International tourism: the most popular countries

Drastic declines due to COVID-19

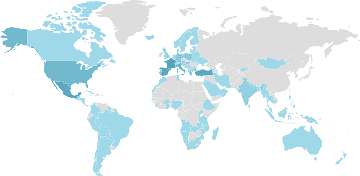

The most popular travel countries.

Germany is the world travel champion

Booming tourism and slump in 2020.

A look at the costs

International tourism, number of arrivals - Country Ranking

Definition: International inbound tourists (overnight visitors) are the number of tourists who travel to a country other than that in which they have their usual residence, but outside their usual environment, for a period not exceeding 12 months and whose main purpose in visiting is other than an activity remunerated from within the country visited. When data on number of tourists are not available, the number of visitors, which includes tourists, same-day visitors, cruise passengers, and crew members, is shown instead. Sources and collection methods for arrivals differ across countries. In some cases data are from border statistics (police, immigration, and the like) and supplemented by border surveys. In other cases data are from tourism accommodation establishments. For some countries number of arrivals is limited to arrivals by air and for others to arrivals staying in hotels. Some countries include arrivals of nationals residing abroad while others do not. Caution should thus be used in comparing arrivals across countries. The data on inbound tourists refer to the number of arrivals, not to the number of people traveling. Thus a person who makes several trips to a country during a given period is counted each time as a new arrival.

Source: World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files.

See also: Thematic map , Time series comparison

More rankings: Africa | Asia | Central America & the Caribbean | Europe | Middle East | North America | Oceania | South America | World |

Development Relevance: Tourism is officially recognized as a directly measurable activity, enabling more accurate analysis and more effective policy. Whereas previously the sector relied mostly on approximations from related areas of measurement (e.g. Balance of Payments statistics), tourism today possesses a range of instruments to track its productive activities and the activities of the consumers that drive them: visitors (both tourists and excursionists). An increasing number of countries have opened up and invested in tourism development, making tourism a key driver of socio-economic progress through export revenues, the creation of jobs and enterprises, and infrastructure development. As an internationally traded service, inbound tourism has become one of the world's major trade categories. For many developing countries it is one of the main sources of foreign exchange income and a major component of exports, creating much needed employment and development opportunities.

Limitations and Exceptions: Tourism can be either domestic or international. The data refers to international tourism, where the traveler's country of residence differs from the visiting country. International tourism consists of inbound (arrival) and outbound (departures) tourism. The data are from the World Tourism Organization (WTO), a United Nations agency. The data on inbound and outbound tourists refer to the number of arrivals and departures, not to the number of people traveling. Thus a person who makes several trips to a country during a given period is counted each time as a new arrival. The data on inbound tourism show the arrivals of nonresident tourists (overnight visitors) at national borders. When data on international tourists are unavailable or incomplete, the data show the arrivals of international visitors, which include tourists, same-day visitors, cruise passengers, and crew members. Sources and collection methods for arrivals differ across countries. In some cases data are from border statistics (police, immigration, and the like) and supplemented by border surveys. In other cases data are from tourism accommodation establishments. For some countries number of arrivals is limited to arrivals by air and for others to arrivals staying in hotels. Some countries include arrivals of nationals residing abroad while others do not. Caution should thus be used in comparing arrivals across countries.

Statistical Concept and Methodology: Statistical information on tourism is based mainly on data on arrivals and overnight stays along with balance of payments information. These data do not completely capture the economic phenomenon of tourism or provide the information needed for effective public policies and efficient business operations. Data are needed on the scale and significance of tourism. Information on the role of tourism in national economies is particularly deficient. Although the World Tourism Organization reports progress in harmonizing definitions and measurement, differences in national practices still prevent full comparability. Arrivals data measure the flows of international visitors to the country of reference: each arrival corresponds to one in inbound tourism trip. If a person visits several countries during the course of a single trip, his/her arrival in each country is recorded separately. In an accounting period, arrivals are not necessarily equal to the number of persons travelling (when a person visits the same country several times a year, each trip by the same person is counted as a separate arrival). Arrivals data should correspond to inbound visitors by including both tourists and same-day non-resident visitors. All other types of travelers (such as border, seasonal and other short-term workers, long-term students and others) should be excluded as they do not qualify as visitors. Data are obtained from different sources: administrative records (immigration, traffic counts, and other possible types of controls), border surveys or a mix of them. If data are obtained from accommodation surveys, the number of guests is used as estimate of arrival figures; consequently, in this case, breakdowns by regions, main purpose of the trip, modes of transport used or forms of organization of the trip are based on complementary visitor surveys.

Aggregation method: Gap-filled total

Periodicity: Annual

Note: This page was last updated on December 28, 2019

Home | About | Search | Site Map | Blog | Indicadores en Español

By: Bastian Herre and Veronika Samborska

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

.png)

- Get started

- Introduction

- Most Visited

Most Visited Countries

Travel Hotspots & Popular Destinations

Every year, millions of people across the globe pack their bags and set off to explore the diverse cultures, breathtaking landscapes, unique cuisines, and historic landmarks that the world's countries have to offer. Transnational tourism plays a monumental role in the global economy and significantly impacts the culture and environment of the countries it touches. Using data on international arrivals collected by the World Tourism Organization, we've compiled a list of the most visited countries across the globe and analyzed what makes these nations so attractive to travelers.

Key findings from the data include:

- France tops the list with a whopping 89.4 million arrivals, corroborating its reputation as a global hotspot for its rich history, cultural heritage, fine wines, and exquisite cuisine.

- Making an impressive appearance in the second place is Spain, boasting 83.7 million arrivals, thanks to its sun-soaked beaches, vibrant nightlife, UNESCO World Heritage Sites, and a rich festive tradition.

- The United States, with its diverse topography, iconic landmarks, and multicultural cities, follows closely, welcoming 79.3 million visitors.

- Interestingly, Asian countries like China, with 65.7 million, Turkey, with 51.2 million, and Thailand, with 39.8 million, emphasize the growing interest in Asian cultures, history, landscapes, and culinary delights.

- Countries with a strong historical and cultural background like Italy, Germany, and the United Kingdom boast high arrival numbers, with 64.5 million, 39.6 million, and 39.4 million respectively, demonstrating the global appetite for cultural tourism.

As we travel the spectrum of countries, from the lavender fields of Provence in France to the bustling cityscape of New York in the United States to the Great Wall of China, it's clear that each nation offers a unique array of experiences and attractions that draw people from around the world.

10 Most Visited Countries

Topping the chart, with a massive number of 89.4 million arrivals, is France. This is a testimony to its enduring popularity amongst tourists, drawn to its diverse regional cultures, historical sites, museums, gastronomy, and the romantic allure of Paris.

Stepping up to the second spot is Spain, counting 83.7 million arrivals. Its combination of historical richness, sundrenched coasts, architectural beauty, flamenco music, and the running of the bulls are among the experiences that keep tourists pouring in.

The United States, a country of vast landscape diversity and iconic cities, seizes the third spot with 79.3 million international visitors. From the swarming streets of New York City to California’s golden coasts and Florida’s amusement parks, there is an endless list of attractions for tourists.

In the fourth spot, we see China, an Asian giant that had an impressive 65.7 million arrivals. With its ancient history, diverse culture, and remarkable landmarks like the Great Wall, it continues to enthrall explorers from around the globe.

Italy marks the fifth position with 64.5 million arrivals. Famed for its art, history, fashion, food, and wine, Italy effortlessly captivates the heart of its visitors.

At the sixth spot, we have Turkey with 51.2 million arrivals. It's a fascinating mix of Eastern and Western culture, joining together Istanbul's grand history and the turquoise coastlines of Antalya.

Heading to the Americas, Mexico lands on the seventh spot with 45.0 million arrivals. Its vibrant culture, mouth watering food, sun-beaten beaches, and famous Mayan and Aztec ruins are a strong pull for tourists.

Thailand welcomes the world at number eight, with 39.8 million arrivals, giving them a taste of Asia through its royal palaces, ancient ruins, ornate temples, and folk traditions, not to mention the famed beaches.

Germany ranks ninth with 39.6 million visitors, who are often drawn towards its picturesque landscapes, historical sites, and of course, Oktoberfest.

The final spot in our list goes to the United Kingdom, with 39.4 million arrivals. Its wealth of history, notable landmarks, and the royal charm of London, added to the cultural riches of Scotland, Wales, and Northern Ireland, make it a bucket list regular.

10 Most Visited Countries:

- France - 89.4M

- Spain - 83.7M

- United States - 79.3M

- China - 65.7M

- Italy - 64.5M

- Turkey - 51.2M

- Mexico - 45.0M

- Thailand - 39.8M

- Germany - 39.6M

- United Kingdom - 39.4M

Full Data Set

To sort the data in the table, click on the column headers.

Frequently Asked Questions

International Tourism, Number of Arrivals - The World Bank

Related Rankings

States with the most counties, most racist states, legal babysitting age by state, most corrupt states, meat consumption by country, true size of countries.

International tourism, number of departures

All Countries and Economies

Country Most Recent Year Most Recent Value

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Annual growth of international visitor arrivals to New Zealand FY 2024, by country

In financial year 2024, the largest group of international visitors to New Zealand arrived from Australia; nonetheless, the growth in international arrivals from Australia was only around 5.3 percent. Although it was the third most prominent country in terms of total visitor arrivals in 2024, China witnessed the largest growth in visitors to Australia, with visitor numbers increasing by over 287 percent from the 2023 financial year.

Annual growth rate of international visitor arrivals to New Zealand in financial year 2024, by country of origin

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

August 2024

New Zealand

year ended June

Note: Stats NZ and licensed by Stats NZ for re-use under the Creative Commons Attribution 4.0 International license. International visitors are defined by the source as overseas residents arriving in New Zealand for a stay of less than 12 months. Values have been rounded. Only the top 20 countries in terms of total visitor arrivals are represented.

Other statistics on the topic

- Monthly number of international visitor arrivals to New Zealand 2019-2024

- Perceived negative impacts of tourism on the environment New Zealand 2023

- Annual number of international visitor arrivals to Auckland New Zealand FY 2020-2023

- Number of international visitor arrivals to New Zealand FY 2024, by country of origin

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in New Zealand "

- Tourism value added as a share of industry GDP New Zealand 2014-2023

- Tourism GDP growth rate New Zealand 2014-2023

- Total tourism expenditure New Zealand 2014-2023, by tourist type

- Total tourism expenditure New Zealand 2022-2023, by product type

- Total number of people employed in the tourism sector New Zealand 2014-2023

- Number of international visitor arrivals to New Zealand FY 2015-2024

- Annual growth of international visitor arrivals to New Zealand FY 2015-2024

- Number of international visitor arrivals to New Zealand FY 2024, by region of origin

- Number of international visitor arrivals to New Zealand FY 2024, by port of entry

- Number of international visitor arrivals to New Zealand FY 2024, by age

- Number of international visitor arrivals to New Zealand FY 2024, by purpose of visit

- Annual number of outbound NZ resident travelers New Zealand FY 2015-2024

- Number of inbound NZ resident arrivals New Zealand FY 2024, by country visited

- Leading tourism experience interests among outbound travelers New Zealand 2022

- Leading sport tourism experience interests of outbound travelers New Zealand 2022

- Leading wilderness tourism interests of outbound travelers New Zealand 2022

- Monthly number of international visitor arrivals to Auckland New Zealand 2019-2024

- Number of international visitor arrivals to Auckland, NZ FY 2023, by country origin

- Share of domestic overnight leisure trips New Zealand 2024, by region

- Top attractions visited by domestic tourists Central Auckland New Zealand FY 2022

- Top attractions visited by domestic tourists South Auckland New Zealand FY 2022

- Top attractions visited by domestic tourists North Auckland New Zealand FY 2022

- Views on the impact of international and domestic tourism on New Zealand 2023

- Views on international tourism impact on post-pandemic economic recovery NZ 2023

- Perceived positive impacts of tourism on the economy and society New Zealand 2023

- Views on the environmental impact of international tourism New Zealand 2023

- Views on the social well-being impact of international tourism New Zealand 2023

- Views on the impact of international tourism on culture, values, and heritage NZ 2023

Other statistics that may interest you Travel and tourism in New Zealand

- Premium Statistic Tourism value added as a share of industry GDP New Zealand 2014-2023

- Premium Statistic Tourism GDP growth rate New Zealand 2014-2023

- Premium Statistic Total tourism expenditure New Zealand 2014-2023, by tourist type

- Premium Statistic Total tourism expenditure New Zealand 2022-2023, by product type

- Premium Statistic Total number of people employed in the tourism sector New Zealand 2014-2023

International tourism

- Premium Statistic Monthly number of international visitor arrivals to New Zealand 2019-2024

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2015-2024

- Premium Statistic Annual growth of international visitor arrivals to New Zealand FY 2015-2024

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2024, by region of origin

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2024, by country of origin

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2024, by port of entry

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2024, by age

- Premium Statistic Number of international visitor arrivals to New Zealand FY 2024, by purpose of visit

Outbound tourism

- Premium Statistic Annual number of outbound NZ resident travelers New Zealand FY 2015-2024

- Premium Statistic Number of inbound NZ resident arrivals New Zealand FY 2024, by country visited

- Premium Statistic Leading tourism experience interests among outbound travelers New Zealand 2022

- Premium Statistic Leading sport tourism experience interests of outbound travelers New Zealand 2022

- Premium Statistic Leading wilderness tourism interests of outbound travelers New Zealand 2022

Tourism in Auckland

- Premium Statistic Monthly number of international visitor arrivals to Auckland New Zealand 2019-2024

- Premium Statistic Annual number of international visitor arrivals to Auckland New Zealand FY 2020-2023

- Premium Statistic Number of international visitor arrivals to Auckland, NZ FY 2023, by country origin

- Premium Statistic Share of domestic overnight leisure trips New Zealand 2024, by region

- Premium Statistic Top attractions visited by domestic tourists Central Auckland New Zealand FY 2022

- Premium Statistic Top attractions visited by domestic tourists South Auckland New Zealand FY 2022

- Premium Statistic Top attractions visited by domestic tourists North Auckland New Zealand FY 2022

Views on tourism

- Premium Statistic Views on the impact of international and domestic tourism on New Zealand 2023

- Premium Statistic Views on international tourism impact on post-pandemic economic recovery NZ 2023

- Premium Statistic Perceived positive impacts of tourism on the economy and society New Zealand 2023

- Premium Statistic Views on the environmental impact of international tourism New Zealand 2023

- Premium Statistic Perceived negative impacts of tourism on the environment New Zealand 2023

- Premium Statistic Views on the social well-being impact of international tourism New Zealand 2023

- Premium Statistic Views on the impact of international tourism on culture, values, and heritage NZ 2023

Further Content: You might find this interesting as well

Now boarding: Faces, places, and trends shaping tourism in 2024

After falling by 75 percent in 2020, travel is on its way to a full recovery by the end of 2024. Domestic travel is expected to grow 3 percent annually and reach 19 billion lodging nights per year by 2030. 1 Unless otherwise noted, the source for all data and projections is Oxford Economics. Over the same time frame, international travel should likewise ramp up to its historical average of nine billion nights. Spending on travel is expected to follow a similar trajectory, with an estimated $8.6 trillion in traveler outlays in 2024, representing roughly 9 percent of this year’s global GDP.

About the authors

This article is a collaborative effort by Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann , with Ivan Gladstone and Jasperina de Vries, representing views from McKinsey’s Travel, Logistics & Infrastructure Practice.

There’s no doubt people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go? We developed a snapshot of current traveler flows, along with estimates for growth through 2030. For the purposes of this report, we have divided the world into four regions—the Americas, Asia, Europe, and the Middle East and Africa.

Our analysis identifies three major themes for industry stakeholders to consider:

- The bulk of travel spending is close to home. Stakeholders should ensure they capture the full potential of domestic travel before shifting their focus to international travelers. And they should start with international travelers who visit nearby countries—as intraregional trips represent the largest travel segment after domestic trips.

- Source markets are shifting. Although established source markets continue to anchor global travel, Eastern Europe, India, and Southeast Asia are all becoming fast-growing sources of outbound tourism.

- The destinations of the future may not be the ones you imagine. Alongside enduring favorites, places that weren’t on many tourists’ maps are finding clever ways to lure international travelers and establish themselves as desirable destinations.

The bulk of travel spending is close to home

International travel might feel more glamorous, but tourism players should not forget that domestic travel still represents the bulk of the market, accounting for 75 percent of global travel spending (Exhibit 1). Domestic travel recovered from the COVID-19 pandemic faster than international travel, as is typical coming out of downturns. And although there has been a recent boom in “revenge travel,” with travelers prioritizing international trips that were delayed by the pandemic, a return to prepandemic norms, in which domestic travel represents 70 percent of spending, is expected by 2030.

The United States is the world’s largest domestic travel market at $1 trillion in annual spending. Sixty-eight percent of all trips that start in the United States remain within its borders. Domestic demand has softened slightly, as American travelers return abroad. 2 Dawit Habtemariam, “Domestic U.S. tourism growth levels off as Americans head overseas,” Skift, August 18, 2023. But tourism players with the right offerings are still thriving: five national parks broke attendance records in 2023 (including Joshua Tree National Park, which capitalized on growing interest from stargazers indulging in “dark sky” tourism 3 Scott McConkey, “5 national parks set attendance records in 2023, and the reasons may surprise you,” Wealth of Geeks, April 16, 2024. ).

China’s $744 billion domestic travel market is currently the world’s second largest. Chinese travelers spent the pandemic learning to appreciate the diversity of experiences on offer within their own country. Even as borders open back up, Chinese travelers are staying close to home. And domestic destinations are benefiting: for example, Changchun (home to the Changchun Ice and Snow Festival) realized 160 percent year-on-year growth in visitors in 2023. 4 Shi Xiaoji, “Why don’t Chinese people like to travel abroad anymore? The global tourism industry has lost 900 billion yuan. What is the situation?,” NetEase, February 12, 2024. In 2024, domestic travel during Lunar New Year exceeded prepandemic levels by 19 percent.

China’s domestic travel market is expected to grow 12 percent annually and overtake the United States’ to become the world’s largest by 2030. Hotel construction reflects this expectation: 30 percent of the global hotel construction pipeline is currently concentrated in China. The pipeline is heavily skewed toward luxury properties, with more than twice as many luxury hotels under construction in China as in the United States.

India, currently the world’s sixth-largest domestic travel market by spending, is another thriving area for domestic travel. With the subcontinent’s growing middle class powering travel spending growth of roughly 9 percent per year, India’s domestic market could overtake Japan’s and Mexico’s to become the world’s fourth largest by 2030. Domestic air passenger traffic in India is projected to double by 2030, 5 Murali Krishnan, “Can India’s airports cope with rapid passenger growth?,” Deutsche Welle, February 7, 2024. boosted in part by a state-subsidized initiative that aims to connect underserved domestic airports. 6 “India is seeing a massive aviation boom,” Economist , November 23, 2023.

When travelers do go abroad, they often stay close to home (Exhibit 2).

Europe and Asia, in particular, demonstrate strong and growing intraregional travel markets.

Recognizing this general trend, stakeholders have been funneling investment toward regional tourism destinations. An Emirati wealth fund, for instance, has announced its intent to invest roughly $35 billion into established hospitality properties and development opportunities in Egypt. 7 Michael Gunn and Mirette Magdy, “UAE’s $35 billion Egypt deal marks Gulf powers’ buying spree,” Bloomberg, April 27, 2024.

Europe has long played host to a high share of intraregional travel. Seventy percent of its travelers’ international trips stay within the region. Europe’s most popular destinations for intraregional travelers are perennial warm-weather favorites—Spain (18 percent), Italy (10 percent), and France (8 percent)—with limited change to these preferences expected between now and 2030.

Despite longer travel distances between Asian countries, Asia’s intraregional travel market is beginning to resemble Europe’s. Intraregional travel currently accounts for about 60 percent of international trips in Asia—a share expected to climb to 64 percent by 2030. As in Europe in past decades, Asian intraregional travel is benefiting from diminishing visa barriers and the development of a low-cost, regional flight network.

Thailand is projected to enjoy continued, growing popularity with Asian travelers. Thailand waived visa requirements for Chinese tourists in 2023 and plans to do the same for Indian tourists starting in 2024. It has aggressively targeted the fast-growing Indian traveler segment, launching more than 50 marketing campaigns directed at Indians over the past decade. The investment may be paying off: Bangkok recently overtook Dubai as the most popular city destination for Indian tourists. 8 “Bangkok overtakes Dubai as top destination for Indians post visa relaxation, reveals Agoda,” PR Newswire, January 18, 2024.

A McKinsey ConsumerWise survey on consumer sentiment, conducted in February 2024, suggests that Chinese travelers are also exhibiting high interest in international travel, with 36 percent of survey respondents indicating that they intend to spend more on international travel in the next three months. 9 Daniel Zipser, “ China brief: Consumers are spending again (outside of China) ,” McKinsey, April 8, 2024. Much of this interest is directed toward regional destinations such as Southeast Asia and Japan, with interest in travel to Europe down from previous years. 10 Guang Chen, Zi Chen, Steve Saxon, and Jackey Yu, “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Given travelers’ preference for proximity, how can tourism stakeholders further capitalize on domestic and intraregional travel demand? Here are a few strategies:

- Craft offerings that encourage domestic tourists to rediscover local gems. Destinations, hotels, and transportation providers can encourage domestic tourists to integrate lesser-known cultural landmarks into their trips to visit friends and relatives. In France, the upscale hotel chain Relais & Châteaux markets historic properties that lie far from classic tourist sights—such as Château Saint-Jean in rural Auvergne—as a welcome escape from the bustle of Paris. In Mexico, the Pueblos Mágicos program has successfully boosted domestic tourist visits to a set of “magical towns” that showcase Mexican heritage.

- Fold one-off domestic destinations into fuller itineraries. Route 66 in the United States is a classic road trip pathway, which spurs visits to attractions all along the highway’s length. Tourism stakeholders can collaborate to create similar types of domestic itineraries around the world. For instance, Mexico has expanded on its Pueblos Mágicos concept by branding coordinated visits to multiple villages as “magical routes.” In France, local tourism boards and vineyards have collaborated to promote bucket list “wine routes” around the country.

- Make crossing borders into neighboring countries seamless. Removing logistical barriers to travel can nudge tourists to upgrade a one-off trip to a single attraction into a bucket list journey across multiple, less-trodden destinations. In Africa, for example, Ethiopian Airlines is facilitating cross-border travel to major regional tourist sites through improved air connectivity. In Asia, Thailand has announced its intent to create a joint visa easing travel among Cambodia, Laos, Malaysia, Myanmar, Thailand, and Vietnam.

Source markets are shifting

The United States, Germany, the United Kingdom, China, and France remain the world’s five largest sources of travelers, in that order. These countries collectively accounted for 38 percent of international travel spending in 2023 and are expected to remain the top five source markets through 2030. But interest in travel is blossoming in other parts of the world—causing a shift in the balance of outbound travel flows (Exhibit 3).

North Americans’ travel spending is projected to hold steady at roughly 3 percent annual growth. US consumers voice growing concerns about inflation, and the most cost-constrained traveler segments are reducing travel, which is affecting ultra-low-cost airlines and budget hotels. Most travelers, however, plan to continue traveling: McKinsey research suggests that American consumers rank international and domestic travel as their highest-priority areas for discretionary spending. Instead of canceling their trips, these consumers are adapting their behavior by traveling during off-peak periods or booking travel further in advance. Travel spending by Europeans paints a slightly rosier picture, with roughly 5 percent projected annual growth. Meanwhile, the projected 12 percent annual growth in Chinese travelers’ spending should anchor substantial increases in travel spending across Northeast Asia.

Alongside these enduring traveler segments, new groups of travelers are emerging. Eastern Europe, India, and Southeast Asia are still comparatively small source markets, but they are developing fast-growing pools of first-time tourists (Exhibit 4).

India’s breakneck GDP growth of 6 percent year over year is bolstering a new generation of travelers, 11 Benjamin Laker, “India will grow to become the world’s third-largest economy by 2027,” Forbes , February 23, 2024. resulting in a projected annual growth in travel spending of 9 percent between now and 2030. Indian air carriers and lodging companies are making substantial investments to meet projected demand. Budget airline IndiGo placed the largest aircraft order in commercial aviation history in 2023, when it pledged to buy 500 Airbus A320 planes 12 Anna Cooban, “Biggest plane deal in history: Airbus clinches massive order from India’s IndiGo,” CNN, June 19, 2023. ; that same week, Air India nearly equaled IndiGo’s order size with purchase agreements for 250 Airbus and 220 Boeing jets. IndiGo later added an order for 30 additional Airbus A350 planes, well suited to serving both domestic and international routes. 13 “Airbus confirms IndiGo's A350 aircraft order,” Economic Times , May 6, 2024. The Indian Hotels Company Limited is ramping up its hotel pipeline, aiming to open two new hotels per month in the near future. International players are not sitting on the sidelines: seven hotel chains are launching new brands in India in 2024, 14 Peden Doma Bhutia, “Indian Hotels expansion plans: 2 new brands launching, 2 hotels opening every month,” Skift, February 2, 2024. including Marriott’s first Moxy- and Tribute-branded hotels in India and entrants from Hilton’s Curio and Tapestry brands. 15 Forum Gandhi, “Check-in frenzy: International hotel giants unleash fresh brands in India’s booming hospitality landscape,” Hindu Businessline , February 13, 2024. Development focus has shifted away from major metropolises such as Mumbai and Delhi and toward fast-developing, smaller cities such as Chandigarh and Hyderabad.

Southeast Asian travel spending is projected to grow at roughly 7 percent per year. Pockets of particularly high growth exist in Cambodia, Malaysia, and the Philippines. To capitalize on this blossoming source market, neighboring countries are rolling out attractive visa arrangements: for example, China has agreed to reciprocal visa waivers for short-term travelers from Malaysia, Singapore, and Thailand. 16 Julienna Law, “China launches ‘visa-free era’ with Southeast Asia. Will travel retail boom?,” Jing Daily , January 30, 2024.

Travel spending by Eastern Europeans is expected to grow at 7 percent per year until 2030—two percentage points higher than spending by Western Europeans. Areas of especially high growth include the Czech Republic, Hungary, and Poland, where middle-class travelers are increasingly venturing farther afield. Major tourism players, including the TUI Group, have tapped into these new source markets by offering charter flights to warm-weather destinations such as Egypt. 17 Hildbrandt von Klaus, “TUI develops Czech Republic as a new source market,” FVW, December 22, 2023.

Although the number of travelers from these new source markets is growing, their purchasing power remains relatively limited. Compared with Western European travelers (who average $159 per night in total travel spending), South Asians spend 20 percent less, Eastern Europeans spend 40 percent less, and Southeast Asians spend 55 percent less. Only 3 percent of the current Asian hotel construction pipeline caters to economy travelers, suggesting a potential supply gap of rooms that could appeal to budget-constrained tourists.

While acknowledging that historical source markets will continue to constitute the bulk of travel spending, tourism players can consider actions such as these to capitalize on growing travel demand from newer markets:

- Reduce obstacles to travel. Countries can look for ways to strategically invest in simplifying travel for visitors from growing source markets. In 2017, for example, Azerbaijan introduced express processing of electronic visas for Indian visitors; annual arrivals from India increased fivefold in two years. Requirements regarding passport photocopies or in-person check-ins can similarly be assessed with an eye toward reducing red tape for travelers.

- Use culturally relevant marketing channels to reach new demographics. Unique, thoughtful marketing strategies can help destinations place themselves on first-time travelers’ bucket lists. For example, after the release of Zindagi Na Milegi Dobara , a popular Bollywood movie shot in Spain with support from the Spanish Ministry of Tourism, Indian tourism to Spain increased by 65 percent. 18 “ Zindagi Na Milegi Dobara part of syllabus in Spain colleges,” India Today , June 6, 2004.

- Give new travelers the tech they expect. Travelers from newer source markets often have access to tech-forward travel offerings. For example, Indian travelers can travel anywhere within their country without physical identification, thanks to the Digi Yatra app. The Southeast Asian rideshare app Grab has several helpful travel features that competitors lack, such as automated menu translation and currency conversion. Tourism stakeholders should consider how to adapt to the tech expectations of newer travelers, integrating relevant offerings that ease journeys.

- Create vibrant experiences tailored to different price points. Crafting lower-budget offerings for more cost-constrained travelers doesn’t need to result in giving them a subpar experience. Capsule hotels, in which guests sleep in small cubbies, began as a response to the high cost of accommodations in Japan, but they have become an attraction in their own right—appearing on many must-do lists. 19 Philip Tang, “24 of the best experiences in Japan,” Lonely Planet, March 23, 2024.

The places you’ll go: The destinations of the future may not be the ones you imagine

The world’s top ten destination countries (the United States, Spain, China, France, Saudi Arabia, Türkiye, Italy, Thailand, Japan, and India, in that order) currently receive 45 percent of all travel spending, including for domestic travel. But some new locales are gaining traction (Exhibit 5).

A significant number of travelers are expanding their horizons, booking journeys to less visited countries that are near to old standbys. For instance, Laos and Malaysia, which both border Thailand—an established destination that is home to Bangkok, the world’s most visited city 20 Katherine LaGrave, “This is the world’s most visited city,” AFAR , January 31, 2024. —are up a respective 20 percent and 17 percent, respectively, in year-over-year international travel spending.

The world’s top ten destination countries currently receive 45 percent of all travel spending, including domestic-travel spending. But some new locales are gaining traction.

Several other countries that have crafted thoughtful tourism demand generation strategies—such as Peru, the Philippines, Rwanda, and Vietnam—are also expected to reap benefits in the coming years. Vietnam logged a remarkable 40 percent increase in tourism spending in the five years before the pandemic. Postpandemic, it has rebounded in part by waiving visa requirements for European travelers (while indicating intent to offer similar exemptions in the future for Chinese and Indian travelers). 21 Ashvita Singh, “Vietnam looks to offer visa-free entry to Indians: India report,” Skift, November 20, 2023. The Philippines has made a concerted effort to shift its sun-and-beach branding toward a more well-rounded image, replacing its long-standing “It’s more fun in the Philippines” tourism slogan with “Love the Philippines.” Peru is highlighting less visited archeological sites while also marketing itself as a top-notch culinary destination through the promotion of Peruvian restaurants abroad. Rwanda is investing in infrastructure to become a major African transit hub, facilitated by Qatar Airways’ purchase of a 60 percent stake in the country’s major airport. 22 Dylan Cresswell, “Rwanda plots ambitious tourism recovery,” African Business , July 28, 2022. Rwanda has also successfully capitalized on sustainable tourism: by charging $1,500 per gorilla trekking permit, for instance, it has maximized revenue while reducing environmental impact.

Tourism players might consider taking some of these actions to lure tourists to less familiar destinations:

- Collaborate across the tourism ecosystem. Promotion is not solely the domain of destination marketing organizations. Accommodation, transportation, and experience providers can also play important roles. In Singapore, for instance, the luxury resort Marina Bay Sands partners extensively with Singapore Airlines and the Singapore Tourism Board to offer compelling tourism offerings. Past collaborations have included flight and stay packages built around culinary festivals. 23 “Singapore Tourism Board, Marina Bay Sands & UOB partner to enliven Marina Bay precinct,” Singapore Tourism Board news release, January 25, 2024.

- Use infrastructure linkage to promote new destinations. By extending route options, transportation providers can encourage visitors to create itineraries that combine familiar destinations with new attractions. In Asia, Thailand’s tourism authority has attempted to nudge visitors away from the most heavily trafficked parts of the country, such as Bangkok and Phuket, and toward less popular destinations.

- Deploy social media to reach different demographics. Innovative social media campaigns can help put a destination on the map. Australia launched its “Ruby the kangaroo” campaign in China to coincide with the return of postpandemic air capacity between the two places. A video adapted for Chinese context (with appropriate gestures and a hashtag in Mandarin) garnered more than 20 million views in a single day on one of China’s largest social media platforms. 24 Nicole Gong, “Can Ruby the kangaroo bring Chinese tourists hopping back to Australia?,” SBS, June 5, 2023.

- Embrace unknown status. “Off the beaten path” messaging can appeal to widely traveled tourists seeking fresh experiences. Saudi Arabia’s “#WhereInTheWorld” campaign promoted the country’s tourist spots by acknowledging that they are less familiar to travelers, using a series of images that compared these spots with better-known destinations.

As tourism stakeholders look to the future, they can take steps to ensure that they continue to delight existing travelers while also embracing new ones. Domestic and intraregional tourism remain major opportunities—catering to local tourists’ preferences while building infrastructure that makes travel more seamless within a region could help capture them. Creative collaboration among tourism stakeholders can help put lesser-known destinations on the map. Travel tides are shifting. Expertly navigating these currents could yield rich rewards.

Caroline Tufft is a senior partner in McKinsey’s London office, Margaux Constantin is a partner in the Dubai office, Matteo Pacca is a senior partner in the Paris office, Ryan Mann is a partner in the Chicago office, Ivan Gladstone is an associate partner in the Riyadh office, and Jasperina de Vries is an associate partner in the Amsterdam office.

The authors wish to thank Abdulhadi Alghamdi, Alessandra Powell, Alex Dichter, Cedric Tsai, Diane Vu, Elisa Wallwitz, Lily Miller, Maggie Coffey, Nadya Snezhkova, Nick Meronyk, Paulina Baum, Peimin Suo, Rebecca Stone, Sarah Fellay, Sarah Sahel, Steffen Fuchs, Steffen Köpke, Steve Saxon, Sophia Wang, and Urs Binggeli for their contributions to this article.

This article was edited by Seth Stevenson, a senior editor in the New York office.

Explore a career with us

Related articles.

The future of tourism: Bridging the labor gap, enhancing customer experience

The promise of travel in the age of AI

From India to the world: Unleashing the potential of India’s tourists

Brits help break tourism record in Spain after MILLIONS visited the country in July alone this year – these are the top destinations for 2024

SPAIN’S tourism bubble shows no signs of bursting as the country welcomed 10.9 million international visitors in July this year – a 7.3% rise year-on-year.

And the avalanche of foreigners splashed out on average €195 a day, totalling €15.5 billion over the course of the month – another huge 11.9% increase on last year.

The Brits once again remain Spain’s most loyal customer, ranking first both in number of tourists and total expenditure.

However they now also outmuscle their European counterparts on the what they fork out per day.

READ MORE: Exclusive: Anti-tourism graffiti brands tourists a ‘plague’ in Spain’s Sevilla as locals mock British visitors who had water thrown on their heads

Over two million Brits arrived last month – a full 20% more than second place France. Collectively they spent €2.8 billion (18.3% of the total), at an average of €196 a day.

The French and the Germans jostle for silver, according to data from the National Institute of Statistics (INE).

Despite there being five Frenchman (1.6 million) for every four Germans (1.3 million) visiting Spain in July, the German still outspent their Gallic neighbours by €1.7 billion to €1.5 billion.

READ MORE: Locals in Spain succeed in shutting down tourist flats in luxury Malaga tower blocks – but one owner blasts them as ‘radical anti-tourism activists who hate foreigners’

Both were relatively miserly while on Spanish shores, with the Germans spending an average of €170 a day and the French just €130 – perhaps a reflection that some visitors were just day trippers driving over the border.

But the real big spenders in Spain come from beyond Europe’s shores.

‘Rest of the world’ (presumably with the Americans and the Emiratis leading the way) splashed out an average of €227 a day.

READ MORE: Spain’s tourism industry is at major risk from climate change, study warns: These areas face losing the most holidaymakers

Spending overall continues to soar, up by 11.9% on average, and by a whopping 20.1% in the Valencian Community

The most popular destination for foreign tourists was the Balearic Islands, which welcomed 2.5 million in July, followed by Catalunya with 2.4 million guests.

The Valencian Community just pips Andalucia to third place, with 1.47 million foreign tourists to 1.46 million respectively.

Over the course of 2024 to July, Spain has welcomed 53 million visitors, with 10.5 million coming from the UK, 7.1 million from France and 6.8 million from Germany.

With Spain enjoying the crown of golden child of Europe as it basks in 2.5% economic growth – significantly higher than the countries from whose tourists it welcomes – it comes as no surprise that a majority of this has come in the tourism sector.

Jose Luis Zoreda, president of the Exceltur, a tourism industry association, claimed that ‘we were responsible for 80% of the whole GDP growth of Spain’ in 2023.

- The Olive Press

Related Articles

‘Cursed’ indoor swimming pool on Spain’s Costa Blanca is closed after ‘leaking 500 litres of water per week’

Benidorm to launch its Low Emission Zone next year as part of EU directive: Locals and tourists will face fines for breaking new rules after initial trial period

Earthquake on the coast of southern Spain rattles a dozen towns in Andalucia

Walter Finch

Walter - or Walt to most people - is a former and sometimes still photographer and filmmaker who likes to dig under the surface. A NCTJ-trained journalist, he came to the Costa del Sol - Gibraltar hotspot from the Daily Mail in 2022 to report on organised crime, corruption, financial fraud and a little bit of whatever is going on. Got a story? [email protected] @waltfinc

Leave a Reply Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Latest from Lead

‘Racism’ row erupts in Spain after mayor of tiny tourist town brands arrival of 200 migrants ‘excessive’

Tourist town on Spain’s Costa Blanca bans new licences for Airbnb-style flats for two years

More from the olive press.

UN Tourism | Bringing the world closer

Competitiveness, market intelligence.

- Policy and Destination Management

- Product Development

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality, and accommodation (data on number of rooms, guest, and nights). It also features a Tourism Recovery Tracker and a Policy tracker as part of UN Tourism´s COVID-19 response.

The UN Tourism World Tourism Barom eter monitors short-term tourism trends on a regular basis to provide global tourism stakeholders with up-to-date analysis on international tourism.

Impact assessment

It is early to assess the impact of the Russian Federation’s military offensive in Ukraine, though it represents a major downside risk for international tourism that could delay the sector’s already weak and uneven recovery .

Market Intelligence Reports

UN Tourism publishes a number of market intelligence reports every year, covering trends analysis, products, segments and markets. Information on the contents of these publications is provided here.

Market Intelligence - Webinars

Impact of covid-19 on tourism.

The COVID-19 pandemic has caused an unprecedented impact on tourism, with a sharp decline in international arrivals of 73% in 2020 and 71% in 2021.

Money blog: Oasis resale U-turn as official reseller lowers fee amid criticism

The Money blog is your place for consumer and personal finance news and tips. Today's posts include Twickets lowering fees for Oasis tickets, the extension of the Household Support Fund and O2 Priority axing free Greggs. Listen to a Daily podcast on the Oasis ticket troubles as you scroll.

Monday 2 September 2024 17:40, UK

- Oasis resale U-turn as Twickets lowers fee after criticism

- Millions to get cost of living payments this winter as scheme extended

- O2 Priority customers fume as Greggs perk scaled back

- Major bank to let first-time buyers borrow up to 5.5 times salary

Essential reads

- 'This job has saved lives': What's it like selling the Big Issue

- Eyewatering rate hike awaiting anyone coming off a five-year fixed

Tips and advice

- Money Problem : 'My dog died but my insurance are still demanding whole year's policy payment'

- Treat savings like monthly bill, says savings guru

- Young people doing 'big no-no' with holiday money - here are the golden rules

Twickets has announced it is lowering its charges after some Oasis fans had to pay more than £100 in extra fees to buy official resale tickets.

The site is where the band themselves is directing people to buy second-hand tickets for face value - having warned people against unofficial third party sellers like StubHub and Viagogo.

One person branded the extra fees "ridiculous" (see more in 10.10 post), after many people had already been left disappointed at the weekend when Ticketmaster's dynamic pricing pushed tickets up by three times the original advertised fee.

Twickets said earlier that it typically charged a fee of 10-15% of the face value of the tickets.

But it has since said it will lower the charge due to "exceptional demand" from Oasis fans - taking ownership of an issue in a way fans will hope others follow.

Richard Davies, Twickets founder, told the Money blog: "Due to the exceptional demand for the Oasis tour in 2025, Twickets have taken the decision to lower our booking fee to 10% and a 1% transactional fee (to cover bank charges) for all buyers of their tickets on our platform. In addition we have introduced a fee cap of £25 per ticket for these shows. Sellers of tickets already sell free of any Twickets charge.

"This ensures that Twickets remains hugely competitive against the secondary market, including sites such as Viagogo, Gigsberg and StubHub.

"Not only do these platforms inflate ticket prices way beyond their original face value but they also charge excessive booking fees, usually in the region of 30-40%. Twickets by comparison charges an average fee of around 12.5%"

The fee cap, which the Money blog understands is being implemented today, will apply to anyone who has already bought resale tickets through the site.

Mr Davies said Twickets was a "fan first" resale site and a "safe and affordable place" for people to trade unwanted tickets.

"The face value of a ticket is the total amount it was first purchased for, including any booking fee. Twickets does not set the face value price, that is determined by the event and the original ticketing company. The price listed on our platform is set by the seller, however no one is permitted to sell above the face-value on Twickets, and every ticket is checked before listing that it complies with this policy," he said.

Meanwhile, hundreds of people have complained to the regulator about how Oasis tickets were advertised ahead of going on sale.

The Advertising Standards Authority said it had received 450 complaints about Ticketmaster adverts for the gigs.

Some expressed their anger on social media , as tickets worth £148 were being sold for £355 on the site within hours of release, due to the "dynamic pricing" systems.

A spokesperson from ASA said the complainants argue that the adverts made "misleading claims about availability and pricing".

They added: "We're carefully assessing these complaints and, as such, can't comment any further at this time.

"To emphasise, we are not currently investigating these ads."

Ticketmaster said it does not set prices and its website says this is down to the "event organiser" who "has priced these tickets according to their market value".

After a long Saturday for millions of Oasis fans in online queues, the culture secretary says surge pricing - which pushed the price of some tickets up by three times their original advertised value to nearly £400 - will be part of the government's review of the ticket market.

On today's episode of the Daily podcast, host Niall Paterson speaks to secondary ticketing site Viagogo. While it wasn’t part of dynamic pricing, it has offered resale tickets for thousands of pounds since Saturday.

Matt Drew from the company accepts the industry needs a full review, while Adam Webb, from the campaign group FanFair Alliance, explains the changes it would like to see.

We've covered the fallout of the Oasis sale extensively in the Money blog today - see the culture secretary's comments on the "utterly depressing" inflated pricing in our post at 6.37am, and Twickets, the official Oasis resale site, slammed by angry fans for its "ridiculous" added fees at 10.10am.

The growing backlash culminated in action from Twickets - the company said it would lower its charges after some fans had to pay more than £100 in extra fees for resale tickets (see post at 15.47).

Tap here to follow the Daily podcast - 20 minutes on the biggest stories every day

Last week we reported that employers will have to offer flexible working hours - including a four-day week - to all workers under new government plans.

To receive their full pay, employees would still have to work their full hours but compressed into a shorter working week - something some workplaces already do.

Currently, employees can request flexible hours as soon as they start at a company but employers are not legally obliged to agree.

The Labour government now wants to make it so employers have to offer flexible hours from day one, except where it is "not reasonably feasible".

You can read more of the details in this report by our politics team:

But what does the public think about this? We asked our followers on LinkedIn to give their thoughts in an unofficial poll.

It revealed that the overwhelming majority of people support the idea to compress the normal week's hours into fewer days - some 83% of followers said they'd choose this option over a standard five-day week.

But despite the poll showing a clear preference for a compressed week, our followers appeared divided in the comments.

"There's going to be a huge brain-drain as people move away from companies who refuse to adapt with the times and implement a 4 working week. This will be a HUGE carrot for many orgs," said Paul Burrows, principal software solutions manager at Reality Capture.

Louise McCudden, head of external affairs at MSI Reproductive Choices, said she wasn't surprised at the amount of people choosing longer hours over fewer days as "a lot of people" are working extra hours on a regular basis anyway.

But illustrator and administrative professional Leslie McGregor noted the plan wouldn't be possible in "quite a few industries and quite a few roles, especially jobs that are customer centric and require 'round the clock service' and are heavily reliant upon people in trades, maintenance, supply and transport".

"Very wishful thinking," she said.

Paul Williamson had a similar view. He said: "I'd love to know how any customer first service business is going to manage this."

We reported earlier that anyone with O2 Priority will have their free weekly Greggs treats replaced by £1 monthly Greggs treats - see 6.21am post.

But did you know there are loads of other ways to get food from the nation's most popular takeaway for free or at a discount?

Downloading the Greggs app is a good place to start - as the bakery lists freebies, discounts and special offers there regularly.

New users also get rewards just for signing up, so it's worth checking out.

And there's a digital loyalty card which you can add virtual "stamps" to with each purchase to unlock discounts or other freebies.

Vodafone rewards

Seriously begrudged Virgin Media O2 customers may want to consider switching providers.

The Vodafone Rewards app, VeryMe, sometimes gives away free Greggs coffees, sausage rolls, sweet treats and more to customers.

Monzo bank account holders can grab a sausage roll (regular or vegan), regular sized hot drink, doughnut or muffin every week.

Birthday cake

Again, you'll need the Greggs award app for this one - which will allow you to claim one free cupcake, cream cake or doughnut for your birthday each year.

Octopus customers

Octopus Energy customers with smart meters can claim one free drink each week, in-store from Greggs (or Caffè Nero).

The Greggs freebie must be a regular size hot drink.

Make new friends

If you're outgoing (and hungry), it may be worth befriending a Greggs staff member.

The staff discount at Greggs is 50% on own-produced goods and 25% off branded products.

If you aren't already aware, Iceland offers four Greggs sausage rolls in a multi-pack for £3.

That means, if you're happy to bake it yourself, you'll only be paying 74p per sausage roll.

Millions of Britons could receive extra cash to help with the cost of living this winter after the government extended the Household Support Fund.

A £421m pot will be given to local councils in England to distribute, while £79m will go to the devolved administrations.

The fund will now be available until April 2025 having been due to run out this autumn.

Councils decide how to dish out their share of the fund but it's often via cash grants or vouchers.

Many councils also use the cash to work with local charities and community groups to provide residents with key appliances, school uniforms, cookery classes and items to improve energy efficiency in the home.

Chancellor Rachel Reeves said: "The £22bn blackhole inherited from the previous governments means we have to take tough decisions to fix the foundations of our economy.

"But extending the Household Support Fund is the right thing to do - provide targeted support for those who need it most as we head into the winter months."

The government has been criticised for withdrawing universal winter fuel payments for pensioners of up to £300 this winter - with people now needing to be in receipt of certain means-tested benefits to qualify.

People should contact their local council for details on how to apply for the Household Support Fund - they can find their council here .

Lloyds Bank app appears to have gone down for many, with users unable to see their transactions.

Down Detector, which monitors site outages, has seen more than 600 reports this morning.

It appears to be affecting online banking as well as the app.

There have been some suggestions the apparent issue could be due to an update.

Another disgruntled user said: "Absolutely disgusting!! I have an important payment to make and my banking is down. There was no warning given prior to this? Is it a regular maintenance? Impossible to get hold of someone to find out."

A Lloyds Bank spokesperson told Sky News: "We know some of our customers are having issues viewing their recent transactions and our app may be running slower than usual.

"We're sorry about this and we're working to have everything back to normal soon."

We had anger of unofficial resale prices, then Ticketmaster's dynamic pricing - and now fees on the official resale website are causing consternation among Oasis fans.

The band has encouraged anyone wanting resale tickets to buy them at face value from Ticketmaster or Twickets - after some appeared for £6,000 or more on other sites.

"Tickets appearing on other secondary ticketing sites are either counterfeit or will be cancelled by the promoters," Oasis said.

With that in mind, fans flocked to buy resale tickets from the sites mentioned above - only to find further fees are being added on.

Mainly Oasis, a fan page, shared one image showing a Twickets fee for two tickets as high as £138.74.

"Selling the in demand tickets completely goes against the whole point of their company too… never mind adding a ridiculous fee on top of that," the page shared.

Fan Brad Mains shared a photo showing two tickets priced at £337.50 each (face value of around £150, but increased due to dynamic pricing on Saturday) - supplemented by a £101.24 Twickets fee.

That left him with a grand total of £776.24 to pay for two tickets.

"Actually ridiculous this," he said on X .

"Ticketmaster inflated price then sold for 'face value' on Twickets with a £100 fee. 2 x £150 face value tickets for £776, [this] should be illegal," he added.

Twickets typically charges between 10-15% of the ticket value as its own fee.

We have approached the company for comment.

Separately, the government is now looking at the practice of dynamic pricing - and we've had a response to that from the Competition and Markets Authority this morning.

It said: "We want fans to get a fair deal when they go to buy tickets on the secondary market and have already taken action against major resale websites to ensure consumer law is being followed properly.

"But we think more protections are needed for consumers here, so it is positive that the government wants to address this. We now look forward to working with them to get the best outcomes for fans and fair-playing businesses."

Consumer protection law does not ban dynamic pricing and it is a widely used practice. However, the law also states that businesses should not mislead consumers about the price they must pay for a product, either by providing false or deceptive information or by leaving out important information or providing it too late.

By James Sillars , business reporter

It's a false start to the end of the summer holidays in the City.

While London is mostly back at work, trading is fairly subdued due to the US Labor (that's labour, as in work) Day holiday.

US markets will not open again until Tuesday.

There's little direction across Europe with the FTSE 100 trading nine points down at 8,365.

Leading the gainers was Rightmove - up 24%. The property search website is the subject of a possible cash and shares takeover offer by Australian rival REA.

The company is a division of Rupert Murdoch's News Corp.

One other point to note is the continuing fluctuation in oil prices.

Brent crude is 0.7% down at the start of the week at $76.

Dragging the cost lower is further evidence of weaker demand in China.

Australia's REA Group is considering a takeover of Rightmove, in a deal which could be worth about £4.36bn.

REA Group said in a statement this morning there are "clear similarities" between the companies, which have "highly aligned cultural values".

Rightmove is the UK's largest online property portal, while REA is Australia's largest property website.

It employs more than 2,800 people and is majority-owned by Rupert Murdoch's News Corp,.

REA Group said: "REA sees a transformational opportunity to apply its globally leading capabilities and expertise to enhance customer and consumer value across the combined portfolio, and to create a global and diversified digital property company, with number one positions in Australia and the UK.

"There can be no certainty that an offer will be made, nor as to the terms on which any offer may be made."

Rightmove has been approached for comment.

A major lender has announced it will allow first-time buyers to borrow up to five-and-a-half times their income in a bid to help more people onto the property ladder.

Lloyds says it has increased its max loan-to-income ratio from 4.49 as the situation is "tough right now" for first-time house hunters.

It means buyers with a household income of £50,000 and a 10% deposit may be able to borrow £275,000 - up from £224,500 at the previous rate.

To qualify, borrowers have to apply for a first-time buyer mortgage with Lloyds or sister bank Halifax, have a total household income of at least £50,000 and a minimum 10% deposit, and not be using shared ownership or shared equity schemes. Normal affordability checks also apply.

Andrew Asaam, homes director at Lloyds Banking Group, said: "Getting the keys to a first home is a big deal, but it's tough right now.

"Aspiring homeowners have been struggling with house prices rising faster than their wages. They need to save for a deposit, keep up with rent, and choose the right mortgage."

Meanwhile, the National Association of Estate Agents' Propertymark president Toby Leek said it was "encouraging" to see banks offering more help to first-time buyers.

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

VIDEO

COMMENTS

UN Tourism systematically collects tourism statistics from countries and territories around the world in an extensive database that provides the most comprehensive repository of statistical information available on the tourism sector. This database consists mainly of more than 145 tourism indicators that are updated regularly. You can explore the data available through the UNWTO database below:

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually.

The analysis presented here is based on 2021 data from the World Tourism Organization and lists the most popular 57 countries. Both the number of tourists and the revenue apply to international travel, i.e., they do not include domestic travelers. A tourist in this context is any guest who spent at least one night in the country.

The UN Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. ... Measures to Support Travel and Tourism This compilation of country and international policy responses aims to share and monitor worldwide measures to mitigate the effects of COVID ...

Countries by tourist arrivals in 2019. The World Tourism rankings are compiled by the United Nations World Tourism Organization as part of their World Tourism Barometer publication, which is released up to six times per year. In the publication, destinations are ranked by the number of international visitor arrivals, by the revenue generated by inbound tourism, and by the expenditure of ...

145 key tourism statistics. Data are collected from countries by UN Tourism through a series of yearly questionnaires that are in line with the International Recommendations for Tourism Statistics (IRTS 2008) standard led by UN Tourism and approved by the United Nations. The latest update took place in 31 January 2024.

Arrivals data measure the flows of international visitors to the country of reference: each arrival corresponds to one in inbound tourism trip. If a person visits several countries during the course of a single trip, his/her arrival in each country is recorded separately. In an accounting period, arrivals are not necessarily equal to the number ...

The data covers various aspects of tourism, such as inbound tourism (including arrivals by region, main purpose, and mode of transport, as well as accommodation and tourism expenditure in the country), domestic Tourism (including trips and accommodation), outbound tourism (including departures and tourism expenditure in other countries ...

Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. Besides the convenient access by alphabetical or geographical selection, the Tourism Statistics section offers a multiple country search as well as other additional data sets.

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...

Yearbook of Tourism Statistics, Data 2017 - 2021, 2023 Edition. Published: April 2023 Pages: 1136. eISBN: 978-92-844-2413-9. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...

International tourism, receipts (current US$) World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Share Details. Label. 1995 - 2020.

Overall, France was the most visited country by inbound travelers worldwide in 2023, with 100 million international tourist arrivals. Spain, the United States, and Italy followed in the ranking ...

Transnational tourism plays a monumental role in the global economy and significantly impacts the culture and environment of the countries it touches. Using data on international arrivals collected by the World Tourism Organization, we've compiled a list of the most visited countries across the globe and analyzed what makes these nations so ...

Deriving from the most comprehensive statistical database available on the tourism sector, the Yearbook of Tourism Statistics focusses on data related to inbound tourism ( total arrivals and overnight stays ), broken down by country of origin.

Globally, travel and tourism's direct contribution to gross domectic product (GDP) was approximately 7.7 trillion U.S. dollars in 2022. This was a, not insignificant, 7.6 percent share of the ...

Tourism Statistics. International tourism receipts are expenditures by international inbound visitors, including payments to national carriers for international transport. These receipts include any other prepayment made for goods or services received in the destination country. They also may include receipts from same-day visitors, except when ...

The UN Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism receipts, tourism share of exports and contribution to GDP, source markets, seasonality, domestic tourism and data on accommodation and employment.

The UN Tourism Statistics Department is committed to developing tourism measurement for furthering knowledge of the sector, monitoring progress, evaluating impact, promoting results-focused management, and highlighting strategic issues for policy objectives.. The department works towards advancing the methodological frameworks for measuring tourism and expanding its analytical potential ...

International tourism, number of departures. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Share Details. Label. 1995 - 2020.

Annual growth rate of international visitor arrivals to New Zealand in financial year 2024, by country of origin [Graph], Statistics New Zealand, August 13, 2024. [Online].

After falling by 75 percent in 2020, travel is on its way to a full recovery by the end of 2024. Domestic travel is expected to grow 3 percent annually and reach 19 billion lodging nights per year by 2030. 1 Unless otherwise noted, the source for all data and projections is Oxford Economics. Over the same time frame, international travel should likewise ramp up to its historical average of ...

Complementary (macroeconomic) indicators. The 2023 Edition of the Compendium of Tourism Statistics presents in English, French and Spanish data for 194 countries from 2017 to 2021. Moreover, in this edition, the context of the COVID-19 pandemic is taken into account, as it has caused an unprecedented situation worldwide that has especially ...

SPAIN'S tourism bubble shows no signs of bursting as the country welcomed 10.9 million international visitors in July this year - a 7.3% rise year-on-year. And the avalanche of foreigners ...

The COVID-19 pandemic has caused an unprecedented impact on tourism, with a sharp decline in international arrivals of 73% in 2020 and 71% in 2021. The UN Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels.

International tourism up 4% in 2021 but still 72% below pre-pandemic levels Global tourism experienced a mild 4% upturn in 2021, with 15 million more international tourist arrivals (overnight visitors) than in 2020 but remained 72% below the levels of pre-pandemic year 2019 according to preliminary estimates. This follows a 73% plunge in international travel in 2020, the worst year on record ...

Australia's REA Group is considering a takeover of Rightmove, in a deal which could be worth about £4.36bn. REA Group said in a statement this morning there are "clear similarities" between the ...