coverage and debt-to-net-worth ratio

- Average industry operating costs as a share of revenue, including purchases, wages, depreciation, utilities, rent, other costs and profit in 2024

- Average sector operating costs as a share of revenue, including purchases, wages, depreciation, utilities, rent, other costs and profit in 2024

- Investment vs. share of economy

Data tables

- Liquidity Ratios (2018-2022)

- Coverage Ratios (2018-2022)

- Leverage Ratios (2018-2022)

- Operating Ratios (2018-2022)

- Assets (2018-2022)

- Liabilities (2018-2022)

- Cash Flow & Debt Service Ratios (2014-2029)

- Revenue per Employee (2014-2029)

- Revenue per Enterprise (2014-2029)

- Employees per Establishment (2014-2029)

- Employees per Enterprise (2014-2029)

- Average Wage (2014-2029)

- Wages/Revenue (2014-2029)

- Establishments per Enterprise (2014-2029)

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Trends in the cost component for industry operators and their impact on industry costs and profitability

Key Statistics

Industry data, data tables.

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

How are IBISWorld reports created?

IBISWorld has been a leading provider of trusted industry research for over 50 years to the most successful companies worldwide. With offices in Australia, the United States, the United Kingdom, Germany and China, we are proud to have local teams of analysts that conduct research, data analysis and forecasting to produce data-driven industry reports.

Our analysts start with official, verified and publicly available sources of data to build the most accurate picture of each industry. Analysts then leverage their expertise and knowledge of the local markets to synthesize trends into digestible content for IBISWorld readers. Finally, each report is reviewed by one of IBISWorld’s editors, who provide quality assurance to ensure accuracy and readability.

IBISWorld relies on human-verified data and human-written analysis to compile each standard industry report. We do not use generative AI tools to write insights, although members can choose to leverage AI-based tools within the platform to generate additional analysis formats.

What data sources do IBISWorld analysts use?

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and our own proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

Key data sources in the UK include:

- Office for National Statistics

- Office for Budget Responsibility

- Bank of England

Analysts also use industry specific sources to complement catch-all sources, although their perspective may focus on a particular organization or representative body, rather than a clear overview of all industry operations. However, when balanced against other perspectives, industry-specific sources provide insights into industry trends.

These sources include:

- Industry and trade associations

- Industry federations or regulators

- Major industry players annual or quarterly filings

Finally, IBISWorld’s global data scientists maintain a proprietary database of macroeconomic and demand drivers, which our analysts use to help inform industry data and trends. They also maintain a database of statistics and analysis on thousands of industries, which has been built over our more than 50-year history and offers comprehensive insights into long-term trends.

How does IBISWorld forecast its data?

IBISWorld’s analysts and data scientists use the sources above to create forecasts for our proprietary datasets and industry statistics. Depending on the dataset, they may use regression analysis, multivariate analysis, time-series analysis or exponential smoothing techniques to project future data for the industry or driver. Additionally, analysts will leverage their local knowledge of industry operating and regulatory conditions to impart their best judgment on the forecast model.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools. We are proud to be the keystone source of industry information for thousands of companies across the world.

Learn more about our methodology and data sourcing on the Help Center .

Frequently Asked Questions

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Travel Agencies in the UK industry in United Kingdom in 2024?

The market size of the Travel Agencies in the UK industry in United Kingdom is £29.4bn in 2024.

How many businesses are there in the Travel Agencies in the UK industry in 2024?

There are 4,484 businesses in the Travel Agencies in the UK industry in United Kingdom, which has declined at a CAGR of 1.7 % between 2019 and 2024.

Has the Travel Agencies in the UK industry in United Kingdom grown or declined over the past 5 years?

The market size of the Travel Agencies in the UK industry in United Kingdom has been declining at a CAGR of 2.0 % between 2019 and 2024.

What is the forecast growth of the Travel Agencies in the UK industry in United Kingdom over the next 5 years?

Over the next five years, the Travel Agencies in the UK industry in United Kingdom is expected to grow.

What are the biggest companies in the Travel Agencies in the UK market in United Kingdom?

The biggest companies operating in the Travel Agencies market in United Kingdom are TUI Travel Ltd, Trailfinders Ltd and Expedia Group Inc

What does the Travel Agencies in the UK in United Kingdom include?

Online booking services and Travel agency services are part of the Travel Agencies in the UK industry.

Which companies have the highest market share in the Travel Agencies in the UK in United Kingdom?

The company holding the most market share in United Kingdom is TUI Travel Ltd.

How competitive is the Travel Agencies in the UK industry in United Kingdom?

The level of competition is high and increasing in the Travel Agencies in the UK industry in United Kingdom.

Turn insights into your advantage

- Instant download

- 145 analyst insights

100% money back guarantee

Leaders win with IBISWorld. Learn how.

Discover. Grow. Succeed.

More than 10,000 businesses partner with ibisworld to achieve and exceed their most ambitious goals..

Accelerate growth with the insights you need. Flexible license options for the entire team.

- Accessible colours

- Asia Pacific

- Latin America

- North America

Leisure and hospitality industry outlook

05 february 2024.

The hospitality industry endured an ongoing battle with inflation throughout 2023. With like-for-like sales only occasionally beating the consumer price index, meaningful covers growth was off the cards for all but the best in class and instead businesses focused on trying to remain cash flow positive.

Looking to 2024, we anticipate a more positive operating landscape for the hospitality industry. In this article we give the outlook for supply and demand in the sector and identify opportunities and challenges in accordance with the latest economic data and our recent consumer sentiment survey.

Supply side disruption eases but challenges remain

On the supply side, food and beverage costs are well down from the heights of 2022, bringing some relief to operators in terms of margin pressure, albeit energy costs remain around twice as high than they were pre-Covid. Additionally, in April we’ll see the largest ever single increase to the National Living Wage for those aged 21 and over (increasing £1.02 to £11.44) and a similarly sharp increase across other age groups. This indicates that operators aren’t out of the woods yet when it comes to rising costs.

The growing cost of rent, energy bills and ingredients are hitting the independent restaurant sector hard. The start of 2024 has already seen numerous high-profile restaurant closures including Simon Rimmer’s Manchester spot Greens, which shut after 33 years; London restaurant Copper & Ink, run by former MasterChef finalist Tony Rodd; and chef James Allcock’s Yorkshire pub the Pig & Whistle. The first quarter is always a particularly acute time for the sector with lower footfall and the need to pay quarterly rent and higher VAT bills after the Christmas period. We expect further casualties as hikes in National Living Wage and business rates from April make more businesses unviable.

In more positive news, staffing issues are easing and vacancies in November were up 30% compared to pre-pandemic. Though high, the industry is a world away from January 2023 when vacancies were up 55% on pre-pandemic levels and some operators were forced to dictate opening hours around staff availability. Following the talent exodus post-Covid, the industry has worked hard to improve company culture and offer a positive working environment for employees. With perceptions towards jobs in hospitality improving and unemployment ticking up this year, we anticipate vacancies to decline in 2024 and staffing pressures to continue to ease.

Outlook for demand improves as consumer finances recover

In 2024, we’ll see more robust like-for-like cover growth as the outlook for demand improves, particularly in the second half of the year when inflation is forecast to fall to the Bank of England’s target rate of 2%. Interest rates will begin a downward trajectory from summer and are forecast to hit 3.9% by the end of the year. Additionally, real wages will continue to grow this year and with tax cut announcements looking increasingly likely in March’s Spring Budget, these factors should culminate in making consumers feel better off overall. But what’s the outlook for demand by market segment?

Pubs to prosper in 2024

In 2023, pubs emerged as top performers in the hospitality industry, favoured by consumers for their value-driven offering. This trend is expected to continue with consumers planning to increase their frequency of visits to these venues by 11% in 2024. As cost-of-living pressures continue to characterise the first half of the year, pubs will benefit from consumers seeking value amidst ongoing financial pressures. Assuming a more favourable summer this year following 2023’s washout, pubs should thrive as patrons enjoy beer gardens and major sporting events such as the Euros. Added to this, the pub industry, like the rest of hospitality, will benefit from a boost to consumer confidence at the back end of the year as inflation normalises and interest rates begin to fall. Pubs are poised to wrap up 2024 on a high note, marking a resilient year ahead for the sector.

Pubs will benefit from changing consumer behaviours this year. Gen Z, one of the groups most affected by the living costs crisis - especially students - plan to increase their visits to pubs by 7% in 2024. Even with all other demographics planning to marginally decrease their visits to these venues, the increased popularity of pubs amongst younger age groups gives these venues an opportunity to target this growing consumer base with their marketing strategies. With 27% of Gen Z aiming to cut their eating and drinking expenses by looking for special deals and discounts, this is a key opportunity that pubs can leverage.

Older consumers offer a lifeline to the nighttime industry

Like-for-like sales for late night bars were down on average -5.5% in 2023, showing the nighttime industry’s continued challenges following Covid-19 lockdowns and cost of living pressures. Revolution Bars, a major operator in the sector, recently announced that it plans to close eight of its least profitable bars this year, an example of the challenges facing the sector.

Unfortunately, the outlook for this year doesn’t bode much better with our recent survey indicating consumers intend to visit late night bars 15% less in 2024 with visits to nightclubs flatlining.

One of the big issues bar and nightclub operators will face in 2024 is the change in consumer habits amongst younger consumers. Where pubs are benefitting from an uptick in frequency of visits from Gen Z and student consumers, this same demographic plan to reduce visits to bars this year by 31% and to nightclubs by 4%. Where pubs represent value to cash-strapped youngsters, bars and nightclubs typically offer a more premium experience with a higher cost attached, which is proving unattractive in the current economic climate.

But there’s a glimpse of light for the nighttime industry in the form of older consumer demographics. Gen X indicate they want to increase their visits to late night bars by 13% this year and Millennials plan to go clubbing 6% more than in 2023. With new concepts coming to the market like Annie Macs ‘Before Midnight’, a 7pm – 12am club night for consumers that ‘need more sleep’, 2024 might be the year we see a shift in nightlife concepts targeted at older consumers who still want to party.

Family-friendly restaurants win-out

Restaurants will see consistent demand in 2024 and will benefit most from high earning households (over £80K per year) and affluent families – those aged between 25 and 54, who have children and have a household income of over £60K per year. These consumers will visit restaurants more than twice as regularly as the average consumer (more than twice a month) and both groups intend to increase the frequency of visits this year.

With 1.6 million consumers due to renew their mortgages this year, concerns around high interest rates will influence the spending intentions of many consumers. Affluent families in particular are set to be one of the most impacted groups, with 93% saying rising interest rates will affect their discretionary purchases in 2024 and will be the main factor influencing their spending over the next 12 months.

So how can restaurants attract and retain this valuable group of customers? One strategy is to offer loyalty programmes. When asked how they would reduce the amount they spent on eating out in the next six months, 41% of affluent families said they would seek out special offers and discounts. This shows that these families are more interested in finding discounts than the average consumer (26%) and suggests loyalty programmes that cater to this group could help to increase customer loyalty and engagement.

Pizza Express is one example of a restaurant taking action to appeal to families. Throughout January, club members will get 50% off dine-in pizzas after research conducted by the business revealed 82% of UK adults said that socialising with friends and family would help them cope with the ‘January blues’. By offering value through their loyalty scheme, Pizza Express is playing it smart to fill covers during the slowest month of trade for the sector.

The return of London continued

In 2022, as Covid restrictions lifted, London was on the back foot compared to the rest of the country when it came to economic recovery. The return of home workers to the city centre was slow which impacted trade for hospitality operators and saw sales performance at the end of 2022 drag behind the rest of the country. 2023 saw the beginning of the bounce back of London, with sales for the year on average up 8.2% on a like-for-like basis inside the M25, compared to 6.5% up outside the M25.

With more corporates either asking staff to come back to offices full-time, or at a minimum three days per week, operators are gearing themselves up for a further uplift in demand in the capital. This coupled with the continued uptick of overseas tourists is seeing operators trial new formats for their offerings to take advantage of increased footfall. For example, Big Table Group have announced that they would test fast-casual versions of existing brands through the launch of pop-ups and double the footprint of their fast-casual restaurant concept Banana Tree. Additionally, Wahaca will open its first new site since 2018 in Paddington this year. With the continued return of office workers and further prospects for increasing overseas travellers to the UK, we expect 2024 to be a strong year for sales performance in London, particularly for casual dining operators with strong, differentiated offerings.

Get in touch

To discuss this analysis, or any business issue you may be facing in the current climate contact our experts, Paul Newman or Robyn Duffy.

- Consumer markets

- Leisure and Hospitality

Consumer outlook 2024 report

From ‘Buy Now, Pay Later’ to loyalty schemes. What drives consumer spending?

Consumer outlook mid year update 2024

Hotels, travel and tourism industry outlook

Retail industry outlook

The consumer behaviours that will define 2024

Trends in the Travel & Tourism Industry 2023

After more than two years of travel bans, draconian entry requirements, and setbacks, tourists began dusting off their passports and suitcases in 2022. As the last vestiges of pandemic-era border restrictions eased, global tourism arrivals grew by 60% last year amid pent-up demand - an upward trend that’s expected to continue in 2023.

However, as the global travel and tourism industry continues its journey to recovery, new and existing challenges will present themselves to businesses. So, let's explore the trends affecting the travel and tourism industry’s landscape, seascape and airspace over the coming months - the opportunities and the potential threats.

Opportunities in the Travel & Tourism Industry

From a virtual shutdown in 2020, to partial recovery in 2021 and full systems go in 2022, will 2023 be the year global travel soars? These latest trends in the travel and tourism industry suggest the future looks bright for businesses that operate in this space.

Tourism arrivals will grow

In its Tourism Outlook 2023 report, the Economist Intelligence Unit (EIU) assesses key travel industry trends. The report predicts that global tourism arrivals will grow by 30% in 2023, but will remain below pre-pandemic levels. According to the EIU, the global economic slowdown, war in Ukraine, and China’s zero-Covid strategy will stunt the recovery following growth of 60% in 2022.

Ana Nicholls, director of industry analysis at EIU, commented on the forecast: “The tourism industry saw a strong recovery during 2022, and we expect that to continue in 2023, particularly if China starts lifting its zero-covid policy as expected. But the industry certainly won’t be immune to the economic slowdown.”