Best Road Trip Cars in 2024 and 2025

We compiled a list of vehicles that are great for road trips. These vehicles are fuel-efficient, reliable, and comfortable, which will help you out on all of your highway adventures.

Kia Motors America |

The Best Cars, Minivans and SUVs for Road Trips

Summer is prime road trip season, whether that means hitting up a national park or getting together with family at a lakeside cabin. Choosing the right new car for an epic road trip can make your vacation more comfortable, more fuel efficient, and even safer, thanks to the new technologies found in many new vehicles. It can also mean less arguing, thanks to USB ports that keep devices charged, Wi-Fi hotspots that keep everyone entertained, and roomy back seats that keep siblings from touching.

Advertisement

We've rounded up the best road trip vehicles available this summer, with everything from sports cars to pickups, with plenty of family-friendly SUVs on the list. As new information becomes available, we update our reviews, so the data found in these slides might not match those reviews exactly.

American Honda Motor Co., Inc. |

2024 Honda CR-V Hybrid

$34,050 | usn overall score: 8.0/10.

The 2024 Honda CR-V Hybrid is a more fuel-efficient version of the popular compact SUV, with up to 43 mpg in the city. A 7-inch touch screen, smartphone connectivity, a Wi-Fi hotspot and four USB ports come standard to keep everyone powered up and entertained.

The interior is one of the nicest in the class, and the standard upholstery is stain-resistant. The seats are comfy in both rows, with room for adults to stretch out even on road trips. The rear seats recline, so whoever is off driving duty can take a nap. Standard adaptive cruise control and lane-keep assist help reduce the fatigue that can come with hours of driving.

More on the 2024 Honda CR-V Hybrid

- Find the best price on the 2024 Honda CR-V Hybrid »

- See 2024 Honda CR-V Hybrid Photos »

- Read the 2024 Honda CR-V Hybrid Full Review »

- See Hybrid SUV Rankings »

Volkswagen of America, Inc. |

2024 Volkswagen Atlas

$36,985 | usn overall score: 8.1/10.

The 2024 Volkswagen Atlas has enough room to bring along everybody and all their gear. It's available with either three rows of seating or two rows in the Cross Sport configuration. The third row is comfy for kids and adults on shorter trips. The Atlas has more cargo space behind the third row than most in its class.

Refreshed for 2024, in either configuration, a 12-inch touch screen with smartphone connectivity and a Wi-Fi hot spot are standard, along with wireless device charging and four USB ports. The Atlas can also tow up to 5,000 pounds when properly configured if you plan to bring a small camper or want to tow some toys for your vacation.

More on the 2024 Volkswagen Atlas

- Find the best price on the 2024 Volkswagen Atlas »

- See 2024 Volkswagen Atlas Photos »

- Read the 2024 Volkswagen Atlas Full Review »

- See Midsize SUV Rankings »

Ford Motor Company |

2024 Ford Mustang

$30,920 | usn overall score: 8.1/10.

Sometimes you want to live the American road trip dream in an impractical sports car. But guess what – the redesigned 2024 Ford Mustang is a rather practical sports car. It's as exciting to drive as you could hope, and it still manages to turn in great fuel economy numbers that won't put a damper on your budget.

The Mustang's interior has been updated with a more modern, tech-forward look. Its standard infotainment system has a large 13.2-inch touch screen and a Wi-Fi hot spot. Standard safety tech includes automatic emergency braking and lane-keep assist. But maybe most importantly, for purposes of the dream, the Mustang is available as a convertible.

More on the 2024 Ford Mustang

- Find the best price on the 2024 Ford Mustang »

- See 2024 Ford Mustang Photos »

- Read the 2024 Ford Mustang Full Review »

- See Sports Car Rankings »

General Motors |

2024 Chevrolet Suburban

$59,200 | overall score: 8.2/10.

The 2024 Chevrolet Suburban is the classic family road trip SUV, and it's the winner of our 2024 Best Large SUV for Families award. It's huge, with more cargo space than almost any SUV out there. It can be configured to seat up to nine people, though that means someone has to sit in the middle of the front bench seat. In any case, the third row provides enough legroom for adults.

The interior is sturdy enough for epic journeys, and it comes with an 8-inch touch screen, wireless smartphone connectivity and six USB ports. Depending on how you configure it, the Suburban can tow up to 8,300 pounds, enough for the average camper. It also comes with driver-assistance features like lane-departure warning and lane-keep assist.

More on the 2024 Chevrolet Suburban

- Find the best price on the 2024 Chevrolet Suburban »

- See 2024 Chevrolet Suburban Photos »

- Read the 2024 Chevrolet Suburban Full Review »

- See Large SUV Rankings »

2024 Kia Carnival

$33,600 | overall score: 8.2/10.

The 2024 Kia Carnival makes a strong case for the classic family minivan as the ultimate road-trip vehicle, especially with pricing that's among the most affordable on this list. It comes with a good list of standard safety features for long drives, including lane-keep assist and blind-spot monitoring.

The interior is upholstered with easy-to-clean materials, and all three rows have enough room for adults, though the third row has a bit less legroom than the first two. It also has lots of cargo space, even with all three rows in use. If you don't need the last row for passengers, it folds flat into the floor for even more cargo space. An 8-inch touch screen, smartphone compatibility and a whopping seven USB ports come standard.

More on the 2024 Kia Carnival

- Find the best price on the 2024 Kia Carnival »

- See 2024 Kia Carnival Photos »

- Read the 2024 Kia Carnival Full Review »

- See Minivan Rankings »

Stellantis |

2024 Chrysler Pacifica Hybrid

$53,425 | usn overall score: 8.3/10.

The plug-in hybrid 2024 Chrysler Pacifica Hybrid achieves up to 30 mpg in combined driving when operating in hybrid mode, which is great for any minivan. Once you reach your destination, plug this family hauler in overnight to be able to drive about 32 miles on electric power.

There's also a ton of tech included, like a 10.1-inch touch screen, wireless smartphone connectivity and Amazon Alexa compatibility. All three rows of seating have lots of head- and legroom, and there's plenty of storage space. Standard safety features include stop-and-go adaptive cruise control and rain-sensing windshield wipers.

More on the 2024 Chrysler Pacifica Hybrid

- Find the best price on the 2024 Chrysler Pacifica Hybrid »

- See 2024 Chrysler Pacifica Hybrid Photos »

- Read the 2024 Chrysler Pacifica Hybrid Full Review »

John M. Vincent | U.S. News & World Report

2024 Lincoln Navigator

$82,765 | usn overall score: 8.6/10.

Wherever your road trip takes you, the 2024 Lincoln Navigator will make sure you arrive in comfort and style. It's one of the best luxury large SUVs, with a well-built and high-quality interior. Standard features include a 13.2-inch touch screen, wireless smartphone connectivity, a Wi-Fi hotspot and five USB ports.

Every seat in all three rows is comfortable, and the available L model adds extra space to an already roomy cargo area. Though the Navigator is large, its powerful engine easily gets it up to speed on the highway. Standard safety features like lane-keep assist and stop-and-go adaptive cruise control can help reduce driver fatigue too.

More on the 2024 Lincoln Navigator

- Find the best price on the 2024 Lincoln Navigator »

- See 2024 Lincoln Navigator Photos »

- Read the 2024 Lincoln Navigator Full Review »

- See Luxury Large SUV Rankings »

Hyundai Motor America |

2024 Hyundai Tucson Hybrid

$32,575 | usn overall score: 8.6/10.

The 2024 Hyundai Tucson Hybrid is among the best in its class and was a finalist for our Best Hybrid SUV for the Money and Best Hybrid SUV for Families awards this year. The regular hybrid is the best for road tripping, with up to 38 mpg on the highway. But it doesn't sacrifice power for efficiency, with enough get-up-and-go for passing on the highway. All-wheel drive is standard for a sure-footed feel.

Inside, there's tons of room for adults in both rows of seating and a huge cargo area. A 10.25-inch touch screen is standard, along with Apple CarPlay , Android Auto , four USB ports and wireless device charging.

GENESIS MOTOR AMERICA |

2024 Genesis G90

$89,200 | usn overall score: 8.7/10.

If your road-trip budget allows for a little luxury. the 2024 Genesis G90 delivers. It has a capable V6 and an optional mild-hybrid powertrain that improves acceleration when passing on the highway. The available air suspension makes long drives a dream, and the extensive list of standard safety features–including adaptive cruise control and a head-up display–eases the tedium of driving.

The Nappa leather interior wraps the road tripper in luxury, and both rows of seating are comfortable for adults. The trunk is large enough for several suitcases, and it opens automatically as you approach. The G90 also has one of the longest powertrain warranties in the business.

More on the 2024 Genesis G90

- Find the best price on the 2024 Genesis G90 »

- See 2024 Genesis G90 Photos »

- Read the 2024 Genesis G90 Full Review »

- See Luxury Large Car Rankings »

2025 Ram 1500

$40,275 | usn overall score: 8.7/10.

If your road trip plan involves a camper or boat, you'll want to look into the 2025 Ram 1500 . When properly equipped, it can tow up to 11,580 pounds. As with most pickups, you can configure the 1500 in whatever way works for you, with bed, cab and powertrain options in addition to trim levels and packages to add on.

All of the available body styles have a spacious, high-quality interior. Quite a few safety features are standard, including stop-and-go adaptive cruise control and rear cross-traffic alert. The infotainment system got an upgrade for the 2025 model year, which means even more available features, including three screen sizes, three sound systems, and a long list of available tech features.

More on the 2025 Ram 1500

- Find the best price on the 2025 Ram 1500 »

- See 2025 Ram 1500 Photos »

- Read the 2025 Ram 1500 Full Review »

- See Full Size Pickup Truck Rankings »

2024 Honda Civic

$23,950 | usn overall score: 8.7/10.

You probably need one car to handle both the daily commute and the road trip vacation, and you need it to be affordable. Enter the 2024 Honda Civic . It's one of the best compact cars in its class, and we named it the 2024 Best Compact Car for the Money . All of its scores are high, especially when it comes to safety. It has the lowest MSRP on our list yet comes standard with desirable amenities like adaptive cruise control and traffic-sign recognition. It's also thrifty, with up to 42 mpg on the highway.

A 7-inch touch screen and smartphone connectivity come standard. The front seats in particular are supportive over the long haul, and the Civic has more overall interior space than most rivals.

More on the 2024 Honda Civic

- Find the best price on the 2024 Honda Civic »

- See 2024 Honda Civic Photos »

- Read the 2024 Honda Civic Full Review »

- See Compact Car Rankings »

Road Trip Car Characteristics

Passenger space: People turn cranky when they aren't comfortable after hours on the road. There needs to be space for everyone to stretch out.

Cargo space: At the very minimum, you'll be bringing luggage along and maybe also camping gear or tubes for floating the river. Make sure there's space for your gear.

Fuel economy: Stopping for gas on a road trip can get expensive. Fuel efficiency, particularly from hybrid powertrains, can ease the pain of stopping at the pump.

Infotainment: An AM/FM radio is no longer sufficient for most people. An infotainment system that's easy to use while driving and can connect to smartphones is key.

Safety tech: Driving long distances causes fatigue, and fatigue causes accidents. Modern driver-assistance features can help you stay alert and in your lane.

Reliability: No one wants to be the car in the breakdown lane while on their road trip. A good predicted reliability score shows that a particular model has on average been a solid performer over time.

Genesis Motor America |

Road Trip Car FAQs

What is the best car for road trips.

The best car for road trips is the one that fits your budget and your needs, so there's no one vehicle that will work for everybody. That said, the 2024 Honda Civic is a strong pick. It provides comfort, features, safety and reliability, and all for one of the lowest price tags on this list.

What is the best SUV for road trips?

The 2024 Hyundai Tucson Hybrid combines a long list of standard features with great fuel economy, and it has one of the most spacious interiors in its class.

What is the best luxury car for road trips?

The 2024 Genesis G90 will take you anywhere in comfort and style. Most of its best features are standard, including leather upholstery.

What is the most comfortable car for long trips?

On a list of very comfortable vehicles, the 2024 Honda CR-V Hybrid is probably the most comfortable, especially for back-seat passengers who can take advantage of the reclining seats. If comfort is your priority, take a look at our list of most comfortable cars for more options.

U.S. News and World Report |

More Shopping Tools From U.S. News & World Report

Plenty of families take road trips, so you might want to check out the winners of our 2023 Best Cars for Families awards too. Maybe you've been left stranded on an unfamiliar road by your former car and are looking for the most reliable cars available. If you know you need to bring along a lot of gear, see our roundup of compact SUVs with the most cargo space .

When you're ready to buy a new car, use our Best Price Program to pre-negotiate a great price with a local dealership. You can arrange for online buying and even vehicle delivery through the program.

U.S. News & World Report |

Best Cars for Road Trips in 2024 and 2025

- 2024 Honda CR-V Hybrid: $34,050 | USN Overall Score: 8.0/10

- 2024 Volkswagen Atlas: $36,985 | USN Overall Score: 8.1/10

- 2024 Ford Mustang: $30,920 | USN Overall Score: 8.1/10

- 2024 Chevrolet Suburban: $59,200 | Overall Score: 8.2/10

- 2024 Kia Carnival: $33,600 | Overall Score: 8.2/10

- 2024 Chrysler Pacifica Hybrid: $53,425 | USN Overall Score: 8.3/10

- 2024 Lincoln Navigator: $82,765 | USN Overall Score: 8.6/10

- 2024 Hyundai Tucson Hybrid: $32,575 | USN Overall Score: 8.6/10

- 2024 Genesis G90: $89,200 | USN Overall Score: 8.7/10

- 2025 Ram 1500: $40,275 | USN Overall Score: 8.7/10

- 2024 Honda Civic: $23,950 | USN Overall Score: 8.7/10

Browse Cars

Recommended Articles

Cars With the Best Gas Mileage

Cherise Threewitt May 24, 2024

Most Comfortable SUVs

Warren Clarke May 16, 2024

Most Reliable SUVs

George Kennedy May 13, 2024

The Safest SUVs

Cherise Threewitt June 6, 2024

Best 6-Passenger Vehicles

Cherise Threewitt May 23, 2024

Best 7-Seater Vehicles in 2024

Warren Clarke May 8, 2024

How to Road Trip Across the United States on a Budget

The Great American Road Trip is a rite of passage in the United States . We Americans have a unique fascination with the open road. It’s built into our cultural DNA. In Jazz Age America, the car was a symbol of freedom — a chance to escape your small town and the watchful eyes of parents.

As the highway system was developed in the 1950s, a wave of kids set out on the road to explore the country, giving new life to America’s car and road trip culture. Today, many still dream of getting in a car and driving into wide open spaces for months on end.

I’ve had the privilege of taking several multi-week and multi-month road trips around the country over the years. From traveling the Deep South to criss-crossing the country coast to coast , I’ve visited almost every state, exploring the myriad nooks and crannies of Uncle Sam’s backyard.

One thing is for certain, in diversity and scale, the United States is virtually unrivaled.

But this isn’t a post about fawning over America and its landscapes ( this post is ). This article is about how you can travel around the US on a budget.

Because, as it turns out, this country is surprisingly easy to travel on the cheap.

While rising gas prices and rental car price gouging post-COVID put a damper on things, it’s still easier than you think to have a budget-friendly road trip adventure around the USA.

In this post, I’ll explain how much I spent on one of my trips, how much you should expect to spend, and how you can save money on your next road trip.

Table of Contents

How Much Did My Cross-Country Road Trip Cost?

How to save money on your road trip, how to save on accommodation, how to save on food, how to save on sightseeing, how to save on transportation.

After 116 days traveling around the United States on this trip, I spent $6,262.67 USD, or $53.98 USD per day. While that is slightly higher than $50 USD a day, there were many parts of my budget I splurged on (see breakdown below) which skewed the number up. I definitely could have visited the country even cheaper if I didn’t have an addiction to Starbucks and sushi.

Here is how the numbers from my road trip break down:

- Accommodations: $1,036.36

- Food: $3,258.23

- Drinks: $438.94

- Gas: $696.98

- Parking: $253.00

- Starbucks: $75.26

- Miscellaneous (movies, toiletries, etc.): $170.00

- Attractions: $269.40

- Taxis: $41.00

- Bus: $17.50

- Subway: $6.00

Let’s break this down. First, my Starbucks addiction was unnecessary and added to my costs. Second, as a lover of sushi, trying various restaurants throughout my road trip drastically raised my food costs. Sushi, after all, is not cheap.

Moreover, I ate as if I wasn’t on a budget and rarely cooked, which is why my food expenses were so high relative to everything else. I would have definitely gone below $50 USD per day if I followed my own advice and cooked more often.

But, while I splurged in some places, three other things really helped me to keep expenses down: First, gas prices were low, averaging around $2.35 USD a gallon over the duration of my trip. (We’re going to discuss how to still do a road trip on a budget with high gas prices in the next section.)

Second, once you leave the big cities, prices for everything drop by nearly half so I spent a lot of time out of cities.

Third, I used Couchsurfing and cashed in hotel points to keep accommodation costs down. That helped a lot.

Overall, I didn’t do too bad and am happy with how much I spent. But is this how much you’ll spend, especially in the face of inflation and high gas prices? Let’s discuss that below.

It’s no secret travel costs a lot lately and inflation and high gas prices have really made super cheap road trips hard if you’re not staying places for free but that doesn’t mean the road trip has to be super expensive.

With that in mind, here’s how to cut your accommodation, sightseeing, food, and transportation costs — all without cutting into your experience!

1. Couchsurf — Couchsurfing is a service that allows you to stay with locals for free. Using this website (or similar ones) is the best way to lower accommodation costs, as you can’t get cheaper than free!

More than that, it’s a wonderful way to meet locals, get insider tips, and find off-the-beaten-track stuff to do in the area you’re visiting. While you’re generally expected to reciprocate your host’s kindness (cooking them a meal, taking them out for drinks or coffee, etc.), it’s still far cheaper than paying for a hotel or motel.

While the app has seen its community shrink in recent years, there are still plenty of hosts across the United States so you’ll rarely find problems finding someone to put you up.

Additionally, if you don’t feel comfortable staying with a stranger, you can use the app to meet people for drinks, coffee, activities, or anything else you want to do. That way, you can still meet a local and get their insider tips without having to stay with them. The app has all kinds of meet-ups and events too so be sure to check it out.

2. Airbnb — I only recommend using Airbnb in rural, out of the way places where hotels are limited. Avoid them as much as possible in other circumstances as they take housing stock off the market. Try to use their Rooms feature if you can!

3. Budget hotels — There are a plethora of cheap roadside hotels such as Motel 6 and Super 8 that will help you stay cheap. Rooms start around $50 USD per night and are super basic and always look well worn. You’ll get a bed, bathroom, TV, tiny closet, and maybe a desk. They are nothing to write home about, but for a quiet place to sleep for a night, they do the trick.

And if you’re traveling with someone you should always say the room is for one person as these hotels charge you more for two people.

Also, make sure you sign up for Booking.com and Hotels.com loyalty programs. Hotels.com gives you a free room after 10 bookings, and Booking.com offers members 10% off bookings, as well as free upgrades and perks if you book multiple times after signing up. They definitely helped a lot.

Pro tip : Book through websites like Mr.Rebates or Rakuten . By using their links before going to Hotels.com or Booking, you’ll get 2-4% cash back in addition to the loyalty program deals.

4. Hotel points — Be sure to sign up for hotel credit cards before you go and use those points when you travel. You can get upwards of 70,000 points as a sign-up bonus, which can translate into a week’s worth of accommodations.

The points came in handy in places where I couldn’t find an Airbnb, hostel, or Couchsurfing host. This saved my butt in big cities around the country. I was glad I had accrued so many hotel points before my trip.

To learn more about, check out these posts:

- The Best Hotel Credit Cards

- The Ultimate Guide to Picking the Best Travel Credit Card

- Points and Miles 101: A Beginner’s Guide

- The Best Travel Credit Cards

5. Hostels — There aren’t many hostels in the United States, and most of them are overpriced. A dorm room typically costs around $30 a night, which means you can obtain a similar private room on Airbnb at the same price. If you are traveling with others, it’s often more economical to get a budget hotel than a bunch of dorm beds.

However, if you are traveling solo and want to meet others, the social benefits may outweigh the lack of value. There were just some times I didn’t want to be alone – I wanted to be around other travelers.

Some of the hostels I loved are:

- Samesun Venice Beach (LA)

- South Beach Hostel (Miami)

- India House (New Orleans)

- ITH Adventure Hostel (San Diego)

- The Green Tortoise (San Francisco and Seattle).

For more hostel suggestions, here’s a list of my favorite hostels in the USA.

6. Camping — Dotted around the country — including around all the national parks — are inexpensive campsites. If you have a tent and camping gear, this is by far the cheapest way to travel. Campsites cost between $10-30 USD per night, which makes seeing the country incredibly affordable. Most campsites have basic amenities like running water, bathrooms, and the ability to upgrade to get electricity.

In addition to your standard campgrounds, check out the sharing economy website Campspace . It lets you pitch a tent on private properties all around the country for a small fee. Much like Airbnb, some plots are super basic and barebones while others are more luxurious, so be sure to poke around for a cheap place to stay as there are plots available all around the country.

It’s also legal to wild camp in national forests and on BLM land unless otherwise marked.

7. Sleep in your car — I know this isn’t glamorous but sleeping in your vehicle brings your accommodation costs down to zero. I know lots of travelers who did this to make their trip more affordable, some sleeping in their car just occasionally and others doing it every night. Chances are you won’t sleep well but you will save money, and that’s a fair trade to some people!

For those traveling in an RV, there are tons of free places to park and camp all around the country. Use iOverlander to find the best spots.

To help you keep your food costs in check, here are a few quick tips:

1. Cook your own meals as often as possible – If you can bring a cooler in your vehicle, you can pack groceries instead of eating out all the time. And if you bring some containers, you can store leftovers in the car too, allowing you to cook larger meals at dinner that you can eat the next day for lunch.

2. Stay in accommodation with a kitchen – If you want to cook, you’ll need a kitchen. Prioritize accommodation like Couchsurfing, Airbnb, and hostels as those will typically provide kitchen access so you can cook your meals.

3. Shop cheap – Avoid the pricier grocery stores like Whole Foods when it comes to getting groceries and stick to budget places like Walmart. It’s not glamorous, but it will be cheap!

4. Find cheap restaurants – When you want to eat out but don’t want to break the bank, use Yelp, ask people on websites like Couchsurfing, or inquire at the desks at hostels for suggestions. Locals have the best tips and insights when it comes to where to eat so they can point you in the right direction. Simply cook, limit your eating out, and be happy!

1. Get a National Parks pass — For $80, you can purchase an annual National Parks and Federal Lands ‘America the Beautiful’ pass that provides access to all 63 national parks (as well as any other recreation areas administered by the National Park Service). In total, you can visit more than 2,000 federal recreation sites with the same pass. At $20-35 USD per visit, seeing five during your trip makes the pass a money saver. When you visit your first park, simply buy the pass and you’re good to go. There’s no need to order it in advance.

The U.S. national park system is amazing and really highlights the diversity of landscapes in the country. You can’t travel across the country without stopping at many of the national parks, especially as you get out west.

2. City tourism cards — City tourism cards allow you to see a large number of attractions (and often include free public transportation) for one price, usually $75-100 USD. They provide free access to museums, reduced access to attractions, and restaurant discounts. Be sure to look into them if you plan on doing a lot of sightseeing, as they generally will save you money. They can be purchased at tourism information centers or online before you go.

3. Free museums and events — Inquire at tourism centers, use Google, or ask hotel or hostel staff for information about free events and museums. Many museums offer occasional free or discounted admission throughout the week. There are always tons of free activities in any city in the United States.

4. Free walking tours and city greeter programs — Many cities in the US have free walking tours or city greeter programs that pair you with a local guide who can give you a brief tour. Whenever I visit a new city, I start my trip off with one of these tours. They show you the lay of the land, introduce you to the main sights, and give you access to an expert local guide that can answer all your questions.

Check in with the local tourism office when you arrive to see what programs and tours are available.

For greeter programs, you’ll need to sign-up in advance before your visit. It’s good to give about 2 weeks’ notice as they have to find someone to take you around. Google “(city name) greeter program” to find them as some are run independently of the city tourism board so might not be listed on their website.

Here are your options when it comes to traveling across the country:

1. Hitchhike — This isn’t something I did on my trip, as I had a car, but it’s very doable (and relatively safe). Here’s a post by my friend Matt who hitchhiked across the United States explaining how to do so and come out alive (don’t worry, it’s safer than you think)..

For more hitchhiking tips, use Hitchwiki .

2. Rideshare — Taking on riders can be a way to lower your costs. On my first trip across the U.S., I offered rides to people I met in hostels. On this trip, I had friends and readers join me along the way. You can post ads on Craigslist and Gumtree and at hostels to find riders. This not only makes the trip more enjoyable but lowers your gas costs. Or if you are a rider, you can use the same services to find rides to get you places.

3. Buy a car — If you don’t have a car or don’t want to rent one, you can buy cheap used cars from car dealers or owners on Craigslist. There are lots of listings, and you can resell the car at the end of your trip to recoup some of your initial purchase cost. While this is easy in other countries, it’s hard to do in the United States, so remember a couple of key points:

- You’ll need a US address for registration documents to get sent to. I would use a hostel or hotel address and then set up a forwarding address with the Post Office.

- You’ll have to buy car insurance, which can greatly add to the costs of your trip.

Another option is to use a car relocation service. This is when you take someone’s car and drive it across the country. You are usually paid, and gas is covered. The downside is you don’t often have a lot of leeway on timing, so you might not have much time to stop and sightsee along the way. Car relocation options are also usually limited. Two companies worth checking out are Transfercar and Hit the Road .

If you just want to rent a car, use Discover Cars .

4. Use gas apps & membership programs – Install GasBuddy , an app that finds the cheapest gas prices near you. It is a must. If you’re going on a longer road trip, sign up for the monthly program; it costs $9.99 but will save you up to 40 cents a gallon.

Also, sign up for every gas loyalty program you can, so as to maximize points and discounts. Moreover, if you get a brand’s credit card, your first 50 gallons usually come with 30 cents off per gallon.

You should also consider getting a Costco membership for cheap gas. They have around 574 stores around the US so you’ll be able to earn the cost of a membership back by saving money on both gas and food.

5. Download parking apps – Parking costs add up — especially in cities. Use apps like BestParking and Parker to find spots and compare prices.

6. Take the bus – If driving is entirely out of the question, you can find bus tickets for as little as $1 USD from Megabus. Greyhound and Flixbus also have cheap rides all around the US. Rides under five hours are usually around $20 USD if you book early, and overnight rides usually cost $50-100. You can save big if you book in advance (often upwards of 75%!).

Don’t let the United States fool you! A road trip across the United States is a fun way to see a lot of diverse landscapes, experience different cultures, and meet interesting people. Traveling America isn’t very expensive once you are outside the big cities and you can easily travel the country on a budget by using the advice in this article.

Book Your Trip to the USA: Logistical Tips and Tricks

Book Your Flight Use Skyscanner to find a cheap flight. They are my favorite search engine because they search websites and airlines around the globe so you always know no stone is left unturned!

Book Your Accommodation You can book your hostel with Hostelworld as they have the biggest inventory and best deals. If you want to stay somewhere other than a hostel, use Booking.com as they consistently return the cheapest rates for guesthouses and cheap hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- Safety Wing (for everyone below 70)

- Insure My Trip (for those over 70)

- Medjet (for additional evacuation coverage)

Looking for the Best Companies to Save Money With? Check out my resource page for the best companies to use when you travel. I list all the ones I use to save money when I’m on the road. They will save you money when you travel too.

Want More Information on the United States? Be sure to visit our robust destination guide on the US for even more planning tips!

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

GET YOUR FREE TRAVEL STARTER KIT

Enter your email and get planning cheatsheets including a step by step checklist, packing list, tips cheat sheet, and more so you can plan like a pro!

Let us plan your trip for you

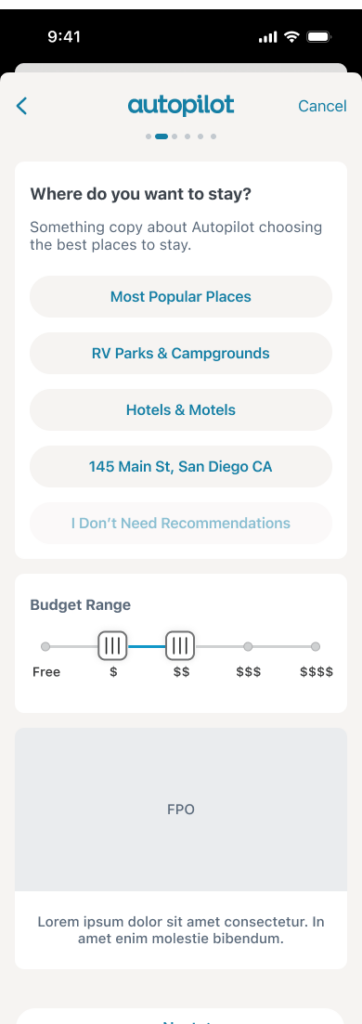

Roadtrippers Autopilot™ creates your itinerary based on what we’ve learned from over 38 million trips. You’re never more than a few clicks away from your next great adventure.

- Auto Travel

Let Autopilot take the wheel planning your next road trip, scenic drive, RV journey and everything in between. Then enjoy the ride while uncovering hidden gems along the way.

Get real-time traffic updates and access to wildfire smoke maps to stay informed and connected throughout your journey.

Collaborate

Share your itinerary with your copilots so they can help with the finishing touches.

Let Roadtrippers be your guide, navigating the twists and turns as you roam the open roads with confidence and ease.

Exclusive Access To Autopilot

Let us do the planning for you! Enter in a few key details and we’ll craft a custom tailored trip just for you.

Choose the right plan for you—and try it free for 7 days

Premium planning.

RV-Friendly Tools

Overnight RV Parking

Start free for 7 days

Then $35.99 (that's only $2.99/month), then $49.99 (that's only $4.17/month), then $59.99 (that's only $4.99/month).

† RV-Friendly routing features (including routing warnings for vehicle hazards and propane restrictions) are available in the U.S. only.

Free 7-day trial

Test drive the best features of Roadtrippers Premium for free! Eligible users will get exclusive access to all the tools needed to plan the perfect road trip.

Create a Roadtrippers account to start your 7-day free trial.

Already have a Roadtrippers account?

We need your email address

Before we can sign you up for Roadtrippers, we need your email address. Click the button below to go to your profile.

Plan your next adventure with a Roadtrippers Premium account

Due after 7-day free trial

Thank you for signing up for a Roadtrippers Subscription

Get started planning your next trip now!

Good news...you already have Roadtrippers!

Thanks for being one of our most dedicated users.

- Sign up Log in Sign out

- Log in Sign out

Plan your journey, find amazing places, and take fascinating detours with our app.

If you used to sign in with Roadpass, you should now use the same username and password to log in directly with Roadtrippers above.

We couldn't find an existing Roadtrippers account using that service. Please try signing in with another option.

We need your email address to send you trip itineraries and other updates.

How do you want to plan your trip?

With just a few questions, our newest Premium feature, Autopilot, will plan your next adventure.

Travel Cost Calculator

Quick links, trip pricing calculator.

Travelmath provides an online cost calculator to help you determine the cost of driving between cities. You can use this data to figure out a budget for a road trip. The driving calculation is based on the average fuel efficiency of your vehicle, and you can change the gas mileage in mpg or L/100 km to match your exact make and model. Gas prices are automatically estimated based on current fluctuations, and again you can adjust these to fit your local gas station prices. Both U.S. and international units are available to make the calculations easier to use, and the output is given for both one-way and round trip travel routes.

Check the driving distance for your planned route, and see if the total driving time requires an overnight stay. If it's a long trip, you may want to research some hotels along the way . Or compare whether it's better to fly or drive to your destination.

Home · About · Terms · Privacy

- Help Center

- 1-866-921-7925

Start Searching

- Packages

- Hotels

- Cruises

- Rental Cars

* Indicates required fields

Rental Period:

pickUpDate - dropOffDate

Pick-Up: pickUpTime - Drop-Off: dropOffTime

Pick-Up Location:

pickUpAddress

pickUpAgencyName

pickUpAgencyAddress

Drop-Off Location:

Same as Pick-Up Location

dropOffAddress

dropOffAgencyName

dropOffAgencyAddress

Coupon Override

Please call.

For drivers under the age of 25, additional fees and/or restrictions may apply.

For information and assistance in completing your reservation, please call:

We're unable to find your location.

Alaska Cruise Tours:

A cruise tour is a voyage and land tour combination, with the land tour occurring before or after the voyage. Unless otherwise noted, optional services such as airfare, airport transfers, shore excursions, land tour excursions, etc. are not included and are available for an additional cost.

Terms & Conditions

We are processing your payment.

Do not refresh your browser or exit this page.

How Much Car Can I Afford? Edmunds Car Affordability Calculator

How much car can you afford? Find out with Edmunds Auto Affordability Calculator.

About Affordability Calculator

These estimates are based on standard industry data, but the values that apply to your purchase may vary. If applicable, please use the information provided to you by your dealer or lender, or use an estimate based on your credit profile and circumstances.

Your target monthly payment includes the estimated sales tax, title and registration fees that would be added to your total loan. The estimated vehicle price range does not include optional items like an extended service plan. Since many cars can be purchased at a discount from the MSRP or list price, we provide a price range.

Your Estimated Price Range is our estimate of the vehicle price (i.e., MSRP or list price) of the car you can afford based on the information you provided or confirmed in the calculator. In calculating this, we take into account that you will also need to pay estimated sales tax, title and registration costs.

How Much Car Can I Afford?

By Ronald Montoya, Senior Consumer Advice Editor

October 3rd, 2019

Fitting a car into your household budget is no easy task, and financial experts do not agree on how to determine its affordability. One school of thought holds that all your automotive expenses — gas, insurance, car payments — should not exceed 20% of your pretax monthly income. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should spend no more than 10%-15% of your annual income on a vehicle purchase. Pretax, post-tax, annual income; these terms are enough to make a person ask: "How much car can I afford?"

There's no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you're leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%-15% is that the payment isn't the totality of what you will be spending. You'll need to factor in the costs of fuel and insurance, and many people overlook that. We put those costs at another 7% of your take-home pay. So, all in, you're looking at a total budget that is ideally, no more than 20% of your monthly take-home pay.

While the 10%-15% rule may not work for everyone, it's a good starting point for finding a target price that won't leave you scrambling to pay your bills every month. Here's how you can get a more customized number for yourself.

1. Calculate Your Automotive Budget

Take a few minutes to run down what you spend every month. From your monthly take-home pay, deduct rent or mortgage, bills, groceries, child expenses, savings, and spending on entertainment. You will then discover how much car you can afford.

Not sure what kind of vehicles can you buy with this monthly payment (or less)? Take a look at the Edmunds affordability calculator, which lists vehicles that fall into the price range you've predetermined. Keep in mind that the prices on the calculator results page will change based on the trim level, options, sales tax and registration fees, etc.

Does it seem like you might not be able to afford the purchase? We know that feeling. New vehicles have gotten more expensive over the years and our salaries haven't kept up. In any case, this amount now represents your automotive budget, which, as we've noted, is more than just the monthly payment. On to estimating fuel costs and insurance fees.

2. Determine Your Fuel and Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you've chosen. Even though it takes a little work to come up with these estimates, you shouldn't overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up; others might have a higher cost to insure.

The EPA's Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you're interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you're OK.

3. Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That's smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you're going to trade in the vehicle during the fourth or fifth year? You'll likely owe more than the car is worth and will have to roll that balance into the next loan. You'd be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you'll have a car that's new enough to avoid major repairs for a while.

An Average New-Car Buyer's Scenario

To make this budgeting less abstract, let's plug in some real-world numbers. The median weekly earnings of a full-time worker in the U.S. was $908 in the second quarter of 2019, according to the U.S. Bureau of Labor and Statistics . This amount translates to an annual income of $47,216.

Paying an estimated 20% in income taxes would translate to a monthly income of about $3,148 for a buyer we'll call John. If we follow our 15% rule, John could handle a monthly car payment of up to $472.

In September 2019, the average amount financed for a new vehicle was $32,928, according to Edmunds data. Let's say John bought a new Honda Pilot for that amount. We'll assume he has solid credit and that all aspects of the deal mirror the industry average. John made an 11% down payment, which comes out to about $4,075. The monthly payment will be $542 because John has opted for the most common loan term of 72 months.

He's already over budget and hasn't yet factored in fuel and insurance costs.

Those pencil out to $120 a month for fuel and about $140 a month for auto insurance, which means John's total monthly automotive expenses are actually $802, or 25% of his monthly take-home pay.

Some people might be OK with spending a quarter of their take-home pay on car ownership, but in John's case, it will put real stress on his financials. And what if you make less than John does? What if you have poor credit? Or what if you have other debt you're trying to pay down? It would make new-car buying a real challenge. The options now are to find a less expensive vehicle, lease or consider a used car.

The Used-Car Option

What would the payment look like if John were to buy used? For starters, the sticker price would be lower than on a new vehicle, and there would be a lower threshold of credit needed for financing the auto loan. Assuming again that John goes with the averages, the amount financed for the used vehicle John chose would be $22,623. The down payment would be just over 10% ($2,660). The monthly payment would be $416, and it would take about 68 months to pay it off. The used-car loan would have an interest rate roughly 3 percentage points higher than that of a new-car loan. But that's typical for used-car lending.

Fuel costs would be roughly the same. Insurance would be slightly less because the car is used. This insurance savings, though, would likely be offset by the added maintenance that comes with an older vehicle. Let's call it a wash and assume the same estimate as for a new car: 8% of take-home pay for insurance and fuel.

By buying a used vehicle, John would be spending $676 a month, or about 21% of his monthly take-home pay. On its face, this purchase would seem to be the most cost-effective since John is taking out a smaller loan.

But it would take five and a half years to pay off the loan amount, at which point the car would be 8 or 9 years old. How much longer will John want to drive it? It's something to keep in mind when choosing a long loan term because the whole point of financing is to be free of a car payment eventually. And if John buys another SUV as soon as the old one is paid off, John might as well be leasing, so let's look at that.

The Lease Option

A three-year lease in 2019 had a monthly payment of $465 and an average down payment of $2,646. Keep in mind that these averages are high because many leased cars are luxury models (think BMW, Mercedes-Benz and the like). Since John is not looking for a luxury vehicle, he should be able to find a midsize SUV for roughly $400 a month and about $1,800 down. One major difference, however, is that John would have to limit driving to about 12,000 miles per year, which is a common mileage limit for advertised lease specials. Adding more miles would cost an extra $25 per month, by our estimates.

John's lease payment would be an easier-to-afford $400 per month, or 12.7% of his take-home pay. When we factor in 7% of take-home pay for fuel and insurance costs, John would be spending about $660 per month on this car, which would be about 21% of his monthly income. That's a touch over our recommended 20% for all auto expenses.

In this scenario, John would be paying much less per month to lease than to buy. John would also have a little more in the bank because of the smaller down payment. On the other hand, John would be limited on the number of miles he can drive (without penalty) and would have to start the process over in three years when the lease is up.

What's the Best Option?

There's a case to be made for each of these approaches to affordability. It is essential to recognize your car-buying history, and if you do commit to a long-term loan, make sure you drive the vehicle for at least a few years after it is paid off.

In the end, the best car-buying scenario will be one that takes into account your bills and other financial responsibilities. Don't shop for a car at the top of your budget. And if it's a stretch for you to buy now, consider saving up a bit more and revisit shopping at a better time. The most important things are to know your budget and remember that there's more to owning a car than just that monthly payment.

Car Affordability Calculator FAQs

How much should you spend on a car payment, how much should your car cost compared to your salary, how much car can i get for $500 a month, what is the relationship between edmunds and carmax.

Join Edmunds

Receive pricing updates, shopping tips & more!

Compare rental car deals to find the right one.

Compare other travel sites, book with flexibility, track prices, filter for what you want, search rental cars by destination, find car rentals.

Save money on rental cars by searching for car rental deals on KAYAK. KAYAK searches for rental car deals on hundreds of car rental sites to help you find the cheapest car rental. Whether you are looking for an airport car rental or just a cheap car rental near you, you can compare discount car rentals and find the best deals faster at KAYAK. KAYAK also compares deals for many different car types. Whether you’re looking for luxury car rentals , SUV rentals , van rentals , pickup truck rentals , convertible car rentals , cargo van rentals or minivan rentals, you’ll find them all on KAYAK.

Las Vegas Rental Cars

- Winchester car rentals

- Nellis AFB car rentals

- North Las Vegas car rentals $25+

- Henderson car rentals $27+

- Enterprise car rentals $32+

- Summerlin South car rentals $35+

- Sunrise Manor car rentals $36+

- Paradise car rentals $36+

- Spring Valley car rentals $39+

- Las Vegas McCarran Airport car rentals $31+

Denver Rental Cars

- Federal Heights car rentals

- Glendale car rentals

- Broomfield car rentals $36+

- Centennial car rentals $40+

- Thornton car rentals $43+

- Westminster car rentals $44+

- Wheat Ridge car rentals $44+

- Sheridan car rentals $48+

- Foxfield car rentals $51+

- Denver Airport car rentals $23+

Chicago Rental Cars

- Rolling Meadows car rentals

- Harwood Heights car rentals

- Mount Prospect car rentals $32+

- Rosemont car rentals $34+

- Oak Park car rentals $38+

- Wilmette car rentals $39+

- Skokie car rentals $41+

- Blue Island car rentals $46+

- Hometown car rentals $53+

- Chicago O'Hare Airport car rentals $30+

San Francisco Rental Cars

- South San Francisco car rentals $29+

- Burlingame car rentals $29+

- Union City car rentals $37+

- San Bruno car rentals $38+

- Daly City car rentals $40+

- Sausalito car rentals $40+

- Millbrae car rentals $40+

- Colma car rentals $41+

- Emeryville car rentals $58+

- San Francisco Airport car rentals $34+

Boston Rental Cars

- Winthrop car rentals

- Medford car rentals $18+

- Newton car rentals $32+

- Norwood car rentals $37+

- Waltham car rentals $40+

- Chelsea car rentals $41+

- Needham car rentals $46+

- Chestnut Hill car rentals $48+

- Everett car rentals $49+

- Boston Logan Airport car rentals $34+

Austin Rental Cars

- Bee Cave car rentals

- Sunset Valley car rentals

- McNeil car rentals

- West Lake Hills car rentals

- Round Rock car rentals $29+

- Pflugerville car rentals $30+

- Manchaca car rentals $30+

- Cedar Park car rentals $30+

- Buda car rentals $37+

- Austin Bergstrom Airport car rentals $28+

Tampa Rental Cars

- Greater Northdale car rentals

- Carrollwood car rentals

- Mango car rentals

- Egypt Lake-Leto car rentals $18+

- Pinellas Park car rentals $31+

- Temple Terrace car rentals $33+

- Seffner car rentals $36+

- Citrus Park car rentals $38+

- Oldsmar car rentals $39+

- Orlando Airport car rentals $14+

Italy Rental Cars

- Milan car rentals $5+

- Rome car rentals $5+

- Bologna car rentals $5+

- Bergamo car rentals $6+

- Naples car rentals $6+

- Catania car rentals $8+

- Palermo car rentals $12+

- Bari car rentals $13+

- Venice car rentals $13+

- Florence car rentals $16+

Iceland Rental Cars

- Keflavik car rentals $29+

- Reykjavik car rentals $30+

- Isafjordur car rentals $42+

- Egilsstaðir car rentals $50+

- Akureyri car rentals $54+

- Hofn car rentals $74+

Los Angeles Rental Cars

- Lawndale car rentals

- South Gate car rentals

- Beverly Hills car rentals $25+

- Rosemead car rentals $27+

- Duarte car rentals $28+

- Long Beach car rentals $28+

- Monrovia car rentals $29+

- Monterey Park car rentals $33+

- Alhambra car rentals $34+

- Los Angeles Airport car rentals $12+

New York Rental Cars

- Carteret car rentals $36+

- North Bergen car rentals $42+

- Edgewater car rentals $45+

- Little Ferry car rentals $46+

- Union City car rentals $46+

- Bronxville car rentals $48+

- Elmont car rentals $50+

- Fairview car rentals $50+

- Tenafly car rentals $51+

- New York John F Kennedy Airport car rentals $37+

Seattle Rental Cars

- Lake Forest Park car rentals

- Tukwila car rentals

- Kenmore car rentals

- Newcastle car rentals

- Burien car rentals $20+

- SeaTac car rentals $44+

- Federal Way car rentals $49+

- Kent car rentals $56+

- Des Moines car rentals $70+

- Seattle/Tacoma Airport car rentals $38+

San Diego Rental Cars

- Coronado car rentals $30+

- La Mesa car rentals $30+

- National City car rentals $30+

- Encinitas car rentals $30+

- Del Mar car rentals $34+

- Santee car rentals $36+

- Lemon Grove car rentals $40+

- Solana Beach car rentals $41+

- San Ysidro car rentals $41+

- San Diego Airport car rentals $29+

Honolulu Rental Cars

- Hālawa car rentals $28+

- Kapolei car rentals $36+

- Waipahu car rentals $38+

- Kailua car rentals $40+

- Aiea car rentals $41+

- Ewa Beach car rentals $45+

- Kaneohe car rentals $103+

- Honolulu Airport car rentals $42+

Fort Lauderdale Rental Cars

- Wilton Manors car rentals

- Hollywood Beach Gardens car rentals

- Dania Beach car rentals $10+

- Broadview Park car rentals $20+

- Plantation car rentals $28+

- Lauderhill car rentals $29+

- North Lauderdale car rentals $33+

- Margate car rentals $33+

- Lauderdale Lakes car rentals $37+

- Fort Lauderdale-Hollywood Airport car rentals $17+

Portland Rental Cars

- Happy Valley car rentals

- Metzger car rentals

- Bethany car rentals

- Beaverton car rentals $29+

- Milwaukie car rentals $32+

- Tigard car rentals $33+

- Aloha car rentals $45+

- Clackamas car rentals $47+

- Tualatin car rentals $64+

- Portland Airport car rentals $39+

Puerto Rico Rental Cars

- Aguadilla car rentals $6+

- San Juan car rentals $9+

- Carolina car rentals $10+

- Ponce car rentals $31+

- Fajardo car rentals $37+

- Bayamón car rentals $46+

- Caguas car rentals $47+

- Mayagüez car rentals $48+

- Vieques car rentals $85+

United States Rental Cars

- Salt Lake City car rentals $18+

- Fort Myers car rentals $20+

- Washington, D.C. car rentals $21+

- Newark car rentals $22+

- Charlotte car rentals $23+

- Kahului car rentals $24+

- Nashville car rentals $26+

- Philadelphia car rentals $29+

- Minneapolis car rentals $33+

- Detroit car rentals $43+

Orlando Rental Cars

- Buena Ventura Lakes car rentals

- Alafaya car rentals

- Doctor Phillips car rentals $30+

- Oviedo car rentals $31+

- Celebration car rentals $33+

- Lake Mary car rentals $38+

- Lockhart car rentals $39+

- Oak Ridge car rentals $41+

- Maitland car rentals $44+

Miami Rental Cars

- Tamiami car rentals

- South Miami car rentals $28+

- Fisher Island car rentals $28+

- Hallandale car rentals $30+

- Hialeah car rentals $30+

- Aventura car rentals $32+

- Miami Lakes car rentals $35+

- South Miami Heights car rentals $37+

- The Hammocks car rentals $52+

- Miami Airport car rentals $10+

Phoenix Rental Cars

- Ahwatukee car rentals

- Glendale car rentals $20+

- Scottsdale car rentals $22+

- Gilbert car rentals $22+

- Mesa car rentals $22+

- Tempe car rentals $27+

- Litchfield Park car rentals $28+

- Queen Creek car rentals $29+

- Anthem car rentals $47+

- Phoenix Sky Harbor Airport car rentals $30+

Houston Rental Cars

- Bellaire car rentals

- Kemah car rentals

- Humble car rentals $26+

- Cypress car rentals $30+

- Seabrook car rentals $34+

- South Houston car rentals $35+

- Cinco Ranch car rentals $35+

- West University Place car rentals $35+

- Jersey Village car rentals $43+

- Houston George Bush Airport car rentals $29+

Atlanta Rental Cars

- Panthersville car rentals

- Clarkston car rentals

- Riverdale car rentals $16+

- Marietta car rentals $29+

- Smyrna car rentals $30+

- Dunwoody car rentals $31+

- Chamblee car rentals $32+

- Brookhaven car rentals $34+

- Peachtree Corners car rentals $36+

- Hartsfield-Jackson Atlanta Airport car rentals $39+

Dallas Rental Cars

- Colleyville car rentals

- Farmers Branch car rentals

- Grapevine car rentals $26+

- Irving car rentals $28+

- Mesquite car rentals $29+

- Grand Prairie car rentals $30+

- Coppell car rentals $31+

- Euless car rentals $33+

- Duncanville car rentals $33+

- Dallas/Fort Worth Airport car rentals $24+

Barcelona Rental Cars

- El Prat de Llobregat car rentals $9+

- Sabadell car rentals $21+

- Badalona car rentals $37+

- Barcelona-El Prat Airport car rentals $10+

Costa Rica Rental Cars

- Alajuela car rentals $5+

- San José car rentals $5+

- Liberia car rentals $5+

- Tamarindo car rentals $5+

- Uvita car rentals $9+

- Jacó car rentals $12+

- La Fortuna car rentals $12+

- Santa Teresa car rentals $12+

- Heredia car rentals $15+

- Quepos car rentals $18+

New Zealand Rental Cars

- Christchurch car rentals $6+

- Auckland car rentals $6+

- Wellington car rentals $7+

- Queenstown car rentals $9+

- Hamilton car rentals $27+

- Dunedin car rentals $28+

- Tauranga car rentals $31+

- Picton car rentals $36+

- Nelson car rentals $43+

Frequently asked questions

How does kayak find such low rental car prices.

KAYAK compares rental car prices from all major car rental companies such as Thrifty, Dollar, Enterprise, Hertz, Payless and more to find you the best deal.

How do I find the best car rental deals on KAYAK?

A simple rental car search at https://www.kayak.com/cars scans for prices on hundreds of travel sites in seconds. We gather car rental deals from across the web and put them in one place. Then on the search results page you can use various filters to compare your options for your preferred rental car type and easily choose the best car rental deal from all of the deals coming straight from the travel sites to your screen, with no extra fee from KAYAK.

What is special about comparing rental car deals on KAYAK?

Looking for the lowest price? We can make that happen. Our car rental price sort gives you quick access to the cheapest and/or the most expensive deals—it’s your trip, so it’s up to you. Sometimes, the same rental car deal will be available on several provider sites. All of these providers are made visible for you to choose from, but we highlight one main car rental provider based on things like customer popularity or ratings.

What kind of cars can I rent on KAYAK?

On KAYAK you can find deals on all types of rental cars including small, medium, large, SUV, van, luxury, pickup truck, convertible and commercial vehicles.

What do I need to know before booking a car rental?

Renting a car can be overwhelming, especially if it’s your first time or you’re renting in a new country. Finding the right price, understanding the add-ons and staying up to date with policy changes can be a challenge. That’s why KAYAK has produced the ultimate guide to renting a car to help you cut though the jargon and make the right choice for your rental car. Find tips and insights for how to book your rental, what car rental insurance you’ll need, how to deal with a car rental agency and what extra fees to expect (and avoid!).

What is the minimum age to rent a car?

The minimum legal age to rent a car depends on the country where you’re renting. In the USA and Canada, drivers must typically be at least 21. However, some states and provinces allow drivers as young as 18 years old to rent a car. In Europe and Asia, the minimum age varies between 18 to 21 years old but some agencies might require drivers to be at least 25. Keep in mind that most agencies add daily fees for renters below 25 years old.

Can I return a rental car to a different location?

You want to pick up a car rental in one city and drop it off in another location? We can arrange that for you. When performing a car rental search on KAYAK, simply select the option "Different drop-off". You'll then be able to enter both your desired pick-up and drop-off locations. Most car rental agencies call this option a "one-way rental" and charge a return fee.

Can new drivers rent a car?

New driver policies vary for each car rental agency. While some require renters to hold a driver’s license for a minimum of 1 year, others only ask for a valid driver’s license for the duration of the rental period. We recommend new drivers to confirm the requirements directly with the rental agency.

Can I rent a car without a credit card?

Renting a car without a credit card is less common but not impossible. Many agencies allow debit card car rentals from airport locations as long as you provide proof of return travel. Be aware that the agency might run a credit check on you and will most likely place an authorized hold on your account as a security deposit. If you plan on paying with a debit card, it’s always a good idea to check the conditions with the rental agency before booking.

Can I drive cross country in a rental car?

In the USA, it's typically not an issue to drive across state lines or to cross the border to Canada. However, you'll most likely pay an extra insurance fee if you want to travel to Mexico. Similar rules apply to Europe, as you'll need to cover a cross-border fee if you want to cross from one country to another. Failing to do so will most likely invalidate your car rental insurance. Crossing borders in Africa and Asia is generally more difficult and additional border documentation is necessary. We recommend always informing the rental agency about your planned itinerary.

Is it cheaper to rent a car at the airport or off-site?

You will generally find the best deals if you select an off-site airport location. Airport car rental agencies offer a very convenient option for renters who want to pick up a car directly on-site. However, as demand is often higher, prices also tend to get slightly more expensive. Some off-site rental agencies offer shuttle service from the airport.

Search cheap rental cars with KAYAK. Search for the cheapest rental car deal for all major destinations around the world . KAYAK searches different travel sites to help you find and book the rental car deal that suits you best.

KAYAK also helps you find the right hotels and train and bus deals for your needs.

- Siteservice

You may prefer one of our worldwide web sites.

- Get a Quote

- Car Guide

- Rental Locations

- Business Renters

- Manage Booking

- Autumn Car Hire Savings

- US Airtours

- US Airtours Splashpage

Online Booking

Latest Offers

Special partner offers, new budget locations.

Take a look at some of our 150+ new locations and check out some of the great discounts across Europe when you prepay!

USA & Canada Offer

10% Off Rentals in the USA or Canada!

Emirates Skywards

Earn more miles when you book with Budget

We give you more for your Budget

Mobile Website

With our new mobile website booking with budget can be quick, simple and on the go!.

New Locations

Budget have recently opened new locations in the UK, France and Spain, including in the Canaries!

Miles & More

Budget is now a partner of Miles & More. Earn Miles with our new partner.

We bring our dog along on our work trips. We've had to nearly double our travel budget to do it.

- Content creators Paul Salley and Brianna Feehan started bringing their dog on work trips last year.

- Together with Koda, a golden retriever, the couple have visited 22 states.

- They found Wyoming and Alabama to be the most pet-friendly destinations so far.

When Paul Salley and Brianna Feehan got their English cream golden retriever in January last year, they figured they would leave the dog with their parents when they traveled.

As content creators, they spend 80% of their time on the road shooting and producing hospitality and lifestyle content for clients, as well as running their Instagram account and blog.

But leaving their dog, Koda, behind started to get too difficult for them. "When we're gone, we're always missing her," Feehan told Business Insider.

The couple decided to take fewer international trips and focus on domestic travel . Last April, they took Koda on her first road trip from Connecticut to Florida.

"She had the best time," said Feehan, who described Koda as the "happiest dog in the world."

Now, the couple, who are in their late-20s, bring Koda with them on every trip they take. To date, they say they've taken around 15 trips and visited 22 states together.

They plan their trips around Koda

From finding dog-friendly accommodations and eateries to ensuring that Koda is comfortable on the road, Salley and Feehan now center their trips around her. This means they stay longer at each accommodation.

"If we move from Airbnb to Airbnb every night, she'll stop eating. She doesn't drink as much," said Salley, who added that Koda has anxiety if they don't spend enough time settling into a new environment.

Car rides are also longer. For their first road trip to Florida, Apple Maps estimated their journey would take 18 hours. But after making more than 10 stops along the way to ensure that the dog was comfortable and had enough water and treats, the journey took 24.

Before they got Koda, they stuck to a tighter budget

When traveling with Koda, they often have to pay extra fees for accommodation. So far, the cheapest pet fee they paid was $30 at a Best Western Hotel, while the most expensive was at a Marriot hotel, where they say the pet fee was $75. Airbnbs usually charge around $50 for pets, they observed.

Related stories

Salley estimates they would spend less than $1,500 on a weeklong trip to Florida if they went alone. He added that the couple would have also saved money by staying in hostels and cheaper places in the past.

But with Koda, their total expenditure on that trip was around $3,000.

For longer trips with Koda, they set a maximum budget of $6,000 for seven weeks. "We also don't try to spend that much, but we definitely set a lot more aside for worst-case scenarios," Salley said.

They recalled a harrowing incident when Koda had diarrhea 14 times on the road. They rushed her to the veterinarian and spent $1,100 on X-rays and bloodwork.

"It was a lot of money, and we wasted two or three days just watching her go outside and be sick. It was awful," Feehan said.

Salley added that pet owners going on trips with their pets should consider buying pet insurance . "Don't expect things to go as planned. there's always going to be a curveball with an animal," he said.

They found Wyoming to be the dog-friendliest and Los Angeles to be one of the least

"We could just walk into a restaurant with our dog and eat with her sitting next to us at a table," Feehan said about Wyoming .

Alabama is a close second. "The beaches, the bars, the shops — everywhere's dog friendly," she added.

On the flip side, the couple said they would never take Koda to New York City for a vacation — even though they only live an hour away.

They once cut their three-day trip short in Los Angeles because they found it lacked dog-friendly accommodations — and were appalled when they saw that one dog park membership cost $120 monthly .

"A lot of dogs live in LA, but we're not used to city life. So, we just pivot and go somewhere else," Feehan said.

Their next goal is to fly abroad with Koda

They are not alone. In June, a Forbes Advisor survey of 10,000 American dog owners found that 33% of respondents travel with their dogs by plane. Of the respondents, 37% also said that being unable to bring their dog on their travels is their top annoyance.

As more pet owners prefer to travel with their pets, some commercial airlines are simplifying the process to bring pets on board. American Airlines updated its policy in March to allow flyers to board with their pet in addition to a carry-on bag.

A growing number of shared private jet flights allows owners to travel more comfortably with their pets — albeit with a hefty price tag. In April, BI reported on pet subscription service BarkBox's launch of its ultra-luxury private jet carrier , Bark Air. The round-trip from New York to Los Angeles costs $12,000 and comes with "dog champagne" and a private chef.

Some pet owners have gone a step further by arranging private jets for their pets. Hong Kong investment banker Gladys Tsoi previously told BI that she spent $38,000 to fly to Japan with her pet poodle on a private jet. Although the trip was costly, she's planning another trip for her two dogs.

The couple no longer see themselves traveling without Koda

"It feels so complete just being the three of us. There's nothing that we really miss from home besides the comforts of home," Feehan said.

"She just helps us relax at a destination and enjoy the beauty of watching her swim or sniff," Salley added.

Before getting Koda, they would be up at sunrise, shooting and vlogging all day. But with Koda, they've learned to slow down .

Watch: Why Seeing Eye dogs are so expensive to breed and train

- Main content

Money blog: Couples reveal how they split finances when one earns more than other

Welcome to the Money, your place for personal finance and consumer news and tips. Read our weekend feature on relationship finances below and let us know how you and your partner divide money in the comments box. We'll be back with live updates on Monday.

Saturday 17 August 2024 12:43, UK

Essential reads

- Couples on how they split finances when one earns more than other

- What's gone wrong at Asda?

- The week in money

- Best of the Money blog - an archive of features

Tips and advice

- All discounts you get as student or young person

- Save up to half price on top attractions with this trick

- Fines for parents taking kids out of school increasing next month

- TV chef picks best cheap eats in London

- 'I cancelled swimming with plenty of notice - can they keep my money?'

Ask a question or make a comment

By Emily Mee , news reporter

Openly discussing how you split your finances with your partner feels pretty taboo - even among friends.

As a consequence, it can be difficult to know how to approach these conversations with our partner or what is largely considered fair - especially if there's a big imbalance salary-wise.

Research by Hargreaves Lansdown suggests in an average household with a couple, three-quarters of the income is earned by one person.

Even when there is a large disparity, some couples will want to pay the same amount on bills as they want to contribute equally.

But for others, one partner can feel resentful if they are spending all of their money on bills while the other has much more to spend and is living a different lifestyle as a result.

At what stage of the relationship can you talk about money?

"We've kind of formally agreed there is some point in a relationship you start talking about kids - there is no generally agreed time that we start talking about money," says Sarah Coles, head of personal finance at Hargreaves Lansdown.

Some couples may never get around to mentioning it, leading to "lopsided finances".

Ms Coles says if you want to keep on top of finances with your partner, you could set a specific date in the year that you go through it all.

"If it's in the diary and it's not emotional and it's not personal then you can properly go through it," she says.

"It's not a question of 'you need to pull more weight'. It's purely just this is what we've agreed, this is the maths and this is how we need to do that."

While many people start talking about finances around Christmas, Ms Coles suggests this can be a "trying time" for couples so February might be a "less emotional time to sit down".

How do you have the conversation if you feel the current arrangement is unfair?

Relationship counsellor at Relate , Peter Saddington, says that setting out the balance as "unfair" shouldn't be your starting point.

You need to be honest about your position, he says, but your conversation should be negotiating as a couple what works for both of you.

Before you have to jump into the conversation, think about:

- Letting your partner know in advance rather than springing it on them;

- Making sure you and your partner haven't drunk alcohol before having the conversation, as this can make it easy for it to spiral;

- Having all the facts to hand, so you know exactly how much you are spending;

- Using 'I' statements rather than 'you'. For example, you could say to your partner: "I'm really worried about my finances and I would like to sit down and talk about how we manage it. Can we plan a time when we can sit down and do it?"

Mr Saddington says if your partner is not willing to help, you should look at the reasons or question if there are other things in the relationship that need sorting out.

If you're having repeated arguments about money, he says you might have opposite communication styles causing you to "keep headbutting".

Another reason could be there is a "big resentment" lurking in the background - and it may be that you need a third party such as a counsellor, therapist or mediator to help resolve it.

Mr Saddington says there needs to be a "safe space" to have these conversations, and that a third party can help untangle resentments from what is happening now.

He also suggests considering both of your attitudes to money, which he says can be formed by your early life and your family.

"If you grew up in a family where there wasn't any money, or it wasn't talked about, or it was pushed that you save instead of spend, and the other person had the opposite, you can see where those conversations go horribly wrong.

"Understanding what influences each of you when it comes to money is important to do before you have significant conversations about it."

What are the different ways you can split your finances?

There's no one-size-fits-all approach, but there are several ways you can do it - with Money blog readers getting in touch to let us know their approach...

1. Separate personal accounts - both pay the same amount into a joint account regardless of income

Paul Fuller, 40, earns approximately £40,000 a year while his wife earns about £70,000.

They each have separate accounts, including savings accounts, but they pay the same amount (£900) each a month into a joint account to pay for their bills.

Paul says this pays for the things they both benefit from or have a responsibility for, but when it comes to other spending his wife should be able to spend as she likes.

"It's not for me to turn around to my wife and expect her to justify why she thinks it's appropriate to spend £150 in a hairdresser. She works her backside off and she has a very stressful job," he says.

However, their arrangement is still flexible. Their mortgage is going up by £350 a month soon, so his wife has agreed to pay £200 of that.

And if his wife wants a takeaway but he can't afford to pay for it, she'll say it's on her.