Avion Travel Insurance Review

Everything you need to know before you buy travel insurance from Avion!

The experts say:

Bonus: enter the code ERGHX10 for a 10% discount. Terms and conditions apply – see the Just Travel Cover review .

What Just Travel Cover customers are saying right now:

- 🤩 Easy to input health information

- 🤩 Prompt email confirmations

- 🤩 Knowledgeable staff

- 🤩 Easy to cover everything needed

- 🤩 Woman was helpful in explaining questions in the health section

- 😞Travel insurance companies with poor customer service and long delays in processing claims.

- 😡Not trustworthy to provide cover in the event of any issues.

- 🤬Aggressive and unhelpful response to complaints.

Just Travel Cover customer reviews summary

Just Travel Cover travel insurance is a hit-or-miss proposition. It can be reasonably priced and the claims process could be simple and efficient, or it could be a frustratingly long and error-ridden experience. Some customers have reported helpful customer service while others were left in the dark with no communication. Those looking for travel insurance should proceed with caution and read the terms and conditions carefully before purchasing. Overall, Just Travel Cover travel insurance gets a 6/10 for its inconsistent performance.

Read the full Just Travel Cover review .

Is there a Just Travel Cover discount code?

Yes, if you enter the code ERGHX10 before 31 December 2024, you'll receive a 10% discount on Just Travel Cover travel insurance. Note that this code cannot be used in conjunction with any other offer.

Who underwrites Avion Travel Insurance?

An insurer called AWP P&C SA underwrites Avion policies via Allianz.

Just Travel Cover works with a number of other underwriters including AIG (who underwrite Holiday Angel and Unity Travel policies), Red Sands Insurance Company (Europe) Limited (who underwrite Good2Go policies), and Lloyds Syndicate 4444, managed by Canopius Managing Agents Limited (who underwrite FreeSpirit policies ).

Who are Just Travel Cover?

Just Travel Cover is an award-winning travel insurance broker based in North East England, recognized for its comprehensive approach to meeting the diverse needs of travellers since 1999. With over two decades of experience, they have insured more than a million passengers, underscoring their reputation as one of the UK's most trusted travel insurance providers.

They claim their service stands out due to its personalized approach to insurance coverage, understanding that each traveller and every trip is unique. Whether it's catering to specific medical conditions, accommodating various holiday activities, or adjusting cover for different trip lengths and destinations, Just Travel Cover aims to tailor insurance policies to fit individual requirements.

A significant aspect of their offering is the provision of cover for pre-existing medical conditions, which is a crucial need for many travellers who often find it challenging to secure adequate insurance. Through a streamlined process, they compare a range of insurers to offer a selection of policies suited to the customer's personal circumstances, often with tiered options like bronze, silver, and gold levels of cover.

Just Travel Cover extends its services beyond individual travellers to include partnerships with travel agents, tour operators, insurance brokers, charities, and health organizations, providing specialized travel insurance solutions for a wide range of needs, from corporate travel to school trips. Brands working with Just Travel Cover in this capacity include Avion , Good2Go , Escape, Unity Travel and Holiday Angel.

Their commitment to quality service and customer satisfaction is reflected in their impressive accolades, including being named the 'Best Travel Insurance Provider' at the Insurance Choice Awards in 2023. This honour, along with a customer satisfaction rate of 95% and the peace of mind they offer to all their clients, solidifies Just Travel Cover's position as a leading provider in the travel insurance industry.

Is Just Travel Cover legit?

Yes, Just Travel Cover is a legitimate travel insurance provider. It is a trading style of Just Insurance Agents Limited, which is authorized and regulated by the Financial Conduct Authority (FCA) with the number 610022 for General Insurance Distribution activities.

In the financial services industry, FCA regulation is a key standard for establishing the credibility and reliability of a company. It means that Just Travel Cover must adhere to strict rules and regulations designed to protect consumers.

Additionally, Just Travel Cover provides company registration details on its website, including its registration in England with Company No 05399196 and its registered office address at Victoria House, Toward Road, Sunderland SR1 2QF.

Just Travel Cover's services are covered by the Financial Ombudsman Service. The Financial Ombudsman Service is an independent service in the UK that settles disputes between consumers and businesses providing financial services. This provides an added layer of protection for consumers, as they have a recourse to an independent body in case of any disputes.

AllClear Travel Insurance Review

Everything you need to know before you buy travel insurance from AllClear!

Co-op Insurance Services Travel Insurance Review

Everything you need to know before you buy travel insurance from Co-op Insurance Services!

Covered2Go Travel Insurance Review

Everything you need to know before you buy travel insurance from Covered2Go!

Reviewed: 100+ UK travel insurance providers

- Privacy Policy

- Car Insurance Reviews

- Pet Insurance Reviews

- Home Insurance Reviews

Copyright © 2023 TravelInsuranceReview.co.uk

Suggested companies

Just travel cover, infinity travels, unity insurance services.

Travel Avion ➫ ♥ ✈ Reviews

In the Travel & Vacation category

Visit this website

Company activity See all

Write a review

Reviews 1.4.

Most relevant

EXTREMELY DISSATISFIED

EXTREMELY DISSATISFIED I unknowingly contacted “Travel Avion” (by phone) through a series of flight searches on a website. I would later discover that Travel Avion had given me misinformation regarding several aspects of the flight schedule for Sunwing. Travel Avion assured me that both flights were direct flights. I clicked “accept terms” in their e-mail to me which “Mike” convinced me did not apply to Sunwing Policy. Travel Avion took my credit card information and subsequently sent me their version of the flight schedule by e-mail. I contacted Sunwing 3 days after booking and found out that Travel Avion’s schedule was very different to Sunwing’s flight schedule (and now conflicted with my ability to fly). Travel Avion tried to convince me that Sunwing had changed their flight schedule. I called Sunwing and they said no changes were ever made regarding those flights. I told Travel Avion that I would not get on the return flight as it would bring me back to Montréal much after my very strict scheduling deadline. I asked Travel Avion for either a change of flight, a refund (due to it being their error) or a credit for a future flight. After some lengthy discussions over the phone, “Mike” finally promised to do something to correct this problem and would send me an e-mail with an acceptable solution. I never heard back from him. To add insult, I received a call at 5pm (not from Sunwing) the day before the flight telling me the departure time was still at 7:10am. Sunwing had confirmed 9:20am departure to me the evening prior. The man who called me (from 1-844-570-8837) refused to say what company he was representing. This experience has left me mentally exhausted, stressed out and about $780 U.S out of pocket. I have since read many complaints of fraud, theft, misinformation, etc. etc. regarding Travel Avion. Why is this company allowed to stay in business? I have voice recordings of my conversations with Travel Avion. I would be more than willing to join a “Class Action Suit” against them.

Date of experience : 14 June 2019

Theft is all I can say

Theft is all I can say. At this point Trsvel Avion have stolen over $331.00 from me. I made a plane reservation for my wife and I to Santa Barbara. We were guaranteed by recording And me asking the agent if my plans would change I would get a full refund. He said yes. I asked this question 4 times. The answer was yes a full refund. So I booked. Well guess what my family said they were not available on my dates after I booked. I said ok I can get a full refund. And rebook later. Well they refunded about $700.00 of the more than )$1,000.00 tickets. This was in late September. I have been told. you will get your $331.00 at next billing cycle. They lied to me. Now Travel Avion have told me I must wait 7 to 15 days to be refunded. Travel Avion have said this 6 times. Now at more than 100 days no refund from travel Avion. Travel Avion are thieves and liars. Do not trust this company. Red flags everywhere. Mark schnittker

Date of experience : 28 December 2018

You bate and switched me twice

You bate and switched me twice. I was able to save almost $500 elsewhere. I would never work with you. I googled United Air and you were the top paid ad-that's on me. This is not how business is done in the States-stick with Asia.

Date of experience : 11 December 2018

Total scam !!

Total scam !!! They did not pay money that I paid them to Delta on time , charged me twice, did not provide any receipts and on top of it they stole $2,000 USD from me - TOTAL SCAM! - do not use it ever! Bunch of thief’s! Cezary Saxon

Date of experience : 12 October 2018

I had an okay experience with their…

I had an okay experience with their treacle services. They helped me through it so I’m happy.

Date of experience : 12 April 2021

not recommend to anyone.

Their every service is terrible! I would definitely not recommend it.

Date of experience : 15 November 2021

STAY AWAY from this company!!

Our last day on vacation got ruined by this company. The worse travel agent ever!! One of our family member try to make an upgrade from coach to first class from costa rica to Seattle. The agent confirmed that’s all set and charged my creditcard. On the departing day, i called Alaska Airlines to confirmed our flight and i figure out that i was NOT in first class, it’s in a premium, which basically in coach. And they over charge me $300 for nothing. I call this company and complain about the situation. The agent keep saying we are in the first class premium! Oh my gosh!!!! I got upset and I clearly explained the difference between first class and premium aka economy but he still said the same thing. I finally said, that we flew from Seattle to costa rica in the first class so i know exactly what the differences. The agent said because it was on sunday so they need to wait for the manager to check the conversation and will give me a call to give me an update. Three day pass by but no update of whatsoever.... and i called again asking about the update and she said someone still working on it and we will give you a call back in 24hr period. Guessed what?! I call over and over again and spoke with 6 different agent but nothing has been done. I got so frustrated and finally they said, they’ll refund my money for one to two billing cycle for the over charge fee ohh wooowww . I work in hotel for several years so i know exactly how long the refund will be in process, it’s usually take about five to seven businesse day but this is just so bizarred. Please people.... DO NOT used this company!! Wasting time, energy and money..... so not worth it. total scam!! I think they don’t even deserve one star for this review. I will give a minus star if I could!!

Date of experience : 16 October 2018

I am not impressed

I am not impressed. I called about 5 times and left a message to call me back. No one did. Then they charged me 1550. 00 twice on my credit card. Wont use them again

Date of experience : 07 November 2018

Terrible dishonest company

I agree with the review before mine. They are FRAUDULENT and SCAM artists. Don't book with them!

Date of experience : 19 March 2019

DO NOT DEAL WITH THIS COMPANY EVER !!!

DO NOT DEAL WITH THIS COMPANY EVER !!!! TERRIBLY DISHONEST, UNPROFESSIONAL AND UNETHICAL COMPANY. Somehow Travel Avion intercepted my purchasing two tickets on the airline's webpage. While trying to process payment Travel Avion's agent came on and never identified himself. The price went up from the time I started purchasing till when he finished. When asked why, he just said it went up, PERIOD. At that time I didn't suspect anything. I received copies of my two tickets, seat selection and baggage cost and then realized it was from Travel Avion. I still was not too concerned as I checked with the airline to see if I had two valid tickets and I did but a couple days later when I still had not received a detailed invoice of who the flight insurance was with, nor policy number nor policy details, nor the cost, I called Travel Avion. When I called them I was told I would not receive a detailed invoice until after I flew. Unbelievable!!! Who ever heard of that when you have paid for a service in full! I then realized I was in serious trouble. I have asked many, many, many, many times for the name of the insurance company and they just do a song and dance. I phoned the airline and verified I did have two valid tickets and kept doing that. Our flight was cancelled because of Covid by the airline so then I started asking Travel Avion for a refund of my tickets. I have been asking for over 1 year. Over one (1) year and I haven't seen a dime !!!! My airline will definitely refund tickets because of Covid but if booked through a third party like Travel Avion then Travel Avion must request this refund. The airline will not refund directly to me. I have told Travel Avion this so many, many times. I gave them a copy of the airline's press release advising that the airline would refund tickets because of Covid. I gave Travel Avion a 1-800 help number from the airline in case they needed assistance with processing my return. It is like beating a dead horse as all they do is come back and tell me to request the refund from the airline or put in an insurance claim with my credit card. My credit card only covers Interruption not Cancellation. My credit card company also will not cancel payment because it has been too long. Because Travel Avion won't give me the name of the flight insurance company I paid for, then I can't go that route either. I am pretty sure they pocketed this money and no insurance company ever received my payment. If I email them, I send one to two dozen emails before they respond and if they do, they come back with things like "call and we will arrange your booking" or "please call us for help on this". Just one stall tactic after another. If I do manage to get through on the phone, the call gets disconnected. This has been a total nightmare. I am out almost $1,800.00 USA. This company needs to loose its licence. For the life of me, I don't understand how it is still in business when I read about 70 some absolutely bad reviews. Why has this operation not been shut done and all charged??? I have to give a 1 star to them because that is what is required by this site but if I could I would give a minus 20. The owner(s) and all employees need to be charged with theft and spend a long time in jail. It is unbelievable that there are people out there that are such scumbags!!! Absolutely deplorable humanbeings!!!

Date of experience : 19 May 2021

Don’t do business with them!!!

Don’t do business with them!!!! They ARE scammers!!!!!

Date of experience : 28 August 2020

Submit a Consumer Complaint to the FTC…

Submit a Consumer Complaint to the FTC | Federal Trade Commission

Date of experience : 04 June 2019

Fabulous service and 24/7 support!

Date of experience : 02 September 2020

Travel experience awosome

Date of experience : 29 December 2020

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

Mon - Fri 9am - 8pm

Sat 9am - 4pm

Sun 10am - 4pm

- 0800 294 2969

- Single Trip Travel Insurance

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Staycations

- Winter Sports

- Business Travel Insurance

- School Trip Travel Insurance

- All No Upper Age Limit Travel Insurance >

- Car Insurance

- Home Insurance

- Smart Luggage

- Life Insurance

Specialist Travel Insurance with no upper age limit

- Angioplasty

- Atrial Fibrillation

- Cardiomyopathy

- High Blood Pressure

- Multiple Sclerosis

- Breast Cancer

- Skin Cancer

- Lung Cancer

- Prostate Cancer

- Crohn’s Disease

- Back Problems

- Osteoporosis

- Coronavirus

- South Africa

- All Africa Insurance >

- All Asia Insurance >

- The Dominican Republic

- All Caribbean Insurance >

- All Central America Insurance >

- All Europe Insurance >

- Puerto Rico

- All North America Insurance >

- New Zealand

- All Oceania Insurance >

- All South America Insurance >

- Get a Quote

- Airport Hotels & Parking

- Travel Money

- Travel Advice

- Working with Us

- Medical Advice Hub

- Brand Showcase

- Meet The Team

- Careers: Apprenticeship Scheme

- Amend your policy

- Your Questions Answered

- Make A Complaint

- Making a Claim

Copyright © 2023. Just Travel Cover

- Travel Tips Advice

- Compare Travel Insurance

- Pre-Existing Medical Conditions

- Holiday Home Insurance

Customer Services

- Opening Times

Victoria House, Toward Road, Sunderland, SR1 2QF

Call: 0800 294 2969

Monday - Thursday 9am - 6pm, Friday 9am - 5.30pm

Buy with Confidence

Secure Payments

UK Call Centre

Leading Broker

Justtravelcover.com is a trading style of Just Insurance Agents Limited, which is authorised and regulated by the Financial Conduct Authority (FCA) number 610022 for General Insurance Distribution activities. Registered in England. Company No 05399196, Victoria House, Toward Road, Sunderland SR1 2QF. Our services are covered by the Financial Ombudsman Service. If you cannot settle a complaint with us, eligible complainants may be entitled to refer it to the Financial Ombudsman Service for an independent assessment. The FOS Consumer Helpline is on 0800 023 4567 and their address is: Financial Ombudsman Service, Exchange Tower, London E14 9SR. Website: www.financial-ombudsman.org.uk/

Privacy Overview

- $120 annual fee

- 35,000 Avion points on approval

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

Welcome bonus and earn rate

What’s fascinating about the RBC Avion Visa Infinite Card is that you get 35,000 Avion Rewards points on approval . Unlike other cards, there’s no minimum spend required to get your points. Occasionally, there’s an enhanced welcome bonus where you can earn an additional 15,000 – 20,000 points. The welcome offer will typically appear on your first statement, but it can take up to two statements to show up.

The earn rate of 1.25 Avion points for every dollar spent on travel and 1 point for every $1 spent on all other purchases . Admittedly, there are many credit cards out there, but Avion Rewards has a lot of value (more on that below).

Benefits and perks

Even though the RBC Avion Visa Infinite Card doesn’t often make the list of the best travel credit cards in Canada, you shouldn’t sleep on it. It has a few interesting and unique benefits that will interest many people.

Petro-Canada discounts

When you link your RBC Avion Visa Infinite Card to your Petro-Points card, you’ll save 3 ¢/L on gas with every fill-up and get 20% more Petro-Points.

Earn Be Well points at Rexall

Linking your RBC Avion Visa Infinite to your Rexall Be Well account allows you to earn 50 Be Well points per $1 spent on eligible purchases at Rexall.

$0 delivery fees with DoorDash

As an RBC Avion Visa Infinite cardholder, you get a free DashPass subscription for 12 months. This entitles you free delivery on orders of $15 or more with DoorDash and additional discounts throughout the year.

Mobile device insurance

When you purchase a mobile device (cellphone or tablet) with your RBC Avion Visa Infinite card, you’re entitled to up to $1,500 in mobile device insurance. This applies to loss, theft, and damage. That said, a depreciation rate of 2% applies to each completed month from the time of purchase.

Travel insurance

- Travel medical – unlimited for 15 days / 3 days if you’re 65 or older

- Trip cancellation – up to $1,500 per person / $5,000 total

- Trip interruption – up to $5,000 per person / $25,000 total

- Flight/trip delay – up to $250 / 4 hours

- Delayed and lost baggage – up to $500 / 4 hours

- Auto rental collision/loss damage – 48 consecutive days / $65,000

- Hotel/motel burglary – $2,500

- Common carrier travel accident – $500,000

Interestingly enough, the RBC Avion Visa Infinite travel insurance is some of the best out there since you get unlimited medical protection. However, the card doesn’t get nearly as much attention as other cards since you’re only covered for 15 days if you’re under the age of 65.

Purchase protection

- Purchase security – 90 days

- Extended warranty – Up to one additional year

When you pay for your purchase in full with your RBC Avion Visa Infinite Card, you get purchase protection for 90 days. This covers your purchases from loss, theft, and damage. In addition, your manufacturer’s warranty is doubled up to one additional year.

How to redeem your points

Avion Rewards , formerly known as RBC Rewards, allows you to redeem 1,000 Avion points for $10 in travel booked through their travel portal. Like other bank travel portals, you’ll find almost every type of travel available, including flights, hotels, car rentals, cruises, and more. The downside is that you can’t book travel outside the portal and apply your points later. That means you can’t shop for the lowest prices or take advantage of status benefits.

On a positive note, you can double the value of your points by using the RBC fixed points program . For example, you can claim 15,000 Avion Rewards points for a round-trip flight within or to an adjacent province or U.S. state with a base ticket value of up to $350. If you maximized this option, your points would now be worth 2.33 cents each, more than double the regular rate.

Avion Rewards also allows you to convert your Avion points to British Airways Avios, Cathay Pacific Asia Miles, WestJet dollars and American Airlines AAdvantage miles. Because of the airline transfer partners, the RBC Avion Visa Infinite Card is one of the best airline credit cards in Canada.

As you can imagine, RBC Rewards is one of the best bank travel loyalty programs in Canada .

RBC Avion Visa Infinite eligibility

The RBC Avion Visa Infinite eligibility is straightforward, as it outlines what’s required on the application page.

- You must be a resident of Canada

- You must be at least the age of majority in the province or territory in which you reside

- You must have a minimum personal income of $60,000 or a household income of $100,000.

Like other credit card providers, no formal credit score requirement is listed. That said, you likely want your credit score to be 660 or higher since that would put you in at least good standing.

How the RBC Avion Visa Infinite compares

Finding comparable cards to the RBC Avion Visa Infinite can be a bit tricky since other cards are popular for different reasons. Some people will focus on the earn rate, while others will look at the flexibility of the points.

RBC Avion Visa Infinite vs. American Express Cobalt

Using the American Express Cobalt Card as a comparable is necessary since it has the highest earning rate in Canada with 5 points per $1 spent on eats and drinks, 3 points per $1 spent on streaming services and recurring bills, 2 points per $1 spent on travel and transit, and 1 point per dollar spent on everything else. Simply put, there’s no comparison. In addition, American Express Membership Rewards is more flexible than Avion Rewards.

RBC Avion Visa Infinite vs. TD First Class Travel Visa Infinite

The TD First Class Travel Visa Infinite Card gives you 3 points per $1 spent (1.5% value) on all your purchases except those made via Expedia for TD, which gives you 9 points per $1 spent or a 4.5% return. Clearly, the TD card has a higher earn rate compared to the RBC Avion Visa Infinite . However, TD Rewards aren’t nearly as flexible.

Although I like the RBC Avion cards and Avion Rewards, there are many cards out there with a much higher earning rate.

Final thoughts

My RBC Avion Visa Infinite review is positive. Although the card doesn’t have the best earning rate, it’s a good card overall and is ideal for people in the following situations:

- You bank with RBC – This is RBC’s flagship credit card that earns you Avion Rewards.

- You want flexible points – You can book any travel found on the travel portal, through the fixed points program, or you can transfer your points to select partners.

- You shop at Rexall regularly – When you link your card, you can earn Be Well points at Rexall.

In the end, RBC is one of the most flexible travel loyalty programs in Canada. If you’re looking to build your credit and travel for less, then the RBC Avion Visa Infinite Card is worth considering.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

Regarding your comments about the “INSURANCE BENIFITS”, I am Sorry but from my experience with over 20 years as a “RBC Visa Infinite Avion” card holder you are totally wrong.

My experience dealing with “the insurance” for the first and only time has been nothing but STRESSFUL and MONTHS of delays and EXTREMELY slow response times only to be told that I am not covered for a reimbursement of a “Airline Cancelled” flight.

The insurance benefits I’ve listed are accurate. However, every insurance policy has different rules in place when it comes to making a claim.

A topic not discussed is that RBC Avion charges on average over 2 percent more on US purchases over 3 of my other credit cards. Very dissapointing to say the least for using my card for foreign travel.

RBC cards charge the standard 2.5% FX fee. This is standard with many credit cards in Canada. Here’s a list of cards that don’t charge FX fees – https://www.moneywehave.com/the-best-no-foreign-transaction-fee-credit-cards-in-canada/

You mention the TD card is effectively 1.5% reward value for every day spending and book your own way travel, but i beleive TD changed their redemption rates slightly a few years back to a tiered scale where redemptions under $1200 are charged at one rate and above $1200 (in the same redemption transaction) are charged at a the better, original redemption rate. I beleive it is 250 points per dollar below $1200 and 200 points per dollar above $1200. Wouldn’t this mean 200/$1, I’d spend $200 for 600 points, then redeem 600 points for $3, which is 1.5%. but if i was under the threshold I’d instead spend $500 for 1500 points, then redeem 1500 points at 250:1 for $6, which works out to 1.167%. so your redemption rate is a sliding scale between 1.167% and 1.5% depending on how long you save points to redeem in a large transaction. Can you confirm your understanding and my math and perhaps do an updated comparison? TD still is a better “raw return rate” but the gap is smaller to the improved partner options RBC has.

I made a comment earlier that wasn’t entirely clear. So the 1.5% return on every day spending assumes you’re using your points on Expedia for TD. As for the sliding scale, the way I read it is that any redemption under $1,200 is 250 TD points for $1 and then 200 point for $1 for anything that costs $1201+. However, that lower redemption rate doesn’t apply for the full amount. It appears the first $1,200 will always be 250 points for $1. So if your purchase is $1,300, only $100 will be 200 points for $1.

So yes, your return when using Book any kind of travel is 1.2% – 1.5%.

As for how it compares to others, Scene+ and American Express Membership Rewards are better since it allows you to redeem your points on any type of travel purchases with no devaluation to your points.

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards, back to reviews, review: rbc® avion visa infinite†.

In this credit card review, we analyze the features and benefits of the RBC® Avion Visa Infinite†, the flagship card in RBC’s Avion lineup.

Written by Tyler Derksen

On April 18, 2024

Read time 19 mins

RBC’s flagship Avion credit card, the RBC® Avion Visa Infinite† , offers a consistently high welcome bonus, strong insurance, and a flexible points currency, all for a reasonable annual fee. In fact, we’ve ranked the RBC® Avion Visa Infinite† as RBC’s best overall credit card product .

That being said, there are some areas in which the RBC® Avion Visa Infinite† falls behind competitors, which we’ll go over in detail in this review.

What we love: c onsistently strong welcome bonus, flexible points, strong travel and retail insurance.

What we’d change: increase category earning rates, r emove foreign transaction fees, include airport lounge access.

Consistently High Welcome Bonus

One of the most attractive features of the RBC® Avion Visa Infinite† is the consistently high welcome bonus.

The welcome bonus tends to fluctuate between 35,000 and 55,000 Avion (Elite) points, with 55,000 points being the card’s all-time high offer.

Typically, a large portion of the welcome bonus is awarded upon approval or upon making your first purchase, which is an easy way to boost your balance. Sometimes, the entire welcome bonus is awarded upon approval, which is even better.

If there’s a second allotment as part of the welcome bonus structure, it’s usually earned after meeting a reasonable minimum spending requirement of $5,000 or so within the first three-to-six months as a cardholder.

- Earn 35,000 RBC Avion points † upon approval†

- Plus, earn 1x 1.25x RBC Avion points † on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights †

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120 †

- Supplementary card fee: $50

We value RBC Avion (Elite) points at 2 cents per point. Using this valuation, we estimate that a welcome bonus of 35,000 points would be worth around $700, and a welcome bonus of 55,000 points would be worth around $1,100.

Depending on how you choose to redeem your points, they could be worth more or less than these estimates, and we’ll speak to some of the different redemption options below.

Straightforward Earning Rates

The earning rates on the RBC® Avion Visa Infinite† are quite simple, and are structured as follows:

- Earn 1.25 RBC Avion (Elite) points per dollar spen t on qualifying travel purchases†

- Earn 1 RBC Avion (Elite) point per dollar spent on all other qualifying purchases†

One of the downsides of the RBC® Avion Visa Infinite† is the card’s lack of elevated earning rates on common purchases, such as groceries, gas, and restaurants, which often have category multipliers on other credit cards.

In fact, this is the card’s biggest weakness, since building up your Avion (Elite) balance is a slow-and-steady process, especially if you’re not a big spender.

On the other hand, the baseline earning rate of 1 Avion (Elite) point per dollar spent is on par with the baseline earning rates on comparable cards.

Plus, given the flexible nature of Avion (Elite) points, you can still get a lot of value from collecting Avion (Elite) points, even without accelerated earning rates.

Flexible RBC Avion (Elite) Points

Compared to similar credit cards offered by other banks, redeeming points is where the RBC® Avion Visa Infinite† really shines.

In fact, in Canada, RBC’s Avion (Elite) points is the only rewards currency other than American Express Membership Rewards that offers the ability to transfer points to external partners.

This means that with the RBC® Avion Visa Infinite†, you can transfer Avion (Elite) points earned through the welcome bonus and on daily spending to the following loyalty programs:

- British Airways Executive Club at a 1:1 ratio

- Cathay Pacific Asia Miles at a 1:1 ratio

- American Airlines AAdvantage at a 1:0.7 ratio

- WestJet Rewards at a 100:1 ratio

Plus, RBC often offers transfer bonus promotions throughout the year, during which the transfer ratio is boosted by 10–50%.

By transferring Avion (Elite) points to one of the above airline loyalty programs – ideally when there’s a transfer bonus – you’ll be able to unlock value from a whole range of award flights in economy, premium economy, business class, and even First Class.

If you don’t want to worry about finding award space or navigating loyalty programs, RBC offers an in-house option called the RBC Air Travel Redemption Schedule , which also provides a great return for your points.

With the RBC Air Travel Redemption Schedule, you can redeem Avion (Elite) points for economy flights close to home or around the world and get an elevated value of up to 2.3 cents per point, depending on the route.

Alternatively, if you’re looking for the most straightforward redemption possible, you can also redeem Avion points at a rate of 1 cent per point against any eligible travel expenses charged to your RBC® Avion Visa Infinite†.

Strong Insurance Coverage

Overall, the insurance coverage on the RBC® Avion Visa Infinite† is fairly strong, and it stands out in a few ways compared to competitors.

For example, the emergency medical insurance on the RBC® Avion Visa Infinite† is unlimited in terms of its dollar amount.† This coverage applies for up to 15 days for eligible travellers who are under 65 years old, and for three days for eligible travellers who are 65 years and older.†

Comparatively, other cards usually cap this insurance benefit at $1 million or $2 million in coverage. However, many other cards also have more generous coverage periods and age categories than those offered by the RBC® Avion Visa Infinite†.

A second standout part of the RBC® Avion Visa Infinite† insurance offerings is the purchase security insurance that covers loss or accidental damage for up to 90 days following the purchase of eligible items with your card.†

Notably, this coverage is for up to $50,000 each calendar year,† making the RBC® Avion Visa Infinite† a great choice for larger purchases.

Lastly, the mobile device insurance on the RBC® Avion Visa Infinite† will cover up to $1,500 if your phone is lost, stolen, suffers accidental damage, or experiences mechanical failure for up to two years from the date of purchase.†

This provides you with the reassurance that you won’t be left with out-of-pocket expenses if anything unfortunate happens to a new device that you purchased with your RBC® Avion Visa Infinite†.

What Else Does the Card Offer?

The RBC® Avion Visa Infinite† comes with some other perks and benefits worth highlighting.

For the past few years, RBC has offered the Friday Friend Pass , which gives cardholders a free second lift pass when purchasing a full-price lift pass at many major ski resorts in Canada.†

If you’re able to make use of this benefit, it’s a great feature that can wind up saving you money when you hit the slopes with a friend or family member.

Additionally, on the Avion Rewards dashboard, you’ll also find a series of RBC Offers for earning bonus Avion points or saving you money on travel and experiences.

For example, one offer that has popped up before is the opportunity to earn extra Avion points when spending at Canadian Marriott Hotels .

With this type of offer, simply charge your hotel stay to your RBC® Avion Visa Infinite†, and you’ll earn bonus points.

The card also comes with other features that can help you save on some daily purchases.

By linking your RBC® Avion Visa Infinite† to a Petro-Points card, you’ll save 3 cents per litre on gas at Petro-Canada, and you’ll also earn more Petro-Points.†

You’ll also receive a complimentary DoorDash DashPass subscription for 12 months, which gives you $0 delivery fees with DoorDash.†

Alternative Cards to Consider

While the RBC® Avion Visa Infinite† offers a generous welcome bonus and access to flexible RBC Avion (Elite) points, there are other cards worth considering, depending on your priorities.

For example, the American Express Cobalt Card also earns flexible rewards points that can be transferred to even more partners, and its earning rates are much stronger than those of the RBC® Avion Visa Infinite†.

Recall that with the RBC® Avion Visa Infinite†, you’ll only earn 1–1.25 Avion (Elite) points per dollar spent, depending on the purchase.

With the American Express Cobalt Card, you can earn 5 Membership Rewards points per dollar spent on dining and groceries, 3 Membership Rewards points per dollar spent on streaming services, 2 Membership Rewards points per dollar spent on gas, public transit, and travel purchases, and 1 Membership Rewards point per dollar spent on all other purchases.

If you have a high volume of spending in any of the accelerated categories, you’ll wind up with a boosted points balance much faster than making the same purchases on the RBC® Avion Visa Infinite†.

If you’d like to add a card for spending outside of Canada and some complimentary lounge visits, the Scotiabank Passport Visa Infinite Card is a great choice.

While the welcome bonus generally isn’t as high as the RBC® Avion Visa Infinite† and the Scene+ points you earn aren’t transferable to airline or hotel partners, the Scotiabank Passport Visa Infinite Card comes with no foreign transaction fees and six complimentary airport lounge visits per year .

Consider this card as a good alternative if you spend a lot outside of Canada, don’t see yourself transferring points to airline partners, and can make use of the complimentary lounge visits.

The RBC® Avion Visa Infinite† is a great credit card, and has earned our pick as the best overall RBC credit card product .

However, the RBC® Avion Visa Infinite† lags behind the competition in terms of earning points on daily spending given the card’s straightforward earning rates.

Additionally, it’d be nice to see better travel benefits added to the card’s features, such as complimentary airport lounge access and no foreign transaction fees.

That being said, if you’re looking for a travel credit card with a constantly high welcome bonus and flexible points for a reasonable annual fee, the RBC® Avion Visa Infinite† is one of the best.

† Terms and conditions apply. Refer to the RBC website for up-to-date offer terms and conditions.

Share this post

Copied to clipboard!

Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Important travel updates and what you need to know

Last Updated: June 27, 2023

Attention: Important Travel Updates

To get the most recent update on your flight status, visit the website of the airline you are travelling with. You’ll need your booking reference number (airline confirmation) on your itinerary to access your flight information.

If you’d like to manage or change your existing booking, please log into Avion Rewards Travel . Once you are in the travel portal click the blue “Help” button at the bottom right corner to make changes or cancel your booking.To cancel or change your trip details:

- Go to Avion Rewards Travel

- Select "My Trips" in the top right corner

- Select your upcoming trip and click “Manage booking”

- Choose “Cancel Flight”, “Change Flight”, or “Change Reservation” and follow the instructions

- To book new travel using Avion points

To book a new flight using an airline travel credit

Airline travel credit rules to remember, insurance policies, cwt vacations update, rbc avion visa infinite privilege for private banking cardholders: new travel advisor service details, to book new travel using avion points:.

Book through Avion Rewards Travel or contact the Avion Rewards Travel Call Centre at 1-877-636-2870 (additional service fees apply).

If you have an airline credit due to a flight cancellation that you’d like to use, contact the Avion Rewards Travel Call Centre at 1-877-636-2870.

Be sure to have the following ready when you call:

- Itinerary number of the original booking

- Travel credit amount

- Traveller name(s)

- Details of your new flight options, including flight numbers for your preferred outbound and/or inbound flights

- Each airline sets their own policy for how you can redeem your credit

- If you use an airline travel credit for a ticket to a destination in a different jurisdiction or region than the original booking, you may incur additional taxes and fees. Applying the credit to a new set of taxes and fees vary based on airline policy. Our agents can’t waive them.

- Some airlines may require you to use the entire credit value at once to receive the full value. Please contact Avion Rewards Travel Call Centre at 1-877-636-2870 for more information

- Airline credits (including taxes and fees) can only be used for air travel with the airline you originally booked with. They cannot be used for other services such as checked bags, upgrades, etc.

- Each airline credit is in the original traveller’s name; you can’t combine airline credits or transfer them to another person

- Airline credits have a travel-by date (sometimes called credit validity)

- When planning to travel, please check your airline’s website for possible changes to your flight experience and any new passenger requirements. Many airlines are making temporary changes to prioritize traveller safety

For credit card insurance coverage, refer to your travel insurance policy/certificate for further details. For other travel insurance, please contact your travel provider directly.

Trip Cancellation and Interruption insurance coverage included with your RBC credit card provides coverage for trips that are paid in full with your RBC credit card (and/or Avion points). Trips booked using a travel credit/voucher are not covered, even if originally purchased on your RBC credit card. Please consider your options, such as purchasing travel insurance when using a travel credit/voucher. If you require assistance or have questions about your coverage, please contact Assured Assistance Inc .

Effective July 31, 2022, you are no longer able to redeem your Avion Points at CWT Vacations locations.

Please contact the location where you originally booked your travel unless otherwise advised. Please refer to the travel advisor contact information on the invoice or email provided to you when you made your original reservation.

CWT Harvey’s Travel will service your existing CWT Vacations’ booking. You can contact CWT Harvey’s Travel by calling at the same number (1-866-926-4070).

Your new travel advisor service is provided by Avion Rewards Travel Concierge for Private Banking . To book travel, call 1-888-ROYAL 8-5, choose a language, select Travel (option 2), then select Travel Concierge for Private Banking (option 2).

Making changes to existing bookings with CWT Vacations

CWT Vacations will continue to service existing bookings. You can contact CWT Vacations at 1-888-ROYAL 8-5, select language and option 2 and 3.

RBC Emails : Please know that RBC will never ask you to provide, confirm or verify personal, login or account information through regular email, text message, phone calls or when signing into an online service. Please disregard any emails or text messages requesting that you reply with confidential information. If you have received a suspicious message from RBC, please forward it to [email protected] .

Supporting Clients Impacted by COVID-19

We remain committed to keeping you informed about actions we’re taking, to support you during this time. Get important information on the support and assistance RBC has made available to help you as we focus on keeping clients and employees safe during this difficult time.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

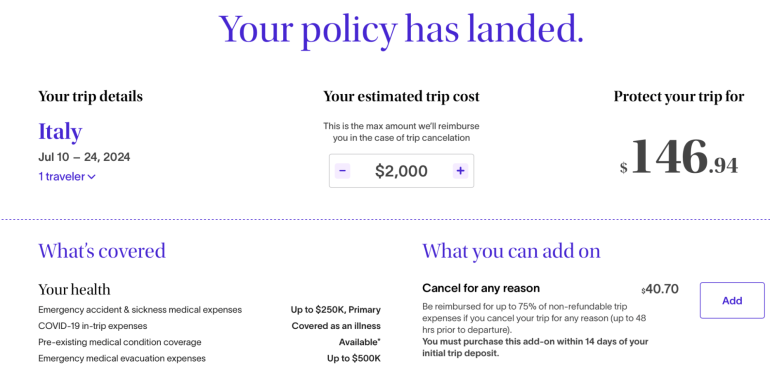

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- In the Media

RBC VISA Infinite Avion Consumer Reviews

- Last 3 months

- Last 6 months

- Last 24 months

Top positive trending topics ?

Top negative trending topics , looking for the best credit card.

Earn 10% cash back on all purchases for the first 3 months ( up to $2,000 in total purchases ). Plus, no annual fee in the first year , including on supplementary cards. A welcome offer value of $350 .

Get this credit card

Are you interested in?

- Home Insurance

- Car Insurance

- Life Insurance

- Business Insurance

We have booked several flights with Avion points in the past with absolutely no issues. I just tried to book a flight that I had just seen online for $200.00+ under the max fare. According to the Avion website I had to use my points as well as pay $665.00 because the flight exceeds the max price. I have paid overages in the past when the flight cost more than the max fare. This extra fee would mean that the flight I want is listed for over $800.00 more than the Airline price. If according to Avion I can book a fare that is up to $1300.00. The fare that I find is $1027.00 I should not pay $665.00. Over half of the price of the ticket. As I said, I've booked several flights in the past. What has changed recently? I don't see the point in paying for this card. If you don't give people what you advertise, I believe it's called fraud.

0 of 0 people found this review helpful. Did you?

Review topics

A total absolute rip off.

The fees associated with booking a flight through my Avion points were HIGHER than the fare to book directly through the airline. I'm not exaggerating. The fees AFTER using my points were more than the cost of booking the entire flight(s) through the airline. I have no idea how this program exists. It's total garbage. And truthfully, it's even worse when trying to use the points to purchase merchandise. I'm done.

RBC AVION deceptive practices. Impossible customer service

This complaint regarding Avion comes after several attempts to use points and book flights over the past 18 months. In each instance, I chose to purchase my tickets directly from the airline instead of using Avion points. The reasons. Many flights that are available from the airlines are not made available through Avion. As a result, Avion booked flights have less connectivity, longer layover times and inconvenient scheduling. The next biggest issue has been the Surcharges on top of points usage for every flight option. Ironically, the surcharges themselves are often more expensive than booking tickets directly from the airline. That doesn't take into consideration the additional Avion points charged on top of those surcharges. Finally, my recent experience booking through Avions Expedia link has resulted in booking me into a hotel that on arrival had no rooms available. The error itself was frustrating but resolvable. Problem was, connecting with Expedia is impossible and their chatbot has very limited ability to resolve anything. Despite many efforts and long hours attempting to communicate with Expedia, it was necessary to charge back the credit card. Don't get me started on the customer service avoidance process that RBC uses to frustrate complaints. After multiple hours online and at least two hangup by RBC staff after being on hold, I was finally able to implement the charge back to Expedia. They never responded. In my sincere and experienced opinion, I suggest not signing on to RBC AVION. In fact, I suggest ditching them.

Scotia Momentum VISA Infinite Card

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases). Plus, no annual fee in the first year, including on supplementary cards. A welcome offer value of $350. What else will you get:

- 4% on eligible recurring bill payments and grocery store purchases

- 2% on eligible gas station and daily transit purchases

- 1% cash back on all other eligible everyday purchases

- Complimentary Concierge Services 24/7 Visa Infinite Dining Series Visa Infinite Music Series Wine Country Wonders Luxury Hotel Privileges

- Comprehensive Travel Insurance & New Mobile Device Insurance coverage

Get this card / Apply online

Abysmal customer service..

This card recently changed the verification process to make purchases online, and this change has rendered this card unusable for me. I have called numerous times to try and find a solution, offered many solutions of my own, and never once yelled or got angry with the reps. But there's clearly now a note or warning on my file, because the last time I called to ask about another potential solution, the rep was unbelievably rude to me, time me there's "no solution" and hung up. That's me cancelling my account and taking my business elsewhere.

Avion call Centre

Absolutely the worst Customer Service compared to any other booking agency. They have “lost” all my travel credits, refused to address the issue, have no supervisor or management department, hang up on customers, refuse to adhere to their own policies. So frustrating and a waste of time and money. Shame on RBC for allowing this type of point system to exist.

False advertising point travel packages

I purchased travel through RBC Avion which included features. Once flight sale processed they advised included features (that are listed as being included to the public) are not. Offered no compensation and advised I could not cancel trip, even though they misrepresented and mis-advertised what the package was.

Scotiabank® Gold American Express® Card

Earn up to 40,000 bonus Scotia Rewards points in your first year (that's up to $400 towards travel). Earn 5 Scotia Rewards points for every $1 you spend at eligible grocery stores, dining and entertainment

Do not use Avion Rewards

It's farud. If you book directly from airline or get all-inclusive package directly from provider, you will save a lot more money. Also any change or cancellation will be a nightmare with Avion rewards even though you have paid extra for flexibility

Don't get scammed

Booked an "all inclusive". Well everything was fine until the airline changed our departure date. It was at that point we found out "all inclusive" is far from. Apparently the fine print says that avion does not have to align the hotel date with your arrival. Noticed the flight change before anyone from that classless, unprofessional, unethical, horrid company notified us. We were told that we should have read the fine print (they were never going to inform us) and left us stranded with a senior and 2 children under 12 in a foreign country in the middle of the night with nowhere to go.

I am unable to book any travel with Avion points. This has been happening for a year. I even called customer service and they cannot book a flight with my points. All those points are wasted. DO NOT get this credit card. The scam is, they first hang up on you and pretend its a dropped call. The next scam is pretending they cannot book with your points. They offer a credit which is no where near the value of the points when used for travel. Total scam, I am surprised this has been allowed to continue for so long.

Scotia Momentum Visa Infinite Card

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases). Plus, no annual fee in the first year, including on supplementary cards. A welcome offer value of $350.

PLEASE HIRE QUALIFIED PEOPLE

I have booked through Avion for at least 15 years. Since Covid it seems that the people answering their phones are simply order takers, not actual travel advisors. They don't understand the complexities of air tickets, routings, changes, cancellations etc. It's so frustrating that it requires about 10 calls to try and fix a simple schedule change, and even then there is no guarantee that it gets done. RBC - you are seriously annoying some of your best clients by not having properly trained advisors to deal with simple or complex requests. Even though I have almost 1 Million points I am very leery to use them because I don't have time to deal with Avion if there are any issues. I'm very tempted to change my credit card as this is not working. I've lost so much time and money on Avion airline bookings as it's easier to walk away than to keep calling, being put on hold, explaining the situation, on hold again, further discussing the issue, on hold again, and then being cut off. Even though the Avion person has my number I've never once had a call back after I've been cut off. This is unacceptable!

Secure and Certified

Your information privacy and security is very important to us. We use the same 256-bit encryption and data security levels as all major banks. Our practices are monitored and verified by VeriSign and Digicert.

Independent

InsurEye is not owned by any bank, insurance company, insurance brokerage or any other financial services institution. We collect, validate, and analyze insurance experiences of real consumers.

We aspire to equip you with insights, data and knowledge to help in making informed decisions around personal finance, insurance quotes, and other important matters. We are always open for your comments.

Helping you make the most out of your money

Searching Money Mentor . . .

The best travel insurance providers.

| Editor-at-large

Updated July 31, 2024

In this guide

If you’re travelling abroad this summer, you may wish to consider travel insurance. We explain what it is and some of the best policies on the market for your holiday.

Last year, UK residents made 86.2 million visits abroad. This was over 15 million trips than what was recorded in 2022 and over four times the figure in 2021, when COVID restrictions kept many people at home.

With many popular events taking place in Europe this year, such as the Euros and the Olympics, this figure may well rise again. So, if you’re taking time outside the country have you considered travel insurance?

In this article we explain:

- What is travel insurance

What does travel insurance cover?

The best travel insurance, what types of travel insurance can you buy.

Read more: Passport renewal costs and waiting times

What is travel insurance?

Travel insurance covers the cost of unforeseen events and mishaps that either stop you from going on holiday or affect you while you’re away.

Depending on the policy, it might cover you for:

- Medical bills if you suffer illness or have an accident while you’re away

- Cancellation of your trip for reasons outside of your control

- Lost or stolen baggage

Policies are usually relatively inexpensive and can give you the peace of mind that your costs will be covered if something bad happens while you are on holiday.

According to the Association of British Insurers (ABI), a trade body, the average claim on travel insurance in 2022 was a little over £970. So while these policies won’t stop bad things from happening, but it can prevent you from having to find the money to pay for unexpected costs even after you return from your holiday.

Read more: Ten budget travel tips

Get annual travel insurance with LV= and earn yourself a voucher too

LV= offers comprehensive travel insurance which covers:

• 24-hour helpline if you need us while you’re away

• No limit on the number of trips you can take throughout the year

• It will cover you up to 31 days at a time on its Essential policy and up to 90 days on our Premier policy

Plus, as an added incentive, new customers can earn themselves an Amazon or Love2Shop voucher. Taking out an Annual Essential policy will earn a £5 voucher and taking out an Annual Premier policy will earn a £10 voucher

Find out more

Many people opt to take out travel insurance to cover potential medical care while away.

Every week, 3,000 Brits need emergency medical treatment while abroad, according to the ABI. But it isn’t just about covering medical costs. It can protect you against a range of unplanned events:

- Cancellation or trip interruption for reasons outside your control

- Missed transport or delayed departure for reasons outside your control

- Personal injury and death, including medical evacuation

- Lost, stolen or damaged items, including baggage, passports and money – check if your home contents insurance protects you

- Accidental damage or injury caused by you

Does travel insurance cover cancelled flights?

Most travel insurers provide basic cover for cancelled flights. Aviva’s travel insurance, for example, will pay out if your flight is cancelled due to an airport shutdown.

If your airline cancels your flight then you should claim a refund directly with them, so your travel insurance could cover other costs such as hotel bookings, vehicle rentals, and other possible excursions.

What are my rights during strike action or travel disruption?

What are my rights during strike action?

If your flights are cancelled due to strike action you might be entitled to compensation from the airline. But for this to apply, customers must have been given less than 14 days’ notice.

It also depends on whether the airline was at fault or not: so if it’s the airline’s staff who are striking, you should be entitled to compensation.

If you’re worried that your flights might be delayed or cancelled, you should also check your travel insurance policy.

Some policies cover you for a cancelled or delayed flight, provided you took out the policy before the strikes were announced.

But if you haven’t yet bought your insurance, you may be out of luck. This is because most insurers won’t cover you for strikes which were already known about.

Read how travel insurance could catch you out.

Below we’ve listed some of the best travel insurance providers on the market, all of which were nominated in Times Money Mentor awards 2023.

Times Money Mentor award winning cover

Best for over-50s

Post Office

Best for those with pre-existing medical conditions

Best for those wanting substantial medical cover

LATEST OFFER: Earn a voucher when you take out annual travel insurance with LV=

Other notable providers

Despite not winning a nomination at the Times Money Mentor awards, these providers also offer a decent policies

Switched On

Cover for you

Expert travel advice and inspiration.

Make informed decisions about your next trip with the help of our award-winning travel writers. From city breaks and beach holidays to cruises and safaris, explore the world like never before.

Visit Times Travel

The best travel insurance for cruises

If you’re thinking about taking a cruise, it’s important to take out special additional cover such as a cruise insurance to protect you.

Cruise insurance is normally offered as an add-on to travel policies, and protects you if you:

- Miss connections to reach the departure

- Fail to get back on board after planned stops

- End up being confined to your cabin

Though if you want a dedicated travel insurance policy for a cruise, here’s an option to consider:

Just Travel Cover

Best for cruise holidays

Wine bars are out, bottle shops are in! Find your trendy local one

Bottle shops are the new wine bars. Think intimate settings, boujee food, and, of course, walls full of tasty bottles to drink. Find your nearest one here .

The best winter sports cover

If you’re planning a skiing and snowboarding trip then it’s important you have insurance that will cover you if you’re involved in an accident on the slopes.

Most travel insurers will offer winter sports cover as an optional add-on to their regular cover and will protect you if you:

- Need to be airlifted off the slopes or rescued and need medical treatment

- Turn up and there’s no snow

- Can’t start skiing and snowboarding because of avalanche risk

- Find out your equipment – such as skis, snowboard and boots – has been stolen

It’s difficult to predict what the next ski season will look like. But if you’re booking now and want cover for the essentials, here’s a policy to factor into your calculations.

InsureandGo

Best for winter sports

What should a basic travel policy cover?

When shopping for travel insurance, you should ensure your policy comes with the following seven things as standard:

1. Medical expenses

This covers the costs of any emergency medical and surgical treatment while you’re away.

It usually costs more for cover in the US as medical bills can run into the tens or hundreds of thousands of dollars. Any treatment that can wait until you get home is not usually included.

Most policies offer cover of £1 million for medical costs in Europe. This is usually £2 million in the US.

2. Repatriation

This is where you might need to be evacuated from the country you’re visiting.

Repatriation usually happens when you need to get back home to the UK in the event of a medical emergency and is usually covered as standard in most travel insurance policies.

3. Cancellation/curtailment

This covers any travel and accommodation costs you have paid for and can’t use or claim back.

You need a good reason to cancel your trip, so make sure you double check the terms and conditions of your policy.

4. Missed departure

This covers your extra accommodation costs and travel expenses should you miss your departure due to situations outside your control.

It usually includes your car breaking down or being involved in an accident. Leaving home at the last minute won’t count.

This covers you for delays to your travel plans, such as severe weather conditions.

Delays known about before (such as strikes) won’t be covered.

6. Baggage cover

This should cover you if your baggage is lost, stolen, damaged or destroyed.

You might need extra cover for gadgets or valuable possessions as there are usually limits on separate items.

Losses need to be reported within a certain time frame and you must have a written report from your airline if it loses your baggage.

7. Personal liability cover

This should cover you if you are liable to pay damages due to:

- Accidental bodily injury to someone

- Or for loss or damage to someone else’s property

- Claims made by family members or employees won’t be covered

What extra cover can you buy?

To provide a peace of mind you might be able to add the following onto your policy too:

- Wedding cover – If you’re travelling abroad for a wedding, some providers might include an add-on which covers damage to your possessions. If you think you need something more comprehensive, then consider a separate wedding insurance policy

- Gadget insurance – While you’re abroad you may wish to cover your laptop, phone, or tablet from theft or damage

- Golf equipment cover – Planning to tee off abroad? Then consider cover for moving your clubs overseas. This type of add on includes cover for your equipment if it is lost, stolen, or accidentally damaged

Read more: Is credit card travel insurance any good?

What is not covered by travel insurance?

Travel insurance won’t cover you for a risk that is known about.

For example, if you have a long-standing illness that means you can’t go on holiday, your insurer might not cover you for the cancellation costs.

Insurers also won’t cover you if you have to cancel your trip for reasons within your control. For example, if you miss your flight because you woke up late, your claim is likely to be rejected.

Travel insurance is also unlikely to cover you if you have been irresponsible. For example, if you leave your valuables in your hold luggage then your policy won’t cover you if these items are damaged.

Each policy will have specific things it won’t cover, and this will vary depending on the provider. So it’s important to read the terms and conditions carefully.

There are two main options to choose from when taking out a travel insurance policy:

- Single trip — covers you for one trip of a specified length only

- Annual multi-trip — covers you for all your trips for one year (if you travel a lot this can work out cheaper than lots of single policies)

You need to make sure that your travel insurance is valid in the country you’re going to. In the UK, providers will offer cover for:

- Europe only

- Or the more expensive, worldwide policies (these either include or exclude the US)

But check first which exact countries providers include in their policies. For example, some policies include Turkey, Morocco, Tunisia and Egypt in their Europe insurance.

There is also specific travel insurance for backpackers, which offers extra cover for those who are likely to be away for an extended period of time or travelling to multiple destinations.

Also bear in mind that if you are doing any extreme sports like skiing or going on a cruise then you might need to buy an add-on.

When should I take out travel insurance?

It’s usually best to take out travel insurance as soon as you have booked your trip.

While many people think of travel insurance as something that covers problems while they are away, some policies cover you for issues, accidents and illnesses that stop you from being able to travel.

Cancellation is one of the main reasons that people claim on a travel insurance policy. If the cancellation happens before you have bought insurance then you wouldn’t be able to claim.

How much should I pay for travel insurance?