- Latest Headlines

- English Edition Edition English 中文 (Chinese) 日本語 (Japanese)

- Print Edition

- More More Other Products from WSJ Buy Side from WSJ The Journal Collection WSJ Shop WSJ Wine

Page Unavailable In Your Region

Buy side from wsj is currently only available inside of the united states. we apologize for any inconvenience. if you have any questions, please reach out to .css-1awxlyl{display:inline;color:var(--color-interactivelink010);-webkit-text-decoration:underline;text-decoration:underline;}@media screen and (prefers-reduced-motion: no-preference){.css-1awxlyl{transition-property:color,fill;transition-duration:200ms,200ms;transition-timing-function:cubic-bezier(0, 0, .5, 1),cubic-bezier(0, 0, .5, 1);}}@media screen and (prefers-reduced-motion: reduce){.css-1awxlyl{transition-property:color,fill;transition-duration:0ms;transition-timing-function:cubic-bezier(0, 0, .5, 1),cubic-bezier(0, 0, .5, 1);}}.css-1awxlyl svg{fill:var(--color-interactivelink010);}.css-1awxlyl:hover:not(:disabled){color:var(--color-interactivelink020);-webkit-text-decoration:underline;text-decoration:underline;}.css-1awxlyl:hover:not(:disabled) svg{fill:var(--color-interactivelink020);}.css-1awxlyl:active:not(:disabled){color:var(--color-interactivelink030);-webkit-text-decoration:underline;text-decoration:underline;}.css-1awxlyl:active:not(:disabled) svg{fill:var(--color-interactivelink030);}.css-1awxlyl:visited:not(:disabled){color:var(--color-interactivevisited010);-webkit-text-decoration:underline;text-decoration:underline;}.css-1awxlyl:visited:not(:disabled) svg{fill:var(--color-interactivevisited010);}.css-1awxlyl:visited:hover:not(:disabled){color:var(--color-interactivevisited010);-webkit-text-decoration:underline;text-decoration:underline;}.css-1awxlyl:visited:hover:not(:disabled) svg{fill:var(--color-interactivevisited010);}.css-1awxlyl:focus-visible:not(:disabled){outline-color:var(--outlinecolordefault);outline-style:var(--outlinestyledefault);outline-width:var(--outlinewidthdefault);outline-offset:var(--outlineoffsetdefault);}@media not all and (min-resolution: 0.001dpcm){@supports (-webkit-appearance: none) and (stroke-color: transparent){.css-1awxlyl:focus-visible:not(:disabled){outline-style:var(--safarioutlinestyledefault);}}} [email protected].

POPULAR ARTICLES

.css-1klgif4-CardLink{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;}.css-1klgif4-CardLink.css-1klgif4-CardLink:any-link{color:rgba(17,17,17,1);}.css-1klgif4-CardLink.css-1klgif4-CardLink:any-link:hover{color:rgba(17,17,17,1);-webkit-text-decoration:none;text-decoration:none;}.css-1klgif4-CardLink.css-1klgif4-CardLink.css-1klgif4-CardLink *{cursor:inherit;} .css-qthp11-CardLink{display:inline;color:var(--color-interactiveLink010);-webkit-text-decoration:none;text-decoration:none;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;}@media screen and (prefers-reduced-motion: no-preference){.css-qthp11-CardLink{transition-property:color,fill;transition-duration:200ms,200ms;transition-timing-function:cubic-bezier(0, 0, .5, 1),cubic-bezier(0, 0, .5, 1);}}@media screen and (prefers-reduced-motion: reduce){.css-qthp11-CardLink{transition-property:color,fill;transition-duration:0ms;transition-timing-function:cubic-bezier(0, 0, .5, 1),cubic-bezier(0, 0, .5, 1);}}.css-qthp11-CardLink svg{fill:var(--color-interactiveLink010);}.css-qthp11-CardLink:hover:not(:disabled){color:var(--color-interactiveLink020);-webkit-text-decoration:underline;text-decoration:underline;}.css-qthp11-CardLink:hover:not(:disabled) svg{fill:var(--color-interactiveLink020);}.css-qthp11-CardLink:active:not(:disabled){color:var(--color-interactiveLink030);-webkit-text-decoration:underline;text-decoration:underline;}.css-qthp11-CardLink:active:not(:disabled) svg{fill:var(--color-interactiveLink030);}.css-qthp11-CardLink:focus-visible:not(:disabled){outline-color:var(--outlineColorDefault);outline-style:var(--outlineStyleDefault);outline-width:var(--outlineWidthDefault);outline-offset:var(--outlineOffsetDefault);}@media not all and (min-resolution: 0.001dpcm){@supports (-webkit-appearance: none) and (stroke-color: transparent){.css-qthp11-CardLink:focus-visible:not(:disabled){outline-style:var(--safariOutlineStyleDefault);}}}.css-qthp11-CardLink.css-qthp11-CardLink:any-link{color:rgba(17,17,17,1);}.css-qthp11-CardLink.css-qthp11-CardLink:any-link:hover{color:rgba(17,17,17,1);-webkit-text-decoration:none;text-decoration:none;}.css-qthp11-CardLink.css-qthp11-CardLink.css-qthp11-CardLink *{cursor:inherit;} .css-jjua3s-HeadlineTextBlock >*{display:inline-block;}.css-jjua3s-HeadlineTextBlock style[data-emotion]{display:none;} .css-1qw2665-HeadlineTextBlock{margin:0;font-family:Escrow Condensed,Times New Roman,serif;font-size:24px;line-height:28.0001px;font-weight:700;letter-spacing:0px;font-style:normal;text-transform:none;font-stretch:normal;padding:0.5px 0px;}.css-1qw2665-HeadlineTextBlock::before{content:'';margin-bottom:-0.2543em;display:block;}.css-1qw2665-HeadlineTextBlock::after{content:'';margin-top:-0.2233em;display:block;}.css-1qw2665-HeadlineTextBlock >*{display:inline-block;}.css-1qw2665-HeadlineTextBlock style[data-emotion]{display:none;} Republicans Better Get on the Ball

The ‘Teen Night’ Scandal Rocking a Tiny Jersey Shore Town

It Sank in 15 Minutes. How Tragedy Struck Mike Lynch’s Yacht.

LATEST PODCASTS

Kamala Harris’s Big DNC Speech Says Little

TNB Tech Minute: AI Companies in China Push Ahead Without Advanced Chips

Stocks Rally as a Rate Cut Draws Closer

Copyright © 2024 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

- Money Transfer

- Rate Alerts

Xe offers an assortment of Travel Tools for your next trip! Whether it’s a currency app on your mobile phone, or Travel Reviews to help you pick your destination, Xe Travel is the perfect resource for you.

Travel Tools

Currency email.

Subscribe to free daily email updates with currency rates for the top 170 currencies. The Xe Currency email also includes news headlines, and central bank interest rates.

Xe Currency Encyclopedia

Read currency profiles with live rates, breaking forex news, and other facts for every world currency. You can also learn about services available for each currency.

Free Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

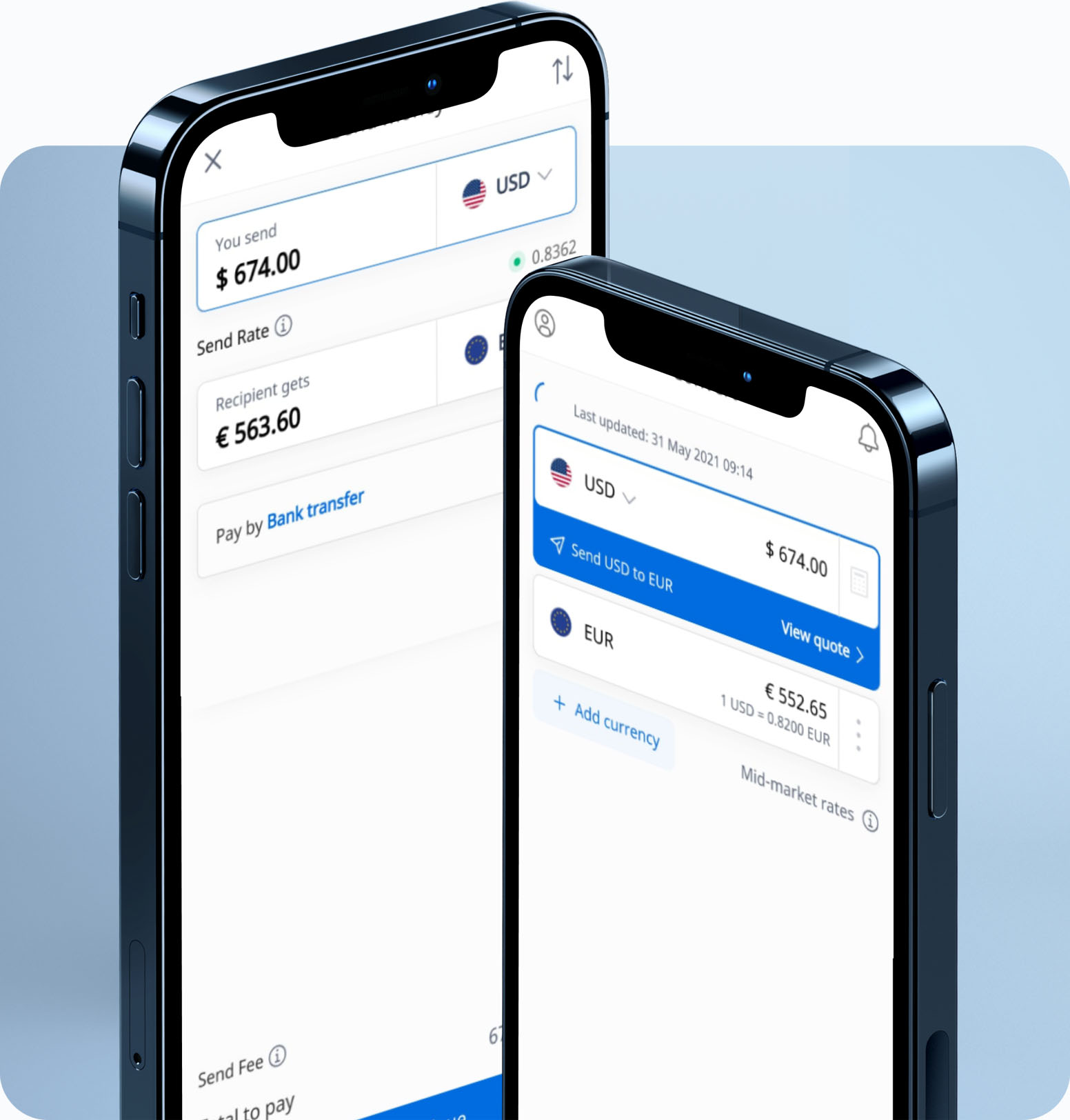

Download the App

Keep track of live mid-market rates for every world currency on your Smartphone. That’s 170+ currencies that you can convert on the go!

Travel Blog Posts

What’s the Best Way to Exchange Your Currency for a Trip Abroad?

Got an international trip coming up? Need to make a currency exchange? Let us talk you through your options.

How to save money on your next European trip

The currency you choose to use will impact the cost of your trip in several ways. By knowing the Euro to Dollar conversion exchange rate, you can save yourself a lot of money on your European getaway.

Your Checklist for International Travel During COVID-19

Do you need to travel overseas soon? Here’s what you’ll need to know before (and during) your time abroad.

Destination Wedding Planning: How to Plan, Execute, and Stay on Budget

It’s no surprise that couples increasingly choose to avoid the high costs of a UK wedding by heading overseas, where costs tend to be more affordable.

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- United States Australia Canada France --> Germany --> Holland --> India Japan --> Ireland --> Malaysia --> Mexico --> New Zealand Philippines --> Singapore Spain --> UAE United Kingdom Other countries Global

- Profile -->

- My Rates -->

- Search Rates

Home Currency Exchange

- Currency Exchange

Buy or Spend which Currency? USD EUR CAD GBP All Currencies

actions right hide768">-->

transfers"> -->

Plane2"> -->, cards"> -->, compare exchange rates, fff500" fill-opacity="0.71"/>, 00f0ff" fill-opacity="0.63"/>.

heading suffix">

How to Save on Currency Exchange and Travel Money

Best Exchange Rates makes it easy to compare retail FX rates from trusted, regulated currency exchange specialists to use when you Travel and Spend abroad.

We show you how to use a multi-currency card or order foreign cash online for better currency exchange rates, convenience and save money for your next trip or overseas online purchase.

Here are a few ways you can save on currency exchange when traveling overseas:

- Compare exchange rates: Shop around to get the best exchange rate. Compare rates from banks, currency exchange offices, and online providers to find the best deal.

- Use a credit card: Credit cards often offer favorable exchange rates, so using one to make purchases in Portugal can save you money. Just be sure to pay off the balance in full each month to avoid interest charges.

- Use a debit card: Debit cards linked to a foreign currency account can also offer good exchange rates. This can be a good option if you don’t have a credit card or don’t want to use one for your trip.

- Avoid exchanging currency at the airport: Currency exchange offices at airports often have lower exchange rates than other options. If possible, wait until you get to your destination to exchange currency.

- Consider using a travel money card: Travel money cards are prepaid cards that you can load with multiple currencies. They can be a convenient and cost-effective way to pay for things while traveling.

- Use ATMs: ATMs often offer competitive exchange rates, and you’ll usually only pay a small fee to your bank for using an ATM abroad. Just be aware of any fees your bank charges for foreign transactions.

- Pay in the local currency: Some merchants may offer to charge you in your home currency instead of the local currency. This is called “dynamic currency conversion.” While it may be convenient, it often results in a less favorable exchange rate for you. It’s usually better to pay in the local currency.

- Best Rate Calculator

- Foreign Transfers

- Large Transfers

- Cross Rate Matrix

- Who We Compare

- Rate Tracker

- Market Update

- Currency Forecasts

- Country guides

- Content Hub

- How-to-Save Guides

- User Forums

- Log in to BER

- Country Sites

- BER.me Profile

- Transfers - Quote

BER is operated by Best Exchange Rates Pty Ltd, a company incorporated under the laws of Australia with company number ABN 68082714841. BER is a comparison website only and not a currency trading platform. BestExchangeRates.com uses cookies. Disclaimer & Terms of Service Privacy

Best Travel Money Exchange Rates Compared & Reviewed

This guide explains the cheapest and most expensive ways to buy travel money. It can help save you money if you are thinking about going abroad and trying to work out the best way to spend while you’re there.

Compare Travel Money Exchange Rates

Commission charges when you buy foreign currency have mostly been phased out. Now most currency operators make money on the difference between the interbank exchange rate and the rate they actually give you.

So the best way to know if you’re getting a good deal is to compare the actual exchange rate you’re getting.

For each of the currency exchange locations below we have used the euro as an example – but where you see a location giving a bad rate (versus the benchmark interbank rate) for euros, you can be pretty much guaranteed you’ll get a bad rate on any other currency at that place too.

Here are the ways to get the most for your money when buying foreign currency, ranked best to worse.

(All exchange rate figures accessed on 31 May 2023.)

What’s in this guide?

1. Currency cards – BEST RATE

Currency cards are debit card-style payment cards designed to be used while you are on holiday or travelling outside the UK to pay for goods and services, usually anywhere you see the Visa or Mastercard symbol. They either come as regular debit cards with travel money functions, or as a separate card that connects to your current account.

Currency cards offer some of the best exchange rates around, and are available from, for example, Starling, Monzo, Revolut , and Curresea.

The euro rates for Monzo and Starling are based on the Mastercard rate so are the same:

- £1 = €1.152 (vs €1.16 inter bank rate)

- On the (free) Curresea Essential plan the euro rate is:

- £1 = €1.152

- On the (paid for) Curresea Elite and Premium Plans the euro rate is:

- £1 = €1.163

- Ease : Currency cards are easy to apply for and usually arrive within a few days. If your bank already offers a travel card service as part of your account you may not even need to apply for a new card. Plus you don’t need to worry about changing up loads of cash before you go away.

- Safety : If you lose cash, it’s usually gone forever. If you lose your currency card you can cancel or freeze it in the app that comes with it to prevent anyone else using your holiday money.

- Virtual wallet: You can add most currency travel cards to your phone’s virtual wallet, so you can still pay if you only have your phone with you.

- Charges : Fees and charges to use your currency card abroad can vary significantly so it’s a good idea to compare different providers before you choose which one to go with. Be aware the card provider – typically either Visa or Mastercard – can add its own fees of 1% to 3% on top of transactions.

- ATM limits : Some card providers limit how much you can withdraw from an ATM in another currency, after which point more charges will kick in.

- No section 75 protection : Debit card payments and purchases are not covered by section 75 of the Consumer Credit Act. But you might be able to make a claim for a refund under a voluntary scheme called ‘chargeback’.

2. Cash point abroad

Withdrawing cash from an ATM abroad can be a good option if you use one of the cards mentioned above, or a travel credit card. They are designed for use while travelling, so give the best rates on foreign exchange, and limit the fees and charges you pay while using them abroad. It is for this reason that cash point abroad is 2nd on this list.

Currensea , for example, as well as offering one of the best exchange rates, allows free ATM withdrawals of up to £500 using its Essential Card (2% fees over), and with its Premium Card (which costs £25 a year) you can make fee free ATM withdrawals up to £500 (1% over).

Just remember – if the ATM tells you a fee applies, always choose to be charged in the local currency of the country you’re in (this also applies to card purchases).

However beware – this is important – if you just take your normal debit card or credit card abroad you can expect high fees from both your bank and the ATM you withdraw cash from every time you use it.

For example, Barclays charges a 2.99% fee for using your standard debit card abroad when making purchases, withdrawing cash or for refunds.

So while you get a pretty decent exchange rate with Barclays (which uses the Visa rate), once the fee is added the real rate is much less. It works out as:

- Visa rate: £1 = €1.161 (vs €1.16 inter bank rate) before charges

- Barclays debit rate after 2.99% fee added £1 = €1.128

- Cheap if you use the right cards: Taking money out at an ATM abroad can be one of the cheapest ways to access cash if you use a card designed for travel that has fee-free options and a good exchange rate (see out Best Rated above).

- Don’t have to carry so much cash : Carrying huge wads of cash is a theft risk. Carrying a couple of cards (one for use and one for back up) is much safer.

- High costs if you use the wrong card : Avoid taking your regular debit or credit card abroad as to use it you will have to pay high fees.

3. Highstreet in the UK

UK highstreets offer a number of exchange rate options, from inside department stores like John Lewis, to specialist foreign exchange rate shops like No1 Currency. The rates will vary from place to place.

At No1 Currency, for example, the online rates are below, although the website says the in store rates may differ from what is advertised.

- £1 = €1.136 (vs €1.16 inter bank rate)

- £100 = €113.67

At John Lewis, on the same day the rate was a little lower.

- £1 = €1.133 (vs €1.16 inter bank rate)

- £100 = €113.38

At Marks & Spencer, the rate was:

- Click & Collect: £1 = €1.138 (vs €1.16 inter bank rate)

- £100 = €113.80

- In-store bureau de change: £1 = €1.119

- £100 = €111.90

At a TUI branch the rate was:

- £1 = €1.139 (vs €1.16 inter bank rate)

- £100 = €113.90

- Click and collect rates : No1 Currency for example gives you a better rate if you order online then pick up in store, rather than have your currency delivered.

- Perks: For example at John Lewis you can earn points when you pay for currency with your Partnership Credit Card.

- Delivery charges : No1 Currency only offers free delivery for orders of £800 or more. At John Lewis the minimum for free home delivery is over £500.

- Minimum orders online: John Lewis, for example, has a £250 minimum for online orders.

4. Online with a supermarket

Most supermarkets sell travel money these days and it can be a convenient way to pick up some currency while you do your weekly shop. You can buy on the day or order online to collect.

As an added bonus, supermarkets offer a better rate on foreign currency for their loyalty card holders, pushing supermarkets up the ranking in terms of rates.

- Standard rate: £1 = €1.130 (vs €1.16 interbank rate)

- £100 = €113

- Tesco Clubcard rate: €1.135

- £100 = €113.50

Sainsbury’s

- £1 = €1.131 (vs €1.16 interbank rate)

- £100 = €113.17

- Sainsbury’s Nectar card rate: €1.1340

- £100 = €113.40

- Loyalty perks and points : Loyalty card holders get better exchange rates, plus you can earn loyalty points when you pay for the currency just like any other purchase.

- Convenience : Order online then pick up when you do your weekly shop.

- Minimum order amounts: For example Tesco has a minimum order amount of £400 worth of currency when you buy online, and a minimum of £500 to have a free home delivery. There is no minimum order amount for Sainsbury’s but a £4.99 fee to have currency bought online delivered at home.

5. Post office

The Post Office is a handy one-stop-shop for lots of holiday related things, from travel insurance to international driving permits, and including travel money. While the Post Office doesn’t offer the best rates on the market, it does have several other advantages that could make it a good option, especially if you are in a hurry.

- £1 = €1.116 (vs €1.16 inter bank rate)

- £100 = €111

- Rate increases : Order online for the best rates on every currency. The more you buy, the better the rate.

- Fast pick up service : You can pick up euros and US dollars from your nearest branch in as little as 2 hours, from selected branches. Order by 2pm (1pm Saturday) to collect the same day, from 2 hours later. Order after 2pm (1pm Saturday) to collect the next working day, from 11am. Or you can choose delivery to your home.

- Refund policy : Will refund 100% of the holiday money you bought if your trip abroad is cancelled

- Queuing : With a number of Post Offices closing, and banks shutting branches that force Post Offices to do more services with less, queues to get you travel money in person can be long.

- Limited currencies: Post Office in my experience don’t carry that much currency and only in a few of the most common types. Beware buying last minute – if you try to just pop in on the day to buy your currency without pre-ordering you may find they have run out, or don’t stock it.

- Buying limits : The minimum you can buy online of a currency is £400 worth, and the maximum is £2,500.

6. At the airport

The only times I have bought currency at the airport it has been out of desperation and from a lack of forward planning – and I have always regretted it. It is typically one of the most expensive (i.e. worst exchange rate) places to buy foreign currency.

But if you’re in a panic because you forgot to get out any cash before your trip, it is at least convenient to be able to grab some foreign currency before your flight.

Two of the most common foreign exchange kiosks you’ll find at UK and global airports are Travelex and Eurochange. The rates below are for their online services – rates in the airport are likely to be worse.

Travelex (online)

- £1 = €1.130 (vs €1.16 inter bank rate)

Eurochange (online)

- £1 = €1.131 (vs €1.16 inter bank rate)

- £100 = €113.10

- Location : If in the rush to get away you forgot to pick up any currency, airport foreign exchange kiosks offer a last minute lifeline.

- Availability of currencies: Because of their location, currency kiosks in international airports tend to be well stocked in multiple currencies, even the less common ones.

- Switching currency : If you are visiting multiple countries on a trip but don’t want to carry large amounts of currency, changing up just what you need at each airport you pass through is an option.

- Expense : You will never get the best foreign exchange rate at an airport.

- Lack of comparison : Even if there is more than one currency store at the airport, they all tend to offer the same rates. Once you’re there you have no other options, you have to take what you can get.

7. Online with a bank

Buying travel money from your local bank might seem like the obvious choice, but surprisingly the rates on offer are likely among the worst you’ll get anywhere in the UK. However the limits on how much you can purchase can be higher (though you won’t get a better rate the more you buy so why bother?)

- £1 = €1.105 (vs €1.16 inter bank rate)

- £100 = €110.51

- £1 = €1.106 (vs €1.16 inter bank rate)

- £100 = €110.67

- High purchase limits : At Barclays, for example, you can order up to £5,000 per person within a 90-day period, and a maximum of £2,500 from that amount can be sent for home delivery to a single residential address.

- Fee free deliveries : HSBC, for example, offers fee-free deliveries on your travel money to HSBC Full and Cash Service branches or to your home. Other banks may charge.

- Limited to customers : You may find you have to be a customer. For example, you’ll need a Barclays debit card or Barclaycard to place your order for currency online there.

- Expensive : Among the worst rates for currency exchange you’ll find anywhere in the UK.

8. Bureau de change abroad – WORST RATE

Bureau de changes abroad are typically in tourist hotspots. And what do we know about tourist hotspots? Rife for pickpockets and overinflated prices. This is the attitude you should take to foreign currency shops in these locations.

One example that proves the ‘expensive option’ point is Ria Money Transfer & Currency Exchange, situated in the busy Plaza de Callao in central Madrid, Spain.

Ria’s exchange rate on 31 May 2023 was:

- £1.00 = €0.99 (vs €1.16 inter bank rate)

Convenient : If you really need cash while you’re abroad, maybe because you’re in a place where your cards are not widely accepted, a local bureau de change may be a lifeline – just expect to pay heavily for that life raft.

- Cost, cost, cost: Buying foreign currency from a currency shop or kiosk in a tourist hotspot (where you are most likely to find them) is an extremely expensive way of getting your hands on cash. Avoid if at all possible.

- Theft risk : Pickpockets may hang around bureau de change just like they hang around ATMs, because they know you have just withdrawn what is probably a large amount of money. Secure your cash hidden away before you leave the kiosk.

Is it still worth getting travel cash ahead of your holidays?

Yes. Absolutely. Cards aren’t accepted everywhere, as I found to my detriment when I arrived in Buenos Aires and tried to take out local currency on my credit card at the foreign exchange desk at the airport.

“Absolutely not possible”, I was told. A combination of a lack of provision to buy currency on credit card there, and the Argentinian peso being just too volatile for credit card providers to let you buy it on their service.

All I had in hard currency was US$100 in Argetininian pesos I had changed in the airport at Rio De Janeiro, Brazil, where I had just come from, and a US$100 bill. Luckily I’d pre-paid my Buenos Aires hotel in advance, and I could easily find restaurants that would accept my credit card. But taxis only took cash, so I spent a lot of time walking – thinking about how I should have brought more pesos with me.

We’ve answered some of the most commonly asked questions when it comes to travel money.

Yes, in most cases. Cash withdrawal fees will probably apply of around 3%, just like they would at home for taking cash out on a credit card, and these will be on top of any currency conversion fees.

Be aware though – in countries with a highly fluctuating exchange rate, like Argentina, you may not be able to buy foreign cash with your credit card (not even at the bureau de change at the airport, for example). You still may be able to pay for goods and services with your credit cards, but check how widely they are accepted before you travel.

Yes, on the whole. When buying travel money online, like with buying anything online, you’re best off sticking to well known brands, whether that be banks, supermarkets, or currency exchange stores.

A large institution or well known brand is less likely to go bust, and that is important because foreign exchange is not a regulated service. This means your cash is not protected if the company you tried to get your foreign currency from closes suddenly.

Yes. Most places that sell you travel money will buy it back from you. But just like when you’re swapping your pounds for foreign currency, when you swap it back you should compare the exchange rates on offer. As a general rule, a location that offers a good rate one way, offers a good rate the other way.

Travel money providers – from the currency shops and bureau de change, to the banks and supermarkets, anywhere basically that sells currency – make money by giving you slightly less than the central banks give them for the foreign money you want to buy.

For example, if a currency provider tells you they will give you €1.131 for every pound you give them, but the central bank rate for euros is €1.157 per pound, the difference is €0.026, which they pocket. This may not sound much, but multiplied over millions of transactions a year, it adds up.

Compare, compare, compare the single unit price – which means the £1 for a €1 rate, or whichever currency you choose, versus the interbank rate, which you can get by just Googling “1 GBP in EUR”.

Places that sell currency, online or in a shop, have to show you the exchange rate for that day. While it’s probably not practical to go traipsing around comparing shops, it’s easy enough to do so online. If you run up against minimum purchase amounts online, still go with the company providing the best rate but visit their location in person.

Also try not to get yourself in a position where you’re desperate to buy foreign currency, either at home or abroad. This means having enough cash on you in remote locations, and tourist hotspots, and before you travel (to avoid the airport currency shops).

Laura Miller has been a financial journalist for more than 10 years, and was on staff at the Telegraph before going freelance in 2019. Her experience includes hosting podcasts and panels, and she writes for the Times and Sunday Times, Daily Mail, Mail on Sunday and the Sun, as well as trade titles. She now lives by the sea in Aberystwyth, west Wales.

You may also be interested in:

Before you go!

Find your perfect account in under 1 minute.

Tell us what is most important to you and we'll match you with expert and user reviews of top rated financial service providers.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Best Places To Exchange Money [Best Rates, Fees, and Convenience]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Senior Editor & Content Contributor

150 Published Articles 766 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![best exchange rates travel money Best Places To Exchange Money [Best Rates, Fees, and Convenience]](https://upgradedpoints.com/wp-content/uploads/2023/09/Person-putting-euros-in-wallet-at-money-exchange.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

How does currency exchange work, exchanging money before you leave, exchanging money while you’re abroad, exchanging money when you get home, best tips to tackle international spending, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When planning a trip abroad, being able to pay for expenses is bound to be a primary concern. While using a credit card for your purchases can give you the best rate, we know it’s not always possible to pay with a credit card everywhere you go.

So, where is the best place to exchange money? Should you exchange money before you leave or while you’re on vacation? And what do you do with leftover currency when your trip is over? We’ll answer all these questions and give you some great tips for exchanging money on your next trip.

An exchange rate is the value at which one currency can be exchanged for another. Frequently, this value is variable and dependent on the market, but sometimes the value can be fixed, or pegged, to another currency.

Banks and currency exchange stores tack on some sort of charge in addition to the market rate, and these fees can vary significantly.

What does this mean for you? Your spending power on your vacation depends on the value of the U.S. dollar and the currency of the country you’ll be visiting. As these values fluctuate over time, planning a trip when the dollar is favorable can benefit you. Also, where you choose to exchange your money matters!

You have the best opportunity to get the best exchange rates before you ever leave home.

The best place to exchange money is at your local bank or credit union. You will get the best currency exchange rates as rates will closely resemble the market rates, with only minimal added costs added on.

You’ll obviously need to do this before you leave unless your bank has an international presence in the country you’ll be visiting, so plan ahead!

Before you head over to the bank, give them a call to see if they have your desired currency on hand. Depending on the currency you need, you may have to order it in advance. If it’s a common currency, sometimes banks will have it available immediately.

The pro of exchanging money before you leave is that you can hit the ground running when you arrive. You can also generally save some money if you get the money from your bank or credit union.

Knowing your destination’s currency conversion in relation to U.S. dollars is important! We recommend using an offline currency conversion app, such as Currency ( iOS ) or Currency Converter Plus ( Android ). You can also just plug it into Google, but it is helpful to have access abroad even if you don’t have an internet connection.

What Not To Do

You might be tempted to exchange money at the airport before you leave, but we generally recommend against this. Airport exchange kiosks and stores are convenient but also tack on big fees and unfavorable rates . This can end up costing you!

You might not need as much cash as you think. Most places accept credit cards, and then you could be stuck carrying excess cash around (and exchanging it back). Try not to take out more than you need.

Regarding traveler’s checks , while they have been popular in the past, they have fallen out of favor. It is increasingly difficult to find a place that will cash them — if your bank even offers them. We don’t recommend exchanging money for traveler’s checks as credit cards (and even debit cards) offer a level of security once only provided by traveler’s checks.

If you’ve already left home and need some tips on exchanging currency, we’ve got you covered!

If you’re wondering how to get local currency when traveling, the easiest way is by using your debit card at an ATM. It’s best to use your bank’s ATM network in order to avoid fees, but any ATM will work. These fees generally range from 1% to 3%. There are cards that will waive (or reimburse) international ATM withdrawal fees, though!

Try to limit your withdrawals and take out the maximum you think you’ll need each time, as there are per-transaction fees as well (generally about $5). In addition, if you’re planning to get money out abroad, knowing your ATM limit is important. You can call your bank to request an increase if it is low.

Also, consider using your credit card when you travel abroad. Most stores and restaurants accept credit cards, which is the easiest and most convenient way to get the best currency exchange rate! Just be sure to select “local currency” and not “pay in U.S. Dollars.”

If you’re looking for a card with no foreign transaction fees , consider popular rewards cards like the American Express ® Gold Card or the Chase Sapphire Preferred ® Card . Both cards also offer a ton of other valuable travel-related benefits!

Whatever you do, don’t get money from a foreign ATM using your credit card. This is considered a cash advance — the fees can be high, and the interest begins to accrue immediately.

Also, we don’t recommend using those currency exchange stores and kiosks (i.e. Travelex) you see at the airport, hotels, and other major tourist destinations. While they might seem convenient, the rates are not favorable, and the fees are much higher than other options.

For example, let’s say you have $100 to exchange for euros and the current market rate for the exchange is €92.64. Your bank might offer you €92, while a currency conversion kiosk might offer €87. Extra fees could also be tacked on that eat away further at your exchange’s value.

If you have some leftover cash, you’ll likely want to convert it back into U.S. dollars. The best way to exchange foreign currency for U.S. dollars will be at your bank or credit union. Unfortunately, they may not buy back all types of currency.

Those currency exchange stores and kiosks we advised against before might be a good option for less-common currencies. The fees are higher, but at least you won’t be stuck with currency you won’t use again!

Another option might be to donate currency to UNICEF’s Change for Good . American Airlines offers envelopes on its planes and at its Admirals Club and Flagship Lounge locations, but you can also mail currency to the following address:

Change for Good UNICEF USA 125 Maiden Lane New York, NY 10038

While exchanging money for cash is a good start, having a good plan in place for all your international spending is important. That’s because it’s just not feasible to pay for all your large expenses (such as hotels, train travel, etc.) with cash. Here is what we recommend:

- Use your debit card to get out cash from an ATM when you’re abroad or bring money from home.

- Bring along a credit card that has no foreign transaction fees and don’t use your credit card to get out cash from an ATM.

- When using your credit card, be sure you choose to pay in local currency.

- Avoid currency stores and kiosks if possible.

- Be aware of the current currency exchange rate to avoid any surprises!

Where you choose to exchange your currency can have an impact on how much money you’ll receive. The best rates are found at banks and credit unions. Even if you exchange money when you’re abroad, you can save money by using your debit card to take cash out of an ATM. Be sure to bring cards that are meant for international travel and you’ll be sure to save!

For rates and fees of the American Express ® Gold Card, click here .

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Best Euros Exchange Rates

There is quite a lot of movement on the pound to euro rate - so keep a close eye and buy early if possible

Delivery Options

Established since 2010. Home delivery is free above £700 with a postal charge of £5 for orders below £700. Payment for your currency can be made via Visa, Mastercard, Apple Pay or Google Pay but using these services incurs a 0.1% additional fee. There are no charges if you pay using the “pay by bank app” or for make a manual bank transfer.

Linkfx Home Delivery

Linkfx Home Delivery was established in 1995. Home delivery is free above £750 with a postal charge of £5 for orders below £750. There is no ‘Click & Collect’ service available.

Currency Online Group

Established in 2006. Home delivery is free above £750 with a postal charge of £5 for orders below £750. “Click and collect” is available in 2 London locations.

Established in 1972. Home delivery is free above £700 with a postal charges of £6 for orders below £700. “Click and collect is available via their London W2 office.

Established in 1975. Home delivery free above £500 with postal charges of £5 for orders below £500. Has 192 “click and collect” outlets throughout the UK.

NM Travel Money

Established in 2018 and part of the NM Money Group which includes eurochange. Home delivery is free above £500 with postal charges of £5 for orders below £500. Has access to the 192 eurochange “click and collect” outlets

Part of the TUI Travel Agent Group. Home delivery is free above £600 with a postal charge of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

First Choice

Provided by TUI Travel Money. Home delivery is free above £600 with postal charges of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

Provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with a postal charge of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and “click & collect” is available at a selected number of stores -check to see if there is one near you.

Part of the John Lewis partnership and provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with postal charges of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and ‘click & collect’ is available at a selected number of these stores -check to see if there is one near you.

Sainsbury’s have offered a travel money service as part of their bank offering since the late nineties. Home delivery is free above £400 with a postal charge of £4.99 for orders below this amount. ‘Click & collect’ is available in Sainsbury’s stores throughout the UK. Check to see if this service is available at a store near you

The Currency Club

Established since 2010. Home delivery and payment via bank transfer is free. Payments via debit card incur a fee of 0.29%. There is no “click & collect” service available.

Established in 1976. Home delivery is free above £600 with postal charges applied on a tiered basis, ranging from £2.99 to £7.49 depending on the amount purchased. ‘Click & collect’ service available. Many of their outlets are at airports and transport hubs -check to see if there is a location convenient to you.

Travel money services offered in conjunction with Travelex. Home delivery is free above £500 with a postal charge of £3.95 for orders below £500. Asda has over 500 stores throughout the UK – check to see if the “click and collect” service is available at a store near you.

Tesco provide travel money services in conjunction with Travelex. Home delivery is free above £500 with postal charges of £4.99 for orders below £149 and £3.95 for orders below £500. Tesco has over 2,500 stores throughout the UK. Check to see if ‘click & collect’ is available at a store near you.

Covent Garden FX

Established in 2001. Home delivery is free above £750 with a postal charge of £6 for orders below £750. “Click & collect” is available from their London store and they also deliver to offices in the City of London.

The Post Office

Post Office has provided travel money services in conjunction with First Rate Exchange Services since 1994. Home delivery is free above £500 with a postal charge of £4.99 for orders below £500. “Click and collect” is available at 100’s of Post Offices throughout the UK. Check to see if this service is available near you.

Rapid Travel Money

Powered by the Currency Club and part of the Sterling Consortium that was established in 1972.Home delivery is free over £1500 with a postal charges of £8.99 for orders below £1500. There is no ‘click & collect’ service available

ABTA Travel Money

ABTA – The Travel Association knows travel and has been a recognised source of advice, guidance and support to travellers for over 70 years. ABTA now offers a Travel Money service with competitive rates on over 60 currencies. Order Online for Click & Collect in just 60 seconds later (depending on branch opening hours and stock availability) from over 190 locations or order before 2:30pm for next working day home delivery.

Currency Exchange Corp

- Established in 1999.

- Home delivery is Free above £800 but postal charges of £6.95 apply to orders below £800

- There is a ‘Click & Collect’ service available in some 16 stores in London & surrounding area but check this service is available at a store convenient to you.

No1 currency - Home Delivery

Established over 20 years ago and part of the Fexco Group. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. Has 180 “click and collect” outlets throughout the UK.

Established since 2007 and part of the Equals Money Group. Requires you to register for an account before ordering currency. Home delivery is free above £750 with postal charges of £7.50 for orders below £500 & £5 for orders between £500 & £750. “Click and collect” is available in a store in London.

Established since 2018. Home delivery is free above £750 with a postal charge of £7.50 for orders below £750. Available for “click and collect” from their office in Slough.

Thomas Exchange

Established in 1993. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. “Click and collect” is available in 9 outlets throughout London.

The travel money service is only available to HSBC, First Direct and Marks and Spencer Account holders. Offers free delivery by post or to HSBC branches

All orders must be paid for with a Barclays debit card or a Barclaycard. Travel money can be collected from Barclays branches or delivered free to your home address. Minimum order £50.

Currency Commentary

The Euro is the 2nd largest traded currency in the world behind the US dollar. There are 20 EU member countries that use the Euro with over 340m people using the Euro each day. These countries are as follows:

Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxemburg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain.

There are 6 Non-EU member countries that also use the Euro:

- Vatican City

It is also worth noting that French overseas territories use the Euro so it is worth taking Euros if you are visiting places such as Guadeloupe, French Guyana, Martinique and Saint-Martin in the Caribbean or Mayotte and Réunion in the Indian Ocean. Likewise, the Portuguese islands of Madeira and the Azores, and the Spanish Canary Islands, also use the Euro

How to get the best deals on your travel money

How do you get the best exchange rate for Euro?

To get the best exchange rate for Euro you should always use a travel money comparison website, they are easy to use and provide you with a simple way of finding the best price. You don’t have to choose the best rate, so for example if you would prefer a well-known brand which maybe costs more, you can do so but at least you understand the difference in cost. The difference in cost between the best and worst rate can be significant, up to £20 on a currency purchase of £750.

If you are happy to buy on-line then how do you get the best on-line exchange rate for Euro?

Firstly, to get the best on-line exchange rate for Euros always use a comparison website. You will be provided with a list of travel money suppliers usually in order of the best price first. If you want a larger number of Euros, say above £500 the best price will almost certainly be a small direct supplier with a less well known brand. You then have a choice as to whether you would prefer to have the money delivered to your home or to collect the money from a local store on the ‘High St’.

If you would like the money delivered to your home, then how do you get the best exchange rate for Eurosfor Home Delivery?

When you are choosing the provider make sure that you understand the postal delivery charges, particularly for amounts below £500 as any additional postal costs will effectively mean that you are receiving less Euros for the £sterling you pay. That is why at besttravelmoney.com we include postal charges for the specific amount of euros requested within the rate you are shown. So, what you see is the cost to you.

There are some practical considerations when choosing home delivery, like making sure the travel money supplier you have chosen for Euros does deliver to where you live. Some of the smaller suppliers with the best rates will only deliver to a small geographical area. Also, remember this is ‘cash’ you are having delivered, so you need to be at home when your Euros arrive.

If you only require a small number of euro or would prefer the convenience of collecting your Euro from a local store how do you get the best exchange rate for Euros on the High St?

We would still recommend you use a travel money comparison website. Choose the travel money provider which you consider having the best combination of rate and convenience for you. Check the supplier you have chosen (whether for example it is Tesco, Sainsbury’s or Eurochange) really does have a collection point near you as not all stores will have the facility.

We still recommend that you order on-line going from the comparison website to your chosen provider website to ensure you get the best deal. You will almost certainly getter a better rate via ‘click & collect’ than just walking into a store and purchasing your Euros.

Keep in mind our FAQ's to make sure your holiday money goes further

Always understand the charges for debit and credit cards.

Many of the costs that you incur while abroad are driven by your UK bank account or credit card, so understanding the costs for your debit or credit cards abroad is important.

Whilst using your debit card in the UK is usually free, using your card abroad often incurs extra charges. Apart from most European holiday destinations the major banks charge a fixed fee every time you use your debit card. There is also a foreign exchange fee (typically 2.99%) on the amount you spend when using your debit card. The newer banks tend to offer better deals. Starling bank and Revolut being two of the better examples.

We have put a table together of debit card charges for most UK banks within the Debit Card FAQ section .

Most credit cards don’t charge a fixed fee for using the card but still charge a percentage on any transaction that you make in a shop or restaurant. Also be careful using your credit card for cash from an ATM as it may be considered a cash advance and incur interest immediately. One of the better credit cards to use abroad is the Halifax Clarity card .

We have put a table together of credit card charges for the major UK card providers within the Credit Card FAQ section .

Always select the local currency in a shop or at an ATM

Something that is becoming more frequent when you go abroad is at an ATM or in shops and restaurants, you may be offered the option to pay in pounds sterling or local currency. Always choose the local currency otherwise you will get a very poor exchange rate and the cost to you can be surprisingly high.

This tiktok we saw explains it well for ATM transactions.

Check overseas ATM charges before pressing 'enter'

Understanding the differing charges applied by ATMs abroad is not easy. In theory ATMs are required to explain their charges before you press enter. Apart from any charges applied by your bank or credit card provider the local ATM owners may have differing exchange rates or local charges. Don’t be afraid to check out several local ATMs and see which offers the best deal.

Simpler options can be to take more local currency with you or use an ATM from a big local bank. ATMs from banks tend to charge less than independent local operators sited in stores or garages for example.

Our travel guides provide the names of the major banks in some different countries

Our travel money guides for countries that use the Euro

Check out our blog posts on places we have been.

All you need to know about cash and cards on a Caribbean cruise

Holidaymakers miss out on over £150m a year by not shopping around for currency

All you need to know about cash and cards when travelling to New Zealand

3 Easy Ways to Boost your Holiday Spending Power

Automated page speed optimizations for fast site performance

- Home ›

- Travel Money ›

Get the best US dollar exchange rate

Compare the latest US dollar exchange rates from the UK's best currency providers

Best US dollar exchange rate

It may come as no surprise that the US dollar is the most popular and widely-traded currency in the world. According to the Bank for International Settlements, nearly 90% of all foreign exchange trades involve the US dollar on one side of the transaction, and it's estimated that more than 60% of all the cash reserves held by central banks around the world are stored in US dollars.

If you're travelling to the USA, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best US dollar exchange rate by comparing a wide range of UK travel money suppliers who have US dollars in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best US dollar exchange rate right now is 1.2981 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of US dollars for home delivery.

The best US dollar exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

US dollar rate trend

Over the past 30 days, the US dollar rate is up 0.9% from 1.2981 on 25 Jul to 1.3098 today. This means one pound will buy more US dollars today than it would have a month ago. Right now, £750 is worth approximately $982.35 which is $8.77 more than you'd have got on 25 Jul.

These are the average US dollar rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to US dollar currency chart .

Timing is key if you want to maximise your US dollars, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the US dollar rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the US dollar rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their US dollars as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your US dollars sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better US dollar rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your US dollars first before you collect them from the store so you benefit from the supplier's better online rate.

US dollar banknotes and coins

US dollars are governed and issued by the central bank of the United States, the Federal Reserve, while the physical production of US dollar banknotes and coins is managed by the Department of the Treasury. Banknotes are printed by the Bureau of Engraving and Printing in Washington D.C., and coins are minted by the United States Mint which has facilities in various US cities including Philadelphia, Denver and San Francisco.

One US dollar ($) can be subdivided into 100 cents (¢). There are seven denominations of US dollar banknotes in circulation: $1, $5, $10, $20, $50 and $100 which are frequently used, plus a rarer $2 bill which is not as widely circulated but is still printed and is legal tender.

All US dollar banknotes feature two insignias that are intended to represent different aspects of American culture and history. The first insignia, known as the Great Seal, depicts a bald eagle with a shield on its chest, holding an olive branch and arrows in its talons. Above the eagle's head is a banner with the Latin phrase "E Pluribus Unum" which means "Out of Many, One", and a constellation of 13 stars representing the original 13 American colonies. The second insignia is the seal of the Federal Reserve System. The front of the seal features an eagle holding a key which represents the Fed's role in controlling the money supply, and a scroll which represents the Fed's responsibility to regulate and oversee banks.

There are four US dollar coins in frequent circulation: 1¢, 5¢ (nickel), 10¢ (dime) and 25¢ (quarter). 50¢ and $1 coins are also minted but are not as widely used.

Dollars are colloquially referred to as 'bucks'. The name was originally used as slang term in 19th century poker games, where a 'buck' was a buck-handled knife that was passed from player to player to indicate whose turn it was to deal. If a player didn't want the responsibility of dealing, they could 'pass the buck' to another player. Over time, the term 'buck' came to be used more broadly to refer to a bet or a wager; eventually becoming synonymous with dollars.

There's no evidence to suggest that you'll get a better deal if you buy your US dollars in the USA. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your US dollars in the USA:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy US dollars when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in the USA

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Tips for saving money while visiting the USA

The USA has a high standard of living, and prices are generally comparable to the UK for things like accommodation, food and transport. Hawaii, New York and California are generally considered to be the expensive states to visit, while Kentucky, Mississippi and Arkansas are among the cheapest.

- Research your accommodation: One of the best ways to save money is by opting for budget accommodation. Hostels, guest houses and AirBnB can be much more affordable than hotels, especially if you rent a room instead of an entire apartment. Hostel chains like Hostelling International, Freehand Hostels and Selina operate modern, budget-friendly accommodation in most large US cities.

- Use public transport: Private taxis and rental cars are an expensive way to get around, so make the most of busses, trains and metros wherever possible. Look out for discounted travel passes like CityPASS and Go Card to save even more on standard fares.