- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to American Airlines Vacation Packages

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What are American Airlines vacation packages?

Will i earn aadvantage award miles when booking a vacation package, what sets american airlines vacation packages apart from others, will i save money by booking an american airlines vacation package, can i use aadvantage miles to book american airlines vacations, are american airlines vacation packages refundable, final thoughts on american airlines vacation packages.

Some travelers book their airline tickets separately, and then plan out the rest of their trip details and reservations later. But booking a vacation package is an easy way to get all the planning done early on. For American Airlines fans, booking American Airlines vacation packages is a good way to bundle their trip needs.

Doing this can also make it possible to book a more affordable vacation. Here’s what you need to know about American Airlines vacation packages.

American Airlines vacation packages include two or more components, such as flights, hotel stays and car rentals.

Travelers can piece together a vacation based on their trip needs. Vacation package reservations can be made at AAVacations.com .

Yes, you’ll earn AAdvantage miles when booking American Airlines vacation packages. You’ll earn 1,000 AAdvantage miles for every vacation package booking that is made online, as long as you provide your AAdvantage number at the time of booking. You have a chance to earn additional bonus miles by booking featured hotels.

If you book a featured hotel, you’ll earn an extra 30,000 AAdvantage miles. You’ll also earn additional AAdvantage miles for the flights that are booked within your package. American Airlines also advertises bonus miles deals where you can earn extra bonus miles when booking a qualifying vacation package. These deals change over time.

If you want to maximize your AAdvantage miles earning potential and are flexible on the destination that you want to visit, check out the current bonus miles offers for trip inspiration.

While you can choose to book vacation packages through another airline or a travel booking website, booking with American Airlines comes with benefits.

For instance, American Airlines gives travelers access to private, unpublished rates on flights and hotels that are not available when booked separately. Additionally, travelers will earn 1,000 bonus AAdvantage miles for every vacation on top of flight miles.

» Learn more: Which American Airlines credit card should you choose?

Yes, you can save money by booking American Airlines vacation packages. For starters, access to unpublished rates could result in a better deal than if you were to book a flight or hotel separately. If you’re not sure if you’re getting a good deal, you can always compare the reservation prices individually to the total price that the American Airlines vacation package is offering.

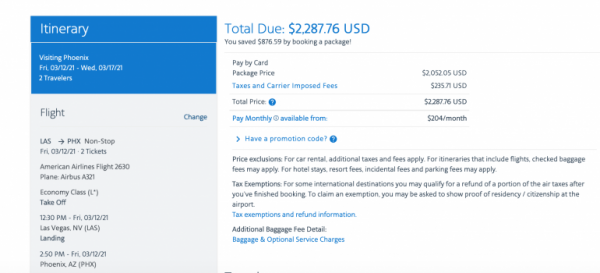

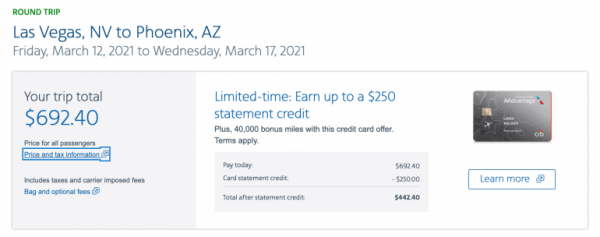

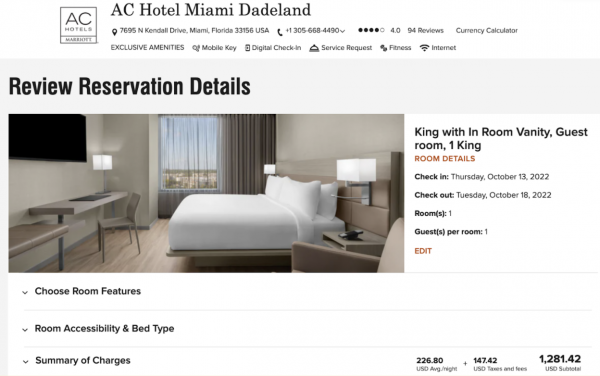

Example trip: An American Airlines vacation package to Florida from Las Vegas

A five-night trip for two from Las Vegas to Florida with a stay at AC Hotel By Marriott Miami Dadeland in October 2022 costs $1,265 when booked through AAVacations.com and $1,955 when booked separately — a meaningful difference of $690.

Now, we look at the individual trip component costs. The same nonstop flights for two to Miami cost $674.

The cost for a five-night stay at AC Hotel Miami Dadeland for the same dates and room type is $1,281.

If you add up the flight and hotel individually, you’d spend $1,955, which is $690 more expensive than the package price of $1,265. That's a pretty big savings, and you’d earn AAdvantage miles on top of it.

When you compare pricing, be sure to look at all booking terms and conditions and make sure that you’re comparing the same offerings.

Yes. You can pay for your trip with AAdvantage miles, so long as the miles come from a single AAdvantage account. A minimum of 1,000 miles is required to apply miles to the purchase of a vacation package.

It’s important to note that when using miles as a form of payment, AAdvantage members will not be eligible to accrue mileage credit in the same reservation.

» Learn more: The best airline and hotel rewards loyalty programs this year

In many cases, American Airlines vacations are not refundable for the full amount. There are cancellation penalties in place depending on when you cancel and whether you paid for pre-departure protection, which is offered when you book a vacation package. Take a look to understand what to expect.

For all vacation packages without pre-departure protection:

For vacation packages with pre-departure protection for non-holiday travel periods:

For vacation packages with pre-departure protection for holiday travel periods:

American Airlines’ holiday travel periods include the Monday before through the Monday after Thanksgiving Day, plus Dec. 20 through Jan. 3.

Note: Cancellations for hotel packages with no air component must be requested by 10:29 PM (CST) the day before check-in for pre-departure protection to be valid. After 10:29 PM the day before check-in, the full package becomes nonrefundable.

If you want to have more flexibility in case you need to cancel your trip, it’s a smart idea to invest in pre-departure protection via travel insurance . This extra protection can give you more confidence when booking American Airlines vacation packages.

» Learn more: The best travel insurance companies

American Airlines Vacations packages simplify the trip booking process. Before finalizing your booking:

Compare the price of a potential vacation package to that of each trip element’s cost to make sure you’re getting a good deal.

Be sure to enter your AAdvantage membership details so you can maximize your miles earning potential.

Check out current bonus miles deals to earn more miles on your booking.

Consider investing in pre-departure protection for added flexibility.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

75,000 Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel.

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Guide to booking American Airlines Vacations packages

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

With coronavirus vaccines being distributed and travel restrictions slowly lifting throughout the world, I can’t help but think about the days I’ll be able to travel freely again. If you’re in the same boat, consider taking a look at the American Airlines Vacations packages — many of which are sure to provide some inspiration!

American Airlines travel packages allow you to book your entire vacation — flights, hotels and car rentals — all through American Airlines. Not only does this take the stress out of planning a trip, but you’ll also score serious discounts and get great perks like American Airlines miles (that can be used for any future trip ) and easy payment options.

Here’s what you need to know about American Airlines Vacations packages so you can make your travel dreams a reality.

Benefits of American Airlines Vacations packages

The benefits of American Airlines travel packages can be boiled down to three categories: savings, rewards and support. Let’s break those benefits down just a bit more, so you can get the full scoop.

Book together and save

Planning your vacation should be exciting, not stressful. With American Airlines Vacations, you can bundle everything you need for your vacation and pay one price. It’s like the all-inclusive resort of vacation deals!

Not only will this save you time and stress in the long run, but it’ll also save you money. American has discounted deals for travelers who book multiple services through their packages. Plus, deals are available to anywhere American flies, so you’ll have plenty of options to choose from.

Earn bonus miles

It’s common knowledge in the points and miles world that American Airlines miles are some of the easiest to earn and most versatile to use. While you can earn major mile bonuses through things like opening up an American Airlines credit card , their travel packages provide another incredible way to earn. Every time you book a package, you’ll earn 1,000 AAdvantage miles just for booking. Even better, when you book featured hotels through their bonus mile offers , you can earn up to 30,000 additional miles!

Buy now, pay later

If you can’t, or don’t want to, pay for your entire trip upfront, American Airlines Vacations has you covered with their buy now, pay later option. With their “UpLift” feature (available when booking), travelers can explore different payment options to take some of the financial burdens off vacation planning. You can choose to pay all now or do monthly installments until your trip is paid off. American is super flexible in helping to find the best payment option for you.

Use miles to book

In terms of rewards, the perks of booking American Airlines packages don’t just stop at earning — you can also redeem rewards to book your vacation. If you have been stockpiling American Airlines miles during the pandemic, or just got a big bonus through a credit card or shopping portal, you can use them to book your vacation package. American also allows you to book using a combination of miles and cash, so don’t worry if you don’t have enough to cover the entire thing.

Booking support

Sometimes, you just need a little help when planning your vacation. While travel agents can get expensive, American’s team of experts is there to help anytime — for free! The extra human support is great to have, and the company also offers travel protection on every trip, so you can rest assured at night in case something doesn’t go according to plan.

How to book through American Airlines Vacations

Step 1: browse by destination or best deals.

American Airlines makes finding the perfect destination a breeze. You can search the website by destination , where you’ll be presented with options everywhere from Hawaii to Panama to Orlando. With inviting images and inspiration for every destination, after scrolling for a bit, you’ll have a hard time picking just one location.

You can also search on the website for vacation deals . This page will show you ways to earn bonus miles, hotel specials, and cheap car rentals, depending on what’s being offered when you look at the site. If you find a deal you can’t pass up, you can select it and begin scheduling the rest of your trip around that deal.

If you already have your dream destination in mind, you can jump right to step two.

Step 2: Select your trip information

Once you figure out where you’re headed, the next step is to enter in all of your travel wants and needs. You’ll first need to choose two or more services to bundle from the options flight, hotel and car.

After you make your choices, enter in the logistics of your vacation. The American Airlines Vacations site has places to add in your travel dates, travel destinations and the number of travelers. Enter your information, press search, and voilà, you’re onto step three.

Step 3: Review your options and choose your package

After you enter your information and hit the search button, you’ll be transported to the travel portal. Here, you’ll see tons of vacation packages for you to scroll through and select. Each deal will tell you the average price per person for the deal and the total price, including how much a monthly payment option would cost. You can also click on the hotel, car, or flight selected to learn more about each service. When you’ve found the perfect package, click “choose this deal” and you’ll be brought to the check out process. It’s that easy!

My favorite deal available

Right now, American Airlines Vacations is running an incredible deal if you book a stay at a Melia Hotel or Resort as part of an American Airlines Vacations package. The booking must be made before February 3, 2021, for travel before November 2021. If you meet these criteria you will automatically earn 25,000 bonus American Airlines miles! And, if you book a 50-minute massage during your stay, you’ll get a second massage for free!

While those perks on their own are good enough, I found a deal for two round trip flights in June from Chicago to Punta Cana for a seven-night stay at the Paradisus Palma Real Golf & Spa Resort that makes it even better. In addition to getting the bonus miles and the free massage with this package, you’ll get the flights and a suite in the hotel for a grand total of $3,364, including taxes and fees.

The absolute cheapest tickets I could find for the flight included in the package is $471 each. For two round-trip flights, that would be $942. The hotel is a seafront, all-inclusive resort on the clear blue waters of the Dominican Republic. It features a spa, fine dining, a bar, private beach access and three swimming pools, just to name a few amenities. For the exact same room, on the exact same dates as included in the package at this resort, it would cost $2,485 including taxes and fees.

Booking the flights and hotel separately, outside the package, would cost you $3,427. Booking with the package would save you $62.82 on just the hotel and airfare. Add in the 25,000 AAdvantage miles you get with the package, which we value at 1.4 cents on average, and that’s an additional $350 in your pocket. Lastly, add in a free 50-minute massage at the Paradisus Palma Real, which is around $130, and you’re officially up $542.82 with this deal.

Bottom line

American Airlines Vacations packages are easy to book and provide a ton of great deals and benefits. Booking a package will save you time, money, and stress, and there’s really no price tag you can put on all of that. Make your daydreams come true and plan that vacation for when it’s safe to travel again. Your future self will thank you!

Alexandra Maloney

Contributor

Alexandra Maloney is a contributor for Million Mile Secrets where she covers points and miles, credit cards, airlines, hotels, and general travel. She's worked as a writing consultant for the University of Richmond and is a features writer for The Collegian UR.

More Topics

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The 10 Best Websites for All-Inclusive Vacation Packages & Deals [2024]

Katie Seemann

Senior Content Contributor and News Editor

367 Published Articles 66 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3357 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![american airlines travel packages The 10 Best Websites for All-Inclusive Vacation Packages & Deals [2024]](https://upgradedpoints.com/wp-content/uploads/2022/05/Dreams-Acapulco-Hyatt-all-inclusive.webp?auto=webp&disable=upscale&width=1200)

Table of Contents

1. cheapcaribbean.com, 2. cheaptickets, 3. apple vacations, 4. all inclusive outlet, 6. american airlines vacations, 8. funjet vacations, 9. hotels.com, all-inclusive vacation package price comparisons, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- Websites like Apple Vacations, All Inclusive Outlet, and Expedia offer extensive all-inclusive packages with competitive pricing, making it easy to plan your vacation.

- Filters and customer reviews help tailor your searches to specific preferences.

- Bundling flights, accommodations, and activities can yield significant savings and simplify your travel planning.

An all-inclusive vacation is a dream for many travelers. Paying for everything upfront means you don’t have to think about how much things cost when you arrive at your destination. Your hotel, flight, food, drinks, and even things like airport transfers can be lumped into a vacation package that can save you money.

In this post, we’ll show you 10 websites offering all-inclusive vacation packages and deals to help you find the best price for your next vacation. So, sit back, relax, and come with us as we explore ways you can get a great deal on your next all-inclusive vacation.

CheapCaribbean.com is a popular site for finding inexpensive vacations. The great thing about this site is that you can filter your results to only show all-inclusive resorts .

To do this, first, enter your destination and travel dates. Then you’ll see your search results. There are lots of filtering options — just scroll down a bit to Experience , and you’ll be able to select only all-inclusive options.

After selecting a resort, you’ll be able to add extras like airport transfers or insurance during the checkout process. If you want to book a flight along with your hotel stay, be sure to select Hotel + Flight before you start your search.

Hot Tip: When booking an all-inclusive resort, be sure to correctly enter the number of guests traveling since prices are quoted per person.

CheapTickets is another website that allows you to narrow your search to include only all-inclusive resorts. After clicking on the all-inclusive filtering option on the left, you can sort your search results by things like price or distance using the sorting options at the top of the page.

One of the nice things about this site is that it has a map feature that allows you to search for hotels by location. This can be helpful if you want a resort close to specific tourist attractions or landmarks.

You may notice that CheapTickets is powered by Expedia, so you might think that both sites offer the same deals. In reality, each site can show different search results and different prices, so it’s a good idea to check both to see which one offers the best deal.

Hot Tip: You may find Hyatt Ziva or Hyatt Zilara properties in your search results for an all-inclusive vacation package. These properties can be booked using World of Hyatt points so keep them in mind if you have World of Hyatt or Chase Ultimate Rewards points burning a hole in your pocket. If you’re planning to pay cash but have Hyatt elite status or are trying to earn Hyatt elite status , you’ll want to book directly since you can’t use or earn elite status when booking through a third party.

If you’ve been searching for a vacation package, chances are you’ve run across Apple Vacations . This company is a leader in providing deals on tropical vacations. The site allows you to easily focus on only all-inclusive resorts by selecting All-Inclusive in the Experiences section of the filtering options.

One of the things that makes Apple Vacations a bit different is the ability to add extras during the booking process . You can add the usual suspects like airport transportation and insurance, but Apple Vacations also offers the ability to book things like spa treatments, a rental car, and sightseeing tours.

Hot Tip: Southwest Airlines flies to many popular vacation spots (including international destinations ) but won’t be included on any third-party website. If you want to check Southwest’s prices, you’ll have to do a separate search on the airline’s website.

All Inclusive Outlet specializes in — you guessed it — all-inclusive vacation packages. However, you can also use it to book cruises.

If you have some flexibility or aren’t sure where you want to go, check out the Hot Deals tab, where you can find deals listed by destination, interest, or special sales. Most packages offered on this site are for destinations in the Caribbean and Mexico. However, you’ll also find a few options for the U.S., Central America, and South America.

One of the unique things about All Inclusive Outlet is that it offers the ability to purchase Cancel for Any Reason insurance . Known as CFAR coverage, it allows you to cancel for reasons that may not be covered by other insurance plans, like COVID-19.

Hot Tip: CFAR insurance is available to purchase as a separate policy, meaning you can get it without having to book your all-inclusive vacation package through a specific website. For more information, you can check out our complete guide to travel insurance to bring you up to speed on what you may or may not need.

Expedia is a popular online travel agency for searching for flights and hotels, but you can also use it to search for all-inclusive vacation packages. After specifying your departure and destination cities and travel dates, look for the all-inclusive filtering option on the left side of your screen.

One of the nice things about Expedia is that it offers the ability to easily see only properties that have generous refund policies . Just be sure to check your specific hotel’s policy before booking since “fully refundable” can have different meanings at different locations.

Another nice thing about using Expedia is the One Key program. You’ll be able to earn and use points (called OneKeyCash) on eligible trips and gain access to special member pricing. Using a travel agency’s rewards program is a great way to earn rewards when you’re not participating in a hotel chain’s loyalty program.

Hot Tip: If you’re a fan of Hyatt and also love all-inclusive resorts, you’ll be thrilled to know that Hyatt has acquired Apple Leisure Group and its AMR Collection which includes luxury all-inclusive resort brands like Secrets, Dreams, Breathless, Zoëtry, Alua, and Sunscape. You can now earn and use World of Hyatt points at most of these resorts.

If you’re in the market for adding to your AA AAdvantage miles , you might be wondering if you can earn miles by booking an all-inclusive vacation package through American Airlines Vacations . The answer is yes . To limit your search to all-inclusive resorts, select All-inclusive resort under the Property Types filter.

You’ll earn a minimum of 1,000 American miles with any package booked through AA Vacations, but keep an eye out for special deals that come with up to 30,000 bonus miles . You’ll also earn Loyalty Points towards elite status with your purchase.

If you already have some American Airlines miles and you’d like to save cash on your vacation, you can book an all-inclusive vacation with miles ! You’ll only get 1 cent per point in value and since we value American Airlines miles at 1.4 cents each, it’s not a great deal. However, if you have miles to spare and would rather have an all-inclusive vacation instead of flights, this could be a way to make that happen.

Hot Tip: You can either earn AAdvantage miles when booking a hotel or vacation package through American Airlines Vacations or you can use them to pay for your trip. For more information, check out our guide to booking travel through American Airlines Vacations .

While you might think of Kayak as a great website to use for flight searches , it can also find hotels, car rentals, cruises, and vacation packages . This easy-to-use site is a metasearch engine. That means it can search for travel on other sites so you can easily see where the good deals are. Then, you’ll be transferred to a separate site to book.

To narrow your search to all-inclusive resorts only, select All-inclusive under Board in the filtering options after specifying your travel details.

You’ll see that each search result lists a separate website where that particular deal can be found. If there are multiple websites offering a similar deal, you’ll be able to see them all by clicking the See all dropdown arrow under View Deal .

Bottom Line: Kayak is a metasearch engine that allows you to search for flights, hotels, car rentals, cruises, and vacation package deals across many online travel agencies at one time. You can learn more about how this website works in our detailed guide to booking travel with Kayak .

Funjet Vacations specializes in vacation packages, especially all-inclusive resorts in Mexico and the Caribbean.

You can search for all-inclusive resorts by clicking on the All-Inclusive tab on the home page and entering your travel information. The search results show lots of information, including Tripadvisor ratings and any extra bonuses available, like free COVID-19 testing or free accommodations for kids.

During the checkout process, you can add extras to your booking, including trip insurance, airport transfer, rental car, and sightseeing tours.

Keep an eye out for Funjet’s Insider Perks program, which offers things like free airport transfers, VIP excursions, and room upgrades when you book select hotels.

Hotels.com is a great way to book independent hotels since it participates in a loyalty program called One Key . It’s a nice way to earn and use points (called OneKeyCash) when you’re not booking through a large loyalty program like World of Hyatt or Marriott Bonvoy .

The filtering option to select only all-inclusive resorts is a little harder to find on Hotels.com than other sites, but it’s there. Just scroll down on your search results page until you see Accommodation type in the filtering options on the left. You can then select all-inclusive from that list.

Be sure to create a free account and log in to do your hotel searches so you can see the “secret prices” that can save you money. We found lots of options that were $7 to $53 cheaper per night after logging in.

Hotels.com’s loyalty program is called OneKey, the same program used by Expedia and Vrbo.

One of the nice things about Orbitz is that in addition to filtering by property type (like all-inclusive), you can filter by cancellation policy so you can quickly see hotels that offer free cancellation.

While Orbitz is fairly similar to many other online travel agencies, one of its benefits is the Orbitz Rewards program. You’ll earn Orbucks on flights, hotels, and vacation packages booked through the platform. Then you can use your Orbucks toward future hotel reservations. This is a great way to participate in a loyalty program when you don’t have loyalty to a specific brand’s program.

Now that we’ve gone over some of the best websites for all-inclusive vacation package deals, let’s do a price comparison to see how these sites stack up against each other.

We priced out a 7-night stay for 2 adults at Riu Palace Las Americas, a popular all-inclusive resort in Cancún, Mexico. We checked prices for just the hotel as well as a hotel and flight package. Here are the results:

Prices were for 2 people in a Junior Suite, the least expensive room available.

In this example, CheapTickets and Orbitz tied for the best price for a hotel and flight while Kayak offered the best price for the hotel only, beating out even the hotel’s website.

Going on an all-inclusive vacation is a dream for many travelers. The ease of paying for everything upfront is very appealing to those looking for ultimate relaxation. However, some all-inclusive resorts can be expensive, so it’s a good idea to look for package deals to help you save money.

There are lots of websites out there to help you do just that. While there isn’t 1 site that always offers the lowest price, with just a small bit of research, you can find a great deal. We hope these website suggestions help you find a fantastic all-inclusive vacation package that’s perfect for your next trip!

Related Posts

![american airlines travel packages The 10 Best Websites for Las Vegas Vacation Packages and Deals [2024]](https://upgradedpoints.com/wp-content/uploads/2020/07/Las-Vegas-Vacation-Packages.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

- American Airlines

Everything You Need to Know About American Airlines Baggage Fees

From what's included to how much it will cost to pack extra, here's what to know before you go.

:max_bytes(150000):strip_icc():format(webp)/alex-schechter-author-pic-651b0cd898b347eeb531e559498d9b83.jpg)

James Anderson / Getty Images

Every airline has its own rules about baggage fees, but if you're traveling with American Airlines, things are pretty straightforward: If you must check a bag, keep it below 50 pounds to avoid a penalty charge on top of the usual baggage fees listed below. Looking to skip the fees altogether? You'll need to gain elite loyalty status or pack very, very light — if you're flying in basic economy or economy class, you'll be able to bring a carry-on and a small personal item with you for free. Read on for a complete breakdown of American Airlines' baggage policy.

Is There a Baggage Fee for Economy Tickets?

On American Airlines, customers seated in economy are allowed one free carry-on and personal item. For flights within the United States, Puerto Rico, and the U.S. Virgin Islands, travelers will pay $40 for their first checked bag and $45 for a second. Fees and restrictions increase beyond your first and second checked bags.

If you check in for your flight online and pay your bag fees then instead of at the airport, you'll receive a $5 discount on your first checked bag across all domestic flights, including to non-contiguous destinations like Hawaii, Alaska, the U.S. Virgin Islands, and Puerto Rico. Travelers headed to certain international destinations , including all transatlantic itineraries, receive one free checked bag.

Is There a Baggage Fee for Basic Economy?

If you're traveling within the U.S., the baggage allowances and fees are the same as those for economy class. But for some destinations, it's a different story if you're flying in a basic economy seat .

Most domestic destinations will cost $35 to $40 for your first checked bag , with prices increasing for each additional bag. Passengers to Cuba will pay a one-way $30 fee. Prepare to pay $75 for your first checked bag on most transatlantic flights and $60 when you head from the U.S. to anywhere in South America.

Generally, we'd recommend that if you plan to check more than one bag, you consider springing for a more premium ticket class that may offset the cost — and deliver a more enjoyable in-flight experience. In certain cases, the reduced fare of the basic economy ticket may be greater than the baggage fee itself, so use your best judgment when deciding how many bags to haul.

American Airlines Bag Fees Broken Down by Destination

American airlines' carry-on bag policy.

According to AA's carry-on policy , every passenger in every class is entitled to one carry-on bag, measuring 22 x 14 x 9 inches, and one personal item, like a purse or a small backpack, measuring 18 x 14 x 8 inches. A musical instrument is considered to be a carry-on item as long as it fits under the seat in front of you or in the overhead bin. Soft garment bags measuring up to 51 inches in total can also be counted as a carry-on item. Pet carriers are considered carry-ons, and additional fees apply to place them under your seat — but never in the overhead compartment.

Diaper bags (one per child), strollers, child safety seats (car seats), breast pumps, medical and mobility devices, and small soft-sided coolers holding breast milk are all allowed, and will not count toward your carry-on limit. If you're traveling carry-on only, remember to pay close attention to TSA rules regarding liquids , which limit what you pack to small containers of 3.4 ounces or less that can be packed into one quart-size resealable bag.

American Airlines' Checked Baggage Policy

According to the carrier's checked baggage policy , you're allowed to take up to 10 checked bags with you on domestic, transatlantic, and transpacific flights, though three or more bags mean you'll need to pay for excess baggage. You cannot exceed more than two bags on a flight bound for Cuba.

You can take up to five checked bags on flights operated by American Airlines to and from Mexico, the Caribbean, and Central and South America, but seasonal and year-round baggage restrictions vary, so check first. That said, bringing along a large number of bags can significantly hike the cost of your trip since prices increase exponentially for each additional checked bag.

If you buy or receive an upgrade, you will not be refunded for any baggage purchases made previously. Passengers who wish to contest a baggage claim or incorrect charge have 45 days to file a claim with support.

What Are the Size and Weight Restrictions for Checked Bags?

To avoid fees, the golden rule for economy and basic economy passengers on American Airlines is to keep your checked bag under 50 pounds and within the total linear dimensions of 62 inches. In other words, your bag's overall measurements must be smaller than 24 inches long, 18 inches wide, and 20 inches high. American Airlines won't accept anything weighing over 100 pounds on any of its flights.

Those with elite airline status can check up to three bags weighing up to 70 pounds each for free, while those traveling in business class or in first class on domestic flights are allowed to bring two bags at this weight.

Fees for Excess and Overweight Baggage

Planning to bring a third or fourth bag? On a domestic flight, your third will cost you $150 and your fourth will cost you $200. On international flights, you're likely to pay $200 for each. Additional bags will cost you $200 apiece no matter where you're flying.

In 2024, American Airlines introduced a rule for overweight and oversize baggage that may relieve economy or basic economy passengers who are off by a few pounds or inches. If your bag is overweight by up to three pounds (53 pounds total) or oversize by three inches (65 inches total), your penalty will be $30 rather than the previous minimum of $100 (or $200, if you're flying to Cuba).

If your bag weighs between 54 and 70 pounds, you're looking at fees of $100 to $200. If it's over 70 pounds, your fee will be $200 at minimum, costing you $450 on flights to Asia (namely Hong Kong, China, South Korea, and Japan), India, and New Zealand. It won't even be accepted on some flights, including to Cuba, Europe, Israel, Qatar, or Australia.

Passengers with both overweight and oversize bags will pay the checked bag fee in addition to whichever penalty amount is higher.

Ways to Avoid Baggage Fees

Certain customers may qualify for free checked bags, including members of AA's loyalty program with elite status , active-duty military personnel with ID, first and business class customers, and passengers bound for specific destinations (see chart above). Using American Airlines co-branded credit cards will also waive the fee for your first checked bag.

Of course the best way to avoid having to pay baggage fees is to master the art of packing light and stick to traveling carry-on only (plus your personal item). Try to pack your outfits by folding them professional-style, then rolling and placing them into compression packing cubes to give you the most space without causing too many wrinkles. Store your socks in your shoes. Try to wear your heaviest items, like jeans and sneakers, so you can carry all your lighter items in your bag. Before your next trip, check out these Travel + Leisure stories for more expert packing tips .

Related Articles

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Explore the Benefits of Flying with American Express Travel®

Whether you’re traveling for business or leisure, make the most of your trip when you book flights through American Express Travel ® . As a Platinum Card ® or Business Platinum Card ® Member, you can enjoy elevated benefits like access to lower airfare, 5X Membership Rewards ® points on flights, and more. 1,2

Get Rewarded when you Book Flights

Enjoy the many flight benefits that come with the Membership Rewards® program. Platinum and Business Platinum Card Members can enjoy fliexibility to earn 5X Membership Rewards points or use Membership Rewards Pay with Points 3 to cover all or part of your next flight booked at AmexTravel.com. Plus, earn miles with airlines as you typically would. Personal Platinum Card Members earn 5X points on up to $500,000 on air purchases per calendar year.

International Airline Program

If you’re ready to book your next flight to your favorite international destination, as a Platinum and Business Platinum Card Member, get exclusive access to lower fares for yourself and up to 7 travel companions traveling on your same itinerary when you book select First, Business, or Premium Economy class tickets on international itineraries through the International Airline Program. 4 To book, log in to AmexTravel.com to search for flights with your preferred destination and dates of travel. Once you see your search results, qualifying flights will be highlighted by the International Airline Program banner.

Trip Planning Tip: Good for lower fares on international round trip flights on premium class seats.

Emirates

Delta Air Lines

Recommended Flights

Recommended Flights offer Platinum and Business Platinum Card Members access to lower fares on select routes through North America on Delta Air Lines and Alaska Airlines through October 1, 2024. 5 To book, login to AmexTravel.com to search for flights with your preferred destination and dates of travel. Once you see your search results, qualifying flights will be highlighted by the Recommended Flights banner.

Trip Planning Tip: Good for lower fares when flying within North America (US, Canada, and Mexico).

*Average value based on Fine Hotels + Resorts bookings in 2020 for stays of two nights. Actual value will vary based on property, room rate, upgrade availability, and use of benefits. Terms apply

Insider Fares

Use Pay with Points to cover the entire fare and redeem fewer points with Insider Fares. Just log in at AmexTravel.com with a Membership Rewards program enrolled American Express® Card account to access Insider Fares. 6 Use the booking tool to search for flights. If there are enough points in your Membership Rewards balance to cover the entire fare, select qualifying flights will be highlighted by the Insider Fares banner.

Trip Planning Trip: Good for accessing points-saving deals when you use Pay with Points for the entire fare, because fewer points are needed.

Lufthansa

Get More for your Trip

Experience the world with American Express Travel and let your journeys take flight with elevated style and convenience. Enjoy trip benefits and extra perks when you fly with your Platinum or Business Platinum Card.

The American Express Global Lounge Collection®

You deserve choices. With the American Express Global Lounge Collection® get complimentary access to plenty, including 1,400+ airport lounges in over 500 airports around the world.* Whether you’re looking for a place to rest and recharge or somewhere to catch up on work, enjoy our growing network of lounges across 140 countries and counting.

- Find an Airport Lounge

Fee Credit for Global Entry or TSA PreCheck®

Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit every 4.5 years after you apply for a five-year membership through any Authorized Enrollment Provider for TSA PreCheck® (up to $85) when the application fee is charged to an eligible Card.‡ If approved for Global Entry, you will receive access to TSA PreCheck® at no additional charge.

- Get Started

$199 CLEAR® Plus Credit

Receive up to $199 in statement credits per calendar year after you sign up and pay for a CLEAR Plus Membership (subject to auto-renewal) with your Platinum or Business Platinum Card®.† With CLEAR, unique attributes, such as eyes or fingerprints, can help its members move faster through security at select airports.

- Learn More about CLEAR Plus Credit

$200 Airline Fee Credit

Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Platinum or Business Platinum Card®.^

- Select an Airline

Frequently Asked Questions

How do I book flights through American Express Travel?

To book a flight, just log on to AmexTravel.com and follow the prompts. You’ll choose your departure and arrival destination, dates of travel, number of travelers, and seats (Economy, Premium Economy, Business Class, First Class). You’ll also have the option to add other services to your travel itinerary.

What other travel services can I book through American Express Travel?

In addition to booking your flight, you’ll also have the option to book hotels, vacation packages, cruises and rental cars at AmexTravel.com.

What American Express flights program is the best for me to use?

In addition to booking a general flight, you’ll also have access to flight benefits such as the International Airline Program, Insider Fares, and Recommended Flights. Here’s a quick overview of each program:

- International Airline Program: gives you exclusive access to lower fares on select seats for yourself and up to seven additional companions, on qualifying round-trip flights originating from the U.S. Learn more here .

- Insider Fares: lets you use Membership Rewards Pay with Points for your entire fare and take advantage of point-saving deals on select flights. Learn more here .

- Recommended Flights: gives you access to lower fares on select flights in North America. Just log in and check the Recommended Flights filter while searching and it will let you know if a lower fare is available. Learn more here.

How can I book my flight with Membership Rewards® points?

- Step 1. Log in to AmexTravel.com to access your Membership Rewards® points balance and begin by searching for a trip.

- Step 2. At checkout, select either "Use Only Points" or "Use Points + Card" then apply points to your booking.

- Step 3. Once your flight is booked, your Card will be charged the full dollar amount. A corresponding credit for the value of points used will be applied to your account in a separate transaction within 48 hours. You can learn more by visiting the How to Use Pay with Points page.

What should I know before booking a flight through American Express Travel?

You can book the following types of flights on American Express Travel Online either online or over the phone.

•Roundtrip flights return to the same airport you departed from.

•One-way flights take you from your starting point to a different returning destination.

•Multiple destination flights allow you to visit multiple destinations during your trip.

What should I know before booking a flight with American Express Travel?

•If you booked your travel with American Express Travel and you need to change/cancel a booking, we will honor the policies of your travel provider.

•Charter fares may be available for roundtrip or one-way flights.

•One-way flights are not available with vacation packages.

If you need more help, contact us by calling the number on the back of your Card.

Are Additional Card Members on Platinum Accounts eligible for flight benefits?

Flights purchased by Additional Platinum Card Members will earn the same 5X Membership Rewards points towards the Basic Card Member's account. The Basic Platinum Card Member can manage who on the account may access and use points for purchases via Pay with Points. Additional Platinum Card Members on Platinum Accounts also have access to the International Airline Program. Companion Platinum Card Members on these accounts do not have access to the International Airline Program.

Terms and Conditions

1. 5X Membership Rewards® Points Platinum Card

Basic Card Members will get 1 Membership Rewards® point for each dollar charged for eligible purchases on their Platinum Card® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com. Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info for more information about rewards.

2. 5X Membership Rewards Points for Business Platinum Card

You will get one point for each dollar charged for an eligible purchase on your Business Platinum Card® from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible travel purchases. Eligible travel purchases include scheduled flights and prepaid flight+hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel, over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight+hotel packages over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 5x Membership Rewards® points, you must both reserve and charge the travel purchase with the same eligible Business Platinum Card®. To modify a reservation you must cancel and rebook your reservation. You can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 5X Membership Rewards® point benefit. To be eligible to receive extra points, Card account(s) must not be cancelled or past due at the time of extra points fulfillment. If booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Additional point bonuses you may receive with your Card on other purchase categories from American Express may not be combined with this benefit (e.g., 1.5X and 2X bonuses for Business Platinum Card Members, etc.). Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. The benefits associated with the Additional Card(s) you choose may be different than the benefits associated with your basic Card. To learn about the benefits associated with Additional Card(s) you choose, please call the number on the back of your Card

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. You may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, you may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

3. Membership Rewards® Pay with Points

To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude non-prepaid car rentals and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If a charge for a purchase is included in a Pay Over Time balance on your Linked Account the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card. Corporate Card Members are not eligible for Pay Over Time.

Membership Rewards® Program

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo .

4. International Airline Program

International Airline Program benefits are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® and Centurion® Members (Delta SkyMiles® Platinum Card Members are not eligible), on international tickets booked through American Express Travel for select first class, business class, and premium economy tickets with participating airlines, subject to availability. Additional Platinum Cards on U.S. Consumer and Business Platinum Card Accounts and Additional Centurion and Additional Platinum Cards on U.S. Consumer and Business Centurion Accounts are also eligible to receive program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Business Expense Card Members on Business Platinum and Centurion Card Accounts are not eligible. Most tickets will originate in and return to U.S. gateway (may exclude certain overseas territories) and select Canadian gateways. One-way travel is permitted on some airlines. An eligible Card Member can book for himself/herself and up to seven passengers traveling on the same itinerary as that Card Member. Bookings must be made using an eligible Card in the Card Member’s name. Discounts are applied to the base airfare. Discounts are not combinable with other offers unless indicated and may not apply to codeshare partners. Airline fare rules and restrictions apply and are subject to change at the discretion of the airline. American Express and the airline reserve the right to modify or revoke airline discount benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in abuse, misuse, or gaming in connection with your airline discount benefits. Tickets are non-refundable unless otherwise indicated. Tickets are non-transferable; name changes are not permitted. Benefits, participating airlines, and ticket availability are subject to change.

5. Recommended Flights

Special offer fares are valid only for eligible U.S. Consumer and Business Platinum Card® and Centurion® Members (Delta SkyMiles® Platinum Card Members are not eligible) on participating airlines for select domestic routes (routes may vary by airline); routes and participating airlines are subject to change during the offer term. The eligible Card Member must be one of the travelers on the booking. Discounts are applied to the base airfare. Discounts are not combinable with other offers unless otherwise specified. Tickets are subject to applicable government-imposed taxes/fees and airline-imposed fees; if baggage, seat-selection or similar items were not included with the tickets, additional fees may apply. Airline fare rules and restrictions and ticket terms and conditions apply and are subject to change at the discretion of the airline. Tickets are non-refundable unless otherwise indicated. Tickets are non-transferable. Applicable fares will display in search results on AmexTravel.com only if the eligible Card Member is logged into his/her account. Changes to tickets (if permitted) may incur an airline-imposed change fee, and/or any difference in fare. Cancellations of tickets (if permitted) may incur an airline-imposed cancellation fee. Special offer is valid for eligible bookings made through American Express Travel from today’s date through October 1, 2024.

6. Insider Fares

Insider Fares are valid only for Membership Rewards® program-enrolled Cards when a Card Member is booking through AmexTravel.com. Insider Fares will display in search results on AmexTravel.com only if an eligible Card Member is logged into his/her account and has enough Membership Rewards points for the entire fare; otherwise, publicly available fares will display. Insider Fares are fares for which less Membership Rewards points are required to purchase the flight. The entire amount of the purchase must be covered using Membership Rewards points. Insider Fares are only available on select flights. When purchasing an Insider Fare, the dollar amount of the fare will be charged to the Card Member’s account and a credit will be issued in that dollar amount on the Card Member’s statement; additionally, the number of Membership Rewards points required for the fare will be deducted from the Card Member’s Membership Rewards account balance. Participating airlines and benefits are subject to change. For more information about the Membership Rewards program visit www.membershiprewards.com/terms .

* The American Express Global Lounge Collection®

U.S Consumer and Business Platinum Card Members and any Additional Platinum Card Members on the Account are eligible for access to the participating lounges in the American Express Global Lounge Collection. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Global Lounge Collection benefit. All lounge access is subject to space availability. Each lounge program within the Global Lounge Collection has its own policies and access to any of the participating lounges is subject to the applicable rules and policies. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. To be eligible for this benefit, Card Account must not be cancelled. Please refer to each program’s terms and conditions to learn more.

The Centurion® Lounge

U.S. Platinum Card Members have unlimited complimentary access to all locations of The Centurion Lounge. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to The Centurion Lounge. All access to The Centurion Lounge is subject to space availability. To access The Centurion Lounge, Platinum Card Members must arrive within 3 hours of their departing flight, for both direct and connecting flights, and present The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Name on boarding pass must match name on the Card. Note that select lounges allow access to Card Members with a confirmed reservation for any same-day travel (departure or arrival). Refer to the specific location’s access policy for more information. Failure to present this documentation may result in access being denied. Card Members must be at least 18 years of age to enter without a parent or legal guardian. All Centurion Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in the Lounge, certain services, products or amenities may be offered for sale. You are responsible for any purchases and/or servicing charges you make in The Centurion Lounge or authorize our Member Services Professionals to make on your behalf. Services available at the Member Services Desk are based on the type of American Express Card used to enter the Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by visitors to The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with Lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Platinum Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

U.S. Platinum Card Members, U.S. Business Platinum Card Members and Additional U.S. Platinum Card Members on the Account will be charged a $50 fee for each guest (or $30 for children aged 2 through 17, with proof of age) unless they have qualified for Complimentary Guest Access. U.S. Platinum Card and U.S. Business Platinum Card Members may qualify for Complimentary Guest Access for up to two (2) guests per visit to locations of The Centurion Lounge in the U.S., Hong Kong International Airport and London Heathrow Airport (“Complimentary Guest Access”), after spending $75,000 or more on eligible purchases on the Platinum Account in a calendar year. Once effective, Complimentary Guest Access will be available for the remainder of the calendar year in which it became effective, the following calendar year, and until January 31 of the next calendar year (for example, if Complimentary Guest Access became effective on May 1, 2023, it would remain effective until January 31, 2025). Eligible purchases made by any Additional Card Members on the Platinum Account will contribute to the purchase requirement. Complimentary Guest Access is limited to two (2) guests per Card Member per visit, regardless of whether you are eligible for complimentary guest access through multiple Platinum Accounts or through other Amex Cards. Guest access policies may vary internationally by location and are subject to change.

Eligibility for Complimentary Guest Access will typically be processed within a week of the Platinum Account’s meeting the purchase requirement, but may take up to 12 weeks to become effective. Complimentary Guest Access status will be reflected in the Benefits tab of your online Account and in the American Express App. Eligible purchases to meet the purchase requirement are for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or other cash equivalents. If a Card Member upgrades or downgrades from a different American Express Card to a Platinum Account, eligible purchases made on that Card Account will count toward meeting the purchase requirement to achieve Complimentary Guest Access on the new Platinum Account.

Escape Lounges – The Centurion® Studio Partner

This benefit is available to U.S. Platinum Card Members. Card Members receive complimentary access to all Escape Lounge locations, including Escape Lounges - The Centurion® Studio Partner locations. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to Escape Lounges, including Escape Lounge – The Centurion® Studio Partner locations. To access an Escape Lounge, Card Members must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Name on boarding pass must match name on the Card and the eligible flight must be booked on a U.S. issued American Express Card. For access at select locations, Card Members must arrive within 3 hours of their departing flight. Refer to the specific location’s access policy for more information. During a layover Card Members may use the Escape Lounge in the connecting airport at any time. For more information on access policies and lounge terms and conditions, see https://escapelounges.com. All access to an Escape Lounge is subject to space availability. Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Escape Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. Card Members may bring up to two complimentary guests per visit. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all the complimentary benefits and amenities afforded to the Escape Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change without notice. Additional restrictions may apply.

Delta Sky Club