- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Travel Insurance Can Rescue a Ski Trip

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Trip delay or cancellation coverage

Accidental injury, travel inconvenience, lost or damaged equipment, should i insure my ski trip.

Snow in the forecast can send winter sports enthusiasts flocking to the mountains for some fresh powder. But unpredictable weather doesn't always make for the easiest travel. Inherently, ski trips might be one of the riskiest to book since you can spend big bucks on ski lift tickets, lodging, airfare and equipment rentals, only to lose the money if the weather doesn't cooperate or an injury occurs.

These kinds of travel woes could affect more travelers as skiing and snowboarding grow in popularity. According to the National Ski Areas Association, there were more than 60 million visits to U.S. ski slopes during the 2021-2022 season, the highest since the organization started keeping track in 1978.

To reduce the risk of losing money on an interrupted or canceled ski trip due to adverse weather, travel insurance can be an option to consider. Some of the more common travel insurance benefits, such as trip delay or cancellation coverage, can come in handy for vacations in winter destinations. Plus, some travelers might already have those benefits through a travel credit card .

» Learn more: The best travel credit cards right now

Standalone travel insurance plans, which can offer more specific coverage tailored to ski trips, are also available. With these policies, travelers can get reimbursed for more particular expenses related to winter sports travel.

Here are the types of coverage travelers can expect to find when shopping for travel insurance for a ski trip.

Trip delay and cancellation coverage is a standard part of most travel insurance plans and can benefit those heading toward winter weather. For example, if flights are delayed because of a snowstorm, this type of coverage can help travelers get money back for days they might've missed at the resort. This usually includes reimbursements for nonrefundable travel expenses such as prepaid lift tickets, equipment rentals and other similar expenses.

Trip delay and cancellation insurance could also pay for extra meals and lodging that travelers may have incurred as a result of a delay.

One important caveat is that this coverage usually kicks in for covered reasons only. An airline delaying a flight would be covered, but a traveler looking at the weather report and wanting to bail on the trip for fear of getting stuck wouldn't be.

Skiers and snowboarders who want complete flexibility to cancel as they please should consider Cancel For Any Reason insurance. This coverage is a special add-on that costs more, but travelers typically receive 50% to 75% of their travel costs back if they cancel for any reason.

» Learn more: 10 best ski hotels to book with points

Injury is another big risk for ski trips. Injured skiers and snowboarders would most likely have to cut their trip short. That's when ski travel insurance with trip interruption coverage would help pay for the costs associated with returning home early.

Note that this coverage differs from travel medical insurance and medical evacuation insurance . Injured travelers will typically have to use some combination of their regular health insurance and travel medical insurance from their winter sports insurance policy (regardless if it's provided through a credit card or bought separately).

"Depending on where you're skiing, your home health insurance might cover you for an accident. But it also might not if you're outside of your home health network, and certainly not if you're traveling internationally," says Stan Sandberg, co-founder of TravelInsurance.com.

Advanced skiers and snowboarders will likely need even more coverage. If adventuring into the backcountry, outside of resort bounds or heli-skiing, consider getting additional insurance coverage for adventure sports.

» Learn more: How to save on a ski trip

This is a vague name for coverage, but it's a good add-on to a travel insurance policy for winter sports trips. "Travel inconvenience," sometimes called "Lost Skier Days," will reimburse travelers if the resort closes because of too much or too little snow.

This type of coverage is typically available from Dec. 1 to March 31 for resorts in the Northern Hemisphere and can reimburse up to $125 in lost expenses per day.

Many travelers are familiar with baggage loss or delay coverage , but some might not know that expensive ski or snowboarding gear might not be covered entirely. After all, typical travel insurance policies insure up to a certain dollar amount only. So if the airline loses your expensive skis, you might not be reimbursed for the full value.

Getting ski travel insurance with coverage for items like skis and snowboards can help. With this coverage, if your gear is delayed, the ski insurance provider will reimburse you, up to a limit, for equipment rentals.

If you're worried about losing the nonrefundable costs of your winter sports-focused vacation, ski travel insurance can provide some peace of mind. Look for coverage that reimburses you in case of winter weather delays or accidental injuries. In addition, travel inconvenience or sports equipment coverage are add-ons that can help you recoup the costs associated with lift tickets and equipment rentals.

Skiing and snowboarding are always an adventure, but delays and accidents don't have to be so costly.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

800-874-2442

"Generali wins out among the best travel insurance companies for its happy combination of below average fees for above average travel coverage."

“I go to France for skiing every year for a month and always feel super safe carrying Generali. I use them for every trip just because that one time, when it happened, they were there for me 100%.”

“We were thrilled when we found out everything was being covered.”

“My husband and I were really surprised by how very smoothly and quickly we received our check.”

Get Travel Insurance for Your Ski Trip

Terms of Use | Privacy Policy | California Privacy Policy | Do Not Sell My Personal Information | © Forbes Advisor, 2021

Trusted by over 6 million travelers every year

Copyright© 1997 - 2023 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: A8511912

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures .

Compare Plans

Frequently Asked Questions

What types of winter sports can travel insurance cover.

Our travel insurance plans can cover skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

The Premium and Preferred plans include Sporting Equipment and Sporting Equipment Delay coverages that can cover winter sports equipment you might bring on a trip, except motorized equipment, dental wear and eyewear.

If your sporting equipment is damaged, lost or stolen during your trip, Sporting Equipment coverage can reimburse the costs to repair or replace your sporting equipment. The Premium plan covers up to $2,000 and the Preferred plan covers up to $1,500.

Sporting Equipment Delay can reimburse you for the cost of locating your delayed Sporting Equipment and having it returned to you, and the cost of renting equipment in the meantime, up to the coverage limit.

The fine print says: "We will not pay for damage to or loss of boats, motors, motorcycles, motor vehicles, aircraft, and other conveyances or equipment, or parts for such conveyances." See Plan Documents for more details.

How can travel insurance help in case of weather delays on my trip?

Bad weather is always a risk when traveling during the winter. If a winter storm hits, flight cancellations and delays are bound to happen and you may take on some unplanned costs. If this happens, the Trip Interruption coverage included with travel insurance can cover for additional expenses to help get you to your destination and onto the slopes or back home, in addition to reimbursing you for lost trip costs. Travel Delay coverage is also included for certain out-of-pocket costs, such as meals, local transportation or even additional lodging or parking charges.

If a weather event, like a blizzard is foreseeable prior to you purchasing the insurance plan, then travel insurance may not cover it. If the plan is purchased after a storm is named, coverage is not provided for losses resulting from that named storm.

Read more about how travel insurance can help when you travel during the winter

What Can Wreck a Ski Trip and How Travel Insurance Can Help

Problems happen with travel plans more often than you might think. One in six U.S. adults reported having to cancel, interrupt or delay their trip.¹ Travel insurance can help protect your vacation investment from certain unforeseen events that could upset your travel plans and cost you.

Find the Plan That Fits Your Trip Best

There’s no better way to understand how travel insurance and assistance can help protect you and your trip than reading real life examples from fellow travelers.

How can travel insurance help me if I get sick or injured?

If you become critically sick or injured during your trip and no suitable local care is available, all of our plans provide coverage for emergency medical evacuation and coverage to reimburse your medical and dental costs. In addition, Trip Interruption coverage can reimburse you for lost trip costs while you're in hospital, including prepaid lift tickets.

This can be extremely helpful if, for example, you have a ski accident on the slopes — it could even require medical transportation by helicopter, which could cost a lot.

Our plans also include 24-hour emergency assistance services that can provide immediate assistance if a traveler becomes seriously ill or injured on their trip.

Could I be covered if I cancel my trip because of work obligations or job loss?

If you lose your job and cancel your trip as a result, you could be reimbursed for your prepaid, nonrefundable, trip costs. Some requirements must be met.

Our plans don't include Trip Cancellation coverage for work obligations that cause you to cancel your trip, except in the case of unexpected active military duty due to a natural disaster or military leave being revoked. If you want travel insurance that can cover for this reason, consider purchasing our Premium plan and adding Trip Cancellation for Any Reason coverage . This coverage reimburses you up to 60% of the penalty amount when you cancel your trip for any reason ( requirements apply ).

- U.S. Consumer Product Safety Commission

- SITA Baggage Report 2018

*Terms and conditions apply. See plan details for more details .

If you're brave enough to take on a black diamond, or maybe vacationing with kids just starting out on the bunny slope, chances are you could use ski insurance. Travel insurance for your ski trip can cover injuries on the slopes and during your vacation and is designed to help with winter travel mishaps like flight delays, cancellations, illness and more.*

What winter sports are covered?

Our travel insurance plans can cover winter sports on your trip, such as skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

You can also choose a plan designed to cover your sporting equipment if it gets damaged, lost, stolen or delayed. Just be sure that the purpose of your trip is not to participate in any organized amateur sports, professional athletic competitions or sporting events, as those are not covered by our plans.*

Find the perfect policy: Compare ski and snowboard travel insurance policies for off piste, backcountry, heli-skiing and more.

Compare travel insurance policies to make sure you've got the right coverage on your next overseas ski or snowboard trip.

Select the activities you'd like to be covered for

Select one or more of the filters below to find the right policy for you. All filters are for both skiing and snowboarding.

- Why you need travel insurance

- Terms of Service

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Climate 100

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Wine Offers

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

7 of the best ski holiday insurance providers to cover you on the slopes

From annual insurance to one-trip coverage, these policies offer protection when on the snow, article bookmarked.

Find your bookmarks in your Independent Premium section, under my profile

Sign up to Simon Calder’s free travel email for expert advice and money-saving discounts

Get simon calder’s travel email, thanks for signing up to the simon calder’s travel email.

After analysing the snowfall, quality of mountain runs and apres-ski vibes to choose your ideal spot to strap on your skis this winter, it's time to consider which winter sports travel insurance is best suited to keep you safe as you reach new altitudes.

Whether resorts without snow , slips causing broken bones, and unpredictable avalanches, plenty can go wrong on the pistes and it's always best to travel prepared.

In the event a ski pole slips through a cable car into the abyss – an not unlikely affair with small children – pistes are closed or lift passes are misplaced, having the right insurance to hire replacement equipment and receive financial compensation to tackle cancellations and medical costs is the key to smooth skiing.

Here are the best providers with which to purchase your winter sports travel insurance policies, allowing you to protect yourself before this season's ski holiday .

Read more on ski holidays :

- 8 of the best ski hotels across Europe

- 6 best ski holidays for beginners: Resorts and all-in packages to reach the pistes

- 8 of the best apres-ski holiday destinations

Do I need insurance for a ski holiday?

Yes – many standard travel insurance policies will not allow you to claim for accidents while taking part in winter sports if you have not taken out specific cover for medical expenses, equipment and piste closures before your ski holiday.

Will I be insured if I ski off-piste?

Several winter sports insurance providers cover off-piste skiing provided you are with a qualified guide and remain on recognised runs – check with your provider to see if off-piste skiing is inclueded in your policy.

Should I get an annual or one-trip policy?

Annual policies tend to provide 21-31 days of winter sports cover, which might work best for avid skiers hitting the slopes every season, whereas a one-trip winter sports extension policy could be better suited to cover a one-off week on the pistes.

Will I be insured if I ski while drunk?

No. You risk your insurance cover being invalid if you injure yourself, your equipment or others while skiing intoxicated with impaired judgement and reaction times or you are not wearing a helmet.

Ski equipment cover: £500

Piste closures: £500

Medical expenses: £5 million

Lost lift pass: £500

NFU Mutual offers winter sports cover for you and your equipment for up to 30 days as an add-on to their standard travel insurance policies. Activities covered include piste skiing, sledging, monoskiing and snowshoeing. Reasonable extra accommodation and transport expenses in the event of avalanche delays are also insured under the policy.

Admiral Gold

Ski equipment cover: £750

Piste closures: £250

Medical expenses: £15 million

Lost lift pass: £250 per week

Admiral Gold features winter sports insurance from just £25 as part of its upgrade package. Cancellation cover and piste closures are included for a maximum of 21 days of winter sports in the annual gold cover and the policy will pay out £200 in the event of an avalanche. Off-piste skiing is also included provided you “go with a qualified guide or instructor and remain on recognised paths”.

Ski equipment cover: £500

Piste closures: £300

Medical expenses: £10 million

Lost lift pass: £250

Barclays offers winter sports cover (excluding freestyle skiing or snowboarding) for 31 days a year, and skiing equipment and piste closures are part of its standard travel insurance policies. The insurance covers emergency rescue services and you can claim back up to £200 for delays should there be an avalanche.

Virgin Money

Piste closures: £400

Virgin Money provides single and multi-trip winter sports insurance for theft or damage to ski equipment, emergency medical treatment caused by skiing slip-ups, and piste closures. Policyholders can also claim up to £400 if their arrival at a ski resort is delayed by an avalanche.

Nationwide FlexPlus

Piste closures: £5,000

Nationwide’s FlexPlus travel insurance features cover for accidents needing medical help on the slopes, lost or stolen ski equipment, and piste or avalanche closures that cause delays or a cancellation of your snow-capped holiday. All FlexPlus current account holders are automatically covered with the travel insurance.

Staysure Signature

Piste closures: £200

Medical expenses: Unlimited

With Staysure Signature , 28 days of winter sports cover are included in “signature” policies, but you can add winter sports travel insurance to other policies for 11 sports (such as skiing, snowshoeing and ice-skating), unused ski-school fees and up to £160 back if you encounter avalanche delays.

Covered 2Go

Ski equipment cover: £1,000

Covered 2Go offers a winter sports travel insurance extension to gold and platinum coverage, including personal liability in case you injure someone else, and there’s up to £500 compensation available in the event of avalanche delays. The winter sports policy also covers guided skiing off-piste, ice-skating and tobogganing – but you must be wearing a helmet and skiing sober for your policy to be valid.

Read our reviews of the best hotels in Europe

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Winter Sports Travel Insurance

Ski and winter sports travel insurance

Whether you’re a regular skier or a complete beginner, accidents can happen on the piste.

Make sure you’re covered by adding mandatory winter sport protection to your travel insurance package. For an extra premium, you’ll be insured for injury, and lost, stolen or damaged equipment. It may even cover you for personal liability or personal accident. Terms and conditions apply.

Protection for skiing and snowboarding, on and off piste

Our winter sports cover gives you extra protection. We'll cover you for a variety of things, including:

- Off-piste skiing and snowboarding (within resort boundaries and in recognised areas)

- Lost, damaged or stolen ski equipment

- Piste closures

So before you hit the slopes, be sure to have all your cover in place. And then you can enjoy the thrill of the downhill.

What’s covered?

Add the winter sports cover option to any Post Office Travel Insurance policy for this extra protection. The cover will cost you an additional premium.

Skiing, snowboarding, airboarding and more

It’s not just skiing and snowboarding. Whether it’s ski-blading, airboarding, skidooing, tobogganing or even snowmobiling, there are plenty of winter sports we can cover you for (1), off piste as well as on (2)

Emergency medical support and evacuation

Your policy includes access to an emergency medical helpline 24 hours a day, 7 days a week. You're also covered for repatriation to your home country

Lost, damaged or stolen equipment

Whether you’ve your own equipment or you’ve hired some, we can cover loss, theft or damage. Terms and conditions apply. Check out our policy wording for details

Piste closure

It can be fun to go up the mountain when the weather’s heavy, but when there’s no snow at all, there’s no point. If the piste is closed because there’s no snow, you could make a claim

All medical conditions considered

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can't help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777 .

Choose a travel insurance cover level

The table shows the maximum cover limits available with ski and winter sports cover for each of our cover levels. You can add ski and winter sports cover for an additional premium.

Policy wording

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Common questions

What is winter sports travel insurance.

Taking part in winter sports can carry much higher risks than those you'll face on other types of holiday. It’s important to make sure that, as well as taking part in winter sports safely and responsibly, you have cover in case something goes wrong. This cover also provides protection for things that can happen to your equipment, such as loss, theft or damage.

Why add winter sports cover?

Whether you have your own equipment or you’re hiring it, replacements can be expensive if they have to come out of your pocket. If you're going on a trip involving winter sports, then adding this cover is mandatory. It's not just your equipment that needs to be covered but you as well. We can help you if you’re taken ill while on the mountain or get injured, and if the weather decides to dry up and there’s no snow on the piste, we can help restore the balance.

Isn’t my Ghic or Ehic card enough protection?

UK citizens travelling in EU countries can access some state-provided healthcare there for free or at a reduced cost. You'll need a UK Global Health Insurance Card (Ghic) or, if it’s still in date, a European Health Insurance Card (Ehic).

Remember, neither card covers any additional cost to return you to the UK or for a relative to stay or fly out to be with you. In a medical emergency you may have no control over the hospital you are taken to or the closest hospital may be private. But medical travel insurance may be able to cover some of the cost for you.

Also, Ehic no longer provides access to healthcare services in Iceland, Liechtenstein, Norway or Switzerland for UK nationals in most cases.

- Read more travel insurance FAQs

Need some help?

Travel insurance help and support.

For emergency medical assistance, to make a claim, find answers to common questions about our cover or get in touch:

Visit our travel insurance support page

Travel insurance policy types

Single-trip cover.

Single-trip Travel Insurance

- Cover for a one-off trip in the UK or abroad

- Perfect for one-off trips or longer holidays of up to 365 days (3)

- No age limit

Annual multi-trip cover

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Backpacker cover

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions.

- For people aged 18 – 60 wanting to travel the world for a gap year or career break

Related travel guides and services

The white stuff is alluring, so make sure you can enjoy it safely, are ready ...

Holidays for teenagers can take some imagination to make sure they’ve got the ...

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting ...

The whole idea of lounging around on the beach is to switch off and enjoy the ...

The status of Schengen visas for international students resident in the UK is ...

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder ...

Do UK residents need travel insurance for Ireland? And what healthcare is ...

Find out about the safety of travelling to Italy as well as the medical care ...

Some vaccinations for Thailand are recommended and some are mandatory in ...

Having your son or daughter go on holiday without you for the first time can be ...

Enjoy that precious time away with your grandchildren, and take some of the ...

With the winter sports season upon us, we conducted a Winter Sports Survey for ...

The opportunities to combine business and leisure have never been greater. You ...

There’s no better feeling than planning an amazing trip to an exotic ...

Ready to jet off on a much-needed break but worrying about what you can take ...

If you're the type of sunchaser who looks forward to that sizzling summer ...

With festivals overseas becoming the new norm, festivalgoers need to do a bit ...

Planning on living the high life with a trip to the UAE’s iconic mega-city, ...

Canada is a vast country of diverse delights – everything from bustling cities ...

The famous cliché of America is that it's big. And it is. Across its six time ...

Whether you’re heading to the beach for a much-needed break or boarding a boat ...

Learn the difference between embassies and consulates, and why you might need ...

The last thing you want to happen on holiday is standing the luggage carousel ...

Learn about the different types of travel insurance available from Post Office, ...

It’s your holiday too, and good preparation can take some of the worry out of ...

It’s one of the most popular holiday hotspots for UK holidaymakers. But what ...

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure ...

Today, Cuba is more accessible than it has been for many decades, and those who ...

It's a proud feeling when children turn eighteen and start holidaying on their ...

If you’re jetting off to Japan soon make sure you have good travel insurance to ...

As you get older, being able to go where you want when you want is all part of ...

Every year, millions of holidaymakers from the UK head to Spain for its ...

Fancy trekking in a remote Asian rainforest? A wild time in New York? Flying ...

Over 60 million people travel from the UK most years for holidays or business. ...

If you're travelling to an EU country from the UK, make sure you take a Global ...

Find out about medical care available to Brits in Mexico, as well as travel ...

It may be a short hop away, but a trip to France is not without its travel ...

Do you need travel insurance for your trip? Is travel insurance worth it? And, ...

Finding out that your airline or holiday company has gone bust is a shock – ...

Going backpacking is one of life’s great adventures. But before you set off ...

If you're living with cancer but love to travel, can you get travel insurance ...

So, you’ve booked your flights, accommodation and activities. What next?

In an average year, millions of Britons go abroad without the right travel ...

Greece and the Greek islands have long been a popular travel destination for us ...

You should be able to get the right cover to travel abroad if you’re diabetic, ...

We all know the feeling – getting to the airport, then a wave of panic comes ...

Perched on the northern tip of Africa, Morocco’s long been a popular ...

Whether you’re travelling solo because of business, you’re hoping to meet ...

How safe is South Africa to visit and why is having travel insurance important ...

Travelling solo means freedom and independence, making new connections and ...

Travel’s a great way to unwind, see the world, open the mind and expand ...

Satisfy your travel craving while making your holiday budget go further. We’ve ...

If you're travelling abroad as a family, it makes sense to take out insurance ...

People flock to the Canary Islands from all over Europe. No wonder, with such ...

Lots of people who need assisted travel at airports are missing out simply ...

Travel insurance for a holiday in the UK isn't something you must have, but it ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

Make sure you’re travelling safely in Egypt with the latest advice and risks, ...

Most of the time, getting a flight is a hassle-free event. If you only take ...

The arrival of Airbnb has helped to transform the travel industry in recent ...

Travelling with high blood pressure is fine – but it’s important to make sure ...

There are several ways to get to the top of the class on your flight – whether ...

Taking your best friend on holiday with you is everyone's ideal situation, but ...

Find out what medical care Brits can access in New Zealand and travel risks to ...

Heading down under for a trip to or around Australia? Make sure you’ve got the ...

Booking a last-minute holiday can get the blood pumping with the sudden thrill ...

For many UK holidaymakers, India is an intriguing and diverse culture with ...

Dark mornings, cold hands, heating bills and chapped lips are among the most ...

There’s nothing worse than falling ill while away from home. Along with the ...

Adventurous holidays can take many forms, from action-packed itineraries in ...

About our travel insurance

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

(1) Limitations may apply.

(2) Within recognised resorts and boundaries.

(3) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to:

365 days for those aged up to and including 70 years

90 days for those aged between 71 and 75

31 days for those aged 76 years and above

0330 880 5099

5p/min plus network extras

Why choose Skicover for winter sports insurance

Get the right winter sports cover for you, quick links to our most common sections.

You are logged in as Click here to access the sales report

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Insurance to Cover Your Ski Vacation

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Summer – Aspen/Snowmass Adventure Sports Trip

- Aspen/Snowmass – Week 1: Season Opener

- Aspen Singles Week 2 – High Season Skiing!

- Jackson Hole: Week One

- Jackson Hole: Week Two

- Steamboat Colorado: Back for 2025!

Whistler Blackcomb: Back For 2025!

- Lake Tahoe 3 Resorts: Heavenly – Kirkwood – Northstar

- Park City Utah

- Testimonials

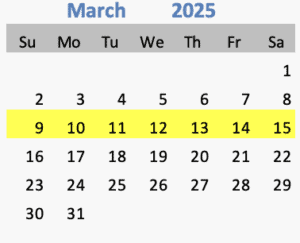

03/09/2025 - 03/15/2025

Shared room $3,100, private room $3,700, pre-nights $ 350.

Season Pass Holders Will Receive a $300 Discount During Registration. Airfare Not Included

Trip Package Details >

Trip itinerary >, hotel information >, trip resources >.

Hi I’m Chuck the “Ski Guy” your trip host!

Feel free to call me with any questions at

215-397-7767 Or email me at [email protected]

If you haven’t joined us before this is what to expect on one of our trips.

We usually draw anywhere from 30 to 50 guests on any given trip. Ages run from 40 to 65+ ( average age at 52+-) with a 50/50 split male to female give or take a few. Abilities are from first time skier to advanced with everything in between so finding new friends to ski with is never a problem.

Visit our testimonial page for past guest comments!!

If you haven’t been to Whistler / Blackcomb it should certainly be on your bucket list, and if you have then you know why guests keep returning!

Whistler / Blackcomb has over 200 trails, 16 bowls, 3 glaciers, 37 lifts and are connected by the Peak 2 Peak Gondola. Both Mountains offer a variety of terrain for the beginner, intermediate as well as the advanced skier/ snowboarder. Also, both Mountains have runs approx. 7 miles long, top to bottom!!

Combined these mountains are the largest skiable areas in North America. The resort base elevation sits at a comfortable 2,142 feet which means you won’t have to deal with altitude sickness if you’re coming from a lower elevation or from seal level.

Whistler has a pedestrian-only Village and offers a free shuttle throughout so getting around is a breeze. Whistler has endless restaurants, more than 200 stores for shopping, spa therapies and even a movie theatre!

Whistler Blackcomb was host to the 2010 Winter Olympics delivers a consistent snow cover for almost 200 days a season and has consistently been rated the number one ski resort in North America. You’ll thoroughly enjoy traveling toWhistler Blackcomb by bus along beautiful Sea-to-Sky Highway which is about two and a half hours away from Vancouver.

TRIP PACKAGE DETAILS

Our Whistler Ski Week Includes: 6 Nights Lodging @ The Crystal Lodge (Base of the Village) No Shuttle!! Arrive Sunday – 6 Nights – Depart Saturday 4 Day Mountain Lift Ticket Included Meals: ……Daily Buffet Breakfast (6) ……Sunday: Welcome Reception with Light Dinner ……Monday: Dinner Included ……Tuesday: Dinner Included ……Friday: Farewell Dinner Included Room Mate Match for Singles On Site Hosts Discounts on Ski Rentals

TRIP ITINERARY

Sunday: Arrive Vancouver Airport before 3 Pm if possible to allow time for baggage pickup, and shuttle to our hotel. 7:00 Meet for group orientation and Included dinner in Hotel Banquet room

Monday: 7-10 AM Full Hot Breakfast. Included 8:00 Rent or Pick Up Pre Ordered Skis 10:00 Meet for group skiing 12:30 Meet for Lunch Location TBD 4:00 Happy Hour! 7:00 Meet for dinner at Hotel Banquet Room. Included

Tuesday: 7-10 AM Full Hot Breakfast 10:00 Group skiing or venture out with friends earlier 12:30 Meet for Lunch Location TBD 4:00 Happy Hour & Hot Tub/Pool! 7:00 Meet for dinner. Location TBD. Included

Wednesday: FREE DAY OR optional Ski Extra Day 7-10 AM Full Hot Breakfast 6:30 “On your own dinner” Meet in hotel lobby for multiple dinner options

Thursday: 7-10 AM Full Hot Breakfast 10:00 Group skiing or venture out with friends earlier 12:30 Meet for Lunch Location TBD 4:00 Happy Hour & Hot Tub/Pool! 6:30 “On your own dinner” Meet in hotel lobby for multiple dinner options

Friday: 7-10 AM Full Hot Breakfast 10:00 Group skiing or venture out with friends earlier 12:30 Meet for Lunch Location TBD 4:00 Happy Hour & Hot Tub/Pool! 7:00 Meet for dinner. Location TBD. Included

Saturday: Travel Day 7-10 AM Full Hot Breakfast Buffet

Note: Alcohol is not included with dinners or Happy Hours Restaurants & Menu Choices Can Vary With Group Size

Optional Day Information (if applicable)

TRIP HOTEL DETAILS

4154 Village Green, Whistler, BC V8E 1H1, Canada

TRIP RESOURCES

Receive a 20% discount on rentals with the link below. They’re located right in our Hotel! Just mention your staying at the Crystal Lodge.

Ski Rental Link

Transportation

Whistler Shuttle

Click here for a customized travel insurance quote

Singles Travel Services recommends that all travelers purchase a travel protection plan to help protect themselves and their trip investment. Travel protection plans can provide coverage for trip cancellation, trip interruption, emergency medical expenses and emergency evacuation/repatriation, trip delay, baggage delay, and more.

TRIP VIDEOS

SIGN UP FOR SINGLES TRIP UPDATES

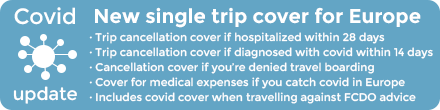

Single trip travel insurance is designed to cover one specific holiday or trip. If you plan to travel more than 2 times per year, our annual multi trip policy may be better value.

We can only cover people up to the age of 85, if you are over this age, you can get cover from our partner Goodtogoinsurance.com. To buy a policy from them online click here , or call them on 0330 024 4478.

An annual multi trip policy can save you money if you travel 2 or more times per year. It also means you won't have to set up a new policy every time you go.

We can only cover people up to the age of 74. If you are over this age you could try our single trip policy which has an age limit of 85. Alternatively, you may get cover from our partner Goodtogoinsurance.com. To buy a policy from them online click here , or call them on 0330 024 4478.

We offer our Globetrotter policy to those looking to travel for between 60 and 365 days on one journey.

We can only cover people up to the age of 65. If you are over this age you could try our single trip policy which has an age limit of 85. Alternatively, you may get cover from our partner Goodtogoinsurance.com. To buy a policy from them online click here , or call them on 0330 024 4478.

Our winter sports policy covers you for a range of activities, on or off-piste (within resort boundaries), whether you are a skier or a snowboarder. Check the policy wording for a full list of the winter sports covered. Adding this cover to annual multi trip policies will cover you for up to 17 days per year.

This includes cover for travel to: England, Scotland, Northern Ireland, Wales and the Isle of Man.

This includes cover for travel to: Aland Islands, Albania, Andorra, Armenia, Austria, Belarus, Belgium, Bosnia-Herzegovina, Bulgaria, Channel Islands (including Guernsey, Jersey, Alderney, Sark and Herm), Chechnya, Croatia, Cyprus, Czech Republic, Denmark (including Faroe Islands), Egypt, Estonia, Finland, France (including Corsica), Georgia, Germany, Gibraltar, Greece (including Greek Isles), Greenland, Hungary, Iceland, Italy (including Aeolian Islands, Sardinia, Sicily), Kosovo, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Moldova, Monaco, Morocco, Netherlands, Norway (including Jan Mayen, Svalbard Is), Poland, Portugal (including Azores, Madeira Islands), Romania, Russia (West of the Urals), San Marino, Serbia/Montenegro (including Kosovo), Slovakia, Slovenia, Spain (including Balearic Islands, Canary Islands), Sweden, Switzerland, Tunisia , Turkey, Ukraine, UK Area (Great Britain and Northern Ireland), The Republic of Ireland and Vatican City.

Please note: This policy excludes travel to countries or regions which the Foreign, Commonwealth and Development Office (FCDO) have advised against travelling to. It is recommended that, before travelling, you check the foreign travel advice area provided by the FCDO which can be found at www.gov.uk/foreign-travel-advice .

Travel anywhere in the world. Please note: This policy excludes travel to countries or regions which the Foreign, Commonwealth and Development Office (FCDO) have advised against travelling to. It is recommended that, before travelling, you check the foreign travel advice area provided by the FCDO which can be found at www.gov.uk/foreign-travel-advice .

Travel anywhere in the world, except USA, Canada, Mexico, Caribbean. Please note: This policy excludes travel to countries or regions which the Foreign, Commonwealth and Development Office (FCDO) have advised against travelling to. It is recommended that, before travelling, you check the foreign travel advice area provided by the FCDO which can be found at www.gov.uk/foreign-travel-advice .

For annual multi trip policies, cancellation cover is provided from the selected policy start date. If you require cancellation cover to begin immediately, please select today as the policy start date.

For single trip policies, cancellation cover is provided from when you purchase your policy.

Please select the traveller who you wish to book insurance for. If there is a group of you, please select the Group type of policy.

A couple who are legally married, common-law partners or living at the same address. All limits and excesses are per person irrespective of one or both travelling on the same trip.

A family is considered to be a legally married couple, a common law husband and wife, a single parent or adult couple who have lived at the same address for at least one year and up to 4 children aged under 18 (or up to 22 if in full time education). Under 2s travel free on an Adult or Couple Policy (please select Family, under Type of policy to set this up).

If your group has more than 8 people, please call us at 0800 068 0060.

Please note: All limits and excesses are per person (unless otherwise stated) irrespective of whether travelling on the same trip or individually.

Travel Insurance for Russia

Explore moscow and st petersburg with the right cover for your holiday .

Russia is the biggest country in the world and offers plenty for holidaymakers to explore, with each city providing new experiences and sights to see.

According to the United Nations’ World Tourism Organisation , the country ranked ninth in Europe for tourist numbers in 2018 with 24.6 million international visitors.

Moscow and St Petersburg are two of the busier cities for holidaymakers, but there is much more to see if you are keen to explore further. Kizhi Island, Vladivostok and Sochi are all stunning destinations to head to if you are planning a trip and they all have unique spots to enjoy.

If you are keen to travel and discover what the country has to offer, then make sure that you have travel insurance in place in case something happens during your trip.

Do I need a visa and travel insurance for Russia?

Travel insurance is essential for a trip to Russia and helps ensure that you have adequate cover for emergency medical costs, as well as protection for your luggage and potential flight delays. Columbus Direct offers both single trip and annual multi-trip policies , and they can be tailored to suit your needs. This includes getting optional add-ons for winter sports , golf cover and extra protection for gadgets that you take with you on holiday.

If you plan to travel to the country, then you will need to apply for a visa from the Russian embassy. All UK citizens aged 12 or over will need to get their fingerprints scanned as part of the application, which involves visiting a visa application centre in the UK. Your visa will include your passport details as well as the dates of your stay. Your passport should also have at least six months remaining at the time that your visa expires. You might also be required to show that you have an insurance policy that is valid for the entirety of your trip.

When visiting as part of a cruise, you don’t require a visa if you are there for less than 72 hours and the tour has been booked through an official company.

Vaccinations

Specific vaccinations aren’t required , but you are advised to ensure that your primary courses and boosters are up to date, such as MMR and the flu vaccine. The NHS website also suggests that you could also consider boosters and vaccines for other illnesses such as diphtheria, tetanus, hepatitis A, hepatitis B and rabies. If you are unsure whether you should get vaccinations, it is worth checking with a GP ahead of your trip. Holidaymakers should also be careful in areas with a high altitude, as it you can sometimes experience negative effects, and you should look out for show signs of Acute Mountain Sickness if you are feeling unwell.

Is Russia part of Europe for travel insurance?

When it comes to getting travel insurance for a holiday in Russia, the type of cover will depend on which region you are travelling to.

West of the Ural Mountains is usually considered to be part of Europe and travel to this province can be covered by a Europe policy. It has a large portion of the country's population, even though it only covers a quarter of the Russian territory, and it includes major cities like Moscow and Saint Petersburg.

The eastern side of the Urals forms part of northern Asia and is commonly known as Siberia. To have valid cover here, you will need to get worldwide travel insurance . This will ensure that you have protection for your trip, including medical cover and personal baggage that is damaged, lost or stolen. If you intend to visit both sides of the country, then you would need to get worldwide insurance to cover both areas.

If you are planning another trip over the next year, then annual multi-trip cover could be the cheaper option. Worldwide coverage would mean that you can travel as far as America, Canada and Australia within a one-year period without the need to get more travel insurance.

Russia travel advice

Arriving in russia.

Visitors are advised to carry their passport with them at all times, as there can often be random checks from police. You will also be required to register with the local authorities if you are staying in a location for more than seven working days. This is normally done automatically for you when staying at a hotel, but your host will need to do it if you are staying somewhere else.

The EHIC is not valid there, which makes travel insurance even more important, as it can help with healthcare costs that you could face. Hospitals often require cash or credit card payments in advance of treatments . You can usually bring prescription medication if you are planning to use it for personal needs, but some medicines require certain prescriptions to be allowed into the country, so it is worth checking with the Russian Embassy if you are unsure.

If you are planning to drive, you will need to get an International Driving Permit (IDP), and your car insurance policy must have a third-party cover as a minimum. The RAC’s guide to driving in the country explains that speed limits vary depending on what area you are in, but generally residential zones are limited to 37mph in built-up areas and 68mph on expressways. When driving you should carry all of your documents with you including your full valid driving licence, IDP, proof of insurance, passport and visa. Your car is also required to carry specific items such as a warning triangle, first aid kit, spare bulb, headlamp beam deflectors and a fire extinguisher.

The size of the country

The current population is estimated to be around 145 million people, making it the ninth most populous country in the world. This is despite it being the largest country in terms of land mass. Moscow is by far the most heavily populated area, with an estimated 12.4 million people living in the capital. The amount of people in Eastern cities is sparser, compared to the west which has considerably more citizens.

As the country is so vast it means that there are several different time zones, so the local time can vary quite dramatically depending on where you are. There are currently eleven time zones spanning across the country, ranging from UST +02.00 in Kaliningrad to UST +12.00 in Chukotka. The time where you are will depend on which region you are staying in, and if you plan to travel around the country then it is likely that your time zone will change several times.

What to do on holiday in Russia

Being such a large country means that it is often impossible to see everything during one visit. The different regions can vary in their culture, as well as the sights and history that you can experience while you are there.

Many tourists will look to visit Moscow, the capital of Russia, during their first trip to the country. Red Square is one of the city’s most visited spots and it is known for its stunning architecture and for being home to the current president. It is also home to several tourist spots include St Basil’s Cathedral and Lenin’s Mausoleum, as well as a market square where you can find vendors selling a variety of items and food.

St Petersburg is the second biggest city, with over five million people living there, and it has several popular tourist spots. The State Hermitage Museum is one of the most well-known tourist attractions, and it is the second-largest art museum in the world. It was founded in 1764 and has a vast art collection spanning over three million items, including work from various parts of the world.

There is also the Church of the Savior on the Spilled Blood , which was built during the 19 th century as a way of memorializing Alexander II. The Peterhof Palace can also be visited in St Petersburg and it has various gardens and palaces to explore. There is also the Winter Palace of Peter I, which visitors can walk around with private tours available for those looking to learn about its history. There is also an exhibition complex with historical items and paintings available to view.

The country has several nature spots to visit such as the Stolby National park near to Krasnoyarsk. There is also the Kamchatka Peninsula which is 1,250 kilometres long and can be found in the far eastern part of Russia. Visitors can see volcanoes, rivers and hot springs, as well as snow peaks in some areas of the region.

If you plan to get involved in some activities during your trip, make sure that it is covered as part of your travel insurance. Columbus Direct includes 150 sports and activities for free with every policy, which ensures that you are protected for football, zip-lining, yoga and various other activities.

If this isn’t enough, you can also get the Adventure pack add-on to include even more sports to your cover, while our Winter Sports option offers protection for skiing, snowboarding and other winter activities. This includes emergency medical treatment and helicopter rescue, as well as cover for your equipment and delays on your trip because of piste closures and avalanches.

How to travel around Russia

It is the largest country in the world and if you are planning to visit more than one area, then you will need to decide on which mode of transport you want to use. There are many different options with local flights and trains considered to be the most popular choices.

There are over 150 airports in Russia, including five in Moscow. Which can make it easier to travel between cities, but you are advised to plan your trip beforehand. Aeroflot is the largest airline in the country, but it doesn’t travel to all airports. This means that you may have to look at other options depending on where you are looking to visit. You can compare them by using Airline Ratings , which rates them by safety standards, and it also includes details on seating, entertainment and food in-flight.

Experience the Trans-Siberian Railway

When it comes to trains, the Trans-Siberian Railway is one of the most well-known rail trips in the world. It runs from Moscow to Vladivostok, while there is also the option to take alternative routes through Mongolia and China . Each journey on the train can provide a different experience, as you have the option of going on various excursions, and the train has many different stops that it can make along the way.

Some of the most popular stops on the Tran-Siberian Railway include Yaroslavl, which is a city originally founded in 1010 and it is a UNESCO World Heritage site . The stunning city has a long history that you can see as you walk through the streets, while there are several 17 th century churches to visit as well.

There is also Lake Baikal , which is a historic lake in the Russian region of Siberia, and it is believed to be the deepest lake in the world. The area has a host of wildlife, including several species of plants that can only be found at the lake, as well as various freshwater fish and seal. Lynx and bears can also be found living in the surrounding area.

Some of the other trains can travel incredibly fast, such as the Sapsan , which moves between Moscow and St. Petersburg at an average speed 155 miles per hour.

What are the risks of travelling to Russia?

Most of the country is safe to visit, particularly if you remain mostly in the tourist areas. There are cases of pick pocketing and theft in some parts, so tourists are advised to keep their belongings close and to not leave any bags unattended. It is particularly common on public transport and in busy streets when travelling through some of the busier cities.

There are also some taxis that operate without a licence, and the safer option is to use a taxi app to book your journey or order a cab through your hotel. There have also been reports of drink spiking, which can lead to robberies and abuse, so it is advised that you buy your own drinks and keep them in your sight.

There have been a few terrorism attacks over the last ten years, including a suicide attack in St Petersburg in April 2017, while there have also been attacks in Moscow and other cities. There has been an increase in civil unrest and kidnapping in North Caucasus, while the Foreign and Commonwealth Office (FCO) has advised against travel to various areas, including Chechnya, Dagestan and Ingushetia.

Russia is also known for having a low tolerance towards LGBT+ issues, and it was ranked poorly by ILGA-Europe , which examines countries and their progress towards equality . The country has no laws in place to protect LGBT+ people from discrimination and hate crimes, and Moscow Pride was banned for 100 years back in 2012. There have been reports of violence and harassment to members of the LGBT+ community, and tourists are advised that public displays of affection could put you in danger if it draws negative attention.

What to do if something happens while I’m away

If you require the emergency services while you are in Russia, the main contact line is 112 .

You can also call 101 for the national emergency telephone line, 102 to reach the police , and 103 for medical emergencies .

You can also reach out to the British Consulate General Ekaterinburg or the British Embassy in Moscow on +7 495 956 7200 .

Your Single Trip Travel Insurance comes with a number of benefits. These include:

- Our policy can protect you from 1-365 days. Even if you only plan on having one trip, you can let your holiday last even longer.

- Cover for up to £15 million provided for medical expenses. Including emergency medical treatment, repatriation and the services of a medical assistance company

- Insurance may be available if you have a pre-existing medical condition . Let us know if you or any other insured parties require additional cover, and we will do our best to accommodate.

- We provide cover for up to 150 sports and activities free of charge. Let you hair down and try your hand at some of the sports and activities which may be on offer.

- Your baggage will be insured for up to £2500, including your valuables and delayed baggage. Should your luggage or personal belongings become delayed, lost, stolen or damaged during your trip.

- Optional - Winter sports , ski and snowboard cover can be included. Which includes a whole lot more than just ski and snowboarding!

- Optional - Gadget cover can be added. Add extra cover for your mobile phone, tablet or laptop with up to £1000 protection against theft, damage or loss on your trip.

- You can be eligible for single trip insurance up to the maximum age of 85 . Be free to travel the world whether you're young, or young at heart

Key benefits of cover:

24h medical assistance services: included.

- Should you require emergency medical treatment or repatriation, our policies provide you with access to a 24hr multilingual staffed medical emergency company.

Medical Expenses: up to £15 million

- Whether its injury or illness, our policies cover you for both emergency in-patient and out-patient treatment, which includes non-routine prescription charges, consultations, physiotherapy and even emergency dental treatment. If it becomes medically necessary to repatriate you back to your home country, then this is covered too.

Cancellation and Curtailment: up to £5,000

- We will compensate you for any unused accommodation and travel expenses which you lose or incur as a result of having to cancel / curtail your holiday due to certain reasons.

Personal Property cover: up to £2,500

- We cover the loss and theft of and damage to your baggage & personal belongings. We also provide you with an allowance to purchase essential replacement items in the event that your checked-in baggage is delayed for a certain period of time.

Frequently Asked Questions:

Am i covered for off piste and without a guide.

You’ll be covered for skiing and snowboarding both on and off piste provided you stay within resort boundaries. You don’t need to be accompanied by a guide.

Why do I need a winter sports policy?

If you’re planning to take part in any winter sports on your trip, you’ll need extra cover to insure you whilst you’re participating in winter sports activities. This extends the policy to cover you whilst you’re skiing or snowboarding – including emergency medical expenses cover if you suffer an injury. It also includes useful extras, like cover for your skiing or snowboarding kit (whether it’s owned or hired), piste closure cover and more

When should I purchase my ski policy?

If you want cover for a single trip, cancellation cover starts as soon as you buy your policy – so if you’ve already put a deposit on your ski holiday or paid for your flights or hotel, it makes sense to sort your travel insurance out right away.

If you’re considering an Annual Multi-Trip policy to cover all your travel this year, then cancellation cover starts from the start date on your policy. So if you’ve paid for your trip, enter the policy start date as today to make sure your holiday is protected.

Don’t forget, there’s a 14 day cooling off period from the date of receiving your policy documentation – during which you can receive a full refund, provided you haven’t already travelled.

Does my EHIC cover me for winter sports in Europe?

The European Health Insurance Card (EHIC) currently allows UK residents to be treated in EU countries as well as Norway, Liechtenstein and Iceland, on the same terms as citizens of the country they are visiting. It doesn’t cover the cost of repatriating you back to the UK airlifts off the mountainside.

Not all countries included in the EHIC agreement have totally free healthcare, so the Foreign and Commonwealth Office have always advised that the EHIC in no way replaces your travel insurance policy but it can help to reduce your costs. We will remove the excess payable on any medical claim where an EHIC has been used.

If you have any unanswered questions, please visit our Winter Sports FAQ’s page for more information .

Latest from our blog View more

Travel insurance tailored for you, why columbus direct.

- FREE airport lounge access if your flight is delayed for more than 1 hour

- Over 150 sports and activities covered free

- Award-winning products and services

- Over 15 million customers since 1988

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

What is A Single-Trip Travel Insurance Policy?

with our partner, Faye

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Single-trip travel insurance plans can help you manage the risks associated with travel, including trip delays , cancellations and medical emergencies. Even if these unwanted events don’t occur on your vacation, single-trip travel insurance provides peace of mind knowing you have financial support if needed.

The best travel insurance providers offer comprehensive coverage to help you avoid sunken cancellation costs and get back on track after a trip interruption. Read on to learn more about single-trip travel insurance and when to purchase a policy.

What Is Single-Trip Travel Insurance?

Single-trip travel insurance covers one trip, with coverage extending from the time of purchase to the date you return home. Single-trip plans are best for casual travelers or those who do not travel internationally often. Frequent travelers may find more value in a multi-destination or annual travel insurance plan.

Single-trip travel insurance protects you from certain risks while traveling. Policies typically reimburse costs related to:

- Trip cancellation (including your flight and hotel)

- Emergency medical treatment or evacuation

- Travel delays and interruptions

- Lost or damaged baggage

- Stolen valuables, like a camera or laptop

Trip interruption and cancellation coverage are limited to unforeseen and uncontrollable events such as natural disasters, unexpected illnesses, a death in the family or an accident. You won’t get reimbursement if you change your mind or break up with your traveling companion before the trip — unless you purchase additional cancel for any reason (CFAR) coverage .

Insurers list coverage exclusions so you are aware of limitations when buying a policy. The fine print will also include coverage limits or the maximum amounts the policy pays for a covered event.

Single Trip Travel Insurance vs. Annual Travel Insurance

Most insurance providers offer multi-trip or annual policies that provide coverage for more than one journey. This option provides more value than single-trip plans in certain situations.

Here are situations in which a single-trip policy may be the better option:

- If you travel frequently but rarely go abroad and want coverage for international travel.

- If you are planning a once-a-year family trip and want cancellation coverage to protect your investment.

- If you are traveling for a special occasion and want protection so you can travel elsewhere if the trip gets canceled.

- If you might require medical coverage while traveling abroad and want to avoid paying for treatment out-of-pocket.

Annual policies are better in some circumstances, including:

- Frequent international travelers may be able to get a better rate with annual coverage.

- Digital nomads and expatriates living abroad for work often need health coverage provided by an annual plan.

- Anyone with more than two trips planned during a calendar year may get better value from multi-trip policies.

In most cases, the decision comes down to how much time you spend abroad and the number of trips you take during a given year.

Who Should Get Single-Trip Travel Insurance?

Single-trip travel insurance can benefit individuals, families or groups who don’t travel frequently and want to cover a specific trip. A travel insurance policy can offer financial protection for trips that require a significant investment.

Many travelers purchase single-trip policies to cover medical expenses. According to the U.S. Department of State , American health insurance does not usually work overseas. If you need emergency care abroad, you will have to pay out of pocket unless you have a travel medical plan.

Here is a closer look at the advantages and drawbacks of single-trip travel coverage:

Benefits of Single-Trip Travel Insurance

Single-trip travel protection provides certain benefits to travelers.

- Flexibility: You can purchase a policy with specific coverage and limits based on what you need for your trip without paying for extras you won’t use.

- Protection from unexpected events: Cancellation and interruption coverage can help you avoid losing your travel investment or spending extra because of an accident, disaster or another event beyond your control.

- Peace of mind: Even if you do not make a claim, travel insurance provides peace of mind knowing you have financial support if you encounter an emergency abroad.

According to the U.S. Travel Insurance Association , travelers use their coverage more than other insurance services — 17.3% of people who purchase trip coverage file a claim. In contrast, only 7.3% of homeowners utilize their house insurance.

Downsides of Single-Trip Travel Insurance