Travel hacking 101: A beginner’s guide to travel hacking like a pro

When I started travel hacking 11 years ago, it was an obscure “hobby” that few had heard about and most dismissed as a scam . Nowadays, seemingly everyone is doing it to some degree. Whether getting in on the latest credit card promotion or snagging a first-class seat for the price of coach, travel hacking has become more popular than ever.

It’s the easiest way to save on travel and improve your experience. Utilizing travel hacking methods, you can fast-track your way to top-tier elite status and earn frequent flyer miles without ever stepping on a plane.

There is endless information about maximizing every dollar (and mile) spent. But if you’re new to this “game” and just want a simple explanation of how it works, you’ve come to the right place.

Here is everything you need to know about getting started with travel hacking.

What is travel hacking?

Travel hacking involves earning frequent flyer miles or points through non-traditional methods and redeeming them for nearly-free travel.

The most common travel hacks include leveraging credit card welcome bonuses for premium cabin flights and taking advantage of sweet spots and generous routing rules to get the best deal on award flights.

How much are points and miles worth?

Points are worth 1-2 cents each, depending on the loyalty program and how you use them. You’ll generally get the highest value by redeeming points for premium cabin flights and luxury hotel stays. Some programs impose a fixed value on points, depending on the fare cost. For example, Southwest Rapid Rewards points are worth 1.3 cents towards Wanna Get Away fares.

The same goes for transferrable rewards. Most of them are worth at least one cent each towards direct travel bookings. For example, Chase Ultimate Rewards® are worth 1.25 cents each towards direct travel bookings for Chase Sapphire Preferred® Card cardholders and 1.5 cents for those with a Chase Sapphire Reserve® through Chase Travel℠.

The difference between points, miles, and rewards

Points, miles, and rewards are different types of loyalty currencies. There are exceptions, but airlines usually issue miles, while points come from hotel loyalty programs or bank rewards.

A good travel hacking strategy involves having a mix of all three currencies.

Transferable rewards

Thanks to their flexibility, transferable bank rewards are the gold standard of loyalty currency. You can transfer them to airline miles or hotel points, usually at a 1:1 ratio or better.

Examples of transferrable rewards include Amex Membership Rewards, Capital One Venture Rewards miles, Chase Ultimate Rewards®, and Citi ThankYou® points.

Airline miles

You might be wondering if it’s worth earning airline miles when you can just transfer your bank rewards points instead.

Well, you should earn airline miles from a co-branded airline credit card for several reasons. For starters, you can supplement welcome bonuses from airline cards with a bonus from a transferrable rewards card to reach your travel goals faster.

In addition, some airlines incentivize you to earn miles (through a co-branded credit card or otherwise). For example, American Airlines counts all co-branded credit card spending towards elite status. Meanwhile, Southwest Rapid Rewards issues the Companion Pass after you earn 125,000 points in a calendar year (which increases to 135,000 next year). Earning airline miles can pay off.

Hotel points

Hotel points can go a long way in reducing out-of-pocket travel expenses. You can earn hotel points from co-branded hotel credit cards, by shopping online, and even by participating in surveys. Hotel credit cards offer generous welcome bonuses, with perks like elite status and annual free nights.

Examples of hotel points you should consider earning include World of Hyatt, Marriott Bonvoy, Hilton Honors, and IHG One Rewards.

How to start travel hacking

Travel hacking is fun and rewarding but can also be a lot of work. There is a wealth of information about ways to earn and burn points for maximum value. But if you’re just learning and want to know the basics, here’s a step-by-step guide to getting started.

Step 1: Set a goal

Before you embark on your travel hacking journey, you’ll want to set a goal. Are you hoping to redeem miles for international travel ? Or perhaps you’re saving up for a family trip to Disneyland. Regardless of your goals, it’s important to identify them early on to determine which credit cards and loyalty programs will help you get there.

Step 2: Choose your rewards program(s)

Once you’ve determined your travel goals, it’s time to pick your loyalty programs. Start with your home airport; if you live in an airline hub city, that airline can be a good starting point. There’s no sense in earning Southwest points if you live in Alaska. You might be better off with the Alaska Mileage Plan program since the airline serves the region and offers domestic and international partners. You’ll have more opportunities to redeem miles, and if you fly the airline often enough, you’ll even earn elite status.

When choosing a loyalty program, keep partner airlines in mind. For example, if you’re saving up for a Hawaiian vacation and want to fly United, you should consider collecting Turkish Miles&Smiles instead. Turkish Airlines is a Star Alliance member, like United, and offers domestic United flights for just 15,000 miles round-trip in economy. Exploring partner programs can help you save on award travel, stretching your miles further.

Choosing a hotel loyalty program might be easier. Think about which hotels you like when traveling and which elite benefits you care about. Most hotel loyalty programs let you earn top-tier status from credit cards alone, so think about which programs offer the best perks and properties in the destinations you like to travel to.

Here’s a look at every major hotel program’s global footprint to help you choose:

- Marriott Bonvoy: Over 8,000 properties in 139 countries

- Hilton Honors: Over 7,000 hotels in 122 countries

- Choice Privileges: Over 7,000 hotels in 40 countries

- IHG One Rewards: Over 6,000 properties worldwide

- Radisson Rewards: Over 1,700 hotels worldwide

- World of Hyatt: Over 1,150 hotels in 70 countries

While it’s good to identify at least one airline and hotel program, you shouldn’t put all your eggs in one basket. Try to collect at least one transferable rewards currency, so you’re not limited to only a few programs.

Transferrable rewards can also protect you against program devaluations — if one airline or hotel increases its redemption requirements, you can transfer your points to another.

Here are some of the most popular transferrable rewards programs:

- American Express Membership Rewards®

- Bilt Rewards

- Capital One Miles

- Chase Ultimate Rewards®

- Citi ThankYou® Rewards

Step 3: Choose a credit card

Once you’ve identified the loyalty program you want to earn points with (and incorporated at least one transferrable currency), it’s time to find a credit card.

When choosing a credit card, you should consider the following features:

Welcome bonus

A high welcome bonus will help you achieve your travel goals much faster. Some credit card bonuses are high enough to cover a round-trip international business class ticket. You’ll incur a 2-5 point credit score hit from every inquiry, so make it count. You should aim for a welcome bonus of at least 50,000 points, and plenty of cards meet that criteria.

Credit card application rules

Remember that some banks have strict application rules when applying for credit cards. For example, American Express limits welcome bonuses to one per lifetime. Meanwhile, Chase’s infamous 5/24 rule prevents you from being approved for a new card if you’ve had five or more in the last 24 months.

Be sure to familiarize yourself with these rules before applying for a card to avoid unnecessary rejection.

Travel perks

Many travel rewards cards come with valuable perks like elite status, airport lounge access, airline fee credits, and annual free nights. Think about which of these perks you’re likely to maximize every year. Doing so can help you choose the best credit card and figure out if the card is worth renewing every year.

Annual fees

Travel hacking can get expensive if you’re not careful about annual fees. Rewards credit card annual fees range from $89-$695. It’s easy to get tempted by a high welcome bonus, but annual fees can dent your travel budget if you’re not careful.

Before settling on a credit card, explore the lower or no-annual-fee version to see if it’s a better fit.

For example, the Capital One Venture X Rewards Credit Card may seem appealing with its welcome bonus, but you’ll pay a lower annual fee with the Capital One Venture Rewards Credit Card .

Step 4: Other ways to earn points

Credit card welcome bonuses are the fastest way to earn points, but they’re not the only way. You can earn points from shopping portals, dining rewards programs, completing surveys, and more.

Shopping portals:

- American AAdvantage eShopping

- Alaska Mileage Plan Shopping

- Delta SkyMiles Shopping

- Free Spirit Online Mall

- Hilton Honors Shopping Mall

- JetBlue TrueBlue Shopping

- Southwest Rapid Rewards Shopping

- United MileagePlus Shopping

Dining rewards programs:

- American AAdvantage Dining

- Alaska Mileage Plan Dining

- Delta SkyMiles Dining

- Free Spirit Dining

- Hilton Honors Dining

- IHG Rewards Club Dining

- JetBlue TrueBlue Dining

- Marriott Eat Around Town

- Southwest Rapid Rewards Dining

- United MileagePlus Dining

Airline companion passes

Airline companion passes are one of the best travel hacking tools to stretch your points further. Some passes are issued annually as a credit card benefit, while others have to be earned. In most cases, you can save 50% or more on airfare with a companion pass.

Here’s a look at companion passes you should consider adding to your travel hacking arsenal:

Alaska Airlines Famous Companion Fare

The Alaska Airlines Famous Companion Fare is a great travel hacking tool for west coast flyers. The pass is issued as part of the welcome bonus on the Alaska Airlines Visa® credit card and reissued annually. Considering the Alaska card has a reasonable annual fee, this is a terrific benefit.

Simply book a companion on the same flight and pay just $99 (plus taxes and fees).

American AAdvantage

You can get an American Airlines Companion Certificate from one of four co-branded credit cards. The spending requirement ranges from $20,000 to $30,000 per year. Once you’ve secured the certificate, you can use it to cover a companion’s airfare for just $99 plus taxes and fees.

- Barclays Aviator Red World Elite Mastercard: Spend $20,000 in a year

- AAdvantage Aviator Silver Mastercard: Spend $20,000 in a year

- AAdvantage Aviator Business Mastercard: Spend $30,000 in a year

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard®: Spend $30,000 in a year

The American Airlines Companion Certificate is only valid on round-trip economy class tickets within the contiguous U.S. For Puerto Rico and U.S. Virgin Island residents, the pass is good for round-trip flights originating in those destinations.

British Airways Travel Together Ticket

The British Airways Travel Together Ticket is issued to British Airways Visa Signature® cardholders who spend $30,000 in a calendar year . This perk can take the sting out of high fuel surcharges imposed on British Airways award tickets transiting through London.

The Travel Together Ticket is valid in all cabins, including first class and international fares .

Delta Companion Passes

Delta has two companion passes: one is valid on economy class tickets only, while the one issued through the Delta SkyMiles® Reserve Card can be applied to first-class travel. You’ll pay just $80 for your companion’s ticket, which is a bargain — especially when using it for first-class flights.

Note that the Delta companion tickets are not valid on award flights or basic economy tickets.

Here’s a list of cards you can earn the companion pass with:

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

Iberia airfare discount

Iberia offers a $1,000 airfare discount on two tickets booked on the same flight. You can earn it by spending $30,000 on the Iberia Visa Signature® Card per calendar year. It’s valid in all cabins, providing ultimate flexibility.

Southwest Companion Pass

The Southwest Companion Pass is one of the most popular travel hacking tools out there. You can get one after completing 100 segments or earning 125,000 Southwest points in a calendar year, though the requirement is increased to 135,000 points in 2023. However, points earned from the Southwest credit card welcome bonuses count towards the pass.

It only takes one business or one personal card welcome bonus to earn the Southwest Companion Pass:

- Southwest Rapid Rewards® Plus Credit Card : Earn 50,000 points after you spend $1,000 within the first three months of account opening

- Southwest Rapid Rewards® Priority Credit Card: Earn 50,000 points after spending $1,000 within the first three months of account opening

- Southwest Rapid Rewards® Premier Credit Card: Earn 50,000 points after spending $1,000 within the first three months of account opening

- Southwest Rapid Rewards® Premier Business Credit Card: Earn 80,000 bonus points after spending $5,000 within the first three months of account opening

Redeeming points

You’ve accrued thousands of points and are ready to start booking your dream vacation. Now what? Redeeming points isn’t exactly easy, and that’s by design. Loyalty programs count on members not doing their due diligence to get as much out of their points and miles as possible.

While booking the first award that pops up in the search result is easy, that’s not the best way to stretch your points. Here are a few concepts you should familiarize yourself with to get the most out of your points:

Stopovers and open jaws

While a simple round-trip flight is great, you can stretch your points further by incorporating stopovers and open jaws into your flights.

A stopover is when you visit an additional destination on your way to your final destination or home. Several airline loyalty programs allow you to add a free stopover to award flights:

- Alaska Mileage Plan (free stopover on one-way awards)

- ANA Mileage Club ( one free stopover and one open-jaw on round-trip awards)

- Cathay Pacific Asia Miles ( up to four destinations per itinerary)

- Emirates Skywards (one free stopover per round-trip)

- Japan Airlines Mileage Bank ( three stopovers or two stopovers and one open-jaw )

- Singapore Krisflyer ( one stopover and one open-jaw per roundtrip flight )

- United MileagePlus (one free stopover within the same region per round-trip flight)

Open jaws are another great way to add a destination to your itinerary. An open jaw is when you return from a different destination than you flew into.

One example of an open-jaw ticket is if you fly from New York to London and then return home from Paris. Many people book this route with Avios because British Airways imposes hefty fuel surcharges on flights departing from London. Savvy travelers will take a train to Paris and fly back from Charles de Gaulle to save money.

But booking an open-jaw doesn’t have to be about saving money. It’s a great way to see multiple destinations on the same trip, especially in Europe, where connecting flights are relatively cheap. Here’s a list of loyalty programs that allow open jaws on round-trip award tickets:

Fourth and fifth night free

Some hotel programs offer free nights when you redeem points for consecutive nights at one property. These deals can help you save as much as 25% on an award stay. The most generous is IHG One, which offers a fourth night free to IHG Rewards Traveler, IHG Rewards Premier, and IHG Rewards Premier Business card members. Meanwhile, Marriott members and Hilton elites get the fifth night free on award stays.

These discounted award rates can help you save thousands of points and book extra free nights at no cost. Factor this into your award-booking strategy, and you’ll stretch your points further.

Take advantage of sweet spots

Sweet spots are awards that are significantly discounted compared to other loyalty programs. Both hotels and airlines have sweet spot awards that can help up your travel hacking game.

For example, Turkish Airlines offers round-trip economy class tickets between the mainland U.S. and Hawaii for just 15,000 miles. That’s what some loyalty programs charge for a one-way ticket, making this an excellent sweet spot award.

Travel hacking is all about finding ways to stretch your points further. You can do this with tactics like searching for generous credit card welcome bonuses, booking flights with stopovers and open jaws, taking advantage of hotel programs that offer free nights, and looking for airline sweet spots.

With a little bit of effort, you can travel hack your way to (nearly) free travel.

Happy travels!

Your money deserves more than a soundbyte.

Get straightforward advice on managing money well.

Most financial content is either an echo chamber for the "Already Rich" or a torrent of dubious advice designed only to profit its creators. For nearly 20 years, we've been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS. Join us today.

We hate spam as much as you do. We generally send out no more than 2-3 emails per month featuring our latest articles and, when warranted, commentary on recent financial news. You can unsubscribe at any time.

What is travel hacking and how do I start?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- • Personal finance

- • Credit cards

- • Rewards credit cards

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Travel hacking can help you score free or discounted flights, hotel stays and more by strategically using rewards earned from credit cards.

- To get started, set a travel goal for yourself and investigate various airline rewards programs. You’ll then want to choose a travel credit card based on factors like your credit score, interest rates and the ability to transfer rewards to partner programs.

- Using shopping portals and dining rewards programs is another way to score extra points, along with taking advantage of card-linked offers from programs like Amex Offers and Chase Offers.

- Stay on top of “mistake fares” by signing up for notifications from airfare deal sites, and consider booking travel during award sales or off-peak travel seasons.

Over the last decade, travel hacking has become a mainstream phenomenon. That’s largely thanks to social media, with influencers showing off exotic destinations on Instagram, reached through the clever use of rewards.

And the appeal is widespread. Families can significantly bring down the cost of a Disney vacation , while the aspirational crowd can book first-class tickets for pennies on the dollar.

As someone who has been travel hacking for over a decade, I’ve seen and done it all. It’s a rewarding hobby that can open up a world of travel opportunities. By hacking flights and hotels, you can save substantially on these expenses.

What is travel hacking?

Travel hacking typically refers to the variety of ways you can earn points and miles toward future travel, often without flying or staying at hotels. It involves strategically using credit card points or miles, or those earned with airline and hotel programs, to score discounted (or free) travel and other perks.

How to start travel hacking

If all of that sounds exciting and you’re eager to get going, here are some tips to help you get started:

The first step in your travel hacking journey is to set a travel goal. Earning points without knowing what you’re working toward can be an exercise in futility. When I started back in 2011, I made the mistake of mainly accruing Delta SkyMiles and American AAdvantage miles for a trip to Europe. I learned pretty late that American Airlines had a weak route network to Europe at the time, and that United MileagePlus miles would have been a much better option back then.

Think about where you want to go well before you start focusing on how you’re earning points. Then, research the best rewards programs to get you there. Bankrate’s travel toolkit highlights a variety of credit card, airline and hotel rewards programs to help you make the best choice.

Find the right rewards credit card

The easiest way to boost your points balance is with a rewards credit card . After you sign up and get approved, you can typically earn a welcome bonus of 50,000 or more points after completing a spending requirement over three or more months. While welcome bonuses are a significant draw, you can also take advantage of category bonuses and annual spending bonuses to maximize your everyday spending long-term.

Those ongoing rewards should be an important factor in your travel rewards card decision . Most people will benefit from credit cards that earn transferable rewards like these:

- American Express Membership Rewards

- Citi ThankYou points

- Chase Ultimate Rewards

- Capital One miles

These currencies offer flexibility because you can transfer them to several airlines or hotel programs at a 1:1 ratio. If one transfer airline doesn’t have award space on your desired travel dates, then you can transfer them to one that does. You’ll have options and stay protected against possible program devaluations as well.

Once you have a general sense of which credit cards to apply for, make sure you qualify and prepare to meet any application requirements. Here are a few things to consider:

- Your credit score . As you might expect, the best travel rewards cards require good credit . To incorporate credit cards into your travel hacking strategy, you’ll need a score of at least 700. If you’re still working on it, consider waiting to apply when you have a better chance of approval.

- The application rules . Every bank has its own rules pertaining to credit card approvals. Chase has the infamous 5/24 rule that restricts welcome bonuses if you’ve applied for five or more credit cards in the last 24 months. Amex’s once-per-lifetime restriction means if you’ve earned a welcome bonus for one card, you likely won’t be able to earn the same bonus again. There are many more credit card application rules to be aware of. Knowing them before you hit “apply” improves your chances of being approved for a travel rewards credit card.

- How much you’ll pay . If you struggle with paying your credit cards off every month, travel hacking with credit cards is probably not for you. That’s because the interest rates on these credit cards are generally high and will negate any rewards you earn. If you’re not confident you can pay off your balances, you’re better off skipping these credit cards and using alternate methods to earn points and miles .

Use shopping portals

Shopping portals are the way to go if you want to further maximize your points and miles earnings. Nearly every major loyalty program has a shopping portal you can earn rewards with, whether it’s your card issuer or your airline of choice. You’ll earn at least one extra point per dollar spent, plus the points from your credit card.

You can even more easily ensure you’re earning the most points possible with a shopping portal aggregator like Cashback Monitor . Type the name of an online merchant, and you’ll get a list of shopping portals alongside their earn rates.

Many shopping portals also offer spend-based bonuses around the holidays and right before the school year starts. These can be pretty lucrative and help you reach your travel goals faster.

Sign up for dining rewards

Dining reward programs are similar to shopping portals in that they require minimal effort to earn extra points. You can join one of seven airline and three hotel-affiliated dining programs to earn up to 8 additional points per dollar spent, including:

- Alaska Airlines Mileage Plan Dining

- American Airlines AAdvantage Dining

- Choice Hotels Eat & Earn

- Delta SkyMiles Dining

- Hilton Honors Dining

- IHG One Rewards Dine & Earn

- JetBlue TrueBlue Dining

- Spirit Airlines Free Spirit Dining

- Southwest Airlines Rapid Rewards Dining

- United Airlines MileagePlus Dining

These programs can even offer first-dine bonuses and extra points when you write reviews or meet certain spending thresholds every year.

You can join all of these programs, but since they’re all part of the same network, you can’t register the same credit card with more than one program at a time. That shouldn’t be too challenging, even if you only have one credit card. Simply register your card with the program of your choice, earn the first-dine bonus and repeat with the other nine programs until you’ve earned them all. Don’t forget to use a credit card that earns bonus points on dining to maximize your earnings.

Get creative with earning rewards

Once you’ve gotten into the habit of maximizing your everyday purchases, it’s time to get creative. What else can you charge to your credit card while still maintaining a balance that you know you can pay off at the end of the month? I once convinced my boss to let me pay a $35,000 supplier invoice with my credit card. I’ve earned thousands of points on rent and mortgage payments through Plastiq . I’ve also used retail arbitrage to flip dresses worn by Kate Middleton and earn spending requirements.

Think outside the box and you could be well on your way to discovering new ways to boost your points.

What are the best travel hacks?

There are countless travel hacks out there, and the best ones are top secret (for good reason). But if you’re just getting started and want to keep things simple, here are the most valuable hacks to know:

Card sign-up bonuses

Credit card sign-up bonuses are by far the best way to get a lot of points within a short time frame. You may even piece together a luxury vacation by strategically applying for credit cards .

Just make sure you’re aware of any issuer rules that take into account how many cards you’ve applied for in the past. You should also be careful when applying to more than one card in a short time frame. Not only will you need to spend even greater amounts to get more than one bonus, but you can hurt your credit score and make yourself look risky to potential lenders.

Double (and triple) dipping

Double- or triple-dipping is one of the best travel hacks out there. Stacking travel hacking methods can help you earn significantly more miles. For example, let’s say you’re in the middle of a home renovation project — you’ve got expenses, and they’re big. If you can do some shopping online for your project, you can double-dip by earning rewards on your credit card and through an online shopping portal.

If you happen to have an Amex card, you could triple dip by taking advantage of Amex Offers . I’ve managed to do this for large expenses like travel bookings and furniture purchases. Before you buy, think about all the possible ways to earn points and find opportunities to combine them.

Mistake fares

There’s more to travel hacking than just earning and redeeming points. One of my favorite ways to hack travel is through mistake fares. Sometimes airlines mess up and publish fares well below market value. I’m talking about a $450 round-trip business class ticket to Shanghai or a $120 economy class ticket to Abu Dhabi. Over the years, there have been dozens of great mistake fares that travel hackers have taken advantage of.

In most cases, airlines have honored these mistake fares, which has been great for savvy travel hackers who managed to book them. Just know that you may need very flexible travel plans and dates to take advantage. A great way to stay on top of mistake fares is to sign up for alerts with Airfarewatchdog and The Flight Deal . These sites parse the web for amazing deals and share them on social media and their websites when they come around.

Maximizing award redemptions

When you’re ready to book that dream vacation you’ve been saving for, there are three types of awards you should look into: Sweet spots , off-peak award charts and award sales. Sweet spots, in particular, can help you save significantly on award flights.

Many airlines and hotel chains offer peak and off-peak award pricing. By being flexible with your travel dates, you can stretch your hard-earned points further.

How can I travel for free?

Despite what travel influencers like to put into their photo captains, there’s no such thing as free travel. You will almost always pay a fee to earn or redeem points. Whether it’s your credit card annual fee, award flight taxes or resort fees , there will always be costs.

But by leveraging credit cards, points and loyalty programs, you can book incredible travel experiences at a fraction of the cost.

The bottom line

Travel hacking can allow you to travel further and in bigger ways than booking with cash. From hotel, airline and transferable points currencies, you can travel for little to no relative cost by using credit cards to pay for your everyday expenses.

If you’re thinking about opening a travel rewards credit card, keep in mind your travel goals, the card’s sign-up bonus and benefits and how you plan to redeem the rewards you earn. From there, you can try more advanced methods of earning points such as through shopping portals or dining programs.

Don’t forget the responsibility that comes with credit card usage. Travel credit cards have higher interest rates, so be sure to pay your card off in full each month as often as you can.

How much are points and miles worth in 2024?

8 of the best ways to use points and miles for travel

Why you should use your issuer’s travel portal

How to earn elite airline status with credit cards

Annoying travel fees you can avoid with the right card lineup

9 major hotel chains with free breakfast

Traveler’s guide to the best frequent flyer programs

Traveling around the world with credit card points

Bankrate's Travel Toolkit

Bucket List

Travel Guides

Travel Hacking 101 – The Beginner’s Guide to Travel Hacking

Table of Contents

Have you ever wondered how some people travel the world so frequently? Wondering how to travel more for less? Travel hacking tips can help you turn your wanderlust into reality. This beginner’s guide to travel hacking will show you how to leverage credit card rewards, points, and miles to make your travel dreams come true while keeping your budget intact.

We have all sat on our couches scrolling through social media, seeing people’s posts while they travel the world and wondering how they manage to jet-set across the globe so often.

Traveling the world is a dream for so many of us, but the cost often makes it seem that this dream is out of reach.

The answer lies within the art of travel hacking. Often concealed from what we see on social media, a substantial component of the travel strategy for many influencers, business travelers, and frequent flyers revolves around the skillful use of points, miles, and rewards.

If you are from a Latin background, I know what you are thinking… “Credit cards are no good.” “Don’t ever get credit cards.” In many Latino households, we are taught that credit cards are your ruin and that you should never have one. We are often taught to fear credit cards and the uncontrollable debt that they can bring. Why? There are many reasons, stereotypes, and myths surrounding this topic. You can read more about them by clicking here.

You should know that there is a safe and strategic way of using credit cards to your benefit. I know you are gasping in Latina , but leveraging these miles and rewards programs can open up many doors to your travel dreams, and I am here to guide you through getting started. So, keep reading to learn what travel hacking is and how to use it to your benefit.

So what is Travel Hacking?

It is a strategy to accumulate and redeem rewards, miles, and points to make your travel aspirations a reality. The objective? To travel more, pay less, and indulge in extraordinary experiences that were once considered unattainable or reserved for a select few. It requires time, effort, and patience to research the best use of your miles and points.

This blog post is a comprehensive guide that will show you the ins and outs of travel hacking, empowering you with the knowledge and tools to embark on your own budget-friendly adventures that will leave you with unforgettable memories and extra money in your pocket.

Benefits of Travel Hacking

More travel.

Imagine a world where airfare and accommodation expenses no longer stop you from exploring new horizons because you only pay taxes on the flights and lodging, or lodging is entirely “free”. Travel hacking opens up so many possibilities for budget-conscious travelers.

A fancier travel experience

Do you want to experience the luxury of business class flights or deluxe suites in five-star hotels? With travel hacking strategies, these upgrades can become a regular occurrence.

Bigger travel budget

Flights and lodging tend to be the most significant expenses when it comes to travel. By saving on these two categories, you can allocate more funds for immersive activities like tasting the local cuisine, guided tours, and authentic cultural experiences.

Destination variety

Travel hacking gives you the freedom to explore a broader range of destinations without worrying about excessive costs.

Risks of Travel Hacking

It is vital to be aware of the potential risks and pitfalls that come with travel hacking. Some Latino parents’ myths and misconceptions about using credit cards stem from these risks. Here are eight of the most significant risks associated with travel hacking:

Debt Accumulation

Travel hacking requires responsible credit card use, including paying off your balances in full each month to avoid interest charges. If you are unable to manage your spending and credit card balances, you could accumulate debt that outweighs the value of the rewards you earn. High-interest rates on credit card debt can quickly counteract the travel savings you may earn by travel hacking.

Credit Score Impact

If you are new at travel hacking, create a strategy for opening credit cards for the sign-up bonuses. Opening too many cards too quickly may cause a temporary dip in your credit score. You may also be denied new cards as your credit score decreases. You can use websites like Credit Karma or Credit Sesame to gain. a general understanding of your credit score. However, please remember that there will be some variance between your actual credit score vs the score that these websites have listed for you.

Annual Fees

Many premium credit cards with valuable rewards come with annual fees, some as high as $695 per year. While the benefits may outweigh the fees, evaluating whether the rewards you’ll earn will justify these fees is essential. Some travel hackers might find themselves paying more in annual fees than the value of the rewards they earn.

Availability and Redemption Hurdles

Securing award availability for flights and accommodations is a process that isn’t guaranteed. You might encounter challenges when redeeming your hard-earned points or miles for your preferred travel dates or destinations, especially when dealing with peak travel seasons or sought-after locations. Furthermore, certain credit cards offer a companion certificate feature in your annual fee. Regrettably, this feature often falls short of delivering value due to its restrictions. Attempting to use companion certificates can often lead to frustrating experiences. If the companion certificate is less restrictive, it will grant your companion an itinerary that mirrors your own, enabling them to share your travel experience for just the cost of applicable taxes.

Account Closure and Loss of Rewards

Credit card issuers closely monitor accounts for suspicious activity, including excessive manufactured spending or other practices that might be perceived as abuse. Engaging in these practices can lead to account closures, loss of earned rewards, and even make it difficult to obtain future credit cards.

Data Privacy Concerns

Scammers know that travel hackers accumulate miles and points intending to use them for flights and accommodations. This can make travel hackers a target for credit card fraud. If your credit card information or reward account is hacked, you may lose your rewards without being able to recuperate them. Increased data exposure makes you more susceptible to phishing attacks, scams, and identity theft attempts. Cybercriminals can use the information you share to create convincing phishing messages or target you with fraudulent activities.

Data Breaches

Sharing personal and financial information with multiple companies and third-party apps increases the potential exposure of your data to cyberattacks or data breaches. If any of the entities you’ve shared information with experiences a breach, your sensitive data could be compromised, leading to identity theft, financial loss, and other security issues.

Third-Party App Security

Some travel hacking strategies involve using third-party apps or platforms to manage rewards, track points, or find deals. Keep in mind that not all third-party apps may have the same security measures in place. Using unsecure apps could expose your data to unauthorized access or misuse.

Is Travel Hacking Legal???

Yes, Travel Hacking is entirely legal. As discussed above, travel hacking involves utilizing various strategies to maximize travel rewards, points, and miles to save money on travel expenses like flights, accommodations, etc. These methods usually involve strategically using loyalty programs, credit card rewards, and promotional offers.

While Travel Hacking is legal, using these programs ethically and responsibly is essential, using legitimate methods to earn rewards and avoiding fraudulent or illegal activities. Some points to keep in mind:

- Terms and Conditions: Always adhere to the terms and conditions of loyalty programs and credit cards. Violating these terms could result in the loss of rewards, account closure, or even legal action.

- Avoid Fraudulent Activities: Engage only in legitimate activities to earn rewards. Fraudulent actions like creating fake accounts, misrepresenting information, or abusing promotions can have serious consequences.

- Be Honest and Transparent: If you’re sharing your travel hacking experiences or tips online, be transparent about your methods and practices. Misleading others could lead to damage to your reputation and potential legal concerns.

- Manufactured Spending Caution: Some travel hackers engage in “manufactured spending,” which involves artificially inflating spending to earn rewards. While not illegal, it can be a gray area and should be approached carefully.

What is manufactured spending?

Manufactured spending involves creating transactions that appear to be regular purchases but are actually intended to generate rewards. This can be achieved through various methods, such as purchasing gift cards, money orders, prepaid cards, or other items that can be easily liquidated back into cash.

Several techniques are used in manufactured spending, including:

- Gift Card Purchases: Buying gift cards with a credit card and then using them to make regular purchases or liquidate them into cash. Credit card companies have caught on to this and will mention that gift card purchases will not count towards your initial spend. Some business credit cards allow the purchase of gift cards to count towards the spend that would earn you the rewards bonus. It is important to read the terms and conditions before you purchase gift cards for this purpose, as you may risk having your account closed. Be very careful when using this technique.

- Prepaid Card Loading: Loading funds onto prepaid cards using credit cards and subsequently using these prepaid cards for regular spending.

- Money Order Purchases: Buying money orders using credit cards, which can then be deposited into your bank account or used to pay off the credit card bill.

- Merchant Category Code (MCC) Manipulation: Identifying merchants that code as a different category (often one that earns more rewards) and making purchases there. Credit card companies monitor for unusual or excessive behavior, and misrepresenting transactions or abusing the system could lead to account closures or loss of rewards.

Want to be a Succesful Travel Hacker?

You will need a solid financial foundation, which includes handling your money like a boss, making smart decisions, and planning your moves strategically.

How to start travel hacking?

Step 1: Have your financial house in order.

You must have a good credit score, pay off your existing debt, manage your current credit card balances, and live within your means.

Start by understanding your credit score and its significance in the travel hacking process. A good credit score increases your chances of being approved for travel and premium rewards credit cards. These travel and premium credit cards come with valuable sign-up bonuses and benefits.

Pay off your existing debt. Keeping a running balance on your card is not really beneficial when it comes to travel hacking. You will pay more interest than you would if you gain travel rewards.

Step 2: Research Loyalty Programs

Review the programs for airline, hotel, and credit cards and understand how loyalty programs work their benefits, and their limitations. Research how to earn points or miles, how the redemptions work, and what fees, if any, you will need to pay to redeem your rewards.

Consider credit cards that offer points that can be transferred to multiple airlines and hotels, such as Chase Ultimate Reward, American Express Membership Points, Citi Thank You Points, and Capital One Travel Rewards. A stash of these points accumulated gives you maximum flexibility in your travel redemptions.

Step 3: Choose the Right Credit Cards:

Focus on credit cards that align with your goals and have large sign-on bonuses and no foreign transaction fees.

Decide what type of travel experiences you want to have. Do you want to focus on earning free flights, free hotel stays, or both? Your goals will guide which credit cards you will apply for.

Pay attention to sign-up bonuses and required spending: If you can’t meet the required spending, do not apply to that credit card. Sign-up bonuses are one of the easiest ways to accumulate thousands of points or miles.

Evaluate whether the benefits and rewards offered by a credit card outweigh its annual fee. Some premium cards come with higher annual fees but offer extensive perks that can offset the cost.

The most important tip I can give you is only open credit cards that you can responsibly manage.

So, What’s Next?

As you can see, travel hacking opens the doors for you to turn your wanderlust into reality. You can redefine how you travel by mastering the art of leveraging points, miles, and rewards and redeeming them for flights and hotel stays. Use the knowledge you’ve gained here to accumulate points that will bring you closer to your dream destinations. Let travel hacking help you live your wildest, budget-friendly, wanderlust-fueled experiences.

Don’t forget to click on to explore the most common misconceptions about credit cards and their use. There are many myths surrounding credit cards in Latino households and it is time that we dispel some of these myths. If you have no credit or are working on increasing it, make sure to learn how you can travel hack without credit .

And while you’re at it, why not subscribe to the newsletter for even more travel hacks, tips, and exclusive offers?

previous post

Maribel Monsalve

Meet Maribel, The Queen of Trips, a survivor who turned her cancer journey into a source of inspiration for fellow travelers. Join her as she fearlessly explores the world, showing that life after cancer is a testament to resilience and the power of living fully.

Related Posts

Wanderlust on a Budget: Essential Credit Card Travel Hacking Strategies You Need to Know

Celebrating Life: 5 Travel and Life Goals for My 44th Year

How To Travel Hack Without Credit or Credit Cards

Post a comment cancelar respuesta.

Save my name, email, and website in this browser for the next time I comment.

Where should you travel next? Take the free quiz!

How to Travel Hack: Travel Hacking 101

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

You might have heard of people “hacking” their way to free business-class flights or swanky hotel stays—and you might have thought it sounded too good to be true. But travel hacking is a legitimate (and fun) hobby that can save you serious money on everything from luxurious beach getaways to backcountry road trips.

Travel hacking can seem daunting at first, but the good news is you can make it as simple or complex as you want. In this guide to travel hacking for beginners, we’ll cover the basics of how to travel hack your way to free trips.

Table of Contents

The Basics of Travel Hacking

There are two basic tenets to becoming a travel hacker. No matter how detailed you want to go, whether you just want to give it a whirl or you’re hoping to become a Jedi Grandmaster Yoda-level hacker, it all boils down to this:

- Earning the most points and miles possible, and

- Finding creative ways to redeem your points and miles to get the most value out of them.

FREE TRAVEL QUIZ

Step 1: Earning Points and Miles

The best place to get started travel hacking is learning how to maximize the points you earn. The faster you rack up points, the sooner you’ll have enough for your dream vacation. Here are some of the simplest ways to accrue points as you learn how to travel hack.

The obvious way to earn points and miles is by traveling. Airlines, hotels, and rental car companies all have membership programs to encourage you to stay loyal to them, so every time you fly or spend the night, you get points.

This doesn’t mean you need to go signing up for a hundred accounts as soon as you start travel hacking. But every time you fly a new airline or stay in a new hotel chain, be sure to join their program so you can score those points. This is an important lesson for travel hacking beginners: Never leave points on the table!

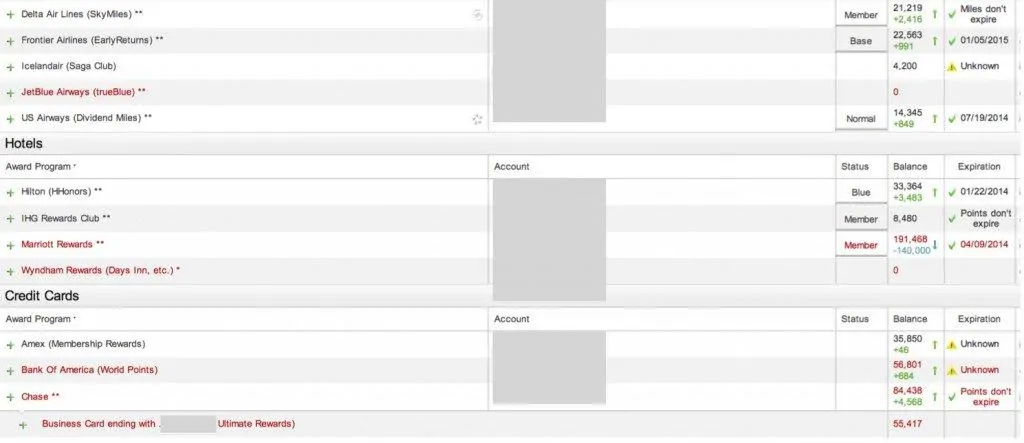

Feeling overwhelmed already? I was too, even when I used to only fly one airline—because I could never remember my login info. Once I started travel hacking and got a few frequent flyer numbers, I made a spreadsheet to keep track of my login info. It’s made the whole process so much easier.

Airlines and hotels often run promotions, like “Book a flight in the next two months and get 5,000 bonus points” or “Stay two nights and earn double points.” These can be very useful to travel hackers.

You usually have to register for promotions, which just means clicking a button. It’s helpful to log in to your loyalty accounts every couple of months to register for any promotions that have popped up, in case you end up booking something in the near future.

Last February I booked seven nights at a Hyatt in Maui using points. It totally slipped my mind that I had already registered for their 2022 New Year promotion. After my trip, I was surprised to find 2,022 bonus points for every two nights deposited in my account, which amounted to over 6,000 free points—for a stay that didn’t cost me a penny.

Dining Portals

Contrary to popular belief, you don’t need to be on the road (or in an airport) every weekend to score serious points and miles. That’s because there are lots of ways to earn points other than traveling. For instance, many major airlines and hotel chains have dining “portals,” where you can earn extra miles or points when you eat out.

Not all restaurants are on the portal, but for the ones that are, you can usually earn a few points per dollar. All you have to do is make an account for free and add your credit card information to link your card. Then when you visit one of the restaurants on the list, be sure to pay with your linked card to earn points.

Keep in mind these points are separate from any travel points your credit card earns (we’ll get to those in a minute).

The best part of dining portals is their promotions. Most will have one when you first sign up—for instance, when you join Southwest’s Rapid Rewards dining program, you’ll get 500 bonus miles the first time you dine as long as it’s in the first 30 days. Besides earning some extra points, it’s a fun way to discover new restaurants in your area.

Shopping Portals

Most airlines also have online shopping portals, which work a little differently. Once you’ve set up your account with your frequent flyer number, you click through the portal’s link to the online store you want. Then when you make a purchase, you earn extra points.

The number of points per dollar varies depending on the retailer and the day. For instance, right now on United’s MileagePlus shopping portal, you can earn 1 mile per dollar at Groupon and 5 miles per dollar at Sephora. Petsmart usually earns .5 miles per dollar, but they recently had a special where it increased to 10. I was almost out of dog food anyway, so you can bet I stocked up.

Travel Credit Cards

I saved the best—and trickiest—for last. If you live in the US, credit cards are the biggest avenue to earning points when you become a travel hacker.

But in order for them to be worthwhile, you have to use them wisely. This means following the two cardinal rules of travel cards:

- Thou shalt not carry a balance on thy credit cards.

- Thou shalt not spend more than thy normally would just to earn points.

If you have or expect to have credit card debt, this particular travel hacking method isn’t for you (yet). This is because travel credit cards have sky-high interest rates, so whatever points you earn will be offset by the interest you end up paying.

If you’re comfortable with using credit cards responsibly and paying your balance in full every month, you’re ready to learn how to travel hack with credit cards—so read on.

Choosing the Right Card

The good news is, there are so many travel cards out there nowadays, there’s bound to be at least one that’s a great fit for you. The bad news is, the options can be overwhelming at first.

For travel hacking beginners, I always recommend starting with a long-term strategy in mind. Find a card that’s a good fit for your lifestyle (more on that in a minute), and that you’ll want to keep in your wallet for years to come.

Advanced travel hackers are constantly adding new cards, and sometimes canceling old ones, and they might have as many as 30 cards at any given time. I’m not there yet—I have a grand total of five cards, and I started out with just one.

Choose one or two cards that make sense for you in the long run. Look at cards’ benefits, which include:

- Bonus points on certain categories of purchases, such as groceries, dining, or drugstores.

- Free travel. For example, the Southwest Priority card provides $75 in statement credits on Southwest purchases per year, while the World of Hyatt card provides one free night at a Hyatt hotel per year.

- Travel perks. Many cards offer perks that make travel more comfortable, like elite status at a hotel chain or access to airport lounges.

- Other perks. These are as varied as the credit cards that offer them, ranging from Peloton membership to statement credits on groceries. If you use them, these perks can save you some serious cash.

Don’t forget to look at cards’ annual fees, too. Many people shy away from cards with fees, but trust me: they can be worth it. Just be sure to weigh the fee against the perks and points to make sure it’s worth it for you.

When people ask me what the best travel card is, I say it depends. It’s all about finding the right fit for you when you start travel hacking. If you’re loyal to a particular airline or hotel chain, you should look into their cobranded credit card options. If not, there are plenty of great all-purpose cards like the Chase Sapphire Preferred or Capital One VentureOne.

My favorite resource for anyone who wants to learn how to travel hack is The Points Guy . They have a ton of information, including detailed reviews of pretty much every travel card on the market.

Scoring the Signup Bonus

Once you have an idea of the right card for you, the first thing to consider is its signup bonus. To try to win your business, credit card companies offer lucrative signup bonuses of tens of thousands of points. When redeemed for travel, these bonuses alone can be worth thousands of dollars.

But you have to make sure you can earn the signup bonus, which usually requires a certain amount of spending in a certain amount of time, such as $4,000 in the first three months. This might seem like a lot, but it’s attainable for most people with some planning.

Going back to the second cardinal rule, don’t buy something you don’t want just to get the signup bonus. However, if there’s a big purchase you’ve been considering, it’s a good idea to time your new credit card to coincide with it. I’ve timed past credit cards with booking big trips, buying new furniture, and even getting LASIK in order to put these high-dollar purchases toward the signup bonus.

If you aren’t redecorating your home or getting eye surgery anytime soon, the holidays are a good time for many people to get a new card. Wait until you’ve got that card in hand before buying gifts for your whole family.

If that’s still not enough to reach your signup bonus, there are more creative ways to “inflate” your spending. Ask family members if you can buy their new furniture/Xbox/plane tickets and have them pay you back. When you go out with friends, pay the tab with your new card and have everyone Venmo you.

Which Card to Use?

When you become a travel hacker, you learn the importance of staying organized. It’s essential to keep track of your credit card perks and points, especially once you have two or three cards in your wallet.

I have a spreadsheet summarizing each card’s point structure, so I know which card to use for which purchases. For instance:

- I use my Chase Sapphire Preferred at restaurants and to book flights and hotels, because it earns 3 points per dollar on dining and 2 on travel.

- I use my Chase Freedom Flex at drugstores, which earn 3 points per dollar.

- I use my Southwest Priority card on Southwest purchases, which earn 3 miles per dollar, and on cable and internet bills, which earn 2 per dollar.

- I use my World of Hyatt card for Hyatt purchases, which earn 4 Hyatt points per dollar, and for gym memberships, which earn 2 per dollar.

- For everything else I use my Capital One Venture One, which earns a flat rate of 1.25 points on all purchases.

The goal is to get as many points as possible on stuff you’d be buying anyway. Of course, you want to make sure the points are points you can actually use. For example, If you always stay in AirBnBs when you travel, it makes no sense to earn Marriott Bonvoy points on a cobranded Marriott card.

If this sounds too complicated, I get it. I was overwhelmed at first, but after a while it started to make sense—and it started to be fun . You might hear some travel hackers referring to “the points and miles game,” because that’s what it feels like. It should be fun, so go as in-depth (or not) as you want.

Now that you know how to accrue points, the next step in learning how to travel hack is making the most out of them when you redeem them. We’ll cover this in the next blog post. Until then, happy earning!

Step 2: Redeeming Points and Miles

If the first step of learning how to travel hack is earning as many points and miles as possible, the second is redeeming them. There are as many ways to redeem points as there are to earn them, so we’ll start with the heavy hitters to kick off your travel hacking journey.

Credit Card Portals

Most travel card companies nowadays have their own travel “portal,” a website where you can book flights, hotels, rental cars, and more—and a place where you can spend the points you’ve earned on your card.

Sometimes you can book travel on these portals and pay directly with your points; other times you’ll pay cash and then get reimbursed as a statement credit. Either way, it comes out to free travel!

Usually the rate is one point to one cent. So for instance, a $500 flight would cost 50,000 points, giving you a value of 1 cent per point. Sometimes it’s a little higher—like on the Chase portal, where you can redeem Chase Ultimate Rewards points at a value of 1.25 cents per point, lowering the cost of your $500 flight to 40,000 points.

This is the easiest way to redeem your miles, but not the most valuable. Since the second step to becoming a travel hacker is getting the most value from your points, you want to aim for more than 1 cent per point.

The Points Guy regularly updates their points and miles valuations , which you can use as benchmarks for your redemptions. For instance, Chase Ultimate Rewards points are currently valued at 2 cents per point. So most travel hackers would consider a “good” redemption one where you get at least 2 cents each out of your points.

However, as with credit cards, it all depends on what works for you. If you just want the simplest way to spend your points, there’s no shame in using the portal—and you’re still getting free travel that you otherwise would have to pay for.

But if you’d like to go a little deeper into how to travel hack, here are some other ways to get even more value from your points.

Travel Partners

Generally the best, or most lucrative, way to spend your points is by transferring them to travel partners. This can send the value of your points skyrocketing—but it can also get complicated pretty fast. Let’s walk through the basics.

Credit card companies like Chase, Capital One, Amex, and Citi all have a roster of travel partners, including airlines, hotel chains, and sometimes rental car companies. This list varies from company to company, and new partners are added fairly often. You can transfer your credit card points to your membership account on one of these transfer partners.

For example, since United is a transfer partner of Chase, you can go into the Chase website, type in your United frequent flyer number, and tell Chase to deposit some of your points into your United account. (Typically you must deposit them in increments of 1,000.)

Then when you go into your United account, you’ll suddenly have miles—even if you’ve never flown United in your life. You can then use these points to pay for award flights on United.

Returning to our earlier example, the $500 flight we looked up on the Chase portal might only cost 20,000 United miles when booked through the United website. This comes out to an excellent value of 2.5 cents per point.

Transfer partners are a great way to use your points, but there are some things to consider. First of all, you’ll need to set up a loyalty account with the airline or hotel you want. You often need to do this just to search for award flight/night availability, so it’s helpful to set up those accounts early.

Also, keep in mind that once you transfer credit card points to travel partners, you can’t transfer them back. Only transfer them once you know that partner has the flights/nights you want, and make your award booking immediately after transferring the points—because the price could change at any time.

I used this technique for my first big hack, when I was still a beginner to travel hacking. I had just gotten my Chase Sapphire Preferred card and earned a whopping 100,000 points for the signup bonus, plus a few thousand more from the first few months of spending. I found a Hyatt hotel in Maui that cost only 15,000 points per night when booked using Hyatt points. I had just enough Chase points to cover seven nights.

I had never stayed at a Hyatt in my life. But I made a loyalty account, transferred 105,000 Chase points to Hyatt, and a few minutes later had booked a week in Maui entirely free of charge. To book this hotel in cash would have cost over $300 per night, plus taxes and fees (which Hyatt doesn’t charge on award stays). I ended up paying exactly zero and getting a value of 2.2 cents per point—not bad!

Free Travel or Better Travel?

If you ask the experts how to travel hack, the answers will be mixed because there are a couple of different approaches. One is to get as much free stuff as possible so you can stretch your dollars over more trips.

Another is to use points and miles to elevate your travel experience. This means relaxing in airport lounges, getting more comfortable airplane seats, or enjoying the perks of elite status at hotels for much less than these things would normally cost.

When I was first learning how to travel hack, I was in the first camp. But I’ve recently started to understand why so many travel hackers are prioritizing travel luxury over savings when harnessing their points and miles.

On a recent trip to Paris, I wanted to pay for my and my partner’s flights with points. I had a stockpile of Capital One miles, and Air France is one of their travel partners. I found economy seats for around 60,000 Air France miles round-trip, for flights that normally would have cost upwards of $1200. This came out to a value of around 2 cents per point, compared to the valuation of 1.85 cents for Capital One miles.

With free plane tickets in hand, we’d cut the cost of our Paris trip down by over half. But when we checked in for our flight the night before, we started exploring seat upgrade options. We thought we might spend an extra $50 per person to get a little extra legroom. Then we saw that we could upgrade to business class—including lie-flat seats—for $400 per person. We’d never flown business class, and a business-class flight to Paris would normally cost over $3000, so we decided to splurge and try it.

After sleeping through the overnight flight in the comfort of my own personal pod, complete with three-course meal and hot towels, I was hooked. Now I’m planning to learn how to travel hack not just for free trips, but to make my travel experiences more memorable.

Final Thoughts: How to Travel Hack

If you want to become a travel hacker, you can choose whatever style works for you. When you start travel hacking, think about your travel and financial goals and how you can use points and miles to achieve them. There’s no right or wrong.

But I think I’ll add a third cardinal rule to my list: Travel hacking should be fun. Think of it as a game. You’re not competing with anyone else, just solving points and miles puzzles to go on whatever trip you want.

Don’t stress about learning all the ins and outs of how to travel hack just yet. Start with a couple of small steps, and go from there. Explore some travel hacking blogs and sign up for their newsletters (I read the Points Guy’s religiously). Learn at your own pace, and soon you’ll be hacking your way to your dream vacation.

Want to keep reading? Check out these posts next:

- 12 Delicious Food Tours in Munich to Book

- 13 Mouth-Watering San Francisco Food Tours

- 11 Tasty Food Tours in Chicago, Illinois

Rachel Craft started traveling after being cooped up for a year during the pandemic, and now she’s hooked. She loves hiking, biking, snorkeling, and discovering vegan eats in the places she visits. When she’s not busy exploring, she writes fantasy and sci-fi stories for children and teens. You can learn more about her writing at www.racheldelaneycraft.com.

Similar Posts

25 Best Bookstores Around the World

24 Hours in Lucerne Itinerary: How to Spend One Day in Lucerne, Switzerland

Everywhere I Traveled to in 2019: Ranked

Where to go in February in USA: 15 US Destinations for a February Getaway

15 Best Countries to Visit in November for an Unforgettable Trip

13 Best Free Things To Do in Lee Vining, California

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Privacy Overview

Press ESC to close

Travel Hacking: The Complete Beginner’s Guide

Travel hacking is something that you have probably heard of, but there’s a good chance that you don’t fully understand what it is or how it works.

The word ‘hacking’ tends to imply some sort of shady activity, but the truth is that travel hacking – just like gym hacking – is about taking advantage of certain bonuses, offers and incentives to save yourself money.

Not only is it completely legal, but it is actually encouraged. A big part of travel hacking is earning miles, reward points, and statuses to exchange for free flights and accommodation. Banks purchase millions of miles and points in bulk from airlines and hotels so that they can distribute them as signup bonuses and ongoing incentives for their new customers. It’s a win-win for everyone involved.

These incentives – along with some other simple ‘hacks’ – make it possible to take big trips on a small budget, explore parts of the world that you’ve only dreamed about, and travel more often without each trip costing you a small fortune.

There are hardcore travel hackers who dedicate their lives to this stuff. They’re willing to take multiple flights to earn certain bonuses, plan trips based on which route will earn them the most miles, and spend hours reading the fine print in hopes of finding a loophole. While that stuff works, it’s completely up to you how far you take it, and in the end it all comes down to how hard you are willing to work for a bargain.

For me, travel hacking is about minimising the costs of travel so I can travel further, and more often. On my last big trip, I used some of the hacks in this guide – like WWOOFing and RTW tickets (more on these later) – to significantly reduce the cost of 6 months travel in Asia, Australia and New Zealand. If I hadn’t, my dream trip wouldn’t have been possible.

This guide is an introduction to travel hacking, so if you’re already a black-belt travel hacking ninja, it probably won’t be much use to you. But for everybody else, it covers the basics and is a resource you can come back to time and time again.

How To Get Free Flights & Accommodation

How to find cheap flights, round-the-world tickets.

The cornerstone of travel hacking is to maintain multiple accounts of Frequent Flyer miles and points. As your balances build up over time, you’ll be able to redeem the miles and points for valuable rewards all over the world.

The simplest way of getting starting is by signing up for a Frequent Flyer program with your favourite airline, and a loyalty program with a hotel chain of your choice. Most major brands offer some sort of loyalty scheme to keep you as a customer, but the catch is that you only get upgrades and benefits when using that brand. There’s nothing to stop you signing up to multiple loyalty schemes though, and if you’re serious about travel hacking this is something you should do. You can view a list of the top loyalty programs on The Points Guy’s website .

If you do decide to sign up for multiple loyalty programs, then use a service such AwardWallet or TripIt to track all of your points.

If you frequently travel with the same airline or use the same hotels, then joining their free rewards program is a no-brainer. But many of these programs have become less valuable in the last few years due to airline mergers, flight cutbacks, and just general program changes.

Today, the single best way to earn large amounts of miles and points that you can use with multiple airlines and hotels is through credit cards. Just one credit card can be enough to earn a free flight, but in my opinion, you should only consider this as an option if you know you can do the two following things:

1. Pay your credit card bill in full every month.

I’m not a financial advisor, but it is absolutely crucial that you only take on new credit cards if you have the ability to pay your bill in full monthly, and no existing credit card debt.

If you’re new to this, you should start conservatively. Earn a free flight or two and make sure you can handle the responsibility of an extra credit card. After that you can step up your game. After all, what’s the point of earning free flights if you don’t have any spending money!

2. Meet the minimum spend requirements to earn the points.

When you sign up for a travel rewards credit card you must meet their minimum spend requirements in order to earn the points bonus. There is absolutely no point in signing up for one if you can’t reach the minimum spend.

The minimum spend can be anything up to $5000 in the first 3 months.

That sounds like a lot of money, but the idea here is that you charge things to it that you already pay for. Rather than going out and buying a new TV that you don’t need, use it to pay your bills and for other big purchases that you would have made anyway.

The bonuses and minimum spends vary from card to card, and are generally much better in the US than they are anywhere else in the world. That said, there are still some great opportunities for those outside of the US, too. Some long-standing favorites are listed below:

In addition to the initial signing-up bonus, these cards come with incentives to keep using them. For example, the Barclays Arrival Plus gives you 2x miles for every dollar you spend. That means if you spend $2000, you’ll get 4000 miles to redeem.

You’re probably wondering what these points actually entitle you to.

Well, it actually depends on how you spend them. Here are a few examples:

- Domestic Economy Airfare: $250 Required Miles: 25,000 ($0.01 point value) Not usually the best use of your miles.

- International Short Haul Economy Airfare: $750 Miles: 35,000 ($0.02 point value) Good value.

- International Long Haul Business Class Airfare: $4,500 Miles: 80,000 ($0.05 point value) Great value.

To get the most value out of your points you should redeem them for high-value experiences. International, premium cabin redemptions are usually the best use of miles.

If you’re not ready to sign up for a credit card, then you can still save money on flights by taking the time to do some research before you book anything.

If you’re planning on taking a longer trip and visiting multiple destinations, you would probably be better off with a round-the-world ticket (which I’ll cover later), but if you’re going to take a short trip, or you only plan on going to a single destination, this first method is perfect:

Step 1: Use Skyscanner as your baseline

There are a lot of great tools out there that are designed to find cheap flights, but my personal favorites are Skyscanner , Kayak and Momondo . Websites like these search for prices from multiple airlines so you can be sure that you’re getting the best deal.

Out of the three of them, Skyscanner makes the best starting point because it offers the most flexibility, which is the key to finding cheap flights.

We can search for flights on any given, day, week, month or even year, and from multiple airports as opposed to just one. The more flexible you are with your search, the more likely you are to find a great deal.

As an example, let’s say that I want to fly from the UK to New York next year. I can get to almost any airport in the UK without too much difficulty, so I’ll search from ‘all airports’, and I don’t mind when I go so I’ll set the departure date to ‘whole year’:

Here are the results: