Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

When To Buy Travel Insurance and How To Best Time Your Purchase

Jessica Merritt

Editor & Content Contributor

108 Published Articles 551 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

169 Published Articles 803 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

Senior Features Editor

122 Published Articles 806 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

What is travel insurance, when to buy travel insurance, is credit card travel insurance enough, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Timing is key when buying travel insurance. It’s best to buy travel insurance within 2 weeks of making your first trip payment . You can buy travel insurance at any time, even after departure with some travel insurance providers. Still, the coverage and policy pricing is better when you buy travel insurance shortly after booking .

The sooner you buy travel insurance, the sooner you’re covered for your travel insurance policy, whether the tour company goes out of business or you get sick before your trip.

Let’s look at the best time to buy travel insurance and the advantages you get when you purchase your travel insurance policy right after booking.

Travel insurance is a type of insurance coverage that offers financial protection and assistance when you’re traveling . Benefits often include trip cancellation, trip interruptions, medical emergencies, baggage loss or delay, and rental car coverage.

The best time to buy travel insurance is within 2 weeks of making your first travel payment , whether that’s booking a flight or putting down a cruise deposit. Generally, any time you make a nonrefundable travel deposit, it’s a good idea to get travel insurance shortly thereafter.

For example, you should get travel insurance after you buy nonrefundable airfare, or when cancellation penalties kick in for cruises or tours.

Benefits of Buying Travel Insurance When You Book

Buying travel insurance shortly after booking gives you immediate coverage for your nonrefundable travel expenses . While you don’t have to get travel insurance right at the booking process, earlier is better. Once you get travel insurance, you’re covered when a trip has to be canceled due to covered reasons.

When you buy travel insurance at booking, you’ll maximize your coverage period for trip cancellation insurance. As long as your trip cancellation insurance is active, you’re covered if you need to cancel your travel due to a covered reason such as illness, injury, death of a family member, natural disaster, or job loss.

Also, your coverage options are usually better when you purchase travel insurance shortly after booking. Some travel insurance companies consider the 2 weeks after booking travel arrangements an advantage period and offer additional coverage or options during this period.

For example, some travel insurance policies offer preexisting medical condition coverage if purchased shortly after booking. If you want preexisting medical condition coverage, you may need to purchase your travel insurance either before or within a day of your final trip payment.

In an advantage period, insurance providers may also offer coverage for the financial default of travel suppliers and may allow you to add optional coverage such as cancellation insurance.

You also lock in pricing when you purchase travel insurance early. Your premium rate won’t increase if you’ve locked it in when you buy travel insurance. But rates could change if you wait until later to secure your travel insurance policy.

Coverage and maximum benefits aside, buying travel insurance when you book just makes sense so you don’t forget to buy it later.

Drawbacks of Buying Travel Insurance When You Book

Paying for a travel insurance policy at booking could strain your travel budget , as it adds another expense on top of the cost of your trip. It could be a lot to pay for at the same time as trip deposits. While you get the most value from your coverage when you buy it early, it could be easier on your budget if you wait and spread out the expense .

You’ll have to estimate the total trip cost you want to cover when you buy your travel insurance policy. If you’re not done booking everything before you buy travel insurance, you might estimate wrong. That means you could have too much or too little coverage for your actual travel costs.

Pre-Travel Insurance Benefits

When you buy travel insurance before your trip departure, you’re covered for cancellation due to covered reasons such as illness or injury before your trip, the death of a family member, job loss, or the airline or tour operator going out of business.

How Early You Can Purchase Travel Insurance

Timing varies between insurance companies, but you can generally get travel insurance up to 12 to 18 months prior to departure . On an annual plan, you can get 12 months of coverage before you need to renew.

You can buy travel insurance before you’ve made your final payment. Even if you’ve only made a deposit, you can enter the total trip costs when you get your travel insurance policy.

How Late You Can Purchase Travel Insurance

Generally, you can purchase travel insurance up to the day before your departure date, though some policies are available post-departure. When you purchase your coverage that close to departure, you generally can’t use your trip cancellation benefit. And you probably won’t be eligible for preexisting condition coverage or Cancel for Any Reason coverage . But you’ll still have the advantage of other coverages such as trip interruption and emergency medical benefits.

It’s fine if you need to pick up travel insurance for last-minute bookings . You generally won’t pay more compared to paying weeks earlier, but you may miss out on coverage features.

What Happens if You Buy Travel Insurance After Departure

Some travel insurance companies allow you to buy a policy after departure. However, your coverage will be subject to waiting periods, conditions, and restrictions. For example, you generally have to wait up to 24 hours for your plan’s trip cancellation and interruption benefits to become active.

Travel insurance is available with many credit cards, but it’s generally less comprehensive than a travel insurance policy. When you consider whether your credit card travel insurance benefit is adequate for your trip, check the coverage limits, what’s covered, and how long it’s covered.

You might not need a standalone travel insurance policy if you’re traveling domestically, have health insurance coverage at your destination, and your major costs, such as air travel and hotel bookings, are flexible or refundable.

The timing of buying travel insurance can influence the value and coverage you get from your travel insurance policy. When you buy travel insurance early, ideally at booking or within 2 weeks of your first trip payment , you’ll get additional benefits such as maximizing your trip cancellation coverage period and access to Cancel for Any Reason coverage. Read our guide to find some of the cheapest travel insurance policies available.

Getting travel insurance closer to your trip departure — or even after departure — is still an option and will offer major travel insurance benefits, but you won’t get as much coverage as you could with an early travel insurance purchase.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Does Travel Insurance Work?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

While every traveler hopes for the best when going on a trip, it's possible for unexpected outcomes to ruin some or all of your vacation. Travel insurance helps in those unfortunate situations by covering the necessary expenses to get you back on the right track.

But how does travel insurance work, how do you buy coverage, and is it a good idea for your next trip? Let’s find out.

What is travel insurance?

Travel insurance protects against financial losses and other risks from unexpected events that occur when traveling. Policies cover the expenses and inconveniences incurred from delayed flights, canceled reservations, lost or delayed luggage, injuries and illness.

You can buy policies that cover one reservation, an entire trip or a specific period of time. Policies can provide protection for a single person or a whole family. Prices vary based on your age, protected items, coverage limits and duration of coverage.

You don’t always have to buy a policy out-of-pocket, though. Some travel cards include built-in travel insurance as a perk. Keep in mind, however, that these policies and their coverage limits vary widely, so it pays to be mindful of what’s covered by any given travel card.

» Learn more: How to find the best travel insurance

Types of travel insurance coverage

Now that we know what it is, how does trip insurance work? There are many types of policies and coverage levels available, depending on your budget and what risks you want to cover.

So what is travel insurance for? Typically it will cover some or all of the following situations:

Trip delay. If your flight or other transportation has delays, you’ll receive compensation to cover food, lodging and other related expenses.

Trip interruption/cancellation. When your trip is interrupted or canceled for a covered reason, it provides financial assistance to make other arrangements to continue your trip or go home early.

Baggage delay. Covers the cost of reasonable clothing, toiletries, medication and other necessary items until your bag arrives.

Lost or damaged baggage. Pays to replace lost or damaged items, including both the luggage itself and personal effects that were in the luggage.

Rental car damage. Commonly called an auto collision damage waiver, this covers the cost to repair or replace a damaged or stolen rental car. Some policies also cover the lost income of the rental to the car agency while it’s being repaired.

Injury or sickness. If you get injured or sick during your trip, this benefit pays for necessary medical care. Depending on the coverage you choose, this benefit may be primary or secondary to your existing medical insurance.

Emergency assistance and transportation. Pays to transport you to the nearest facility that offers adequate medical care to treat your illness or injury. In some cases, this may mean transporting you back to your home country.

Keep in mind that many travel insurance policies do not provide protection for COVID-related situations or pre-existing medical conditions.

» Learn more: Trip cancellation insurance explained

How to use your travel insurance

Travel insurance works like most insurance policies. You purchase coverage for a period of time to protect against certain risks. When a covered event occurs, you file a claim with the insurance company to request payment or reimbursement for financial losses.

In most cases, travel insurance covers only prepaid or non-cancelable reservations. If you are able to cancel your reservations for a full refund, you should cancel them directly with that company as soon as possible. Additionally, most travel insurance policies do not cover reservations booked with airline miles or hotel points .

When you submit a claim, you’ll need to provide documentation for your loss. For example, you should document the cause of the issue (e.g., flight delay or cancellation) and provide copies of your receipts to substantiate your claims. Since there are many different types of losses that could occur, your claims process may vary by company and type of loss.

» Learn more: How do travel insurance claims work?

How to get travel insurance coverage

For travelers interested in getting a travel insurance policy, there are three primary ways to obtain coverage — purchase a standalone policy, use travel card benefits, or add on coverage when booking a trip.

Purchase a travel insurance policy

Many companies sell travel insurance as standalone policies that vary in length from a single trip to a full year. Your policy can cover a single person or an entire family. Policies range from those that offer basic coverage to others that are very robust and cover almost every possibility. Coverage options start from around $20 per trip.

For frequent travelers, it may make sense to purchase a full year of coverage instead of buying a policy for each individual trip.

» Learn more: When you don’t need to buy travel insurance

Access via travel card benefits

Many travel cards include protections that cover issues with your flight, bags and other aspects of your trip. These protections are included at no extra charge, and their coverage levels vary from card to card. You may have travel protections from some of the travel cards that are already in your wallet.

Here's a sample of the coverage available from some popular cards:

Terms apply.

» Learn more: The best credit cards for travel insurance benefits

Get add-on protection for your trip

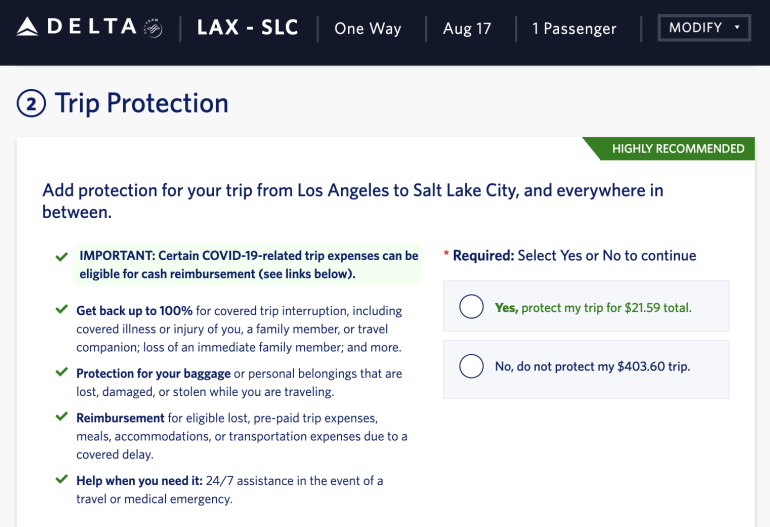

Some companies offer travelers the option of purchasing insurance when booking a trip. However, they are generally limited in nature and usually cover only that specific reservation.

Below is an example of an add-on policy proposed by Delta Air Lines for a flight from Los Angeles to Salt Lake City for a refundable, first-class fare.

In most situations, these add-on policies only make sense for a large financial commitment, such as a cruise or a premium cabin flight. Even then, you should compare how the add-on insurance works versus buying a general policy that could cover your entire trip.

» Learn more: Airline travel insurance vs. independent travel insurance

If you’re interested in buying travel insurance

Now that we've answered "how does travel insurance work," you can see how it can be a smart way to protect your trip in case an unexpected problem occurs. Coverage limits and benefits vary by company and budget, so shop around for the best deal. Review your travel card benefits to ensure that you’re not paying for coverage that you’re already getting for free. And, if you have a claim, document everything and compile your receipts to request reimbursement right away.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

sign up and keep track of your travel insurance events

When to Buy Travel Insurance and Assistance Services: Timing is Everything

Read below for more about timing your travel protection purchase.

Jump to these sections:

- When should I buy travel protection?

Can you buy travel protection after booking a flight?

- Last minute travel protection

- Top reasons to buy early

During the complications of trip planning and booking, the last thing you should have to worry about is when to buy travel insurance and assistance services for the trip. We’ll help you answer that question, so you can focus on having a great trip.

In this post, we break down the best time to buy travel protection and when it's possible to get a plan, including buying last minute and details on when you should buy in order to qualify for coverage for pre-existing medical conditions and Trip Cancellation for Any Reason .

Some coverages and features of our travel protection plans include time sensitive factors that are important to understand in order to get the most out of what you pay for. At Generali Global Assistance, we try to make our plans easy to understand .

Imagine.... you set up your trip way in advance, paid for it all and even shopped around for travel protection . You didn't buy a plan right away, thinking you had plenty of time before you leave. But, when you get around to making the purchase to help protect your trip, you realize it's too late to qualify for coverage for your pre-existing medical condition! You can avoid this kind of situation by considering a key factor—timing when to buy travel insurance and assistance services.

When is the best time to buy travel protection?

We suggest you buy a travel protection plan when you make your first trip payment, like airfare or a cruise. That way you maximize your coverage period in case you need to cancel your trip.

For cruises and tours, it may not be an issue until cancellation penalties start to kick in. That could be at six months prior to departure.

Later on, you can add coverage to the same plan for your hotel, tours and other pre-paid, non-refundable trip costs. It’s best to contact us to add coverage as soon as possible after you make new trip payments to be sure you have coverage for your full trip cost.

When can you buy travel insurance and assistance services?

Generali Global Assistance travel protection plans can be purchased online up to 18 months before the trip departure date and up until the day prior to departure.

Often travelers will pay for a trip in installments, and they wonder when they can buy travel protection, since they haven't paid fully yet. Rest assured—you can. When getting a quote, simply enter the total trip costs that you will be paying and you can modify the plan if those costs change, as long as you have not left on your trip, filed a claim or incurred any losses.

When is it too late to buy travel insurance and assistance services?

You are not able to buy a Generali Global Assistance travel protection plan on the day you are leaving on your trip or once you are on your trip. At 12 a.m. the day you depart for your trip it becomes too late to buy travel protection.

Yes, you can buy travel protection once you've booked your flight. In fact, you should wait to buy it until you book your flight and know the ticket price.

Generali Global Assistance travel insurance can be purchased up to 18 months before the trip departure date and up until the day prior to departure.

Often times travelers will pay for a trip in installments, and they wonder when they can buy travel insurance, since they haven't paid fully yet. Rest assured—you can. When getting a quote, simply enter the total trip costs that you will be paying and you can modify the plan if those costs change, as long as you have not left on your trip or incurred any losses.

When is it too late to buy travel insurance?

You cannot buy a Generali travel insurance plan on the day you are leaving on your trip or once you are on your trip. At 12 a.m. the day you depart for your trip it becomes too late to buy travel insurance.

Can you buy travel insurance after booking a flight?

Yes, you can buy travel insurance once you've booked your flight. In fact, you should wait to buy travel insurance until you book your flight and know the ticket price.

Also read: • How Travel Insurance Can Help When You Fly • What to do if Your Flight is Canceled: Tips to Work with Airlines & Travel Insurance • Reasons to Get Air Travel Insurance

Last Minute Travel Protection

Procrastinators are welcome here. While we don't suggest waiting too long before insuring your trip, you can get a last minute travel protection plan from Generali Global Assistance. The last chance for you to buy a plan from us is the day before you leave on your insured trip. Sorry—you won't be able to buy a plan at the airport as you're leaving, when you leave your home or once you arrive at your destination.

Trip Cancellation coverage starts the day after purchase at 12:01 a.m. We'll email your plan confirmation, so you'll have all of the information you need when you leave in case you need to contact us for assistance on your trip.

One downside to buying last minute travel protection is that certain coverages are dependent on when you buy your plan and may not be available if you buy last minute. Read the next section for more details.

Learn more about travel protection: • What is Travel Insurance? • How Much Does Travel Insurance Cost? • Top 5 Reasons to Get Travel Insurance

Top Reasons to Buy Early

Trip cancellation.

Life is unpredictable, so it makes sense to be covered for as much time as possible before you start traveling. All sorts of things can throw a wrench into your travel plans after you've paid for the trip, forcing you to cancel. Why wait to insure your trip until the week before you leave?

When travelers can’t go on their trip due to a covered reason, Trip Cancellation coverage pays for forfeited, pre-paid, non-refundable travel arrangements. Travelers can get maximum coverage for Trip Cancellation if they purchase their plan as soon as they make their first trip payment, like airfare.

If you're interested in Trip Cancellation for Any Reason*, an available add-on coverage with our Premium Plan, don't wait to insure your trip. Your plan must be purchased within 24 hours of the initial deposit for your trip in order to qualify for the coverage. Learn more about Trip Cancellation for Any Reason and other requirements that must be met.

Also read: Cancel For Any Reason Travel Insurance—Is it Really that Simple?

Pre-Existing Conditions

Some travelers may need to look for plans that offer coverage for pre-existing medical conditions when they insure their trip, and it’s important to understand the purchase window to qualify for that feature. If you don't buy a plan during the right timeframe, you might not be covered for Trip Cancellation, Medical and Dental and other claims related to that pre-existing condition.

Coverage for pre-existing conditions is included with our Premium Plan , but coverage must be bought prior to or within 24 hours of the final trip payment, travelers must be medically able to travel at the time the coverage is purchased and they must insure 100% of their pre-paid trip costs that would be subject to cancellation penalties or restrictions. Coverage for pre-existing conditions isn’t available with all our plans.

An important advantage offered by our plans is that the exclusion for pre-existing conditions does not apply to non-traveling family members. In other words, if a family member who is not traveling with you has a pre-existing medical condition, and you must cancel your trip because their illness unexpectedly arises, you can still be covered.

Also read: Pre-Existing Conditions and Travel Insurance—5 Things Most People Get Wrong

Travel Protection Review Period

Another reason to buy travel protection soon after booking is how easy it is to get a refund of the plan cost if you review the details and decide it’s not right for you.

Travelers who have bought a plan but wish to cancel it and receive a full refund of their plan cost, may do so within a designated number of days from the date of purchase as long as they haven’t left for their trip or filed a claim. This is referred to as a “free look” period and is available with all Generali Global Assistance travel protection plans.

While the timeframe for the free look period varies from state to state, it is generally 10 days from purchase. Travelers should refer to their Plan Documents to determine the number of free look period days available in their state of residence.

When you’re ready to buy, what do you do first?

The first step to get travel protection is to give us some information about your trip so you can compare plans and prices. It’s easy and you can jump right into it at our Get a Quote page . We’ll take you through the step-by-step process of choosing and buying a plan and if you need more guidance you can follow our How to Buy Travel Protection Guide .

Other Timing FAQs

The Trip Cancellation coverage included with your plan goes into effect the day after you purchase travel protection at 12:01 a.m. Coverage ends on your scheduled departure date and once you begin your trip, you can no longer be reimbursed for Trip Cancellation.

As soon as you depart, the other coverages in your plan become effective, including Medical and Dental, Trip Interruption, Travel Delay, Emergency Assistance and Transportation, Baggage and more . Those coverages end as soon as one of these occurs: You return from your trip, the trip is completed, your scheduled return date arrives (unless you qualify for extension of coverage ), or your arrival at the destination on a one-way trip.

A variety of Travel Services are included with your plan. Concierge Services are available to use as soon as you purchase your plan and end when you return. Travel Support Services can be used during your trip. ID Theft Resolution Services are also available for a full 180 days starting on the scheduled departure date.

If you buy travel protection after a storm is named, your plan will not provide coverage for storm-related claims. See our Storm Coverage Alerts for more information.

We suggest you buy travel protection when you make your first trip payment, like airfare or a cruise. That way you have a long coverage period in case you need to cancel your trip, and if you need to file a claim related to a storm, you will have bought the plan well before the storm was forecasted.

Generali travel protection plans can be purchased online up to 18 months before the trip departure date and up until the day prior to departure.

Learn more: How does travel insurance work?

No surprise, the best time to buy travel protection is usually as early as possible, just in case you need to cancel your trip. But, no matter when you decide to help protect your trip, travelers should remember to consider travel protection from a reputable provider such as Generali Global Assistance.

If you have other questions about travel insurance and assistance services, we're here to help.

Travel Resources

* This coverage is not available to residents of New York.

Average Customer Rating:

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Tricky travel insurance questions answered by experts

Erica Lamberg

Alyce Meserve

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Published 6:00 a.m. UTC July 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Powerofforever, Getty Images

- Travel insurance is subject to the terms and conditions of your policy, so it’s vital to read your policy documents to understand the scope of coverage, policy limits and exclusions of your plan.

- Although your credit card may offer some valuable travel insurance benefits, make sure the coverage limits are a fit with your travel plans and circumstances.

- You can buy travel insurance even if you don’t have any prepaid, nonrefundable costs to cover.

Travel insurance can be a sound investment that protects your trip costs, health and the value of your belongings while you’re on a trip. Most comprehensive travel insurance plans provide coverage for the following issues: trip cancellation, trip delay, trip interruption, medical expense, emergency medical evacuation and baggage loss protection.

Your plan documents will provide an overview of the scope of coverage, including what your travel insurance covers , the limitations and what is excluded from your coverage.

It’s important to read your policy thoroughly and carefully so you can get the most value from your travel insurance plan.

Even when a policy is comprehensive, you may still have questions and concerns about the scope of what your plan will cover, how the policy works regarding reimbursement and more. We’ve asked travel insurance experts to explain the fine print and address some pressing travel insurance questions to help you be a more informed traveler and be best protected on your trip.

Do I need to buy travel insurance if my credit card covers it?

You may hold a credit card with travel insurance benefits that are provided when you use that credit card to pay for your trip. But its coverage might not be sufficient for an expensive or international trip.

“Many credit card providers include no additional charge travel insurance coverage as part of a customer’s selection of a particular card,” said Scott Adamski, spokesperson with AIG Travel . “Based on the card type and level, benefits vary significantly, so it’s incumbent on the cardholder to review the terms and conditions in order to understand what coverages, if any, are included in the card.”

He cautions that cardholders should review limits of coverage to determine whether they are adequate for their needs. “In one review of credit card trip cancellation coverage, a particular card offers a $1,500 maximum trip cancellation benefit. If the customer were taking a trip with, for example, a $5,000 trip cost, there may be a limitation as to getting reimbursement above the benefit level through the coverage under the credit card,” said Adamski.

Another important consideration is that select credit cards may provide limited or no medical expense coverage . As most domestic health insurance isn’t accepted in foreign countries, make certain you are prepared with health coverage when traveling outside the U.S.

Travel insurance policies that you buy from a third party let you customize your coverage so you can get the benefits you need for a particular trip. These standalone policies offer a larger list of covered cancellation and interruption reasons, missed connection benefits, optional upgrades like adventure bundles, rental car coverage or increased limits on baggage, trip delay and medical and emergency evacuation protection . Plus, the only way to get “ cancel for any reason ” and “interruption for any reason” coverage is through a third-party policy.

Although many credit cards provide baggage and trip delay insurance, getting a claim paid can take an extended period. Because airlines sometimes provide compensation for delayed flights and baggage, the credit card company may require you to prove what the airline reimbursed you before it will consider your claim.

“It is important to understand all parameters of the coverage, and you should review the details of any coverage you have through your credit cards,” Adamski said. He added, that due to the limitations described above, a third-party travel insurance program may be a great complement to the coverage offered through a credit card.

Can I insure only part of my trip?

Daniel Durazo, spokesperson for Allianz Partners US, said indeed you could purchase travel insurance to cover only part of your prepaid travel expenses.

If, for instance, your flights are refundable and your car rental is cancellable, you may only want to buy travel insurance for the value of your prepaid accommodations.

Travel insurance costs an average of 5% to 6% of the prepaid, nonrefundable trip expenses you want to insure. Insuring a lower amount will bring down the cost of your travel insurance policy.

Can I insure a trip with a value of $0?

Adamski with AIG said, yes, you can insure a trip with a zero value. “In fact, purchasing a travel insurance plan where there are no prepaid nonrefundable costs is not uncommon, and a common scenario includes the use of airline or similar mileage to pay for travel,” he said.

So when someone is using rewards miles to purchase air tickets or other components of a travel experience, there may not be any non-refundable amount. “An insured can still purchase an AIG Travel plan at $0 trip cost and benefit from the comprehensive coverages offered in the plan, i.e., medical expense, baggage and medical evacuation,” said Adamski.

Is it worth buying annual travel insurance?

Opting to buy an annual travel insurance plan may be a sound purchase for frequent travelers. “Typically, an annual plan may offer lower benefits and limited coverage for scenarios such as trip cancellation, trip interruption or travel delays but will, conversely, have robust coverage for medical expense and medical evacuation benefits,” explained Adamski.

Therefore, someone who’s taking a number of low-cost trips using domestic air travel may elect to buy an annual plan specifically for more catastrophic events, such as a medical evacuation, particularly if they’re not as concerned about protecting the low-cost airfares, he said.

As an example, parents who have children located throughout the U.S. and are paying for lower costs, such as domestic air tickets to travel and then staying with their children, have relatively low out-of-pocket costs. “An annual plan may be a good fit. However, if those parents decide to take a vacation and book a $25,000 cruise, an individual travel insurance plan would be a good option,” clarified Adamski.

Annual policies can vary widely in terms of how or whether they cover pre-existing conditions. Some policies may cover pre-existing conditions if you buy the plan shortly after paying the initial deposit, while others cover them only if you experience an acute flare-up. However, some don’t offer any extra protection and restrict coverage to a medical history look-back period.

To ascertain if a plan is correct for your travel circumstances, be sure to thoroughly review the terms and conditions, benefits, coverages and limits of your travel insurance policy.

When will travel insurance arrange payment for a medical emergency?

According to Durazo with Allianz, depending on your personal situation, you may need to pay up front for medical care or be able to rely on your travel insurance to handle payment.

“If you experience a minor injury, such as needing to get stitches for a cut or getting a splint for a sprained ankle, there’s a possibility you will need to pay out of pocket and get reimbursed later,” said Durazo.

However, he said, should you experience a more serious injury that leaves you in the hospital for more than 24 hours, that’s typically when an insurance company can guarantee advance payment for medical care, up to the limit of your specific policy.

“Experiencing a medical emergency when you’re far from home can be incredibly stressful,” said Durazo. “That’s why it’s essential to purchase emergency medical coverage from a credible travel insurance company, who you know will be there for you when you have a problem.”

Expert tip: A travel insurance company with a medical assistance team can help direct you to the local, pre-screened medical providers, provide translation services when speaking with medical professionals outside of your own country, guarantee payments to hospitals and help transfer you to a more appropriate medical facility for top care.

What if my health insurance covers me?

Relying solely on your health insurance provider in a foreign country can leave you in a vulnerable situation. Even if your domestic health insurance reimburses for medical expenses incurred outside of the country — and many don’t — it may require you to get pre-authorization, find an in-network provider and submit reimbursement claims. This could put you in a tough spot if you need to pay for medical care before you can leave the country.

Travel medical insurance , which is included in comprehensive travel insurance plans, can provide additional guidance and advance payments to ensure your safe return home.

According to Durazo, if your health insurance is accepted abroad, it’s important to speak with your health insurance provider to determine if your policy also includes coverage for potentially expensive emergency medical evacuation and transportation.

“Emergency medical transportation, especially by air ambulance, can cost tens of thousands of dollars and be very difficult to arrange on your own,” said Durazo. “Your travel insurance policy can arrange and pay for costly emergency medical transportation.”

Can I get reimbursed if I’m too anxious to travel?

Travel insurance recognizes numerous “covered perils,” that would allow you to cancel your trip — even last-minute — and still be covered, subject to the terms of the insurance policy, said Adamski with AIG. “However, fear of travel is not a covered reason, nor is — as a more specific example — a concern that a developing tropical cyclone could become a hurricane and hit a certain destination when a traveler is scheduled to be there,” he said.

However, many travel insurance plans offer an optional “cancel for any reason” (CFAR) upgrade that would provide coverage for circumstances like these. The decision to pay extra for CFAR coverage is closely connected to the traveler’s risk tolerance, the value of the trip and circumstances that may arise that may not be covered under the terms and conditions of the base travel insurance plan, said Adamski.

“The key benefit put plainly is that this optional coverage could provide reimbursement for prepaid, nonrefundable trip costs in circumstances where no other coverage may apply. It is of great importance that travelers carefully review the terms of any policies that offer a CFAR option to get specifics on coverage amounts, limits or exclusions,” said Adamski.

For example, if a traveler has purchased the optional CFAR coverage and needs to cancel for a non-covered reason under their AIG travel insurance plan, Adamski said they may be reimbursed up to 50% of their prepaid, nonrefundable trip cost. “Please note that, under the terms of CFAR, the traveler must cancel the trip more than 48 hours prior to their planned trip departure,” he emphasized.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Erica Lamberg is a regular contributor to Fox News, Fox Business, Real Simple, Forbes Advisor, AAA and USA TODAY. She writes about business, travel, personal finance, health, travel insurance and work/life balance. She is based in suburban Philadelphia.

Alyce Meserve is an experienced insurance, personal finance and travel writer. Alyce is a licensed insurance professional in life, health and property and casualty, and holds an Executive Certificate in Financial Planning from Duke University.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations last week

How travel insurance works for baggage

Travel insurance Erica Lamberg

What does travel delay insurance cover?

Travel insurance Mandy Sleight

Travel insurance for UK trips

Travel insurance Amy Fontinelle

What is trip interruption insurance?

What are your rights during an airline meltdown?

Hurricanes and travel insurance

Generali Global Assistance travel insurance review 2024

Travel insurance Jennifer Simonson

Travel insurance for vacations to Italy

Travel insurance Timothy Moore

Survey: 20% of Americans have had a life-changing experience while traveling

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Cheapest travel insurance of September 2024

Average flight costs: Travel, airfare and flight statistics 2024

All you need to know about annual travel insurance policies

As demand for travel soars and everything from weather to staffing issues leads to higher prices and cancellations, it's more important than ever to protect your trip arrangements with travel insurance .

However, it's not always easy figuring out which type of plan to pick. There are standard policies that cover general delays, interruptions and cancellations; "cancel for any reason" plans that account for personal whims in addition to unforeseen circumstances; and lesser-known annual options.

In this article, I'll go over what you need to know about the third type: annual travel insurance coverage.

What is annual travel insurance?

Annual travel insurance plans (also known as multi-trip plans) last for one year and generally cover all trips taken within that period until either the policy expires or the maximum payout amounts are reached. The policy usually kicks in for trips that take you more than a certain distance from home.

For example, my Allianz AllTrips Prime annual plan remains in effect for one year following the purchase date of my policy. I'm covered on all trips during which I'm at least 100 miles from my residence.

This differs from standard travel insurance, which is purchased on a per-trip basis and covers only one specifically insured journey per policy. Standard policies begin when travel for the insured trip begins and end when the insured trip ends, rather than covering multiple travel experiences within a specific period of time.

What does annual travel insurance cover?

Coverage depends on the plan you purchase. There are usually several tiers from which to choose, with the lowest offering the least coverage and the highest offering the most.

Using my policy as an example, I'm covered for up to $3,000 per year in trip interruption expenses, including hotel room coverage at $250 per night, which I used when I was recently isolated for 10 days after testing positive for COVID-19.

My policy also offers a $3,000 annual trip cancellation benefit, $20,000 in emergency medical coverage, $100,000 in emergency transportation (including medevac services), $45,000 in rental car theft and damage protection, $25,000 in travel accident coverage and $1,000 for essentials in the event of baggage loss or damage, along with a handful of other small benefits.

Note that many annual policies do not include things like "cancel for any reason" coverage or trip interruption benefits. If those items are important to you, check with your provider before making a purchase.

How much is an annual travel insurance policy?

Sure, an annual travel insurance policy may sound great, but how much does one cost? I was surprised to find that insuring your trips for a whole year with an annual policy is often not much more expensive than insuring one or two trips individually, depending on the options you select.

A decent annual travel insurance plan will likely set you back a couple hundred dollars. The more coverage you add, the more expensive the plan will become. The cost also changes depending on variables like your age and where you live.

The best thing to do is contact your preferred provider for a quote or check out an aggregator like InsureMyTrip to compare premiums.

Which companies offer annual travel insurance plans?

The Points Guy recommends the following travel insurance providers , all of which sell annual or semi-annual policies:

- Allianz Travel Insurance .

- Seven Corners .

- Travel Guard .

- World Nomads .

When should I purchase annual travel insurance?

There are several reasons why annual travel insurance might be better for you than separate policies for individual trips. If you travel a lot — more than two or three times annually — it could be more cost-effective than purchasing separate policies for each journey.

For me, it makes sense because I travel for a living, often taking a dozen or more trips each year. Also, much of my travel is comped, which makes insurance more difficult to acquire. (If I haven't paid for a cruise, flight or hotel, I can't attach a dollar amount to it and, therefore, often can't insure it. I also wouldn't be able to provide purchase receipts in the event something went wrong and had to file a claim.)

Other factors to consider include your health, how adventurous your travels might be, whether you have coverage as a credit card perk and how much your travel arrangements cost versus how much coverage you can get with an annual plan versus individual policies.

Another consideration right now is COVID-19. For me, the annual plan made sense because most of Allianz's individual plans don't cover issues linked to COVID-19. However, the annual coverage I purchased does.

Other things to know about annual travel insurance policies

Here are a few additional tidbits I learned after filing a trip interruption claim under my annual travel insurance policy. Keep them in mind when deciding if an annual policy is right for you.

- Before committing to the purchase of any travel insurance plan, make sure to inquire about specific components that are important to you. For me, those were COVID-19 coverage, trip interruption benefits and medevac coverage.

- Know that your coverage does not reset each time you travel when you opt for an annual policy. So, if you have a trip that goes awry, you file a claim and you max out the benefit allowed by your plan, you won't have that benefit available to you for the remainder of your policy year.

- Depending on your policy, you might have to return home between travel sessions in order for each trip to be covered. Taking several back-to-back trips could prevent them from qualifying for coverage under your annual insurance plan, so be sure to read the fine print, and plan accordingly.

- If you purchase annual or multi-trip travel insurance, keep your policy card and provider phone number with the other important documents you bring when you travel so they're easily accessible in a pinch.

- If you find yourself in a covered situation for which you'd like to seek reimbursement, keep all receipts and take photos that will help to support your claims when they're submitted.

- Don't assume all your expenses will be reimbursed, even if you think they'll be covered. It doesn't hurt to try, but in my case, my Allianz plan only partially covered the hotel expenses I submitted.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Insurance 101: How Travel Insurance Works

What is travel insurance?

Travel insurance is a plan you purchase that protects you from certain financial risks and losses that can occur while traveling. These losses can be minor, like a delayed suitcase, or significant, like a last-minute trip cancellation or a medical emergency overseas.

In addition to financial protection, the other huge benefit of travel insurance is access to assistance services , wherever you are in the world. Our elite team of travel and medical experts can arrange medical treatment in an emergency, monitor your care, serve as interpreters, help you replace lost passports and so much more. Sometimes, they even save travelers’ lives.

A few things you should know about travel insurance:

- Benefits vary by plan. It’s important to choose a plan that fits your needs, your budget and your travel plans. Here are definitions of all available travel insurance benefits.

- Travel insurance can’t cover every possible situation. Allianz Travel Insurance is named perils travel insurance, which means it covers only the specific situations, events, and losses included in your plan documents, and only under the conditions we describe.

- Travel insurance is designed to cover unforeseeable events —not things you could easily see coming, or things within your control. If, for example, you wait to buy insurance for your beach trip until after a named hurricane is hustling toward your destination, your losses wouldn’t be covered.

How does travel insurance work?

In most scenarios, travel insurance reimburses you for your covered financial losses after you file a claim and the claim is approved. Filing a claim means submitting proof of your loss to Allianz Global Assistance, so that we can verify what happened and reimburse you for your covered losses. You can file a claim online , or do it on your phone with the Allyz ® TravelSmart app .

How does this work in real life? Let’s say you purchase the OneTrip Prime Plan , which includes trip cancellation benefits, to protect your upcoming cruise to Cozumel. Two days before departure, you experience a high fever and chest pain. Your doctor diagnoses bacterial pneumonia and advises you to cancel the trip. When you notify the cruise line, they tell you it’s too late to receive a refund.

Without travel insurance, you’d lose the money you spent on your vacation. Fortunately, a serious, disabling illness can be considered a covered reason for trip cancellation , which means you can be reimbursed for your prepaid, nonrefundable trip costs. Once you’re feeling better, you gather the required documents—such as your airfare and cruise line receipts and information about any refunds you did or did not receive—and you file a claim . You can even choose to receive your reimbursement by direct deposit, to your debit card, or via check.

Sometimes, this process works a little differently. Travel insurance may pay your expenses upfront if you require emergency medical treatment or emergency transportation while traveling overseas. Or, with the OneTrip Premier and OneTrip Prime plans, you may be eligible to receive a fixed payment of $100 per day for a covered travel delay or $100 for a covered baggage delay . No receipts for purchases are required; all you need is proof of your covered delay.

Many travelers are wondering: Can COVID-19 be considered a covered reason for trip cancellation? And can travel insurance help if you become seriously ill with COVID-19 while traveling? Most of our travel insurance plans now include epidemic-related covered reasons (benefits vary by plan and are not available in all jurisdictions). The Epidemic Coverage Endorsement adds covered reasons to select benefits for certain losses related to COVID-19 and any future epidemic. To see if your plan includes this endorsement and what it covers, please look for "Epidemic Coverage Endorsement" on your Declarations of Coverage or Letter of Confirmation. Terms, conditions and exclusions apply. Benefits may not cover the full cost of your loss. All benefits are subject to maximum limits of liability, which may in some cases be subject to sublimits and daily maximums.

> Learn more: Travel Insurance and COVID-19: The Epidemic Coverage Endorsement Explained

How to choose a travel insurance plan

There’s a wide range of Allianz Travel Insurance plans, each with different benefits and benefit limits. So how do you know which is best for you? To begin, get a quote for your upcoming trip. When you enter your age, trip costs and trip dates, we can recommend a few plans for you. Then, you can compare the costs and benefits of each.

If you’re a budget-conscious traveler who’s traveling in the U.S., you may like the OneTrip Cancellation Plus Plan . It includes trip cancellation, trip interruption and trip delay benefits.

If you want protection in case of medical emergencies overseas, but you have few pre-paid trip expenses, you may consider the OneTrip Emergency Medical Plan . This affordable plan includes emergency medical and emergency transportation benefits, as well as other post-departure benefits, but not trip cancellation/interruption.

If you want the reassurance of carrying substantial travel insurance benefits, the best fit may be the OneTrip Prime Plan . This plan also covers kids 17 and under for free when traveling with a parent or grandparent (not available on policies issued to Pennsylvania residents).

If you’re planning several trips in the next 12 months, consider annual travel insurance such as the AllTrips Prime Plan . It gives you affordable protection for a full year of travel, including benefits for trip cancellation and interruption; emergency medical care; lost/stolen or delayed baggage; and Rental Car Damage and theft protection (available to residents of most states).

> Find the right travel insurance plan for you

How to get the most from your travel insurance plan

Don’t wait too long to buy travel insurance! The best time to buy travel insurance is immediately after you’ve completed your travel arrangements. The earlier you buy insurance, the bigger your coverage window. Also, you must buy your plan within 14 days of making your initial trip deposit in order to be eligible for the pre-existing medical condition benefit (not available on all plans).

Read your plan documents before you leave. If you're not completely satisfied with your plan, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven't started your trip or initiated a claim. Premiums are non-refundable after this period.

Call us when you need help. If you have questions about how travel insurance works, or how to file a claim, or which benefits you need, please contact us ! Our representatives are available 24/7. If you’re already traveling, and you’re facing a travel crisis or just need some advice, call our emergency assistance hotline .

> Read more about how we can help

Related Articles

- What Does Travel Insurance Cover?

- How Travel Insurance Covers Family Members

- Trip Delay, Trip Interruption and Trip Cancellation Insurance Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

5 reasons to get travel insurance if you have health challenges

- By Mr. Digital Fingers

- Sep 10, 2024

Traveling can be one of the most rewarding experiences, but when you have health challenges, the excitement may come with additional concerns. Ensuring you’re protected with the right travel insurance is more than just a precaution — it’s an essential part of planning a safe and worry-free trip. If you’re managing a chronic illness or any health condition, travel insurance can offer peace of mind and a safety net in case things don’t go as planned. In this article, we’ll explore five critical reasons why getting travel insurance is vital for travelers facing health challenges.

1. Emergency medical coverage

One of the most important reasons to get travel insurance is the medical coverage it provides in case of an emergency. While many people assume their regular health care insurance will cover them while they’re abroad, that’s often not the case. Travel insurance steps in when your regular health care plan doesn’t, covering everything from unexpected illnesses to injuries sustained during your travels.

For individuals with pre-existing health challenges, this coverage becomes even more important. Suppose your health condition flares up while you’re miles away from home. The costs of emergency care — whether for a hospital visit, urgent care or specialized treatment — can add up quickly, especially in countries where health care is expensive. Having travel insurance with medical coverage ensures that you don’t have to choose between getting the care you need and protecting your finances.

2. Protection for trip interruptions and cancellations

Health challenges can be unpredictable, and sometimes, they may interfere with your ability to travel at the last minute. If you need to cancel your trip due to a sudden health issue or hospitalization, travel insurance can cover the non-refundable costs of your flight, accommodations and activities. Without insurance, you might find yourself paying for a trip you couldn’t take, adding financial stress to an already difficult situation.

Trip interruption coverage can also be invaluable. If you need to return home early because of a health-related emergency, this part of your travel insurance will help cover the costs of unused portions of your trip, along with the expenses of arranging last-minute travel back home. For anyone managing chronic illnesses or other health concerns, the reassurance of being able to change plans without heavy penalties can ease a lot of anxiety.

3. Access to emergency medical evacuation

In the unfortunate event of a serious medical emergency while traveling, the need for specialized care or a transfer to a different medical facility may arise. In these cases, emergency medical evacuation can be critical, and without travel insurance, the costs can be astronomical. For those with existing health issues, having access to medical evacuation coverage could be a lifesaver.

Imagine being in a remote area or a country where medical services are not equipped to handle your health needs. Travel insurance can arrange and cover the cost of transporting you to a hospital that can provide the necessary care, ensuring that distance or location doesn’t stand in the way of receiving quality treatment. Medical evacuations can cost tens of thousands of dollars, and travel insurance makes sure you’re protected from those financial burdens.

4. Peace of mind for traveling companions

Traveling with health challenges doesn’t only affect you — it can also be a source of worry for your loved ones and travel companions. By securing travel insurance, you provide not just for your own peace of mind, but also for theirs. Your friends or family members can enjoy the trip knowing that if your health takes a sudden turn, there’s a safety net in place to address any medical needs, trip changes or other concerns that may arise.

For travelers who might need assistance during emergencies, having insurance means your companions can stay focused on supporting you rather than scrambling to figure out how to handle unexpected costs or logistical issues. The emotional security of knowing that help is available when needed makes the entire travel experience more enjoyable for everyone involved.

5. Coverage for prescription medications and ongoing treatment

If you live with a chronic condition that requires regular medication or ongoing treatments, travel can introduce unique challenges. Lost or delayed baggage, changing time zones or unfamiliar health care systems can all make it difficult to manage your prescriptions and medical care. Travel insurance can help cover the costs of replacing lost medications or arranging care if your regular treatment schedule is disrupted.

Additionally, some travel insurance policies offer options for pre-existing condition waivers, allowing travelers with chronic health issues to ensure their ongoing treatment needs are covered while abroad. This can be a significant relief if you rely on medications or regular treatments to manage your health.

For many, simply knowing that if their medication is lost or damaged there’s a backup plan brings immense peace of mind. Travel insurance serves as a vital tool in ensuring that, even when the unexpected happens, your health is never compromised.

Travel insurance is essential for peace of mind

Travel is an opportunity to experience new cultures, connect with different people, and make unforgettable memories. But when you have health challenges, the logistics of ensuring you’re protected can be overwhelming. Securing travel insurance tailored to your health needs not only safeguards your health but also protects your finances and ensures you have access to care, no matter where in the world you are.

By covering emergency medical situations, trip cancellations, medical evacuations and even the management of ongoing conditions, travel insurance transforms travel from a potential risk into a more secure adventure. Ultimately, it’s not just about protecting yourself from the financial burden of an unexpected medical situation — it’s about giving yourself the freedom to travel with confidence.

If you face health challenges and are considering travel, make travel insurance a priority. It’s the one investment that ensures you’re prepared for anything and can fully enjoy your trip without the stress of potential medical or financial worries hanging over your head. Traveling is meant to be a fulfilling and enriching experience, and with the right insurance, you can explore the world with the peace of mind you deserve .

This story was created using AI technology.

Sign up for Rolling Out news straight to your inbox.

- chronic illness travel , emergency medical care , health challenges , medical coverage , medical evacuation , prescription coverage , travel insurance , travel peace of mind , travel safety , trip cancellations

7 warning signs that a stroke is occurring

The essential vaccinations to get for travel to Africa and Asia

What you need to know about navigating airport security

Safe travel tips for women visiting Egypt

7 things to do to protect yourself when heading to Mexico

The financial benefits of off-season travel to your dream destinations

- More in Travel

How to plan the perfect fishing trip with your friend

10 reasons to go on a cross country road trip

Bringing your dog or cat on a cruise? Follow these rules

- Community News

- Justice For All

- All Entertainment

- Reality Check

- All Culture

- Relationships

- Cocktail & Beer

- Creative Lens

- All Business

- Black Intellectuals

- Diversity Equity & Focus

- Sisters with Superpowers

- Home Ownership & Real Estate

- Entrepreneurs & Business Leaders

- Executive Suite

- Finance & Wealth

- Marketing & Branding

- Be the Match Atlanta

- Food & Nutrition

- Browse Places & Events

- Visit Hōtel

- HBCU Culture

- Privacy Policy

IMAGES

VIDEO

COMMENTS

Accidents Happen. Get Travel Insurance Protection. Worldwide Coverage. Compare Plans. Consumer Voice Provides Best & Most Updated Reviews to Help You Make an Informed Decision!

This means you'll need to at least know where you're going, when you're going and the cost of your trip before purchasing travel insurance. 🤓 Nerdy Tip. Multi-trip or annual travel ...

The second best time to buy travel insurance is within 14 days of making your first trip payment. The 14-day mark is significant when you're buying travel insurance, because it's the cutoff point for the existing medical condition benefit. Many of our plans include this benefit, which means that you, a traveling companion or family member ...

Some travel insurance treats pandemics the same as any other sickness, meaning if you contract a disease like Covid-19 during your trip, your medical expenses can be covered. When you're looking for travel insurance, take the time to read the exclusions, and make sure it treats pandemic diseases the same as other sicknesses if you want to be ...

The best time to buy travel insurance is within 2 weeks of making your first travel payment, whether that's booking a flight or putting down a cruise deposit. Generally, any time you make a nonrefundable travel deposit, it's a good idea to get travel insurance shortly thereafter. For example, you should get travel insurance after you buy ...

Because of this, the effective date of the plan will be one minute after midnight the day after you bought the plan. If you purchased your travel insurance on April 26th at 4:13pm, your plan will go into effect on April 27th at 12:01am. This will allow you to utilize your trip cancellation coverage if needed.