U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage Size and Weight Limits by Airline (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

How to Renew Your Passport Online

For the first time since March 2023, online passport renewals are available.

13 Best Carry-on Luggage Pieces 2024 - We Tested Them All

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

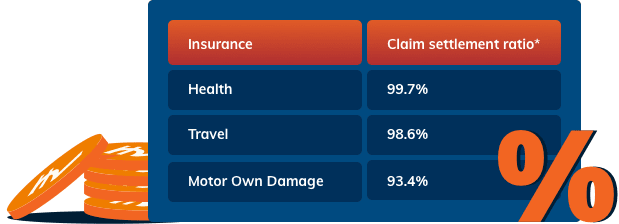

Your Guide to Understanding Claim Settlement Ratios: What It Is and Why It Matters

Imagine this: You're going about your day when an unexpected incident occurs.

Your leg gets damaged in a minor collision, leaving you in need of immediate surgery. You turn to your insurance company, hoping they'll come to your rescue just like they promised. But how do you know if they'll actually deliver on their word?

That's where the claim settlement ratio comes in.

In simple terms, the claim settlement ratio is like a report card for insurance companies. It tells you how well they handle claims.

Will they swiftly process your claim and get you back on the road, or will they leave you hanging?

In this blog, we’ll explore how the claims settlement ratio works and how they directly impact your insurance experience.

What is Claim Settlement Ratio?

A claims settlement ratio is a crucial metric used in the insurance industry to evaluate an insurance company's performance in settling claims. It is a ratio expressed as a percentage that represents the number of claims successfully settled by the insurer divided by the total number of claims filed during a specific period.

The claims settlement ratio serves as a valuable indicator of an insurer's ability to fulfil its obligations and promptly handle valid claims.

A higher ratio implies that a significant proportion of the claims received by the insurance company have been successfully resolved and settled. Conversely, a lower ratio suggests a higher number of unsettled or rejected claims.

By analysing the claims settlement ratio, insurance companies, policyholders, and industry stakeholders gain insights into the efficiency and effectiveness of an insurer's claims handling process. It helps assess the insurer's track record in meeting their contractual commitments and providing timely assistance to policyholders in times of need.

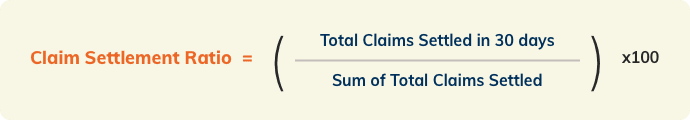

Calculation of Claim Settlement Ratio

To calculate the claim settlement ratio, the total number of claims settled within a particular period is divided by the total number of claims received during the same period. The formula is as follows:

Claim Settlement Ratio = (Number of Claims Settled / Number of Claims Received) x 100

For example, if an insurance company received 1,000 claims and settled 900 of them, the claim settlement ratio would be 90% [(900/1000) x 100].

Interpretation of Claim Settlement Ratio

The interpretation of the claim settlement ratio depends on the context and comparison with industry standards.

A high claim settlement ratio, generally above 90% , indicates that the insurance company has a good track record of honouring claims and providing financial support to policyholders. It reflects the insurer's commitment to fulfilling its contractual obligations.

On the other hand, a low claim settlement ratio, below the industry average, may raise concerns about the insurer's ability to handle claims efficiently. It could suggest a higher likelihood of claim rejections or delays, potentially leading to dissatisfaction among policyholders.

It's important to note that claim settlement ratios may vary across different types of insurance policies and market conditions. For instance, health insurance claim settlement ratios may differ from those of life insurance or motor insurance.

Therefore, when interpreting claim settlement ratios, it is crucial to consider the specific insurance segment and compare the ratio with industry benchmarks to gain a comprehensive understanding of an insurance company's performance in claim settlement.

Why Claim Settlement Ratio matters

- Trust and credibility: A high claim settlement ratio indicates that the insurer has a track record of honouring claims and fulfilling its obligations. This instils confidence in policyholders that their claims will be handled fairly and promptly, strengthening the trust they have in the insurance company.

- Financial security: Policyholders seek insurance coverage to protect themselves financially in the event of unforeseen circumstances. A robust claim settlement ratio indicates that the insurer has the resources and stability to provide the necessary financial support when policyholders need it the most.

- Customer satisfaction: When policyholders experience a loss or damage covered by their insurance policy, a smooth and efficient claims process is crucial. A high claim settlement ratio indicates that the insurance company has a reputation for resolving claims effectively, minimising inconvenience, and providing timely assistance. This contributes to a positive customer experience and satisfaction with their insurance provider.

- Comparison between insurance companies: The claim settlement ratio allows for a comparison between different insurance companies in the market. Policyholders can use this ratio as a benchmark to evaluate the performance of insurers when choosing an insurance provider. By comparing claim settlement ratios, policyholders can make informed decisions and select an insurer with a proven track record of settling claims and meeting their obligations.

Four Factors affecting Claim Settlement Ratio

- Insurance company's efficiency: One of the key factors influencing the claim settlement ratio is the efficiency of the insurance company's claims handling process. Companies with streamlined and well-structured procedures for claim assessment, verification, and settlement are more likely to have a higher claim settlement ratio. This efficiency ensures that valid claims are processed promptly and accurately, leading to a higher customer satisfaction rate.

- Policyholder's adherence to terms and conditions: The adherence of policyholders to the terms and conditions outlined in their insurance policies significantly impacts the claim settlement ratio. Policyholders must fulfil their obligations, such as timely premium payments and providing accurate information while applying for coverage. Failure to comply with these requirements can result in claim rejections or delays, affecting the overall claim settlement ratio.

- Accuracy of documentation: Accurate documentation plays a crucial role in claim settlement. Policyholders need to provide complete and precise information when filing claims. Any discrepancies or missing details can lead to claim denials or prolonged processing times. Insurance companies rely on documentation to assess the validity of claims, and errors or incomplete information can hinder the settlement process and lower the claim settlement ratio.

- Fraudulent claims: Instances of fraudulent claims have a negative impact on the claim settlement ratio. Insurance companies face the challenge of identifying and combating fraudulent activities, such as false claims or exaggeration of damages. These fraudulent claims not only increase costs for the insurer but also lead to a lower claim settlement ratio. Implementing robust fraud detection measures is essential for maintaining a healthy claim settlement ratio and ensuring fair treatment for genuine policyholders.

Claims Settlement process

The claims settlement process in the insurance industry involves several key steps and factors. Here's a condensed version that includes additional information:

Step 1: Notification: Policyholders inform the insurance company about their claim, typically through online portals, phone calls, or email.

Step 2: Documentation: Policyholders submit necessary documents, such as claim forms, incident reports, photographs, police reports, or medical records.

Step 3: Assessment and investigation: The insurance company investigates the claim, verifies details, assesses coverage, and determines the extent of the loss or damages. They may assign an adjuster or investigator if needed.

Step 4: Evaluation: The insurance company evaluates the claim's validity and assesses coverage based on policy terms, exclusions, deductibles, and limits.

Step 5: Decision: The insurance company approves, partially approves, or denies the claim, providing a written explanation for claim denials.

Step 6: Settlement: If approved, the insurance company proceeds with the settlement, which can include financial compensation, repair/replacement, or services, based on policy coverage.

Step 7: Payment: The insurance company initiates the payment, typically within a specific timeframe, such as 10-30 days after claim approval. The actual duration may vary between insurance companies.

Step 8: Closure: After payment, the policyholder acknowledges receipt, and the claim is officially closed. The insurance company updates its records accordingly.

It's important to note that claim settlement timelines, minimum and maximum limits, and specific procedures can vary based on insurance companies, policy types, and regional regulations. Policyholders should refer to their insurance policy documents or contact their insurance provider for precise details regarding these factors.

How to avoid your claims getting rejected?

To increase the chances of your insurance claims being accepted and avoid rejections, consider the following tips:

- Understand your policy: Read and understand the terms and conditions of your insurance policy thoroughly. Familiarise yourself with the coverage limits, exclusions, and claim filing procedures. This knowledge will help you ensure that your claims are within the policy's scope.

- Provide accurate information: When submitting a claim, ensure that all the information you provide is accurate and complete. Any discrepancies or missing details can lead to claim rejections. Double-check all the documentation and forms to ensure they are filled out correctly.

- Timely reporting: Report your claim to the insurance company promptly. Delayed notifications can raise questions about the validity of the claim and may lead to its rejection. Adhere to the specified time limits mentioned in your policy for reporting claims.

- Document the incident: Gather as much evidence as possible to support your claim. Take photographs of the damage or loss, keep receipts, obtain police reports (if applicable), and collect any relevant documentation that can substantiate your claim.

- Be transparent: Be honest and transparent when communicating with the insurance company. Provide all the requested information truthfully and cooperate with any investigations or inquiries conducted by the insurer.

- Maintain records: Keep copies of all the documents related to your insurance policy and claims. This includes policy documents, correspondence with the insurer, claim forms, receipts, and any other supporting evidence. Having organised records will help in case of any disputes or clarifications.

- Seek professional assistance: If you find the claims process complex or have difficulty understanding certain aspects, consider seeking professional assistance. Insurance agents or claim advisors can provide guidance and help you navigate the process effectively.

- Follow up: Stay in touch with the insurance company throughout the claims process. Inquire about the progress of your claim, ask for updates, and follow up on any outstanding requirements. Being proactive demonstrates your commitment to resolving the claim promptly.

Remember, each insurance policy and claim is unique, so it's essential to review your specific policy terms and follow the procedures outlined by your insurer. If you have any doubts or questions, reach out to your insurance company for clarification to ensure a smooth claims process.

Top 10 Claim Settlement Ratios for Health Insurance in India

- Are claim settlement ratios available for public access? Yes, claim settlement ratios are often disclosed by insurance companies and can be accessed through their annual reports, websites, or regulatory bodies. Policyholders and potential customers can review these ratios to assess an insurer's claim settlement performance.

- Is a high claim settlement ratio beneficial? Yes, the higher the ratio, the more reliable the insurer. The claim settlement ratio is the percentage of claims settled by an insurance company in a given year. It is used to assess the company's credibility.

- How frequently are claim settlement ratios updated? Claim settlement ratios are typically updated on an annual basis. Insurance companies report their ratios for a specific period, commonly for the previous fiscal year. It's advisable to refer to the most recent data available for an up-to-date assessment.

- What does a 99% claim settlement ratio mean? If an insurer has a claim settlement ratio of 99%, it means that they have successfully settled 99% of the claims they have received. This should give some comfort to policyholders as to how their claims will get handled in the future.

- What is the typical timeline for claim settlement after approval? The timeline for claim settlement after approval can vary between insurance companies. However, it is common for insurers to initiate payment within 10-30 days after claim approval.

- Is there a maximum limit on claim settlement amounts? Yes, insurance policies typically have maximum limits or coverage caps for claim settlements. These limits vary depending on the type of policy and coverage purchased.

- Are there any minimum claim amounts required for settlement? Some insurance policies may have a minimum claim amount requirement. This means that claims below a certain threshold may not be eligible for settlement.

- What documents are typically required for claim settlement? The specific documents required for claim settlement can vary depending on the type of insurance and the nature of the claim. Commonly requested documents include claim forms, incident reports, invoices, receipts, photographs, medical records, police reports, and any other supporting evidence related to the claim.

Enjoyed reading it? Spread the word

More articles like this.

This is Why Your Health Insurance Claim Was Rejected!

How To Get A Superior Health Claims Experience - Even In A Health Emergency

.HEIC.jpg)

Nova Benefits Extends Pro Bono Support In Approval For A Delayed Cashless Claim

Get nova benefits for your team.

Schedule a call with us and we’ll get back to you

Request a Callback

By continuing, you agree to NovaBenefits Terms of Use and Privacy Policy

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in August 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

If you don't have sufficient travel insurance coverage via your credit card , you can supplement your policies with third-party plans.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers.

Top credit cards with travel insurance

Methodology

Best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at nearly all plan levels.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

» Jump to the best cards with travel insurance

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Offers direct billing.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

IHG One Rewards Premier Credit Card

Earn 5 free nights at an IHG property after $4k in spend (each night valued at up to 60k points).

Credit Cards

Financial planning.

- Cheapest Car Insurance

- Cheapest Full Coverage Car Insurance

- Car Insurance Cost Calculator

- Best Car Insurance

- Compare Car Insurance Costs

- Average Cost of Car Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Best Life Insurance Companies

- Best Universal Life Insurance

- Best Life Insurance for Seniors

- Compare Quotes

- Best Auto and Home Insurance Bundle

- Homeowners Insurance

- Renters Insurance

- Health Insurance

- Pet Insurance

- Small Business Insurance

Insurance Guidance

- Conventional Mortgages

- Jumbo Loans

- Best HELOC Loans and Rates

- Get a HELOC With Bad Credit

- Pay Off Your Mortgage With a HELOC

- Pros and Cons of HELOCs

- The HELOC Approval Process

- Mortgage Payment Calculator

- Reverse Mortgage Calculator

- FHA vs. Conventional Loan Calculator

- Private Mortgage Insurance Calculator

- Debt-to-Income Ratio Calculator

Mortgage Guidance

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Travel Rewards Credit Cards

- Best Airline Credit Cards

- Best Credit Cards for Excellent Credit

- Best Business Credit Cards

- Best American Express Cards

- Best Capital One Credit Cards

- Best Chase Credit Cards

- Best Citi Credit Cards

- Best Bank of America Credit Cards

- Cash Back Calculator

- Pros and Cons of Balance Transfers

- Practical Guide for Improving Credit Fast

- Average Credit Score by Age

- Credit Cards For Bad Debt

- Credit Card Glossary

Recent Credit Card Reviews & Comparisons

- Best Personal Loans of 2024

- Best Personal Loans for Excellent Credit

- Best Personal Loans for Good Credit

- Best Personal Loans for Bad Credit

- Best Same-Day Approval Loans

- Best Personal Loans for Debt Consolidation

- Best Private Student Loans

- Best Student Loans for Bad Credit

- Best Student Loans for International Students

- Best Low-Interest Student Loans

- Best Student Loans Without a Co-Signer

- Personal Loan Calculator

- Auto Loan Calculator

- Student Loan Calculator

- How to Calculate Loan Payments

- Can You Get a Personal Loan With Bad Credit?

Loans Guidance

- Compound Interest Calculator

- Cost of Living Calculator

- Financial Literacy Handbook

- Guide to Retirement Planning

- Ultimate Guide to Budgeting

- Understanding Types of Debt

- How to Pay Down Student Loan Debt

- How to Start Saving & Investing

- Should You Rent or Buy a House

- How to Pay for College

- Guide to Buying a Car

- Guide to Negotiating Salary

- Safest Cities in America

- Top Cities for Job Seekers

- Most & Least Tax-Friendly States

- Most Dangerous Days for DUIs

Our Review of the Top 10 Travel Insurance Providers for Any Destination

Reviews of the Top 10 Best Travel Insurance Companies

Mary Purcell

Mary Purcell is a freelance writer and health and finance researcher in Piedmont, Calif., with expertise in policy analysis. She is fluent in Spanish and has a master's degree in Latin American studies from Georgetown University. Her articles have appeared on LimeHealth, Narrative, Consumer Health Interactive, and other outlets.

Quality Verified

MoneyGeek is dedicated to providing trustworthy information to help you make informed financial decisions. Each article is edited, fact-checked and reviewed by industry professionals to ensure quality and accuracy.

Updated: October 27, 2022

- Top 10 Travel Insurance Providers

Our Methodology

Before you buy.

Advertising & Editorial Disclosure

Whether you're planning your honeymoon, a family trip to Hawaii or a business trip to meet new clients, travel insurance can provide protection when your plans go astray. There are generally three main types of travel insurance: travel cancellation and disruption; medical assistance and evacuation; and baggage loss and delay. We researched dozens of travel insurance companies to pick the best in the industry. The right plan for you may depend on the nature of your travels, who is traveling and your budget. But whatever your needs, these 10 picks are financially stable, reliable companies with a good track record and comprehensive coverage.

Our Top 10 Travel Insurance Providers

Best : Overall, and for families with kids Travelex Insurance Services is a leading travel insurance provider based in Omaha, Neb. Its parent company, Travelex, has been a worldwide leader in foreign currency exchange for decades, and Travelex Insurance was started in 1996. The company's travel insurance policies are underwritten by Old Republic Insurance Company and Transamerica Casualty Insurance company, which has a financial rating of A+ from A.M. Best, and TransAmerica Casualty Insurance Company, which has A.M. Best ratings of A. The company has won the international luxury travel network Virtuoso's Best Travel Insurance Provider award for eleven years in a row. It is accredited by the Better Business Bureau, which gives it an A+ rating.

Coverage: Travelex offers two main coverage plans - basic and select (family-friendly) - and two flight insurance opt-ins. They offer protection for both leisure and business travelers. Like many companies here, they cover younger children (17 and under) at no additional cost. The company boasts a high claims paid rate (previously reported at 94 percent).

Website/mobile apps: The Travelex mobile website allows you to shop and purchase policies, get emergency assistance, and access trip-related documents from your phone. You can initiate a claim and check the status of your claim online.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Basic $377, Select $333, Max $895

Best for : Frequent travelers Allianz Travel Insurance is part of the giant multinational corporation Allianz, which has over 140,000 employees on five continents. Allianz insures over 80 million customers worldwide. The company has been around for over 100 years. In fact, Allianz insured the Wright Brothers' first flight in 1903. Today Allianz is accredited with the Better Business Bureau, which gives them an A+ rating. Its financial rating from A.M. Best is A+.

Coverage: Allianz offers a handful of distinct plans including those for frequent travelers. If you travel for business, for example, it might be worth investing in an annual plan that covers both medical and lost baggage expenses for all your trips throughout the year.

Website/mobile apps: Back in 2013 Allianz won an award for its TravelSmart mobile app, which connects travelers to approved hospitals in over 120 countries. The app also allows travelers to check on flight statuses, get emergency international assistance, and access their policy while on the road.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $304.

Best for : Luxury Travel TravelGuard is a subsidiary of AIG. Its policies are underwritten by National Union Fire Insurance Company of Pittsburgh, which has an A.M. Best financial rating of A. The company is accredited with the Better Business Bureau and has a rating of A+.

Coverage: TravelGuard includes trip assistance - including dealing with lost bags, cancelled flights, or medical emergencies - via agents who are available 24 hours a day. They offer three basic plan levels - Deluxe, Preferred, Essential - as well as numerous additional upgrades and packages. Upgrades can cover things like last-minute trips where cancellation isn't a factor. TravelGuard stands out in its overage levels - it will insure a trip coverage up to $500,000, higher than the average industry coverage. All of its plans include concierge service and 24-hour emergency assistance.

Website/mobile apps: TravelGuard has an online Claims tool that allows clients to easily file a claim from a computer or mobile device. The tool speeds up the claims process while allowing users to upload photos and documents, electronically sign claims forms, and check the status of a claim from their phones.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Silver $252/Gold $309 / Platinum $655

Best for : Traveling with pets San Diego-based Generali Global Assistance has provided travel insurance since 1991. The insurance division has previously been known as CSA Travel Protection. Generali Global is accredited by the Better Business Bureau and has an A+ rating and an A financial rating from A.M. Best.

Coverage: CSA offers three plans: Standard, Preferred and Premium. It covers telemedicine services with its plans and medical costs if a person becomes sick or injured during their trip. It also reimburses medical costs if you pay out of pocket. As with most travel insurance companies, CSA offers 24/7 emergency assistance, concierge services, identity theft resolution services and a 10-day "free look" period. If you change your mind within 30 days of purchasing the insurance and before you start your trip, the company will provide a full refund. It offers pet relocation services: If you have a medical emergency and cannot take care of your pet while on vacation, it will return your pet home. It also has a Pet Service Locator to help you find vets or other pet services on your travels. For pre-existing medical conditions, you would need to purchase the Premium plan before or at least 24 hours in advance of your final trip payment. You will also need to be medically able to travel, and your prepaid expenses are insured.

Website/mobile apps: They walk you through the claim-filing process step-by-step on their website .

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $298.52 Standard / $346.28 Preferred / $398 Premium

Best for : Budget Adventure Travel World Nomads has targeted its insurance at independent travellers and adventure-seekers. If your vacation includes activities like kite sailing, snowboarding, or bungee jumping, this might be the company for you. The company is recommended by Lonely Planet and National Geographic Adventure... But you don't have to be an adventure seeker to benefit from the very competitive rates offered by World Nomads. The company's policies are underwritten by Lloyd's, which has an A financial rating from A.M. Best.

Coverage: World Nomad offers two levels of insurance plans, which include all of the typical coverage options. In addition, it offers coverage for cameras, laptops, digital gear, and all sorts of travel activities.

Website: World Nomads has an interactive website that allows you to ask questions related to travel and receive both informative articles and blog posts from fellow travelers. It has also developed language apps for iPhones. And you can purchase policies and file claims online from anywhere in the world.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $185 to $255. World Nomad doesn't ask the cost of your trip for the online quote, or the number of travelers, but does distinguish between single, couple, and family groups. The quote tool offers an option to donate to a cause in your destination as well.

Best for : Workaholics In addition to providing travel insurance, AXA offers trip other assistance through its network of over 9,000 staff members in over 30 offices around the world. The company has a financial rating of A from A.M. Best. American Modern Home Insurance - which has an A+ financial rating from A.M. Best - underwrites AXA travel policies. AXA Assistance has an A+ rating from the Better Business Bureau.

Coverage: AXA offers three plans (gold, silver, platinum). It offers an additional "cancel for any reason" policy, which will cover up to 75 percent of your pre-paid non-refundable trip costs. This option must be purchased within 14 days of your first trip payment, but it's a good option for people whose jobs are unpredictable.

Website/mobile app: The website provides a clear chart outlining the three levels of service and their coverage, and it is fast and easy to get an online quote.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $342 Silver / $395 Platinum / $492 Gold

Best for : Study abroad/Expats HTH Travel Insurance is a leader in providing medical coverage for international students and expatriates. The company's policies are underwritten by Nationwide, which has an A+ financial rating from A.M. Best. HTH is not rated by the Better Business Bureau, but it is a member of the U.S. Travel Insurance Association (USTIA) and has signed on to its Code of Ethics.

Coverage: In addition to providing traditional comprehensive trip insurance, HTH specializes in providing medical coverage for students, faculty, and expats living abroad. The long-term overseas coverage only covers medical issues, not trip cancellation or lost baggage. The plan will pay up to $1,000,000 for a medical evacuation and contains no lifetime limit.

Website/mobile apps: The website offers a lot of information about overseas travel and living and provides straightforward quotes. The mPassport app gives you access to thousands of doctors around the world who speak English.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Economy $389, Classic $456, Preferred $546.

Best for : Mobile app aficionados Warren Buffet's Berkshire Hathaway is not known for travel insurance, but it is rapidly gaining recognition in the market for its technological advances in the field. It launched its travel protection program in 2014 and has been winning over customers with its fast claims payments. Berkshire Hathaway has an A.M. Best financial rating of A++. It is accredited with the Better Business Bureau and has an A+ rating.

Coverage: BHTP offers six distinct plans tailored to meet your specific travel needs. Options are available for adrenaline junkies, low-budget fliers, family vacationers, business travelers, and even those looking to relax on a cruise.

Website/mobile apps: Berkshire Hathaway is a leader in providing mobile apps to facilitate rapid claims and payments. You can file a claim online or via the mobile app, which also allows you to track flights, get help finding lost luggage, rebook flights and purchase policies. Getting an online quote is also possible, but the process isn't quite as smooth.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: ExactCare Family: $249; ExactCare: $346.

Best for : International volunteers or employees The Indiana-based Seven Corners began offering international medical insurance in 1993. Today Seven Corners offers a wide range of travel insurance to U.S. residents and foreigners visiting the U.S. It also offers group plans to companies, non-profits and U.S. government agencies seeking to protect their staff and volunteers when traveling. It is the travel insurance provider for the Peace Corps and other U.S. government agencies. Different plans are underwritten by different companies. The popular RoundTrip comprehensive plans are underwritten by Nationwide, with an A+ financial rating from A.M. Best. Other plans are underwritten by Lloyds of London or U.S. Fire Insurance Company, both of which have A ratings from A.M. Best.