- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Revolut travel card review: Rates, fees & limits [2024]

The Revolut travel card is a multi-currency card you can use for convenient spending and withdrawals in the US and when you’re abroad.

This guide walks through everything you need to know about how the Revolut travel card works, its key features and benefits, and the fees associated with using it. We’ll also touch on some alternatives to use abroad, such as the Wise travel card, as a comparison.

Revolut travel card: key features

Revolut offers 3 different account plans

- The Standard plan has no monthly fee to pay, while the Premium and Metal account plans have monthly costs, but also include more features and higher no-fee transaction limits.

- All accounts come with a travel card for spending and withdrawals, but the exact card type you get will depend on the account tier you choose. With the highest tier of account you get an exclusive solid steel Metal card, while all account types can also opt for a personalized card.

- Virtual cards are also available on all account plans, which can be used for mobile and online spending, and added to a walleye like Apple Pay.

We’ll walk through the Revolut travel card in detail throughout this guide, including how it works at home and abroad.

Go to Revolut Here are a few pros and cons of the Revolut travel card to kickstart our full review:

The Revolut travel card offers an easy and flexible way to hold, spend and exchange multiple currencies, with just your card and your phone. You’ll be able to choose the plan that suits your specific needs and transaction requirements, including some with no monthly costs associated. Once you’ve opened a verified account you can order your physical card in the Revolut app, and start spending right away online or using a mobile wallet, with your virtual card.

Who is the Revolut travel card for?

The Revolut travel card can suit frequent travelers as well as anyone living, studying or working abroad. You may want to get a Revolut travel card if:

- You’re a traveler spending in foreign currencies often

- You love to shop online at home and abroad

- You want a virtual card for security

- You’d prefer to manage your money using just your phone

Go to Revolut

What is a Revolut travel card?

The Revolut travel card is a payment card linked to a Revolut digital account. There are several different Revolut cards which are issued with different Revolut account plans – all are debit cards, and all can be used for global spending and cash withdrawals.

If you are looking for more information about Revolut: Revolut review

Is the Revolut Travel card a multi-currency card?

Yes. You can hold around 25 currencies in the Revolut account and spend conveniently in multiple currencies around the world.

Compare the Revolut travel money card to alternative options like the Wise travel money card , to see which suits you best. More on that, next.

Alternatives to Revolut travel card

Non-bank providers like Revolut can be a cost effective way to spend at home and abroad. They’ve often got fairly low fees, and tend to be innovative, offering some helpful and unusual account features to suit different customer needs.

Here’s a quick look at how Revolut lines up on features and fees against a couple of other non-bank services from Wise and Chime .

*Information correct at time of writing, 13th October 2023

Go to Revolut Go to Wise

Wise travel card

Hold 40+ currencies and spend in 150+ countries, with mid-market rate currency conversion, no minimum balance and no monthly fees. You can open your Wise account online and order a card for home delivery. Use your card to spend and make cash withdrawals globally, and get instant in-app notifications to keep on top of your finances.

Go to Wise

Learn more: Wise card review

Chime debit card

Chime accounts have no monthly fees and no minimum balance. In fact there are very few fees to worry about at all. You can only hold USD in your Chime account, but you’ll still be able to use your card around the world to spend in any currency. Your overseas spending will be converted back to USD using the network exchange rate with no foreign transaction fee.

Revolut travel card fees & spending limits

As with any travel card, there are some fees involved in using the Revolut travel card. There are also a few limits applied to keep customers and their accounts safe. Here’s a rundown of the limits for the Revolut travel card:

*Details correct at the time of research – 13th October 2023

Here are the Revolut travel card fees you’ll need to be familiar with:

Exchange rates

All Revolut accounts have some currency exchange every month which uses the mid-market exchange rate. Standard plan holders can convert up to 1,000 USD a month, Premium plan holders can get 10,000 USD a month and Metal plan holders have unlimited conversion with the mid-market rate.

It’s important to note that out of hours conversion fees apply, which means you pay 1% extra when exchanging currencies at the weekend or overnight. If your plan has a limited amount of mid-market rate conversion, you’ll be charged a 0.5% fair usage fee once this is exceeded.

How to get Revolut travel card

To order your Revolut travel card you’ll need to have an active Revolut account. Download the Revolut app, and you can get your new account in just a few taps, by entering your personal information and getting verified.

Once you’ve got your Revolut account set up all you need to do is open the Revolut app and go to the ‘Cards’ tab. Here you’ll see the option to get a physical or virtual card, and to create a card PIN.

What documents you’ll need

To verify your Revolut account you’ll need to upload a selfie and a photo of one of the following documents:

- Driving license

If you don’t have these documents available, you can reach out to Revolut to understand which other documents may be used in your specific situation.

What happens when the card expires?

Revolut will contact you 28 days before your card is due to expire, so you can order a new one in good time. Standard shipping has no fee when getting a new card to replace an expiring Revolut travel card.

How to use a Revolut travel card?

The Revolut travel card is a debit card issued on either the Visa or Mastercard network. That means you can use it to pay or make a withdrawal anywhere you see the logo of your card’s network being displayed, globally. You’ll also be able to add your card or your virtual card to your preferred mobile wallet for on the go payments.

How to withdraw cash with a Revolut travel card?

To make an ATM withdrawal with a Revolut travel card you’ll need to first find an ATM that supports your card network. You can then just insert the card into the ATM and enter your PIN, then the amount you want to withdraw. Easy.

Is the card safe?

Yes. The Revolut card in the US is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Visa.

How to use the Revolut travel card overseas?

You can spend with your Revolut travel card in about 150 countries , anywhere the card network is accepted. If you hold the currency you need in your account there’s no fee, but an exchange or fair usage fee may apply in some situations – if you’ve exhausted your monthly currency exchange limits, or if you’re exchanging out of hours for example.

If Revolut doesn’t support holding the currency you need, it’s worth checking out Wise which has a broader selection of 40+ currencies for holding and exchange.

Conclusion: is the Revolut travel card worth it?

The Revolut travel card is a flexible option for holding 25+ currencies and spending globally in 150+ countries. Depending on the account tier you select you may pay a monthly fee, and some transaction fees are also likely to apply. Compare the Revolut travel card against some alternatives like the Wise travel card and the Chime debit card to see which suits you best.

The Wise card may suit you if you’re looking for a powerful international account that can hold 40+ currencies, and receive payments in multiple currencies with local bank details. Chime may be a good pick for customers looking for a USD account with pretty much no fees to pay which you can use at home and abroad.

Revolut travel card review FAQ

How does the Revolut travel card work?

The Revolut travel card is linked to a digital account you can hold about 25 currencies in. Add money to your account in USD and then you can start spending and making withdrawals globally.

Is the Revolut travel card an international card?

Yes. The Revolut travel card supports spending in about 150 countries, and you can hold 25+ currencies in your account.

Are there any alternatives to a Revolut travel card?

Other non-bank providers like Wise and Chime also offer spending cards which have their own features and fees. It’s worth comparing these against the Revolut travel card to see which suits you best.

My Honest Revolut Travel Card Review: Pros & Cons of Revolut

Posted on Last updated: March 21, 2024

I will gladly admit that 1/3 of my success in life is simply me being in the right place at the right time. I found Revolut at a Tech startup conference in London earlier this year and they told me about their money cloud program.

Basically, you save money while traveling because Revolut holds/exchanges the Great British Pound, the U.S. Dollar, and the Euro… all in one place. Backed by Master Card, the Revolut card can be used in any country (using any currency) as a normal domestic debit card AND you can send people money via apps like Facebook and WhatsApp.

In my line of work, I get paid in USD but I need to pay my bills in GBP and I’m constantly in Europe throwing Euros like Kanye (not really).

During my last two years abroad, I’ve been paying ridiculous fees just to access MY MONEY and The Universe has clearly brought Revolut into my life to rectify this issue.

So shut up and take my money.

Since the program is still in its developing stages, you have to be invited in order to join and the landing page doesn’t have all of the details… but I do. So let’s break it down further. So why is Revolut revolutionary for travelers like you and me?

What is the Revolut Travel Card?

Revolut has the vision of making sending and spending abroad as easy as it is at home, which is made of three parts:

1) Sending Money with Revolut

Revolut allows users to send money through SMS/WhatsApp/Email and via URL. The recipient can retrieve money by downloading the Revolut app or by entering their bank account details after following the link.

Revolut currently allows deposits and withdrawals in GBP, USD, and EUR as well as sending in 20 other currencies (AUS, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, RON, SGD, ZAR, SEK, CHF, THB, TRY, AED).

2) Exchanging Money with Revolut

Revolut provides the best possible exchange rate, the interbank rate. No hidden fees or spread! Revolut currently offers currency exchange between GBP, USD, and EUR however this will soon expand this list.

3) Spending Money with Your Revolut Card

With the multi-currency card, you can spend abroad without the horrendous fees.

Revolut’s multi-currency card currently supports GBP, USD, and EUR and can be used online as well as offline immediately after there topping up on the Revolut app.

Even if you spend abroad Revolut will automatically do the exchange so you get the most out of your money!

Fees and Charges

Plain and simply, 1% on exchanges with maximum fee charges of GBP120 per year.

Super low fees and capped charges ensure that whether you are sending, exchanging, or spending money, with Revolut, you avoid horrific fees so that your money can be spent on the things that really matter!

Security of the Revolut Travel Card

Revolut ensures that all money sent and stored on Revolut is secured by working with Optimal Payments, which is a registered and regulated e-money issuer by the FCA (reference FRN: 900015).

Optimal Payments manages ring-fenced Barclays accounts which means all money is secured against the possible distress of Revolut, Optimal Payments, and Barclays.

Additionally, Revolut only operates on mobile apps as these platforms provide better protection against hacking than web-based applications. Your money is also secured for up to 85,000 GBP. Awesome.

With ATM fees, transaction fees, and currency exchange fees piling up, I’ve been losing 75 USD A MONTH since I moved to London.

That could have bought me a round trip to Paris and so much more. Join the movement. It’s your money, do what you want with it.

Disclosures

The Revolut USA Prepaid Visa® and Prepaid Mastercard® are issued by Metropolitan Commercial Bank pursuant to a license from Visa U.S.A. Inc. for Visa cards, and Mastercard International for Mastercard cards, and may be used everywhere Visa or Mastercard are accepted.

Banking services are provided by Metropolitan Commercial Bank, Member FDIC, and are subject to the terms of a Cardholder Agreement. “Metropolitan Commercial Bank” and “Metropolitan” are registered trademarks of Metropolitan Commercial Bank © 2014.

A note from Metropolitan Commercial Bank: Funds in your Revolut Prepaid Card Account are held at an FDIC-insured institution. Your funds will be held at or transferred to Metropolitan Commercial Bank, an FDIC-insured institution.

While there, your funds are insured up to $250,000 by the FDIC in the event Metropolitan Commercial Bank fails if specific deposit insurance requirements are met and your card is registered. See fdic.gov/deposit/deposits/prepaid.html for details. FDIC insurance does not protect your funds in the event of Revolut’s failure or from the risk of theft or fraud.

Related Posts:

- Best Banks for Digital Nomads

- How I Made Thousands of Dollars Traveling the World as a Digital Nomad

- When Parents Say No to Traveling

- Why You Can’t Afford To Travel?

- The Challenges of Living Abroad

Vanessa Wachtmeister is a travel tech professional and the creator of the wealth & wanderlust platform, Wander Onwards. Vanessa is originally from Los Angeles, California, she is a proud Chicana, and she has been living abroad for the last 9 years. Today, she helps people pursue financial and location independence through her ‘Move Abroad’ Master Class, financial literacy digital products, and career workshops.

Thursday 3rd of December 2015

The promotion is not working anymore?

Marcus Bryant

Tuesday 8th of September 2015

It is a great idea - actually there are no transaction fees (they earn their money from the mastercard transaction fee when you use it). A Word of caution though - when attempting to credit my account via transfer the reference field got corrupted and it couldn't be processed. One week later they still haven't found my money and just keep apologizing - no offer of compensation and no solution so far. Their back office is extremely poor IF things do go wrong.

Jonas Hürbin

Thursday 4th of June 2015

Got to your post by searching the internet for a way to save money abroad. When I first read your post, revolut didn't support Android Phones, they now do, so I joined them as well. Great idea and great post. I will give it a try during my travels ;)

Sarah Elizabeth

Tuesday 14th of April 2015

Brilliant idea. Thanks for sharing. I'm lucky enough that my bank is kind to me about living abroad and withdrawing money, but there is definitely always money lost between transfers and exchange rates every now and then.

Revolut Travel Card Review: Save Money Abroad

Last Updated on August 15, 2023 by Natalia

If you’re looking to avoid unnecessary charges and bad exchange rates when you travel, then this Revolut travel card review is for you. We’ve been using Revolut since 2016, and by now we can safely say it’s saved us hundreds, if not thousands of pounds. Changing money in advance is a thing of the past, as you can now arrive at your destination and use a Revolut prepaid card to get a better rate than currency exchanges ever offer. Although there are a number of different cards available, we personally think that there’s only one winner if you compare Revolut vs Monzo vs N26 travel cards or any of the other competitors. Revolut charges just 2% if you exceed your monthly withdrawal limit compared to the 3% Monzo charge, and N26 charge 1.7% on all transactions on free accounts. On top of that, the standard free Revolut accounts allows you to convert up to £1,000/€1,000 a month with no charge. If you’re looking for better features, then there’s also the option to sign up for a Premium or Metal Revolut account, although these accounts do come at a small cost. We fully recommend signing up now, but if you want to know more then check out our Revolut travel card review below!

Sign up to Revolut today via our referral link and get your first travel card delivered completely free! Click here to sign up!

Table of Contents

Available currencies

One of the most important things with any travel card is the number of currencies supported for card payments and ATM withdrawals. Revolut allows you to make card payments and ATM withdrawals in over 150 different currencies, which means it provides you with great versatility almost anywhere you travel. All major currencies are supported through the card, so unless you’re going really off the beaten path then Revolut will support almost every currency you need. We’ve been using our Revolut travel cards since 2016 and since then have been able to use them everywhere we’ve visited throughout Europe, Asia, Central America and South America.

Some of the currencies that aren’t yet supported are the Zimbabwean Dollar, Tuvaluan Dollar, Armenian Dram, Faroese Króna and Eritrean Nakfa. Even if you’re visiting one or more of the countries where the currency isn’t supported, it’s still worth getting a card for when you travel elsewhere. More and more currencies are becoming supported, so don’t be surprised if soon you’re able to use your Revolut card anywhere in the world!

Exchange Rate

Revolut travel card uses the real exchange rate, so whatever currency you’re changing you will almost always find that Revolut offer a better exchange rate than any of your other options. If you had £10, you wouldn’t actively choose to throw it away, but if you’re getting a bad currency conversion rate then throwing away money is exactly what you’re doing. Considering a Revolut travel card is completely free, you may as well get more currency for your money! Click here to save money when spending abroad by signing up for Revolut!

As the real exchange rate changes in real-time, the rate you will receive depends on when you convert your currency. Rates will fluctuate throughout the day, so you may get slightly different rates if you make a number of payments throughout the day.

Although Revolut uses the real exchange rate, the rates are fixed over the weekend to protect against fluctuations. This means that during weekends there is a fee of 1% on any transaction that involves currency conversion.

To avoid being affected by these markups we recommend making ATM withdrawals during weekdays. It will also affect card payments over the weekend, but there is no way to avoid these and it still almost always works out cheaper than using your normal debit card or a currency exchange.

How to get the best exchange rate with Revolut

There’s a very simple tip to make sure you get the best exchange rate when paying with your Revolut card. When using your card abroad you may be asked whether you would prefer to pay in the local currency or your home currency. Always opt to pay in the local currency.

If you don’t pay in the local currency then the merchant will make the conversion, which normally means you’ll get a very bad exchange rate and will end up paying more. Paying in the local currency allows Revolut to make the conversion (if required) using the real exchange rate, which means you will get a substantially better rate. Sometimes when making card payments abroad the merchant may select for you to pay in your home currency without giving you the choice to pay in the local currency. Always check what currency you’re being charged in and ask to pay in the local currency if you notice you’re being charged in your home currency. Some merchants will insist you will get a better rate by paying in your home currency, but that is never the case.

Make sure to also check what currency you’re paying in when making an ATM withdrawal. Some ATM machines will ask whether you want to use their conversion, but through experience we can say it’s always better to reject this. The phrasing will make it sound like you may be charged more for rejecting their rate, but as Revolut use the real exchange rate you are almost always going to be getting a better rate by rejecting the machine’s conversion and allowing Revolut to convert the currency for you.

Revolut card fees and charges

There are currently three different types of Revolut account: Standard, Premium and Metal. The standard account is completely free to use, whereas the premium and metal accounts require a monthly or yearly fee. There are a number of advantages of upgrading to a metal or premium account, so it’s important to know the difference between the accounts.

Two of the main differences between the accounts are the amount you can withdraw from foreign ATMs each month without incurring a fee, and the amount of currency you can convert each month without a fee. Find out the difference in fees and charges on the different Revolut accounts below:

Standard Revolut Travel Card Account

The standard free Revolut account allows you to make cash withdrawals abroad up to the equivalent of £200/€200 a month without any extra fees or charges. Once you go over this limit there is a 2% fee on any further withdrawals for the remainder of that month.

There is a much higher fee-free limit for transactions that require a currency exchange, such as making a card payment or ATM withdrawal in Euros and paying for it in Pounds. Revolut allows you to convert up to £1,000 a month at the real exchange rate without any charges. If you go over this limit, any payment or ATM withdrawal that requires a currency exchange will incur a charge of 0.5%. Unless you’re planning to spend huge amounts then this limit is unlikely to affect you!

Plus Revolut Travel Card Account

A new option from Revolut is to upgrade the free account to Revolut Plus for £2.99 a month. Here you get some additional perks such as up to £1000 in insurance if something you have purchased with this travel card is faulty or have fraudulent activity on the account.

As well as this there are a few other benefits from upgrading, however if you are looking to upgrade in terms of value for money in our opinion it’s worth doing one of the other options such as premium or metal.

Premium Revolut Travel Card Account

Upgrading to a Revolut premium account costs £6.99/€7.99 per month, and enables you to withdraw up to £400/€400 from foreign ATMs in the local currency without any extra fees or charges. Like with the standard account, once you exceed this limit there is a 2% fee on any further withdrawals within that month.

There is no limit for the amount of currency you can exchange on the premium plan, so if you intend to regularly convert over £1,000 a month it’s worth upgrading.

Metal Revolut Travel Card Account

A Revolut metal account costs £12.99/€13.99 per month, and allows you to withdraw up to £600/€600 from foreign ATMs in the local currency without any extra charges or fees. If you exceed this monthly limit then there is a 2% fee on any further withdrawals.

Like with the premium plan, there is no limit to the amount of currency you can exchange on a Revolut metal account.

Click here to compare the fees and charges of the standard, premium and metal Revolut accounts!

It’s easy to check how much you’ve withdrawn or how much money you’ve converted each month by going to the profile section of your app and selecting ‘Price plan’. That way you can avoid accidentally going over these limits and ensure that you don’t get any charges you aren’t expecting!

In our opinion, Revolut’s fees are more reasonable than their major competitors. For example, Monzo charge a 3% fee on any withdrawals that exceed the £200 monthly limit. Another competitor, N26, charge 1.7% on all withdrawals using their standard free account. Considering Revolut only charge when you exceed £200 a month but charge less than Monzo, then in our mind the best option is Revolut.

Personally we think it’s quite easy to avoid withdrawing over £200 a month, which means you won’t be charged any extra fees. If you prefer withdrawing cash and think you’re likely to exceed this limit regularly then it’s probably worth upgrading to either the premium or metal Revolut account. These accounts not only allow you to withdraw more money without extra fees, but also have a host of other advantages which we cover at the end of this article!

Hold multiple currencies simultaneously

As well as allowing you to spend in over 150 different currencies, Revolut also has the capability to hold money in a number of currencies at once. It’s currently possible to hold money in British Pounds (GBP), American Dollars (USD), Euros (EUR) as well as 27 other currencies including New Zealand Dollars (NZD), Turkish Lira (TRY) and South African Rand (ZAR).

The ability to hold different currencies at the same time is a useful one if you’d rather change some money to another currency all in one go, instead of the conversion being made each time you make a card payment or ATM withdrawal.

It’s important to know that Revolut travel cards are unable to draw from 2 currencies to make one payment. For example if you want to pay $100 USD using the card, it will only be possible if you have a high enough balance in one currency to make the transaction. If you do not hold the equivalent of $100 USD in one currency the transaction cannot go through, even if between currencies you have enough money. This is a relatively unlikely scenario, but should you find it happens to you then just use the app to convert enough money to one currency in order to pay.

There are a number of ways to top up your Revolut travel card, all of which are extremely easy. One of the options, and our personal favourite, is to top up using your debit card. Once you’ve registered your debit card this means you can top up within the app in a matter of seconds from anywhere in the world. Competitors like Monzo and N26 don’t allow you to top up directly from your debit card, which in our opinion gives Revolut a slight edge over the competition.

Another way of topping up your Revolut account is by bank transfer. To find your account details to do this you just need to select the ‘transfer to your Revolut account’ option when you’re on the top up screen of the app. You will then be presented with your Revolut account number and relevant details to top up for both local and international payments. This option takes slightly longer than topping up by debit card as you will need to log in to your online banking to actually make the payment. If you would prefer to do it this way then you have the option, but we personally prefer to top up via our debit card as it’s quicker and can be done instantly from within the Revolut app.

Another great feature of Revolut is the ability to set an automatic top up from your bank card once your balance falls below a certain amount. This is an ideal way to make sure you don’t run out of money when you’re travelling but don’t have any access to the internet access in order to top up.

Although signing up for a Revolut travel card itself is free, you normally have to pay for the delivery of your card. Fortunately for you, if you sign up using our link then standard delivery is completely free too! That means you won’t have to spend a penny to get yourself set up on Revolut – so you can start saving money on your next trip!

Click here to sign up for Revolut today and get free delivery of your first card!

Tracked and express delivery options are available too, but you will have to pay for these. The timeframe for delivery depends on the option you select. Standard delivery and tracked delivery both have a timeframe of 9 working days until you receive your card, although in our experience the cards are often delivered in 4-5 working days anyway. Express delivery has a timeframe of 3-4 working days to receive your card. Check out the list below to see the cost of different delivery options when you sign up for a Revolut card:

Standard Delivery – 9 working days – £4.99 GBP/€5.99 or completely free if you click here and sign up via our link!

Tracked Delivery – 9 working days – £7.99 GBP. Tracked delivery is only available in Great Britain, Guernsey, Jersey and the Isle of Man.

Express Delivery – 3-4 working days – £11.99/€19.99 although the cost may be higher depending on the delivery address.

Please note that prices may vary depending on your currency and location.

Alternatively, if you sign up for either a premium or metal Revolut card account then express delivery is completely free.

Make sure to order your card in plenty of time before your trip, especially if you’re opting for the standard delivery. It’s worth planning ahead to make sure you have your card in time so that you can spend your money hassle-free on your travels. Click here to sign up to Revolut now and get your first card completely free!

Revolut Card Limits

Although we’ve gone over some of the spending limits above, we thought it deserve its own section so that everything you need to know is in one place. The following limits apply to a standard Revolut account:

- No fee ATM withdrawals up to £200 per month. If you exceed this amount you will be charged a 2% fee.

- Convert up to £1,000 fee-free per month. If you exceed this amount you will be charged a fee of 0.5%.

- £3,000 limit for ATM withdrawals within 24 hours.

Customer service

Revolut offer great customer service for all users. There is a help chat function in the app which allows you to speak to a bot named ‘Rita’ who is able to provide generic answers to any queries you may have. If this doesn’t solve your issue then just type ‘Live Agent’ and you will be connected to a Revolut customer service representative who will be able to help. It usually only takes a few minutes to be able to speak to a representative, but if the chat function is busy it may take longer. The customer service chat is available 24/7, with priority support available for customers with a premium or metal account.

There are loads of other great benefits that come with signing up for a Revolut account, some of which don’t fit into any of the categories above. These range from push notifications on your phone when you make a payment to the ability to buy travel insurance to make sure you’re covered for your trip. The list below covers some of our favourite extras that come with signing up for a standard Revolut account:

- Alerts on your phone when you make a payment.

- Ability to disable your card instantly using the app if you lose it.

- Option to enable location based security to help prevent fraud.

- Option to buy travel insurance and device insurance through Revolut.

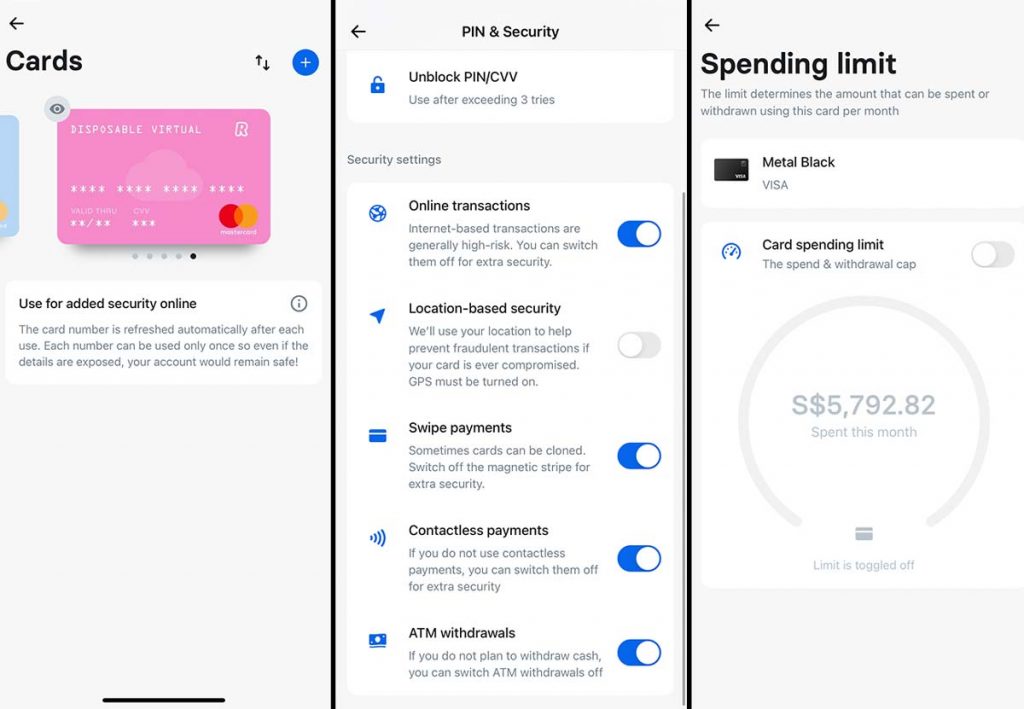

- Option to disable any of the following: Swipe payments, Contactless payments, ATM withdrawals and Online Transactions.

- Special edition cards are sometimes available. For example, rainbow-coloured cards were released for free to celebrate Pride in 2019.

- Revolut Vault – a money saving tool that rounds up every payment you make and puts the spare change aside in order to help you save up for a target amount of money. Click here to find out more!

- Ability to set monthly spending limits.

What do you need to sign up for Revolut?

Revolut need to verify your identity, which means you will need to provide some ID during the sign up process. You can easily provide your ID through the app, which has easy to follow instructions to guide you through the process of signing up. To further verify your identity you will need to provide personal information including your name, address, phone number, email address and date of birth in order to set up an account.

Premium options

If you like the sound of the above but want higher limits and added perks then upgrading to either a premium or metal Revolut account is probably worth it. Signing up for a Revolut premium account costs £6.99/€7.99 per month, whereas a Revolut metal account costs £12.99/€13.99 per month. Alternatively, both plans are discounted if you pay for a year up front. Find out the additional benefits that come with Revolut premium and metal below:

Revolut Premium Account

- Ability to withdraw up to £400 per month from ATMs without any fee.

- Exchange money in 29 fiat currencies with no monthly limit.

- Free overseas medical insurance.

- Free delayed baggage/flight insurance.

- Free global express delivery.

- Priority customer support.

- Access to 5 cryptocurrencies.

- Exclusive card designs only available to Premium members.

- Disposable virtual cards for safe online shopping.

- Ability to instantly book access to over 1,000 airport lounges around the world.

Revolut Metal Account

- Ability to withdraw up to £600 per month from ATMs without any fee.

- 0.1% cashback on card payments within Europe and 1% cashback on card payments outside of Europe.

- Exclusive Revolut Metal card only available to Metal customers.

- One free airport lounge pass, plus the ability to instantly book access to over 1,000 airport lounges around the world.

- A concierge to help you manage your lifestyle.

So, is Revolut worth it?

Simply put, yes. In our opinion, you’re actively choosing to throw money away if you don’t sign up for a Revolut account. It’s completely free to sign up, and it’s certain to save you money in the long run even if you only spend a few days abroad a year. Considering there’s absolutely no cost to you, we recommend signing up now so you can start saving money on your next trip!

Ready to sign up? Click here to apply for a Revolut travel card today!

Please note that some links in this article are affiliate links, which means if you make a purchase we make a small commission at no extra cost to you. This money is used to support this website and cover the costs of keeping it online and free to access!

Like this guide to the Revolut travel card? Pin it!

© Something of Freedom 2015-2024

- Destinations

- Travel Tips

- Travel With Us

- Paid Travel Internship

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

Revolut Review —Travelling For 10 Months with Only One Multi-currency Card For Money

This Revolut Review took many months to test. Download Revolut here — Apple Store or Google Play .

It’s been a while since we travelled, so when we were selected by Airbnb to Live Anywhere around the world for 10 months, we immediately got down to planning for a long trip.

Read also : Guide to Singapore’s Vaccinated Travel Lanes

One of the challenges we faced was figuring our cash situation. Do we bring 10 months’ worth of cash? Or just suck it up and pay hefty surcharges at ATMs overseas — not to mention unfavourable rates 🙁

Setting up local bank accounts in different destinations would also be too much of a hassle.

So when Revolut reached out and asked us to review their product, we thought it was the perfect opportunity to put its different functions to the test.

For our 10 month trip, it was the only financial card we brought along.

We’re not financial experts, but we tried our best to test the card in every situation common to a traveller — both long and short term travel. Hope you find this Revolut review useful!

Note: This Revolut Review is for Singapore Residents only. There are different product features for different markets around the world.

Disclosure : While the writer was provided with a spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

But first, what is Revolut?

Revolut is a financial super-app that is best known for its multi-currency wallet and remittance services amongst frequent travellers and expats.

Credit cards typically charge too much for currency exchange so multi-currency wallets/cards like Revolut makes it a lot more affordable and convenient to pay overseas. In fact, their exchange rates are usually very close to that of Google and often better than a physical money changer in Singapore!

Revolut also allows you to hold multiple currencies in your account, letting you lock in favourable exchange rates ahead of time.

Revolut Review: How Revolut works

Revolut works like a supercharged multi-currency pre-paid debit card, with plenty of security and lifestyle features that make it attractive to use overseas.

Picking a Revolut plan to suit your needs

Revolut is free to use, but you can get more features and benefits with their paid subscriptions. There are three Revolut cards with monthly subscription plans . Here’s a quick summary:

We’re on the Metal Plan and the card looks and feels gorgeous. It also gives us a higher limit for ATM withdrawals, lower currency exchange fees, priority customer support, insurance, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending .

While a free card will be suitable for most of our travels, the metal plan is super useful for long-term travelling or overseas living.

Using Revolut for cashless transactions

Revolut works like a debit card, and can be used anywhere that accepts Visa or Mastercard . The difference with traditional debit/credit cards is that it uses real exchange rate without any markup.

Read also : Multi-currency Cards vs Miles Credit Cards

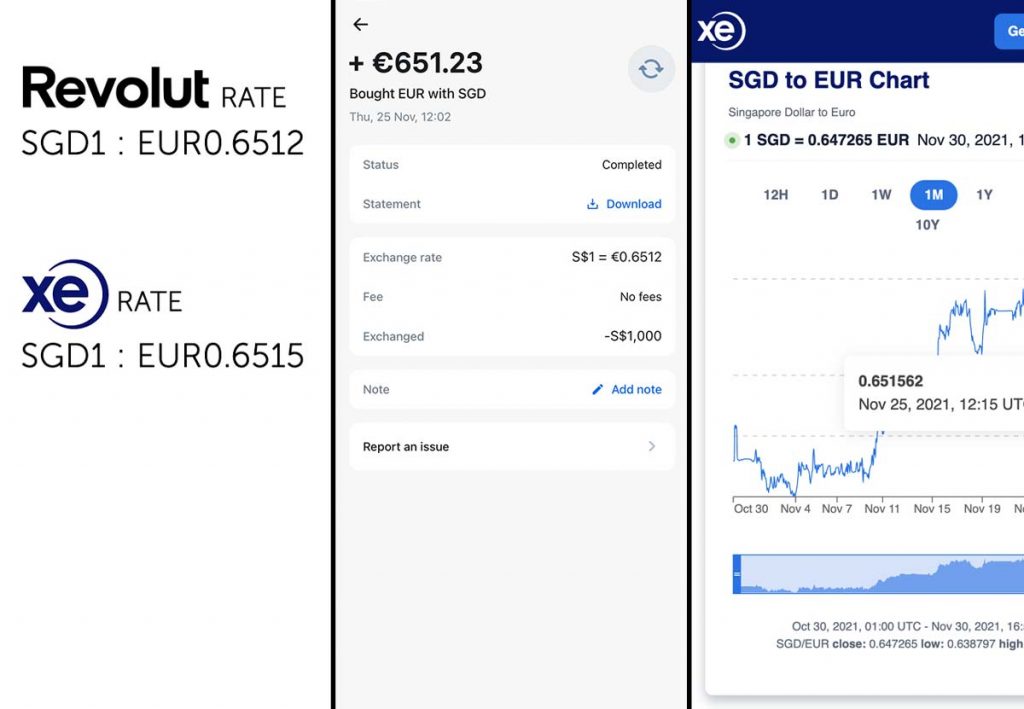

According to Revolut, the ‘real’ exchange rates (or interbank rates ) are “based on the foreign exchange market data feeds that we get from a range of different independent sources.” While it sounds a little iffy, the rates we regularly got were usually the same as the internet rate or sometimes even better.

Other than using the physical card for payment, Revolut can also be linked to your smart devices (smartphones, smartwatches etc) for more convenience.

All you need is to make sure the card has a sufficient balance for your transaction.

Top-up is available via bank transfer, debit cards, credit cards, and even Apple Pay.

Once you’ve topped up the card, you can either exchange it to the local currency, or leave it in your home currency and it will use the real exchange rate at the time of transaction.

It also serves as a multi-currency wallet so you can store up to 28 different currencies at once.

Currency Exchange Fees : 0-2% depending on membership and market hours

Currency exchange fees are charged after a certain amount is spent on the card, but don’t worry, this resets each month. The amount depends on your membership plan:

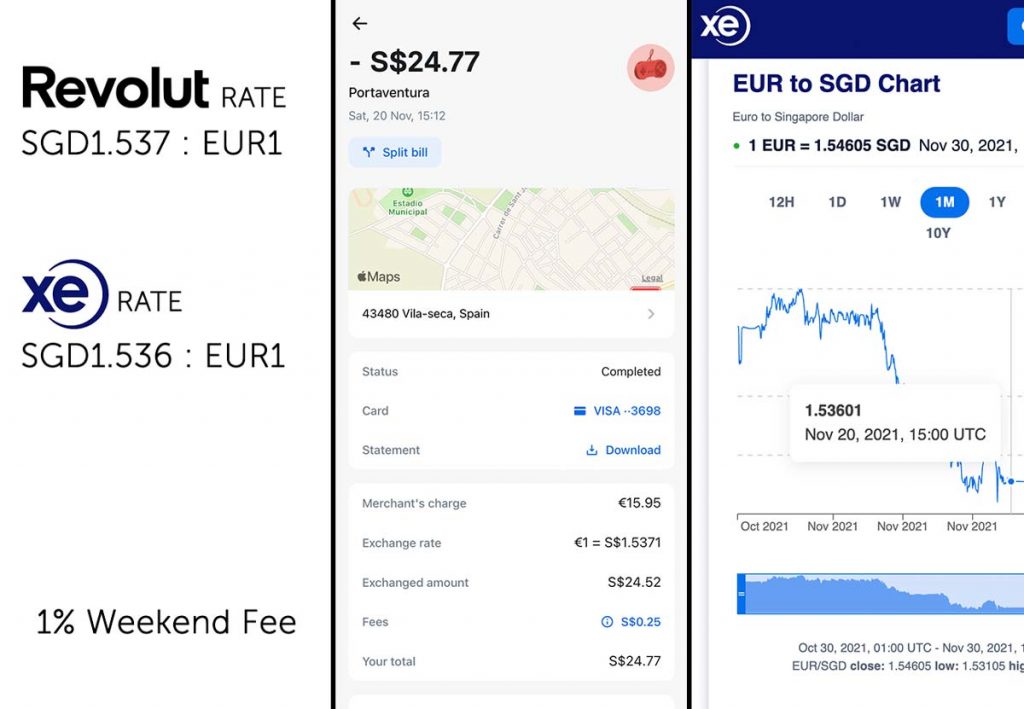

Weekend fee: 1–2% depending on the currency

Revolut also charges a fee for exchanges over the weekend to protect against market fluctuations when it’s closed.

We were charged an additional 1% for transactions over the weekend when converting from SGD to EUR.

* Pro-tip: Exchange money before the weekend to avoid additional fees

The good thing is that the process is transparent and the foreign exchange rate can be viewed on the Revolut app before any transactions involving foreign exchange.

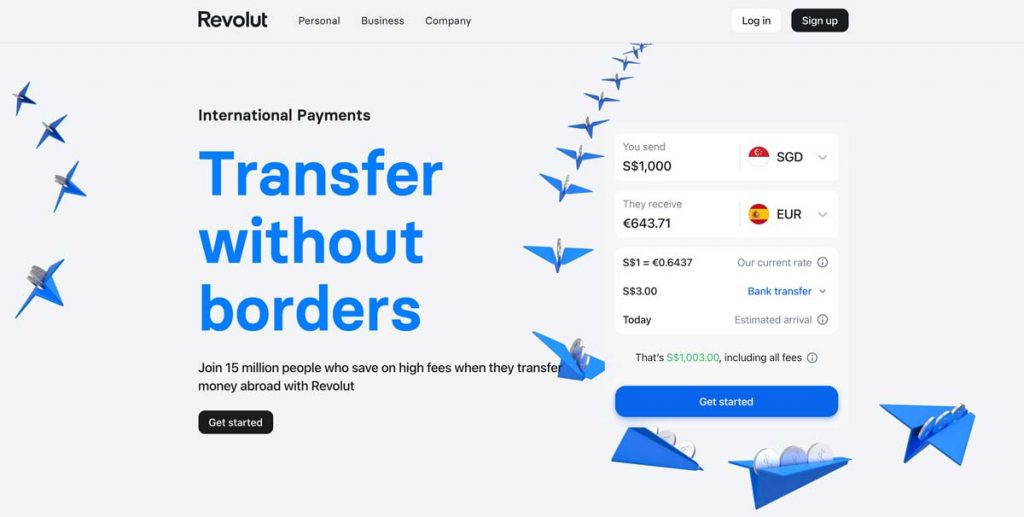

Using Revolut as a remittance service

Revolut supports over 28 currencies (including SGD), which means you can transfer money to foreign bank accounts at a much lower fee. The fees are stated upfront and uses the more favourable interbank transfer exchange rate. Perfect for those studying or working overseas who need to remit cash.

You can use their in-app or website calculator to get an estimate.

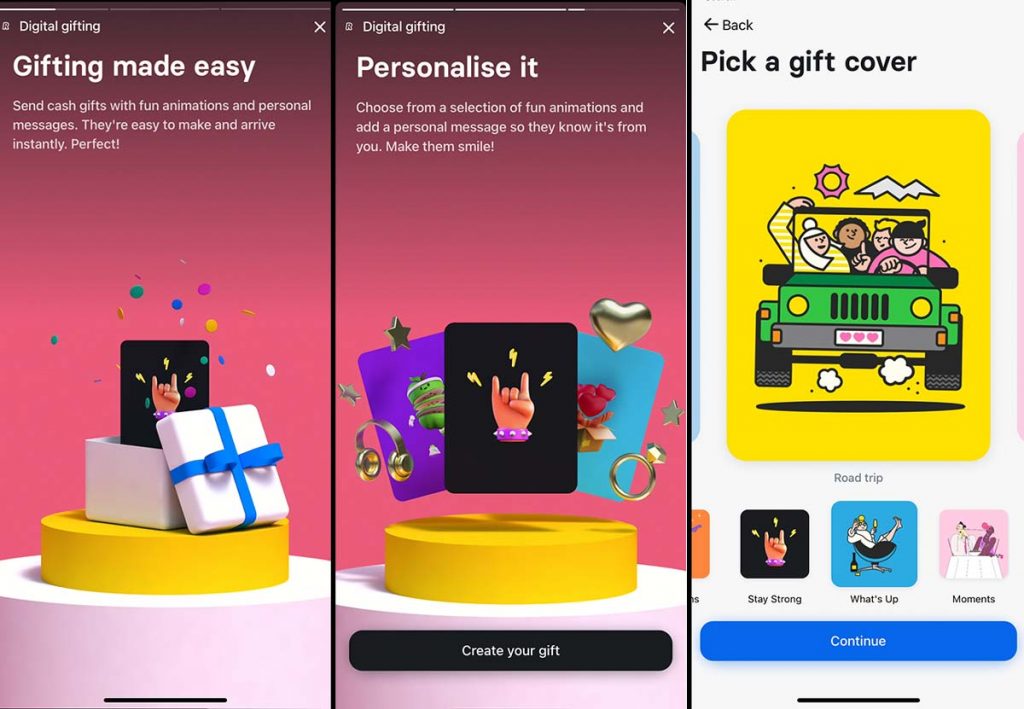

Revolut also allows you to transfer money to other Revolut users for free. As all members of our team have a Revolut account, it was easy to transfer money in the local currency to each other without having to convert to SGD first. There’s also the option of sending money in the form of gifts, which includes adorable animated cards that make it a little more fun.

You can even set up Group Bills, allowing you to split bills easily with every member of the party. Compared to other budgeting apps, you can “settle up” directly into your Revolut account.

Using Revolut to withdraw cash at local ATMs

This is generally fuss-free and ATM withdrawal on Revolut is free up to a monthly cap based on your membership level: Standard: S$350/month Premium: S$700/month Metal Card: S$1050/month

A 2% usage fee is charged only after you’ve exceeded your limit. Some foreign banks may still charge a transaction fee even though Revolut doesn’t.

Here’s a 2019 community-created list of transaction fees for different banks (if any) by country .

We withdrew money at OTP Banka in Croatia for free.

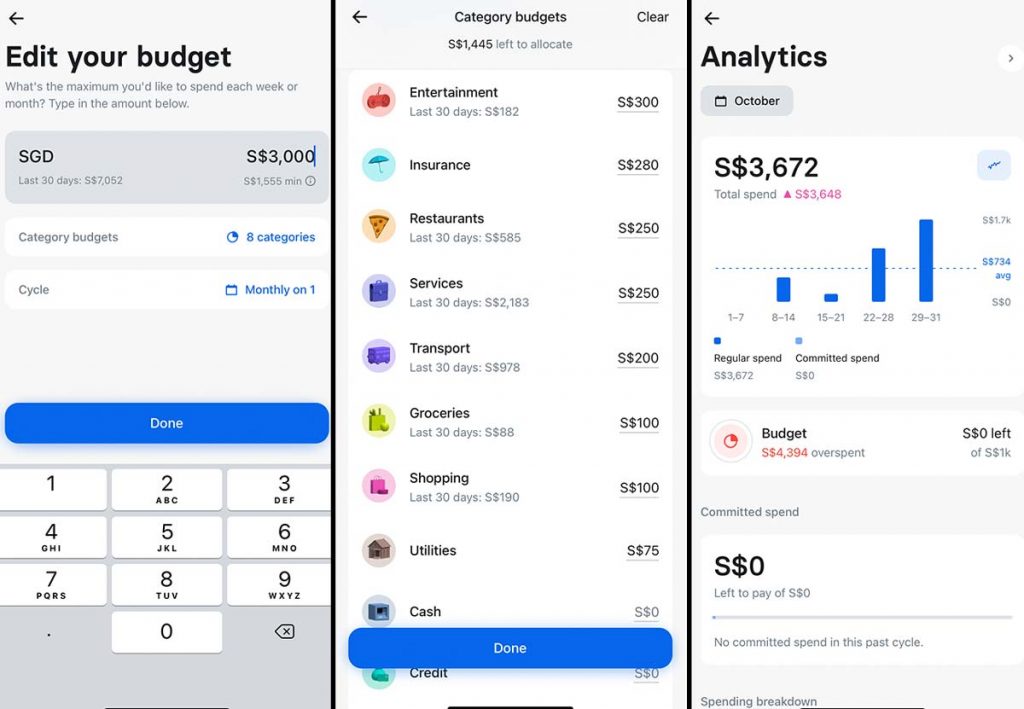

Revolut App Budgeting & Lifestyle Features

Beyond using Revolut to pay for stuff, there are also a few budgeting and analytics tools on the app to help keep your spending in check. Set monthly budgets by categories, receive notifications when you are overspending, and get insights into your spending habits.

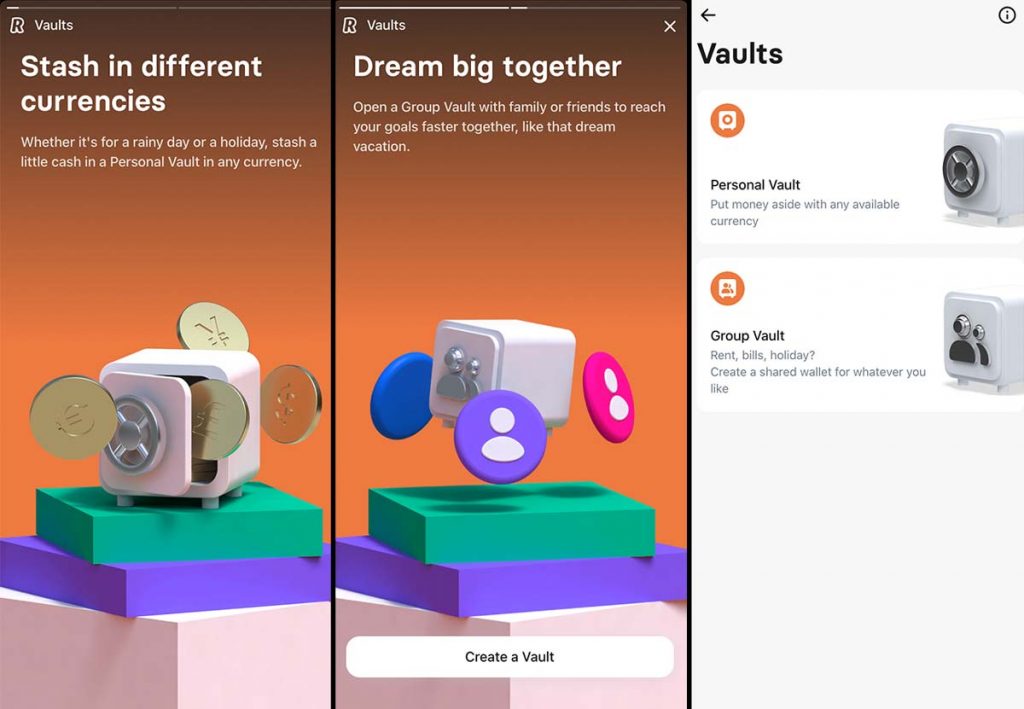

You can also set up Personal & Group Vaults to work towards your saving goals. Revolut tries to make this effortless by automatically rounding up your purchases to the nearest dollar and saving it in your account.

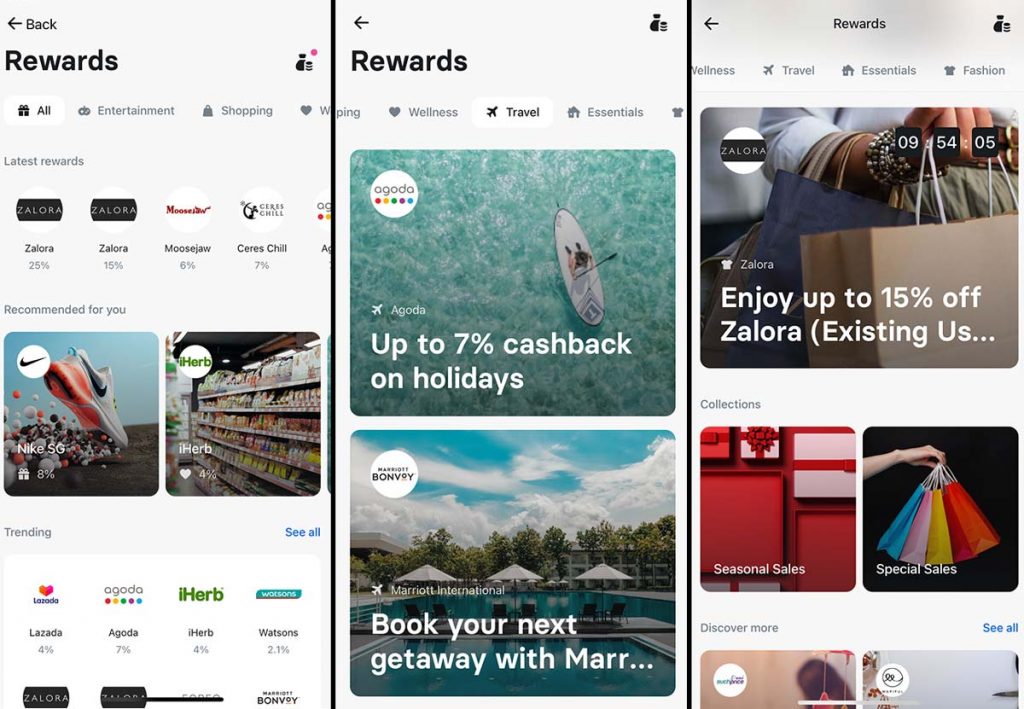

For online shoppers, the Rewards feature allows you to get additional cashback when you pay with Revolut.

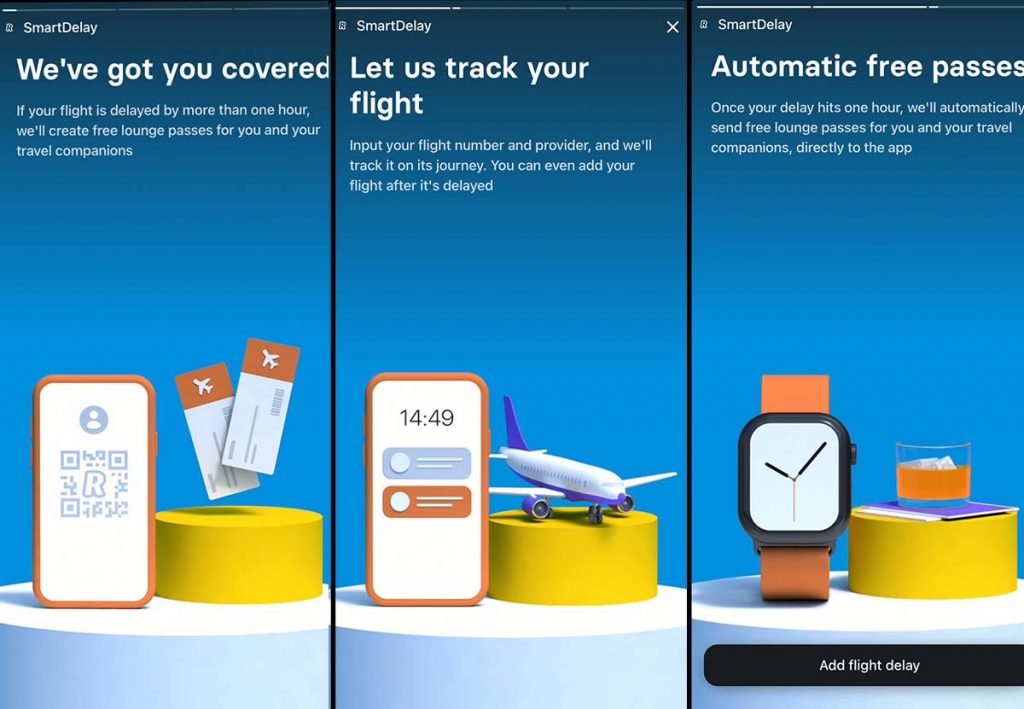

If your flights are delayed for more than one hour, Premium and Metal Plan users also get complimentary lounge passes for their companions and themselves under Smart Delay .

Even if there’s no flight delay, Premium and Metal Plan users can purchase Lounge Passes on the App if you simply want to take a break.

Revolut Security Features Review

Convenient access and control of security features For long-term travel, these security features were extra useful. For example, we may want to disable magnetic stripe use in certain countries with a reputation for copying credit cards. In other instances, we may want to increase spending limits if we know we’ll be shopping more.

Revolut allows you to easily toggle security features like location-based security, use of contactless payments, ATM withdrawals, online payments, magnetic stripe usage, and spending limits via the app. This means even if you lose it without realising, the card cannot be misused since the features only work when you activate them.

You can easily change your PIN number, or unblock your own PIN if it has been accidentally blocked.

My favourite is the ‘Freeze card’ feature, which allows you to temporarily deactivate your card through the Revolut app . I’m sure many of us have been in situations where we think we’ve lost our credit card, only to find them a few days later after going through the trouble of calling the bank and having it deactivated permanently.

All these features make it super convenient as you can easily change them on the app instead of calling the bank.

Disposable Virtual Cards

You can also create Disposable Virtual Cards — perfect for times when you need to make online payments via foreign websites that might have questionable security protocols.

Disposable Virtual Cards are automatically refreshed after every use and can only be used once. So even if your details are exposed, your account will remain safe!

Revolut Review — thoughts after using Revolut for a few months

Over the last couple of months, our Revolut account generally worked really well. We used it for our everyday expenses and simply didn’t leave home without it.

The currency exchange rates were very favourable and the security controls were robust and useful. I personally loved the UI, which is intuitive and easy to navigate.

The biggest drawback would probably be the need for data connection. You need a data connection to top-up, so it’s important to make sure that you always have extra money in the account for unexpected purchases or emergencies. You don’t want to get stuck without money in a small town or rural area!

We also occasionally experienced situations where Revolut flags a suspicious transaction and blocks the card. While it’s easily resolved by logging into the app to unblock the card and mark it as a legit transaction, I can imagine how this might be a problem if you happen to be without data connection.

That said, I hardly carry my wallet around anymore and simply leave home with some emergency cash and the Revolut app on my smartphone. As the world becomes more connected and cashless, I can only imagine how using a multi-currency wallet and super-app like Revolut will become the main form of payment.

If you’d like to give Revolut a try, apply for an account and download the app here: – Apple App Store – Google Play

Revolut is also giving usersa 3% cash back on travel expenses till 23 December. More information here !

Hope you found this Revolut Review useful. Do let us know if you have any questions or suggestions to improve this review.

Disclosure : While the writer was provided with spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

This post was brought to you by Revolut .

For more travel inspiration, follow us on Facebook , Instagram , and YouTube .

View this post on Instagram A post shared by thetravelintern.com 🇸🇬 (@thetravelintern)

RELATED ARTICLES MORE FROM AUTHOR

How to Pay in China Without WeChat or Alipay — New Cashless Solution For Singaporeans

JR Pass Budget Alternatives — Is the JR Pass, Single Shinkansen Tickets or Regional Passes More Worth It?

11 Travel Hacks and Pro-tips from Frequent Travellers

Changi is Giving Away 4 Business Class Tickets/Month Until End Oct 2024 — Here’s How to Get Yours

Mobile Payment in China: Step-by-step Guide to Using Alipay and WeChat Pay without a Chinese Bank Account

9 Must-Have Remote Working Travel Essentials That Make Life Easier While on The Road

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Family-friendly Uluru Itinerary — 7 Days in Australia’s Famous Rugged Outback

Ultimate Portugal Guide for First-timers — 19 Things to do in...

38 New Deals and Attractions in Singapore this August 2024

SATS Premier Lounge Review (Changi T3) — Upgraded with a New...

5 Lesser-Known Destinations for Your Year-End Getaway from Singapore

- Terms Of Use

- Privacy Policy

International Money Made Simple

Revolut Card Review

About Author: Hi, I’m Quinn Askeland. In 2014, I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio .

The Revolut Card is more than just mobile money and travel freedom while avoiding the crazy fees banks charge.

H ere’s the deal:

- You can use it to spend in over 150 currencies at a competitive exchange rate, with transparent fees .

- Lots of useful features such as instant payment notifications, budgeting tools, and a bunch of optional travel benefits .

- Revolut has a standard (zero monthly fee) option but it is interesting to compare with Wise which has is simpler with easy to understand fees.

In this Revolut card review, we’ll take a closer look at to see if Revolut has the right card for you .

We’ll also compare the different cards, uncover the card’s benefits, pricing, fees, and even shine a spotlight on the negative and positive customer reviews .

Disclosure: This post may contain offers and affiliate links to save you money and it also helps us to keep providing the best information. For more information, see our disclosures here .

Based on 143,600+ reviews on Trustpilot, Revolut has an “Excellent” rating of 4.3/5. Of these reviews, 75% are 5 stars and commend the Revolut app for its user-friendliness, features, support, currency exchange, ease of transferring money, and overall open-banking experience.

How to Choose the Right Card

1. Starting with Table 1 (below), you can quickly get an idea of which card/s are more likely to be best for you 2. Table 2 (below) will help to clarify your choices by comparing fees and limits 3. Finally (below) >> See the cards in your country

1. Revolut Cards Compared – The Basics

Table 1: standard vs plus vs premium vs metal vs ultra, table 2: standard vs plus vs premium vs metal vs ultra, 2. revolut cards compared – fees & limits, >> the cards by country.

Because of the many options you can choose with Revolut, it helps to start with the right country: For the UK use their latest price and feature comparison chart (opens a new tab to keep reading).

For Europe – choose your country here

US residents click here (opens a new tab to keep reading) for pricing in USD dollars and different offerings.

Australian residents click here (opens a new tab to keep reading) for pricing in Aussie dollars and different offerings.

All other countries select your country here .

While there are many potential fees the most important one for many people is the exchange rate.

Revolut’s currency exchange fees are subject to variability based on factors such as the time of day and your subscription plan.

- Weekdays: No fees for currency exchanges made within your plan limit between 6 PM New York time on Sunday and 5 PM New York time on Friday.

- Weekends: A fixed 1% fee is applied to all currency exchanges made between 5 PM New York time on Friday and 6 PM New York time on Sunday, regardless of your subscription plan.

- Additional Fees: If you’re a standard customer and exceed your plan limit, an extra 1% fee is imposed per exchange. However, Plus customers benefit from a reduced 0.5% fee in such cases.

2.2 Physical and Virtual Cards

All Revolut members can create disposable virtual cards. These are debit cards that only exist in the Revolut app and can be discarded at any time. You can use these card details to make transactions online without a physical card.

Revolut users can get access to disposable virtual cards. These cards get automatically deleted after they are used. This adds a further layer of security to your online transactions and is ideal for subscriptions you are not sure you want to keep.

As a Premium user, you can choose from three stylish colours for your Premium card: black, grey, and pink. These cards have a premium design that makes them stand out.

If you are a Metal customer, you can enjoy the exclusive Metal card made of solid reinforced steel. The Metal card has a luxurious design. You can select from five elegant colours for your Metal card: black, gold, rose gold, silver, and space grey.

Ultra customers can access the world of exclusivity with their Ultra card. This card is platinum-plated and has a sophisticated appearance. The Ultra card is the most premium card that Revolut offers.

Customers cannot choose between Visa or Mastercard providers for their physical cards, this is based on location.

2.3 Managing Currencies

2.4 atm withdrawals and other perks.

Revolut members can withdraw cash from ATMs in-network for free* up to a certain amount. The withdrawal limit depends on your plan. Check the below table for more details.

After hitting the withdrawal limits of your plan, you will pay a 2% fee (of the withdrawal amount**) for each withdrawal you make.

Revolut allows you to save money in saving vaults and earn interest on your savings.

There are budgeting and analytical tools as well to manage your money better.

3. Best Revolut Card Alternative

The Wise card is the closest rival to the Revolut card. Both are great services and have their pros and cons.

In a nutshell, Wise is about function and Revolut is about style. For example, Wise has a simpler fee structure and has a bigger reach with more comprehensive multi-currency management whereas Revolut has ridiculously hip metal or ultra cards and more tools for savers, investors and travellers through their paid subscription offerings.

Check out our detailed Revolut vs Wise comparison for more.

4. When Standard (no fee) or Paid Plans Might Be Better

The table below presents a summary of Revolut’s standard and premium cards and their pros and cons.

When Standard (no monthly fee) is Better

- You are not a frequent traveller

- You only transfer small amounts

- You are not a big spender

- You don’t need everyday insurance

- You don’t need full features access for Revoluts under 18 account

- You are not keen on lounge passes and purchase protection

- You don’t care about a higher savings interest rate

- You don’t need a discount on event ticket purchases

When Paid Plan is Better

- If you like to travel frequently

- Have no problem committing to an extra fee because the benefits outweigh it

- You want to save money on your transfers

- You like to save while spending hassle-free with your debit or credit card

- You want the travel insurance Revolut offers

- You want more under 18 account access with full features for more than one child

- You like to have lounge passes, cashback rewards, and purchase protection

- You want to save money on your travel booking and ticket purchases

- You like having a higher savings rate

5. Is Metal Worth It?

Lots of people want to know if paying a monthly subscription for a Metal card is worth the money. The truth is, some of the features make the Revolut metal card a great option for frequent travellers and big spenders who want to save money and enjoy extra perks:

- Enjoy excellent exchange rates and transparent fees when you spend in 150+ currencies

- Inexpensive compared to other travel cards and digital banks

- Access exclusive airport lounges and get priority customer support

- Make 5 international transfers/month with no fees

- Enjoy travel benefit insurance for delayed, damaged, or lost luggage, delayed or disrupted flights, global medical insurance, car hire excess insurance, winter sports insurance, and personal liability insurance*. *T&Cs apply to all insurance benefits

- Earn up to 1% cashback on your purchases in any of the 29 supported currencies when you use your Revolut Metal card. Monthly cap and terms apply.

- Book your accommodation through Revolut Metal and get up to 10% cashback

- You can take out up to £800/month (or an equivalent amount in a foreign currency) from more than 55,000 ATMs in-network with no extra charge from Revolut every rolling month*. *ATM fair-usage fees apply

- Unique and exclusive reinforced Steel Metal card design with express delivery of card in 1-3 business days.

Premium, Metal, and Ultra can get you discounted airport lounge passes, global medical insurance, winter sports insurance, luggage loss and flight delay insurance***. It also allows you to share bills with your group and get phone insurance.

*Third-party ATM providers may charge a withdrawal fee and weekend fees may apply **subject to a min. fee of £1/withdrawal ***T&Cs apply to all insurance benefits

6. Revolut Account Features

6.1 multi-currency account.

Revolut was specifically created to cater to travellers and international professionals. Its key strength lies in its multi-currency support, which enables fast and cost-effective currency exchange. This can be done either within the Revolut app or while making card payments or withdrawing money from ATMs.

For individuals, Revolut offers multi-currency accounts that allow you to hold and manage 30+ currencies. You can also get travel insurance if you upgrade to a paid plan. It lets you split bills with your friends and family.

Regardless of the account type, all Revolut accounts, including the standard plan, come with a debit card at no extra cost from Revolut. You can also schedule payments for your bills and subscriptions.

6.2 Currency Exchange

One reason why Revolut is an attractive choice for travel cards is that they give you some of the best transparent exchange rates you can find.

Users can use the Revolut currency converter to see the real exchange rate at any moment for 30+ currencies.

Revolut has a variable exchange rate for money currency exchanges, which changes all the time. You can see this rate on the app when you make an exchange.

Sometimes, Revolut also charges an exchange fee, which depends on factors like the currencies involved and the time of the exchange. You can also see this fee on the app if it applies.

6.3 Revolut App

Revolut is a monetary app that aims to be a better substitute for conventional banks. It is called “Revolut: Spend, Save, Trade” in the Google Play Store, and in the App Store its name is “Revolut – Mobile Finance.”

As a new kind of digital service, Revolut’s major goal is to provide good money-related services to on-the-go users, and that’s why the App is an important part of the user experience. It has a user-friendly design with balances and transactions clearly shown.

The interactive nature of the whole experience also helps users to see their usage at a glance.

Revolut has a lot of features for analytics and budgeting to help users manage their money. In this section, users set monthly spending limits for each category. They can also see how they spend money by month.

Revolut app comes with industry-standard security measures and is completely safe.

6.4 Savings Vaults, Interest

When you put money into a Savings Vault, Revolut takes it from your account and sends it to a trustee, who then moves it on to the bank for you.

You can use the Revolut app to save money to Savings Vaults instantly. Savings Vaults do not charge you any fees. You can withdraw money from them as per the terms you signed when you made the deposit.

Everything that happens will be visible to you inside the Revolut app. The information inside the app is updated in real-time.

You can choose from fixed or variable interest rate Saving Vault.

6.5 Insurance (UK, USA, EEA, Australia)

Travel and medical insurance are part of the plan for Premium, Metal, and Ultra Revolut customers in the UK, and the European Economic Area (EEA).

Global medical insurance is not available for US and Australian customers and it seems like there are no plans to add it.

Revolut travel insurance has specific benefits and limits in each country, so we advise you to check them for your country.

The Revolut travel insurance* covers:

- Trip disruption and cancellation

- Emergency dental care

- Emergency medical expenses abroad

- Lost or damaged baggage protection

- Luggage delays (4 hours or more)

- Flight delays (1 hour or more)

*T&Cs apply to all insurance benefits

7. Safety, Security and Fraud Prevention

Revolut is completely safe to use. It has been around for several years and has never been compromised.

They have a full Banking Licence in Lithuania but not in the UK.

Likewise, Revolut uses location-specific security and only allows transactions when the card and phone are at the same location.

Virtual disposable cards help prevent payment fraud by automatically getting deleted after a single use. You can also disable any card from the app with a single click.

The Revolut vault app uses the latest safety protocols. It has four layers of safeguards:

- Pin & password

- 2-factor authentication (2FA)

- Fingerprint (biometrics)

- Face recognition.

All your personal data is protected using a state-of-the-art encryption protocol. They also conduct regular security audits to keep up with the latest trends.

8. What others are saying (Real Reviews)

Revolut card users like the most:

- Travel and savings made better

- Robust budgeting and expenditure tracking

- Streamlined money transfer services

- Instant card freezing and unfreezing options

“I’ve had my metal card for a few years now. An example of my use over the last couple of weeks is that, whilst waiting for a flight to Cape Town took advantage of the heavily discounted lounge access with 3 fellow travellers. Before the flight, I changed from Sterling to Zar at a great rate without charges. What’s not to like about that? I don’t use any other card whilst away. I live in Gibraltar and flip across into Spain a couple of times a week, so I have both Sterling and Euro in my Revolut wallet permanently of course. I don’t need another card and can’t find one better than Revolut.” – Neil Crawford

What Revolut users don’t like:

- Freezing Accounts

- Customer Service

“My cards were stolen and money were withdrawn from both of my cards, so I made an objection to both of the banks and Revolut was the only bank to refuse my objection and not pay me back. They even suggested that I was informed about the withdrawal of this money (700€), although I have tried to block my card as soon as I was aware that it was stolen. I was one minute late!” – JH

By far the majority of reviews are positive but the negative ones indicate the challenges that services like Revolut face. For example, regulators require services like Revolut to jump through hoops which can often mean they need to freeze funds but generally, this gets sorted out with a small delay and some ID. Customer service is also designed to be efficient at the expense of being able to speak to a real human easily.

With Revolut card, you can experience a new way of managing your finances. It is a convenient and versatile payment card that is packed with awesome features. You can also upgrade to Revolut’s premium plans and enjoy more perks, such as no-fair usage limits on currency exchange, higher ATM withdrawal limits, lounge access, travel discounts, and more.

Revolut offers a flexible alternative to traditional banking products, especially for those who travel frequently or have a global lifestyle.

For us, one of the standout features of the Revolut card is its ability to offer multi-currency accounts with competitive exchange rates. This is very convenient for frequent travellers, freelancers, and international businesses, who don’t need to open multiple traditional bank accounts or pay excessive transaction fees. The card also gives you real-time exchange rates and instant transfers between Revolut users, simplifying and speeding up financial transactions.

Revolut is not a replacement for your regular bank, but it can be a useful addition to your financial toolkit. It is important to be aware of the fees (above) , plan limitations (above) , and security (above) before signing up. Reading customer reviews (above) can also give you more insight into the service.

A comparable choice to Revolut cards is Wise card . Wise has wider coverage, as you can transact in over 160 countries. No subscription fees and lets you exchange at the mid-market rate. There are still fees but you can also check the real amount your recipient gets with the Wise calculator (no sign-up required). Happy Money!

The opinions expressed within the content are solely the author’s and do not reflect the opinions and beliefs of Revolut. However, please be aware that a commission may be earned through affiliate links.

- T&C’s apply. See https://www.revolut.com/legal/terms/ for more detailed information

Revolut Card Review (Uncovered) → 8 Things You Must Know

In this Revolut card review, we compare the card's features, different plans and pricing, fees, benefits and perks, and customer reviews.

Similar Posts

Wise card review.

I have used the Wise card for a few years and now I have found it to be reliable and easy to use. The app is a critical piece of the puzzle because you will find it is the control centre for the card where you can pretty much do everything you can think of….

Airwallex Review

In the dark times of old school banking (just a few years ago), businesses either juggled accounts in different countries or paid exorbitant fees for a multi currency account. The biggest expense though might be the time it took to administer everything especially when you consider expenses in different currencies, accounting, approvals, reporting and cards…

Currencies Direct Review – 6 Must Knows

Using a money transfer service like Currencies Direct can save you a huge amount of money compared to a bank. In this review, we will uncover when Currencies Direct one of the best you can choose as well as a few alternatives that might be better. Currencies Direct is a great way to save money…

WorldRemit Review

WorldRemit is a great way to send more money home if you are serious about reducing fees. In this review, we’ll show you when WorldRemit works well and also some other options that may work well. WorldRemit stands out as a good option for sending money abroad. It’s not expensive, and you can send even…

Xoom vs Western Union

In my quest to find fast, easy, and affordable ways to send money abroad, Xoom and Western Union are top of my list especially because Xoom is owned by PayPal. So, which one is better for you? In this article, we will compare Xoom and Western Union in terms of coverage, payment methods, transfer speeds…

MoneyGram Review – 8 Things You Need To Know

Disclosure: This post may contain offers and affiliate links to save you money and it also helps us to keep providing the best information. For more information, see our disclosures here. 1. Quicktake On Trustpilot, MoneyGram is rated 4.5/5 with over 35k reviews, which is considered “Excellent”. 83% of the reviews are positive and say…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

How to use Revolut for travel – 15+ ways to save money and time abroad

Finally, i have gotten to the point where i get to talk about my absolute favorite pre-paid debit card: revolut. i use it almost daily since moving to switzerland 5 years ago and have used it in a lot of countries, including japan , the maldives , iceland , sweden , the us, the czech republic , turkey, dubai, israel, poland , and all around the european union. i have specified all of these countries because they all have different currencies, and revolut was incredibly easy to use in all of them. so read more if you want to know how to use revolut for travel expenses and save money and time abroad..

Revolut is an online financial company that offers a range of financial services, including accounts and currency exchange, through its financial mobile app. One of the most popular features of Revolut is its pre-paid travel card, which allows users to spend money abroad without incurring high fees or incredibly high exchange rates. With Revolut, you can easily manage your money while on the go, making it a popular choice for frequent travelers.

Revolut’s travel card offers a number of benefits that make it an attractive option for those looking to save money while traveling. One of the key advantages of the card is that it allows users to spend money in over 150 currencies at the real exchange rate, which is often much lower than the rate offered by traditional banks.

Additionally, users can withdraw up to a certain amount of money from ATMs each month without incurring any fees (from Revolut, the ATM itself can incur fees though), making it a convenient option for those who need cash while traveling. Overall, Revolut’s travel card is a great option for those looking to manage their money efficiently while on the go.

Of course, it does have some situations when you’ll have to pay fees. Nothing is free in life, after all, and as a business, they need to make money to be able to keep the lights on. What matters is that these fees are transparent, you will always know about them before performing any action, and you can plan some things ahead so that you avoid some of them altogether. In case you didn’t know, I have a full list of free travel apps , and I absolutely loved checking all of them out for you.

And one very special disclaimer I need to make, apart from the usual one. All the information published here is valid at the moment of publication, to the best of my knowledge. Since the subject of money and healthy financial decision-making is of great importance to me, please check out the detailed Terms & Policies from Revolut for the most up-to-date information. If in doubt, always seek professional advice, no matter what anyone else might tell you.

Also, even if the Standard subscription for Revolut is technically free, it doesn’t mean that it doesn’t have limits in place. You’ll have to check each situation you will use it in to see if any fees will occur. For example, ATM withdrawals are free under a certain amount per month, transfers are free under a certain amount as well, and so on. Free does not mean limitless, so check this out every time you want to make a change. Luckily, Revolut has a very transparent fee model, and you’ll know before you click what will be fees that will apply to you.

Yes, it’s true guys, there might be affiliate links in this awesome, free post. This means that if you decide to buy something that you find here, and you use one of my links to do so, I will earn a small commission at no extra cost to you. I plan to use this money on ice cream, chocolate, and to travel more so I can write these useful guides for you. As an Amazon Associate, I earn from qualifying purchases.

Table of Contents

Using revolut abroad – the basics.

Using Revolut abroad is a great way to save money on foreign exchange fees and to have access to your funds while traveling. Here are some basic tips to keep in mind when using Revolut abroad:

- Activate Your Card: Before traveling, activate your Revolut card and verify your identity in the Personal Details section of the app. This will ensure that you can use your card without any issues.

- Top Up Your Account: To use your Revolut card abroad, you will need to top up your account with funds. The best way to do this is via a bank transfer, as it has no fees from Revolut (it can have fees from your bank though, but you’ll have to check this with them). You can also use a debit or credit card, but there may be fees associated with this.

- Use the Correct Currency: When using your Revolut card abroad, make sure to use the correct currency for the country you are in. Revolut supports over 150 currencies, so you can easily switch between them in the app.

- Avoid Weekends: Revolut adds some fees on weekends for certain actions like currency exchange, so it is best to plan such activities during the weekdays.

- Withdraw Cash Smartly : Revolut offers free ATM withdrawals up to a certain limit. However, some ATMs may charge additional fees, so it is best to withdraw larger amounts of cash to avoid multiple transactions.

As you can see, using Revolut abroad is a great way to save money on foreign exchange fees and to have access to your funds while traveling. With a little bit of planning and preparation, you can use your Revolut card with confidence and ease.

How to plan a trip for the first time

45+ best free travel apps you want to download for your next trip

How to display travel souvenirs – 50+ creative ways

Go cashless with revolut.

One of the very first things I can tell you is that I have started to use cash less and less since I have Revolut . In both Iceland and Sweden, I haven’t even seen a coin or bill. In Japan, we withdrew money from ATMs as the country itself is still quite cash-demanding, but we used the card as well.

Since it provides so many options to go cashless, I love Revolut for this now. You have the physical card, of course, but you also have virtual cards you can use. You can also add it to ApplePay or other wallet apps, send and receive money easily and instantly if it’s between Revolut users, and use all of the other cool features that enable you to go cash-free.

Making Payments

Revolut offers an array of convenient ways to make payments while traveling. Users can make instant payments worldwide, hassle-free, and at great rates. Here are some ways to make payments with Revolut:

- Physical Card: Ensure to order a physical card in advance for card-present payments and cash withdrawals. With a physical card, users can make payments at any Point of Sale (POS) terminal that accepts Mastercard or Visa.

- Virtual Card: Users can create virtual cards on their Revolut app. Virtual cards are ideal for online payments, as they provide an extra layer of security. Users can create a virtual card for each online store they use, and if the card is compromised, they can delete it without affecting other cards.

- QR Code: Revolut users can make payments using QR codes. To pay with a QR code, users need to scan the code using their Revolut app and confirm the payment amount.

- Peer-to-Peer Payments: Revolut allows users to send and receive money instantly with other Revolut users for free. Users can also send money to non-Revolut users by using their phone number or email address.

It is important to note that Revolut charges a small fee for some transactions, such as ATM withdrawals and currency exchange, especially for bigger amounts of money. Users should check the fees and limits section of the app before making any payments.

Exchanging Currency

When traveling abroad, exchanging currency is a necessary task. With Revolut, travelers can exchange over 30 currencies at real rates with no admin fee. When exchanging currency, Revolut offers several options to choose from. Users can either exchange currency manually or set up automatic exchanges to avoid travel fund shortages.

It’s important to note that a small fee can apply for exchanging currencies, especially if doing so during the weekend or for bigger amounts of money in any rolling 30-day period. Before performing any exchange, you will see in the app if you have any incurring fees that will be added to your transaction. This way, you can decide for yourself if you’re willing to pay the price or not.

Send money to other Revolut users

Whether they are traveling with you or not, your friends might benefit from instant transfers if they’re Revolut users. Especially if you’re traveling as a group, common expenses will appear all the time, and it’s so easy to send money like this. The app basically works like a chat to send money, this is how simple it is.

The transfer will be instant if the recipient has a Revolut account, and they will receive a notification of the transfer. If they don’t have a Revolut account, they will receive a text message with instructions on how to sign up and claim the transfer. Revolut offers free transfers to other Revolut users, so you won’t have to worry about any fees or hidden costs.

There are quite a few ways to send money to group members through Revolut, and I will go into more detail below. But keep in mind that you can either send them money straight away, request money yourself from other people, use the Split the Bill feature, or even have group vaults.

Splitting bills in a group

When traveling with a group, splitting bills can be a hassle and cause unnecessary stress. Fortunately, Revolut offers a feature called Group Bills that makes it easy to split expenses with friends and family. To get started with Group Bills, simply create a group and invite your friends or family members to join.

Once everyone has joined, you can start adding bills to the group. Each bill can be split evenly among the members or you can specify how much each person owes. Revolut also allows users to add notes and receipts to each bill, making it easier to keep track of expenses and avoid any confusion or disputes.

When it’s time to settle up, Revolut makes it easy to transfer money between group members. You can either transfer the full amount owed or just a portion of it.

It’s important to note that Group Bills might be only available for users with a Premium or Metal account. However, even if you have a Standard account, you can still split bills with other Revolut users by using the Split Bill feature.

Overall, Revolut’s Group Bills feature is a convenient and stress-free way to split expenses when traveling with a group. By using this feature, you can avoid awkward conversations about money (I’m not the only one who feels that discussions about money are shameful, right?) and ensure that everyone pays their fair share.

How to keep valuables safe while traveling – 50 tips to keep your stuff safe when abroad

Buy nice or cry twice – 15 travel items to buy nice and 15 to get on a budget

SafetyWing travel insurance review