Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

324 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

43 Published Articles 3380 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1203 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, travel insurance and covid-19, american express travel insurance options, additional information, how american express travel insurance compares, the value of travel insurance comparison sites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

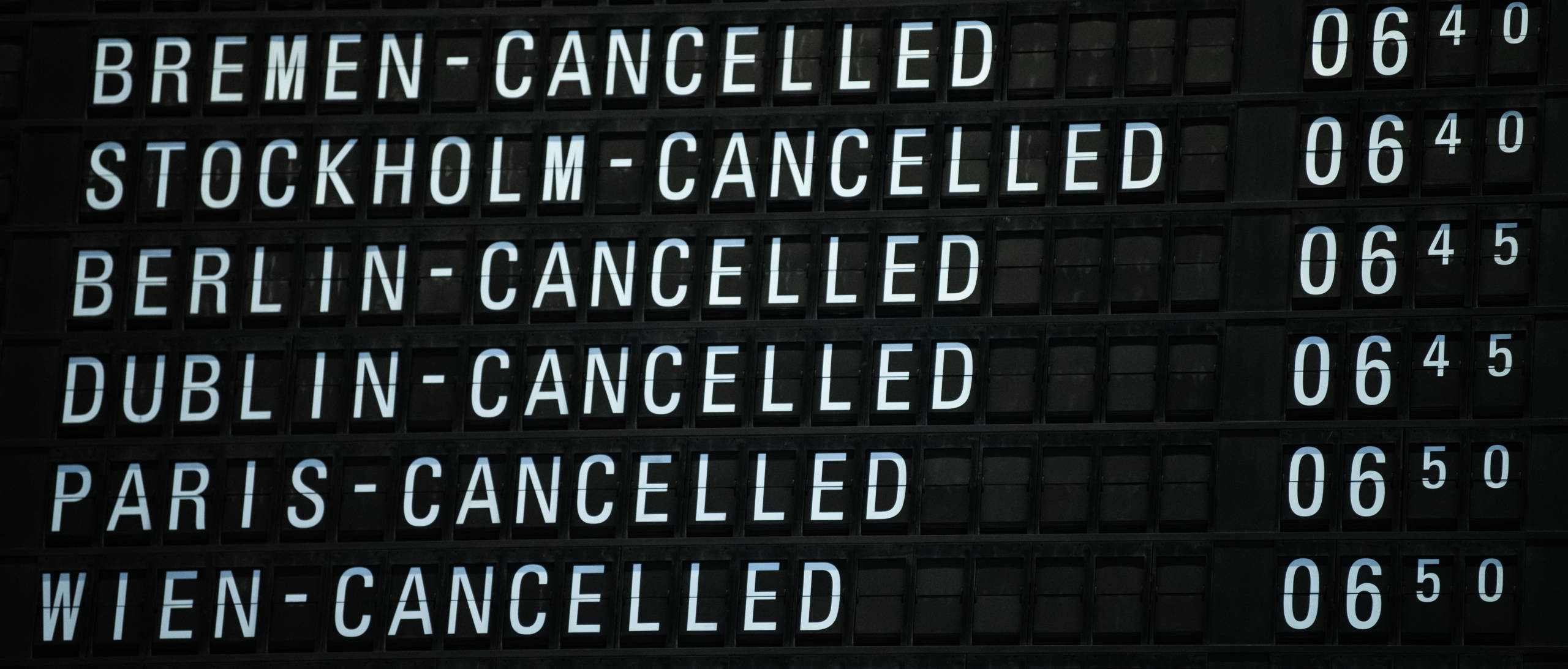

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

Package Policy Options

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.

With package policies, you can expect to find the following coverages. The limits of coverage differ based on the policy plan you select.

- Trip Cancellation/Interruption — Receive reimbursement for prepaid non-refundable expenses due to cancellation for covered reasons and additional costs if your trip is disrupted, also for covered reasons.

- Global Medical Protection — Receive worldwide emergency medical and dental coverage for the first 60 days of your trip and access to emergency evacuation/repatriation services.

- Travel Accident Protection — Receive coverage for accidental death/dismemberment from the time you leave on your trip until the time you arrive home.

- Global Baggage Protection — Coverage varies from $250 to $2,500 for lost luggage depending on the level selected. Baggage delay coverage starts from 3- to over 24-hour delays, depending on the policy plan selected.

- Global Trip Delay — Receive up to $300 per day, $1,000 per trip, depending on the level of coverage selected. Coverage is valid for delayed/canceled flights or involuntary-denied boarding.

- 24-Hour Travel Assistance — Have global access to planning and emergency assistance before and during your trip.

Bottom Line: American Express Travel Insurance offers 4 different levels of package policies, each comprising a collection of coverages most travelers look for. The plan you select and the level of coverage limits chosen determine the amount of the premium cost.

Custom Select Coverage Options

If some of the coverages in the package plan are not important to you, you can select only the coverage(s) you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you don’t need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Pricing By Age

Like most travel insurance companies, American Express Travel Insurance prices its products within age brackets. The price for coverage is the same for everyone in that specific age bracket.

Based on dozens of quotes obtained, pricing brackets were determined to be as follows:

- Age 17 to 40

- Age 41 to 65

- Age 66 to 70

- Age 70 to 80

- Age 81 or over

Knowing this upfront can help you determine if you’re at the beginning of the highest price bracket or the end. For example, if you are 40 years old, you’re going to pay less than a 41-year-old in the next pricing bracket but the same as a 17-year-old.

If you’re a senior and want to learn more about purchasing travel insurance in your 60s, 70s, and beyond , the tips in our article will help guide you in the right direction.

Bottom Line: Knowing a travel insurance company’s age pricing brackets can help you determine which company offers you the best value for your money.

Cancellations and Changes

Here is some information you should know about cancellations and changes to an American Express Travel Insurance policy.

- You can change or modify your policy prior to your trip.

- You can request a full refund within 14 days after receiving your policy documents. Some restrictions vary by state.

- If you have purchased American Express Travel Insurance and your trip was canceled due to COVID-19, you may qualify for a policy refund . Contact AMEX Assurance Company for details at [email protected]. Terms apply.

- Once your trip is completed, you cannot request a refund.

Hot Tip: Due to the overall decrease in travel, many travel insurance companies now allow you to cancel your travel insurance and receive a full refund or extend your policy without extra charges.

To Other Travel Insurance Companies

When comparing other package policies to American Express Travel Insurance, the company’s premiums came up higher overall for this specific trip and traveler (1-week trip, 40-year-old, total value $3,000).

The first policy above with Assistance USA for $77, for example, has coverages similar to the Silver Amex plan which has a premium of $133. The coverage on the $102 Assistance USA plan above compares more with the Amex Gold plan at $157.

Prices will vary considerably based on the types of coverages selected, age, and limits of each coverage. We used policy comparison websites and found similar but not identical policies. With so many different coverage options, it’s difficult to compare apples to apples.

This is a very limited comparison — your results will be different based on your specific details. The most important factors to consider are that you’re purchasing from a highly-rated company, the coverages are a match for your needs, and the premium is one with which you’re comfortable paying.

To Credit Card Travel Insurance

The travel insurance coverages that comes complimentary on your credit card can serve to provide coverage for some trips. For example, if you book a domestic round-trip flight, a hotel, and a rental car, you may have sufficient coverages on your credit card to cover that trip.

Credit card travel insurance coverage, however, is not a replacement for a comprehensive travel insurance policy , for these reasons:

- Most credit card travel insurance coverage is secondary and in excess of other coverage you might have. You’ll normally be working with 2 (or more) entities to get your claim resolved.

- Credit card travel insurance is administered by a third party, not by the issuing financial institution, thus making the claims process potentially redundant and complicated.

- You generally won’t find medical coverage on a credit card. The Platinum Card ® from American Express and the Chase Sapphire Reserve ® offer emergency medical evacuation and there is a small medical benefit on the Chase Sapphire Reserve card.

- Coverage limits are set on credit card travel insurance. Travel insurance policies can offer higher limit options.

- Credit card travel insurances have requirements such as purchasing the trip with the associated credit card.

- Additional coverages can be added to travel insurance policies such as CFAR insurance, a preexisting conditions waiver, and other benefits not available with credit cards.

Bottom Line: While the travel insurance coverages that come with credit cards may be sufficient to cover a simple trip where there is no large investment at stake, these coverages are by no means a replacement for a comprehensive travel insurance policy.

Because travel insurance is widely available and quite competitive, you may find drastic differences in the price you’ll pay between companies and policy offerings. Selecting a company is not difficult as there are dozens of reputable, highly financially-rated, established companies, but comparing policies is essential for getting the best value for your money.

One way to easily compare pricing and coverages is to utilize a travel insurance comparison site to narrow down the appropriate options for your situation.

Here are some of the most popular, easy-to-use comparison sites that only feature highly financially-rated travel insurance companies.

TravelInsurance.com

- Coverage is available instantly

- The comparison tool is easy to use

- The company has a “best price guarantee”

InsureMyTrip

- Calls are handled by licensed agents

- The website contains educational information for understanding travel insurance coverages and policies

- Features nearly 2 dozen companies

SquareMouth

- Compare 90 different policies from over 20 different companies

- Customer service receives high accolades

- Over 86,000 reviews

Bottom Line: Utilizing a travel insurance comparison website can help you quickly narrow your choices to policies that fit your needs and your budget.

There is no doubt that American Express is a financially-stable, established, and well-respected travel insurance company.

One of the company’s strengths is that it offers the consumer the ability to purchase needed coverages separately , such as medical insurance for an international trip. The premiums for such coverage are also very competitively priced. This could be a huge plus if you are not interested in duplicating credit card travel insurance coverages or in having just secondary or excess coverage.

One downside, especially in today’s environment, is that American Express Travel Insurance does not sell CFAR insurance. If this is important to you, you should attempt to find the coverage elsewhere by using comparison sites.

Another downside that may or may not be important is that American Express Travel Insurance does not sell annual or multi-trip policies. You must purchase a new policy for each individual trip.

Also, like several other travel insurance companies, high-risk adventurous activities may not be covered with American Express Travel Insurance. You might look to a company specializing in insuring these activities such as World Nomads .

If you want to make sure you’re purchasing from an established company and have specific coverages you’re more interested in than others, American Express Travel Insurance is a solid decision . For package travel insurance policies, you might be able to realize modest savings by shopping around, but you won’t go wrong with the company selection of choosing American Express Travel Insurance.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Introduction to American Express Travel Protection

Types of travel protection offered, american express travel protection: a guide to your benefits.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card, Amex EveryDay® Preferred Credit Card, American Express® Green Card, The Plum Card® from American Express. The details for these products have not been reviewed or provided by the issuer.

- Some American Express cards offer trip cancellation and interruption benefits .

- You'll find these perks on cards like The Platinum Card® from American Express.

- If you're eager to sign up for a travel credit card with perks, compare each card's offerings.

Overview of Travel Protection Benefits

While credit card insurance and travel protection coverage are usually considered secondary to rewards programs and other cardholder perks, these benefits can be equally important if you travel.

When you pay for a trip with a credit card that offers trip cancellation and interruption insurance, for example, you can get reimbursed for some of your travel expenses in the event your vacation is halted for reasons beyond your control. Meanwhile, trip delay insurance lets you apply for some reimbursement when a delay of your trip results in surprise expenses, such as an unplanned hotel stay near the airport when your flight is on hold.

Importance of Travel Insurance

Chase credit cards like the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card have really st o od out for years in terms of the protections they offer, and with some of the highest limits out there. Still, American Express is still coming around — it recently added trip cancellation and interruption insurance, along with trip delay coverage, to many of its top rewards credit cards.

If you're in the market for an American Express card and you're hoping to take advantage of important travel benefits, consider the cards below and their expanded travel protections.

Trip Cancellation and Interruption Insurance

New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 per account per year) you can use for reimbursement of prepaid travel expenses like airfare and hotels. This coverage can come in handy if your trip is canceled for a covered reason beyond your control, or you're stuck in your destination and require an extended stay and additional costs before you can return home.

Note that this coverage is good for round-trip travel booked with your credit card, meaning you have to pay for travel expenses with a common carrier with your American Express credit card in order to be eligible.

American Express cards that qualify for this coverage include:

- The Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve Business American Express Card

Other versions of the Amex Platinum card — including the Goldman Sachs, Morgan Stanley, and corporate flavors — also offer this coverage, as do all versions of the Amex Centurion (black) card , which is invite-only.

Baggage Insurance Plan

Quite a few American Express credit cards also offer a baggage insurance plan, although this isn't a new or upgraded benefit from the card issuer. This coverage can come in handy if your luggage is lost or stolen during a covered trip. To be eligible for this coverage, you have to pay for travel with a common carrier (airfare, cruise fare, etc.) with your American Express credit card.

The amount of coverage you'll receive depends on the card you have. For example, baggage insurance from the The Platinum Card® from American Express offers up to $3,000 in coverage per person for carry-on luggage and up to $2,000 per person in coverage for some types of checked baggage.

With baggage insurance from the Amex EveryDay® Preferred Credit Card , on the other hand, you'll only qualify for up to $1,250 in coverage per person for carry-on luggage and up to $500 for covered checked baggage, although an extra benefit of $250 is offered for qualified "high risk items" like jewelry or sporting equipment.

American Express cards that come with baggage insurance include:

- The Platinum Card® from American Express (including various versions)

- American Express® Gold Card (including various versions)

- American Express® Green Card (including various versions)

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Amex EveryDay® Preferred Credit Card

- The Plum Card® from American Express

American Express business cards with baggage insurance include:

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- The Hilton Honors American Express Business Card

- Lowe's Business Rewards Card from American Express

- Amazon Business Prime American Express Card

- Amazon Business American Express Card

Various versions of the Amex Centurion card and several Amex corporate cards also offer baggage insurance.

Travel Accident Insurance

Some American Express cards also offer secondary auto rental coverage, which means this coverage kicks in after other policies you have are exhausted, as opposed to primary car rental coverage.

While this benefit applies to many Amex cards, note that coverage limits can vary. With the Amex Gold card, for example, coverage is limited to $50,000 per rental agreement for damage or theft, yet the Amex Platinum card offers up to $75,000 in coverage. The insurance doesn't cover personal liability, either.

Also note that this coverage comes with a certain amount of Accidental Death or Dismemberment Coverage that varies by card. With , for example, you'll receive up to $200,000 in coverage per person and up to $300,000 in coverage per car accident for accidental death and dismemberment. Make sure to read your credit card's terms and conditions so you know exactly how much coverage you have.

American Express cards that come with secondary auto rental coverage include:

- The Platinum Card® from American Express (including various versions)

- Delta SkyMiles® Blue American Express Card

- Hilton Honors American Express Card

- Marriott Bonvoy American Express® Card (no longer available to new applicants)

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Amex Everyday® Credit Card from American Express

And business cards from Amex that offer secondary car rental insurance include:

While American Express did offer travel accident insurance on some of its cards, this coverage was effectively dropped as of January 1, 2020. The same is true for the American Express Roadside Assistance Hotline, which is no longer available.

Trip Delay Insurance

In January of 2020, American Express also rolled out an upgraded trip delay insurance benefit for many of its top rewards credit cards. While this perk may seem like an unusual one, there are so many scenarios where trip delay coverage could help you save money and avoid surprise expenses when travel is delayed beyond your control.

With trip delay coverage from Amex, you can be reimbursed for up to $500 per trip for hotel stays, meals, and other miscellaneous required expenses when your flight or other trip plans are delayed by more than six hours. If you're sitting at the airport and your flight is suddenly delayed until the next morning, for example, you could use this coverage to get reimbursed for a nearby airport hotel and your dinner, then for an Uber or Lyft ride back to the airport.

To qualify for American Express trip delay coverage, you need to pay for your round-trip travel expenses with a common carrier with your credit card.

Amex cards that come with trip delay coverage include:

- American Express® Gold Card

- American Express® Green Card

Again, the various versions of the Amex Platinum and Amex Centurion cards also offer trip delay insurance.

Most travel protections are automatically activated when you use your American Express card to book your travel. However, specific activation steps, if any, depend on the benefit.

Covered reasons for trip cancellation or interruption typically include illness, severe weather, and other unforeseen events, reimbursing you for non-refundable travel expenses.

Yes, baggage insurance plans come with coverage limits, which vary depending on the card and the type of loss (e.g., lost, damaged, or stolen baggage).

The Global Assist Hotline offers medical, legal, and other emergency coordination and assistance services, but financial costs for services rendered are typically the cardholder's responsibility.

Eligibility for specific travel protections varies by card. Premium cards often offer more comprehensive protections compared to basic cards.

For rates and fees of The Platinum Card® from American Express, please click here.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Watch: Marketing leaders have to help their companies keep pace with the rapidly changing worlds of their customers, says Elizabeth Rutledge, CMO of American Express

- Main content

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Purchase Protection on Travel Cards

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How does AmEx purchase protection work?

Which cards have amex purchase protection, how to file an amex purchase protection claim, amex purchase protection review.

From porch pirates to Murphy's law, a lot can go awry between the time you buy an item and make use of that purchase. Thankfully, many credit cards offer so-called "purchase protection" that covers theft, damage and loss within a set time after purchase. For example, if you have an American Express card, the chances are that card provides AmEx purchase protection.

However, not all purchases and losses are covered by AmEx purchase protection. Let's look at how Amex purchase protection works, which AmEx cards feature it and the limitations and exclusions of this coverage.

AmEx purchase protection covers lost, stolen or damaged items within the first 90 days after purchase.

This coverage is complimentary on most AmEx cards — including some debit, prepaid and reloadable AmEx cards. All you need to do to get this coverage is to use your eligible AmEx card to make a covered purchase of a tangible item.

If that item is lost, stolen or damaged within the first 90 days, file a Notice of Claim within 30 days to start the claims process. Here, you'll need to provide a copy of the purchase receipt and proof of loss.

That proof of loss depends on the circumstances.

If a loss is due to theft, you may need to provide a copy of the police report.

In the case of a damage claim, you may need to send in the broken item.

Dozens of AmEx cards offer purchase protection benefits.

Personal cards with purchase protections from AmEx include:

The Platinum Card® from American Express .

American Express® Gold Card .

Blue Cash Preferred® Card from American Express .

Amex EveryDay® Credit Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Hilton Honors American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant® American Express® Card .

Delta SkyMiles® Reserve American Express Card .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Blue American Express Card .

Terms apply.

Meanwhile, here's the list of small business cards from AmEx with this benefit:

The Business Platinum Card® from American Express .

American Express® Business Gold Card .

The Blue Business® Plus Credit Card from American Express .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Reserve Business American Express Card .

Delta SkyMiles® Gold Business American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy Business® American Express® Card .

However, the purchase protection coverage amounts and limitations vary between AmEx cards. Plus, AmEx can change the coverage at any time. So, checking the terms for your AmEx card when you need coverage is essential. Terms apply.

» Learn more: The best travel credit cards right now

Limitations and exclusions on AmEx cards

As with any insurance or coverage product, AmEx purchase protection comes with limitations and exclusions. Let's take a look at the current coverage on The Platinum Card® from American Express as an example. Terms apply.

At the time of writing, The Platinum Card® from American Express holders are covered for up to 90 days from the date of a covered purchase of an eligible item. Big spenders should note that the purchase protection on The Platinum Card® from American Express only covers up to $10,000 per covered purchase. Each eligible AmEx card is covered for up to $50,000 in claims per year. Terms apply.

» Learn more: The best credit cards for travel insurance benefits

Unfortunately, if you're affected by a natural disaster , AmEx purchase protection only covers a maximum of $500 in claims per event.

AmEx purchase protection excludes a long list of types of purchases, including:

Animals or living plants.

Antiques, artwork and previously used items.

Cash and cash-like items — including gift certificates, stamps and coins.

Intangible items — such as software.

Land, buildings, or permanent fixtures.

Medical or dental devices.

Motorized vehicles.

Plus, not all damage and losses are covered. For example, AmEx won't approve a claim for damage to an item "purchased for play." So, you can't claim purchase protection if your baseball bat or hockey stick breaks. AmEx purchase protection also doesn't cover losses when the item isn't "reasonably safeguarded" — such as leaving it in an unlocked car or publicly unattended. Terms apply.

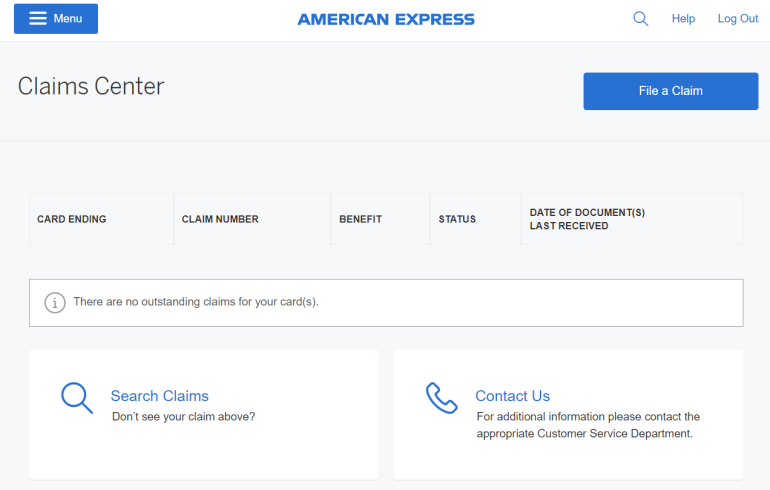

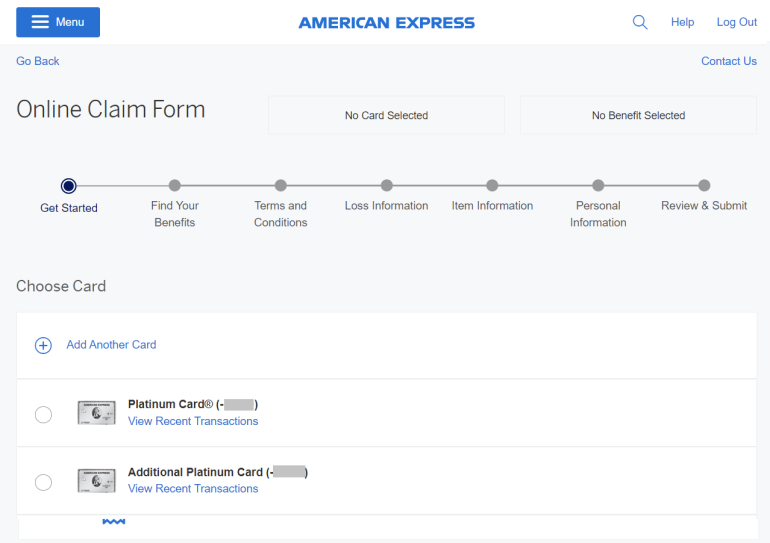

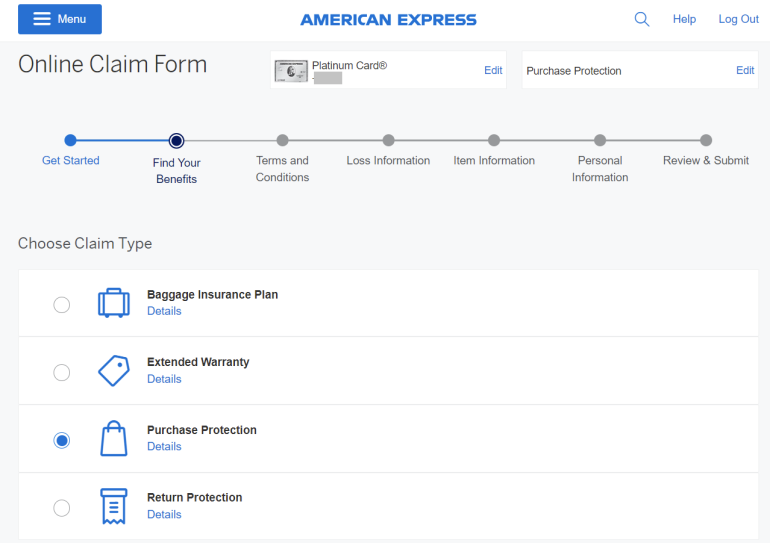

AmEx makes it easy to file a purchase protection claim on its website. To start the process, log into your AmEx account and go to the claims center page .

Click "file a claim" and select the card for which you're filing a claim, enter your date of purchase and click "continue."

Select "purchase protection" on the next page and continue the process.

Yes, cardmembers of the American Express® Gold Card are covered by AmEx's purchase protection coverage. However, this card is so packed with benefits that this coverage doesn't make the card's highlights on the AmEx website. Instead, check the benefits guide to see the card's purchase protection coverage.

In short, covered purchases are covered for up to 90 days from the date of purchase for up to $10,000 per covered purchase and up to $50,000 per eligible card per calendar year. Terms apply.

In addition to stolen and damaged items, AmEx purchase protection also covers items lost within the coverage period. Just make sure to file a notice of claim within 30 days of the loss. Also, note that some losses are excluded — such as if you left the item in an unlocked car.

Eligible AmEx cardmembers can still file a purchase protection claim for a covered loss even if you've redeemed Membership Rewards points for all or part of that purchase — including Pay With Points redemptions.

Yes, cardmembers of the

American Express® Gold Card

are covered by AmEx's purchase protection coverage. However, this card is so packed with benefits that this coverage doesn't make the card's highlights on the AmEx website. Instead, check the benefits guide to see the card's purchase protection coverage.

AmEx purchase protection is complimentary coverage provided on most AmEx cards that covers theft, loss and damage to eligible items within the first 90 days of purchase. Terms apply.

Like insurance, purchase protection is one of those things that you hope you never have to use. Check the details of your card's coverage to see if your incident is covered. Remember you need to provide a copy of the purchase receipt and file a Notice of Claim within 30 days of the loss or damage. Terms apply.

All information about Amex EveryDay® Credit Card has been collected independently by NerdWallet . Amex EveryDay® Credit Card is no longer available through NerdWallet.

All information about The Amex EveryDay® Preferred Credit Card from American Express has been collected independently by NerdWallet. The Amex EveryDay® Preferred Credit Card from American Express is no longer available through NerdWallet.

All information about Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

All information about Business Green Rewards Card from American Express has been collected independently by NerdWallet. Business Green Rewards Card from American Express is no longer available through NerdWallet.

Insurance Benefit: Purchase Protection

Purchase Protection is an embedded benefit of your Card Membership and requires no enrollment. It can help protect Covered Purchases made on your Eligible Card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase date. The coverage is limited up to $10,000 per occurrence, up to $50,000 per Card Member account per calendar year. Coverage Limits Apply.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by AMEX Assurance Company.

When an American Express® Card Member charges a Covered Purchase with their Eligible Card, Purchase Protection can help protect their Covered Purchases for up to 90 days from the Covered Purchase date if it is stolen or accidentally damaged. The coverage is limited up to $1,000 per occurrence, up to $50,000 per Card Member account per calendar year.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Entry Requirements for St. Petersburg

Visa for travel to st. petersburg.

Travelers can get a Russian e-visa to visit St. Petersburg and the rest of the country.

Foreign nationals can apply online for a visa valid across the whole Russian territory , including the city of Saint Petersburg. The application process is 100% online which means there’s no need to visit a Russian embassy.

Do I Need a Visa to Travel to Saint Petersburg?

Most foreign nationals need a visa to travel to St Petersburg in Russia . Citizens of just a few countries can visit Russia without a visa for a limited period.

The quickest and most convenient option for travelers is the Russian e-visa . The application process is 100% online.

Passport holders from more than 50 countries can apply, including citizens of the European Union.

Remember you need to register your visa within 7 days of arriving in Russia . Most hotels register guests at check-in, otherwise, you need to go to a local migration office. Full list of eVisa eligible countries:

Do I need a visa to visit St Petersburg on a cruise ship?

Passengers on an international cruise can disembark in Saint Petersburg and tour the city for up to 72 hours without a visa .

Rules for visa-free entry to St. Petersburg :

- Cruise passengers must take part in organized tours that have been approved by the Russian government

- The tour guide must stay with visitors the whole time until they return to the cruise ship

- Visa-free travelers must spend the night on the ship

If you arrive on a St. Peter Line ferry from Helsinki or Tallinn , you can stay in a hotel or other accommodation in St.Petersburg, you do not have to spend the night on the ship like other cruise passengers. Note that if you are arriving by train from Helsinki, you need a visa.

What Is the e-visa for St. Petersburg?

The Russia e-visa is an electronic travel permit for Saint Petersburg and other Russian destinations.

Here’s what you need to know about the electronic visa.

- Stay for up to 16 days

- Travel to Russia once (single entry)

- Valid for 60 days

- For tourism, business, and humanitarian travel

For longer stays or to visit for other purposes, you need a different type of Russian visa for your trip to St. Petersburg.

Documents Required to Get an e-visa for St. Petersburg

To get a visa for Saint Petersburg online, you must meet the eVisa requirements for Russia . Here’s what you need to apply:

Email address

You need to provide a valid email address to receive updates about your visa application and your approved e-visa. If you do not have an email account, you’ll need to create one before getting started with your visa application.

Valid passport

Your passport must have been issued by a country eligible for the Russian e-visa. Start filling out the e-visa application form to check your nationality is eligible. Your passport must be valid for at least 6 months.

Passport-style photo

Every e-visa applicant needs to upload a passport-style photo. The photo must have been taken in the last 6 months and show your current appearance. Look straight at the camera and maintain a neutral facial expression.

Applicants must pay the Russia e-visa fees online by debit or credit card. Transactions through this site are secure, your details are protected by Secure Sockets Layer software.

Only electronic copies of your documents are required. Simply upload an image of your passport photo page and a digital photograph. For your convenience, you can fill out your application form today and upload your documentation when it’s convenient for you.

Apply for a Russian e-visa for Saint Petersburg

If you have the documents listed above, you can get started with your visa application for St Petersburg . It’s a 3-step process:

- Fill out the electronic visa application form

- Upload your supporting documents

- Pay the e-visa fees and submit your form

You’ll need to wait 4 to 7 days to receive your visa . Allow time for delays or information requests.

Information to complete the e-visa application for Saint Petersburg

The information you need to provide on your e-visa application form for St Petersburg includes:

- Personal and passport information

- Family and employment details

- Travel dates and accommodation

- Contact details

Review all your information carefully before submitting your application . Mistakes or missing information could cause processing delays.

Apply through this site and a visa expert will review your application before it’s sent for official processing . We detect errors and correct errors that could negatively impact your visa outcome.

Can I apply for an e-visa if I only visit St. Petersburg?

Yes , you can apply for an e-visa even if you will only visit St Petersburg. Anyone who needs a visa to enter Russia needs a visa for St Petersburg, eligible nationalities can apply online.

Tourists should apply online for the Russia e-visa and use it to travel to St Petersburg . The visa allows you to visit other areas of the country, too. Your entire stay in Russia must not exceed 16 days.

St Petersburg Entry Points With an e-visa

With a Russia e-visa, you can travel to Saint Petersburg through the following entry points:

- Pulkovo International Airport (LED), St Petersburg

- St Petersburg Marine Station and Passenger Ports

- Saint Petersburg - Finlyandskiy (railroad)

You must print the e-visa and carry it with the passport used to apply when entering Russia . Holding a visa does not guarantee entry to Russia — Russian immigration officials will verify your documents and check you meet the entry conditions.

Other Russian entry points for e-visa holders

You can cross the border through any of the authorized e-visa entry points and continue your journey to Saint Petersburg by train, bus/car, or plane.

Other important Russian entry points are:

- Kaliningrad entry points

- Moscow entry points

- Sochi entry points

- Vladivostok entry points

Russian Cities Near St. Petersburg

Saint Petersburg is a major center and tourist destination. The city is well connected by land, air, and sea both nationally and internationally .

Find below some of the most popular Russian destinations from St Petersburg :

- Golden Ring

- Kaliningrad

- Nizhny Novgorod

- Veliky Novgorod

- Vladivostok

- Yekaterinburg

List of Embassies in Saint Petersburg

Being such an international hub, Saint Petersburg hosts a number of foreign consulates and embassy branches even though it is not the capital city. Find them below.

Albanian Honorary Consulate in St. Petersburg, Russia Address: 950 Arcadia Street, Hatfield 0083 Telephone: (+7) 676 506 29 26 Email: [email protected]

Angolan Honorary Consulate in St. Petersburg, Russia Address: Frunze str., 22, office 4, 191123 Telephone: (+7) (812) 332 6102 Email: [email protected]

Armenian Consulate General in St. Petersburg, Russia Address: 1A, Yerevan Street Telephone: (+7) (8622) 671 642 Email: [email protected]

Australian Honorary Consulate in St. Petersburg, Russia Address: Italyanskaya 1, 191186 Telephone: (+7) (812) 325 7333 Email: [email protected]

Austrian Honorary Consulate in St. Petersburg, Russia Address: schultz gt. 1 Telephone: (+7) 2 8892-4081 / 2 Email: [email protected]

Azerbaijani Consulate General in St. Petersburg, Russia Address: Ulitsa Marata 73 Telephone: (+7) (812) 311 29 44 Email: [email protected]

Bangladeshi Honorary Consulate in St. Petersburg, Russia Address: 1st Floor, 78 Chekhova Street Telephone: (+7) (4232) 229 938 Email: [email protected]

Belarussian Embassy Branch Office in St. Petersburg, Russia Address: St. Petersburg 191124 Telephone: (+7) (812) 273-00-78

Belgian Consulate General in St. Petersburg, Russia Address: Economic Representation of Flanders Dom Shvetsiya Malaya - Konyushennaya 1/3A, Of. B13, 191186 St. Telephone: (+7) (812) 718.76.58 Email: [email protected]

Brazilian Honorary Consulate in St. Petersburg, Russia Address: Shpalernaya st., 36, office 324, 190000, St. Petersburg Telephone: (+7) (921) 894-32-45

Bulgarian Consulate General in St. Petersburg, Russia Address: 121 East 62nd Street, 191 123 Telephone: (+7) (812) 273 73 47 Email: [email protected]

Chilean Honorary Consulate in St. Petersburg, Russia Address: Av. Constantino Nery, no. 508-C - Centro Telephone: (+7) (212) 306 50 00 Email: [email protected]

Chinese Consulate General in St. Petersburg, Russia Address: Via Benaco 4, 190121 Telephone: (+7) 812-7147670 Mail: [email protected]

Cypriot Consulate General in St. Petersburg, Russia Address: 189, Chapaevskaya Street 191123 Telephone: (+7) (988) 245 43 02 Email: [email protected]

Czech Consulate General in St. Petersburg, Russia Address: Saad Bin Gharir Street, Al-Nuzha Quarter 191 015 Telephone: (+7) 21 274 35 12 Email: [email protected]

Danish Honorary Consulate General in St. Petersburg, Russia Address: ul. Mussakhanov 80/I Telephone: (+7) (312) 663 443 Email: [email protected]

Dominican Republic Honorary Consulate in St. Petersburg, Russia Address: 10, rue Léopold Heder 191123 Telephone: (+7) (212) 293-8356 / 7 Email: [email protected]

El Salvador Honorary Consulate in St. Petersburg, Russia Address: 5/3 Kievskaya st. 190000 Email: [email protected]

Estonian Consulate General in St. Petersburg, Russia Address: C/ Claudio Coello, 91, 1º. Dcha 197101 Telephone: (+7) 603 702 500 Email: [email protected]

Ethiopian Honorary Consulate in St. Petersburg, Russia Address: Ul Bolshaya Morskaya, 53/8, lit. A, pom. 22H Telephone: (+7) 99 091 8357 Email: [email protected]

Finnish Consulate General in St. Petersburg, Russia Address: Ul. Tshaikovskogo 71, 191028 Telephone: (+7) 812-273 7321 Email: [email protected]

French Consulate General in St. Petersburg, Russia Address: 15 quai de la Moïka, 191186 Telephone: (+7) 21 793 75 70

German Consulate General in St. Petersburg, Russia Address: Skarpögatan 9 Box 27832 191123 Telephone: (+7) (812) 320 24 00 Email: [email protected]

Greek Consulate General in St. Petersburg, Russia Address: Hotel Europe Mikhailovskaya Ulitsa 1/7, 191123 Telephone: (+7) 812 3296407-9

Guatemalan Honorary Consulate in St. Petersburg, Russia Address: Naberezhnaya Reki Moiki, 79, 190005 Telephone: (+7) 921-754-46-83 Email: [email protected]

Guinean Honorary Consulate in St. Petersburg, Russia Address: 196084 Telephone: (+7) 812 312-39-22 Email: [email protected]

Hungarian Consulate General in St. Petersburg, Russia Address: 28 de Julio 129, 191025 Telephone: (+7) 36 97 95 Email: [email protected]

Icelandic Honorary Consulate in St. Petersburg, Russia Address: 3rd Floor, 18/1 Vardanants Street, 199178 Telephone: (+7) 6387 7777 Email: [email protected]

Indian Consulate General in St. Petersburg, Russia Address: 5 Rawdon Street Telephone: (+7) 812-2721988 Email: [email protected]

Indonesian Honorary Consulate in St. Petersburg, Russia Address: 81, Cantonments Road Telephone: (+7) 1 856 677

Irish Honorary Consulate in St. Petersburg, Russia Address: Avenue du Général Kérim Nassour Telephone: (+7) 3 9318 3300 Email: [email protected]

Israeli Consulate General in St. Petersburg, Russia Address: 188, Min Zu Road, World Financial Centre (WFC), 49th floor, 191180 Telephone: (+7) (28) 3827 5445 / 46 / 57 Email: [email protected]

Kazakh Consulate General in St. Petersburg, Russia Telephone: (+7) 812 312-09-87 Email: [email protected]

South Korean Consulate General in St. Petersburg, Russia Address: No. 45, Tchaikovsky Street 191014 Telephone: (+7) (3952) 250 - 301 Email: [email protected]

Kyrgyz Embassy Branch Office in St. Petersburg, Russia Address: Sakko Lane 4, Office 4, 191024 Telephone: (+7) (391) 234-34-08 Email: [email protected]

Latvian Consulate General in St. Petersburg, Russia Address: 16 A Lashkarbegi Str. Telephone: (+7) 812 327 60 54 Email: [email protected]

Lithuanian Consulate General in St. Petersburg, Russia Address: Proletarskaya 133, 191123 Telephone: (+7) (812) 327 02 30 Email: [email protected]

Luxembourg Honorary Consulate in St. Petersburg, Russia Address: Nevski Prospekt 58, 198000 Telephone: (+7) 812 718 34 50 Email: [email protected]

Maltese Honorary Consulate in St. Petersburg, Russia Address: Kosol Corporation Limited, 198103 Telephone: (+7) (812) 7188209 Email: [email protected]

Monegasque Honorary Consulate General in St. Petersburg, Russia Address: 42, quai des Anglais, 190000 Telephone: (+7) 2 644 2744 Email: [email protected]

Nepalese Honorary Consulate in St. Petersburg, Russia Address: Ul Dubikovskaya, 55 Telephone: (+7) 812 719 8128 Email: [email protected]

Netherlands Consulate General in St. Petersburg, Russia Address: Rua de Moçambique, Predio Farmacia Cabral, 191186 Telephone: (+7) 812-3340200 Email: [email protected]

North Macedonia Honorary Consulate in St. Petersburg, Russia Address: Avda. de San José de la Montaña 14, 1, 191 040 Telephone: (+7) 232 463 82 82 Email: [email protected]

Norwegian Consulate General in St. Petersburg, Russia Address: C. Emiliano Zapata 28 Altos, 191014 Telephone: (+7) (8152) 400 300 Email: [email protected]

Pakistani Honorary Consulate General in St. Petersburg, Russia Address: 47, rue Stélios Kazantzidis, Pylaia - Ktiro thermi 1, 194044 Telephone: (+7) 2810 225 991 Email: [email protected]

Peruvian Honorary Vice Consulate in St. Petersburg, Russia Address: Ul Sadovaya, 53, lit. A, 4th floor Telephone: (+7) (812) 677-13-20 Email: [email protected]

Polish Consulate General in St. Petersburg, Russia Address: ul. 5-a Sowietskaja 12/14, 191036 Telephone: (+7) (812) 3363 140 / 1 Email: [email protected]

Portuguese Honorary Consulate in St. Petersburg, Russia Address: 4a Avenida "A" 13-25, Zona 9, 194044 Telephone: (+7) (415) 546 1155 Email: [email protected]

Romanian Consulate General in St. Petersburg, Russia Address: Str. Garohovaia, nr.4, 191186 Telephone: (+7) 812 3126141

Serbian Honorary Consulate in St. Petersburg, Russia Address: Pavla Mudrona 12, 191011 Telephone: (+7) 289 580 240

Seychellois Honorary Consulate in St. Petersburg, Russia Address: ul. Na Wzgórzu 36, 199106 Telephone: (+7) 505 84 54 Email: [email protected]

Slovakian Consulate General in St. Petersburg, Russia Address: Lokoty 4, 194 223 Telephone: (+7) 212 286 8434

Slovenian Honorary Consulate in St. Petersburg, Russia Address: Pereulok Antonenko 6-a, office 208, 190005 Telephone: (+7) 812 31 44 185

Spanish Consulate General in St. Petersburg, Russia Address: Lenina Avenue, 38A, Office 515, 191028 Telephone: (+7) 21 6391 7870 Email: [email protected]

Swedish Consulate General in St. Petersburg, Russia Address: Bundesgasse 26, 191186 Telephone: (+7) (812) 329 14 30 Email: [email protected]

Syrian Honorary Consulate in St. Petersburg, Russia Address: Devyataya Sovetskaya 10/12 Email: [email protected]

Tajik Consulate General in St. Petersburg, Russia Address: Building 74, Street between Dastgheyb 4 & 6, Rahnamaee Sq. to Filistin, 192007 Telephone: (+7) 383 349 5970 Email: [email protected]

Thai Honorary Consulate General in St. Petersburg, Russia Address: 1 Lubens’ka Street, 199053 Telephone: (+7) (4232) 267-366

Turkish Consulate General in St. Petersburg, Russia Address: Ulitsa Svobody 73, 191036 Telephone: (+7) 495 234 4060 Email: [email protected]

Ukrainian Consulate General in St. Petersburg, Russia Address: Off. 5, 6, Malaya Morskaya Street, 191124 Telephone: (+7) (812) 271 47 77 Email: [email protected]

Uruguayan Honorary Consulate in St. Petersburg, Russia Address: tachek Ave., 57, pom. 38H Telephone: (+7) 812 326-32-41

Uzbek Consulate General in St. Petersburg, Russia Address: 28g Suvorova Str. Telephone: (+7) 965 519 42 22

Japanese Consulate General in St. Petersburg, Russia Address: Nab. Reki Moiki 29, 191065 Telephone: (+7) (812) 314-1434 / 1418 Email: [email protected]

Italian Consulate General in St. Petersburg, Russia Address: Taouyah, Corniche Nord, Cité Guissé Villa N°4, Commune de Ratoma, 190068 Telephone: (+7) 812 3123217 Email: [email protected]

Sonne und Amex Vorteile: In diesen 6 Hotels auf Ibiza

Yoga und Wellness mit Meerblick: Six Senses Ibiza

Luxusresort auf den klippen: 7pines resort ibiza, boutiquehotel mit sterneküche: bless hotel ibiza, 5-sterne-luxus am strand von s’argamassa: me ibiza, strandhotel nahe der inselhauptstadt: nobu hotel ibiza bay, hotel in ibiza-stadt nur für erwachsene: the standard, ibiza, sonne, strand, top-hotels: we’re going to ibiza, faq: häufige fragen und antworten.

Das Resort Six Senses Ibiza liegt im Norden der Insel, etwa 35 Minuten Autofahrt vom Flughafen Ibiza entfernt. In dem Hotel kannst du dich in eine der 137 mit natürlichen Materialien eingerichteten Suiten oder Villen zurückziehen, einfach am Pool mit Meerblick entspannen – oder an Yoga-Retreats oder Longevity -Programmen teilnehmen.

Das 5-Sterne-Hotel auf Ibiza lädt zudem mit vier hoteleigenen Restaurants zum Essen nach Lust und Laune ein. Frische Meeresfrüchte im Restaurant North unter knorrigen Bäumen oder doch lieber lateinamerikanische Küche im The Beach Caves Restaurant direkt am Wasser? Da ist für jeden Geschmack etwas dabei.

Must-do: Deinen Aufenthalt mit der American Express Platinum Card buchen und Vorteile sichern.

Vorteilhaft unterkommen

Das 7Pines Resort Ibiza erwartet dich in San José, einem ruhigen Ort im Südwesten von Ibiza. Das 5-Sterne-Hotel in einem Pinienhain verfügt über drei Pools. Der Infinity-Pool nur für Erwachsene am Rande der Klippen bietet einen spektakulären Ausblick aufs Meer. Der Laguna-Pool lädt Familien mit Kindern zum Planschen ein, der Spa-Pool Ruhesuchende zur Entspannung.

Das Top-Hotel auf Ibiza hat vier Bars und zwei Restaurants, die für das leibliche Wohl der Gäst:innen sorgen. Dazu zählt das elegante Gourmetrestaurant The View, das Tasting Menus mit vier bis sechs Gängen anbietet, die vom Mittelmeerraum inspiriert werden.

Must-do: Mit einem Cocktail in der Hand am allabendlichen Sonnenuntergangsritual im Cone Club mit Meerblick teilnehmen.

Tipps für Foodies: Essen gehen auf Ibiza

Im Osten der Insel thront das Bless Hotel Ibiza über der Bucht Cala Nova. Es hat ein herrliches Spa inklusive Hydrotherapie-Bereich, in dem du als Platinum Card Inhaber:in dein Hotelguthaben in Höhe von 100 US-Dollar beispielsweise für eine belebende Massage einlösen kannst.*

Befreit von jeglichen Verspannungen musst du dich entscheiden: Schwimmen im Infinity-Außenpool oder über den direkten Zugang an den Strand? Vielleicht möchtest du dich zunächst stärken: Das hoteleigene Restaurant Etxeko Ibiza erhielt 2023 einen Michelin-Stern und vereint baskische Einflüsse mit internationaler gehobener Küche.

Nice to know: In dem modernen Boutiquehotel auf Ibiza ist sogar ein Wellnessurlaub mit Hund möglich, sofern dein Vierbeiner weniger als zehn Kilogramm wiegt.

200 Euro für deine Reise nach Ibiza

Das ME Ibiza liegt im Osten der Insel, direkt am Strand von S’Argamassa. Dank Late Check-out bis 16 Uhr* kannst du als Platinum Card Inhaber:in am Abreisetag ausschlafen und auf der Dachterrasse nur für Erwachsene noch eine letzte Runde im Pool schwimmen oder auf den bequemen balinesischen Betten relaxen.

Du möchtest auch das berühmte Nachtleben von Ibiza kennenlernen? Kein Problem: Im Erdgeschoss des Hotels legen täglich DJ:anes auf.

Must-do: Die vielfältigen Sportangebote im Haus nutzen, zum Beispiel Anti-Gravity-Yoga, auch bekannt als Aerial Yoga, oder Kajak fahren entlang der Küste.

Für einen Strandurlaub am Rande von Ibiza-Stadt eignet sich das Nobu Hotel Ibiza Bay . Das 5-Sterne-Haus mit zwei Pools liegt direkt am Strand Talamanca. Es ist auch eine Unterkunft für Familien mit Kleinkindern: Neben geräumigen Familienzimmern gibt es einen Kids Club mit umfangreichem Programm.

Das Hotelguthaben in Höhe von 100 US-Dollar, das du dank deiner Platinum Card für deinen Aufenthalt bekommst, kannst du in dem schicken Hotel auf Ibiza für kreative Cocktails am Pool einlösen.* Oder du gönnst dir frische Meeresfrüchte im Beach-Restaurant Chambao.

Nice to know: Möchtest du luxuriös dinieren, reservierst du am besten einen Tisch im Restaurant Nobu, in dem das Team rund um Chef Enrico Maimonte japanische Fusionsküche serviert.

Planst du eine Ibizareise als Paar, mit der Freundesgruppe oder allein, findest du mit der Adults-only-Unterkunft The Standard, Ibiza den idealen Ausgangspunkt für Streifzüge über die Insel. Das Boutiquehotel mit 67 Zimmern befindet sich zentral in der Einkaufsstraße Vara de Rey, eine Fußgängerzone mit vielen schönen Boutiquen und Restaurants.

Auf der Dachterrasse des schönen Ibiza-Hotels kannst du nicht nur im Rooftop-Pool mit Blick auf die befestigte Altstadt Dalt Vila baden, sondern in den Sommermonaten auch Tag und Nacht kühle Drinks zu dir nehmen.

Nice to know: The Standard gehört zur The Hotel Collection von American Express. In diesen Hotels bekommen sowohl Inhaber:innen einer Platinum Card als auch einer Gold Card viele Vorteile wie ein Zimmerupgrade bei der Ankunft (sofern verfügbar).*

Platinum Card oder Gold Card: Welche American Express Kreditkarte begleitet dich nach Ibiza?

Deine reisegewohnheiten, deine einsparungen im jahr.

Ibizas schöne Strände und die internationale Partyszene machen die Baleareninsel zu einem beliebten Reiseziel für Sonnenanbeter:innen und Feierwillige. Bunte Hippiemärkte, die malerische Altstadt von Ibiza-Stadt und grüne Pinienwälder bieten sich zudem als abwechslungsreiche Ausflugsziele an. Wichtig ist nur die Wahl des richtigen Hotels, damit du deine Reisepläne ohne weite Wege umsetzen kannst und dich rundum wohlfühlst.